Form 8-K - Current report

21 Noviembre 2023 - 6:00AM

Edgar (US Regulatory)

KOHLS Corp false 0000885639 0000885639 2023-11-21 2023-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 21, 2023

KOHL’S CORP

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Wisconsin |

|

001-11084 |

|

39-1630919 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

| N56 W17000 Ridgewood Drive |

|

|

| Menomonee Falls, Wisconsin |

|

|

|

53051 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 262 703-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $.01 par value |

|

KSS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 21, 2023, Kohl’s Corporation (the “Company”) issued a press release reporting its earnings for the quarter ended October 28, 2023 and provided earnings guidance for fiscal 2023. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein. A copy of the presentation materials for the November 21, 2023 quarterly earnings conference call is attached as Exhibit 99.2 and incorporated by reference herein.

| Item 7.01 |

Regulation FD Disclosure. |

See Item 2.02.

The information in Items 2.02 and 7.01, including the exhibits attached hereto, is furnished solely pursuant to Items 2.02 and 7.01 of Form 8-K. Consequently, such information is not deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Further, the information in Items 2.02 and 7.01, including the exhibits, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933.

As previously announced, on November 7, 2023, the Board of Directors of the Company declared a quarterly cash dividend of $0.50 per share. The dividend will be paid on December 20, 2023, to all shareholders of record at the close of business on December 6, 2023.

Cautionary Statement Regarding Forward-Looking Information and Non-GAAP Measures

This current report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “intends,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Forward-looking statements include the information under “2023 Financial and Capital Allocation Outlook.” Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which is expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and the Company undertakes no obligation to update them.

In the attached presentation materials, the Company provides information regarding free cash flow, which is not a recognized term under U.S. generally accepted accounting principles (“GAAP”) and does not purport to be an alternative to net income as a measure of operating performance. A reconciliation of free cash flow is provided in the presentation materials attached hereto as Exhibit 99.2. The Company believes that the use of this non-GAAP financial measure provides investors with enhanced visibility into its results with respect to the impact of certain costs. Because not all companies use identical calculations, this presentation may not be comparable to other similarly titled measures of other companies.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

KOHL’S CORPORATION |

|

|

|

|

| Date: November 21, 2023 |

|

|

|

By: |

|

/s/ Jennifer Kent |

|

|

|

|

|

|

Jennifer Kent

Senior Executive Vice President,

Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

Kohl’s Reports Third Quarter Fiscal 2023 Financial Results

MENOMONEE FALLS, Wis.—(BUSINESS WIRE)—November 21, 2023— Kohl’s Corporation (NYSE:KSS) today reported results for the third quarter

ended October 28, 2023.

| |

• |

|

Net sales decreased 5.2% and comparable sales decreased 5.5% |

| |

• |

|

Diluted earnings per share of $0.53 |

| |

• |

|

Updates full year 2023 diluted earnings per share guidance to $2.30 to $2.70 |

| |

• |

|

Remains committed to strengthening balance sheet and to maintaining current dividend

|

Tom Kingsbury, Kohl’s chief executive officer, said “Kohl’s third quarter earnings reflect strong gross margin and

expense management as well as additional progress against our strategic priorities. I am pleased with our store performance driven by strong growth in Sephora and the newness in our home and gifting initiatives. This reinforces our actions are

working and resonating with our customers. In addition, we drove a 13% reduction in inventory as we benefited from our new disciplines.”

“Our

strategies to reposition Kohl’s for improved sales and earnings performance remain in the early stages. The work we have done in 2023 will continue to build momentum and set us up to be successful in 2024. I continue to be impressed with the

entire Kohl’s team for their hard work and agility in executing against our strategic priorities in 2023,” Kingsbury continued.

