Third Quarter 2024 Highlights

- Revenue of $670 million increased 2 percent compared to prior

year

- Reported gross margin was 44.7 percent. Adjusted gross margin

was 45.0 percent and increased 150 basis points compared to prior

year on a reported basis, excluding the out-of-period duty charge

in that period

- Reported EPS was $1.26. Adjusted EPS of $1.37 increased 12

percent compared to prior year on a reported basis, excluding the

out-of-period duty charge in that period

- Inventory decreased 24 percent compared to prior year

- The Company repurchased $40 million of shares

- As previously announced, the Company’s Board of Directors

declared a regular quarterly cash dividend of $0.52 per share, a 4

percent increase compared to Q2’24

Updated Full Year 2024 Financial Outlook

- Revenue is now expected to be $2.60 billion ($2.57 to $2.63

billion prior outlook)

- Adjusted gross margin is now expected to be 45.1 percent (44.8

percent prior outlook), representing an increase of 260 basis

points compared to the prior year on an adjusted basis, excluding

the out-of-period duty charge in that period

- Adjusted operating income is expected to be $385 million

(higher end of $377 to $387 million prior outlook), representing an

increase of 11 percent (10 to 11 percent prior outlook) compared to

the prior year on an adjusted basis, excluding the out-of-period

duty charge in that period. Adjusted operating income includes a $6

million impact from supply chain and inventory management actions

compared to the prior outlook

- Adjusted EPS is now expected to be $4.83 (approximately $4.80

prior outlook), representing an increase of 9 percent (8 percent

prior outlook) compared to the prior year on an adjusted basis,

excluding the out-of-period duty charge in that period. Adjusted

EPS includes an $0.08 impact from supply chain and inventory

management actions compared to the prior outlook

- Cash from operations is now expected to exceed $360 million

(exceed $350 million prior outlook)

Kontoor Brands, Inc. (NYSE: KTB), a global lifestyle apparel

company, with a portfolio led by two of the world’s most iconic

consumer brands, Wrangler® and Lee®, today reported financial

results for its third quarter ended September 28, 2024.

“Our third quarter results exceeded expectations driven by

strong execution and business fundamentals,” said Scott Baxter,

President, Chief Executive Officer and Chair of Kontoor Brands.

“The investments in our brands continue to drive market share

gains, expanded distribution, category growth and new innovation

platforms. Fueled by our Jeanius transformation program, momentum

for the business is building, supported by increased investment

capacity and capital allocation optionality that position us to

deliver strong returns for stakeholders in the years ahead.”

Third Quarter 2024 Income Statement

Review

Revenue was $670 million and increased 2 percent compared

to the prior year. The increase was driven by growth in global

direct-to-consumer and U.S. wholesale, partially offset by a

decline in international wholesale revenue.

U.S. revenue was $530 million and increased 5 percent compared

to the prior year. Wholesale revenue increased 5 percent driven by

expanded distribution, market share gains and strength in

point-of-sale, partially offset by retailer inventory management

actions. Direct-to-consumer increased 5 percent driven by 9 percent

growth in digital partially offset by a 2 percent decline in

brick-and-mortar retail.

International revenue was $141 million, a 5 percent decrease

compared to the prior year. International wholesale decreased 7

percent and direct-to-consumer was flat, with 11 percent growth in

digital partially offset by a 6 percent decrease in owned

brick-and-mortar retail. Europe decreased 6 percent (8 percent

decrease in constant currency), with 9 percent growth in

direct-to-consumer (7 percent growth in constant currency) more

than offset by a 9 percent decline in wholesale (11 percent decline

in constant currency). Asia increased 2 percent, with 5 percent

growth in wholesale partially offset by a 7 percent decrease in

direct-to-consumer. Non-U.S. Americas decreased 12 percent (6

percent decrease in constant currency).

Wrangler brand global revenue was $464 million, a 4 percent

increase compared to the prior year. Wrangler U.S. revenue

increased 5 percent, driven by 10 percent growth in

direct-to-consumer and 5 percent growth in wholesale. Wrangler

international revenue decreased 3 percent, driven by a decline in

wholesale partially offset by growth in direct-to-consumer.

Lee brand global revenue was $202 million, a 3 percent decrease

compared to the prior year. Lee U.S. revenue increased 1 percent

driven by growth in the wholesale channel partially offset by a

decline in direct-to-consumer. Lee international revenue decreased

7 percent driven by a decline in wholesale and brick-and-mortar

retail, partially offset by growth in digital.

Gross margin increased 320 basis points to 44.7 percent

on a reported basis and increased 150 basis points to 45.0 percent

on an adjusted basis compared to prior year reported results,

excluding the out-of-period duty charge in that period. Adjusted

gross margin expansion was driven by the benefits from lower

product costs and supply chain efficiencies, partially offset by

lower pricing.

Selling, General & Administrative (SG&A) expenses

were $201 million or 30.0 percent of revenue on a reported basis.

