UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

HUNTINGTON INGALLS INDUSTRIES, INC.

(Exact name of the registrant as specified in its charter)

| | | | | |

| |

| DELAWARE | 1-34910 |

(State or other jurisdiction of incorporation) | (Commission File Number) |

| |

| 4101 WASHINGTON AVENUE, NEWPORT NEWS, VIRGINIA | 23607 |

| (Address of principal executive offices) | (Zip code) |

Thomas E. Stiehle (757) 380-2000

(Name and telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

| | | | | |

| ☒ | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

| |

| ☐ | Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended _______. |

Introduction

This Specialized Disclosure Report (Form SD) for Huntington Ingalls Industries, Inc. (“HII” or the “Company”) is provided in accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”) for the reporting period from January 1 to December 31, 2023.

Conflict Minerals are defined by the Securities and Exchange Commission (“SEC”) as cassiterite, columbite-tantalite, wolframite and gold, and their derivatives, which are limited to tin, tantalum and tungsten (referred to as “3TGs”). The Rule requires an SEC registrant to determine if its products contain 3TGs and whether their origin is any of the “Covered Countries,” which include the Democratic Republic of Congo, the Republic of the Congo, the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia and Angola.

HII conducted a Reasonable Country of Origin Inquiry (“RCOI”) to determine the origin of 3TGs identified in its supply chain. Due to the unavailability of details and information through the supply chain back to smelters, HII is not able to determine the origin of all 3TGs in its products covered by this reporting period.

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Details regarding HII’s RCOI can be found in HII’s Conflict Minerals Report provided as Exhibit 1.01 hereto and publicly available at https://hii.com/legal/conflict-minerals-report/.

Any references to the HII website in this Form SD and the Conflict Minerals Report filed as Exhibit 1.01 and available on such website are for convenience only, and the contents of that site are not incorporated by reference into, and are not otherwise a part of, this Form SD or the Conflict Minerals Report.

Certain statements in this Form SD and the Conflict Minerals Report filed as Exhibit 1.01 constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that is not based on historical fact, including statements containing the words “believes,” “may,” “plans,” “will,” “could,” “should,” “estimates,” “continues,” “anticipates,” “intends,” “expects” and similar expressions. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. These forward-looking statements are based on current expectations concerning the Company’s future actions to engage contract manufacturers, to identify to the extent possible the source of 3TGs in its products and to take other actions regarding its product sourcing. The Company’s actual actions or results may differ materially from those expected or anticipated in the forward-looking statements due to both known and unknown risks and uncertainties including, but not limited to, decisions to make changes in the Company’s ongoing improvement efforts and delays or difficulties in engaging contract manufacturers and identifying the sources of 3TGs contained in the Company’s products. HII assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

Item 1.02 Exhibit

HII’s Conflict Minerals Report as required under Item 1.01.

Section 3 – Exhibits

Item 3.01 Exhibits

Exhibit 1.01 – Conflict Minerals Report of Huntington Ingalls Industries, Inc. as required by Items 1.01 and 1.02 of this Form.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

Huntington Ingalls Industries, Inc.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| By: | | /s/ Thomas E. Stiehle | | Date: May 31, 2024 |

| Name: | | Thomas E. Stiehle | | |

| Title: | | Executive Vice President and Chief Financial Officer | | |

Exhibit 1.01

CONFLICT MINERALS REPORT

This Conflict Minerals Report (“CMR”) for the reporting period of January 1 to December 31, 2023, is provided in accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”).

COMPANY BACKGROUND

Huntington Ingalls Industries, Inc. (“HII,” the “Company,” “we,” “us,” or “our”) is a global, all-domain defense partner, building and delivering the world's most powerful, survivable naval ships and technologies that safeguard America’s seas, sky, land, space, and cyber. For more than a century, our Ingalls Shipbuilding segment (“Ingalls”) in Mississippi and Newport News Shipbuilding segment (“Newport News”) in Virginia have built more ships in more ship classes than any other U.S. naval shipbuilder, making us America's largest shipbuilder. Our Mission Technologies segment develops integrated technology solutions and products that enable today’s connected, all domain force. Headquartered in Newport News, Virginia, we employ over 44,000 people domestically and internationally.

