Webcast to be Held Today at 10 AM ET

Lifezone Metals Limited’s (NYSE: LZM) Chief Executive

Officer, Chris Showalter, and Chief Financial Officer, Ingo

Hofmaier, are pleased to provide an overview of Lifezone’s

achievements during the past quarter and the Q1 2024 unaudited

financial summary.

Lifezone is advancing its Kabanga Nickel Project, located in

north-west Tanzania, through a strategic partnership with the

Government of Tanzania and BHP. Kabanga is believed to be one of

the world's largest and highest-grade undeveloped nickel sulfide

deposits. In addition, Lifezone has a partnership with Glencore to

recycle platinum, palladium and rhodium in the United States.

Q1 2024 highlights:

- +1.8 million hours worked at the Kabanga Nickel Project without

a lost time injury.

- Two-phased development plan for Kabanga announced: initial 1.7

million tonne per year plus 1.7 million tonne per year Phase 2

expansion for base case 3.4 million tonne per year underground

mining operation, concentrator and Hydromet refinery in the

Definitive Feasibility Study for a fully-integrated direct-to-metal

operation in Tanzania (refer to Lifzone’s February 26, 2024 news

release).

- Results from 11 exploration drillholes completed at the Safari

Link Area, of which 7 holes intercepted high-grade nickel, copper

and cobalt mineralization, including:

- KL23-29: 15.1 meters grading 2.24% nickel, 0.24% copper,

and 0.18% cobalt, (2.83% nickel-equivalent) and representing a ~300

meter step out to the north-east of existing Mineral Resources

(refer to Lifezone’s January 29, 2024 news release).

- Lifezone received the Kahama Hydromet Refinery Licence from the

Government of Tanzania, and Kahama will be located within a newly

promulgated Special Economic Zone.

- Achieved high recoveries through metallurgical test work,

supporting the design of the Kabanga Concentrator and Kahama

Refinery (refer to Lifezone’s February 26, 2024 news release).

- Kabanga Nickel Project connected to the Tanzanian national

power grid via 33-kilovolt line.

- Fully funded Phase 1 partnership with Glencore for pilot plant

and Feasibility Study to recycle platinum, palladium and rhodium

from spent automotive catalytic converters in the United States

(refer to Lifezone’s January 10, 2024 news release).

- $50 million non-brokered private placement of unsecured

convertible debentures closed (4-year, SOFR +4%, $8.00/share

conversion; refer to Lifezone’s March 27, 2024 news release).

- Healthy cash position of $79.6 million as at March 31, 2024,

not including final $4.9 million proceeds from convertible

debenture placement received on April 1, 2024.

- Basic and diluted loss per share of $0.05 for Q1 2024, compared

to basic and diluted loss per share of $0.10 in Q1 2023.

Mr. Showalter stated: “In the first quarter of 2024, we made

significant progress in advancing our Kabanga Nickel Project in

Tanzania across various fronts and remaining on track to complete

the Definitive Feasibility Study by the end of Q3 2024. This

included advancements in areas such as concentrator and refinery

design work and mine planning, and the evaluation of potential

resource additions. During the period, the Government of Tanzania

continued to demonstrate its steadfast support for Kabanga with the

issuance of the Kahama Hydromet Refinery Licence and the

declaration of the Special Economic Zone – two critical milestones

for our Kabanga Nickel Project. We remain close with the Government

of Tanzania, our local communities and BHP, our project partner, as

we advance Kabanga.

Beyond Kabanga, the closing of funding for Phase 1 of our PGM

recycling partnership with Glencore during the quarter marked

another significant achievement for Lifezone. This partnership

enables us, in parallel with Kabanga, to demonstrate the

versatility and benefits of our Hydromet Technology in yet another

compelling, large and growing metals recycling market and focused

here in the United States. We look forward to concluding our pilot

project in Q3 2024.”

More than 1.8 million hours worked without lost time

injury

Lifezone operates with safety as an ongoing, front-of-mind

initiative at every level. The Company has recorded more than 1.8

million hours worked without a lost time injury at the Kabanga

Nickel Project. This is a testament to Lifezone’s commitment to

promoting and implementing comprehensive workplace health and

safety measures, which include rigorous monitoring and reporting

systems. In addition, there have been zero environmental incidents

year-to-date.