On an adjusted basis, SG&A expenses were $195 million, or 29.1

percent of revenue, representing an increase of 5 percent compared

to the prior year on a reported basis, driven by an increase in

demand creation investments, product development and distribution

expenses.

Operating income was $98 million on a reported basis. On

an adjusted basis, operating income was $107 million and increased

8 percent compared to the prior year on a reported basis, excluding

the out-of-period duty charge in that period. Adjusted operating

margin of 15.9 percent increased 80 basis points compared to the

prior year on a reported basis, excluding the out-of-period duty

charge in that period.

Earnings per share (EPS) was $1.26 on a reported basis.

On an adjusted basis, EPS was $1.37 compared to reported EPS of

$1.22 in the prior year, excluding the out-of-period duty charge in

that period, representing an increase of 12 percent.

Balance Sheet and Liquidity

Review

The Company ended the third quarter with $269 million in cash

and cash equivalents, and $745 million in long-term debt.

Inventory at the end of the third quarter was $462 million, down

24 percent compared to the prior year.

As of the end of the third quarter, the Company had no

outstanding borrowings under the Revolving Credit Facility and $494

million available for borrowing against this facility.

As previously announced, the Company’s Board of Directors

declared a regular quarterly cash dividend of $0.52 per share, a 4

percent increase compared to the second quarter of 2024, payable on

December 19, 2024, to shareholders of record at the close of

business on December 9, 2024.

Consistent with a commitment to return cash to shareholders, the

Company repurchased $40 million of common stock during the third

quarter. When combined with the strong dividend, the Company

returned a total of $68 million to shareholders during the third

quarter and $168 million year-to-date. The Company has $215 million

remaining under its authorized share repurchase program.

Updated 2024 Outlook

“We are raising our full year outlook driven by

better-than-expected third quarter results, stronger profitability

and cash generation,” said Scott Baxter, President, Chief Executive

Officer and Chair of Kontoor Brands. “Our business is positioned to

strengthen in the fourth quarter, as evidenced by accelerating

revenue growth, gross margin expansion, stronger operating earnings

growth and further reductions in inventory. We will continue to

manage the business conservatively in light of the uncertain

environment, but remain confident in our ability to drive strong

returns for the balance of the year and into 2025.”

The Company’s updated 2024 outlook includes the following:

- Revenue is now expected to be $2.60 billion ($2.57 to

$2.63 billion prior outlook), including fourth quarter revenue of

approximately $695 million, reflecting growth of approximately 4

percent. The Company continues to expect market share gains, growth

from channel and category expansion, and expanded distribution to

be offset by conservative retailer inventory management and

macroeconomic pressures on consumer spending around the globe.

- Adjusted gross margin is now expected to be 45.1 percent

(44.8 percent prior outlook), representing an increase of 260 basis

points compared to adjusted gross margin in the prior year,

excluding the out-of-period duty expense in that period. Adjusted

gross margin includes a 20 basis point impact from supply chain and

inventory management actions compared to the prior outlook. In the

fourth quarter, the Company expects adjusted gross margin to be

44.6 percent (44.3 percent prior outlook), representing an increase

of 150 basis points compared to prior year adjusted gross margin,

excluding the out-of-period duty expense in that period. Gross

margin expansion is driven by the benefits of lower product costs,

direct-to-consumer mix, and supply chain efficiencies.

- Adjusted SG&A is expected to increase 4 percent

compared to adjusted SG&A in the prior year, consistent with

the prior outlook. The Company will continue to invest in its

brands and capabilities in support of long-term profitable growth,

including demand creation, direct-to-consumer and international

expansion.

- Adjusted operating income is expected to be $385 million

(higher end of $377 to $387 million prior outlook), reflecting an

increase of 11 percent (10 to 11 percent prior outlook) compared to

adjusted operating income in the prior year, excluding the

out-of-period duty expense in that period. Adjusted operating

income includes a $6 million impact from supply chain and inventory

management actions compared to the prior outlook. The supply chain

actions, mainly expedited freight, are expected to secure inventory

positions this year in support of fourth quarter and first half

2025 growth expectations. The inventory management actions are a

result of the Company’s continued focus on improving the

composition of its inventory and driving further reductions in

inventory and increased cash flow while establishing an even

stronger foundation for the business for 2025. Fourth quarter

adjusted operating income is expected to be $105 million,

reflecting growth of more than 20 percent.

- Adjusted EPS is now expected to be $4.83 (approximately

$4.80 prior outlook), including an incremental $0.08 impact from

supply chain and inventory management actions compared to the prior

outlook. Excluding the out-of-period duty expense in the prior

year, adjusted EPS is expected to increase 9 percent (8 percent

prior outlook). In the fourth quarter, the Company expects adjusted

EPS of $1.31. Full year 2024 adjusted EPS includes an approximate

5-percentage point headwind from a higher tax rate, including an

approximate 25-percentage point headwind in the fourth

quarter.

- Capital Expenditures are now expected to be $25 million

($35 million prior outlook).

