false

0001822928

0001822928

2024-11-08

2024-11-08

0001822928

hlly:CommonStockParValue00001PerShareCustomMember

2024-11-08

2024-11-08

0001822928

hlly:WarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareCustomMember

2024-11-08

2024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 8, 2024

HOLLEY INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-39599

|

87-1727560

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

2445 Nashville Road, Suite B1, Bowling Green, KY

|

|

42101

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(270) 782-2900

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, par value $0.0001 per share

|

|

HLLY

|

|

New York Stock Exchange

|

|

Warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share

|

|

HLLY WS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On November 8, 2024, Holley Inc. (the “Company”) issued a press release announcing its financial results and operational highlights for the Company’s third quarter ended September 29, 2024 and providing outlook and guidance for the fourth quarter and full year 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information under Item 2.02 of this Report, including Exhibit 99.1, attached hereto, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or Securities Act of 1933, as amended, expect as expressly set forth by specific reference in such a filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

HOLLEY INC.

|

| |

|

|

| |

By:

|

/s/ Jesse Weaver

|

| |

|

Name: Jesse Weaver

|

|

Date: November 8, 2024

|

|

Title: Chief Financial Officer

|

Exhibit 99.1

PRESS RELEASE

|

|

2445 Nashville Road, Suite B1

Bowling Green, Kentucky 42101

Holley.com

|

HOLLEY REPORTS THIRD QUARTER 2024 RESULTS;

EXECUTION UPON STRATEGIC INITIATIVES DRIVING GROWTH IN KEY AREAS OF THE BUSINESS

COMPLETEDANOTHER SUCCESSFUL EVENT SEASON WITH STRONG ENTHUSIAST ENGAGEMENT

Delivered third quarter financial results within guidance

Moody’s Ratings Upgrades Holley’s CFR to B2

Targeted efforts and marketing calendar event support normalizing distribution partner inventory levels

BOWLING GREEN, Ky. – November 8, 2024 – Holley Performance Brands (NYSE: HLLY), a leader in automotive aftermarket performance solutions, today announced financial results for its third quarter ended September 29, 2024.

Third Quarter Highlights vs. Prior Year Period

| |

● |

Net Sales decreased (14.4%) to $134.0 million compared to $156.5 million last year |

| |

●

|

Net Loss was $(6.3) million, or $(0.05) per diluted share, compared to Net Income of $0.8 million, or $0.01 per diluted share last year

|

| |

●

|

Net Cash Used by Operating Activities was $(1.7) million compared to Net Cash Provided by Operating Activities of $22.5 million last year |

| |

●

|

Adjusted Net Loss1 was $(0.5) million compared to Adjusted Net Income of $3.5 million last year

|

| |

●

|

Adjusted EBITDA1 was $22.1 million compared to $27.9 million last year |

| |

●

|

Free Cash Flow1 was $(2.1) million compared to $21.7 million last year

|

1See “Use and Reconciliation of Non-GAAP Financial Measures” below.

“We continued our progress in our organizational transformation through the third quarter and are encouraged by the immediate impact that our new team members have made in their short time here. Our organization now operates with unprecedented capabilities and professionalism, as demonstrated by the significant advancements we've made across our business operations, even in a challenging macroeconomic environment. Of note, digital modernization and customer service optimization, B2B sales capabilities, new and targeted product launches and revamped pricing strategy have all been upgraded within the last year and well positioned to drive our organic growth engine,” said Matthew Stevenson, President and CEO of Holley.

Stevenson commented, "We are pleased to report that our well-executed marketing calendar helped drive a 16% year-over-year increase in our direct-to-consumer channel and a 10% median lift in B2B out-the-door sales during the event windows. Our marketing events helped our B2B customers align their inventory positions with overall market demand. Also, through focused effort, strategy, and execution, we are seeing significant growth in some of our power brands year to date, such as ADS, Stilo, Dinan, APR, and Simpson, some up as much as over 30%.

However, overall quarterly sales were impacted by distributor inventory normalization driven by two significant factors: alignment to overall macro demand and our greatly improved order fulfillment capability. Our lead times are significantly better than a year ago, so our major customers are reducing their required safety stock.

Our operational efforts also contributed to the quarter's success, with year-over-year improvements in Gross Margin, a 133% increase in revenue per SKU year-to-date, and a 25% rise in new product revenue year-to-date. Additionally, we concluded the event season with strong attendance at our flagship LS Fest East event in Bowling Green, which attracted record attendance of 45,000 enthusiasts."