Kabanga Nickel Project and Kahama Hydromet Refinery – a

modern metals supply chain solution in Tanzania

During Q1 2024, the concentrator and refinery design work and

mine planning continued for the Kabanga Nickel Project and progress

was made on the various technical workstreams supporting the

Definitive Feasibility Study. The two-phased development plan was

finalized and will form the basis of the Definitive Feasibility

Study – this will involve a 1.7 million tonne per year Phase 1 with

an additional 1.7 million tonne per year Phase 2 expansion, for an

expected 3.4 million tonne per year operation in the aggregate.

The Kabanga Nickel Project is currently 69.7% owned by Lifezone, and Measured and

Indicated Resources attributable to

Lifezone total 43.6 million tonnes grading 2.02% nickel,

0.28% copper and 0.16% cobalt (2.57% nickel-equivalent) plus

Inferred Resources attributable to

Lifezone total 17.5 million tonnes grading 2.23% nickel,

0.31% copper and 0.16% cobalt (2.79% nickel-equivalent; refer to

the November 2023 Kabanga Mineral Resource Update Technical Report

Summary).

The November 2023 Mineral Resource Update assumes an underground

mining rate of 2.2 million tonnes per year. However, based on the

size of the Kabanga Resources, Lifezone believes that a higher

throughput of 3.4 million tonnes per year will provide a more

optimal outcome in the Definitive Feasibility Study.

Pilot test work on-going to confirm the design of the Kahama

Hydromet Refinery for the Definitive Feasibility Study

During the quarter, extensive metallurgical testing was

completed to inform the process designs for the Kabanga

Concentrator and the Kahama Hydromet Refinery. Concentrator test

work conducted on a range of variability composite samples achieved

high nickel recoveries to concentrate. This confirmed historical

pilot-plant results and was indicative of achieving an exceptional

refinery feed with low levels of deleterious elements. Test work in

support of the Kahama Hydromet Refinery design was conducted at

Lifezone’s Simulus Laboratory in Perth, Australia. Results

confirmed the preliminary findings and demonstrated that high

recoveries for nickel, copper and cobalt are possible within short

processing timeframes (refer to Lifezone’s February 26, 2024 news

release). Pilot refinery test work is on-going and the designs for

the Kabanga Concentrator and Kahama Hydromet Refinery continue to

be optimized for the Definitive Feasibility Study.

Results from 2023 exploration drilling at Kabanga indicate

opportunity for future resource addition at the Safari Link

Area

Building on the November 2023 Mineral Resource Update, Lifezone

announced during Q1 2024 the discovery of additional high-grade

nickel mineralization at the Safari Link Area at Kabanga. Notably,

a 300-meter step-out hole KL23-29 intercepted 15.1 meters of

mineralization grading 2.83% nickel-equivalent. Based on this, and

other, mineralized intercepts, Lifezone’s geologists believe that

Safari Link represents the best opportunity for future resource

addition. The Safari Link Area is not included in the current

Mineral Resource Estimate (refer to Lifezone’s January 29, 2024

news release).

Strong ongoing support from the Government of

Tanzania

The Government of Tanzania is a partner in the Kabanga Nickel

Project through its 16% free-carried interest. During the first

quarter of 2024, the Government continued to demonstrate its strong

commitment to Kabanga, enabling Lifezone to achieve critical

Project milestones.

The Tanzania Electric Supply Company Limited (“TANESCO”)

completed construction and installation of a 33-kilovolt power line

connecting Kabanga Nickel Project operations camp, located on the

Special Mining Licence, to the regional power grid. With reliable

grid electricity, the Project will be able to reduce its reliance

on more emissions-intensive diesel generators.

In March, Lifezone received the Multi-Metal Processing Facility

Licence for the Kahama Hydromet Refinery. The issuance of the

Licence followed the formal gazettement of the Special Economic

Zone (Declaration) Notice, 2024 which declared the Buzwagi Mining

Area (the site of Barrick Gold’s past producing Buzwagi Gold Mine)

a Special Economic Zone. The Kahama Refinery will be located within

the Special Economic Zone, which will provide certain tax and other

economic benefits.

Lifezone also received the Environmental Impact Assessment

certificate of approval from the Government of Tanzania during Q1

2024 for the establishment and operation of the Kahama Hydromet

Refinery.

The Kahama Hydromet Refinery stands to benefit from access to a

highly trained workforce and legacy infrastructure associated with

the now-closed Buzwagi Gold Mine, including existing accommodations

and office buildings, regional power connections, a sealed airstrip

and main road connections and transnational railway in near

proximity. This “plug-and-play” industrial hub brings significant

project execution and capital cost benefits, as well as turning a

past-producing mine liability into a long-term asset. Lifezone will

not be taking on any legacy liabilities in relation to the closure

of the Buzwagi Gold Mine.