- For the full year, the Company expects an effective tax

rate of approximately 20 percent. Interest expense is

expected to approximate $32 million. Other Expense is

expected to be in the range of $12 million to $14 million.

Average shares outstanding are expected to be approximately

56 million, excluding the impact of any future share

repurchases.

- The Company now expects cash flow from operations to

exceed $360 million ($350 million prior outlook) driven by the

combination of accelerated earnings growth and further reductions

in inventory.

- The Company’s 2024 outlook does not reflect any material

impacts from Project Jeanius.

Preliminary 2025 Outlook and Project

Jeanius

- The Company expects its growth momentum to continue into 2025

driven by continued market share gains, category expansion and new

distribution. Based on current visibility, the Company expects

revenue growth of approximately 4 percent in the first half of

2025.

- Adjusted gross margin expansion is expected to be driven by the

benefits of structural mix, supply chain initiatives, and Project

Jeanius, partially offset by modest product cost inflation and the

impact of ongoing supply chain volatility.

- Adjusted operating income growth is expected to outpace revenue

growth driven by gross margin expansion, SG&A leverage and the

benefits of Project Jeanius. The Company expects to continue to

increase the rate of investment behind its growth priorities such

as demand creation, category expansion, international expansion and

direct-to-consumer.

- The benefits from Project Jeanius are expected to be weighted

to the second half of 2025 as supply chain initiatives begin to

scale. Project Jeanius is expected to provide modest SG&A

benefits in the first half of 2025, with accelerating benefits in

the second half driven by combined gross margin and SG&A

initiatives.

- The Company expects another year of robust cash generation

driven by earnings growth and improved net working capital

management, providing significant capital allocation

optionality.

This release refers to “adjusted” amounts from 2024 and 2023 and

“constant currency” amounts, which are further described in the

Non-GAAP Financial Measures section below. Unless otherwise noted,

“reported” and “constant currency” amounts are the same. As

previously disclosed, third quarter 2023 results included a $13

million duty charge related to prior periods and full year 2023

results included a $14 million duty charge related to prior years.

All per share amounts are presented on a diluted basis. Amounts as

presented herein may not recalculate due to the use of unrounded

numbers.

Webcast Information

Kontoor Brands will host its third quarter 2024 conference call

beginning at 8:30 a.m. Eastern Time today, October 31, 2024. The

conference will be broadcast live via the Internet, accessible at

https://www.kontoorbrands.com/investors. For those unable to listen

to the live broadcast, an archived version will be available at the

same location.

Non-GAAP Financial Measures

Adjusted Amounts - This release

refers to “adjusted” amounts. Adjustments during 2024 represent

charges related to business optimization activities and actions to

streamline and transfer select production within our internal

manufacturing network. Adjustments during 2023 represent charges in

the second quarter related to strategic actions taken by the

Company to drive efficiencies in our operations, which included

reducing our global workforce, streamlining and transferring select

production within our internal manufacturing network and

globalizing our operating model. Additional information regarding

adjusted amounts is provided in notes to the supplemental financial

information included with this release.

Constant Currency - This release

refers to “reported” amounts in accordance with GAAP, which include

translation and transactional impacts from changes in foreign

currency exchange rates. This release also refers to “constant

currency” amounts, which exclude the translation impact of changes

in foreign currency exchange rates.

Reconciliations of these non-GAAP measures to the most

comparable GAAP measures are presented in the supplemental

financial information included with this release that identifies

and quantifies all reconciling adjustments and provides

management's view of why this non-GAAP information is useful to

investors. While management believes that these non-GAAP measures

are useful in evaluating the business, this information should be

viewed in addition to, and not as an alternate for, reported

results under GAAP. The non-GAAP measures used by the Company in

this release may be different from similarly titled measures used

by other companies.

For forward-looking non-GAAP measures included in this filing,

the Company does not provide a reconciliation to the most

comparable GAAP financial measures because the information needed

to reconcile these measures is unavailable due to the inherent

difficulty of forecasting the timing and/or amount of various items

that have not yet occurred and have been excluded from adjusted

measures. Additionally, estimating such GAAP measures and providing

a meaningful reconciliation consistent with the Company’s

accounting policies for future periods requires a level of

precision that is unavailable for these future periods and cannot

be accomplished without unreasonable effort.

About Kontoor Brands

Kontoor Brands, Inc. (NYSE: KTB) is a global lifestyle apparel

company, with a portfolio led by two of the world’s most iconic

consumer brands: Wrangler® and Lee®. Kontoor designs, manufactures,

distributes, and licenses superior high-quality products that look

good and fit right, giving people around the world the freedom and

confidence to express themselves. Kontoor Brands is a purpose-led

organization focused on leveraging its global platform, strategic

sourcing model and best-in-class supply chain to drive brand growth

and deliver long-term value for its stakeholders. For more

information about Kontoor Brands, please visit

www.KontoorBrands.com.