Key Operating Metrics and Strategic Highlights

| |

●

|

Growth in significant areas of the business, including DTC and multiple key power brands |

| |

●

|

Total net inventory reduced to $179.3 million compared to $207.2 million Q3 of last year; inventory turns improved to 2.2x compared to 1.9x last year |

| |

●

|

Moody’s Ratings (Moody’s) upgraded Holley's corporate family rating (CFR) to B2 from B3, probability of default rating to B2-PD from B3-PD and senior secured ratings to B2 from B3, noting that the outlook remains stable and the speculative grade liquidity (SGL) rating is unchanged at SGL-2 on August 8, 2024 |

| |

● |

Holley’s bank-adjusted EBITDA leverage ratio1 at quarter end of 4.25x was well below covenant ceiling of 5.00x |

1See “Use and Reconciliation of Non-GAAP Financial Measures” below.

Jesse Weaver, Holley's CFO, added, "We continued to make progress with our financial priorities in the third quarter. We were, once again, recognized by the ratings agencies for the work we have done to strengthen our balance sheet shown by the Moody’s ratings upgrades in August.”

Weaver added, "While our sales were at the low end of the guidance range, this was largely due to continued softness in the industry and our distribution partners taking advantage of the successful out-the-door sales events to clean up their inventories going into the back half of the year. Overall, we're encouraged by our out-the-door sales numbers relative to the overall market and believe that, despite being down, our efforts to partner more closely with distribution partners and investments in DTC are allowing us to maintain our share gains in this challenging environment. Given the performance in Q3 and the continued softness impacting our consumer base, we have lowered our expectations for the full year. While we’re excited about continuing our expanded channel partnership going into Holley Days, we believe this revised outlook is warranted given current industry trends and the current level of uncertainty around distribution partner inventory adjustments going into 2025."

Outlook

Holley is providing the following outlook for the fourth quarter and full-year 2024:

|

Metric

|

Fourth Quarter 2024 Outlook

|

Full Year 2024 Outlook

|

|

Net Sales

|

$133 - $143 million

|

$595 - $605 million

|

|

Adjusted EBITDA*

|

$24 - $29 million

|

$115 - $120 million

|

|

Capital Expenditures

|

|

$6 - $8 million

|

|

Depreciation and Amortization Expense

|

|

$23 - $25 million

|

|

Interest Expense

|

|

$50 - $55 million

|

|

Bank-adjusted EBITDA Leverage Ratio*

|

|

4.35x - 4.15x

|

* Holley is not providing reconciliations of forward-looking fourth quarter 2024 and full year 2024 Adjusted EBITDA outlook and full year 2024 Bank-adjusted EBITDA Leverage Ratio outlook because certain information necessary to calculate the most comparable GAAP measure, net income, is unavailable due to the uncertainty and inherent difficulty of predicting the occurrence and the future financial statement impact of certain items. Therefore, as a result of the uncertainty and variability of the nature and amount of future adjustments, which could be significant, Holley is unable to provide these forward-looking reconciliations without unreasonable effort. Accordingly, Holley is relying on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude these reconciliations.

Holley notes that its outlook for the fourth quarter and full-year 2024 may vary due to changes in assumptions or market conditions and other factors described below under “Forward-Looking Statements.”

Conference Call

A conference call and audio webcast has been scheduled for 8:30 a.m. Eastern Time today to discuss these results. Investors, analysts, and members of the media interested in listening to the live presentation are encouraged to join a webcast of the call available on the investor relations portion of the Company’s website at investor.holley.com. For those that cannot join the webcast, you can participate by dialing 877-407-4019 (Toll Free) or 201-689-8337 (Toll) using the access code of 13748642.

For those unable to participate, a telephone replay recording will be available until Friday, November 15, 2024. To access the replay, please call 877-660-6853 (Toll Free) or 201-612-7415 (Toll) and enter confirmation code 13748642. A web-based archive of the conference call will also be available on the Company’s website.

Additional Financial Information

The Investor Relations page of Holley’s website, investor.holley.com contains a significant amount of financial information about Holley, including our earnings presentation, which can be found under Events & Presentations. Holley encourages investors to visit this website regularly, as information is updated, and new information is posted.

About Holley Inc.

Holley Performance Brands (NYSE: HLLY) is a leading designer, marketer, and manufacturer of high-performance products for car and truck enthusiasts. Holley offers a leading portfolio of iconic brands that deliver innovation and inspiration to a large and diverse community of millions of avid automotive enthusiasts who are passionate about the performance and personalization of their classic and modern cars. Holley has disrupted the performance category by putting the enthusiast consumer first, developing innovative new products, and building a robust M&A process that has added meaningful scale and diversity to its platform. For more information on Holley, visit https://www.holley.com.

