0000052988false00000529882024-09-032024-09-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________________

Form 8-K

___________________________

Current Report

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): September 3, 2024

Jacobs Solutions Inc.

(Exact name of Registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | | 1-7463 | | 88-1121891 |

(State or other jurisdiction of incorporation or organization) | | (SEC File No.) | | (IRS Employer identification number) |

| | | | |

1999 Bryan Street | Suite 3500 | Dallas | Texas | 75201 |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number (including area code): (214) 583-8500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

_________________________________________________________________ | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock | $1 par value | J | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Election of New Director

On September 3, 2024, the Board of Directors (the “Board”) of Jacobs Solutions Inc. (the “Company”) increased the size of the Board from 13 to 14 authorized directors and elected Michael W. Collins to fill the vacancy, effective as of September 23, 2024. Mr. Collins will serve for an initial term that will expire at the annual meeting of shareholders in 2025.

The Board, after consideration of all facts and circumstances, affirmatively determined that Mr. Collins is an independent director under the corporate governance standards of the New York Stock Exchange (the “NYSE”) and the Company’s guidelines for determining independence. The Board also determined that Mr. Collins is “financially literate” as required by the NYSE listed company manual and is an “audit committee financial expert” under the applicable rules of the U.S. Securities Exchange Commission (the “SEC”), as such qualifications are interpreted by the Board in its business judgment.

In connection with his election, Mr. Collins will receive the standard, annual compensation for the Company’s non-management directors. This annual compensation includes (i) a cash retainer in the amount of $125,000 per year, and (ii) pursuant to the Company’s 1999 Outside Director Plan, as amended and restated, an award of restricted stock units with an aggregate value of $190,000, pro-rated based on his election date. Mr. Collins will also be eligible to participate in the Jacobs Director Deferral Plan.

There were no understandings or other agreements or arrangements between Mr. Collins, on the one hand, and any other person, on the other hand, pursuant to which he was appointed as a director of the Company. Furthermore, there are no transactions between Mr. Collins and the Company that would be required to be reported under Item 404(a) of Regulation S-K.

On September 6, 2024, the Company issued a press release announcing the appointment of Mr. Collins to the Board, a copy of which is attached as Exhibit 99.1 to this report and incorporated herein by reference.

Changes to Board Leadership

On September 3, 2024, the Board approved (ii) the appointment of Mr. Robert V. Pragada, the Company’s Chief Executive Officer, as Chair of the Board and (ii) the appointment of Mr. Louis V. Pinkham as Lead Independent Director of the Board, in each case effective as of the closing date of the Company's previously announced spin-off transaction, which will combine its Critical Mission Solutions business and portions of its Divergent Solutions business, including Cyber & Intelligence, with Amentum Parent Holdings LLC (the “Separation Transaction”).

A copy of the press release announcing the appointment of Mr. Pragada as Chair and Mr. Pinkham as Lead Independent Director is attached as Exhibit 99.2 to this report and is incorporated herein by reference.

Changes to Committee Composition and Leadership

The Board also approved the following changes to the leadership and composition of the standing Committees of the Board, in each case effective as of the closing date of the Separation Transaction:

•Audit Committee: (i) Mr. Collins and Vice Admiral Mary M. Jackson will be added as members, (ii) Mr. Manny Fernandez will serve as Chair and (iii) Mr. Robert A. McNamara and Ms. Julie A. Sloat will no longer serve as members.

•Nominating and Corporate Governance Committee: (i) Mr. McNamara and Vice Admiral Jackson will be added as members, (ii) Mr. McNamara will serve as Chair and (iii) Mr. Pinkham will no longer serve as a member.

•Human Resource and Compensation Committee: (i) Mr. Collins and Ms. Sloat will be added as members and (ii) Messrs. Fernandez and Pinkham will no longer serve as members.

•ESG and Risk Committee: (i) Mr. Fernandez will be added as a member and (ii) Ms. Sloat will serve as Chair.

The Board also determined that Vice Admiral Jackson is “financially literate” as required by the NYSE listed company manual and is an “audit committee financial expert” under the applicable rules of the SEC, as such qualifications are interpreted by the Board in its business judgment.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d)Exhibits: | | | | | |

| 99.1 | |

| 99.2 | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 6, 2024

| | | | | |

| |

| | |

| JACOBS SOLUTIONS INC. |

| | |

| By: | /s/ Bob Pragada |

| | Bob Pragada |

| |

| | Chief Executive Officer |

Exhibit 99.1

| | | | | |

| |

| 1999 Bryan Street, Suite 3500 |

| Dallas, Texas 75201 |

| 1.214.583.8500 |

Press Release

| | | | | |

| FOR IMMEDIATE RELEASE | September 6, 2024 |

Michael Collins Appointed to Jacobs Board of Directors

Further strengthening advisory and consulting Board acumen

DALLAS – Jacobs (NYSE:J) announced today the election of Michael Collins to its Board of Directors, effective September 23, 2024.