Forward-Looking Statements

Certain statements included in this release and attachments are

“forward-looking statements” within the meaning of the federal

securities laws. Forward-looking statements are made based on our

expectations and beliefs concerning future events impacting the

Company and therefore involve several risks and uncertainties. You

can identify these statements by the fact that they use words such

as “will,” “anticipate,” “estimate,” “expect,” “should,” “may” and

other words and terms of similar meaning or use of future dates. We

caution that forward-looking statements are not guarantees and that

actual results could differ materially from those expressed or

implied in the forward-looking statements. We do not intend to

update any of these forward-looking statements or publicly announce

the results of any revisions to these forward-looking statements,

other than as required under the U.S. federal securities laws.

Potential risks and uncertainties that could cause the actual

results of operations or financial condition of the Company to

differ materially from those expressed or implied by

forward-looking statements in this release include, but are not

limited to: macroeconomic conditions, including elevated interest

rates, inflation, recessionary concerns and fluctuating foreign

currency exchange rates, as well as continuing global supply chain

issues and geopolitical events, continue to adversely impact global

economic conditions and have had, and may continue to have, a

negative impact on the Company’s business, results of operations,

financial condition and cash flows (including future uncertain

impacts); the level of consumer demand for apparel; reliance on a

small number of large customers; supply chain and shipping

disruptions, which could continue to result in shipping delays, an

increase in transportation costs and increased product costs or

lost sales; intense industry competition; the ability to accurately

forecast demand for products; the Company’s ability to gauge

consumer preferences and product trends, and to respond to

constantly changing markets; the Company’s ability to maintain the

images of its brands; increasing pressure on margins; e-commerce

operations through the Company’s direct-to-consumer business; the

financial difficulty experienced by the retail industry; possible

goodwill and other asset impairment; the ability to implement the

Company’s business strategy; the stability of manufacturing

facilities and foreign suppliers; fluctuations in wage rates and

the price, availability and quality of raw materials and contracted

products; the reliance on a limited number of suppliers for raw

material sourcing and the ability to obtain raw materials on a

timely basis or in sufficient quantity or quality; disruption to

distribution systems; seasonality; unseasonal or severe weather

conditions; the Company's and its vendors’ ability to maintain the

strength and security of information technology systems; the risk

that facilities and systems and those of third-party service

providers may be vulnerable to and unable to anticipate or detect

data security breaches and data or financial loss or maintain

operational performance; ability to properly collect, use, manage

and secure consumer and employee data; disruption and volatility in

the global capital and credit markets and its impact on the

Company's ability to obtain short-term or long-term financing on

favorable terms; legal, regulatory, political and economic risks;

changes to trade policy, including tariff and import/export

regulations; the impact of climate change and related legislative

and regulatory responses; compliance with anti-bribery,

anti-corruption and anti-money laundering laws by the Company and

third-party suppliers and manufacturers; changes in tax laws and

liabilities; the costs of compliance with or the violation of

national, state and local laws and regulations for environmental,

consumer protection, employment, privacy, safety and other matters;

continuity of members of management; labor relations; the ability

to protect trademarks and other intellectual property rights; the

ability of the Company’s licensees to generate expected sales and

maintain the value of the Company’s brands; the Company maintaining

satisfactory credit ratings; restrictions on the Company’s business

relating to its debt obligations; volatility in the price and

trading volume of the Company’s common stock; anti-takeover

provisions in the Company’s organizational documents; and

fluctuations in the amount and frequency of our share repurchases.

Many of the foregoing risks and uncertainties will be exacerbated

by any worsening of the global business and economic

environment.

More information on potential factors that could affect the

Company's financial results are described in detail in the

Company’s most recent Annual Report on Form 10-K and in other

reports and statements that the Company files with the SEC.

KONTOOR BRANDS, INC.

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended

September

%

Nine Months Ended

September

%

(Dollars and shares in thousands, except

per share amounts)

2024

2023

Change

2024

2023

Change

Net revenues

$

670,194

$

654,540

2%

$

1,908,294

$

1,937,672

(2)%

Costs and operating expenses

Cost of goods sold

370,684

383,075

(3)%

1,052,280

1,129,245

(7)%

Selling, general and administrative

expenses

201,189

185,983

8%

598,020

564,599

6%

Total costs and operating

expenses

571,873

569,058

—%

1,650,300

1,693,844

(3)%

Operating income

98,321

85,482

15%

257,994

243,828

6%

Interest expense

(11,178

)

(10,454

)

7%

(30,852

)

(30,390

)

2%

Interest income

2,965

964

208%

8,006

2,074

286%

Other expense, net

(3,335

)

(3,764

)

(11)%

(9,239

)

(9,142

)

1%

Income before income taxes

86,773

72,228

20%

225,909

206,370

9%

Income taxes

16,225

12,697

28%

44,085

44,147

—%

Net income

$

70,548

$

59,531

19%

$

181,824

$

162,223

12%

Earnings per common share

Basic

$

1.27

$

1.06

$

3.27

$

2.90

Diluted

$

1.26

$

1.05

$

3.22

$

2.85

Weighted average shares

outstanding

Basic

55,421

56,151

55,655

55,962

Diluted

56,054

56,956

56,416

56,914

Basis of presentation for all financial tables within this

release: The Company operates and reports using a 52/53-week

fiscal year ending on the Saturday closest to December 31 each

year. For presentation purposes herein, all references to periods

ended September 2024 and September 2023 correspond to the 13-week

and 39-week fiscal periods ended September 28, 2024 and September

30, 2023, respectively. References to September 2024, December 2023

and September 2023 relate to the balance sheets as of September 28,

2024, December 30, 2023 and September 30, 2023, respectively.

