Delivered second quarter net sales of $169.5

million Debt and Credit Ratings upgraded by S&P Global

Ratings Exited Covenant Relief Period and continues progress

on deleverage with $10MM prepayment

Holley Performance Brands (NYSE: HLLY), a leader in automotive

aftermarket performance solutions, today announced financial

results for its second quarter ended June 30, 2024.

Second Quarter Highlights vs. Prior

Year Period

- Net Sales decreased 3.3% to $169.5 million compared to $175.3

million last year

- Net Income was $17.1 million, or $0.14 per diluted share,

compared to $13.0 million, or $0.11 per diluted share, last

year

- Net Cash Provided by Operating Activities was $25.7 million

compared to $30.7 million last year

- Adjusted Net Income1 was $12.6 million compared to $16.0

million last year

- Adjusted EBITDA1 was $37.4 million compared to $37.9 million

last year

- Free Cash Flow1 was $24.4 million compared to $29.0 million

last year

1See “Use and Reconciliation of Non-GAAP Financial Measures”

below.

“In the second quarter, amidst a challenging macroeconomic

landscape, we achieved significant strides in the pivotal areas of

our transformation, which may not be immediately apparent due to

the broader market conditions. Through ongoing improvements in our

operations, we met all of our financial priorities related to cash

flow, deleveraging, and cost to serve, as well as completed the

final pieces of enhancing our organization's capabilities with the

addition of a new Senior Vice President of Operations and Supply

Chain. We are thrilled to welcome, Alex Buccilli, SVP of Operations

and Supply Chain to further strengthen our operational strategies,

supporting our vision for sustained growth,” said Matthew

Stevenson, President and CEO of Holley.

Stevenson commented, “Our focus on the transformation centered

on driving growth through enhancing our digital capabilities and

customer experiences, deepening distributor partnerships, product

management and innovation, and strategic pricing, is beginning to

bear fruit, as evident by the meaningful year-over-year growth in

our direct-to-consumer channel as well as the highly successful

Memorial Day campaign where we collaborated with our distribution

partners to drive their out the door sales. Moreover, we're proud

to continue teaming up with the industry distribution partners to

drive their out the door sales. Additionally, we take pride in the

innovative products we introduced during the second quarter, which

span across our remarkable innovative offerings of brands.”

Key Operating Metrics and Strategic

Highlights

- Year-over-Year Order trends improving both on an annual and

sequential basis

- Total net inventory reduced to $173.5 million compared to

$217.5 million Q2 of last year; inventory turns improved to 2.2x

compared to 1.9x last year

- S&P Global Ratings (S&P) upgraded Holley’s issuer

credit rating to ‘B’ from ‘B-’ and senior secured issue-level

rating to ‘B’ from ‘B-’ on June 13, 2024

- Completed additional $10 million in early debt paydown against

the Company’s first lien term loan facility in Q2

- Holley’s bank-adjusted EBITDA leverage ratio1 at quarter end of

4.02x was well below the amended covenant ceiling of 5.00x for Q2

of 2024

- Exited the Covenant Relief Period

1See “Use and Reconciliation of Non-GAAP Financial Measures”

below.

Jesse Weaver, Holley's CFO, added, "This quarter, we once again

met our financial priorities. Our improved leverage ratio, backed

by robust profitability, debt reduction, and more consistent free

cash flow generation, was recognized by S&P Global Ratings with

an upgraded credit and debt rating in June. I'm incredibly proud of

our team and their efforts during this transformation, which has

reinvigorated the focus on organic growth and allowed us to

effectively make progress on the financial priorities we set out

over 18 months ago."

Weaver added, "While we are making significant strides in our

transformation, the overall macroeconomic environment remains

fraught with uncertainty. Consequently, we believe adopting a

conservative stance in our outlook for the latter half of the year

is a prudent measure. Nonetheless, we are confident in the

trajectory we have set and remain enthusiastic about the company's

growth prospects. Our ability to capture market share, even in a

softening market, reinforces our optimism for the future."

