International Seaways, Inc. (NYSE: INSW) (the “Company,”

“Seaways,” or “INSW”), one of the largest tanker companies

worldwide providing energy transportation services for crude oil

and petroleum products, today reported results for the third

quarter 2024.

HIGHLIGHTS & RECENT DEVELOPMENTS

Quarterly Results:

- Net income for the third quarter of 2024 was $92 million, or

$1.84 per diluted share.

- Adjusted net income(1) for the third quarter of 2024 was $78

million, or $1.57 per diluted share.

- Adjusted EBITDA(1) for the third quarter of 2024 was $130

million.

Robust Balance Sheet:

- Total liquidity was approximately $694 million as of September

30, 2024, including total cash (1) of $153 million and $541 million

undrawn revolving credit capacity.

- Repaid $50 million on the Company’s $500 million RCF,

increasing undrawn revolver capacity.

- Net loan-to-value remained historically low at approximately

13.5% as of September 30, 2024.

Fleet Optimization Program:

- Sold a 2008-built MR for net proceeds of approximately $24

million.

Returns to Shareholders:

- Repurchased 501,646 shares for a total cost of approximately

$25 million, representing an average purchase price of $49.81 per

share.

- Paid a combined $1.50 per share in regular and supplemental

dividends in September 2024.

- Declared a combined dividend of $1.20 per share to be paid in

December 2024, representing 75% of adjusted net income(1) for the

third quarter.

“We continue to execute on our balanced capital allocation

strategy, utilizing our strong cash generation in third quarter to

deliver double-digit returns to our shareholders,” said Lois K.

Zabrocky, International Seaways President and CEO. “Including the

combined dividend of $1.20 per share declared for the fourth

quarter, aggregate dividends in 2024 will total $5.77 per share, or

12% of the average share price. We remain committed to a balanced

capital allocation approach, as we continue to look for attractive

opportunities to enhance our fleet, while optimizing returns to

shareholders.”

Ms. Zabrocky added, “Market fundamentals remain strong for

tankers in the near term, supported by global oil demand growth,

which is expected to be at or above historical growth rates.

Ton-mile demand remains elevated due to geopolitical events that

could take significant time to unwind. While newbuilding orders

have risen to about 13% of the global tanker fleet, nearly half of

the existing fleet is expected to be over 20 years old by the time

the newbuildings deliver into the market. We expect that these

dynamics will continue to drive strong earnings, positioning

Seaways to generate significant free cash flow and continue

building on our track record of investing in our fleet and

returning substantial cash flow to shareholders.”

Jeff Pribor, the Company’s CFO stated, “We returned nearly $100

million to investors in dividends and share repurchases during the

third quarter, representing 84% of the prior quarter’s adjusted net

income that was returned to shareholders. With ample cash and

liquidity of $694 million, a record low net loan-to-value and low

spot cash break evens, we are well-positioned to continue creating

value by executing our balanced capital allocation strategy.”

THIRD QUARTER 2024 RESULTS

Net income for the third quarter of 2024 was $92 million, or

$1.84 per diluted share, compared to net income of $98 million, or

$1.99 per diluted share, for the third quarter of 2023. The

decrease was primarily driven by a decrease in TCE revenues(1) and

an increase in vessel expenses and depreciation and amortization,

reflecting the delivery of six modern MR vessels during the second

quarter of 2024, partially offset by gains on the sale of one

vessel in the third quarter of 2024.

Shipping revenues for the third quarter were $225 million,

compared to $242 million for the third quarter of 2023.

Consolidated TCE revenues(1) for the third quarter were $220

million, compared to $236 million for the third quarter of

2023.

Adjusted EBITDA(1) for the third quarter was $130 million,

compared to $151 million for the third quarter of 2023.

Crude Tankers

Shipping revenues for the Crude Tankers segment were $103

million for the third quarter of 2024, compared to $114 million for

the third quarter of 2023. TCE revenues(1) were $99 million for the

third quarter, compared to $111 million for the third quarter of

2023. This decrease was attributable to a decrease in spot rates as

the average spot earnings of the VLCC, Suezmax and Aframax sectors

were approximately $29,700, $38,000 and $25,100 per day,

respectively, compared with approximately $41,000, $38,700 and

$34,000 per day, respectively, during the third quarter of

2023.

