As filed with the Securities and Exchange Commission on March 1, 2023

| | |

Registration Statement No. 333- |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Nomad Foods Limited

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| British Virgin Islands | | Not Applicable |

(State or other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

No. 1 New Square

Bedfont Lakes Business Park, Feltham, Middlesex TW14 8HA

+(44) 208 918 3200

(Address and telephone number of Registrant’s principal executive offices)

Mariposa Capital, LLC

500 South Pointe Drive, Suite 240, Miami Beach, FL 33139

Tel: (786) 482-6320

(Name, address and telephone number of agent for service)

| | | | | | | | |

| Copies to: | |

| Flora R. Perez, Esq. Brian J. Gavsie, Esq. Greenberg Traurig, P.A. 401 East Las Olas Boulevard, Suite 2000 Fort Lauderdale, FL 33301 Tel: (954) 765-0500 | |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the SEC pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standard† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

PROSPECTUS

Ordinary Shares

Preferred Shares

Debt Securities

Warrants

We may offer, issue and sell, from time to time, in one or more offerings and series, together or separately, our ordinary shares, preferred shares, debt securities or warrants (collectively, the “securities”), in amounts, at prices and on terms that will be determined at the time of any such offering and described in one or more supplements to this prospectus. The debt securities, preferred shares and warrants we may offer may be convertible into or exercisable or exchangeable for ordinary shares or other securities of Nomad Foods Limited or debt or equity securities of one or more other entities.

From the date of this prospectus, we may offer the securities from time to time in amounts, at prices and on terms determined by market conditions at the time of the offering. Each time we offer securities for sale using this prospectus, we will provide specific terms and describe the specific manner in which we will offer these securities in supplements to this prospectus. The prospectus supplement may also add, update or change the information in this prospectus.

This prospectus may not be used to offer or sell securities unless accompanied by a prospectus supplement that includes a description of the method and terms of the offering.

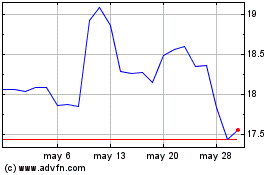

Our ordinary shares are listed on the New York Stock Exchange (the “NYSE”) under the ticker symbol “NOMD.”

Investing in our securities involves risks. Please refer to the “Risk Factors” section on page 2 and the supplemental risk factors contained in any applicable prospectus supplement and in the documents we incorporate by reference for a description of the risks you should consider before making an investment decision. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 1, 2023.

TABLE OF CONTENTS

This prospectus is part of a shelf registration statement that we have filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may, from time to time, offer and sell or otherwise transfer the securities described in this prospectus and in an accompanying prospectus supplement, if required, in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. Each time we sell our securities using this prospectus, if and to the extent necessary, we will provide a prospectus supplement that will contain specific information about the terms of that offering, including the type, number or amount of securities being offered, the manner of distribution, the identity of any underwriters or other counterparties and other specific material terms related to the offering. Such prospectus supplement may also add update or change information contained in this prospectus. To the extent that any statement made in an accompanying prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in the accompanying prospectus supplement. You should read both this prospectus and any prospectus supplement together.

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We do not take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We have not authorized any other person to provide you with different or additional information and are not making an offer to sell or transfer the securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of the prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

For investors outside of the United States, we have not done anything that would permit the offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to the offering and the distribution of this prospectus outside of the United States.

Unless the context otherwise requires, references in this prospectus to “Nomad,” the “Company,” “we,” “us” and “our” refer to Nomad Foods Limited and its consolidated subsidiaries.

THE COMPANY

We are Europe’s leading frozen food company with a portfolio of best-in-class food brands within the frozen category, including fish, vegetables, poultry, meals and pizza and ice cream. Our products are sold primarily through large grocery retailers under the “Birds Eye” brand in the United Kingdom and Ireland, “Findus” in Italy, France, Spain, Sweden, Switzerland and Norway, “iglo” in Germany and other continental markets, “La Cocinera” in Spain, “Ledo” in south-eastern Europe and “Frikom” in Serbia and North Macedonia. The majority of our products are in the savory frozen food market, where according to Nielsen, our market share in the countries we operate stood at 18% in 2022 (2021: 18%, figures exclude markets covered by the Fortenova acquisition). For the categories in which we operate, we maintain the number one position in sixteen European geographies, namely the United Kingdom, Italy, Germany, France, Sweden, Austria, Norway, Switzerland, Belgium, The Netherlands, Portugal, Ireland, Croatia, Serbia, Bosnia & Herzegovina and North Macedonia. The countries representing our top six markets, collectively, the United Kingdom, Italy, Germany, France, Sweden and Austria, represented approximately 80% of the total European savory frozen food markets.