Outlook

Holley is providing the following outlook for the third quarter

and full-year 2024:

Metric

Third Quarter 2024

Outlook

Full Year 2024 Outlook

Net Sales

$133 - $153 million

$605 - $645 million

Adjusted EBITDA *

$20 - $30 million

$117 - $132 million

Capital Expenditures

$6 - $8 million

Depreciation and Amortization

Expense

$24 - $26 million

Interest Expense

$50 - $55 million

Bank-adjusted EBITDA Leverage

Ratio *

3.75x - 4.25x

* Holley is not providing reconciliations of forward-looking

third quarter 2024 and full year 2024 Adjusted EBITDA outlook and

full year 2024 Bank-adjusted EBITDA Leverage Ratio outlook because

certain information necessary to calculate the most comparable GAAP

measure, net income, is unavailable due to the uncertainty and

inherent difficulty of predicting the occurrence and the future

financial statement impact of certain items. Therefore, as a result

of the uncertainty and variability of the nature and amount of

future adjustments, which could be significant, Holley is unable to

provide these forward-looking reconciliations without unreasonable

effort. Accordingly, Holley is relying on the exception provided by

Item 10(e)(1)(i)(B) of Regulation S-K to exclude these

reconciliations.

Holley notes that its outlook for the third quarter and

full-year 2024 may vary due to changes in assumptions or market

conditions and other factors described below under “Forward-Looking

Statements.”

Conference Call A conference

call and audio webcast has been scheduled for 8:30 a.m. Eastern

Time today to discuss these results. Investors, analysts, and

members of the media interested in listening to the live

presentation are encouraged to join a webcast of the call available

on the investor relations portion of the Company’s website at

investor.holley.com. For those that cannot join the webcast, you

can participate by dialing 877-407-4019 (Toll Free) or 201-689-8337

(Toll) using the access code of 13747636.

For those unable to participate, a telephone replay recording

will be available until Wednesday, August 14, 2024. To access the

replay, please call 877-660-6853 (Toll Free) or 201-612-7415 (Toll)

and enter confirmation code 13747636. A web-based archive of the

conference call will also be available on the Company’s

website.

Additional Financial

Information The Investor Relations page of Holley’s

website, investor.holley.com contains a significant amount of

financial information about Holley, including our earnings

presentation, which can be found under Events & Presentations.

Holley encourages investors to visit this website regularly, as

information is updated, and new information is posted.

About Holley Inc. Holley

Performance Brands (NYSE: HLLY) is a leading designer, marketer,

and manufacturer of high-performance products for car and truck

enthusiasts. Holley offers a leading portfolio of iconic brands

that deliver innovation and inspiration to a large and diverse

community of millions of avid automotive enthusiasts who are

passionate about the performance and personalization of their

classic and modern cars. Holley has disrupted the performance

category by putting the enthusiast consumer first, developing

innovative new products, and building a robust M&A process that

has added meaningful scale and diversity to its platform. For more

information on Holley, visit https://www.holley.com.

Forward-Looking Statements

Certain statements in this press release may be considered

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

relate to future events or Holley’s future financial or operating

performance. For example, projections of future revenue and

adjusted EBITDA and other metrics, along with statements regarding

the impact of organizational changes, are forward-looking

statements. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “expect,”

“intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,”

“or” or the negatives of these terms or variations of them or

similar terminology. Such forward-looking statements are subject to

risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. These forward-looking statements

are based upon estimates and assumptions that, while considered

reasonable by Holley and its management, are inherently uncertain.

Factors that may cause actual results to differ materially from

current expectations include, but are not limited to: 1) the

ability of Holley to grow and manage growth profitably which may be

affected by, among other things, competition; to maintain

relationships with customers and suppliers; and to retain its

management and key employees; 2) Holley’s ability to compete

effectively in our market; 3) Holley’s ability to successfully

design, develop, and market new products; 4) Holley’s ability to

respond to changes in vehicle ownership and type; 5) Holley’s

ability to maintain and strengthen demand for our products; 6)

Holley’s ability to effectively manage our growth; 7) Holley’s

ability to attract new customers in a cost-effective manner; 8)