Forward-Looking Statements

Certain statements in this press release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Holley’s future financial or operating performance. For example, projections of future revenue and adjusted EBITDA and other metrics, along with statements regarding the impact of organizational changes, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “or” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Holley and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: 1) the ability of Holley to grow and manage growth profitably which may be affected by, among other things, competition; to maintain relationships with customers and suppliers; and to retain its management and key employees; 2) Holley’s ability to compete effectively in our market; 3) Holley’s ability to successfully design, develop, and market new products; 4) Holley’s ability to respond to changes in vehicle ownership and type; 5) Holley’s ability to maintain and strengthen demand for our products; 6) Holley’s ability to effectively manage our growth; 7) Holley’s ability to attract new customers in a cost-effective manner; 8) Holley’s ability to expand into additional consumer markets; 9) costs related to Holley being a public company; 10) disruptions to Holley’s operations, including as a result of cybersecurity incidents; 11) changes in applicable laws or regulations; 12) the outcome of any legal proceedings that have been or may be instituted against Holley; 13) general economic and political conditions, including the current macroeconomic environment, political tensions, and war (including the conflict in Ukraine, the conflict in the Middle East, and the possible expansion of such conflicts and potential geopolitical consequences); 14) the possibility that Holley may be adversely affected by other economic, business, and/or competitive factors, including recent events affecting the financial services industry (such as the closures of certain regional banks); 15) Holley’s estimates and expectations of its financial performance and future growth prospects; 16) Holley’s ability to anticipate and manage through disruptions and higher costs in manufacturing, supply chain, logistical operations, and shortages of certain company products in distribution channels; and 17) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Annual Report on Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 14, 2024, and/or disclosed in any subsequent filings with the SEC. Although Holley believes the expectations reflected in the forward-looking statements are reasonable, nothing in this press release should be regarded as a representation by any person that the forward-looking statements or projections set forth herein will be achieved or that any of the contemplated results of such forward looking statements or projections will be achieved. There may be additional risks that Holley presently does not know or that Holley currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Holley undertakes no duty to update these forward-looking statements, except as otherwise required by law.

Investor Relations:

Anthony Rozmus / Neel Sikka

Solebury Strategic Communications

203-428-3324

holley@soleburystrat.com

Media Relations Contacts:

Jordan Moore, jmoore@tinymightyco.com / Rachel Withers, rwithers@tinymightyco.com

Tiny Mighty Communications

615-454-2913

[Financial Tables to Follow]

|

HOLLEY INC. and SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

For the thirteen weeks ended

|

|

|

For the thirty-nine weeks ended

|

|

| |

|

September 29,

|

|

|

October 1,

|

|

|

Variance

|

|

|

Variance

|

|

|

September 29,

|

|

|

October 1,

|

|

|

Variance

|

|

|

Variance

|

|

| |

|

2024

|

|

|

2023

|

|

|

($)

|

|

|

(%)

|

|

|

2024

|

|

|

2023

|

|

|

($)

|

|

|

(%)

|

|

|

Net Sales

|

|

$ |

134,038 |

|

|

$ |

156,530 |

|

|

$ |

(22,492 |

) |

|

|

-14.4 |

% |

|

$ |

462,170 |

|

|

$ |

503,997 |

|

|

$ |

(41,827 |

) |

|

|

-8.3 |

% |

|

Cost of Goods Sold

|

|

|

81,732 |

|

|

|

98,156 |

|

|

|

(16,424 |

) |

|

|

-16.7 |

% |

|

|

287,512 |

|

|

|

308,162 |

|

|

|

(20,650 |

) |

|

|

-6.7 |

% |

|

Gross Profit

|

|

|

52,306 |

|

|

|

58,374 |

|

|

|

(6,068 |

) |

|

|

-10.4 |

% |

|

|

174,658 |

|

|

|

195,835 |

|

|

|

(21,177 |

) |

|

|

-10.8 |

% |

|

Selling, General, and Administrative

|

|

|

30,109 |

|

|

|

28,880 |

|

|

|

1,229 |

|

|

|

4.3 |

% |

|

|

97,675 |

|

|

|

87,998 |

|

|

|

9,677 |

|

|

|

11.0 |

% |

|

Research and Development Costs

|

|

|

4,620 |

|

|

|

6,100 |

|

|

|

(1,480 |

) |

|

|

-24.3 |

% |

|

|

13,743 |

|

|

|

18,935 |

|

|

|

(5,192 |

) |

|

|

-27.4 |

% |

|

Amortization of Intangible Assets

|

|

|

3,436 |

|

|

|

3,687 |

|

|

|

(251 |

) |

|

|

-6.8 |

% |

|

|

10,307 |

|

|

|

11,040 |

|

|

|

(733 |

) |

|

|

-6.6 |

% |

|

Restructuring Costs

|

|

|

954 |

|

|

|

415 |

|

|

|

539 |

|

|

|

129.9 |

% |

|

|

1,566 |

|

|

|

2,106 |

|

|

|

(540 |

) |

|

|

-25.6 |

% |

|

Write-down of assets held-for-sale

|

|

|

7,505 |

|

|

|

- |

|

|

|

7,505 |

|

|

|

100.0 |

% |

|

|

7,505 |

|

|

|

- |

|

|

|

7,505 |

|

|

|

100.0 |

% |

|

Other Operating Expense (Income)