Our brands are household names with long histories and local heritage in their respective markets. Our Birds Eye brand was established in 1922 and is primarily marketed in the United Kingdom and Ireland. The Findus brand, which is marketed in Italy, France, Spain, Sweden, Switzerland and Norway, was formed in Italy in 1941 and has a loyal following in each of its respective geographies. The iglo brand, founded in 1956, has a long-standing history and is marketed in Germany and other continental European countries. Ledo (established in 1958) and Frikom (established in 1975) are the lead brands with strong heritage in south-eastern Europe.

Our principal executive offices are located at No. 1 New Square, Bedfont Lakes Business Park, Feltham, Middlesex TW14 8HA. Our telephone number is +(44) 208 918 3200 and our fax number is +(44) 208 918 3491. Our registered office is located at Ritter House, Wickhams Cay II, Road Town, Tortola, VG1110 British Virgin Islands and its telephone number is (284) 852-7900. Our registered agent in the United States is Mariposa Capital, LLC, 500 South Pointe Drive, Suite 240 Miami Beach, Florida 33139.

RISK FACTORS

Any investment in the securities is speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 20-F, or any updates in our reports on Form 6-K, together with all of the other information appearing in, or incorporated by reference into, this prospectus and any applicable prospectus supplement. The risks so described are not the only risks facing our company. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition and results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus and the documents incorporated or deemed to be incorporated by reference herein may constitute forward-looking statements that do not directly or exclusively relate to historical facts. You should not place undue reliance on such statements because they are subject to numerous uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. Forward-looking statements included in this prospectus and the documents incorporated by reference herein include statements regarding:

•our beliefs and intentions regarding our strategic initiatives and their impact on the growth and profitability of our business;

•our intent to profitably grow our business through our strategic initiatives;

•our intent to seek additional acquisition opportunities in food products and our expectation regarding competition for acquisitions;

•our beliefs regarding the impact of the exit by the UK from the EU ("Brexit") on our business;

•our expectations concerning our ability to fund our liquidity requirements and to raise cash through equity and debt offerings;

•our expectations concerning our capital expenditures in 2023;

•our beliefs regarding our sales, marketing and advertising strategies, competitive strengths and ability to successfully compete in the markets in which we participate;

•our expectations concerning consumer demand for our products, our future growth opportunities, market share and sales channels, including online channels;

•our beliefs and intentions regarding the impact of key industry trends on our business, our actions in response to such trends and the resulting impact on our profitability and competitive position;

•our future operating and financial performance;

•our belief that we have sufficient spare capacity to accommodate future growth in our main product categories and to accommodate the seasonal nature of some of our products;

•our beliefs and intentions regarding our sustainability program;

•the anticipated benefits of diversifying our sources of sustainable food products and reduced exposure to Russia;

•our intent to rely on some of the available foreign private issuer exemptions to the NYSE corporate governance rules; and

•the accuracy of our estimates and key judgments regarding certain tax matters and accounting valuations.

The forward-looking statements contained in this prospectus and the documents incorporated or deemed to be incorporated by reference herein are based on assumptions that we have made in light of our management’s experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. As you read and consider this prospectus, you should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in these forward-looking statements. These factors include but are not limited to:

•the long-term impact of the COVID-19 pandemic on our business, suppliers, co-manufacturers, distributors, transportation or logistics providers, customers, consumers and employees;

•disruptions or inefficiencies in our operations or supply chain, including as a result of the COVID-19 pandemic, and our ability to maintain the health and safety of our workforce;

•the duration, spread and intensity of the COVID-19 pandemic and related government restrictions and other government responses;

•our ability to successfully implement our strategies and strategic initiatives and recognize the anticipated benefits of such strategic initiatives;

•the anticipated benefits from our recent acquisitions including the Fortenova Group's Frozen Food Business Group (the "Fortenova Acquisition") and Findus Switzerland business may take longer to realize and may cost more to achieve than expected, particularly since the Fortenova Acquisition represents entry into a new product category and new geographies;

•uncertainty about the potential adverse impact of Brexit on currency exchange rates, global economic conditions and cross-border agreements that affect our business;

•the loss of any of our executive officers or members of our senior management team or other key employees;

•the loss of any of our major customers or a decrease in demand for our products;

•changes in consumer preferences and our failure to anticipate and respond to such changes or to successfully develop and renovate products;

•our ability to successfully interpret and respond to key industry trends and to realize the expected benefits of our responsive actions;

•our ability to protect our brand names and trademarks;