We conduct most of our business with the U.S. Government, primarily the Department of Defense. As prime contractor, principal subcontractor, team member, or partner, we participate in many high-priority U.S. defense programs. Ingalls includes our non-nuclear ship design, construction, repair, and maintenance businesses. Newport News includes all of our nuclear ship design, construction, overhaul, refueling, and repair and maintenance businesses. Our Mission Technologies segment provides a wide range of services and products, including command, control, computers, communications, cyber, intelligence, surveillance, and reconnaissance systems and operations; the application of Artificial Intelligence and machine learning to battlefield decisions; defense and offensive cyberspace strategies and electronic warfare; unmanned autonomous systems; live, virtual, and constructive training solutions; fleet sustainment; and critical nuclear operations.

HII procures a large variety of products from many different suppliers. Some of the products HII procures from suppliers contain conflict minerals, which are also referred to as “3TGs” (“conflict minerals” and “3TGs” are tin, tantalum, tungsten and gold, as more specifically described in and covered by the Securities and Exchange Commission’s regulations and guidance). HII is a downstream purchaser and a number of steps removed in the supply chain from the mining and smelting of 3TGs. As a result, HII relies on its suppliers to represent whether the products they are supplying to HII contain 3TGs. Additionally, HII does not purchase raw ore or unrefined conflict minerals from mines or smelters and does not purchase products directly from any of the covered countries specified in the Rule (Democratic Republic of Congo, the Republic of the Congo, the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia and Angola), referred to collectively as the “DRC” in this CMR.

This CMR relates to HII products that were manufactured, or contracted to be manufactured, and completed during calendar year 2023 and that contain necessary 3TGs. This CMR was not subjected to an independent private sector audit. Statements provided below are made in good faith and reflect the Company’s supplier infrastructure and information obtained to address the Rule. Factors that could affect the accuracy of statements in this CMR include, but are not limited to, incomplete supplier data or available smelter data, errors or omissions by suppliers or smelters, evolving identification of smelters, and incomplete information from industry or other third-party sources.

CONFLICT MINERALS POLICY

HII has adopted a conflict minerals policy and related procedures focused on HII’s commitment to sourcing components and materials from suppliers that share its ethical values and that support compliance with the Securities and Exchange Commission’s regulations, as well as HII’s disclosure obligations related to conflict minerals. HII’s policy is summarized on our website at: https://hii.com/legal/conflict-minerals-report/. HII supports the sourcing of conflict minerals from the DRC through smelters that have been independently verified as “conflict-free.” The conflict minerals policy and related procedures have guided HII’s development of internal systems, supply chain due diligence efforts, and Reasonable Country of Origin Inquiry (“RCOI”).

HII’s efforts related to conflict minerals include: maintaining internal policies, procedures, practices, processes, and systems designed to obtain information about 3TGs that may be incorporated into HII’s products and their origin; improving transparency through our product supply chain; and, more generally, providing knowledge to and achieving engagement from our suppliers concerning the requisite conflict minerals issues. Additionally, HII belongs to and participates with professional organizations that devote time and focus to understanding conflict minerals matters and how to appropriately obtain accurate data about the sources of conflict minerals. Through these organizations, HII has supported measures to encourage our supply chain to understand and comply with the Rule.

