Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Noviembre 2023 - 1:53PM

Edgar (US Regulatory)

Nuveen

Mortgage

and

Income

Fund

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

LONG-TERM

INVESTMENTS

-

139.1%

(100.0%

of

Total

Investments)

X–

MORTGAGE-BACKED

SECURITIES

-

99.3%

(71.4%

of

Total

Investments)

X

101,577,406

$

500

(b)

Alen

Mortgage

Trust,

(TSFR1M

reference

rate

+

4.114%

spread),

2021

ACEN,

144A

9.447%

4/15/34

$

260,218

1,000

BANK,

2019

BN21,

144A

2.500%

10/17/52

499,070

1,000

(c)

BANK

2017-BNK6,

2017

BNK6

3.851%

7/15/60

810,759

1,000

BBCMS

Mortgage

Trust

2020-C6,

2020

C6,

144A

3.811%

2/15/53

723,798

1,500

(c)

Benchmark

Mortgage

Trust,

2020

B18,

144A

4.139%

7/15/53

1,308,579

1,500

CD

2016-CD2

Mortgage

Trust,

2016

CD2

4.111%

11/10/49

1,122,933

1,978

(c)

CD

2017-CD3

Mortgage

Trust,

2017

CD3

4.696%

2/10/50

1,078,982

845

(c)

CD

Mortgage

Trust,

2016

CD1

3.631%

8/10/49

535,141

24

CF

Mortgage

Trust,

2020

P1,

144A

2.840%

4/15/25

23,166

672

CFK

Trust

2019-FAX,

2019

FAX,

144A

4.791%

1/15/39

570,532

429

CHL

Mortgage

Pass-Through

Trust

2006-HYB1,

2006

HYB1

3.951%

3/20/36

380,402

1,500

(c)

COMM

2013-LC13

Mortgage

Trust,

2013

LC13,

144A

5.387%

8/10/46

1,314,753

925

(c)

COMM

2014-CCRE15

Mortgage

Trust,

2014

CR15

4.795%

2/10/47

808,248

700

COMM

2014-CCRE15

Mortgage

Trust,

2014

CR15,

144A

4.795%

2/10/47

572,225

1,452

(c)

COMM

2014-CCRE19

Mortgage

Trust,

2014

CR19,

144A

4.697%

8/10/47

1,246,426

800

(c)

COMM

2015-CCRE25

Mortgage

Trust,

2015

CR25

4.667%

8/10/48

722,631

1,000

COMM

Mortgage

Trust,

2014

CR17

4.377%

5/10/47

910,576

1,800

(c)

COMM

Mortgage

Trust,

2015

CR24

3.463%

8/10/48

1,434,048

1,000

(c)

COMM

Mortgage

Trust,

2014

UBS2

4.947%

3/10/47

956,852

1,500

(c)

COMM

Mortgage

Trust,

2014

UBS3,

144A

4.767%

6/10/47

997,697

1,245

COMM

Mortgage

Trust,

2015

CR25

3.768%

8/10/48

1,017,913

1,400

COMM

Mortgage

Trust,

2015

CR22,

144A

3.000%

3/10/48

1,019,609

1,160

COMM

Mortgage

Trust,

2014

CR14

4.585%

2/10/47

1,029,923

2,000

(c)