Holley’s ability to expand into additional consumer markets; 9)

costs related to Holley being a public company; 10) disruptions to

Holley’s operations, including as a result of cybersecurity

incidents; 11) changes in applicable laws or regulations; 12) the

outcome of any legal proceedings that have been or may be

instituted against Holley; 13) general economic and political

conditions, including the current macroeconomic environment,

political tensions, and war (including the conflict in Ukraine, the

conflict in the Middle East, and the possible expansion of such

conflicts and potential geopolitical consequences); 14) the

possibility that Holley may be adversely affected by other

economic, business, and/or competitive factors, including recent

events affecting the financial services industry (such as the

closures of certain regional banks); 15) Holley’s estimates and

expectations of its financial performance and future growth

prospects; 16) Holley’s ability to anticipate and manage through

disruptions and higher costs in manufacturing, supply chain,

logistical operations, and shortages of certain company products in

distribution channels; and 17) other risks and uncertainties set

forth in the section entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in the Annual Report on Form

10-K for the year ended December 31, 2023 filed with the U.S.

Securities and Exchange Commission (“SEC”) on March 14, 2024,

and/or disclosed in any subsequent filings with the SEC. Although

Holley believes the expectations reflected in the forward-looking

statements are reasonable, nothing in this press release should be

regarded as a representation by any person that the forward-looking

statements or projections set forth herein will be achieved or that

any of the contemplated results of such forward looking statements

or projections will be achieved. There may be additional risks that

Holley presently does not know or that Holley currently believes

are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. You should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made. Holley undertakes no duty to

update these forward-looking statements, except as otherwise

required by law.

[Financial Tables to Follow]

HOLLEY INC. and

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (In thousands) (Unaudited)

For the thirteen weeks

ended

For the twenty-six weeks

ended

June 30,

July 2,

Variance

Variance

June 30,

July 2,

Variance

Variance

2024

2023

($)

(%)

2024

2023

($)

(%)

Net Sales

$

169,496

$

175,262

$

(5,766

)

-3.3

%

$

328,132

$

347,467

$

(19,335

)

-5.6

%

Cost of Goods Sold

99,203

105,514

(6,311

)

-6.0

%

205,780

210,006

(4,226

)

-2.0

%

Gross Profit

70,293

69,748

545

0.8

%

122,352

137,461

(15,109

)

-11.0

%

Selling, General, and Administrative

34,570

29,101

5,469

18.8

%

67,566

59,118

8,448

14.3

%

Research and Development Costs

4,311

6,182

(1,871

)

-30.3

%

9,123

12,835

(3,712

)

-28.9

%

Amortization of Intangible Assets

3,435

3,674

(239

)

-6.5

%

6,871

7,353

(482

)

-6.6

%

Restructuring Costs

(3

)

352

(355

)

nm

612

1,691

(1,079

)

-63.8

%

Other Operating Expense (Income)

102

485

(383

)

-79.0

%

94

536

(442

)

-82.5

%

Operating Expense

42,415

39,794

2,621

6.6

%

84,266

81,533

2,733

3.4

%

Operating Income

27,878

29,954

(2,076

)

-6.9

%

38,086

55,928

(17,842

)

-31.9

%

Change in Fair Value of Warrant

Liability

(3,402

)

2,017

(5,419

)

nm

(6,529

)

3,452

(9,981

)

nm

Change in Fair Value of Earn-Out

Liability

(1,058

)

961

(2,019

)

nm

(1,707

)

1,389

(3,096

)

nm

Loss on Early Extinguishment of Debt

—

—

-

nm

141

—

141

nm

Interest Expense, Net

13,178

9,899

3,279

33.1

%

24,182

28,197

(4,015

)

-14.2

%

Non-Operating Expense

8,718

12,877

(4,159

)

-32.3

%

16,087

33,038

(16,951

)

nm

Income Before Income Taxes

19,160

17,077

2,083

12.2

%

21,999

22,890

(891

)

-3.9

%

Income Tax Expense (Benefit)

2,055

4,098

(2,043

)

nm

1,164

5,664

(4,500

)

-79.4

%

Net Income

$

17,105

$

12,979

$

4,126

31.8

%

$

20,835

$

17,226

$

3,609

21.0

%

Comprehensive Income:

Foreign Currency Translation

Adjustment

44

272

(228

)

-83.8

%

(142

)

73

(215

)

nm

Total Comprehensive Income

$

17,149

$

13,251

$

3,898

29.4

%

$

20,693

$

17,299

$

3,394

19.6

%

Common Share Data:

Basic Net Income per Share

$

0.14

$

0.11

$

0.03

27.3

%

$

0.18

$

0.15

$

0.03

20.0

%

Diluted Net Income per Share

$

0.14

$

0.11

$

0.03

27.3

%

$

0.17

$

0.15

$

0.02

13.3

%

Weighted Average Common Shares Outstanding

- Basic

118,470

117,221

1,249

1.1

%

118,171

117,187

984

0.8

%

Weighted Average Common Shares Outstanding

- Diluted

119,261

117,869

1,392

1.2

%

119,383

117,557

1,826

1.6

%

nm - not meaningful

HOLLEY INC. and

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEET (In

thousands) (Unaudited)

As of

June 30,

December 31,

2024

2023

Assets

Cash and cash equivalents

$

53,080

$

41,081

Accounts receivable

56,061

48,360

Inventory

173,518

192,260

Prepaids and other current assets

16,348

15,665

Assets held for sale

2,096

-

Total Current Assets

301,103

297,366

Property, Plant and Equipment, Net

43,491

47,206

Goodwill

419,056

419,056

Other Intangibles, Net

403,483

410,465

Other Noncurrent Assets

30,958

29,250

Total Assets

$

1,198,091

$

1,203,343

Liabilities and Stockholders’ Equity

Accounts payable

$

58,595

$

43,692

Accrued interest

359

455

Accrued liabilities

41,130

42,129

Current portion of long-term debt

7,437

7,461

Total Current Liabilities

107,521

93,737

Long-Term Debt, Net of Current Portion

548,698

576,710

Deferred Taxes

48,642

53,542

Other Noncurrent Liabilities

30,061

38,203

Total Liabilities

734,922

762,192

Common Stock

12

12

Additional Paid-In Capital

375,194

373,869

Accumulated Other Comprehensive Loss

(852

)

(710

)

Retained Earnings

88,815

67,980

Total Stockholders’ Equity

463,169

441,151

Total Liabilities and Stockholders’

Equity

$

1,198,091

$

1,203,343

HOLLEY INC. and

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) (Unaudited)

For the thirteen weeks

ended

For the twenty-six weeks

ended

June 30,

July 2,

June 30,

July 2,

2024

2023

2024

2023

Operating

Activities

Net Income

$

17,105

$

12,979

$

20,835

$

17,226

Adjustments to Reconcile to Net Cash

3,621

109

14,592

13,983

Changes in Operating Assets and

Liabilities

4,952

17,656

9,094

3,174

Net Cash Provided by Operating

Activities

25,678

30,744

44,521

34,383

Investing

Activities

Capital Expenditures, Net of

Dispositions

(1,325

)

(1,699

)

(2,416

)

(2,382

)

Net Cash Provided by (Used in) Investing

Activities

(1,325

)

(1,699

)

(2,416

)

(2,382

)

Financing

Activities

Net Change in Debt

(11,857

)

(6,788

)

(28,605

)

(14,072

)

Deferred financing fees

—

(310

)

—

(1,427

)

Payments from Stock-Based Award

Activities

(516

)

(39

)

(1,437

)

(73

)

Net Cash Provided by (Used in) Financing

Activities

(12,373

)

(7,137

)

(30,042

)

(15,572

)

Effect of Foreign Currency Rate

Fluctuations on Cash

(27

)

16

(64

)

161

Net Change in Cash and Cash

Equivalents

11,953

21,924

11,999

16,590

Cash and Cash

Equivalents

Beginning of Period

41,127

20,816

41,081

26,150

End of Period

$

53,080

$

42,740

$

53,080

$

42,740

We present certain information with respect to EBITDA, Adjusted

EBITDA, Adjusted EBITDA Margin, Bank-adjusted EBITDA Leverage

Ratio, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net

Income, Adjusted Diluted EPS and Free Cash Flow as supplemental

measures of our operating performance and believe that such

non-GAAP financial measures are useful to investors in evaluating

our financial performance and in comparing our financial results

between periods because they exclude the impact of certain items

that we do not consider indicative of our ongoing operating

performance. We believe that the presentation of these non-GAAP

financial measures enhances the usefulness of our financial

information by presenting measures that management uses internally

to establish forecasts, budgets, and operational goals to manage

and monitor our business. We believe that these non-GAAP financial

measures help to depict a more realistic representation of the

performance of our underlying business, enabling us to evaluate and

plan more effectively for the future.