Amounts herein may not recalculate due to the use of unrounded

numbers.

KONTOOR BRANDS, INC.

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

September 2024

December 2023

September 2023

ASSETS

Current assets

Cash and cash equivalents

$

269,427

$

215,050

$

77,828

Accounts receivable, net

230,435

217,673

236,816

Inventories

461,510

500,353

605,234

Prepaid expenses and other current

assets

104,855

110,808

113,186

Total current assets

1,066,227

1,043,884

1,033,064

Property, plant and equipment, net

106,842

112,045

110,399

Operating lease assets

54,638

54,812

63,114

Intangible assets, net

11,778

12,497

12,553

Goodwill

209,843

209,862

209,413

Other assets

203,795

212,339

197,387

TOTAL ASSETS

$

1,653,123

$

1,645,439

$

1,625,930

LIABILITIES AND EQUITY

Current liabilities

Short-term borrowings

$

—

$

—

$

—

Current portion of long-term debt

—

20,000

17,500

Accounts payable

201,863

180,220

182,448

Accrued and other current liabilities

204,375

171,414

168,356

Operating lease liabilities, current

21,050

21,003

20,975

Total current liabilities

427,288

392,637

389,279

Operating lease liabilities,

noncurrent

36,572

36,753

41,348

Other liabilities

87,350

80,215

79,084

Long-term debt

744,986

763,921

768,595

Total liabilities

1,296,196

1,273,526

1,278,306

Commitments and contingencies

Total equity

356,927

371,913

347,624

TOTAL LIABILITIES AND EQUITY

$

1,653,123

$

1,645,439

$

1,625,930

KONTOOR BRANDS, INC.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Nine Months Ended

September

(In thousands)

2024

2023

OPERATING ACTIVITIES

Net income

$

181,824

$

162,223

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation and amortization

29,052

27,405

Stock-based compensation

16,316

9,017

Other, including working capital

changes

59,066

(51,119

)

Cash provided by operating

activities

286,258

147,526

INVESTING ACTIVITIES

Property, plant and equipment

expenditures

(11,841

)

(21,553

)

Capitalized computer software

(2,766

)

(8,940

)

Other

(1,858

)

(837

)

Cash used by investing

activities

(16,465

)

(31,330

)

FINANCING ACTIVITIES

Borrowings under revolving credit

facility

—

288,000

Repayments under revolving credit

facility

—

(288,000

)

Repayments of term loan

(40,000

)

(7,500

)

Repurchases of Common Stock

(85,677

)

—

Dividends paid

(83,306

)

(80,719

)

Shares withheld for taxes, net of proceeds

from issuance of Common Stock

(1,769

)

(2,506

)

Other

—

(7,297

)

Cash used by financing

activities

(210,752

)

(98,022

)

Effect of foreign currency rate changes on

cash and cash equivalents

(4,664

)

475

Net change in cash and cash

equivalents

54,377

18,649

Cash and cash equivalents – beginning

of period

215,050

59,179

Cash and cash equivalents – end of

period

$

269,427

$

77,828

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Business Segment

Information

(Unaudited)

Three Months Ended

September

% Change

% Change Constant

Currency (a)

(Dollars in thousands)

2024

2023

Segment revenues:

Wrangler

$

464,107

$

444,539

4%

4%

Lee

202,343

208,027

(3)%

(3)%

Total reportable segment

revenues

666,450

652,566

2%

2%

Other revenues (b)

3,744

1,974

90%

90%

Total net revenues

$

670,194

$

654,540

2%

2%

Segment profit:

Wrangler

$

97,753

$

81,556

20%

20%

Lee

23,355

20,735

13%

11%

Total reportable segment profit

$

121,108

$

102,291

18%

18%

Corporate and other expenses

(26,307

)

(20,091

)

31%

31%

Interest expense

(11,178

)

(10,454

)

7%

7%

Interest income

2,965

964

208%

211%

Profit (loss) related to other revenues

(b)

185

(482

)

138%

139%

Income before income taxes

$

86,773

$

72,228

20%

20%

Nine Months Ended

September

% Change

% Change Constant

Currency (a)

(Dollars in thousands)

2024

2023

Segment revenues:

Wrangler

$

1,302,846

$

1,293,171

1%

1%

Lee

597,085

636,684

(6)%

(6)%

Total reportable segment

revenues

1,899,931

1,929,855

(2)%

(2)%

Other revenues (b)

