Helix Announces Its 6.75% Convertible Senior Notes Due 2026 Will Remain Convertible

29 Diciembre 2023 - 4:00PM

Business Wire

Helix Energy Solutions Group, Inc. (NYSE: HLX) announced today

that its 6.75% Convertible Senior Notes due 2026 (the “Notes”) will

remain convertible at the option of the holders from January 1,

2024 through March 31, 2024, as provided in the indenture governing

the Notes (as supplemented, the “Indenture”).

This press release is made pursuant to a provision in the

Indenture that requires publication of this notice of

convertibility. As of January 1, 2024 the Notes will be convertible

and will remain convertible through March 31, 2024, as a result of

the Closing Sale Price of Helix’s Common Stock being more than the

Conversion Trigger Price in effect on each applicable Trading Day

during at least 20 of the last 30 consecutive Trading Days of the

calendar quarter ending December 31, 2023.

To convert interests in a Global Note held through the

Depository Trust Company (“DTC”), a holder must deliver to DTC the

appropriate instruction form for conversion pursuant to DTC’s

conversion program and pay the amount of interest and tax or duty,

if required. To convert a Certificated Note, a holder must (a)

complete and manually sign the Conversion Notice, as set forth in

the Note, with appropriate signature guarantee, or facsimile of the

Conversion Notice and deliver the completed Conversion Notice to

The Bank of New York Mellon Trust Company, N.A., the trustee, as

conversion agent (the “Conversion Agent”), (b) surrender the Note

to the Conversion Agent, (c) furnish appropriate endorsements and

transfer documents, if required by the Registrar or Conversion

Agent, (d) pay the amount of interest, if required and (e) pay any

tax or duty, if required.

Upon surrendering Notes for conversion in accordance with the

Indenture, a holder of the Notes will receive through the

Conversion Agent either shares of Common Stock, cash or a

combination of cash and shares of Common Stock, at Helix’s

election.

Holders of the Notes may obtain further information on how to

convert their Notes by contacting the Conversion Agent at: The Bank

of New York Mellon Trust Company, N.A., 2001 Bryan Street, 10th

Floor, Dallas, TX 75201, Attention: Corporate Trust Reorg. or email

inquiries to CT_Reorg_Unit_Inquiries@bnymellon.com.

Capitalized terms used in this press release and not otherwise

defined herein have the meanings given to them in the

Indenture.

About Helix

Helix Energy Solutions Group, Inc., headquartered in Houston,

Texas, is an international offshore energy services company that

provides specialty services to the offshore energy industry, with a

focus on well intervention, robotics and full field decommissioning

operations. Our services are centered on a three-legged business

model well positioned for a global energy transition by maximizing

production of remaining oil and gas reserves, supporting renewable

energy developments and decommissioning end-of-life oil and gas

fields. For more information about Helix, please visit our website

at www.helixesg.com.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks, uncertainties and assumptions that could cause our

results to differ materially from those expressed or implied by

such forward-looking statements. All statements, other than

statements of historical fact, are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, without limitation, any statements regarding

settlement of the Notes, conversion consideration and any impact on

our financial and operating results and estimates. Forward-looking

statements are subject to a number of known and unknown risks,

uncertainties and other factors that could cause results to differ

materially from those in the forward-looking statements, including

but not limited to market conditions and other risks described from

time to time in our reports filed with the Securities and Exchange

Commission (“SEC”), including our most recently filed Annual Report

on Form 10-K and in our other filings with the SEC, which are

available free of charge on the SEC's website at www.sec.gov. We

assume no obligation and do not intend to update these

forward-looking statements, which speak only as of their respective

dates, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231229204983/en/

Erik Staffeldt, Executive Vice President and CFO Ph:

281-618-0465 email: estaffeldt@helixesg.com

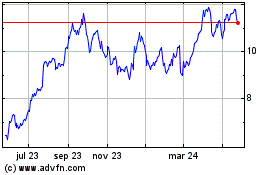

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

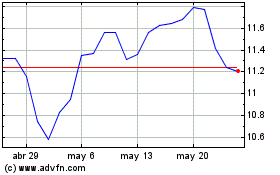

De Ene 2025 a Feb 2025

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025