Mettler-Toledo International Inc. (NYSE: MTD) today announced

second quarter results for 2024. Provided below are the

highlights:

- Reported sales declined 4% compared with the prior year. In

local currency, sales decreased 2% in the quarter as currency

reduced sales growth by 2%.

- Net earnings per diluted share as reported (EPS) were $10.37,

compared with $9.69 in the prior-year period. Adjusted EPS was

$9.65, a decrease of 5% over the prior-year amount of $10.19.

Adjusted EPS is a non-GAAP measure, and a reconciliation to EPS is

included on the last page of the attached schedules.

Second Quarter Results

Patrick Kaltenbach, President and Chief Executive Officer,

stated, “Our team continued to execute very well in the second

quarter and delivered good Laboratory sales growth in Europe and

the Americas. As expected, market conditions in China remained

weak. We continue to benefit from our productivity and margin

initiatives, which helped mitigate the impact of foreign exchange

headwinds and supported better-than-expected financial

results.”

GAAP Results

EPS in the quarter was $10.37, compared with the prior-year

amount of $9.69. EPS included a one-time non-cash tax benefit of

$1.07 per share.

Compared with the prior year, total reported sales declined 4%

to $946.8 million. By region, reported sales increased 5% in Europe

and 2% in the Americas and declined 16% in Asia/Rest of World.

Earnings before taxes amounted to $243.2 million, compared with

$263.4 million in the prior year.

Non-GAAP Results

Adjusted EPS was $9.65, a decrease of 5% over the prior-year

amount of $10.19.

Compared with the prior year, total sales in local currency

declined 2% as currency reduced sales growth by 2%. By region,

local currency sales increased 6% in Europe and 2% in the Americas

and declined 12% in Asia/Rest of World. Adjusted Operating Profit

amounted to $284.1 million, compared with the prior-year amount of

$307.7 million.

Adjusted EPS and Adjusted Operating Profit are non-GAAP

measures. Reconciliations to the most comparable GAAP measures are

provided in the attached schedules.

Six Month Results

GAAP Results

EPS was $18.60, compared with the prior-year amount of $18.15,

and included the previously mentioned one-time non-cash tax benefit

of $1.07 per share.

Compared with the prior year, total reported sales declined 2%

to $1.873 billion. By region, reported sales increased 6% in Europe

and 3% in the Americas and declined 14% in Asia/Rest of World.

Earnings before taxes amounted to $463.7 million, compared with

$490.0 million in the prior year.

Non-GAAP Results

Adjusted EPS was $18.53, a decrease of 2% over the prior-year

amount of $18.82.

Compared with the prior year, total sales in local currency

declined 1% as currency reduced sales growth by 1%. By region,

local currency sales increased 6% in Europe and 2% in the Americas

and declined 11% in Asia/Rest of World. Excluding the first quarter

benefit from delayed fourth quarter 2023 shipments, year-to-date

local currency sales declined 4%, including flat local currency

sales in Europe and the Americas and a 12% decline in Asia/Rest of

World. Adjusted Operating Profit amounted to $551.4 million,

compared with the prior-year amount of $574.2 million.

Adjusted EPS and Adjusted Operating Profit are non-GAAP

measures. Reconciliations to the most comparable GAAP measures are

provided in the attached schedules.

Outlook

Management cautions that market conditions are uncertain and

could change quickly. Based on today's assessment, management

anticipates local currency sales for the third quarter of 2024 will

increase approximately 1%, and Adjusted EPS is forecast to be $9.90

to $10.05, representing growth of 1% to 3%. Included in the third

quarter guidance is an estimated 1% headwind to Adjusted EPS growth

due to adverse currency.

For the full year, management anticipates local currency sales

in 2024 will increase approximately 2%, and Adjusted EPS is

forecast to be in the range of $40.20 to $40.50, representing

growth of approximately 6% to 8%. Included in the full year

guidance is an estimated 2% headwind to Adjusted EPS growth due to

adverse currency. This compares with previous local currency sales

growth guidance of approximately 2% and Adjusted EPS guidance of

$39.90 to $40.40.

The Company does not provide GAAP financial measures on a

forward-looking basis because we are unable to predict with

reasonable certainty and without unreasonable effort the timing and

amount of future restructuring and other non-recurring items.

Conclusion

Kaltenbach concluded, “Market conditions globally have remained

soft, especially in China. However, we expect our local currency

sales to return to growth in the second half of the year primarily

due to easier comparisons, as well as execution of our Spinnaker

sales and marketing program and leveraging our innovative product

portfolio. We remain focused on continuing to strengthen our

Company for the future and believe we are in an excellent position

to continue to gain market share and deliver future growth.”