Sustainability is a foundational consideration in all

decisions taken by Lifezone.

Lifezone strives to attain the highest standards of

environmental stewardship, societal impact, and governance

practices. The specific focus in Q1 2024 has been to maintain

ongoing sustainability-related activities while initiating

sustainability data reporting. Highlights include:

- Engagement with key stakeholders throughout the quarter,

including the Government of Tanzania, local Ngara District

officials, and members of the surrounding communities. Notably,

monthly engagements with the Hon. District Commissioner and

District Executive Director provide regular updates to local

Government on the multiple ongoing Corporate Social Responsibility

projects.

- Grievance mechanism workshops were conducted to provide the

local communities with awareness of the grievance management

process. Twenty-one new suggestion boxes were installed, and weekly

community mobile unit outreaches were conducted that provide host

communities with multiple opportunities for engagement and a

platform for discussion.

- Completion of Lifezone’s 2023 Social Investment and Corporate

Social Responsibility commitments, which are expected to benefit

approximately 8,200 community members within the Ngara District.

Two specific examples of the 10 completed projects include: the

construction of the Mumiramira Dispensary maternity ward providing

critical services to more than 6,000 local community members

including women and children, and the construction of 16 pit-hole

toilets at the Murugunga Primary School and the Nyanza Pre-primary

School providing nearly 900 students with access to cleaner and

more hygienic toilet facilities.

- Following the Local Skills and Supplier Mapping Roadshow

completed in 2023, Lifezone facilitated a contract between a local

farming cooperative and the principal food vendor for the Kabanga

camp.

Healthy cash balance following recent private

placement

As of March 31, 2024, Lifezone Metals had unaudited consolidated

cash and cash equivalents of $79.6 million, an increase of $30.2

million from $49.4 million as of December 31, 2023. The increase

reflects proceeds received from the $50 million non-brokered

unsecured convertible debentures, $1.5 million proceeds received

from Glencore relating to the partnership to recycle platinum,

palladium and rhodium in the United States, offset by cash usage of

$15.6 million during the period. The March 31, 2024 cash balance

does not include the final $4.9 million of proceeds from the

convertible debenture placement subsequently received on April 1,

2024.

The unsecured convertible debentures were issued to a consortium

of marquee investors, led by Harry Lundin (Bromma Asset Management

Inc.) and Rick Rule. The instruments bear interest over a 48-month

term, payable quarterly, at a rate of the Secured Overnight

Financing Rate (“SOFR”) plus 4.0% per annum and are convertible

into common shares of Lifezone at a price of $8.00 per share.

Table 1: Summary of condensed profit and loss for the three

months ended March 31, 2024 and 2023, respectively.

For the three months

ended,

March 31,

March 31,

Change

2024

2023

$

$

$

(unaudited)

(unaudited)

Revenue

41,389

495,687

(454,298

)

Cost of sales

(10,944

)

-

(10,944

)

Gross profit

30,445

495,687

(465,242

)

(Loss) gain on foreign exchange

(167,740

)

80,887

(248,627

)

General and administrative expenses

(4,068,771

)

(7,632,017

)

3,563,246

Operating loss

(4,206,066

)

(7,055,443

)

2,849,377

Interest income

457,209

130,194

327,015

Interest expense

(96,141

)

(47,998

)

(48,143

)

Loss before tax

(3,844,998

)

(6,973,247

)

3,128,249

Exchange loss on translation of foreign

operations

(10,368

)

(82,315

)

(27,053

)

Total other comprehensive loss for the

period

(3,954,366

)

(7,055,562

)

3,101,196

Weighted-average shares outstanding -

diluted

119,459,223

62,680,131

Basic and diluted net loss per ordinary

share

(0.05

)

(0.10

)

Revenue of $41,389 for the three months ended March 31, 2024

related to technical and laboratory services provided by Lifezone’s

subsidiary, Simulus Group, to third party customers. Presently, the

Simulus Laboratory is almost exclusively used for test work, pilot

work and other Definitive Feasibility Study related work for the

Kabanga Nickel Project and the platinum, palladium and rhodium

recycling project. Once these projects are completed, third party

revenues are expected to increase.