PRODUCTS COVERED AND REPORTING YEAR ACTIVITY

For products completed and delivered by HII in 2023, which included manned and unmanned vessels, vessel components, electronic systems and wire harnesses, HII conducted an RCOI as more specifically described below. The results of the RCOI led HII to conduct due diligence with regard to a limited number of suppliers to four of the Company’s business units. The information provided by those suppliers indicated that some 3TGs contained in certain of their products supplied to HII business units may have originated in the DRC. As further discussed below in “Information Regarding Country of Origin and Due Diligence Results,” the vast majority of our suppliers indicated that they were either sourcing from smelters determined by the Responsible Minerals Initiative (“RMI”) to be conformant to its Responsible Minerals Assurance Process (“RMAP”), actively arranging to source from conformant smelters, or sourcing 3TGs from countries other than the DRC. While certain suppliers indicated that they sourced 3TGs from smelters designated as non-conformant by RMI or smelters that do not participate in RMI’s RMAP, those suppliers could not determine whether any 3TGs sourced from the DRC were contained in any products supplied to HII. Accordingly, HII has insufficient information from or about these smelters to understand their sources of 3TGs.

REASONABLE COUNTRY OF ORIGIN INQUIRY

HII’s RCOI was designed to determine whether the 3TGs in our relevant products originated in the DRC. In part, HII’s RCOI process included:

•maintaining a conflict minerals working group comprised of representatives from HII’s compliance, legal, and supply chain functions (at both the corporate and business unit levels), with access to external advisors with conflict minerals subject matter expertise;

•maintaining policies to support compliance with the Securities and Exchange Commission’s conflict minerals regulations and guidance;

•making information available to HII’s suppliers about, and linked access to, the Securities and Exchange Commission’s conflict minerals regulations and guidance, as well as other supporting publications and access to the extensive conflict minerals resource center of HII’s third party conflict minerals data vendor;

•requiring suppliers, as part of the purchase order process, to represent whether their products contain 3TGs and, if so, requiring the suppliers to provide a completed RMI Conflict Minerals Reporting Template (“CMRT”) containing information about the type and origin of 3TGs in their products; and

•conducting periodic reviews with the Company’s supply chain organizations to understand the data and information submitted by suppliers and additional steps that were taken to seek additional information from suppliers.

In response to HII’s country of origin inquiries, several of HII’s suppliers indicated that they lacked definitive information from their supply chains, making it possible that certain of their products contained one or more 3TGs sourced from the DRC. Accordingly, HII believes that, based upon the results of its RCOI, it was appropriate to conduct due diligence measures to obtain additional information, as described below.

DESIGN OF DUE DILIGENCE

HII’s due diligence measures are designed to conform and track to the Organization for Economic Cooperation and Development’s (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High Risk Areas.

DUE DILIGENCE MEASURES PERFORMED

Establish Strong Company Management Systems

•As noted above, maintaining a conflict minerals working group comprised of representatives from HII’s compliance, legal, and supply chain functions (at both the corporate and business unit levels), with access to external advisors with conflict minerals subject matter expertise.

•Maintaining a conflict minerals policy and related procedures to address HII’s commitment to comply with the Rule. HII’s policy is summarized on our website at https://hii.com/legal/conflict-minerals-report/. HII’s policy and implementing procedure include commitments such as:

•To the extent practicable, and consistent with our contractual obligations to our customers, refraining from relationships that could knowingly result in:

▪aiding, directly or indirectly, armed groups operating in the DRC through sales of 3TGs; or

▪the willful concealment of information related to the transport of 3TGs from the DRC and their use in manufactured products.

•Sourcing components and materials from suppliers that share our ethical values. Our procedure outlines the requirements to survey our suppliers and obtain necessary details to support compliance with the Rule. The procedure further identifies the functional parties within the Company responsible for supporting the Rule and assessing the presence of any inconsistencies associated with supplier survey responses.

•Educating relevant employees about our conflict minerals program and reporting obligations through a web-based conflict minerals training course or in-person training, as appropriate.

•Reviewing the conflict minerals program as an element in our corporate annual compliance plan, which covers HII’s risk management of conflict minerals compliance.

•Selecting and utilizing a third party conflict minerals data vendor to collect and manage CMRT responses from suppliers and verify the accuracy of the data provided.