Collins is currently a Partner and most recently served as the Chief Operating Officer at global management consulting firm Bain & Company, previously serving as Chief Financial Officer. Since joining Bain in 1992, he has worked with management teams to develop and execute growth strategies, evaluate acquisitions and divestitures, improve capabilities and implement organizational change. He has also assisted clients across numerous industries, including retail, consumer products, telecommunications, automotive and media and entertainment.

Jacobs CEO Bob Pragada said, “We are delighted to have Michael join our Board of Directors. His global management consulting experience will bring invaluable insights and strategic guidance as we continue to grow our higher value, high margin consulting and advisory services. We look forward to his contributions as we continue to expand our global impact and deliver sustainable innovative solutions to our clients.”

Collins holds a bachelor’s degree in accounting (with high honors) from Loyola University, Chicago, and an MBA from Harvard Business School.

At Jacobs, we're challenging today to reinvent tomorrow by solving the world's most critical problems for thriving cities, resilient environments, mission-critical outcomes, operational advancement, scientific discovery and cutting-edge manufacturing, turning abstract ideas into realities that transform the world for good. With approximately $16 billion in annual revenue and a talent force of more than 60,000, Jacobs provides a full spectrum of professional services including consulting, technical, scientific and project delivery for the government and private sector. Visit jacobs.com and connect with Jacobs on Facebook, Instagram, LinkedIn and X.

# # #

Certain statements contained in this press release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that do not directly relate to any historical or current fact. When used herein, words such as “expects,” “anticipates,” “believes,” “seeks,” “estimates,” “plans,” “intends,” “future,” “will,” “would,” “could,” “can,” “may,” and similar words are intended to identify forward-looking statements. We base these forward-looking statements on management's current estimates and expectations, as well as currently available competitive, financial and economic data. Forward-looking statements, however, are inherently uncertain. There are a variety of factors that could cause business results to differ materially from our forward-looking statements including, but not limited to, our plans to spin off and merge with Amentum our Critical Missions Solutions business and a portion of our Divergent Solutions business in a proposed transaction that is intended to be tax-free to stockholders for U.S. federal income tax purposes, the timing of the award of projects and funding and potential changes to the amounts provided for under the Infrastructure Investment and Jobs Act and other legislation related to governmental spending, as well as general economic conditions, including inflation and the actions taken by monetary authorities in response to inflation, changes in interest rates and foreign currency exchange rates, changes in capital markets, the possibility of a recession or economic downturn, geopolitical events and conflicts, and the impact of any future pandemic or infectious disease outbreak, including the related reaction of governments on global and regional market conditions, among others. For a description of some additional factors that may occur that could cause actual results to differ from our forward-looking statements, see the discussions contained under Item 1 - Business; Item 1A - Risk Factors; Item 3 - Legal Proceedings; and Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations in our most recently filed Annual Report on Form 10-K, and Item 2 - Management's Discussion and Analysis of Financial Condition and Results of Operations; Item 1 - Legal Proceedings; and Item 1A - Risk Factors in our most recently filed Quarterly Report on Form 10-Q, as well as the company's other filings with the Securities and Exchange Commission. The company is not under any duty to update any of the forward-looking statements after the date of this press release to conform to actual results, except as required by applicable law.

For press/media inquiries:

media@jacobs.com

Exhibit 99.2

| | | | | |

| |

| 1999 Bryan Street, Suite 3500 |

| Dallas, Texas 75201 |

| 1.214.583.8500 |

Press Release

| | | | | |

| FOR IMMEDIATE RELEASE | September 6, 2024 |

Bob Pragada Appointed Chair of Jacobs Board of Directors; Louis Pinkham Named Lead Independent Director

DALLAS – Jacobs (NYSE:J) announced today that Bob Pragada, Jacobs’ CEO, has been appointed to the additional position of Chair of the Board effective upon close of the separation of its Critical Mission Solutions and Cyber and Intelligence businesses. Pragada becomes the fourth Chair in the company’s history.

Steve Demetriou, who has served as Chair since 2016, will be joining Amentum as their new Executive Chair following the separation, where he will bring his wealth of experience and leadership to guide that company's continued success.