|

|

|

119 |

|

|

|

(28 |

) |

|

|

147 |

|

|

|

nm |

|

|

|

213 |

|

|

|

508 |

|

|

|

(295 |

) |

|

|

-58.1 |

% |

|

Operating Expense

|

|

|

46,743 |

|

|

|

39,054 |

|

|

|

7,689 |

|

|

|

19.7 |

% |

|

|

131,009 |

|

|

|

120,587 |

|

|

|

10,422 |

|

|

|

8.6 |

% |

|

Operating Income

|

|

|

5,563 |

|

|

|

19,320 |

|

|

|

(13,757 |

) |

|

|

-71.2 |

% |

|

|

43,649 |

|

|

|

75,248 |

|

|

|

(31,599 |

) |

|

|

-42.0 |

% |

|

Change in Fair Value of Warrant Liability

|

|

|

(1,041 |

) |

|

|

2,064 |

|

|

|

(3,105 |

) |

|

|

nm |

|

|

|

(7,570 |

) |

|

|

5,516 |

|

|

|

(13,086 |

) |

|

|

-237.2 |

% |

|

Change in Fair Value of Earn-Out Liability

|

|

|

(634 |

) |

|

|

700 |

|

|

|

(1,334 |

) |

|

|

nm |

|

|

|

(2,341 |

) |

|

|

2,089 |

|

|

|

(4,430 |

) |

|

|

-212.1 |

% |

|

Loss on Early Extinguishment of Debt

|

|

|

— |

|

|

|

— |

|

|

|

- |

|

|

|

nm |

|

|

|

141 |

|

|

|

— |

|

|

|

141 |

|

|

|

100.0 |

% |

|

Interest Expense, Net

|

|

|

15,010 |

|

|

|

13,712 |

|

|

|

1,298 |

|

|

|

9.5 |

% |

|

|

39,192 |

|

|

|

41,909 |

|

|

|

(2,717 |

) |

|

|

-6.5 |

% |

|

Non-Operating Expense

|

|

|

13,335 |

|

|

|

16,476 |

|

|

|

(3,141 |

) |

|

|

-19.1 |

% |

|

|

29,422 |

|

|

|

49,514 |

|

|

|

(20,092 |

) |

|

|

-40.6 |

% |

|

Income Before Income Taxes

|

|

|

(7,772 |

) |

|

|

2,844 |

|

|

|

(10,616 |

) |

|

|

-373.3 |

% |

|

|

14,227 |

|

|

|

25,734 |

|

|

|

(11,507 |

) |

|

|

-44.7 |

% |

|

Income Tax Expense (Benefit)

|

|

|

(1,484 |

) |

|

|

2,092 |

|

|

|

(3,576 |

) |

|

|

nm |

|

|

|

(320 |

) |

|

|

7,756 |

|

|

|

(8,076 |

) |

|

|

-104.1 |

% |

|

Net Income

|

|

$ |

(6,288 |

) |

|

$ |

752 |

|

|

$ |

(7,040 |

) |

|

|

-936.2 |

% |

|

$ |

14,547 |

|

|

$ |

17,978 |

|

|

$ |

(3,431 |

) |

|

|

-19.1 |

% |

|

Comprehensive Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency Translation Adjustment

|

|

|

386 |

|

|

|

(176 |

) |

|

|

562 |

|

|

|

-319.3 |

% |

|

|

244 |

|

|

|

(103 |

) |

|

|

347 |

|

|

|

-336.9 |

% |

|

Total Comprehensive Income

|

|

$ |

(5,902 |

) |

|

$ |

576 |

|

|

$ |

(6,478 |

) |

|

|

-1124.7 |

% |

|

$ |

14,791 |

|

|

$ |

17,875 |

|

|

$ |

(3,084 |

) |

|

|

-17.3 |

% |

|

Common Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Net Income per Share

|

|

$ |

(0.05 |

) |

|

$ |

0.01 |

|

|

$ |

(0.06 |

) |

|

|

-600.0 |

% |

|

$ |

0.12 |

|

|

$ |

0.15 |

|

|

$ |

(0.03 |

) |

|

|

-20.0 |

% |

|

Diluted Net Income per Share

|

|

$ |

(0.05 |

) |

|

$ |

0.01 |

|

|

$ |

(0.06 |

) |

|

|

-600.0 |

% |

|

$ |

0.12 |

|

|

$ |

0.15 |

|

|

$ |

(0.03 |

) |

|

|

-20.0 |

% |

|

Weighted Average Common Shares Outstanding - Basic

|

|

|

118,694 |

|

|

|

117,397 |

|

|

|

1,297 |

|

|

|

1.1 |

% |

|

|

118,345 |

|

|

|

117,257 |

|

|

|

1,088 |

|

|

|

0.9 |

% |

|

Weighted Average Common Shares Outstanding - Diluted

|

|

|

118,694 |

|

|

|

119,246 |

|

|

|

(552 |

) |

|

|

-0.5 |

% |

|

|

119,154 |

|

|

|

118,120 |

|

|

|

1,034 |

|

|

|

0.9 |

% |

|

nm - not meaningful

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOLLEY INC. and SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEET

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

As of |

|

| |

|

September 29, |

|

|

December 31, |

|

| |

|

2024

|

|

|

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

50,751 |

|

|

$ |

41,081 |

|

|

Accounts receivable

|

|

|

44,492 |

|

|

|

48,360 |

|

|

Inventory

|

|

|

179,285 |

|

|

|

192,260 |

|

|

Prepaids and other current assets

|

|

|

16,332 |

|

|

|

15,665 |

|

|

Assets held for sale

|

|

|

7,696 |

|

|

|

- |

|

|

Total Current Assets

|

|

|

298,556 |

|

|

|

297,366 |

|

|

Property, Plant and Equipment, Net

|

|

|

42,718 |

|

|

|

47,206 |

|

|

Goodwill

|

|

|

413,245 |

|

|

|

419,056 |

|

|

Other Intangibles, Net

|

|

|

398,804 |

|

|

|

410,465 |

|

|

Other Noncurrent Assets

|

|

|

30,911 |

|

|

|

29,250 |

|

|

Total Assets

|

|

$ |

1,184,234 |

|

|

$ |

1,203,343 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

52,738 |

|

|

$ |

43,692 |

|

|

Accrued interest

|

|

|

487 |

|

|

|

455 |

|

|

Accrued liabilities

|

|

|

41,164 |

|

|

|

42,129 |

|

|

Current portion of long-term debt

|

|

|

7,479 |

|

|

|

7,461 |

|

|

Total Current Liabilities

|

|

|

101,868 |

|

|

|

93,737 |

|

|

Long-Term Debt, Net of Current Portion

|

|

|

548,905 |

|

|

|

576,710 |

|

|

Deferred Taxes

|

|

|

45,008 |

|

|

|

53,542 |

|

|

Other Noncurrent Liabilities

|

|

|

29,710 |

|

|

|

38,203 |

|

|

Total Liabilities

|

|

|

725,491 |

|

|

|

762,192 |

|

| |

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

12 |

|

|

|

12 |

|

|

Additional Paid-In Capital

|

|

|

376,670 |

|

|

|

373,869 |

|

|

Accumulated Other Comprehensive Loss

|

|

|

(466 |

) |

|

|

(710 |

) |

|

Retained Earnings

|

|

|

82,527 |

|

|

|

67,980 |

|

|

Total Stockholders’ Equity

|

|

|

458,743 |

|

|

|

441,151 |

|

|

Total Liabilities and Stockholders’ Equity

|

|

$ |

1,184,234 |

|

|

$ |

1,203,343 |

|

|

HOLLEY INC. and SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

For the thirteen weeks ended

|

|

|

For the thirty-nine weeks ended

|

|

| |

|

September 29,

|

|

|

October 1,

|

|

|

September 29,

|

|

|

October 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

(6,288 |

) |

|

$ |

752 |

|

|

$ |

14,547 |

|

|

$ |

17,978 |

|

|

Adjustments to Reconcile to Net Cash

|

|

|

12,879

|

|

|

|

15,463 |

|

|

|

26,832 |

|

|

|

29,446 |

|

|

Changes in Operating Assets and Liabilities

|

|

|

(8,339 |

) |

|

|

6,265 |

|

|

|

1,394 |

|

|

|

9,439 |

|

|

Net Cash Provided by (Used in) Operating Activities

|

|

|

(1,748 |

) |

|

|

22,480 |

|

|

|

42,773 |

|

|

|

56,863 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Expenditures, Net of Dispositions

|

|

|

(311 |

) |

|

|

(743 |

) |

|

|

(2,727 |

) |

|

|

(3,125 |

) |

|

Net Cash Used in Investing Activities

|

|

|

(311 |

) |

|

|

(743 |

) |

|

|

(2,727 |

) |

|

|

(3,125 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Change in Debt

|

|

|

(227 |

) |

|

|

(26,365 |

) |

|

|

(28,832 |

) |

|

|

(40,437 |

) |

|

Deferred financing fees

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,427 |

) |

|

Payments from Stock-Based Award Activities

|

|

|

(45 |

) |

|

|

(1,061 |

) |

|

|

(1,482 |

) |

|

|

(1,134 |

) |

|

Net Cash Used in Financing Activities

|

|

|

(272 |

) |

|

|

(27,426 |

) |

|

|

(30,314 |

) |

|

|

(42,998 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Foreign Currency Rate Fluctuations on Cash