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Bank-adjusted

EBITDA Leverage Ratio, Adjusted Gross Profit, Adjusted Gross

Margin, Adjusted Net Income, Adjusted Diluted EPS and Free Cash

Flow are not prepared in accordance with generally accepted

accounting principles (“GAAP”) and may be different from non-GAAP

and other financial measures used by other companies. These

measures should not be considered as measures of financial

performance under GAAP, and the items excluded from or included in

these metrics are significant components in understanding and

assessing our financial performance. These metrics should not be

considered as alternatives to net income, gross profit, net cash

provided by operating activities, or any other performance

measures, as applicable, derived in accordance with GAAP.

We define EBITDA as earnings before depreciation, amortization

of intangible assets, interest expense, and income tax expense. We

define Adjusted EBITDA as EBITDA adjusted to exclude, to the extent

applicable, restructuring costs, which includes operational

restructuring and integration activities, termination related

benefits, facilities relocation, and executive transition costs;

changes in the fair value of the warrant liability; changes in the

fair value of the earn-out liability; equity-based compensation

expense; inventory charges primarily due to product rationalization

initiatives that are part of a portfolio transformation aimed at

eliminating unprofitable or slow-moving SKUs; gain or loss on the

early extinguishment of debt; notable items that we do not believe

are reflective of our underlying operating performance, including

litigation settlements and certain costs incurred for advisory

services related to identifying performance initiatives; and other

expenses or gains, which includes gains or losses from disposal of

fixed assets, franchise taxes, and gains or losses from foreign

currency transactions. We define Adjusted EBITDA Margin as Adjusted

EBITDA divided by net sales.

HOLLEY INC. and

SUBSIDIARIES USE AND RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (In thousands) (Unaudited)

For the thirteen weeks

ended

For the twenty-six weeks

ended

June 30,

July 2,

June 30,

July 2,

2024

2023

2024

2023

Net Income

$

17,105

$

12,979

$

20,835

$

17,226

Adjustments:

Interest Expense, Net

13,178

9,899

24,182

28,197

Income Tax Expense

2,055

4,098

1,164

5,664

Depreciation

2,669

2,468

5,133

4,953

Amortization

3,435

3,674

6,871

7,353

EBITDA

38,442

33,118

58,185

63,393

Restructuring Costs

(3

)

352

612

1,691

Change in Fair Value of Warrant

Liability

(3,402

)

2,017

(6,529

)

3,452

Change in Fair Value of Earn-Out

Liability

(1,058

)

961

(1,707

)

1,389

Equity-Based Compensation Expense

1,621

1,806

2,762

2,200

Inventory Charges (Gain)

(878

)

(800

)

8,835

(800

)

Loss on Early Extinguishment of Debt

—

—

141

—

Notable Items

2,594

(16

)

5,694

8

Other Expense

102

485

94

536

Adjusted EBITDA

$

37,418

$

37,923

$

68,087

$

71,869

Net Sales

$

169,496

$

175,262

$

328,132

$

347,467

Net Income Margin

10.1

%

7.4

%

6.3

%

5.0

%

Adjusted EBITDA Margin

22.1

%

21.6

%

20.7

%

20.7

%

We define the Bank-adjusted EBITDA Leverage Ratio as Net Debt

divided by our Bank-adjusted EBITDA for the trailing twelve-month

(“TTM”) period, as defined under our Credit Agreement entered into

in November 2021, as amended, which is used in calculating covenant

compliance.

TTM June 30, 2024

Net Income

$

22,789

Adjustments:

Interest Expense, Net

56,731

Income Tax Expense (Benefit)

3,899

Depreciation

10,488

Amortization

14,075

EBITDA

107,982

Restructuring Costs

1,562

Change in Fair Value of Warrant

Liability

(5,870

)

Change in Fair Value of Earn-Out

Liability

(793

)

Equity-Based Compensation Expense

7,853

Inventory Charges

8,835

Gain on Early Extinguishment of Debt

(560

)

Notable Items

6,971

Other Expense

323

Adjusted EBITDA

126,303

Additional Permitted Charges

1,903

Adjusted EBITDA per Credit

Agreement

$

128,206

Total Debt

$

565,317

Less: Permitted Cash and Cash

Equivalents

50,000

Net Indebtedness per Credit Agreement

$

515,317

Bank-adjusted EBITDA Leverage Ratio

4.02 x

We define adjusted gross profit as gross profit excluding

inventory charges primarily due to product rationalization

initiatives that are part of a portfolio transformation aimed at

eliminating unprofitable or slow-moving SKUs. We define Adjusted

Gross Margin as Adjusted Gross Profit divided by net sales.