•the commercial success of our Green Cuisine brand of products, including as a result of its expansion into continental Europe, and other innovations introduced to the markets, and other innovations introduced to the markets and our ability to accurately forecast the brand’s performance;

•our ability to effectively compete in our markets, including the ability of our Green Cuisine brand to effectively penetrate the markets in continental Europe;

•our ability to commercialize sustainability and accelerate our presence in discounter stores;

•economic conditions that may affect our future performance including increases in inflation and exchange rate fluctuations;

•fluctuations in the availability of food ingredients and packaging materials that we use in our products;

•our ability to effectively mitigate factors that negatively impact our supply of raw materials;

•disruptions in our information technology systems, whether as a result of cyber attack or otherwise, supply network, manufacturing and distribution facilities or our workforce or the workforce of our suppliers;

•our ability to continue to comply with covenants and the terms of our credit instruments and our ability to obtain additional financing, as needed, to fund our liquidity requirements and capital expenditures;

•availability of debt and equity financing under favorable terms;

•increases in operating costs, including labor costs, and our ability to manage our cost structure;

•the occurrence of liabilities not covered by our insurance;

•our ability to successfully implement, and engage other stakeholders in implementing, our sustainability program;

•our ability to successfully diversify;

•the loss of our financial arrangements with respect to receivables factoring;

•the loss of our foreign private issuer status;

•the effects of reputational damage from unsafe or poor-quality food products, particularly if such issues involve products we manufactured or distributed;

•our failure to comply with, and liabilities related to, environmental, health and safety laws and regulations; and

•changes in applicable laws or regulations.

You should not place undue reliance on our forward-looking statements because the matters they describe are subject to certain risks, uncertainties and assumptions that are difficult to predict. Our forward-looking statements are based on the information currently available to us and speak only as of the date on the cover of this prospectus, the date of any prospectus supplement, or, in the case of forward-looking statements incorporated by reference, the date of the filing that includes the statement. Over time, our actual results, performance or achievements may differ from those expressed or implied by our forward-looking statements, and such difference might be significant and materially adverse to our security holders. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law.

We have identified some of the important factors that could cause future events to differ from our current expectations and they are described in this prospectus and supplements to this prospectus under the caption “Risk Factors,” as well as in our most recent Annual Report on Form 20-F, and in other documents that we may file with the SEC, all of which you should review carefully. Please consider our forward-looking statements in light of those risks as you read this prospectus and any prospectus supplement.

USE OF PROCEEDS

Unless stated otherwise in a prospectus supplement, we expect to use the net proceeds we receive from the sale of securities described in this prospectus will be used for general corporate purposes.

When a particular series of securities is offered, the related prospectus supplement will set forth our intended use for the net proceeds received from the sale of those securities. Pending application for specific purposes, the net proceeds may be invested in marketable securities.

DESCRIPTION OF SHARE CAPITAL

General

We are a company organized under the laws of the British Virgin Islands with limited liability. We are registered at the Registry of Corporate Affairs of the British Virgin Islands under number 1818482, and our affairs are governed by the provisions of our Memorandum and Articles and by the provisions of applicable British Virgin Islands law.

Our Memorandum and Articles authorize the issuance of an unlimited number of shares, no par value, which may be ordinary shares or founder preferred shares. As of February 20, 2023, 174,240,609 ordinary shares and no founder preferred shares were issued and outstanding.

Under our Memorandum and Articles, subject to the BVI Business Companies Act, 2004 (as amended) (the “BVI Act”) and any other applicable legislation, our purpose is to carry on or undertake any business or activity, do any act or enter into any transaction and have full rights, powers and privileges for these purposes. For the purposes of Section 9(4) of the BVI Act, there are no limitations on the business that we may conduct.

The following is a summary of the material provisions of our ordinary and founder preferred shares and our Memorandum and Articles. The following description is intended as a summary only and is qualified in its entirety by reference to the complete text of our Memorandum and Articles which is attached as an exhibit to our Annual Report on Form 20-F for the fiscal year ended December 31, 2022. We urge you to read the full text of that exhibit.

Ordinary Shares

The following summarizes the rights of holders of our ordinary shares:

•each holder of our ordinary shares is entitled to one vote per ordinary share on all matters to be voted on by shareholders generally;

•the holders of our ordinary shares are entitled to share ratably in dividends and other distributions as may be declared from time to time by our board of directors out of funds legally available for that purpose, if any; and

•subject to the BVI Act, upon our liquidation, dissolution or winding up, the holders of our ordinary shares, will be entitled to the distribution of the remaining assets pro rata to the number of fully paid up shares held by each holder relative to the total number of issued and fully paid up ordinary shares immediately prior to the winding up.