Product Carriers

Shipping revenues for the Product Carriers segment were $122

million for the third quarter of 2024, compared to $127 million for

the third quarter of 2023. TCE revenues(1) were $121 million for

the third quarter, compared to $125 million for the third quarter

of 2023. This decrease is primarily attributable to a decline in

LR1 spot earnings to approximately $46,900 per day from $56,300 per

day partially offset by an increase in MR spot earnings to $29,000

per day from $26,600 per day.

YEAR-TO-DATE 2024 RESULTS

Net income for the nine months ended September 30, 2024 was $381

million, or $7.66 per diluted share, compared to net income of $424

million, or $8.58 per diluted share, for the first nine months of

2023.

Shipping revenues for the nine months ended September 30, 2024

were $757 million, compared to $821 million for the first nine

months of 2023. Consolidated TCE revenues(1) for the first nine

months of 2024 were $743 million, compared to $808 million for the

first nine months of 2023.

Adjusted EBITDA(1) for the nine months ended September 30, 2024

was $488 million, compared to $565 million for the first nine

months of 2023.

Crude Tankers

Shipping revenues for the Crude Tankers segment were $355

million for the first nine months of 2024, compared to $399 million

for the first nine months of 2023. TCE revenues(1) for the Crude

Tankers segment were $344 million for the first nine months of

2024, compared to $389 million for the first nine months of

2023.

Product Carriers

Shipping revenues for the Product Carriers segment were $402

million for the first nine months of 2024, compared to $422 million

for the first nine months of 2023. TCE revenues(1) for the Product

Carriers segment were $399 million for the first nine months of

2024 compared to $419 million for the first nine months of

2023.

BALANCE SHEET ENHANCEMENTS

During the third quarter of 2024, the Company repaid $13 million

in mandatory payments required under its existing debt facilities

and sale leaseback arrangements. For the nine months ended

September 30, 2024, the Company repaid $56 million of mandatory

debt payments.

In April 2024, the Company amended and extended the $750 Million

Facility, under which the Company had a remaining term loan balance

of $95 million and undrawn revolver capacity of $257 million prior

to closing. The new agreement consists of a $500 million revolving

credit facility (the “$500 Million RCF”) that matures in January

2030. Under the terms of the $500 Million RCF, capacity is reduced

on a quarterly basis by approximately $13 million, based on a

20-year age-adjusted profile of the collateral vessels. The $500

Million RCF bears an interest rate based on term SOFR +185bps (the

“margin”) and includes similar sustainability-linked features as

included in the $750 Million Credit Facility, which could impact

the margin by five basis points. The sustainability-linked features

are aimed at reducing the Company’s carbon footprint, targeting

expenditures toward energy efficiency improvements and maintaining

a safety record above the industry average. Prior to executing the

agreement, the Company prepaid the outstanding balance on the ING

Credit Facility of $20 million and included the collateral vessel

in the $500 Million RCF. The $500 Million RCF saves approximately

$20 million per quarter in mandatory debt repayments and reduces

future interest expense through a margin reduction of over 85 basis

points.

In June 2024, the Company borrowed $50 million under the $500

Million RCF, which was repaid during the third quarter. Following

the repayments and amortizing capacity during the third quarter,

aggregate undrawn revolving capacity was $541 million at September

30, 2024.

FLEET OPTIMIZATION PROGRAM

In July 2024, the Company sold a 2008-built MR for net proceeds

of approximately $24 million. During 2024, the Company sold three

vessels for aggregate net proceeds of $72 million. In the second

quarter of 2024, a 2009-built MR and a 2008-built MR were sold for

aggregate net proceeds of $48 million. In connection with vessel

sales, the Company recorded gains of $41 million in aggregate

during 2024.

During the nine months ended September 30, 2024, the Company

took delivery of six modern MR vessels for an aggregate

consideration of $232 million. In connection with the acquisitions,

the Company issued 623,778 common shares to the sellers,

representing 15% of the aggregate consideration with the remaining

funding provided by cash on hand.

