0001104485FALSE00011044852024-07-292024-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2024

NORTHERN OIL AND GAS, INC.

(Exact name of Registrant as specified in its charter) | | | | | | | | |

Delaware | 001-33999 | 95-3848122 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

4350 Baker Road, Suite 400 Minnetonka, Minnesota | 55343 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (952) 476-9800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 | | NOG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 29, 2024, Northern Oil and Gas, Inc. issued a press release that includes certain financial and operating information for the second quarter of 2024. A copy of the press release is furnished as Exhibit 99.1 hereto.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | Press release of Northern Oil and Gas, Inc., dated July 29, 2024. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: July 29, 2024 | NORTHERN OIL AND GAS, INC. By /s/ Erik J. Romslo Erik J. Romslo Chief Legal Officer and Secretary |

NOG Provides Shareholder Return Update; Plans Mid-Year Increase to Quarterly Dividend

HIGHLIGHTS

•Repurchased 895,076 shares of common stock during Q2 2024

•Repurchased 1,444,432 shares in total during Q1 and Q2 2024

•Board of Directors approved new $150 million share repurchase authorization

•Management will recommend that the Board of Directors approve a 5% mid-year increase to NOG’s quarterly common stock dividend, to $0.42 per share, for the third quarter of 2024

MINNEAPOLIS--(BUSINESS WIRE)--Northern Oil and Gas, Inc. (NYSE: NOG) (the “Company” or “NOG”) provided a shareholder return update.

SHAREHOLDER RETURN UPDATE

NOG repurchased 895,076 shares of common stock during the second quarter of 2024 at an average price, inclusive of commissions, of $38.96 per share. During the first half of 2024, the Company repurchased 1,444,432 shares at an average price, inclusive of commissions, of approximately $37.99 per share. In total, the Company has allocated approximately $55 million to share repurchases year-to-date. Additionally, the Company has declared common stock dividends totaling approximately $80 million year-to-date, bringing capital allocated to shareholder returns to approximately $135 million in the first half of 2024.

In July 2024, NOG’s Board of Directors approved a new $150 million common stock repurchase authorization, replacing its prior authorization which was substantially depleted. Under this program, shares may be repurchased periodically, including in the open market or privately negotiated transactions. The actual timing, manner, number, and value of shares repurchased, if any, will depend on a number of factors, including the availability of free cash flow, market price, general market and economic conditions, applicable legal and contractual requirements, and other business considerations.

Per Company policy, interim modifications to the dividend can be driven by material changes in realized commodity prices, significant corporate actions or other events, prior to the Company’s planned annual dividend review during the first quarter of a given fiscal year. Management intends to submit a request to the Board of Directors for a 5%, or $0.02, mid-year increase to NOG’s quarterly common stock dividend, to $0.42 per share, for the third quarter of 2024. The recommendation is driven by strong cash flow experienced year-to-date and a robust business outlook, combined with the confidence in the cash flows to be provided by NOG’s pending acquisitions, Under Delaware law, the Board may not approve dividends more than 60 days before the record date.

The Company continues to plan for its regularly scheduled annual review of dividend policy with the Board of Directors in the first quarter of 2025.

MANAGEMENT COMMENTS

“NOG continues with a multi-pronged approach to creating value,” commented Nick O’Grady, NOG’s Chief Executive Officer. “We see benefits to retiring our shares when attractive, increasing our cash returns to our shareholders when appropriate, and continuing to find organic and inorganic growth opportunities to drive the highest possible long term total return for our investors. Our share repurchases and recommendation for a mid-year increase to our dividend are a testament to the confidence we have in NOG’s future.”

“Per our policy, significant corporate actions can warrant interim increases to the dividend prior to our annual review,” commented Chad Allen, NOG’s Chief Financial Officer. “We believe our strong base business outlook and the significant cash flows associated with our pending acquisitions also provide capacity for additional shareholder returns over time.”

ABOUT NOG

NOG is a real asset company with a primary strategy of acquiring and investing in non-operated minority working and mineral interests in the premier hydrocarbon producing basins within the contiguous United States. More information about NOG can be found at www.noginc.com.

SAFE HARBOR

This press release contains forward-looking statements regarding future events and future results that are subject to the safe harbors created under the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). All statements other than statements of historical facts included in this release regarding NOG’s dividend plans and practices (including timing and amounts), financial position, business strategy, plans and objectives of management for future operations, and other matters are forward-looking statements. When used in this release, forward-looking statements are generally accompanied by terms or phrases such as “estimate,” “guidance,” “project,” “predict,” “believe,” “expect,” “continue,” “anticipate,” “target,” “could,” “plan,” “intend,” “seek,” “goal,” “will,” “should,” “may” or other words and similar expressions that convey the uncertainty of future events or outcomes. Items contemplating or making assumptions about actual or potential future trends or operating results also constitute such forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties, and important factors (many of which are beyond NOG’s control) that could cause actual results to differ materially from those set forth in the forward-looking statements, including the following: changes in crude oil and natural gas prices, the pace of drilling and completions activity on NOG's properties and properties pending acquisition, NOG's ability to acquire additional development opportunities, integration and benefits of property acquisitions, or the effects of such acquisitions on NOG’s cash position and levels of indebtedness, changes in NOG's reserves estimates or the value thereof, general economic or industry conditions, nationally and/or in the communities in which NOG conducts business, changes in the interest rate environment, legislation or regulatory requirements, conditions of the securities markets, NOG's ability to consummate any pending acquisition transactions, other risks and uncertainties related to the closing of pending acquisition transactions, NOG's ability to raise or access capital, changes in accounting principles, policies or guidelines, financial or political instability, acts of war or terrorism, and other economic, competitive, governmental, regulatory and technical factors affecting NOG's operations, products, services and prices.

NOG has based these forward-looking statements on its current expectations and assumptions about future events. While management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond NOG's control. NOG does not undertake any duty to update or revise any forward-looking statements, except as may be required by the federal securities laws.

Evelyn Leon Infurna

Vice President of Investor Relations

(952) 476-9800

ir@northernoil.com

Source: Northern Oil and Gas, Inc.

v3.24.2

Cover

|

Jul. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 29, 2024

|

| Entity Registrant Name |

NORTHERN OIL AND GAS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33999

|

| Entity Tax Identification Number |

95-3848122

|

| Entity Address, Address Line One |

4350 Baker Road, Suite 400

|

| Entity Address, City or Town |

Minnetonka

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55343

|

| City Area Code |

952

|

| Local Phone Number |

476-9800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

NOG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001104485

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

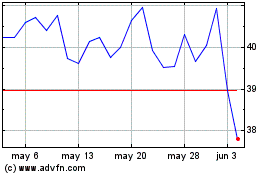

Northern Oil and Gas (NYSE:NOG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Northern Oil and Gas (NYSE:NOG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024