Founder Preferred Shares

In connection with our initial public offering of securities in April 2014, we issued an aggregate of 1,500,000 founder preferred shares to our founder entities. Effective January 3, 2023 in accordance with its terms, each founder preferred share automatically converted into one ordinary share. No founder preferred shares are currently outstanding and no additional founder preferred shares are expected to be issued.

Founder preferred shares conferred upon the holder the following: (i) the right to one vote per founder preferred share on all matters to be voted on by shareholders generally and vote together with the holders of ordinary shares; (ii) commencing on January 1, 2015 and for each financial year thereafter (a) once the average price per ordinary share for the “dividend determination period” (i.e. the last ten consecutive trading days of a year) was at least $11.50 (which condition was satisfied for the year ended December 31, 2015), the right to receive an “annual dividend amount” (as defined in our Memorandum and Articles), payable in ordinary shares or cash, at the Company’s sole option; and (b) the right to receive dividends and other distributions as may be declared from time to time by the Company’s board of directors with respect to the ordinary shares (such dividends to be distributed among the holders of founder preferred shares, as if for such purpose the founder preferred shares had been converted into ordinary shares immediately prior to such distribution) plus an amount equal to 20% of the dividend which would be distributable on such number of ordinary shares equal to the “preferred share dividend equivalent” (as defined in our Memorandum and Articles); (iii) in addition to amounts payable pursuant to clause (ii) above, the right, together with the holders of ordinary shares, to receive such portion of all amounts available for distribution and from time to time distributed by way of dividend or otherwise at such time as determined by the directors; (iv) the right to an equal share (with the holders of ordinary shares on a share for share basis) in the distribution of the surplus assets of Nomad on its liquidation as are attributable to the founder preferred shares; and (v) the ability to convert into ordinary shares on a 1-for-1 basis (mandatorily upon a change of control or the seventh full financial year after an acquisition).

Additional Preferred Shares

We are registering preferred shares which, subject to shareholder approval, we may offer and sell from time to time pursuant to a prospectus supplement. If authorized, such issuances of preferred shares could adversely affect the voting power of holders of ordinary shares and reduce the likelihood that holders of ordinary shares will receive dividend payments and payments upon liquidation. The issuance of preferred shares also could have the effect of delaying, deterring or preventing a change in control of our company.

Indemnification Matters

British Virgin Islands law does not limit the extent to which a company’s articles of association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the British Virgin Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud or the consequences of committing a crime. Our Memorandum and Articles provide that we may indemnify any person who is or was a director or who is or was, at our request, serving as a director of, or in any other capacity is or was acting for, another entity, against all expenses, including legal fees, and against all judgments, fines and amounts paid in settlement and reasonably incurred in connection with legal, administrative or investigative proceedings. A person may be indemnified only if he or she acted honestly and in good faith with a view to our best interests and, in the case of criminal proceedings, had no reasonable cause to believe that his or her conduct was unlawful. The decision of our board of directors as to whether the director or officer acted honestly and in good faith with a view to our best interests and as to whether the director or officer had no reasonable cause to believe that his or her conduct was unlawful, is in the absence of fraud sufficient for the purpose of indemnification, unless a question of law is involved. The termination of any proceedings by any judgment, order, settlement, conviction or the entry of no plea does not, by itself, create a presumption that a director or officer did not act honestly and in good faith and with a view to our best interests or that the director or officer had reasonable cause to believe that his or her conduct was unlawful.

In addition, we have entered into indemnification agreements with our directors pursuant to which we agreed to indemnify them against a number of liabilities and expenses incurred by such persons in connection with claims made by reason of their being a director.

We have purchased and maintain insurance in relation to any of our directors or officers against any liability asserted against the directors or officers and incurred by the directors or officers in that capacity.

Shareholders’ Meetings and Consents

The following summarizes certain relevant provisions of British Virgin Islands laws and our Memorandum and Articles in relation to our shareholders’ meetings:

•we are required to hold an annual general meeting in each calendar year provided that not more than 15 months shall elapse between the date of one annual meeting and the date of the next, unless such period is extended, or such requirement is waived, by a resolution of the shareholders;

•the board of directors may convene meetings of shareholders at such times and in such manner and places within or outside the British Virgin Islands as the board considers necessary or desirable;

•upon the written request of shareholders entitled to exercise 30% or more of the voting rights in respect of a matter for which a meeting is requested, the directors are required to convene a meeting of shareholders;

•when convening a meeting, the board of directors must give not less than ten days’ notice of a meeting of shareholders to: (i) those shareholders who are entitled to vote at the meeting; and (ii) the other directors;