COMM

Mortgage

Trust,

2015

CR23

4.443%

5/10/48

1,588,396

100

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

4.650%

spread),

2022

R07,

144A

9.965%

6/25/42

106,666

625

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

5.500%

spread),

2021

R03,

144A

10.815%

12/25/41

623,321

3,000

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

6.250%

spread),

2022

R03,

144A

6.349%

3/25/42

3,304,946

2,550

(b),(c)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

4.500%

spread),

2022

R02,

144A

9.815%

1/25/42

2,614,797

1,000

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

9.850%

spread),

2022

R03,

144A

14.823%

3/25/42

1,115,144

3,000

(b),(c)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

6.000%

spread),

2021

R01,

144A

11.315%

10/25/41

3,032,692

450

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

6.750%

spread),

2022

R09,

144A

12.065%

9/25/42

493,860

200

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

3.100%

spread),

2022

R04,

144A

8.415%

3/25/42

203,295

460

(b),(c)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

3.850%

spread),

2022

R06,

144A

9.165%

5/25/42

477,988

300

(b),(c)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

5.600%

spread),

2022

R08,

144A

9.528%

7/25/42

324,894

1,605

(b),(c)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

3.900%

spread),

2023

R06,

144A

9.188%

7/25/43

1,625,034

2,100

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

6.000%

spread),

2022

R01,

144A

11.315%

12/25/41

2,123,138

2,250

(b),(c)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

4.750%

spread),

2023

R05,

144A

10.065%

6/25/43

2,350,909

1,900

(b)

Connecticut

Avenue

Securities

Trust

2022-R07,

(SOFR30A

reference

rate

+

12.000%

spread),

2022

R07,

144A

17.296%

6/25/42

2,239,652

960

(b),(c)

Connecticut

Avenue

Securities

Trust

2022-R07,

(SOFR30A

reference

rate

+

6.800%

spread),

2022

R07,

144A

12.115%

6/25/42

1,062,538

33,000

DOLP

Trust,

2021

NYC,

(I/O),

144A

0.665%

5/10/41

1,204,662

4,000

(b),(c)

Fannie

Mae

-

CAS,

(SOFR30A

reference

rate

+

5.550%

spread),

2023

R02,

144A

10.865%

1/25/43

4,283,905

Nuveen

Mortgage

and

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

MORTGAGE-BACKED

SECURITIES

(continued)

$

640

FARM

21-1

Mortgage

Trust,

2021

1,

144A

3.240%

7/25/51

$

440,115

85

Flagstar

Mortgage

Trust,

2017

2,

144A

4.002%

10/25/47

72,845

7,647

Freddie

Mac

Multifamily

ML

Certificates,

2021

ML12,

(I/O)

1.303%

7/25/41

729,346

1,000

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

7.100%

spread),

2022

DNA1,

144A

12.415%

1/25/42

1,007,015

3,000

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

7.000%

spread),

2022

HQA1,

144A

9.997%

3/25/42

3,250,569

455

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

4.350%

spread),

2022

DNA3,

144A

9.665%

4/25/42

476,459

2,275

(b),(c)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

3.400%

spread),

2022

DNA1,

144A

8.715%

1/25/42

2,282,075

3,000

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

7.500%

spread),

2021

DNA6,

144A

12.815%

10/25/41

3,094,147

3,750

(b),(c)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

5.650%

spread),

2022

DNA3,

144A

8.647%

4/25/42

3,980,894

4,900

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

4.750%

spread),

2022

DNA2,

144A

10.065%

2/25/42

4,974,040

115

(b)

Freddie

Mac

Strips,

(SOFR30A

reference

rate

+

5.806%

spread),

2014

327,

(I/O)

0.492%

3/15/44

8,281

900

(b),(c)

Freddie

Mac

Structured

Agency

Credit

Risk

Debt

Notes,

(SOFR30A

reference

rate

+

4.000%

spread),

2022

HQA2,

144A

9.315%

7/25/42

937,480

7,146

(b),(c)

Government

National

Mortgage

Association,

(SOFR30A

reference

rate

+

6.250%

spread),

2020

133,

(I/O)

0.936%

9/20/50

716,212

1,400

(b)

GS

Mortgage

Securities

Corp

Trust,

(TSFR1M

reference

rate

+

3.464%

spread),

2021

ARDN,

144A

8.797%

11/15/36

1,301,443

1,100

(b)