Other Matters

The Company will host a conference call to discuss its quarterly

results tomorrow morning (Friday, August 2) at 7:30 a.m. Eastern

Time. To listen to a live webcast or replay of the call, visit the

investor relations page on the Company’s website at

investor.mt.com. The presentation referenced on the conference call

will be located on the website prior to the call.

METTLER TOLEDO (NYSE: MTD) is a leading global supplier of

precision instruments and services. We have strong leadership

positions in all of our businesses and believe we hold global

number-one market positions in most of them. We are recognized as

an innovation leader and our solutions are critical in key R&D,

quality control, and manufacturing processes for customers in a

wide range of industries including life sciences, food, and

chemicals. Our sales and service network is one of the most

extensive in the industry. Our products are sold in more than 140

countries and we have a direct presence in approximately 40

countries. With proven growth strategies and a focus on execution,

we have achieved a long-term track record of strong financial

performance. For more information, please visit www.mt.com.

Forward-Looking Statements Disclaimer

You should not rely on forward-looking statements to predict our

actual results. Our actual results or performance may be materially

different than reflected in forward-looking statements because of

various risks and uncertainties, including statements about

expected revenue growth, inflation, ongoing developments related to

Ukraine, and the Israel-Hamas war. You can identify forward-looking

statements by terminology such as “may,” “will,” “could,” “would,”

“should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “potential,” or “continue.”

We make forward-looking statements about future events or our

future financial performance, including earnings and sales growth,

earnings per share, strategic plans and contingency plans, growth

opportunities or economic downturns, our ability to respond to

changes in market conditions, planned research and development

efforts and product introductions, adequacy of facilities, access

to and the costs of raw materials, shipping and supplier costs,

gross margins, customer demand, our competitive position, pricing,

capital expenditures, cash flow, tax-related matters, the impact of

foreign currencies, compliance with laws, effects of acquisitions,

and the impact of inflation, ongoing developments related to

Ukraine, and the Israel-Hamas war on our business.

Our forward-looking statements may not be accurate or complete,

and we do not intend to update or revise them in light of actual

results. New risks also periodically arise. Please consider the

risks and factors that could cause our results to differ materially

from what is described in our forward-looking statements, including

inflation, ongoing developments related to Ukraine, and the

Israel-Hamas war. See in particular “Factors Affecting Our Future

Operating Results” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.”

METTLER-TOLEDO INTERNATIONAL

INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in

thousands except share data) (unaudited)

Three months ended

Three months ended

June 30, 2024

% of sales

June 30, 2023

% of sales

Net sales

$

946,750

(a)

100.0

$

982,117

100.0

Cost of sales

381,082

40.3

398,574

40.6

Gross profit

565,668

59.7

583,543

59.4

Research and development

45,771

4.8

47,245

4.8

Selling, general and administrative

235,796

24.9

228,594

23.3

Amortization

18,178

1.9

18,042

1.8

Interest expense

18,950

2.0

19,249

2.0

Restructuring charges

5,329

0.6

8,021

0.8

Other charges (income), net

(1,533

)

(0.2

)

(1,011

)

(0.1

)

Earnings before taxes

243,177

25.7

263,403

26.8

Provision for taxes

21,363

2.3

49,476

5.0

Net earnings

$

221,814

23.4

$

213,927

21.8

Basic earnings per common share: Net earnings

$

10.42

$

9.75

Weighted average number of common shares

21,279,006

21,944,645

Diluted earnings per common share: Net earnings

$

10.37

$

9.69

Weighted average number of common

21,392,550

22,080,602

and common equivalent shares Note:

(a) Local currency sales

decreased 2% as compared to the same period in 2023.

RECONCILIATION OF EARNINGS BEFORE TAXES TO ADJUSTED

OPERATING PROFIT Three months ended Three months ended

June 30, 2024 % of sales June 30, 2023 % of sales Earnings

before taxes

$

243,177

$

263,403

Amortization

18,178

18,042

Interest expense

18,950

19,249

Restructuring charges

5,329

8,021

Other charges (income), net

(1,533

)

(1,011

)

Adjusted operating profit

$

284,101

(b)

30.0

$

307,704

31.3

Note:

(b) Adjusted operating profit

decreased 8% as compared to the same period in 2023.