•a meeting of shareholders held in contravention of the requirement to give notice is valid if shareholders holding at least 90% of the total voting rights on all the matters to be considered at the meeting have waived notice of the meeting, and for this purpose the presence of a shareholder at the meeting shall constitute waiver in relation to all the shares that such shareholder holds;

•a shareholder may be represented at a meeting of shareholders by a proxy who may speak and vote on behalf of the shareholder;

•a meeting of shareholders is duly constituted if, at the commencement of the meeting, there are present in person or by proxy one shareholder entitled to vote on resolutions of shareholders to be considered at the meeting (a “quorum”);

•a resolution of shareholders is valid only if approved at a duly convened and constituted meeting of shareholders by the affirmative vote of a majority of the votes of the shares entitled to vote thereon that were present at the meeting and were voted or consented to in writing by a majority of the votes of shares entitled to vote thereon.

Board of Directors

The management of our Company is vested in a board of directors. Our Memorandum and Articles provide that our board of directors must be composed of at least one member. Subject to the BVI Act and our Memorandum and Articles, our directors may be appointed by resolution of shareholders or by the board of directors, without the approval of shareholders, for such term as the shareholders or directors, as applicable, determine. In the case of a vacancy in the office of a director because of death, retirement, resignation, dismissal, removal or otherwise, the remaining directors may appoint a successor and fill such vacancy. Directors are not required to be shareholders.

Our board of directors consists of ten members. Two members of the board present or represented at a board meeting constitutes a quorum, except where otherwise decided by the directors or where there is a sole director, in which case the quorum shall be one. Actions at a meeting are adopted by a majority vote. Our board of directors may also take action by means of a written consent signed by a majority of directors.

Our board of directors is vested with the power to borrow or raise money and secure any debt or binding obligations on the Company. The board may delegate the daily management of our business, as well as the power to represent us in our day-to-day business, to individual directors, agents or committees (with the power to sub-delegate) as it deems fit. The board may determine the conditions of appointment and dismissal as well as the remuneration and powers of any persons or committees so appointed. The board may also determine the purpose, powers and authorities as well as the procedures and such other rules as may be applicable to committees it creates.

Disclosure Requirements

Our Memorandum and Articles provide that we may, by notice in writing, require any person to whom we know or have reasonable cause to believe to have been interested in our shares at any time during the three years preceding such notice, to confirm whether or not that is the case and to give such further information as may be required by our Memorandum and Articles. If a shareholder is in default of supplying us with the information required within the prescribed period, our directors, in their absolute discretion, may serve a direction notice on the shareholder which may direct that, in respect of the shares in which default has occurred, the shareholder shall not be entitled to attend or vote in meetings of shareholders. Additionally, if the shares in which the default has occurred represent at least 0.25% of the number of the class concerned, the direction notice may direct that dividends on such shares be retained by the Company and that no transfer of the shares shall be registered until the default is rectified.

Comparison of Shareholder Rights

We were incorporated under, and are governed by, the laws of the British Virgin Islands. The following discussion summarizes material differences between the rights of holders of ordinary shares and the rights of holders of common stock of a typical corporation incorporated under the laws of the State of Delaware.

Director’s Fiduciary Duties

Under Delaware corporate law, a director of a solvent Delaware corporation owes fiduciary duties to the corporation and its shareholders. These duties have two components: the duty of care and the duty of loyalty. The duty of care requires that a director inform himself or herself of all material information regarding a decision. The duty of loyalty requires that a director act in a manner he or she reasonably believes to be in the best interests of the corporation and its shareholders. A director must not use his corporate position for personal gain or advantage. The duty of loyalty prohibits self-dealing by a director and mandates that the best interest of the corporation and its shareholders take precedence over any interest possessed by a director, officer or controlling shareholder that is not shared by the shareholders generally. In general, the “business judgment rule” presumes that actions of the board of directors are made on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the corporation and its shareholders. This presumption may be rebutted by evidence of a breach of the directors’ fiduciary duties. If this presumption is rebutted, the board of directors bear the burden of proving that the actions were “entirely fair” to the corporation or its minority shareholders. In addition, Delaware common law imposes “heightened” judicial scrutiny on actions of directors in certain circumstances, such as upon a sale of the corporation.

British Virgin Islands law provides that every director of a British Virgin Islands company in exercising his powers or performing his duties, shall act honestly and in good faith and in what the director believes to be in the best interests of the company. Additionally, the director shall exercise the care, diligence, and skill that a reasonable director would exercise in the same circumstances taking into account the nature of the company, the nature of the decision and the position of the director and his responsibilities. In addition, British Virgin Islands law provides that a director shall exercise his powers as a director for a proper purpose and shall not act, or agree to the company acting, in a manner that contravenes British Virgin Islands law or the memorandum and articles of association of the company.