GS

Mortgage

Securities

Corp

Trust,

(TSFR1M

reference

rate

+

1.897%

spread),

2018

TWR,

144A

7.230%

7/15/31

544,500

1,500

GS

Mortgage

Securities

Corp

Trust

2017-SLP,

2017

SLP,

144A

4.744%

10/10/32

1,421,716

700

(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

reference

rate

+

2.397%

spread),

2018

TWR,

144A

7.730%

7/15/31

290,500

1,000

(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

reference

rate

+

1.747%

spread),

2018

TWR,

144A

7.080%

7/15/31

645,000

700

(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

reference

rate

+

3.097%

spread),

2018

TWR,

144A

8.430%

7/15/31

205,800

892

(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

reference

rate

+

4.222%

spread),

2018

TWR,

144A

9.555%

7/15/31

77,269

1,000

(b)

GS

Mortgage

Securities

Corp

Trust

2021-ARDN,

(TSFR1M

reference

rate

+

2.864%

spread),

2021

ARDN,

144A

8.197%

11/15/36

934,033

2,000

(c)

GS

Mortgage

Securities

Trust,

2016

GS4

4.078%

11/10/49

1,609,073

1,000

Hudson

Yards

Mortgage

Trust,

2019

55HY,

144A

3.041%

12/10/41

687,934

441

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2019-ICON

UES,

2019

UES,

144A

4.601%

5/05/32

415,828

377

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2019-ICON

UES,

2019

UES,

144A

4.601%

5/05/32

357,889

366

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2020-NNN,

2020

NNN,

144A

3.972%

1/16/37

291,514

856

JP

Morgan

Mortgage

Trust,

2018

6,

144A

3.891%

12/25/48

693,625

2,000

(c)

JPMBB

Commercial

Mortgage

Securities

Trust,

2014

C22

4.700%

9/15/47

1,546,502

1,930

(c)

JPMBB

Commercial

Mortgage

Securities

Trust,

2017

JP6

3.854%

7/15/50

1,359,993

1,849

(c)

JPMBB

Commercial

Mortgage

Securities

Trust,

2017

JP7,

144A

4.529%

9/15/50

1,230,577

1,000

(c)

JPMBB

Commercial

Mortgage

Securities

Trust

2015-C27,

2015

C27

3.898%

2/15/48

912,455

760

(c)

JPMBB

Commercial

Mortgage

Securities

Trust

2015-C29,

2015

C29

4.118%

5/15/48

697,505

1,189

(c)

JPMBB

Commercial

Mortgage

Securities

Trust

2016-C1,

2016

C1

4.859%

3/17/49

1,049,967

2,000

(c)

JPMCC

Commercial

Mortgage

Securities

Trust

2017-JP5,

2017

JP5

3.904%

3/15/50

1,493,198

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

MORTGAGE-BACKED

SECURITIES

(continued)

$

1,500

JPMCC

Commercial

Mortgage

Securities

Trust

2017-JP6,

2017

JP6,

144A

4.604%

7/15/50

$

977,063

1,098

(c)

Morgan

Stanley

Bank

of

America

Merrill

Lynch

Trust

2014

C19,

2014

C19

4.000%

12/15/47

994,007

226

Morgan

Stanley

Capital

I

Trust

2015-MS1,

2015

MS1

4.158%

5/15/48

208,528

183

Morgan

Stanley

Mortgage

Loan

Trust

2007-15AR,

2007

15AR

3.275%

11/25/37

120,784

1,000

MRCD

Mortgage

Trust,

2019

PARK,

144A

2.718%

12/15/36

587,996

750

MSCG

Trust,

2015

ALDR,

144A

3.577%

6/07/35

655,915

250

MSCG

Trust,

2015

ALDR,

144A

3.577%

6/07/35

212,277

1,050

(b)

Natixis

Commercial

Mortgage

Securities

Trust,

(TSFR1M

reference

rate

+

4.329%

spread),

2019

MILE,

144A

9.662%

7/15/36

698,876

1,000

(b)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

reference

rate

+

2.829%

spread),

2019

MILE,

144A

8.162%

7/15/36

766,461

1,000

(b),(c)