Third

Quarter 2023 Results

Comparisons refer to the 13-week period ended October 28, 2023 versus the 13-week period ended October 29, 2022

| |

• |

|

Net sales decreased 5.2% year-over-year, to $3.8 billion, with comparable sales down 5.5%.

|

| |

• |

|

Gross margin as a percentage of net sales was 38.9%, an increase of 158 basis points.

|

| |

• |

|

Selling, general & administrative (SG&A) expenses increased 1.9%

year-over-year, to $1.4 billion. As a percentage of total revenue, SG&A expenses were 33.5%, an increase of 235 basis points year-over-year. |

| |

• |

|

Operating income was $157 million compared to $200 million in the prior year. As a percentage of

total revenue, operating income was 3.9%, a decrease of 82 basis points year-over-year. |

| |

• |

|

Net income was $59 million, or $0.53 per diluted share. This compares to net income of

$97 million, or $0.82 per diluted share in the prior year. |

| |

• |

|

Inventory was $4.2 billion, a decrease of 13% year-over-year. |

| |

• |

|

Operating cash flow was $151 million. |

Nine Months Fiscal Year 2023 Results

Comparisons refer to the 39-week period ended October 28, 2023 versus the

39-week period ended October 29, 2022

| |

• |

|

Net sales decreased 4.5% year-over-year, to $10.9 billion, with comparable sales down 5.0%.

|

| |

• |

|

Gross margin as a percentage of net sales was 39.0%, an increase of 56 basis points.

|

| |

• |

|

Selling, general & administrative (SG&A) expenses decreased 0.2%

year-over-year, to $3.9 billion. As a percentage of total revenue, SG&A expenses were 33.9%, an increase of 150 basis points year-over-year. |

| |

• |

|

Operating income was $418 million compared to $548 million in the prior year. As a percentage of

total revenue, operating income was 3.6%, a decrease of 91 basis points year-over-year. |

| |

• |

|

Net income was $131 million, or $1.18 per diluted share. This compares to net income of

$254 million, or $2.02 per diluted share in the prior year. |

| |

• |

|

Operating cash flow was $379 million. |

2023 Financial and Capital Allocation Outlook

For the full year 2023, the Company updates its financial outlook and currently expects the following:

| |

• |

|

Net sales: A decrease of (2.8%) to (4%), includes the impact of the 53rd week which is worth approximately

1% year-over-year. This compares to the Company’s prior guidance of a decrease of (2%) to (4%). |

| |

• |

|

Operating margin: Approximately 4.0%, which is consistent with the Company’s prior guidance.

|

| |

• |

|

Diluted earnings per share: In the range of $2.30 to $2.70, excluding any

non-recurring charges. This compares to the Company’s prior guidance range of $2.10 to $2.70. |

| |

• |

|

Capital Expenditures: Towards the lower end of $600 million to $650 million, including expansion

of its Sephora partnership and store refresh activity. |

| |

• |

|

Dividend: On November 7, 2023, Kohl’s Board of Directors declared a quarterly cash dividend on

the Company’s common stock of $0.50 per share. The dividend is payable December 20, 2023 to shareholders of record at the close of business on December 6, 2023. |

Third Quarter 2023 Earnings Conference Call

Kohl’s will host its quarterly earnings conference call at 9:00 am ET on November 21, 2023. A webcast of the conference call and the related

presentation materials will be available via the Company’s web site at investors.kohls.com, both live and after the call.

Cautionary

Statement Regarding Forward-Looking Information

This press release contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,”

or similar expressions to identify forward-looking statements. Forward-looking statements include the information under “2023 Financial and Capital Allocation Outlook.” Such statements are subject to certain risks and uncertainties, which

could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s

Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements

relate to the date initially made, and the Company undertakes no obligation to update them.

About Kohl’s

Kohl’s (NYSE: KSS) is a leading omnichannel retailer built on a foundation that combines great brands, incredible value and convenience for

our customers. Kohl’s serves millions of families in our more than 1,100 stores in 49 states, online at Kohls.com, and through our Kohl’s App. For a list of store locations or to shop online, visit Kohls.com. For more information

about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com.