Amendment of Governing Documents

Under Delaware corporate law, with very limited exceptions, a vote of the shareholders of a corporation is required to amend the certificate of incorporation. In addition, Delaware corporate law provides that shareholders have the right to amend the corporation’s bylaws, but the certificate of incorporation may confer such right on the directors of the corporation.

Consent in Lieu of Meeting

Under Delaware corporate law, a consent in lieu of a meeting of the directors must be unanimous to take effect. Under British Virgin Islands law and our Memorandum and Articles, only a majority of the directors are required to sign a written consent.

Under Delaware corporate law, unless otherwise provided in the certificate of incorporation, any action to be taken at any annual or special meeting of shareholders of a corporation may be taken without a meeting by consent of the holders of outstanding stock having not less than the minimum number of votes that would be necessary to take that action at a meeting at which all shareholders entitled to vote were present and voted. If any shareholder action is taken by less than unanimous consent, notice of such action must be given to those shareholders who have not consented and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if the record date for notice of such meeting had been the date that consents signed by a sufficient number of shareholders were delivered to the corporation.

Our Memorandum and Articles provides that any shareholder action permitted to be taken at a shareholder meeting may also be taken by written consent of a majority of the votes of shares entitled to vote thereon. If any shareholder resolution is adopted otherwise than by the unanimous written consent of all shareholders, a copy of such resolution shall be sent to all shareholders not consenting to such resolution.

Shareholder Proposals

Under Delaware corporate law, a shareholder has the right to put any proposal before the annual meeting of shareholders, provided it complies with any notice provisions in the certificate of incorporation or bylaws of the corporation. A special meeting may be called by the board of directors or any other person authorized to do so in the governing documents, but shareholders may be precluded from calling special meetings. British Virgin Islands law and our Memorandum and Articles provide that our directors shall call a meeting of the shareholders if requested in writing to do so by shareholders entitled to exercise at least 30% of the voting rights in respect of the matter for which the meeting is requested.

Sale of Assets

Under Delaware corporate law, a vote of the shareholders is required to approve a sale, lease or exchange of assets of a corporation (including property or assets of its subsidiaries) only when all or substantially all assets are being sold to a person other than a subsidiary of the Company. Under British Virgin Islands law generally, shareholder approval is required when more than 50% of a company’s total assets by value are being disposed of or sold to any person if not made in the usual or regular course of the business carried out by the company. Under our Memorandum and Articles this requirement of British Virgin Islands law has been disapplied and accordingly no shareholder approval is required in relation to such a disposal or sale.

Redemption of Shares

Under Delaware corporate law, by provision of the certificate of incorporation, any class or series of stock may be made subject to redemption by the corporation at its option, at the option of the holders of that stock or upon the happening of a specified event, provided that after such redemption shares of a class or series of stock with full voting power remain outstanding. The class or series of stock may, by provision of the certificate of incorporation,

be made redeemable for cash, property or rights, as specified in the certificate of incorporation or in the resolution of the board of directors providing for the issue of the stock pursuant to the power expressly vested in the board of directors by the certificate of incorporation. Under Delaware corporate law, shares also may be repurchased with the consent of both the corporation and the holder, except that shares may not be repurchased for more than the price at which such shares may then be redeemed at the option of the corporation. Both the redemption and repurchase of shares of a Delaware corporation are subject to certain solvency limitations established by Delaware corporate law and Delaware common law. As permitted by British Virgin Islands law and our Memorandum and Articles, shares may be repurchased, redeemed or otherwise acquired by us. However, the consent of the shareholder whose shares are to be repurchased, redeemed or otherwise acquired must be obtained, except as specified in the terms of the applicable class or series of shares.

Squeeze-Out Merger

Under the Delaware General Corporation Law § 253, in a process known as a “short form” merger, a corporation that owns at least 90% of the outstanding shares of each class of voting stock of another corporation and where at least one of the corporations is a Delaware corporation and the laws of the jurisdiction of the other corporation don’t prohibit such action, may either merge the other corporation into itself or merge itself into the other corporation by executing, acknowledging and filing with the Delaware Secretary of State a certificate of ownership and merger setting forth a copy of the resolution of its board of directors authorizing such merger. If the parent corporation is a Delaware corporation that is not the surviving corporation, the merger also must be approved by a majority of the outstanding stock of the parent corporation entitled to vote thereon and the resolution must include provision for the pro rata issuance of stock of the surviving corporation to the holders of the stock of the parent corporation on surrender of any certificate therefor. If the parent corporation does not own all of the stock of the subsidiary corporation immediately prior to the merger, the minority shareholders of the subsidiary corporation party to the merger have appraisal rights as set forth in § 262 of the Delaware General Corporation Law.