PKHL

Commercial

Mortgage

Trust

2021-MF,

(TSFR1M

reference

rate

+

2.114%

spread),

2021

MF,

144A

7.447%

7/15/38

828,664

1,000

(b)

PNMAC

GMSR

ISSUER

TRUST,

(1-Month

LIBOR

reference

rate

+

3.850%

spread),

2018

GT1,

144A

9.284%

2/25/25

1,001,618

40,180

SLG

Office

Trust,

2021

OVA,

144A

0.258%

7/15/41

569,339

1,624

(b),(c)

SMR

Mortgage

Trust,

(TSFR1M

reference

rate

+

3.950%

spread),

2022

IND,

144A

9.282%

2/15/39

1,521,818

1,500

Spruce

Hill

Mortgage

Loan

Trust,

2020

SH1,

144A

3.827%

1/28/50

1,291,733

127,100

SUMIT

2022-BVUE

Mortgage

Trust,

2022

BVUE,

(I/O),

144A

0.179%

2/12/41

660,666

428

(c)

UBS-Barclays

Commercial

Mortgage

Trust

2013-C5,

144A

3.649%

3/10/46

392,557

1,500

VNDO

Trust,

2016

350P,

144A

4.033%

1/10/35

1,149,540

1,300

(c)

Wells

Fargo

Commercial

Mortgage

Trust

2015-NXS1,

2015

NXS1

4.278%

5/15/48

1,083,447

Total

Mortgage-Backed

Securities

(cost

$114,569,927)

101,577,406

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

ASSET-BACKED

SECURITIES

-

39.8%

(28.6%

of

Total

Investments)

X

40,762,282

1,151

AASET

2020-1

Trust,

2020

1A,

144A

6.413%

1/16/40

$

149,730

1,500

(b),(c)

ACRE

Commercial

Mortgage

Ltd,

(TSFR1M

reference

rate

+

2.714%

spread),

2021

FL4,

144A

8.045%

12/18/37

1,388,400

857

(c)

Air

Canada

2020-2

Class

A

Pass

Through

Trust,

2020

A,

144A

5.250%

4/01/29

827,103

696

(c)

Air

Canada

2020-2

Class

B

Pass

Through

Trust,

2020

A,

144A

9.000%

10/01/25

703,054

550

Avis

Budget

Rental

Car

Funding

AESOP

LLC,

2021

2A,

144A

4.080%

2/20/28

468,488

295

Bojangles

Issuer

LLC,

2020

1A,

144A

3.832%

10/20/50

270,128

500

(b)

Bonanza

RE

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

4.870%

spread),

2020

A,

144A

10.305%

12/23/24

446,650

250

(b)

Bonanza

RE

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

5.750%

spread),

144A

11.183%

3/16/25

175,000

250

(b)

Bonanza

RE

Ltd,

144A

4.555%

1/08/24

125,000

750

(b)

Bonanza

RE

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

8.250%

spread),

144A

12.787%

1/08/26

754,125

509

(c)

British

Airways

Class

A

Pass

Through

Trust,

2020

A,

144A

4.250%

11/15/32

456,607

415

(c)

British

Airways

Class

B

Pass

Through

Trust,

2020

A,

144A

8.375%

11/15/28

421,882

2,000

Cars

Net

Lease

Mortgage

Notes

Series,

2020

1A,

144A

4.690%

12/15/50

1,649,333

775

CARS-DB4

LP,

2020

1A,

144A

4.520%

2/15/50

680,337

3

(d)

Carvana

Auto

Receivables

Trust,

2021

P2,

144A

0.000%

5/10/28

560,000

250

(b)

Cayuga

Park

CLO

Ltd,

(TSFR3M

reference

rate

+

6.262%

spread),

2020

1A,

144A

1.000%

7/17/34

232,450

375

(b)

