UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number 001-36906

INTERNATIONAL GAME TECHNOLOGY PLC

(Translation of registrant’s name into English)

10 Finsbury Square, Third Floor

London, EC2A 1AF

United Kingdom

(Address of principal executive offices)

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

| Form 20-F | ☒ | Form 40-F | ☐ | |

| | | | |

| | | | |

| | | | |

OTHER EVENTS

As previously disclosed, on July 26, 2024, International Game Technology PLC, a public limited company incorporated under the laws of England and Wales ("IGT"), and Ignite Rotate LLC, a Delaware limited liability company and a direct wholly owned subsidiary of IGT (“Spinco”), entered into definitive agreements with Everi Holdings Inc., a Delaware corporation ("Everi"), Voyager Parent, LLC, a Delaware limited liability company (“Buyer”), and Voyager Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of Buyer (“Buyer Sub,” and together with the IGT, Spinco, Everi and Buyer, the “Parties”), pursuant to which, and subject to the terms and conditions of the definitive agreements, the Parties agreed to consummate certain proposed transactions (collectively, the “Proposed Transaction”), as a result of which, among other matters, IGT's Gaming & Digital and Everi will be simultaneously acquired by a newly formed holding company owned by funds managed by affiliates of Apollo Global Management, Inc.

The consummation of the Proposed Transaction is conditioned upon, among other matters, the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). The applicable waiting period under the HSR Act expired at 11:59 p.m., Eastern time, on November 20, 2024. The Proposed Transaction also remains subject to other conditions and regulatory approvals.

Forward-Looking Statements

This Form 6-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, related to Proposed Transaction. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws. These forward-looking statements involve risks and uncertainties that could significantly affect the financial or operating results of IGT. These forward-looking statements may be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “foresee,” “intend,” “may,” “plan,” “project,” “should,” “will,” and “would” and the negative of these terms or other similar expressions. Forward-looking statements in this Form 6-K include, among other things, statements about the anticipated steps associated with, and the ability of the Parties to consummate, the Proposed Transaction. These forward-looking statements involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. These risks and uncertainties include, among other things, risks related to the possibility that the conditions to the consummation of the Proposed Transaction will not be satisfied in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits of the Proposed Transaction; the ability to retain and hire key personnel; negative effects of the announcement or failure to consummate the Proposed Transaction on the market price of IGT’s ordinary shares and on IGT’s operating results; the occurrence of any event, change or other circumstances that could give rise to the termination of the separation and sale agreement and/or the merger agreement relating to the Proposed Transaction; significant transaction costs, fees, expenses and charges; operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining employee, customer, or other business, contractual, or operational relationships following the Proposed Transaction announcement or closing of the Proposed Transaction and the diversion of the attention of the management team of IGT from its ongoing business); failure to consummate or delay in consummating the Proposed Transaction for any reason; risks relating to any resurgence of the COVID-19 pandemic or similar public health crises; risks related to competition in the gaming and lottery industries; dependence on significant licensing arrangements, customers, or other third parties; risks related to the financing of the Proposed Transaction; economic changes in global markets, such as currency exchange, inflation and interest rates, and recession; government policies (including policy changes affecting the gaming industry, taxation, trade, tariffs, immigration, customs, and border actions) and other external factors that IGT cannot control; regulation and litigation matters relating to the Proposed Transaction; unanticipated adverse effects or liabilities from business divestitures; risks related to intellectual property, privacy matters, and cyber security (including losses and other consequences from failures, breaches, attacks, or disclosures involving information technology infrastructure and data); other business effects (including the effects of industry, market, economic, political, or regulatory conditions); and other risks and uncertainties, including, but not limited to, those described in IGT’s Annual Report on Form 20-F on file with the U.S. Securities and Exchange Commission (the "SEC") and from time to time in other filed reports including IGT’s Reports on Form 6-K.

A further description of risks and uncertainties relating to IGT can be found in its most recent Annual Report on Form 20-F and Reports on Form 6-K, all of which are filed or furnished with the SEC and available at www.sec.gov.

There can be no assurance that the Proposed Transaction will in fact be consummated. IGT does not intend to update the forward-looking statements contained in this Form 6-K as a result of new information or future events or developments, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| Date: November 21, 2024 | INTERNATIONAL GAME TECHNOLOGY PLC |

| | |

| | | |

| | By: | /s/ Pierfrancesco Boccia |

| | | Pierfrancesco Boccia |

| | | Corporate Secretary |

2

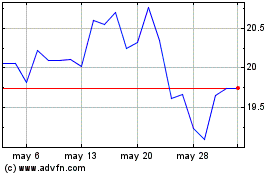

International Game Techn... (NYSE:IGT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

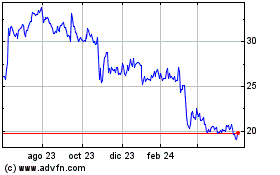

International Game Techn... (NYSE:IGT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024