8,363

7,817

7%

7%

Total net revenues

$

1,908,294

$

1,937,672

(2)%

(2)%

Segment profit:

Wrangler

$

260,758

$

223,639

17%

16%

Lee

71,816

77,473

(7)%

(7)%

Total reportable segment profit

$

332,574

$

301,112

10%

10%

Corporate and other expenses

(82,745

)

(65,815

)

26%

26%

Interest expense

(30,852

)

(30,390

)

2%

2%

Interest income

8,006

2,074

286%

286%

Loss related to other revenues (b)

(1,074

)

(611

)

76%

76%

Income before income taxes

$

225,909

$

206,370

9%

9%

(a) Refer to constant currency definition

on the following pages.

(b) We report an “Other” category to

reconcile segment revenues and segment profit to the Company's

operating results, but the Other category does not meet the

criteria to be considered a reportable segment. Other includes

sales and licensing of Rock & Republic®, other company-owned

brands and private label apparel.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Business Segment Information –

Constant Currency Basis (Non-GAAP)

(Unaudited)

Three Months Ended September

2024

As Reported

Adjust for Foreign

(In thousands)

under GAAP

Currency Exchange

Constant Currency

Segment revenues:

Wrangler

$

464,107

$

220

$

464,327

Lee

202,343

(22

)

202,321

Total reportable segment

revenues

666,450

198

666,648

Other revenues

3,744

—

3,744

Total net revenues

$

670,194

$

198

$

670,392

Segment profit:

Wrangler

$

97,753

$

61

$

97,814

Lee

23,355

(266

)

23,089

Total reportable segment profit

$

121,108

$

(205

)

$

120,903

Corporate and other expenses

(26,307

)

15

(26,292

)

Interest expense

(11,178

)

—

(11,178

)

Interest income

2,965

30

2,995

Profit (loss) related to other

revenues

185

1

186

Income before income taxes

$

86,773

$

(159

)

$

86,614

Nine Months Ended September

2024

As Reported

Adjust for Foreign

(In thousands)

under GAAP

Currency Exchange

Constant Currency

Segment revenues:

Wrangler

$

1,302,846

$

(1,201

)

$

1,301,645

Lee

597,085

563

597,648

Total reportable segment

revenues

1,899,931

(638

)

1,899,293

Other revenues

8,363

—

8,363

Total net revenues

$

1,908,294

$

(638

)

$

1,907,656

Segment profit:

Wrangler

$

260,758

$

(459

)

$

260,299

Lee

71,816

(93

)

71,723

Total reportable segment profit

$

332,574

$

(552

)

$

332,022

Corporate and other expenses

(82,745

)

(75

)

(82,820

)

Interest expense

(30,852

)

—

(30,852

)

Interest income

8,006

(6

)

8,000

Loss related to other revenues

(1,074

)

1

(1,073

)

Income before income taxes

$

225,909

$

(632

)

$

225,277

Constant Currency Financial Information

The Company is a global company that reports financial

information in U.S. dollars in accordance with GAAP. Foreign

currency exchange rate fluctuations affect the amounts reported by

the Company from translating its foreign revenues and expenses into

U.S. dollars. These rate fluctuations can have a significant effect

on reported operating results. As a supplement to our reported

operating results, we present constant currency financial

information, which is a non-GAAP financial measure that excludes

the impact of translating foreign currencies into U.S. dollars. We

use constant currency information to provide a framework to assess

how our business performed excluding the effects of changes in the

rates used to calculate foreign currency translation. Management

believes this information is useful to investors to facilitate

comparison of operating results and better identify trends in our

businesses.

To calculate foreign currency translation on a constant currency

basis, operating results for the current year period for entities

reporting in currencies other than the U.S. dollar are translated

into U.S. dollars at the average exchange rates in effect during

the comparable period of the prior year (rather than the actual

exchange rates in effect during the current year period).

These constant currency performance measures should be viewed in

addition to, and not as an alternative for, reported results under

GAAP. The constant currency information presented may not be

comparable to similarly titled measures reported by other

companies.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Reconciliation of Adjusted

Financial Measures - Quarter-to-Date (Non-GAAP)

(Unaudited)

Three Months Ended

September

(Dollars in thousands, except per share

amounts)

2024

Cost of goods sold - as reported under

GAAP

$

370,684

Restructuring and transformation costs

(a)

(2,058

)

Adjusted cost of goods sold

$

368,626

Selling, general and administrative

expenses - as reported under GAAP

$

201,189

Restructuring and transformation costs

(a)

(6,382

)

Adjusted selling, general and

administrative expenses

$

194,807

Diluted earnings per share - as

reported under GAAP

$

1.26

Restructuring and transformation costs

(a)

0.11

Adjusted diluted earnings per

share

$

1.37

Net income - as reported under

GAAP

$

70,548

Income taxes

16,225

Interest expense

11,178

Interest income

(2,965

)

EBIT

$

94,986

Depreciation and amortization

9,522

EBITDA

$

104,508

Restructuring and transformation costs

(a)

8,440

Adjusted EBITDA

$

112,948

As a percentage of total net revenues

16.9

%

Non-GAAP Financial Information: The

financial information above has been presented on a GAAP basis and

on an adjusted basis. EBIT, EBITDA and adjusted presentations are

non-GAAP measures. See “Notes to Supplemental Financial Information

- Reconciliation of Adjusted Financial Measures” at the end of this

document. Amounts herein may not recalculate due to the use of

unrounded numbers.