CIFC

Funding

2022-II

Ltd,

(TSFR3M

reference

rate

+

7.000%

spread),

2022

2A,

144A

12.320%

4/19/35

363,340

750

(b)

CIFC

Funding

Ltd,

(SOFR

reference

rate

+

3.550%

spread),

2022

4A,

144A

8.858%

7/16/35

743,572

385

(b)

CIFC

Funding

Ltd,

(3-Month

LIBOR

reference

rate

+

6.762%

spread),

2020

2A,

144A

12.088%

10/20/34

363,746

Nuveen

Mortgage

and

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

ASSET-BACKED

SECURITIES

(continued)

$

250

(b)

Citrus

Re

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

5.100%

spread),

144A

5.100%

6/07/25

$

246,850

250

Cologix

Data

Centers

US

Issuer

LLC,

2021

1A,

144A

5.990%

12/26/51

203,910

1,118

CyrusOne

Data

Centers

Issuer

I,

2023

1A,

144A

5.450%

4/20/48

947,607

918

EWC

Master

Issuer

LLC,

2022

1A,

144A

5.500%

3/15/52

844,367

476

FOCUS

Brands

Funding

LLC,

2018

1,

144A

5.184%

10/30/48

453,569

1,500

Frontier

Issuer

LLC,

2023

1,

144A

8.300%

8/20/53

1,420,926

1,500

Frontier

Issuer

LLC,

2023

1,

144A

11.500%

8/20/53

1,446,015

500

(b)

Goldentree

Loan

Opportunities

IX

Ltd,

(TSFR3M

reference

rate

+

5.922%

spread),

2014

9A,

144A

11.291%

10/29/29

500,068

500

(b)

GoldentTree

Loan

Management

US

CLO

1

Ltd,

(3-Month

LIBOR

reference

rate

+

7.762%

spread),

2021

11A,

144A

8.563%

10/20/34

430,402

486

Hardee's

Funding

LLC,

2020

1A,

144A

3.981%

12/20/50

409,099

355

(b)

Helios

Issuer,

LLC,

2023

B,

144A

6.000%

8/22/50

307,658

500

Hertz

Vehicle

Financing

III

LLC,

2022

1A,

144A

4.850%

6/25/26

467,809

250

(b)

Hestia

Re

Ltd,

(1-Month

U.S.

Treasury

Bill

reference

rate

+

9.500%

spread),

144A

14.935%

4/22/25

241,625

180

HIN

Timeshare

Trust

2020-A,

2020

A,

144A

6.500%

10/09/39

165,672

252

HIN

Timeshare

Trust

2020-A,

2020

A,

144A

5.500%

10/09/39

232,695

640

Jack

in

the

Box

Funding

LLC,

2019

1A,

144A

4.476%

8/25/49

594,082

610

Jonah

Energy

Abs

I

LLC,

2022

1,

144A

7.200%

11/20/37

594,699

328

LUNAR

AIRCRAFT

2020-1

LTD,

2020

1A,

144A

3.376%

2/15/45

283,588

500

(b)

Madison

Park

Funding

XXXVI

Ltd,

(TSFR3M

reference

rate

+

5.460%

spread),

2019

36A,

144A

5.764%

4/15/35

492,140

1,125

(b)

Magnetite

XXIII

Ltd,

(TSFR3M

reference

rate

+

6.562%

spread),

2019

23A,

144A

7.484%

1/25/35

1,103,829

250

(b)

Matterhorn

Re

Ltd,

(SOFR

reference

rate

+

5.250%

spread),

144A

5.889%

3/24/25

243,600

500

Mercury

Financial

Credit

Card

Master

Trust,

2022

3A,

144A

10.680%

6/21/27

497,663

500

Mercury

Financial

Credit

Card

Master

Trust,

2023

1A,

144A

9.590%

9/20/27

500,481

500

Mercury

Financial

Credit

Card

Master

Trust,

2023

1A,

144A

8.040%

9/20/27

501,796

125

MetroNet

Infrastructure

Issuer

LLC,

2023

1A,

144A

10.850%

4/20/53

119,461

125

MetroNet

Infrastructure

Issuer

LLC,

2023

1A,

144A

8.010%

4/20/53

120,105

1,467

Mexico

Remittances

Funding

Fiduciary

Estate

Management

Sarl

,

144A

4.875%

1/15/28

1,308,994

1,277

(d)