Table 2: Comparison of general and administrative expenses

for the three months ended March 31, 2024 and 2023,

respectively.

For the three months

ended,

March 31,

March 31,

Change

2024

2023

$

$

$

(unaudited)

(unaudited)

Amortization of intangible assets

39,384

34,081

5,303

Audit & accountancy fees

119,162

281,908

(162,746

)

Consulting fees

889,174

588,844

300,330

Depreciation of property and equipment

331,068

38,255

292,813

Depreciation of right of use asset

115,786

31,015

84,771

Directors' fees

180,445

51,363

129,082

Insurance

456,579

5,074

451,505

Laboratory cost

268,385

-

268,385

Professional & Legal Fees

367,763

1,849,803

(1,482,040

)

Rent

109,331

58,901

50,430

Travel

121,347

408,834

(287,487

)

Wages & employee benefits

938,663

1,554,506

(615,843

)

Other administrative expenses

131,684

2,729,433

(2,597,749

)

General and administrative expenses

4,068,771

7,632,017

(3,563,246

)

Total general and administrative expenses were $4,068,771 for

the three months ended March 31, 2024 compared to $7,632,017 for

three months ended March 31, 2023. The decrease in the general and

administrative expenses is due to lower professional and legal

expenses, which were higher in early 2023 relating to the SPAC

Transaction and listing at the NYSE which was completed on July 6,

2023. The expenses for the three months ended March 31, 2023

included around $3.5 million that were later capitalized in line

with Lifezone’s accounting policies given that during 2023 the

prospect and confidence that the Kabanga Nickel can be developed

into a profitable mining operation increased based on material

progress made by the project and feasibility study teams.

During Q1 2024, Lifezone completed a group-wide program of

rightsizing the organization to ensure the effective allocation of

capital to those projects and workstreams most critical to the

Company. This included lasting cost reductions, such as staff

reductions across the organization and the termination of

non-critical work.

Table 3: Comparison of cash flows for the three months ended

March 31, 2024 and 2023, respectively.

For the three months

ended,

March 31,

March 31,

Change

2024

2023

$

$

$

(unaudited)

(unaudited)

Opening cash

49,391,627

20,535,210

28,856,417

Operating activities

(4,151,273

)

(6,367,678

)

(2,216,405

)

Investing activities

(11,286,567

)

(2,908,515

)

(8,378,052

)

Financing activities

45,644,831

47,468,612

(1,823,781

)

Net increase in cash and cash

equivalents

30,206,991

38,192,419

(7,985,428

)

Closing cash

79,598,618

58,727,629

20,870,989

a) Cash flow from operating

activities

Net cash used in operating activities of Lifezone was $4,151,273

for the three months ended March 31, 2024, primarily consisting of

$3,954,366 of comprehensive loss for the period, adjusted for (i)

items such as non-cash, interest income, amortization of

intangibles, foreign exchange loss, interest income, interest

expense and depreciation of property and equipment and right-of-use

assets cumulatively amounting to $292,910 and (ii) working capital

changes, primarily consisting of an increase in trade and other

receivables of $332,116, decrease in related party receivables of

$738,511, increase in fuel inventories of $23,574, increase in

prepaid expenses of $229,005, decrease in prepaid mining license of

$246,263 and a decrease in trade and other payables of

$1,347,906.

b) Cash flow from investing

activities

Net cash used in investing activities of Lifezone was

$11,286,567 for the three months ended March 31, 2024, of which

$11,712,346 related to the investment in Kabanga Nickel Project,

which is classified as an exploration and evaluation asset under

IFRS 6, expenditures relating to the acquisition of property and

equipment amounting to $8,488 and patent costs incurred amounting

to $22,942, which were partially offset by interest received from

banks amounting to $457,209.

Costs capitalized relating to the Kabanga Nickel Project include

appropriate technical and administrative overheads. Given the

advanced stage of the Definitive Feasibility Study and the fact

that Tembo Nickel Ltd is exclusively engaged in advancing the

Kabanga Nickel Project, almost all Tanzanian in-country costs are

capitalized. The capitalized costs also include costs to keep our

licenses in good standing and permitting, government relations and

community work related to the Kabanga Nickel Project. In Q1 2024 we

spent around $2.8 million on compensation payments for physically

and economically displaced households. This activity started in

November 2023 and is planned to be completed by the end of Q2

2024.

c) Cash flow from financing

activities

Net cash provided by financing activities of Lifezone was

$45,644,831 for the three months ended March 31, 2024, was

primarily due to proceeds from the convertible debenture

transaction of $44,325,000 (net of issue costs $675,000), proceeds

of $1,500,000 from Phase 1 partnership with Glencore to recycle

platinum, palladium and rhodium in the United States, and offset by

account of payment of lease liabilities of $180,170.