(a) See Note 1 of “Notes to Supplemental

Financial Information - Reconciliation of Adjusted Financial

Measures” at the end of this document.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Summary of Select GAAP and

Non-GAAP Measures

(Unaudited)

Three Months Ended

September

2024

2023

(Dollars in thousands, except per share

amounts)

GAAP

Adjusted

GAAP

Net revenues

$

670,194

$

670,194

$

654,540

Gross margin

$

299,510

$

301,568

$

271,465

As a percentage of total net revenues

44.7

%

45.0

%

41.5

%

Selling, general and administrative

expenses

$

201,189

$

194,807

$

185,983

As a percentage of total net revenues

30.0

%

29.1

%

28.4

%

Operating income

$

98,321

$

106,761

$

85,482

As a percentage of total net revenues

14.7

%

15.9

%

13.1

%

Earnings per share - diluted

$

1.26

$

1.37

$

1.05

Non-GAAP Financial Information: The

financial information above has been presented on a GAAP basis and

on an adjusted basis. These adjusted presentations are non-GAAP

measures. See “Notes to Supplemental Financial Information -

Reconciliation of Adjusted Financial Measures” at the end of this

document.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Disaggregation of

Revenue

(Unaudited)

Three Months Ended September

2024

Revenues - As Reported

(In thousands)

Wrangler

Lee

Other

Total

Channel revenues

U.S. Wholesale

$

373,643

$

105,342

$

3,577

$

482,562

Non-U.S. Wholesale

51,599

65,268

—

116,867

Direct-to-Consumer

38,865

31,733

167

70,765

Total

$

464,107

$

202,343

$

3,744

$

670,194

Geographic revenues

U.S.

$

406,656

$

119,254

$

3,744

$

529,654

International

57,451

83,089

—

140,540

Total

$

464,107

$

202,343

$

3,744

$

670,194

Three Months Ended September

2023

Revenues - As Reported

(In thousands)

Wrangler

Lee

Other

Total

Channel revenues

U.S. Wholesale

$

355,608

$

103,564

$

1,799

$

460,971

Non-U.S. Wholesale

53,644

71,433

—

125,077

Direct-to-Consumer

35,287

33,030

175

68,492

Total

$

444,539

$

208,027

$

1,974

$

654,540

Geographic revenues

U.S.

$

385,501

$

118,352

$

1,974

$

505,827

International

59,038

89,675

—

148,713

Total

$

444,539

$

208,027

$

1,974

$

654,540

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Summary of Select Revenue

Information

(Unaudited)

Three Months Ended

September

2024

2023

2024 to 2023

(Dollars in thousands)

As Reported under GAAP

% Change Reported

% Change Constant

Currency

Wrangler U.S.

$

406,656

$

385,501

5%

5%

Lee U.S.

119,254

118,352

1%

1%

Other

3,744

1,974

90%

90%

Total U.S. revenues

$

529,654

$

505,827

5%

5%

Wrangler International

$

57,451

$

59,038

(3)%

(2)%

Lee International

83,089

89,675

(7)%

(7)%

Total International revenues

$

140,540

$

148,713

(5)%

(5)%

Global Wrangler

$

464,107

$

444,539

4%

4%

Global Lee

202,343

208,027

(3)%

(3)%

Global Other

3,744

1,974

90%

90%

Total revenues

$

670,194

$

654,540

2%

2%

Non-GAAP Financial Information: The

financial information above has been presented on a GAAP basis and

on a constant currency basis, which is a non-GAAP financial

measure. See “Business Segment Information – Constant Currency

Basis (Non-GAAP)” for additional information on constant currency

financial calculations.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Adjusted Return on Invested

Capital (Non-GAAP)

(Unaudited)

(Dollars in thousands)

Trailing Twelve Months Ended

September

Numerator

2024

2023

Net Income

$

250,595

$

213,828

Plus: Income taxes

40,843

68,920

Plus: Interest income (expense), net

31,147

37,796

EBIT

$

322,585

$

320,544

Plus: Restructuring and transformation

costs (a)

26,832

6,679

Plus: Operating lease interest (b)

1,213

1,009

Adjusted EBIT

$

350,630

$

328,232

Adjusted effective income tax rate (c)