Mosaic

Solar

Loan

Trust,

2019

2A,

144A

0.000%

9/20/40

498,509

798

(d)

Mosaic

Solar

Loan

Trust,

2020

1A,

144A

0.000%

4/20/46

563,695

821

Mosaic

Solar

Loan

Trust

2020-2,

2020

2A,

144A

5.420%

8/20/46

722,870

477

MVW

2020-1

LLC,

2020

1A,

144A

4.210%

10/20/37

450,723

221

MVW

2020-1

LLC,

2020

1A,

144A

7.140%

10/20/37

211,218

500

Oportun

Funding

2022-1

LLC,

2022

1,

144A

6.000%

6/15/29

479,138

324

Oportun

Funding

XIV

LLC,

2021

A,

144A

5.400%

3/08/28

313,733

350

Oportun

Issuance

Trust,

2021

C,

144A

5.570%

10/08/31

306,732

1,000

Oportun

Issuance

Trust

2021-B,

2021

B,

144A

5.410%

5/08/31

904,726

925

(b)

Palmer

Square

CLO

Ltd,

(TSFR3M

reference

rate

+

5.300%

spread),

2023

1A,

144A

10.626%

1/20/36

938,306

625

(b)

Palmer

Square

CLO

Ltd,

(TSFR3M

reference

rate

+

6.350%

spread),

2022

1A,

144A

11.676%

4/20/35

617,541

250

Purchasing

Power

Funding

LLC,

2021

A,

144A

4.370%

10/15/25

239,543

947

Purewest

Funding

LLC,

2021

1,

144A

4.091%

12/22/36

897,600

500

(b)

Residential

Reinsurance

2022

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

7.000%

spread),

144A

12.435%

12/06/26

501,150

400

(b)

Residential

Reinsurance

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

6.510%

spread),

2020

A,

144A

6.510%

12/06/24

393,160

500

(b)

SD

Re

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

9.250%

spread),

144A

14.685%

11/19/24

487,300

650

SERVPRO

Master

Issuer

LLC,

2019

1A,

144A

3.882%

10/25/49

593,199

571

Sesac

Finance

LLC,

2019

1,

144A

5.216%

7/25/49

537,437

275

Sierra

Timeshare

2020-2

Receivables

Funding

LLC,

2020

2A,

144A

6.590%

7/20/37

262,993

44

Sierra

Timeshare

Receivables

Funding

LLC,

2019

3A,

144A

4.180%

8/20/36

41,676

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

ASSET-BACKED

SECURITIES

(continued)

$

1,000

(b)

Sixth

Street

CLO

XIX

Ltd,

(3-Month

LIBOR

reference

rate

+

6.162%

spread),

2021

19A,

144A

6.035%

7/20/34

$

967,608

451

Start

II

LTD,

2019

1,

144A

5.095%

3/15/44

356,373

1,000

(b)

TCW

CLO

Ltd,

(3-Month

LIBOR

reference

rate

+

6.860%

spread),

2021

2A,

144A

6.985%

7/25/34

920,191

500

(b)

Ursa

Re

II

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

7.000%

spread),

144A

12.435%

12/06/25

518,750

1,156

Vivint

Solar

Financing

V

LLC,

2018

1A,

144A

7.370%

4/30/48

1,046,422

556

VR

Funding

LLC,

2020

1A,

144A

6.420%

11/15/50

514,873

1,050

VREG

Films

Inc

,

2023

23-1

10.550%

11/15/50

1,019,161

Total

Asset-Backed

Securities

(cost

$45,194,731)