•Periodically briefing executive management, including the Chief Financial Officer and the Audit Committee of the Board of Directors, on the conflict minerals requirements and related Company activities.

•Maintaining communications with our supply chain through our corporate conflict minerals website at https://hii.com/legal/conflict-minerals-report/, which includes Frequently Asked Questions, links to third

party information on conflict minerals, and a link to our grievance mechanism, or OpenLine, as discussed further below.

•Employing mechanisms for interested persons to submit concerns or grievances, including our OpenLine as the tool to capture and track internal or external concerns or grievances regarding aspects of the Rule. The OpenLine is available 24 hours a day, seven days a week, and can be accessed either by phone or through the website (1-877-631-0020, https://secure.ethicspoint.com/domain/media/en/gui/47460/index.html).

Identify and Assess Supply Chain Risk

•Requiring suppliers as part of the purchase order process to represent whether their products contain 3TGs and, if so, requiring the suppliers to provide our third party conflict minerals data vendor with a completed CMRT containing information about the type and origin of 3TGs in their products.

•Including a purchase order requirement for each supplier to provide an updated CMRT to our third party conflict minerals data vendor if the status of any product changes prior to final delivery.

•Identifying suppliers of products to HII that may contain 3TGs and asking our third party conflict minerals data vendor to follow up with non-responsive suppliers to request submission of CMRTs or similar information by a specified date. Where a supplier is unable to provide a CMRT, information on its sub-tier suppliers of products or components that may require 3TGs for their production or functionality is requested by our vendor. Those sub-tier suppliers for whom contact information is obtained, and subsequent tiers of suppliers as needed, are then engaged via email or phone to build a chain-of-custody back to the smelter or refiner. If major suppliers do not respond to several e-mail reminders and follow-up phone calls from our vendor, we directly contact those suppliers to obtain CMRTs or other acceptable information about the type and origin of 3TGs in their products.

•Conducting a targeted self-assessment to identify items with a higher risk of containing 3TGs if no CMRT was submitted by the supplier.

•Including a purchase order clause that allows HII to either withhold up to 10% of the purchase order price or terminate the purchase order if HII determines that any representation made by the supplier is inaccurate or incomplete in any respect, or if the supplier fails to timely submit the information required by the clause. In 2023, HII found no instances where it was necessary under the purchase order clause to find replacement sources of supply, withhold payments, or terminate a supplier relationship.

•Reviewing suppliers’ CMRT responses with assistance from our third party conflict minerals data vendor.

•In certain instances our third party vendor may assist us in performing additional due diligence on the sourcing of 3TGs.

Design and Implement a Strategy to Respond to Supply Chain Risks

•Maintaining membership and participation in the Aerospace Industries Association (“AIA”) and its conflict minerals working group, as well as RMI, to stay current on industry “best practices” for conflict minerals due diligence efforts.

•Supporting, through membership in RMI and participation on its due diligence practices team, the assessment of whether smelters and refiners have carried out the OECD five step due diligence process for responsible supply chains of 3TGs from the DRC.

•Analyzing supplier responses and evaluating information in a manner designed to provide HII with a reasonable basis for conclusions disclosed in the Form SD filed on May 31, 2024, and this Conflict Minerals Report, including evaluating the raw number of supplier responses and relative dollar values of

purchased products represented by such responses, as well as focusing on suppliers relevant to the reporting period.

•Supporting information-sharing systems within our industry aimed at improving assessment of supplier due diligence in the supply chain of minerals from conflict-affected and high-risk areas, such as comparing smelters and refiners identified by the HII supply chain with the RMAP information.

•Contacting, through participation in the AIA’s conflict minerals working group, selected smelters or refiners through a formal letter from the AIA to encourage participation in the RMAP.

•As necessary, providing periodic updates to executive management on any actions taken in response to identified risks associated with conflict minerals in HII’s supply chain.