Under the BVI Act, subject to any limitations in a company’s memorandum and articles of association, members holding 90% of the votes of the outstanding shares entitled to vote, and members holding 90% of the votes of the outstanding shares of each class of shares entitled to vote, may give a written instruction to the company directing the company to redeem the shares held by the remaining members. In our Memorandum and Articles, we have opted out of the BVI Act’s squeeze out provisions.

Variation of Rights of Shares

Under Delaware corporate law, a corporation may vary the rights of a class of shares with the approval of a majority of the outstanding shares entitled to vote thereon, and if such variation would change the rights of such class so as to affect them adversely, with the approval of a majority of the outstanding shares of such class, voting separately as a single class. As permitted by British Virgin Islands law and our Memorandum and Articles, we may vary the rights attached to any class with the written consent of at least 50% of the holders of each class of shares affected or by a resolution passed by at least 50% of the votes cast by eligible holders of the issued shares of the affected class at a separate meeting of the holders of that class.

Election of Directors

Under Delaware corporate law, unless otherwise specified in the certificate of incorporation or bylaws of a corporation, directors are elected by a plurality of the votes of the shares entitled to vote on the election of directors and vacancies and newly created directorships resulting from an increase in the number of directors may be filled by a majority of the directors then in office (although less than a quorum) or by a sole remaining director. Subject to the BVI Act and pursuant to our Memorandum and Articles, directors shall be appointed at any time, and from time to time, by our directors, without the approval of shareholders, either to fill a vacancy or as an alternate or additional director. The shareholders may, by a majority vote, appoint any person as a director.

Removal of Directors

Under Delaware corporate law generally, a director of a corporation without a classified board may be removed, with or without cause, by the holders of a majority (or such larger portion set forth in the certificate of incorporation) of the outstanding shares entitled to vote at an election of directors. Under Delaware corporate law, generally a director of a corporation with a classified board may be removed only for cause with the approval of a majority (or such larger portion set forth in the certificate of incorporation) of the outstanding shares entitled to vote at an election of directors, unless the certificate of incorporation provides otherwise. Under Delaware corporate law, generally a director may resign at any time upon notice given in writing or by electronic transmission to the corporation.

Our Memorandum and Articles provide that a director may be removed at any time if he or she: (i) resigns by written notice to the Company; (ii) is requested to resign by written notice of all of the other directors; (iii) ceases to be a director by virtue of any provision of law or becomes prohibited by law from or is disqualified from being a director; (iv) becomes bankrupt or makes any arrangement or composition with his creditors generally or otherwise has any judgment executed on any of his assets; (v) becomes of unsound mind or incapable; (vi) is absent from meetings of directors for a consecutive period of 12 months and the other directors resolve that his office shall be vacated; (vii) dies; or (viii) a resolution of shareholders is approved by a majority of the shares entitled to vote on such matter passed at a meeting of shareholders called for the purposes of removing the director or for purposes including the removal of the director or a written special resolution of shareholders is passed by at least 75% of the votes of shares entitled to vote thereon.

Mergers

Under Delaware corporate law, one or more constituent corporations may merge into and become part of another constituent corporation in a process known as a merger. A Delaware corporation may merge with a foreign corporation as long as the law of the foreign jurisdiction permits such a merger. To effect a merger under Delaware General Corporation Law § 251, an agreement of merger must be properly adopted and the agreement of merger or a certificate of merger must be filed with the Delaware Secretary of State. In order to be properly adopted, the agreement of merger must be adopted by the board of directors of each constituent Delaware corporation by a resolution or unanimous consent in lieu of a meeting. In addition, the agreement of merger generally must be approved at a meeting of shareholders of each constituent Delaware corporation by a majority of the outstanding stock of such corporation entitled to vote, unless the certificate of incorporation provides for a supermajority vote. In general, the surviving corporation is vested in all of the assets and liabilities of the disappearing corporation or corporations as a result of the merger.

Under the BVI Act, two or more companies may merge or consolidate in accordance with the statutory provisions. A merger means the merging of two or more constituent companies into one of the constituent companies, and a consolidation means the uniting of two or more constituent companies into a new company. In order to merge or consolidate, the directors of each constituent company must approve a written plan of merger or consolidation, which must be authorized by a resolution of shareholders. One or more companies may also merge or consolidate with one or more companies incorporated under the laws of jurisdictions outside the British Virgin Islands if the merger or consolidation is permitted by the laws of the jurisdictions in which the companies incorporated outside the British Virgin Islands are incorporated. In respect of such a merger or consolidation, a British Virgin Islands company is required to comply with the provisions of the BVI Act, and a company incorporated outside the British Virgin Islands is required to comply with the laws of its jurisdiction of incorporation.