During 2024, the Company entered into three time charter

agreements on two 2009-built MRs and a 2014-built LR2. The charters

have durations of around three years and were delivered to the

charterers during the third quarter. From October 1, 2024 through

expiry, total future contracted revenues aggregate to approximately

$345 million, excluding any applicable profit share.

The Company has contracts to build six scrubber-fitted,

dual-fuel (LNG) ready, LR1 vessels in Korea with K Shipbuilding Co,

Ltd at a price in aggregate of approximately $359 million. The

vessels are expected to be delivered beginning in the second half

of 2025 through the third quarter of 2026. These vessels are

expected to deliver into our niche Panamax International Pool,

which has consistently outperformed the market.

RETURNS TO SHAREHOLDERS

In September 2024, the Company paid a combined dividend of $1.50

per share of common stock, composed of a regular quarterly dividend

of $0.12 per share of common stock and a supplemental dividend of

$1.38 per share.

On November 6, 2024, the Company’s Board of Directors declared a

combined dividend of $1.20 per share of common stock, composed of a

regular quarterly dividend of $0.12 per share of common stock and a

supplemental dividend of $1.08 per share of common stock. Both

dividends will be paid on December 27, 2024, to shareholders with a

record date at the close of business on December 13, 2024.

During the third quarter of 2024, the Company repurchased and

retired 501,646 shares of its common stock in open market

purchases, at an average price of $49.81 for an aggregate cost of

approximately $25 million. In November 2024, the Company’s Board of

Directors authorized an increase to $50 million for the share

repurchase program that expires at the end of 2025.

(1) This is a non-GAAP financial measure used throughout this

press release; please refer to the section “Reconciliation to

Non-GAAP Financial Information” for explanations of our non-GAAP

financial measures and the reconciliations of reported GAAP to

non-GAAP financial measures.

CONFERENCE CALL

The Company will host a conference call to discuss its third

quarter 2024 results at 9:00 a.m. Eastern Time on Thursday,

November 7, 2024. To access the call, participants should dial

(833) 470-1428 for domestic callers and (929) 526-1599 for

international callers and entering 730934. Please dial in ten

minutes prior to the start of the call. A live webcast of the

conference call will be available from the Investor Relations

section of the Company’s website at https://www.intlseas.com.

An audio replay of the conference call will be available until

November 14, 2024, by dialing (866) 813-9403 for domestic callers

and +44 204 525 0658 for international callers, and entering Access

Code 826562.

ABOUT INTERNATIONAL SEAWAYS, INC.

International Seaways, Inc. (NYSE: INSW) is one of the largest

tanker companies worldwide providing energy transportation services

for crude oil and petroleum products in International Flag markets.

International Seaways owns and operates a fleet of 83 vessels,

including 13 VLCCs, 13 Suezmaxes, five Aframaxes/LR2s, 14 LR1s

(including six newbuildings), and 38 MR tankers. International

Seaways has an experienced team committed to the very best

operating practices and the highest levels of customer service and

operational efficiency. International Seaways is headquartered in

New York City, NY. Additional information is available at

https://www.intlseas.com.

Forward-Looking Statements

This release contains forward-looking statements. In addition,

the Company may make or approve certain statements in future

filings with the U.S. Securities and Exchange Commission (the

“SEC”), in press releases, or in oral or written presentations by

representatives of the Company. All statements other than

statements of historical facts should be considered forward-looking

statements. These matters or statements may relate to plans to

issue dividends, the Company’s prospects, including statements

regarding vessel acquisitions and disposals, expected synergies,

trends in the tanker markets, and possibilities of strategic

alliances and investments. Forward-looking statements are based on

the Company’s current plans, estimates and projections, and are

subject to change based on a number of factors. Investors should

carefully consider the risk factors outlined in more detail in the

Annual Report on Form 10-K for 2023 for the Company and in similar

sections of other filings made by the Company with the SEC from

time to time. The Company assumes no obligation to update or revise

any forward-looking statements. Forward-looking statements and

written and oral forward-looking statements attributable to the

Company or its representatives after the date of this release are

qualified in their entirety by the cautionary statements contained

in this paragraph and in other reports previously or hereafter

filed by the Company with the SEC.