Accounting treatment of the convertible loan note

The convertible loan note issued on March 27, 2024 is considered

to be a hybrid IFRS 9 – Financial instrument comprising a financial

liability (loan) and embedded derivative. The economic

characteristics and risks of the embedded derivative are not

regarded as closely related to the economic characteristics and

risks of the host debt instrument as the value of the derivative is

driven by Lifezone’s share price, resulting in the derivative

liability being accounted for separately from the host debt

instrument. On initial recognition, both elements are valued at

fair value. Subsequently, the loan element minus apportioned

transaction costs will be accounted for at amortized cost with the

embedded derivative being remeasured at each reporting date and

accounted for at fair value through profit or loss. As the

conversion feature may be exercised by the holder at any time, the

convertible loan note is classified as a current liability. Full

disclosure will be provided as part of the required half-year

consolidated financial statements, as of June 30, 2024.

TODAY: webcast with Lifezone’s senior management at 10 AM ET

The company invites shareholders, investors, and members of the

media to join the executive team for a virtual presentation and

discussion of Lifezone’s Q1 2024 activities and outlook. The

presentation will be followed by a Q&A session where

participants can engage directly with senior management.

Event details:

- Date: Monday, May 13, 2024

- Time: 10:00 AM Eastern Time

- Location: Virtual (please click the webcast registration

link).

The presentation slides will be available on Lifezone’s website.

The webcast will be archived and accessible for replay for a

limited time after the event.

Qualified Persons

The exploration results disclosed in this news release have been

prepared under the supervision of and approved by Sharron

Sylvester, BSc (Geol), RPGeo AIG (10125), Technical Director –

Geology at OreWin Pty Ltd. Ms. Sylvester is considered to be a

Qualified Person in accordance with the U.S. Securities and

Exchange Commission (US SEC) Regulation S-K subpart 1300 rules for

Property Disclosures for Mining Registrants (S-K 1300) and is

considered independent of Lifezone Metals.

If you would like to sign up for Lifezone Metals news alerts,

please register here.

About Lifezone Metals

At Lifezone Metals (NYSE: LZM), our mission is to provide

cleaner and more responsible metals production and recycling. Using

a scalable platform underpinned by our Hydromet Technology, we

offer the potential for lower energy, lower emission and lower cost

metals production compared to traditional smelting.

Our Kabanga Nickel Project in Tanzania is believed to be one of

the world's largest and highest-grade undeveloped nickel sulfide

deposits. By pairing with our Hydromet Technology, we are working

to unlock a new source of LME-grade nickel, copper and cobalt for

the global battery metals markets, to empower Tanzania to achieve

full in-country value creation and become the next premier source

of Class 1 nickel. A Definitive Feasibility Study for the project

is due for completion in Q3 2024.

Through our US-based, platinum, palladium and rhodium recycling

partnership, we are working to demonstrate that our Hydromet

Technology can process and recover platinum group metals from

responsibly sourced spent automotive catalytic converters in a

cleaner and more efficient way than conventional smelting and

refining methods.

https://lifezonemetals.com

Forward-Looking Statements

Certain statements made herein are not historical facts but may

be considered “forward-looking statements” within the meaning of

the Securities Act of 1933, as amended, the Securities Exchange Act

of 1934, as amended and the “safe harbor” provisions under the

Private Securities Litigation Reform Act of 1995 regarding, amongst

other things, the plans, strategies, and prospects, both business

and financial, of Lifezone Metals Limited and its subsidiaries

and/or affiliates.

Forward-looking statements generally are accompanied by words

such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “should,” “would,” “plan,”

“predict,” “potential,” “seem,” “seek,” “future,” “outlook” or the

negatives of these terms or variations of them or similar

terminology or expressions that predict or indicate future events

or trends or that are not statements of historical matters;

provided that the absence of these does not mean that a statement

is not forward-looking. These forward-looking statements include,

but are not limited to, statements regarding future events, the

estimated or anticipated future results of Lifezone Metals, future

opportunities for Lifezone Metals, including the efficacy of

Lifezone Metals’ hydrometallurgical technology (Hydromet

Technology) and the development of, and processing of mineral

resources at, the Kabanga Project, and other statements that are

not historical facts.