|

|

|

2 |

|

|

|

(218 |

) |

|

|

(62 |

) |

|

|

(57 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Change in Cash and Cash Equivalents

|

|

|

(2,329 |

) |

|

|

(5,907 |

) |

|

|

9,670 |

|

|

|

10,683 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of Period

|

|

|

53,080 |

|

|

|

42,740 |

|

|

|

41,081 |

|

|

|

26,150 |

|

|

End of Period

|

|

$ |

50,751 |

|

|

$ |

36,833 |

|

|

$ |

50,751 |

|

|

$ |

36,833 |

|

We present certain information with respect to EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Bank-adjusted EBITDA Leverage Ratio, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net Income, Adjusted Diluted EPS and Free Cash Flow as supplemental measures of our operating performance and believe that such non-GAAP financial measures are useful to investors in evaluating our financial performance and in comparing our financial results between periods because they exclude the impact of certain items that we do not consider indicative of our ongoing operating performance. We believe that the presentation of these non-GAAP financial measures enhances the usefulness of our financial information by presenting measures that management uses internally to establish forecasts, budgets, and operational goals to manage and monitor our business. We believe that these non-GAAP financial measures help to depict a more realistic representation of the performance of our underlying business, enabling us to evaluate and plan more effectively for the future.

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Bank-adjusted EBITDA Leverage Ratio, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net Income, Adjusted Diluted EPS and Free Cash Flow are not prepared in accordance with generally accepted accounting principles (“GAAP”) and may be different from non-GAAP and other financial measures used by other companies. These measures should not be considered as measures of financial performance under GAAP, and the items excluded from or included in these metrics are significant components in understanding and assessing our financial performance. These metrics should not be considered as alternatives to net income, gross profit, net cash provided by operating activities, or any other performance measures, as applicable, derived in accordance with GAAP.

We define EBITDA as earnings before depreciation, amortization of intangible assets, interest expense, and income tax expense. We define Adjusted EBITDA as EBITDA adjusted to exclude, to the extent applicable, restructuring costs, which includes operational restructuring and integration activities, write-down of assets held-for-sale, termination related benefits, facilities relocation, and executive transition costs; changes in the fair value of the warrant liability; changes in the fair value of the earn-out liability; equity-based compensation expense; inventory charges primarily due to product rationalization initiatives that are part of a portfolio transformation aimed at eliminating unprofitable or slow-moving SKUs; gain or loss on the early extinguishment of debt; notable items that we do not believe are reflective of our underlying operating performance, including litigation settlements and certain costs incurred for advisory services related to identifying performance initiatives; and other expenses or gains, which includes gains or losses from disposal of fixed assets, franchise taxes, and gains or losses from foreign currency transactions. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by net sales.

|

HOLLEY INC. and SUBSIDIARIES

|

|

USE AND RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

For the thirteen weeks ended

|

|

|

For the thirty-nine weeks ended

|

|

| |

|

September 29,

|

|

|

October 1,

|

|

|

September 29,

|

|

|

October 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net Income

|

|

$ |

(6,288 |

) |

|

$ |

752 |

|

|

$ |

14,547 |

|

|

$ |

17,978 |

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense, Net

|

|

|

15,010 |

|

|

|

13,712 |

|

|

|

39,192 |

|

|

|

41,909 |

|

|

Income Tax Expense (Benefit)

|

|

|

(1,484 |

) |

|

|

2,092 |

|

|

|

(320 |

) |

|

|

7,756 |

|

|

Depreciation

|

|

|

2,231 |

|

|

|

2,785 |

|

|

|

7,364 |

|

|

|

7,738 |

|

|

Amortization

|

|

|

3,436 |

|

|

|

3,687 |

|

|

|

10,307 |

|

|

|

11,040 |

|

|

EBITDA

|

|

|

12,905 |

|

|

|

23,028 |

|

|

|

71,090 |

|

|

|

86,421 |

|

|

Restructuring Costs

|

|

|

954 |

|

|

|

415 |

|

|

|

1,566 |

|

|

|

2,106 |

|

|

Change in Fair Value of Warrant Liability

|

|

|

(1,041 |

) |

|

|

2,064 |

|

|

|

(7,570 |

) |

|

|

5,516 |

|

|

Change in Fair Value of Earn-Out Liability

|

|

|

(634 |

) |

|

|

700 |

|

|

|

(2,341 |

) |

|

|

2,089 |

|

|

Equity-Based Compensation Expense

|

|

|

1,521 |

|

|

|

2,970 |

|

|

|

4,283 |

|

|

|

5,170 |

|

|

Write-down of Assets Held-for-Sale

|

|

|

7,505 |

|

|

|

- |

|

|

|

7,505 |

|

|

|

- |

|

|

Strategic Product Rationalization Charge

|

|

|

— |

|

|

|

— |

|

|

|

8,835 |

|

|

|

(800 |

) |

|

Loss on Early Extinguishment of Debt

|

|

|

— |

|

|

|

— |

|

|

|

141 |

|

|

|

— |

|

|

Notable Items

|

|

|

785 |

|

|

|

556 |

|

|

|

6,479 |

|

|

|

564 |

|

|

Other Expense (Income)