Category: Earnings

Consolidated Statements of

Operations

($ in thousands, except per share

amounts)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Shipping Revenues:

Pool revenues

$

170,007

$

194,465

$

603,970

$

701,634

Time and bareboat charter revenues

36,842

27,587

99,030

66,849

Voyage charter revenues

18,341

19,656

54,000

52,558

Total Shipping Revenues

225,190

241,708

757,000

821,041

Operating Expenses:

Voyage expenses

5,503

5,756

14,537

13,434

Vessel expenses

71,269

64,596

202,490

188,516

Charter hire expenses

7,245

11,297

20,841

30,599

Depreciation and amortization

39,304

33,363

109,974

95,356

General and administrative

13,411

12,314

37,494

35,082

Other operating expenses

985

—

2,715

—

Third-party debt modification fees

-

148

168

568

(Gain)/loss on disposal of vessels and

other assets, net

(13,499)

74

(41,402)

(10,648)

Total operating expenses

124,218

127,548

346,817

352,907

Income from vessel operations

100,972

114,160

410,183

468,134

Other income

3,211

646

8,525

8,308

Income before interest expense and income

taxes

104,183

114,806

418,708

476,442

Interest expense

(12,496)

(16,817)

(37,808)

(51,678)

Income before income taxes

91,687

97,989

380,900

424,764

Income tax benefit/(provision)

1

(52)

1

(432)

Net income

$

91,688

$

97,937

$

380,901

$

424,332

Weighted Average Number of Common

Shares Outstanding:

Basic

49,544,412

48,861,356

49,302,367

49,008,901

Diluted

49,881,317

49,275,022

49,677,238

49,442,825

Per Share Amounts:

Basic net income per share

$

1.85

$

2.00

$

7.72

$

8.65

Diluted net income per share

$

1.84

$

1.99

$

7.66

$

8.58

Consolidated Balance Sheets

($ in thousands)

September 30,

December 31,

2024

2023

(Unaudited)

ASSETS

Current Assets:

Cash and cash equivalents

$

103,309

$

126,760

Short-term investments

50,000

60,000

Voyage receivables

191,093

247,165

Other receivables

15,682

14,303

Inventories

378

1,329

Prepaid expenses and other current

assets

9,721

10,342

Current portion of derivative asset

2,087

5,081

Total Current Assets

372,270

464,980

Vessels and other property, less

accumulated depreciation

2,045,331

1,914,426

Vessels construction in progress

24,401

11,670

Deferred drydock expenditures, net

82,628

70,880

Operating lease right-of-use assets

12,295

20,391

Pool working capital deposits

33,794

31,748

Long-term derivative asset

214

1,153

Other assets

16,913

6,571

Total Assets

$

2,587,846

$

2,521,819

LIABILITIES AND EQUITY

Current Liabilities:

Accounts payable, accrued expenses and

other current liabilities

$

45,796

$

57,904

Current portion of operating lease

liabilities

7,673

10,223

Current installments of long-term debt

49,823

127,447

Total Current Liabilities

103,292

195,574

Long-term operating lease liabilities

6,773

11,631

Long-term debt

600,689

595,229

Other liabilities

2,462

2,628

Total Liabilities

713,216

805,062

Equity:

Total Equity

1,874,630

1,716,757

Total Liabilities and Equity

$

2,587,846

$

2,521,819

Consolidated Statements of Cash

Flows

($ in thousands)

Nine Months Ended September

30,

2024

2023

(Unaudited)

(Unaudited)

Cash Flows from Operating

Activities:

Net income

$

380,901

$

424,332

Items included in net income not affecting

cash flows:

Depreciation and amortization

109,974

95,356

Amortization of debt discount and other

deferred financing costs

3,093

4,491

Deferred financing costs write-off

—

1,952

Stock compensation

5,736

5,912

Earnings of affiliated companies

(42)

20

Other – net

(519)

(2,140)

Items included in net income related to

investing and financing activities:

Gain on disposal of vessels and other

assets, net

(41,402)

(10,648)

Loss on extinguishment of debt

—

1,323

Payments for drydocking

(43,855)

(27,622)

Insurance claims proceeds related to

vessel operations

1,004

2,858

Changes in operating assets and

liabilities

38,626

67,085

Net cash provided by operating

activities

453,516

562,919

Cash Flows from Investing

Activities:

Expenditures for vessels, vessel

improvements and vessels under construction

(216,589)

(192,218)

Proceeds from disposal of vessels and

other assets

71,915

20,036

Expenditures for other property

(880)

(1,035)

Investments in short-term time

deposits

(125,000)

(210,000)

Proceeds from maturities of short-term

time deposits

135,000

215,000

Pool working capital deposits

(1,532)

(1,334)

Net cash used in investing activities

(137,086)

(169,551)

Cash Flows from Financing

Activities:

Borrowing on revolving credit

facilities

50,000

50,000

Repayments on revolving credit

facilities

(50,000)

—

Repayments of debt

(39,851)

(323,685)

Proceeds from sale and leaseback

financing, net of issuance and deferred financing costs

—

169,717

Payments on sale and leaseback financing

and finance lease

(36,831)

(123,732)

Payments of deferred financing costs

(5,759)

(3,006)

Premium and fees on extinguishment of

debt

—

(1,323)

Repurchase of common stock

(25,000)

(13,948)

Cash dividends paid

(225,385)

(247,001)

Cash paid to tax authority upon vesting or

exercise of stock-based compensation

(7,055)

(5,158)

Net cash used in financing activities

(339,881)

(498,136)

Net decrease in cash and cash

equivalents

(23,451)

(104,768)

Cash and cash equivalents at beginning of

year

126,760

243,744

Cash and cash equivalents at end of

period

$

103,309

$

138,976

Spot and Fixed TCE Rates Achieved and Revenue Days

The following tables provides a breakdown of TCE rates achieved

for spot and fixed charters and the related revenue days for the

three months ended September 30, 2024 and the comparable period of

2023. Revenue days in the quarter ended September 30, 2024 totaled

6,671 compared with 6,663 in the prior year quarter. A summary

fleet list by vessel class can be found later in this press

release. The information in these tables excludes commercial pool

fees/commissions averaging approximately $954 and $874 per day for

the three months ended September 30, 2024 and 2023,

respectively.

Three Months Ended September

30, 2024

Three Months Ended September

30, 2023

Spot

Fixed

Total

Spot

Fixed

Total

Crude Tankers

VLCC

Average TCE Rate

$

29,711

$

31,903

$

40,961

$

35,319

Number of Revenue Days

881

276

1,157

870

297

1,167

Suezmax

Average TCE Rate

$

38,044

$

30,979

$

38,708

$

30,973

Number of Revenue Days

1,014

183

1,197

1,012

184

1,196

Aframax

Average TCE Rate

$

25,119

$

38,574

$

34,046

$

38,652

Number of Revenue Days

186

91

277

232

73

305

Total Crude Tankers Revenue

Days

2,081

550

2,631

2,114

554

2,668

Product Carriers

Aframax (LR2)

Average TCE Rate

$

-

$

39,498

$

32,603

$

-

Number of Revenue Days

-

69

69

92

-

92

Panamax (LR1)

Average TCE Rate

$

46,899

$

-

$

56,295

$

-

Number of Revenue Days

594

-

594

685

-

685

MR

Average TCE Rate

$

29,006

$

21,920

$

26,563

$

21,200

Number of Revenue Days

2,685

692

3,377

2,836

382

3,218

Total Product Carriers Revenue

Days

3,279

761

4,040

3,613

382

3,995

Total Revenue Days

5,360

1,311

6,671

5,727

936

6,663

Revenue days in the above table exclude days related to full

service lighterings. In addition, during 2024 and 2023, certain of

the Company’s vessels were employed on transitional voyages, which

are excluded from the table above.

During the 2024 and 2023 periods, each of the Company’s LR1s

participated in the Panamax International Pool and transported

crude oil cargoes exclusively.

Fleet Information

As of September 30, 2024, INSW’s fleet totaled 82 vessels, of

which 62 were owned, 14 were chartered in and six contracted

newbuildings.