These statements are based on the current expectations of

Lifezone Metals’ management and are not predictions of actual

performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Lifezone Metals

and its subsidiaries. These statements are subject to a number of

risks and uncertainties regarding Lifezone Metals’ business, and

actual results may differ materially. These risks and uncertainties

include, but are not limited to: general economic, political and

business conditions, including but not limited to the economic and

operational disruptions; global inflation and cost increases for

materials and services; reliability of sampling; success of any

pilot work; capital and operating costs varying significantly from

estimates; delays in obtaining or failures to obtain required

governmental, environmental or other project approvals; changes in

government regulations, legislation and rates of taxation;

inflation; changes in exchange rates and the availability of

foreign exchange; fluctuations in commodity prices; delays in the

development of projects and other factors; the outcome of any legal

proceedings that may be instituted against the Lifezone Metals; our

ability to obtain additional capital, including use of the debt

market, future capital requirements and sources and uses of cash;

the risks related to the rollout of Lifezone Metals’ business, the

efficacy of the Hydromet Technology, and the timing of expected

business milestones; the acquisition of, maintenance of and

protection of intellectual property; Lifezone’s ability to achieve

projections and anticipate uncertainties (including economic or

geopolitical uncertainties) relating to our business, operations

and financial performance, including: expectations with respect to

financial and business performance, financial projections and

business metrics and any underlying assumptions; expectations

regarding product and technology development and pipeline and

market size; the effects of competition on Lifezone Metals’

business; the ability of Lifezone Metals to execute its growth

strategy, manage growth profitably and retain its key employees;

the ability of Lifezone Metals to reach and maintain profitability;

enhancing future operating and financial results; complying with

laws and regulations applicable to Lifezone Metals’ business;

Lifezone Metals’ ability to continue to comply with applicable

listing standards of the NYSE; the ability of Lifezone Metals to

maintain the listing of its securities on a U.S. national

securities exchange; our ability to comply with applicable laws and

regulations; stay abreast of accounting standards, or modified or

new laws and regulations applying to our business, including

privacy regulation; and other risks that will be detailed from time

to time in filings with the U.S. Securities and Exchange Commission

(SEC).

The foregoing list of risk factors is not exhaustive. There may

be additional risks that Lifezone Metals presently does not know or

that Lifezone Metals currently believes are immaterial that could

also cause actual results to differ from those contained in

forward-looking statements. In addition, forward-looking statements

provide Lifezone Metals’ expectations, plans or forecasts of future

events and views as of the date of this communication. Lifezone

Metals anticipates that subsequent events and developments will

cause Lifezone Metals’ assessments to change. However, while

Lifezone Metals may elect to update these forward-looking

statements in the future, Lifezone Metals specifically disclaims

any obligation to do so.

These forward-looking statements should not be relied upon as

representing Lifezone Metals’ assessments as of any date subsequent

to the date of this communication. Accordingly, undue reliance

should not be placed upon the forward-looking statements. Nothing

herein should be regarded as a representation by any person that

the forward-looking statements set forth herein will be achieved or

that any of the contemplated results in such forward-looking

statements will be achieved. You should not place undue reliance on

forward-looking statements in this communication, which are based

upon information available to us as of the date they are made and

are qualified in their entirety by reference to the cautionary

statements herein. In all cases where historical performance is

presented, please note that past performance is not a credible

indicator of future results.

Except as otherwise required by applicable law, we disclaim any

obligation to publicly update or revise any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data, or methods, future events, or other changes

after the date of this communication, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240513896112/en/

Investor Relations – North America Evan Young SVP:

Investor Relations & Capital Markets

evan.young@lifezonemetals.com Investor Relations – Europe

Ingo Hofmaier Chief Financial Officer

ingo.hofmaier@lifezonemetals.com Media Enquiries David

Petrie Manager: Corporate Communications

david.petrie@lifezonemetals.com

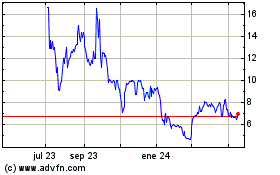

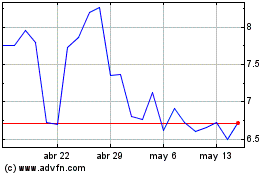

Lifezone Metals (NYSE:LZM)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Lifezone Metals (NYSE:LZM)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025