Knight-Swift Transportation Announces Updated First and Second Quarter Earnings Guidance

17 Abril 2024 - 8:00AM

Business Wire

Knight-Swift Transportation Holdings Inc. (NYSE: KNX)

("Knight-Swift", the "Company", or "we") today announced an update

to its earnings guidance for the first and second quarters of

2024.

Based on preliminary results, the Company now expects that

Adjusted EPS(1) for the first quarter of 2024 will range from $0.11

to $0.12 (which is an update from the previously-announced

expectation of $0.37 to $0.41). This range includes a loss of $0.08

per share for the third-party insurance business that ceased

operation at the end of the quarter; excluding this insurance loss,

the expected Adjusted EPS range would be $0.19 to $0.20.

The full truckload industry continues to be challenging and

oversupplied with capacity. The weather disruption in January had a

greater impact than initially estimated, as the subsequent recovery

was not sufficient to offset the negative impact to volumes and

operating costs for the quarter. The early part of the bid season

led to greater than expected pressure on freight rates as some

shippers are still trying to push rates down further. In some

cases, we have lost contractual volumes because we were not willing

to commit to further concessions on what we view as unsustainable

contractual rates. This resulted in more of our capacity being

allocated to the spot market, which creates further pressure on

revenue per mile and utilization in the near term but positions

capacity to react to changes in the market. The softer volume and

pricing headwinds also impacted our Logistics volumes and margins,

with further volume pressure on Logistics as we diverted loads to

the asset division to partially offset the contractual volume

losses noted above.

The less-than-truckload (LTL) segment continues to show positive

volume and yield trends year-over-year, though the impact of the

weather disruption was greater on this business relative to our

Truckload segment as our LTL network footprint is not nationwide

and is more concentrated in the areas affected by the weather in

the first quarter. While the subsequent volume recovery was more

pronounced in the LTL market than in truckload, it was not enough

to offset the outsized impact to our operating costs, resulting in

lower operating income than expected. Volumes normalized into March

and April, and we remain focused on improving our margins while

expanding our footprint as we operationalize many of the properties

we have recently purchased.

The Company also expects that Adjusted EPS(1) for the second

quarter of 2024 will range from $0.26 to $0.30 (which is an update

from the previously-announced expectation of $0.53 to $0.57). This

updated range assumes the more challenging market conditions noted

above continue, such as the bid season trends and less pronounced

seasonality in the truckload market than originally projected and

reflects:

- Truckload segment operating ratios in the mid-90’s for our

existing businesses and continued roughly break-even operating

results for U.S. Xpress with overall revenues stabilizing at

declines of roughly 5% from the fourth quarter level due to

headwinds on revenue per mile and on dedicated services;

- LTL segment operating ratio performing at similar levels as the

second quarter of 2023 with year-over-year revenue growth of

10-15%;

- Logistics segment operating ratio in the mid-90’s with

year-over-year revenue growth of 10 to 15%, as a result of the U.S.

Xpress acquisition;

- Intermodal segment operating ratio approaching breakeven during

the quarter with revenues down slightly year-over-year; and

- All Other segments operating income of approximately $10-15

million for the quarter before including the $11.7 million

intangibles asset amortization.

We plan to provide third quarter 2024 guidance in conjunction

with the first quarter 2024 earnings release on April 24, 2024. Our

Adjusted EPS ranges are based on the current freight market, recent

trends, and the current beliefs, assumptions, and expectations of

management.

(1)

Our calculation of Adjusted EPS

starts with US GAAP diluted earnings per share and adds back the

after-tax impact of intangible asset amortization (which is

expected to be approximately $0.08 per quarter), noncash

impairments, and certain other unusual noncash items, if any.

Forward Looking Statements

This press release contains certain statements that may be

considered forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, and such

statements are subject to the safe harbor created by those sections

and the Private Securities Litigation Reform Act of 1995, as

amended. All statements, other than statements of historical or

current fact, are statements that could be deemed forward-looking

statements, including, without limitation, statements relating to

expected Adjusted EPS, the future freight environment (including,

without limitation, rates, volumes, capacity, and seasonality),

future performance and financial results of our businesses,

including revenues, operating income, and operating ratios, and our

future LTL network. Forward-looking statements are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified, which could cause future events and actual

results to differ materially from those set forth in, contemplated

by, or underlying the forward-looking statements. Forward looking

statements are subject to various risks and uncertainties,

including, but not limited to current beliefs, assumptions, and

expectations of management, and those risks, uncertainties, and

other factors identified from time-to-time in our filings with the

Securities and Exchange Commission. Our preliminary results for the

first quarter of 2024 have not been subjected to all the review

procedures associated with the release of actual financial results

and are premised on certain assumptions. Among the other factors

enumerated herein, estimates and adjusting entries made during the

review process and the completion of all review procedures and

preparation of financial statements in accordance with generally

accepted accounting principles could cause our actual results for

the first quarter of 2024 to differ from the preliminary results.

Readers should review and consider the factors that may affect

future results and other disclosures in the Risk Factors section of

Knight-Swift Transportation Holdings Inc.'s Annual Report on Form

10-K for the year ended December 31, 2023, and various disclosures

in our press releases, stockholder reports, and other filings with

the SEC. We expressly disclaim any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240417007823/en/

Adam Miller, CEO, or Andrew Hess, CFO - (602) 606-6349

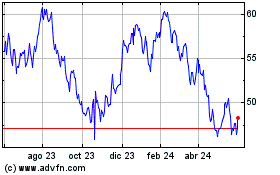

Knight Swift Transportat... (NYSE:KNX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

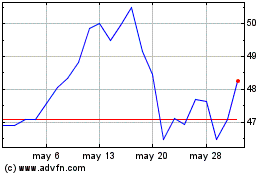

Knight Swift Transportat... (NYSE:KNX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025