During Steve’s tenure as Chair, he led Jacobs through a period of substantial growth and transformation. Under his leadership, the company expanded its global footprint, diversified its portfolio, and solidified its position as a leader in sustainability and technology-driven solutions.

Pragada joined Jacobs in 2006, becoming CEO and joining the Board in 2023 following several successful senior leadership roles. His appointment as Chair reflects his deep commitment to Jacobs' mission and his vision for the company's future.

"We are excited to have Bob Pragada step into the role of Chair," said Steve Demetriou. "His leadership and experience have been instrumental in shaping Jacobs into the great company it is today. I am confident Bob will continue to drive the company forward with the same passion and dedication that has defined his career."

"I am deeply honored and proud to be appointed Chair of Jacobs, a company where I have spent the last 18 years of my career. I’m looking forward to continuing to work with our Board of Directors, our leadership team and our employees to deliver solutions for some of the world’s toughest challenges. On behalf of the entire Jacobs team, I want to express our deepest gratitude to Steve for his exceptional leadership and unwavering

commitment to Jacobs," said Bob Pragada. "Steve's vision and guidance have been pivotal in positioning Jacobs as a global leader, and we wish him all the best in his new role at Amentum."

Jacobs remains dedicated to pushing the boundaries of innovation and delivering world-class solutions to its clients. With Bob Pragada at the helm as both CEO and Chair, the company is well-positioned to continue its trajectory of growth and excellence.

Following the successful closure of the CMS transaction, Jacobs’ current Lead Independent Director, Chris Thompson, will move to the Amentum Board, and Louis Pinkham has been elected to serve as Lead Independent Director. Pinkham, currently CEO of Regal Rexnord, joined the Jacobs Board in Sept 2023.

At Jacobs, we're challenging today to reinvent tomorrow by solving the world's most critical problems for thriving cities, resilient environments, mission-critical outcomes, operational advancement, scientific discovery and cutting-edge manufacturing, turning abstract ideas into realities that transform the world for good. With approximately $16 billion in annual revenue and a talent force of more than 60,000, Jacobs provides a full spectrum of professional services including consulting, technical, scientific and project delivery for the government and private sector. Visit jacobs.com and connect with Jacobs on Facebook, Instagram, LinkedIn and X.

# # #

Certain statements contained in this press release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that do not directly relate to any historical or current fact. When used herein, words such as “expects,” “anticipates,” “believes,” “seeks,” “estimates,” “plans,” “intends,” “future,” “will,” “would,” “could,” “can,” “may,” and similar words are intended to identify forward-looking statements. We base these forward-looking statements on management's current estimates and expectations, as well as currently available competitive, financial and economic data. Forward-looking statements, however, are inherently uncertain. There are a variety of factors that could cause business results to differ materially from our forward-looking statements including, but not limited to, our plans to spin off and merge with Amentum our Critical Missions Solutions business and a portion of our Divergent Solutions business in a proposed transaction that is intended to be tax-free to stockholders for U.S. federal income tax purposes, the timing of the award of projects and funding and potential changes to the amounts provided for under the Infrastructure Investment and Jobs Act and other legislation related to governmental spending, as well as general economic conditions, including inflation and the actions taken by monetary authorities in response to inflation, changes in interest rates and foreign currency exchange rates, changes in capital markets, the possibility of a recession or economic downturn, geopolitical events and conflicts, and the impact of any future pandemic or infectious disease outbreak, including the related reaction of governments on global and regional market conditions, among others. For a description of some additional factors that may occur that could cause actual results to differ from our forward-looking statements, see the discussions contained under Item 1 - Business; Item 1A - Risk Factors; Item 3 - Legal Proceedings; and Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations in our most recently filed Annual Report on Form 10-K, and Item 2 - Management's Discussion and Analysis of Financial Condition and Results of Operations; Item 1 - Legal Proceedings; and Item 1A - Risk Factors in our most recently filed Quarterly Report on Form 10-Q, as well as the company's other filings with the Securities and Exchange Commission. The company is not under any duty to update any of the forward-looking statements after the date of this press release to conform to actual results, except as required by applicable law.

For press/media inquiries:

media@jacobs.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

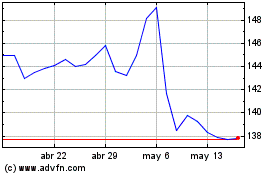

Jacobs Solutions (NYSE:J)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Jacobs Solutions (NYSE:J)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025