40,762,282

Total

Long-Term

Investments

(cost

$159,764,658)

142,339,688

Borrowings

-

(8.6)%

(e),(f)

(8,820,000)

Reverse

Repurchase

Agreements,

including

accrued

interest

-

(30.3)%(g)

(31,011,469)

Other

Assets

&

Liabilities,

Net

- (0.2)%

(170,170)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

102,338,049

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Mortgage-Backed

Securities

$

–

$

101,577,406

$

–

$

101,577,406

Asset-Backed

Securities

–

39,140,078

1,622,204

40,762,282

Total

$

–

$

140,717,484

$

1,622,204

$

142,339,688

Nuveen

Mortgage

and

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

The

following

is

a

reconciliation

of

the

Fund’s

Level

3

investments

held

at

the

beginning

and

end

of

the

measurement

period:

The

valuation

techniques

and

significant

unobservable

inputs

used

in

recurring

Level

3

fair

value

measurements

of

assets

as

of

the

end

of

the

reporting

period,

were

as

follows:

The

table

below

presents

the

transfers

in

and

out

of

the

three

valuation

levels

for

the

Fund

as

of

the

end

of

the

reporting

period

when

compared

to

the

valuation

levels

at

the

end

of

the

previous

fiscal

year.

Changes

in

valuation

inputs

or

methodologies

may

result

in

transfers

into

or

out

of

an

assigned

level

within

the

fair

value

hierarchy.

Transfers

in

or

out

of

levels

are

generally

due

to

the

availability

of

publicly

available

information

and

to

the

significance

or

extent

the

Adviser

determines

that

the

valuation

inputs

or

methodologies

may

impact

the

valuation

of

those

securities.

Level

3

Mortgage

and

Income

Fund

Asset-Backed

Securities

Balance

at

the

beginning

of

period

$11

Gains

(losses):

-

Net

realized

gains

(losses)

(1,554)

Change

in

net

unrealized

appreciation

(depreciation)

103,233

Purchases

at

cost

-

Sales

at

proceeds

(8)

Net

discounts

(premiums)

48,048

Transfers

into

1,622,204

Transfers

(out

of)

(149,730)

Balance

at

the

end

of

period

$1,622,204

Change

in

net

unrealized

appreciation

(depreciation)

during

the

period

of

Level

3

securities

held

as

of

period

end

$(360,195)

Fund

Asset

Class

Market

Value

Techniques

Unobservable

Inputs

Range

JLS

Asset-Backed

Securities

1,622,204

Third

Party

Vendor

Broker

Quote

$39.04

-

$22,400.00

Level

1

Level

2

Level

3

Transfers

In

(Transfers

Out)

Transfers

In

(Transfers

Out)

Transfers

In

(Transfers

Out)

Asset-Backed

Securities

$-

$-

$149,730

$-

$1,622,204

$(149,730)

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$44,226,396

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(d)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(e)

Borrowings

as

a

percentage

of

Total

Investments

is

6.2%.

(f)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$28,870,384

have

been

pledged

as

collateral

for

borrowings.

(g)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

21.8%.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

I/O

Interest

only

security

LIBOR

London

Inter-Bank

Offered

Rate

SOFR

30A

30

Day

Average

Secured

Overnight

Financing

Rate

TSFR

1M

CME

Term

SOFR

1

Month

TSFR

3M

CME

Term

SOFR

3

Month

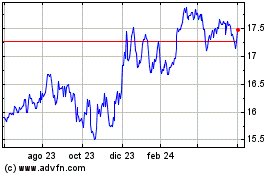

Nuveen Mortgage and Income (NYSE:JLS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

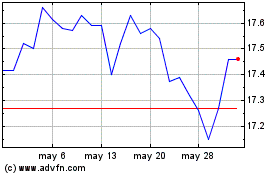

Nuveen Mortgage and Income (NYSE:JLS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024