METTLER-TOLEDO INTERNATIONAL

INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in

thousands except share data) (unaudited)

Six months ended

Six months ended

June 30, 2024

% of sales

June 30, 2023

% of sales

Net sales

$

1,872,699

(a)

100.0

$

1,910,855

100.0

Cost of sales

758,898

40.5

780,746

40.9

Gross profit

1,113,801

59.5

1,130,109

59.1

Research and development

92,186

4.9

92,722

4.9

Selling, general and administrative

470,186

25.1

463,232

24.2

Amortization

36,406

1.9

35,821

1.9

Interest expense

38,182

2.0

37,433

2.0

Restructuring charges

14,993

0.8

12,295

0.6

Other charges (income), net

(1,876

)

(0.0

)

(1,407

)

(0.1

)

Earnings before taxes

463,724

24.8

490,013

25.6

Provision for taxes

64,401

3.5

87,660

4.5

Net earnings

$

399,323

21.3

$

402,353

21.1

Basic earnings per common share: Net earnings

$

18.70

$

18.28

Weighted average number of common shares

21,358,339

22,013,662

Diluted earnings per common share: Net earnings

$

18.60

$

18.15

Weighted average number of common

21,468,995

22,164,394

and common equivalent shares Note:

(a) Local currency sales decreased 1% as

compared to the same period in 2023.

RECONCILIATION OF EARNINGS BEFORE TAXES TO ADJUSTED

OPERATING PROFIT

Six months ended

Six months ended

June 30, 2024

% of sales

June 30, 2023

% of sales

Earnings before taxes

$

463,724

$

490,013

Amortization

36,406

35,821

Interest expense

38,182

37,433

Restructuring charges

14,993

12,295

Other charges (income), net

(1,876

)

(1,407

)

Adjusted operating profit

$

551,429

(b)

29.4

$

574,155

(b)

30.0

Note:

(b) Adjusted operating profit decreased 4%

as compared to the same period in 2023.

METTLER-TOLEDO INTERNATIONAL

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(amounts in thousands)

(unaudited)

June 30, 2024 December 31, 2023 Cash and cash

equivalents

$

70,810

$

69,807

Accounts receivable, net

634,710

663,893

Inventories

366,395

385,865

Other current assets and prepaid expenses

106,392

110,638

Total current assets

1,178,307

1,230,203

Property, plant and equipment, net

768,664

803,374

Goodwill and other intangibles assets, net

933,513

955,537

Other non-current assets

368,680

366,441

Total assets

$

3,249,164

$

3,355,555

Short-term borrowings and maturities of long-term debt

$

311,246

$

192,219

Trade accounts payable

199,462

210,411

Accrued and other current liabilities

770,474

778,452

Total current liabilities

1,281,182

1,181,082

Long-term debt

1,746,638

1,888,620

Other non-current liabilities

374,106

435,791

Total liabilities

3,401,926

3,505,493

Shareholders’ equity

(152,762

)

(149,938

)

Total liabilities and shareholders’ equity

$

3,249,164

$

3,355,555

METTLER-TOLEDO INTERNATIONAL

INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (amounts

in thousands) (unaudited)

Three months ended

Six months ended

June 30,

June 30,

2024

2023

2024

2023

Cash flow from operating activities: Net earnings

$

221,814

$

213,927

$

399,323

$

402,353

Adjustments to reconcile net earnings to net cash provided by

operating activities: Depreciation

12,351

12,194

24,873

24,217

Amortization

18,178

18,042

36,406

35,821

Deferred tax benefit

(1,774

)

(2,368

)

(3,837

)

(1,766

)

One-time non-cash discrete tax benefit

(22,982

)

-

(22,982

)

-

Other

4,541

4,195

9,263

8,222

Increase (decrease) in cash resulting from changes in operating

assets and liabilities

25,378

20,821

4,447

(48,774

)

Net cash provided by operating activities

257,506

266,811

447,493

420,073

Cash flows from investing activities: Proceeds from sale of

property, plant and equipment

668

412

668

412

Purchase of property, plant and equipment

(23,810

)

(28,751

)

(41,201

)

(51,947

)

Proceeds from government funding (a)

-

1,264

-

1,264

Acquisitions

(1,473

)

-

(2,473

)

(613

)

Other investing activities

2,783

(15,837

)

12,239

(14,414

)

Net cash used in investing activities

(21,832

)

(42,912

)

(30,767

)

(65,298

)

Cash flows from financing activities: Proceeds from borrowings

572,715

475,903

1,022,578

1,080,921

Repayments of borrowings

(598,912

)

(455,215

)

(1,017,192

)

(958,731

)

Proceeds from exercise of stock options

6,305

7,614

8,136

19,087

Repurchases of common stock

(212,499

)

(250,000

)

(424,998

)

(499,999

)

Acquisition contingent consideration payment

-

(5,626

)

-

(5,626

)

Other financing activities

(1,910

)

(103

)

(1,910

)

(714

)

Net cash used in financing activities

(234,301

)

(227,427

)

(413,386

)

(365,062

)

Effect of exchange rate changes on cash and cash equivalents

(754

)

(1,983

)

(2,337

)

(2,105

)

Net increase (decrease) in cash and cash equivalents

619

(5,511

)

1,003

(12,392

)

