Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

19 Noviembre 2024 - 8:00AM

Edgar (US Regulatory)

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON NOVEMBER 19, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

ISSUER TENDER OFFER STATEMENT UNDER SECTION 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

AMENDMENT NO. 2

NYLI MACKAY

DEFINEDTERM MUNI OPPORTUNITIES FUND

(Name of Subject Company)

NYLI MACKAY DEFINEDTERM MUNI OPPORTUNITIES FUND

(Name of Filing Person (Issuer))

COMMON SHARES OF BENEFICIAL INTEREST, PAR VALUE $0.01 PER SHARE

(Title of Class of Securities)

56064K100

(CUSIP Number

of Class of Securities)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey

City, New Jersey 07302

(212) 576-7000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person)

Copies to:

Thomas C.

Bogle, Esq.

Corey F. Rose, Esq.

Dechert LLP

1900 K

Street, NW

Washington, DC 20006

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party tender offer subject to Rule 14d-1. |

| |

☒ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

EXPLANATORY NOTE

This Amendment No. 2 (“Amendment No. 2”) amends and supplements the Tender Offer Statement on Schedule TO initially filed with the

Securities and Exchange Commission (the “SEC”) on October 17, 2024 (the “Schedule”), as amended by Amendment No. 1 to the Schedule filed with the SEC on November 15, 2024, by NYLI MacKay DefinedTerm Muni

Opportunities Fund, a diversified, closed-end management investment company organized as a Delaware statutory trust (the “Fund”), pursuant to Rule 13e-4 under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the Fund’s offer to purchase up to 100% of the Fund’s issued and outstanding common shares of beneficial interest for cash at a price per

share equal to the net asset value per share as of the close of ordinary trading on the NYSE on November 14, 2024, upon the terms and subject to the conditions set forth in the Offer to Purchase and the related Letter of Transmittal (which

together constitute the “Offer”).

Filed as Exhibit (a)(7) to this Amendment No. 2 is the press release issued by the Fund on

November 19, 2024, announcing the final results of the Offer. The information in the Offer to Purchase and the Letter of Transmittal, previously filed with the Schedule as Exhibits (a)(1)(i) and (a)(1)(ii), respectively, is incorporated by

reference into this Amendment No. 2 in response to Items 1 through 9 and Item 11 of the Schedule.

ITEM 10. FINANCIAL STATEMENTS

Not applicable.

ITEM 12(a). EXHIBITS

|

|

|

| (a)(1)(i) |

|

Letter to Shareholders and Offer to Purchase1 |

|

|

| (a)(1)(ii) |

|

Letter of Transmittal1 |

|

|

| (a)(1)(iii) |

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees1 |

|

|

| (a)(1)(iv) |

|

Letter to Clients and Client Instruction Form1 |

|

|

| (a)(1)(v) |

|

Notice of Guaranteed Delivery1 |

|

|

| (a)(2) |

|

Not applicable |

|

|

| (a)(3) |

|

Not applicable |

|

|

| (a)(4) |

|

Not applicable |

|

|

| (a)(5) |

|

Press Release dated October 17, 20241 |

|

|

| (a)(6) |

|

Press Release dated November 15, 20242 |

|

|

| (a)(7) |

|

Press Release dated November 19, 2024* |

|

|

| (b) |

|

Not applicable |

|

|

| (d)(1) |

|

Management Agreement between Registrant and New York Life Investment Management LLC, dated as of June 26, 20121 |

|

|

| (d)(2) |

|

Amendment to Management Agreement between Registrant and New York Life Investment Management LLC, dated as of February

28, 20181 |

|

|

| (d)(3) |

|

Subadvisory Agreement by and between New York Life Investment Management LLC and MacKay Shields LLC, dated as of June

26, 20121 |

|

|

| (d)(4) |

|

Amendment to the Subadvisory Agreement by and between New York Life Investment Management LLC and MacKay Shields LLC, dated as of February

28, 20181 |

|

|

| (g) |

|

Not applicable |

|

|

| (h) |

|

Not applicable |

| 1. |

Previously filed on Schedule TO-I via EDGAR on October 17, 2024

and incorporated herein by reference. |

| 2. |

Previously filed on Amendment No. 1 to the Schedule TO-I via EDGAR

on November 15, 2024 and incorporated herein by reference. |

ITEM 12(b). De-SPAC Transaction.

