Form 8-K - Current report

31 Octubre 2024 - 6:30AM

Edgar (US Regulatory)

false000021622800002162282024-10-302024-10-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: October 30, 2024

(Date of earliest event reported)

ITT INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Indiana | 001-05672 | 81-1197930 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

100 Washington Boulevard

6th Floor

Stamford, CT 06902

(Address of principal executive offices) (Zip Code)

(914) 641-2000

(Registrant’s telephone number, including area code)

Not Applicable

Former name or former address, if changed since last report Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $1 per share | ITT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 under the Securities Exchange Act of 1934 (17 CFR 240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

In recognition of Mr. Luca Savi’s outstanding performance since becoming Chief Executive Officer of ITT Inc. (the “Company”), and to ensure that he is properly incentivized to remain with the Company for the long term, on October 30, 2024, the Compensation and Human Capital Committee (the “Committee”) of the Board of Directors (the “Board”) of the Company adopted a Chief Executive Officer Retention Plan (the “CEO Retention Plan”) to provide for the grant of additional Restricted Stock Units (the “RSUs”) to Mr. Savi. This action was also taken based on feedback received from investors regarding Mr. Savi’s contributions and impact.

The initial grant under the CEO Retention Plan consists of RSUs with a fair market value equal to $7,000,000 granted under the Company’s 2011 Omnibus Incentive Plan (the “Equity Plan”). Mr. Savi is also eligible to receive a performance-earned annual retention grant under the CEO Retention Plan in the first quarter of each of calendar years 2025, 2026, 2027, 2028 and 2029 (each such grant, a “Performance-Earned Annual Retention Grant”). Each Performance-Earned Annual Retention Grant will consist of RSUs granted under the Equity Plan with a fair market value based on the “Performance Unit Award Payout” divided by the “Target Units” (expressed as a percentage), each as determined under Mr. Savi’s performance unit award agreement for the most recently completed performance period, as follows:

| | | | | | | | | | | |

| “Performance Unit Award Payout” ÷ “Target Units” | Performance-Earned Annual Retention Grant Value |

| Less than 105% | | $ | 0 | | |

| 105%-119.9% | | $ | 4,000,000 | | |

| 120%-139.9% | | $ | 5,000,000 | | |

| 140%-159.9% | | $ | 6,000,000 | | |

| 160% or above | | $ | 7,000,000 | | |

Mr. Savi’s performance unit awards have a three-year performance period based on a preestablished Target Unit threshold, with performance tied equally to the Company’s three-year total shareholder return performance relative to a group of peer companies and the Company’s return on invested capital.

RSUs granted under the CEO Retention Plan from 2024 to 2028 will vest on the later of (i) December 31, 2028 and (ii) the first anniversary of the date of grant, provided that Mr. Savi is continuously employed by the Company or an affiliate of the Company through December 31, 2028. RSUs granted as the Performance-Earned Annual Retention Grant in calendar year 2029, if any, will vest on the first anniversary of the date of grant provided that Mr. Savi is continuously employed by the Company or an affiliate through December 31, 2029. In the event that Mr. Savi’s employment is terminated due to death, disability, separation from service by the Company other than for cause or a resignation by Mr. Savi for good reason and within two years of a change in control, Mr. Savi may be eligible to retain all or a portion of his awards under the CEO Retention Plan. In addition, if Mr. Savi were to resign in 2029, Mr. Savi may be able to retain all or a portion of his 2029 Performance-Earned Annual Retention Grant based on the timing and circumstances of the termination of his employment.

The Committee determined that adoption of the CEO Retention Plan is in the best interests of the Company and its shareholders and that its terms are appropriate. Among other things, the Committee considered Mr. Savi’s record of strong performance, exceptional leadership and value creation for shareholders since the start of his tenure as CEO in 2019, and feedback from the Company’s shareholders as part of its investor outreach program. The Committee also conducted an extensive market analysis with the assistance of the Committee’s independent compensation consultant. The Committee determined that the structure of the CEO Retention Plan appropriately encourages retention and reflects its confidence in

Mr. Savi’s leadership. The CEO Retention Plan is aligned with the Company’s overall executive equity compensation program.

Regarding Mr. Savi’s performance, during his near 6-year tenure as CEO, the Company has achieved the following (through 2023 unless otherwise noted):

•Achieved a 230% total shareholder return through September 30, 2024, compared to an S&P 500 index return of 153% and an S&P 400 Mid-Cap Index return of 105% during the same period (assumes all dividends reinvested).

•Grown its market capitalization from $4 billion to over $12 billion as of September 30, 2024, a 20% compound annual growth rate ("CAGR").

•Increased annual revenues to over $3 billion while expanding adjusted operating margin by 350 basis points and growing adjusted EPS by 61%.

•Since 2020, when the pandemic impacted the performance of most multi-industrial companies, the Company's annual revenues have increased 32% (10% CAGR), adjusted EPS has grown 63% (18% CAGR), and adjusted operating margin has expanded 250 bps.

•Effectively deployed over $3.2 billion of capital as of September 30, 2024 through five acquisitions, the strategic divestiture of the Company's legacy asbestos liabilities, the return of over $1 billion of capital to the Company's shareholders through dividends and share repurchases and $0.5 billion of capital expenditures.

•Maintained the Company’s investment-grade credit ratings.

•Drove an embedded safety-first culture, reducing the Company’s overall incident frequency rate from 1.1 in fiscal year 2018 to 0.6 in fiscal year 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ITT Inc. |

| (Registrant) |

| | | |

| October 31, 2024 | By: | /s/ Lori B. Marino |

| | Name: | Lori B. Marino |

| | Title: | Senior Vice President, General Counsel and Corporate Secretary |

| | | (Authorized Officer of Registrant) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

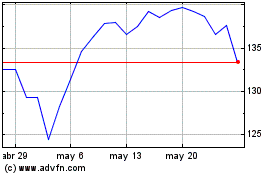

ITT (NYSE:ITT)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

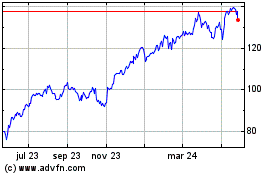

ITT (NYSE:ITT)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025