|

|

|

119 |

|

|

|

(28 |

) |

|

|

213 |

|

|

|

508 |

|

|

Adjusted EBITDA

|

|

$ |

22,114 |

|

|

$ |

29,705 |

|

|

$ |

90,201 |

|

|

$ |

101,574 |

|

|

Net Sales

|

|

$ |

134,038 |

|

|

$ |

156,530 |

|

|

$ |

462,170 |

|

|

$ |

503,997 |

|

|

Net Income Margin

|

|

|

-4.7 |

% |

|

|

0.5 |

% |

|

|

3.1 |

% |

|

|

3.6 |

% |

|

Adjusted EBITDA Margin

|

|

|

16.5 |

% |

|

|

19.0 |

% |

|

|

19.5 |

% |

|

|

20.2 |

% |

We define the Bank-adjusted EBITDA Leverage Ratio as Net Debt divided by our Bank-adjusted EBITDA for the trailing twelve-month ("TTM") period, as defined under our Credit Agreement entered into in November 2021, as amended, which is used in calculating covenant compliance.

| |

|

TTM September 29, 2024

|

|

|

Net Income

|

|

$ |

15,749 |

|

|

Adjustments:

|

|

|

|

|

|

Interest Expense, Net

|

|

|

58,029 |

|

|

Income Tax Expense (Benefit)

|

|

|

323 |

|

|

Depreciation

|

|

|

9,934 |

|

|

Amortization

|

|

|

13,824 |

|

|

EBITDA

|

|

|

97,859 |

|

|

Restructuring Costs

|

|

|

2,101 |

|

|

Change in Fair Value of Warrant Liability

|

|

|

(8,975 |

) |

|

Change in Fair Value of Earn-Out Liability

|

|

|

(2,127 |

) |

|

Equity-Based Compensation Expense

|

|

|

6,404 |

|

|

Write-down of Assets Held-for-Sale

|

|

|

7,505 |

|

|

Strategic Product Rationalization Charge

|

|

|

8,835 |

|

|

Gain on Early Extinguishment of Debt

|

|

|

(560 |

) |

|

Notable Items

|

|

|

7,200 |

|

|

Other Expense

|

|

|

470 |

|

|

Adjusted EBITDA

|

|

|

118,712 |

|

|

Additional Permitted Charges

|

|

|

2,441

|

|

|

Adjusted EBITDA per Credit Agreement

|

|

$ |

121,153 |

|

|

Total Debt

|

|

$ |

565,126 |

|

|

Less: Permitted Cash and Cash Equivalents

|

|

|

50,000 |

|

|

Net Indebtedness per Credit Agreement

|

|

$ |

515,126 |

|

|

Bank-adjusted EBITDA Leverage Ratio

|

|

4.25 x

|

|

We define adjusted gross profit as gross profit excluding inventory charges primarily due to product rationalization initiatives that are part of a portfolio transformation aimed at eliminating unprofitable or slow-moving SKUs. We define Adjusted Gross Margin as Adjusted Gross Profit divided by net sales.

| |

|

For the thirteen weeks ended

|

|

|

For the thirty-nine weeks ended

|

|

| |

|

September 29,

|

|

|

October 1,

|

|

|

September 29,

|

|

|

October 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Gross Profit

|

|

$ |

52,306 |

|

|

$ |

58,374 |

|

|

$ |

174,658 |

|

|

$ |

195,835 |

|

|

Adjust for: Strategic Product Rationalization Charge

|

|

|

— |

|

|

|

— |

|

|

|

8,835 |

|

|

|

(800 |

) |

|

Adjusted Gross Profit

|

|

$ |

52,306 |

|

|

$ |

58,374 |

|

|

$ |

183,493 |

|

|

$ |

195,035 |

|

|

Net Sales

|

|

$ |

134,038 |

|

|

$ |

156,530 |

|

|

$ |

462,170 |

|

|

$ |

503,997 |

|

|

Gross Margin

|

|

|

39.0 |

% |

|

|

37.3 |

% |

|

|

37.8 |

% |

|

|

38.9 |

% |

|

Adjusted Gross Margin

|

|

|

39.0 |

% |

|

|

37.3 |

% |

|

|

39.7 |

% |

|

|

38.7 |

% |

We define Adjusted Net Income as earnings excluding the after-tax effect of changes in the fair value of the warrant liability, changes in the fair value of the earn-out liability, write-downs of assets held-for-sale, and gain or loss on the early extinguishment of debt. We define Adjusted Diluted EPS as Adjusted Net Income on a per share basis. Management uses these measures to focus on on-going operations and believes that it is useful to investors because it enables them to perform meaningful comparisons of past and present consolidated operating results. We believe that using this information, along with net income and net income per diluted share, provides for a more complete analysis of the results of operations.