For the thirteen weeks

ended

For the twenty-six weeks

ended

June 30,

July 2,

June 30,

July 2,

2024

2023

2024

2023

Gross Profit

$

70,293

$

69,748

$

122,352

$

137,461

Adjust for: Inventory Charges (Gains)

(878

)

(800)

8,835

(800)

Adjusted Gross Profit

$

69,415

$

68,948

$

131,187

$

136,661

Net Sales

$

169,496

$

175,262

$

328,132

$

347,467

Gross Margin

41.5

%

39.8

%

37.3

%

39.6

%

Adjusted Gross Margin

41.0

%

39.3

%

40.0

%

39.3

%

We define Adjusted Net Income as earnings excluding the

after-tax effect of changes in the fair value of the warrant

liability, changes in the fair value of the earn-out liability, and

gain or loss on the early extinguishment of debt. We define

Adjusted Diluted EPS as Adjusted Net Income on a per share basis.

Management uses these measures to focus on on-going operations and

believes that it is useful to investors because it enables them to

perform meaningful comparisons of past and present consolidated

operating results. We believe that using this information, along

with net income and net income per diluted share, provides for a

more complete analysis of the results of operations.

For the thirteen weeks

ended

For the twenty-six weeks

ended

June 30,

July 2,

June 30,

July 2,

2024

2023

2024

2023

Net Income

$

17,105

$

12,979

$

20,835

$

17,226

Special items:

Adjust for: Change in Fair Value of

Warrant Liability

(3,402

)

2,017

(6,529

)

3,452

Adjust for: Change in Fair Value of

Earn-Out Liability

(1,058

)

961

(1,707

)

1,389

Adjust for: Loss on Early Extinguishment

of Debt

—

—

111

—

Adjusted Net Income

$

12,645

$

15,957

$

12,710

$

22,067

For the thirteen weeks

ended

For the twenty-six weeks

ended

June 30,

July 2,

June 30,

July 2,

2024

2023

2024

2023

Net Income per Diluted Share

$

0.14

$

0.11

$

0.17

$

0.15

Special items:

Adjust for: Change in Fair Value of

Warrant Liability

(0.03

)

0.02

(0.05

)

0.03

Adjust for: Change in Fair Value of

Earn-Out Liability

(0.01

)

0.01

(0.01

)

0.01

Adjust for: Loss on Early Extinguishment

of Debt

—

—

—

—

Adjusted Diluted EPS

$

0.10

$

0.14

$

0.11

$

0.19

We define Free Cash Flow as net cash provided by operating

activities minus cash payments for capital expenditures, net of

dispositions. Management believes providing Free Cash Flow is

useful for investors to understand our performance and results of

cash generation after making capital investments required to

support ongoing business operations.

For the thirteen weeks

ended

For the twenty-six weeks

ended

June 30,

July 2,

June 30,

July 2,

2024

2023

2024

2023

Net Cash Provided by Operating

Activities

$

25,678

$

30,744

$

44,521

$

34,383

Capital Expenditures, Net of

Dispositions

(1,325

)

(1,699

)

(2,416

)

(2,382

)

Free Cash Flow

$

24,353

$

29,045

$

42,105

$

32,001

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806428779/en/

Investor Relations: Anthony Rozmus / Neel Sikka Solebury

Strategic Communications 203-428-3324 holley@soleburystrat.com

Media Relations Contacts: Jordan Moore,

jmoore@tinymightyco.com / Rachel Withers, rwithers@tinymightyco.com

Tiny Mighty Communications 615-454-2913

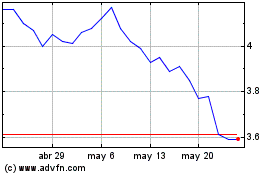

Holley (NYSE:HLLY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Holley (NYSE:HLLY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024