15

%

24

%

Adjusted net operating profit after

taxes

$

298,309

$

248,789

Denominator

September 2024

September 2023

September 2022

Equity

$

356,927

$

347,624

$

208,099

Plus: Current portion of long-term debt

and other borrowings

—

17,500

14,593

Plus: Noncurrent portion of long-term

debt

744,986

768,595

824,793

Plus: Operating lease liabilities (d)

57,622

62,323

49,140

Less: Cash and cash equivalents

(269,427

)

(77,828

)

(58,053

)

Invested capital

$

890,108

$

1,118,214

$

1,038,572

Average invested capital (e)

$

1,004,161

$

1,078,393

Net income to average debt and

equity (f)

22.4

%

19.6

%

Adjusted return on invested

capital

29.7

%

23.1

%

Non-GAAP Financial Information:

Adjusted return on invested capital (“ROIC”) is a non-GAAP measure.

We believe this metric is useful in assessing the effectiveness of

our capital allocation over time. ROIC may be different from

similarly titled measures used by other companies. Amounts herein

may not recalculate due to the use of unrounded numbers.

(a) See Note 2 of “Notes to Supplemental

Financial Information - Reconciliation of Adjusted Financial

Measures” at the end of this document.

(b) Operating lease interest is based upon

the discount rate for each lease and recorded as a component of

rent expense within “Selling, general and administrative expenses”

in the Company's statements of operations. The adjustment for

operating lease interest represents the add-back to earnings before

interest and taxes (“EBIT”) based upon the assumption that

properties under our operating leases were owned or accounted for

as finance leases. Operating lease interest is added back to EBIT

in the adjusted ROIC calculation to account for differences in

capital structure between us and other companies.

(c) Effective income tax rate adjusted for

restructuring and transformation costs and the corresponding tax

impact. See Note 2 of “Notes to Supplemental Financial Information

- Reconciliation of Adjusted Financial Measures” at the end of this

document.

(d) Total of “Operating lease liabilities,

current” and “Operating lease liabilities, noncurrent” in the

Company's balance sheets.

(e) The average is based on the “Invested

capital” at the end of the current period and at the end of the

comparable prior period.

(f) Calculated as “Net income” divided by

average “Debt” and “Equity.” “Debt” includes the current and

noncurrent portion of long-term debt as well as other short-term

borrowings. The average is based on the subtotal of “Debt” and

“Equity” at the end of the current period and at the end of the

comparable prior period.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Reconciliation of Adjusted

Financial Measures - Notes (Non-GAAP)

(Unaudited)

Notes to Supplemental Financial

Information - Reconciliation of Adjusted Financial Measures

Management uses non-GAAP financial

measures internally in its budgeting and review process and, in

some cases, as a factor in determining compensation. In addition,

adjusted EBITDA is a key financial measure for the Company's

shareholders and financial leaders, as the Company's debt financing

agreements require the measurement of adjusted EBITDA, along with

other measures, in connection with the Company's compliance with

debt covenants. While management believes that these non-GAAP

measures are useful in evaluating the business, this information

should be considered supplemental in nature and should be viewed in

addition to, and not as an alternate for, reported results under

GAAP. In addition, these non-GAAP measures may be different from

similarly titled measures used by other companies.

(1) During the three months ended

September 2024, restructuring and transformation costs included

$6.3 million related to business optimization activities and $2.1

million related to streamlining and transferring select production

within our internal manufacturing network. Total restructuring and

transformation costs resulted in a corresponding tax impact of $2.0

million for the three months ended September 2024.

(2) During the trailing twelve months

ended September 2024, restructuring and transformation costs were

$26.8 million related to business optimization activities,

streamlining and transferring select production within our internal

manufacturing network, optimizing and globalizing our operating

model and reductions in our global workforce. Total restructuring

and transformation costs resulted in a corresponding tax impact of

$6.6 million for the trailing twelve months ended September

2024.

During the trailing twelve months ended

September 2023, restructuring and transformation costs were $6.7

million net, related to strategic actions taken by the Company to

drive efficiencies in our operations, which included reducing our

global workforce, streamlining and transferring select production

within our internal manufacturing network and globalizing our

operating model, a pension curtailment gain, other employee-related

benefits and other costs. Total restructuring and transformation

costs resulted in a corresponding tax impact of $1.1 million for

the trailing twelve months ended September 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031459571/en/

Investors: Michael Karapetian, (336) 332-4263 Vice

President, Corporate Development, Strategy, and Investor Relations

Michael.Karapetian@kontoorbrands.com

or

Media: Julia Burge, (336) 332-5122 Director, External

Communications Julia.Burge@kontoorbrands.com

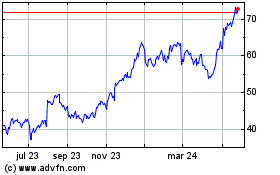

Kontoor Brands (NYSE:KTB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

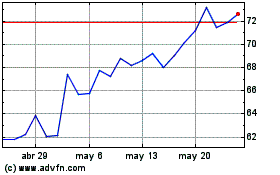

Kontoor Brands (NYSE:KTB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024