Total at September 30, 2024

Vessel Fleet and Type

Vessels Owned

Vessels

Chartered-in1

Total Vessels

Total Dwt

Operating Fleet

VLCC

4

9

13

3,910,572

Suezmax

13

-

13

2,061,754

Aframax

4

-

4

452,375

Crude Tankers

21

9

30

6,424,701

LR2

1

-

1

112,691

LR1

6

1

7

522,698

MR

34

4

38

1,901,526

Product Carriers

41

5

46

2,536,915

Total Operating Fleet

62

14

76

8,961,616

Newbuild Fleet

LR1

6

-

6

441,600

Total Newbuild Fleet

6

-

6

441,600

Total Operating and Newbuild

Fleet

68

14

82

9,403,216

(1) Includes bareboat charters, but

excludes vessels chartered in where the duration of the charter was

one year or less at inception.

Reconciliation to Non-GAAP Financial Information

The Company believes that, in addition to conventional measures

prepared in accordance with GAAP, the following non-GAAP measures

may provide certain investors with additional information that will

better enable them to evaluate the Company’s performance.

Accordingly, these non-GAAP measures are intended to provide

supplemental information, and should not be considered in isolation

or as a substitute for measures of performance prepared with

GAAP.

(A) Adjusted Net Income

Adjusted net income consists of net income adjusted for the

impact of certain items that we do not consider indicative of our

ongoing operating performance. This measure does not represent or

substitute net income or any other financial item that is

determined in accordance with GAAP. While adjusted net income is

frequently used as a measure of operating results and performance,

it may not be necessarily comparable with other similarly titled

captions of other companies due to differences in methods of

calculation. The following table reconciles net income, as

reflected in the consolidated statement of operations, to adjusted

net income:

Three Months Ended

September 30,

Nine Months Ended

September 30,

($ in thousands)

2024

2023

2024

2023

Net income

$

91,688

$

97,937

$

380,901

$

424,332

Third-party debt modification fees

-

148

168

568

Write-off of deferred financing costs

-

1,343

-

1,952

(Gain)/loss on disposal of vessels and

other assets, net of impairments

(13,499)

74

(41,402)

(10,648)

Provision for settlement of multi-employer

pension plan obligations

44

-

1,019

-

Loss on extinguishment of debt

-

1,211

-

1,323

Adjusted Net Income

$

78,233

$

100,713

$

340,686

$

417,527

Weighted average shares outstanding

(diluted)

49,881,317

49,275,022

49,677,238

49,442,825

Adjusted Net Income per diluted share

$

1.57

$

2.04

$

6.85

$

8.44

(B) EBITDA and Adjusted EBITDA

EBITDA represents net income before interest expense, income

taxes, and depreciation and amortization expense. Adjusted EBITDA

consists of EBITDA adjusted for the impact of certain items that we

do not consider indicative of our ongoing operating performance.

EBITDA and Adjusted EBITDA do not represent, and should not be a

substitute for, net income or cash flows from operations as

determined in accordance with GAAP. Some of the limitations are:

(i) EBITDA and Adjusted EBITDA do not reflect our cash

expenditures, or future requirements for capital expenditures or

contractual commitments; (ii) EBITDA and Adjusted EBITDA do not

reflect changes in, or cash requirements for, our working capital

needs; and (iii) EBITDA and Adjusted EBITDA do not reflect the

significant interest expense, or the cash requirements necessary to

service interest or principal payments, on our debt. While EBITDA

and Adjusted EBITDA are frequently used as a measure of operating

results and performance, neither of them is necessarily comparable

to other similarly titled captions of other companies due to

differences in methods of calculation. The following table

reconciles net income as reflected in the condensed consolidated

statements of operations, to EBITDA and Adjusted EBITDA:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands)

2024

2023

2024

2023

Net income

$

91,688

$

97,937

$

380,901

$

424,332

Income tax (benefit)/provision

(1)

52

(1)

432

Interest expense

12,496

16,817

37,808

51,678

Depreciation and amortization

39,304

33,363

109,974

95,356

EBITDA

143,487

148,169

528,682

571,798

Third-party debt modification fees

-

148

168

568

Write-off of deferred financing costs

-

1,343

-

1,952

(Gain)/loss on disposal of vessels and

other assets, net of impairments

(13,499)

74

(41,402)

(10,648)