Cash and cash equivalents: Beginning of period

70,191

89,085

69,807

95,966

End of period

$

70,810

$

83,574

$

70,810

$

83,574

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES

TO ADJUSTED FREE CASH FLOW Net cash provided by operating

activities

$

257,506

$

266,811

$

447,493

$

420,073

Payments in respect of restructuring activities

5,966

5,415

15,680

7,398

Transition tax payment

10,723

8,042

10,723

8,042

Proceeds from sale of property, plant and equipment

668

412

668

412

Purchase of property, plant and equipment, net (a)

(23,810

)

(24,907

)

(41,201

)

(44,815

)

Acquisition payments (b)

-

4,775

-

4,775

Adjusted free cash flow

$

251,053

$

260,548

$

433,363

$

395,885

Notes:

(a)

In September 2021, the Company entered into an agreement with the

U.S. Department of Defense to increase the domestic production

capacity of pipette tips and enhance manufacturing automation and

logistics. The Company received funding of $35.8 million in prior

years, which offset capital expenditures. During the three and six

months ended June 30, 2023 the Company received funding proceeds of

$1.3 million. During the three and six months ended June 30, 2023

the related purchase of property, plant and equipment of $3.8

million and $7.1 million, respectively, are excluded from Adjusted

free cash flow.

(b)

Includes $4.4 million of the PendoTECH contingent consideration

payment that was reported in net cash provided by operating

activities as required by U.S. GAAP for the three and six months

ended June 30, 2023.

METTLER-TOLEDO INTERNATIONAL

INC.

OTHER OPERATING STATISTICS SALES GROWTH BY

DESTINATION (unaudited)

Americas

Europe

Asia/RoW

Total

U.S. Dollar Sales Growth Three Months Ended June 30, 2024

2%

5%

(16%)

(4%)

Six Months Ended June 30, 2024

3%

6%

(14%)

(2%)

Local Currency Sales Growth

Three Months Ended June 30, 2024

2%

6%

(13%)

(2%)

Six Months Ended June 30, 2024

2%

6%

(11%)

(1%)

Note:

(a)

The Company estimates net sales for the six months ended June 30,

2024 benefited by 3% from recovering previously delayed shipments

from the fourth quarter of 2023. By geographic destination, net

sales benefited approximately 2% in the Americas, 6% in Europe and

1% in Asia/Rest of World.

RECONCILIATION OF DILUTED EPS

AS REPORTED TO ADJUSTED DILUTED EPS

(unaudited)

Three months ended

Six months ended

June 30,

June 30,

2024

2023

% Growth

2024

2023

% Growth

EPS as reported, diluted

$

10.37

$

9.69

7

%

$

18.60

$

18.15

2

%

Purchased intangible amortization, net of tax

0.24

(a)

0.23

(a)

0.47

(a)

0.46

(a) Restructuring charges, net of tax

0.20

(b)

0.29

(b)

0.56

(b)

0.45

(b) Income tax expense

(1.16

)

(c)

(0.02

)

(c)

(1.10

)

(c)

(0.24

)

(c) Adjusted EPS, diluted

$

9.65

$

10.19

-5

%

$

18.53

$

18.82

-2

%

Notes:

(a)

Represents the EPS impact of purchased intangibles amortization of

$6.5 million ($5.0 million net of tax) and $6.7 million ($5.2

million net of tax) for the three months ended June 30, 2024 and

2023, and of $13.1 million ($10.1 million net of tax) and $13.3

million ($10.3 million net of tax) for the six months ended June

30, 2024 and 2023, respectively.

(b)

Represents the EPS impact of restructuring charges of $5.3 million

($4.3 million after tax) and $8.0 million ($6.5 million after tax)

for the three months ended June 30, 2024 and 2023, and $15.0

million ($12.1 million after tax) and $12.3 million ($10.0 million

after tax) for the six months ended June 30, 2024 and 2023,

respectively, which primarily include employee related costs.

(c)

Represents the EPS impact of the difference between our quarterly

and estimated annual tax rate before non-recurring discrete items

during the three and six months ended June 30, 2024 and 2023 due to

the timing of excess tax benefits associated with stock option

exercises. Also includes a reported EPS reduction of $1.07 for the

three and six months ended June 30, 2024 for the one-time non-cash

discrete tax benefit resulting from the reduction of uncertain tax

position liabilities related to the settlement of a tax audit.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801458990/en/

Adam Uhlman Head of Investor Relations METTLER TOLEDO Direct:

614-438-4794 adam.uhlman@mt.com

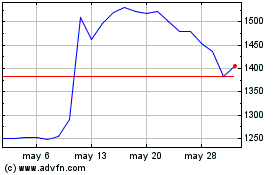

Mettler Toledo (NYSE:MTD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Mettler Toledo (NYSE:MTD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024