| |

|

For the thirteen weeks ended

|

|

|

For the thirty-nine weeks ended

|

|

| |

|

September 29,

|

|

|

October 1,

|

|

|

September 29,

|

|

|

October 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net Income

|

|

$ |

(6,288 |

) |

|

$ |

752 |

|

|

$ |

14,547 |

|

|

$ |

17,978 |

|

|

Special items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjust for: Change in Fair Value of Warrant Liability

|

|

|

(1,041 |

) |

|

|

2,064 |

|

|

|

(7,570 |

) |

|

|

5,516 |

|

|

Adjust for: Change in Fair Value of Earn-Out Liability

|

|

|

(634 |

) |

|

|

700 |

|

|

|

(2,341 |

) |

|

|

2,089 |

|

|

Adjust for: Write-down of Assets Held-for-Sale

|

|

|

7,505 |

|

|

|

— |

|

|

|

7,505 |

|

|

|

— |

|

|

Adjust for: Loss on Early Extinguishment of Debt

|

|

|

— |

|

|

|

— |

|

|

|

111 |

|

|

|

— |

|

|

Adjusted Net Income

|

|

$ |

(458 |

) |

|

$ |

3,516 |

|

|

$ |

12,252 |

|

|

$ |

25,583 |

|

| |

|

For the thirteen weeks ended

|

|

|

For the thirty-nine weeks ended

|

|

| |

|

September 29,

|

|

|

October 1,

|

|

|

September 29,

|

|

|

October 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net Income per Diluted Share

|

|

$ |

(0.05 |

) |

|

$ |

0.01 |

|

|

$ |

0.12 |

|

|

$ |

0.15 |

|

|

Special items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjust for: Change in Fair Value of Warrant Liability

|

|

|

(0.01 |

) |

|

|

0.02 |

|

|

|

(0.06 |

) |

|

|

0.05 |

|

|

Adjust for: Change in Fair Value of Earn-Out Liability

|

|

|

(0.01 |

) |

|

|

0.01 |

|

|

|

(0.02 |

) |

|

|

0.02 |

|

|

Adjust for: Write-down of Assets Held-for-Sale

|

|

|

0.06 |

|

|

|

— |

|

|

|

0.06 |

|

|

|

— |

|

|

Adjust for: Loss on Early Extinguishment of Debt

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Adjusted Diluted EPS

|

|

$ |

(0.01 |

) |

|

$ |

0.04 |

|

|

$ |

0.10 |

|

|

$ |

0.22 |

|

We define Free Cash Flow as net cash provided by operating activities minus cash payments for capital expenditures, net of dispositions. Management believes providing Free Cash Flow is useful for investors to understand our performance and results of cash generation after making capital investments required to support ongoing business operations.

| |

|

For the thirteen weeks ended

|

|

|

For the thirty-nine weeks ended

|

|

| |

|

September 29,

|

|

|

October 1,

|

|

|

September 29,

|

|

|

October 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net Cash Provided by (Used in) Operating Activities

|

|

$ |

(1,748 |

) |

|

$ |

22,480 |

|

|

$ |

42,773 |

|

|

$ |

56,863 |

|

|

Capital Expenditures, Net of Dispositions

|

|

|

(311 |

) |

|

|

(743 |

) |

|

|

(2,727 |

) |

|

|

(3,125 |

) |

|

Free Cash Flow

|

|

$ |

(2,059 |

) |

|

$ |

21,737 |

|

|

$ |

40,046 |

|

|

$ |

53,738 |

|

v3.24.3

Document And Entity Information

|

Nov. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HOLLEY INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 08, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39599

|

| Entity, Tax Identification Number |

87-1727560

|

| Entity, Address, Address Line One |

2445 Nashville Road, Suite B1

|

| Entity, Address, City or Town |

Bowling Green

|

| Entity, Address, State or Province |

KY

|

| Entity, Address, Postal Zip Code |

42101

|

| City Area Code |

270

|

| Local Phone Number |

782-2900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001822928

|

| CommonStockParValue00001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

HLLY

|

| Security Exchange Name |

NYSE

|

| WarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HLLY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hlly_CommonStockParValue00001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hlly_WarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

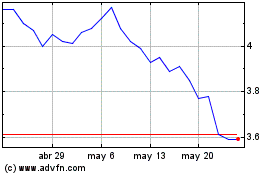

Holley (NYSE:HLLY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Holley (NYSE:HLLY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024