Not applicable.

ITEM 12(c). Filing Fees.

Filing Fee Exhibit.

ITEM 13. INFORMATION REQUIRED BY

SCHEDULE 13E-3

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

| NYLI MACKAY DEFINEDTERM MUNI OPPORTUNITIES FUND |

|

| /s/ Kirk C. Lehneis |

| Kirk C. Lehneis |

| President |

November 19, 2024

EXHIBIT INDEX

NYLI MacKay DefinedTerm Muni Opportunities Fund Announces Final Results of Tender Offer

NEW YORK, Nov. 19, 2024 – NYLI MacKay DefinedTerm Muni Opportunities Fund (NYSE: MMD) (the “Fund”) today announced the final results

of a tender offer.

As previously announced, the Fund conducted a tender offer allowing shareholders to offer up to 100% of their shares for repurchase

for cash at a price per share equal to 100% of the net asset value per share determined on the date the tender offer expires. The tender offer expired on November 14, 2024, at 5:00 p.m. Eastern time.

In the tender offer, 9,147,341 common shares were tendered, representing approximately 32.8% of the Fund’s common shares outstanding. Properly tendered

shares will be repurchased as promptly as practicable at $16.89 per share, which was the NAV of the Fund as of the close of ordinary trading on the New York Stock Exchange on the expiration date, November 14, 2024. Shareholders

participating in the tender offer will not receive the November or December 2024 monthly distributions on tendered shares. The anticipated payment date is on or about November 20th, 2024.

Shareholders of the Fund who have questions regarding the tender offer should contact Georgeson LLC, the information agent for the Fund’s tender offer, toll-free at 1-866-735-3249.

As a result of the successful completion of the tender offer, the following will be

implemented:

| |

• |

|

The Board of Trustees of the Fund has approved, and the Fund’s Agreement and Declaration of Trust will be

amended to reflect, a new 12-year term for the Fund with a termination date of December 31, 2036. |

| |

• |

|

New York Life Investment Management LLC, the investment adviser to the Fund, will waive 0.06% of the Fund’s

management fee from December 31, 2024, until December 31, 2025. As a result of the waiver, the Fund’s net management fee, which is applied to managed assets, would be reduced from 0.60% to 0.54%. |

The Fund’s daily New York Stock Exchange closing prices, net asset values per share, as well as other information are available by clicking here or by

calling the Fund’s shareholder servicing agent at (855) 456-9683.

For more insights from MacKay

Municipal Managers™ and our New York Life Investments affiliates click here.

There are risks

inherent in any investment, including market risk, interest rate risk, credit risk and the possible loss of principal. There can be no assurance that the Fund’s investment objectives will be achieved. Shares of

closed-end funds frequently trade at a discount from their net asset value, which may increase investor risk.

Past performance is no guarantee of future results, which will vary.

About New York Life Investments

With over

$750 billion in assets under management as of September 30, 2024, New York Life Investments, a Pensions & Investments’ Top 30 Largest Money Manager1, is comprised of the

affiliated global asset management businesses of its parent company, New York Life Insurance Company, and offers clients access to specialized, independent investment teams through its family of affiliated boutiques. New York Life Investments

remains committed to clients through a combination of the diverse perspectives of its boutiques and a long-lasting focus on sustainable relationships.

| 1 |

New York Life Investment Management ranked 26th largest institutional investment manager in Pensions &

Investments’ Largest Money Managers 2024 published June 2024, based on worldwide institutional AUM as of 12/31/23. No direct or indirect compensation was paid for the creation and distribution of this ranking. |

About MacKay Municipal Managers™

MacKay Municipal ManagersTM is a recognized leader in active municipal bond investing and is entrusted

with $82 billion in assets under management, as of September 30, 2024. The team manages a suite of highly rated municipal bond solutions available in multiple vehicles. MacKay Municipal

ManagersTM is a fundamental relative-value bond manager that combines a top-down approach with bottom-up, credit

research. Our investment philosophy is centered on the belief that strong long-term performance can be achieved with a relative value, research driven approach in a highly fragmented, inefficient municipal bond market.