Carry Out Independent Third Party Audit of Supply Chain Due Diligence at Identified Points in the Supply Chain

•Due to the downstream nature of our business, HII does not have direct relationships with smelters or refiners and therefore does not perform audits of these entities. Through its membership in RMI, however, HII supports third party audits of supply chain due diligence by RMI’s RMAP, which conducts independent, third-party audits of smelters and refiners to determine those that can be validated as having systems that ensure the minerals are responsibly sourced according to the OECD guidance. We use the RMI audit status database and RCOI information as key inputs to help us prepare this Conflict Minerals Report and manage conflict minerals risk in our supply chain.

Report on Supply Chain Due Diligence

•This Conflict Minerals Report is HII’s public annual report on the due diligence efforts of our supply chain.

•HII posts this report annually at https://hii.com/legal/conflict-minerals-report/.

INFORMATION REGARDING COUNTRY OF ORIGIN AND DUE DILIGENCE RESULTS

We do not to our knowledge, directly purchase 3TGs from the DRC. We leverage our membership in RMI and its RMAP, which audits smelters’ and refiners’ due diligence activities. The data we utilized for certain statements in this report was obtained through our membership in RMI, using the Reasonable Country of Origin Inquiry report for RMI member HUNT.

HII or its third party conflict minerals data vendor engaged with each supplier that suggested possible sourcing of 3TGs from the DRC to obtain further supporting documentation for their statements. These suppliers responded with either (i) conflict minerals disclosure on a company-wide basis in which they were unable to verify whether the specific products sold to HII contained 3TGs sourced from the DRC, or (ii) additional information that indicated the names and locations of known smelters from which their 3TGs may have originated, but without additional information to verify whether the 3TGs in their products sold to HII originated from the DRC.

Based on the information received, the vast majority of our suppliers indicated that they were either sourcing from RMI conformant smelters, actively arranging to source from conformant smelters, or sourcing 3TGs from other than the DRC. While certain suppliers indicated that they sourced 3TGs from smelters designated as non-conformant by RMI or smelters that do not participate in RMI’s RMAP, those suppliers could not determine

whether any 3TGs sourced from the DRC were contained in any products supplied to HII. Accordingly, HII has insufficient information from or about these smelters to understand their sources of 3TGs. Because information was generally provided from suppliers at a company or divisional level and was not tied to specific products, we did not have sufficient information to specifically identify the facilities that sourced the 3TGs included in our products, or to identify the specific country of origin of such 3TGs.

ONGOING EFFORTS

HII is continuing its efforts to:

•Determine which supplier-provided products contain 3TGs;

•Obtain additional information from direct suppliers, as well as others in or with knowledge of the supply chain, as to whether their products contain 3TGs and, if so, the origin of those 3TGs, as additional conflict minerals and smelter information becomes available to the supply chain;

•Remain actively involved in and participate with industry and other groups, including AIA and RMI, to ascertain best practices and to obtain and share information that may assist in determining whether purchased products contain 3TGs and, if so, the origin of those 3TGs and whether the 3TGs were sourced from conflict-free sources;

•Support industry efforts to expand participation of smelters and refiners in sourcing due diligence audit programs;

•Make available resources and information to non-issuer suppliers about the Securities and Exchange Commission’s conflict minerals reporting requirements, as well as information about RMI and other informative measures designed to educate about the importance of conflict-free sourcing; and

•Encourage responsible sourcing from the DRC.

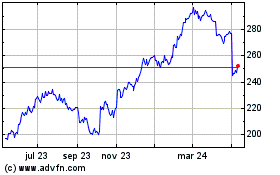

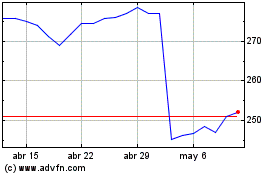

Huntington Ingalls Indus... (NYSE:HII)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Huntington Ingalls Indus... (NYSE:HII)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024