Contacts

Investor Relations:

Mark Rupe, (262) 703-1266, mark.rupe@kohls.com

Media:

Jen Johnson, (262) 703-5241, jen.johnson@kohls.com

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| (Dollars in Millions, Except per Share Data) |

|

October 28, 2023 |

|

|

October 29, 2022 |

|

|

October 28, 2023 |

|

|

October 29, 2022 |

|

| Net sales |

|

$ |

3,843 |

|

|

$ |

4,052 |

|

|

$ |

10,876 |

|

|

$ |

11,386 |

|

| Other revenue |

|

|

211 |

|

|

|

225 |

|

|

|

644 |

|

|

|

693 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

4,054 |

|

|

|

4,277 |

|

|

|

11,520 |

|

|

|

12,079 |

|

| Cost of merchandise sold |

|

|

2,349 |

|

|

|

2,541 |

|

|

|

6,638 |

|

|

|

7,013 |

|

| Gross margin rate |

|

|

38.9 |

% |

|

|

37.3 |

% |

|

|

39.0 |

% |

|

|

38.4 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general, and administrative |

|

|

1,360 |

|

|

|

1,334 |

|

|

|

3,902 |

|

|

|

3,910 |

|

| As a percent of total revenue |

|

|

33.5 |

% |

|

|

31.2 |

% |

|

|

33.9 |

% |

|

|

32.4 |

% |

| Depreciation and amortization |

|

|

188 |

|

|

|

202 |

|

|

|

562 |

|

|

|

608 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

157 |

|

|

|

200 |

|

|

|

418 |

|

|

|

548 |

|

| Interest expense, net |

|

|

89 |

|

|

|

81 |

|

|

|

262 |

|

|

|

226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

68 |

|

|

|

119 |

|

|

|

156 |

|

|

|

322 |

|

| Provision for income taxes |

|

|

9 |

|

|

|

22 |

|

|

|

25 |

|

|

|

68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

59 |

|

|

$ |

97 |

|

|

$ |

131 |

|

|

$ |

254 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average number of shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

110 |

|

|

|

118 |

|

|

|

110 |

|

|

|

124 |

|

| Diluted |

|

|

111 |

|

|

|

119 |

|

|

|

111 |

|

|

|

126 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.54 |

|

|

$ |

0.82 |

|

|

$ |

1.19 |

|

|

$ |

2.05 |

|

| Diluted |

|

$ |

0.53 |

|

|

$ |

0.82 |

|

|

$ |

1.18 |

|

|

$ |

2.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KOHL’S CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

| (Dollars in Millions) |

|

October 28, 2023 |

|

|

October 29, 2022 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

190 |

|

|

$ |

194 |

|

| Merchandise inventories |

|

|

4,239 |

|

|

|

4,874 |

|

| Other |

|

|

291 |

|

|

|

366 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

4,720 |

|

|

|

5,434 |

|

| Property and equipment, net |

|

|

7,861 |

|

|

|

8,117 |

|

| Operating leases |

|

|

2,492 |

|

|

|

2,318 |

|

| Other assets |

|

|

394 |

|

|

|

365 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

15,467 |

|

|

$ |

16,234 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,918 |

|

|

$ |

2,014 |

|

| Accrued liabilities |

|

|

1,324 |

|

|

|

1,436 |

|

| Borrowings under revolving credit facility |

|

|

625 |

|

|

|

668 |

|

| Current portion of: |

|

|

|

|

|

|

|

|

| Long-term debt |

|

|

111 |

|

|

|

164 |

|

| Finance leases and financing obligations |

|

|

84 |

|

|

|

95 |

|

| Operating leases |

|

|

94 |

|

|

|

109 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

4,156 |

|

|

|

4,486 |

|

| Long-term debt |

|

|

1,638 |

|

|

|

1,747 |

|

| Finance leases and financing obligations |

|

|

2,714 |

|

|

|

2,791 |

|

| Operating leases |

|

|

2,780 |

|

|

|

2,595 |

|

| Deferred income taxes |

|

|

107 |

|

|

|

165 |

|

| Other long-term liabilities |

|

|

321 |

|

|

|

354 |

|

| Shareholders’ equity: |

|

|

3,751 |

|

|

|

4,096 |

|

| Total liabilities and shareholders’ equity |

|

$ |

15,467 |

|

|

$ |

16,234 |

|

|

|

|

|

|

|

|

|

|

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended |

|

| (Dollars in Millions) |

|

October 28, 2023 |

|

|

October 29, 2022 |

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

131 |

|

|

$ |

254 |

|

| Adjustments to reconcile net income to net cash provided by (used in) operating

activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

562 |

|

|

|

608 |

|

| Share-based compensation |

|

|

31 |

|

|

|

37 |

|

| Deferred income taxes |

|

|

(25 |

) |

|

|

(41 |

) |

| Non-cash lease expense |

|

|

70 |

|

|

|

81 |

|

| Other non-cash items |

|

|

13 |

|

|

|

12 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Merchandise inventories |

|

|

(1,046 |

) |

|

|

(1,802 |

) |

| Other current and long-term assets |

|

|

66 |

|

|

|

102 |

|

| Accounts payable |

|

|

588 |

|

|

|

331 |

|

| Accrued and other long-term liabilities |

|

|

58 |

|

|

|

76 |

|

| Operating lease liabilities |

|

|

(69 |

) |

|

|

(83 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) operating activities |

|

|

379 |

|

|

|

(425 |

) |

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Acquisition of property and equipment |

|

|

(495 |

) |

|

|

(733 |

) |

| Proceeds from sale of real estate |

|

|

15 |

|

|

|

31 |

|

| Other |

|

|

(11 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(491 |

) |

|

|

(702 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Net borrowings under revolving credit facility |

|

|

540 |

|

|

|

668 |

|

| Treasury stock purchases |

|

|

— |

|

|

|

(658 |

) |

| Shares withheld for taxes on vested restricted shares |

|

|

(13 |

) |

|

|

(21 |

) |

| Dividends paid |

|

|

(165 |

) |

|

|

(184 |

) |

| Repayment of long-term borrowings |

|

|

(164 |

) |

|

|

— |

|

| Finance lease and financing obligation payments |

|

|

(68 |

) |

|

|

(81 |

) |

| Proceeds from financing obligations |

|

|

19 |

|

|

|

9 |

|

| Proceeds from stock option exercises |

|

|

— |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

149 |

|

|

|

(266 |

) |

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

|

37 |

|

|

|

(1,393 |

) |

| Cash and cash equivalents at beginning of period |

|

|

153 |

|

|

|

1,587 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

190 |

|

|

$ |

194 |

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2 Kids uniform Men’s Nike image footwear

image

11 16

tightly. strong growth and the newness in our home decor and gifting

initiatives and set us up to be successful in 2024

New image

Focus on stores driving improved performance ● Re-established

stores as a key focal point of our strategy ● New leadership focused on driving increased store productivity ● Investments in improved merchandising and enhanced customer experience ● Favorable customer response to date from our

efforts Q3 2023 YTD 2023 Store comparable Store comparable sales ~(1%) vs. last sales slightly positive year vs. last year

900 Sephora shops by year end 2023

(2.8%) (3%) to (4%) vs. 2022, includes a 1% benefit from the 53rd week

A few of these 4 Approx. 4.0% images are summer apparel - probably makes sense to update for seasonal $2.30 $2.70 $2.20 to $2.60 Replace with fall apparel image Diluted

Pleased with store performance driven by strong growth in Sephora and

the newness in our home decor and gifting initiatives

$0.82 January 28, 2023 Twelve Months Ended

Update images - Holiday theme

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

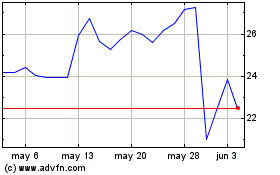

Kohls (NYSE:KSS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Kohls (NYSE:KSS)

Gráfica de Acción Histórica

De May 2023 a May 2024