Provision for settlement of multi-employer

pension plan obligations

44

-

1,019

-

Loss on extinguishment of debt

-

1,211

-

1,323

Adjusted EBITDA

$

130,032

$

150,945

$

488,467

$

564,993

(C) Cash

September 30,

December 31,

($ in thousands)

2024

2023

Cash and cash equivalents

$

103,309

$

126,760

Short-term investments

50,000

60,000

Total Cash

$

153,309

$

186,760

(D) Free Cash Flow

Free cash flow represents cash flows from operating activities,

less mandatory repayments of debt (including those under sale and

leaseback agreements) less capital expenditures excluding payments

made to acquire a vessel or vessels, which the Company believes is

useful to investors in understanding the net cash generated from

its core business activities after certain mandatory

obligations.

($ in thousands)

2023

2024

For the three months ended:

September 30

December 31

March 31

June 30

September 30

Net cash provided by operating activities

(1)

$

148,463

$

125,483

$

156,442

$

167,939

$

129,135

Repayments of debt (1)

(132,152)

(108,365)

(19,538)

-

-

Payments on sale and leaseback (1)

(10,946)

(12,233)

(12,146)

(12,179)

(12,506)

Less: optional prepayments (2)

104,312

(3)

88,382

-

-

-

Expenditures for vessels (1)

(4,150)

(12,941)

(26,420)

(176,455)

(13,714)

Expenditures for other property (1)

(449)

(436)

(701)

(100)

(79)

Less: payments for acquiring vessels

(2)

-

11,548

23,200

174,896

11,854

Free Cash Flow

$

105,078

$

91,438

$

120,837

$

154,101

$

114,690

(1)

Reflects current period balance

on the face of the Consolidated Statement of Cash Flows, less the

prior quarter’s balance on the face of the Consolidated Statement

of Cash Flows. The captions have been adjusted for summary

purposes; the complete list of captions are as follows, in order as

in the table above: Net cash provided by operating activities,

Repayments of debt, Payments and advance payment on sale and

leaseback financing and finance lease, Expenditures for vessels,

vessel improvements and vessels under construction, and

Expenditures for other property. For the period ended September 30,

2023, Repayments of Debt include the line item Premium and fees on

extinguishment of debt.

(2)

Payments for acquiring vessels

include the contractual payments for the LR1 newbuildings. In

addition, during the three months ended March 31, 2024, the Company

announced the acquisition of six MRs for a total contract price of

$232 million, of which 10% was paid in deposit in the same quarter.

The vessels delivered during the second quarter of 2024.

(3)

In connection with the execution

of the revolving credit facility (“$160 Million Facility”) in the

third quarter of 2023, the Company drew $50 million as of September

30, 2023. During October 2023, the Company repaid the outstanding

amounts on the facility.

(E) Time Charter Equivalent (TCE) Revenues

Consistent with general practice in the shipping industry, the

Company uses TCE revenues, which represents shipping revenues less

voyage expenses, as a measure to compare revenue generated from a

voyage charter to revenue generated from a time charter. Time

charter equivalent revenues, a non-GAAP measure, provides

additional meaningful information in conjunction with shipping

revenues, the most directly comparable GAAP measure, because it

assists Company management in making decisions regarding the

deployment and use of its vessels and in evaluating their financial

performance. Reconciliation of TCE revenues of the segments to

shipping revenues as reported in the consolidated statements of

operations follow:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands)

2024

2023

2024

2023

Time charter equivalent revenues

$

219,687

$

235,952

$

742,463

$

807,607

Add: Voyage expenses

5,503

5,756

14,537

13,434

Shipping revenues

$

225,190

$

241,708

$

757,000

$

821,041

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106146002/en/

Investor Relations & Media: Tom Trovato,

International Seaways, Inc. (212) 578-1602

ttrovato@intlseas.com

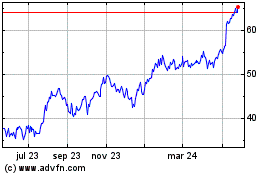

International Seaways (NYSE:INSW)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

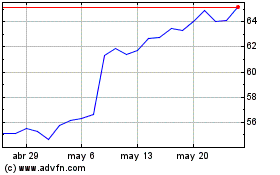

International Seaways (NYSE:INSW)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024