About MacKay Shields LLC

MacKay Shields LLC (together

with its subsidiaries, “MacKay”)2, a New York Life Investments company, is a global asset management firm with $151 billion in assets under management3 as of September 30, 2024. MacKay manages fixed income strategies for high-net worth individuals and institutional clients through separately managed

accounts and collective investment vehicles including private funds, collective investment trusts, UCITS, ETFs, closed end funds and mutual funds. MacKay provides investors with specialty fixed income expertise across global fixed income markets

including municipal bonds, high yield bonds, investment grade bonds, structured credit, and emerging markets debt. The MacKay Shields client experience provides investors direct access to senior investment professionals. MacKay maintains

offices in New York City, Princeton, Los Angeles, London and Dublin. For more information, please visit www.mackayshields.com or follow us on Twitter or LinkedIn.

Media Contact:

Sara Guenoun | New York Life | (212) 576-4757 | Sara_j_Guenoun@newyorklife.com

Investors Contact:

855-456-9683

| 2 |

MacKay Shields is a wholly owned subsidiary of New York Life Investment Management Holdings LLC, which is

wholly owned by New York Life Insurance Company. |

| 3 |

Assets under management (AUM) as of September 30, 2024 represents assets managed by MacKay Shields LLC and

its subsidiaries but excludes certain accounts and other assets over which MacKay Shields continues to exercise discretionary authority to liquidate but which are no longer actively managed. |

Calculation of Filing Fee Tables

SC TO-I

(Form Type)

NYLI MacKay

DefinedTerm Muni Opportunities Fund

(Exact Name of Registrant as Specified in its Charter)

Table 1 – Transaction Valuation

|

|

|

|

|

|

|

| |

|

|

|

| |

|

Transaction

Valuation |

|

Fee Rate |

|

Amount of

Filing Fee |

| |

|

|

|

| Fees to Be

Paid |

|

— |

|

— |

|

— |

| |

|

|

|

| Fees Previously

Paid |

|

$475,393,095.80 (1) |

|

$153.10 (2) |

|

$72,782.68 |

| |

|

|

|

| Total Transaction

Valuation |

|

$475,393,095.80 (1) |

|

— |

|

— |

| |

|

|

|

| Total Fees Due for

Filing |

|

— |

|

— |

|

— |

| |

|

|

|

| Total Fees

Previously Paid |

|

— |

|

— |

|

$72,782.68 |

| |

|

|

|

| Total Fee

Offsets |

|

— |

|

— |

|

— |

| |

|

|

|

|

Net Fee Due |

|

— |

|

— |

|

$0 |

| (1) |

The Transaction Valuation was calculated by multiplying 27,926,793.602 shares of NYLI MacKay DefinedTerm Muni

Opportunities Fund by $17.02 (100% of the Net Asset Value per share as of the close of ordinary trading on the New York Stock Exchange on October 10, 2024). |

| (2) |

Calculated at $153.10 per $1,000,000.00 of the Transaction Valuation in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, as modified by the Section 6(b) Filing Fee Rate Advisory for Fiscal Year 2025. |

Table 2 – Fee Offset Claims and Sources

Not applicable.

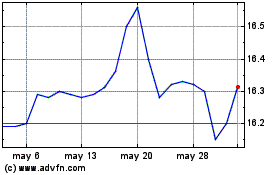

NYLI MacKay DefinedTerm ... (NYSE:MMD)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

NYLI MacKay DefinedTerm ... (NYSE:MMD)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025