Shareholders not otherwise entitled to vote on the merger or consolidation may still acquire the right to vote if the plan of merger or consolidation contains any provision that, if proposed as an amendment to the memorandum and articles of association, would entitle them to vote as a class or series on the proposed amendment. In any event, all shareholders must be given a copy of the plan of merger or consolidation irrespective of whether they are entitled to vote at the meeting or consent to the written resolution to approve the plan of merger or consolidation.

Inspection of Books and Records

Under Delaware corporate law, any shareholder of a corporation may, upon proper demand, and for any proper purpose, inspect or make copies of the corporation’s stock ledger, list of shareholders and other books and records. Members of the public, on payment of the requisite fee, can obtain a copy of a Delaware corporation’s certificate of incorporation. Under British Virgin Islands law, members of the general public, on payment of a nominal fee, can obtain copies of the public records of a company available at the office of the British Virgin Islands Registrar of Corporate Affairs, including the company’s certificate of incorporation, its memorandum and articles of association (with any amendments), records of license fees paid to date, any articles of dissolution, any articles of merger and a register of charges if the company has elected to file such a register.

A shareholder of a company is entitled, on giving written notice to the company, to inspect:

(a) the memorandum and articles of association;

(b) the register of members;

(c) the register of directors; and

(d) the minutes of meetings and resolutions of shareholders and of those classes of shares of which he or she is a shareholder.

In addition, a shareholder may make copies of or take extracts from the documents and records referred to in (a) through (d) above. However, subject to the memorandum and articles of association of the company, the directors may, if they are satisfied that it would be contrary to the company’s interests to allow a shareholder to inspect any document, or part of any document, specified in (b), (c) or (d) above, refuse to permit the shareholder to inspect the document or limit the inspection of the document, including limiting the making of copies or the taking of extracts from the records. Where a company fails or refuses to permit a shareholder to inspect a document or permits a shareholder to inspect a document subject to limitations, that shareholder may apply to the court for an order that he or she should be permitted to inspect the document or to inspect the document without limitation.

Where a British Virgin Islands company keeps a copy of the register of members or the register of directors at the office of its registered agent, it is required to notify the registered agent of any changes to the originals of such registers, in writing, within 15 days of any change; and to provide the registered agent with a written record of the physical address of the place or places at which the original register of members or the original register of directors is kept. Where the place at which the original register of members or the original register of directors is changed, the company is required to provide the registered agent with the physical address of the new location of the records within 14 days of the change of location.

A British Virgin Islands company is also required to keep at the office of its registered agent or at such other place or places, within or outside the British Virgin Islands, as the directors determine the minutes of meetings and resolutions of shareholders and of classes of shareholders, and the minutes of meetings and resolutions of directors and committees of directors. If such records are kept at a place other than at the office of the company’s registered agent, the company is required to provide the registered agent with a written record of the physical address of the place or places at which the records are kept and to notify the registered agent, within 14 days, of the physical address of any new location where such records may be kept. Our registered agent in the British Virgin Islands is: Intertrust Corporate Services (BVI) Limited, Ritter House, Wickhams Cay II, Road Town, Tortola, British Virgin Islands.

Conflict of Interest

Under Delaware corporate law, a contract or transaction between a corporation and a director or officer, or between a corporation and any other organization in which a director or officer has a financial interest or is a director or officer, is not void or voidable as long as (i) the material facts as to the director’s or officer’s relationship or interest are disclosed or known and either (A) a majority of the disinterested directors authorizes the contract or transaction in good faith or (B) the shareholders vote in good faith to approve the contract or transaction or (ii) the contract or transaction is fair to the corporation when it is authorized, approved or ratified by the board of directors, a committee thereof or the shareholders. Delaware corporate law permits the corporation to renounce, in its certificate of incorporation or by action of its board of directors, any interest or expectancy of the corporation in, or in being offered an opportunity to participate in, specified business opportunities or specified classes or categories of business opportunities that are presented to the corporation or one or more of its officers, directors or stockholders.

The BVI Act provides that a director shall, forthwith after becoming aware that he or she is interested in a transaction entered into or to be entered into by the company, disclose that interest to the board of directors of the company. The failure of a director to disclose that interest does not affect the validity of a transaction entered into by the director or the company, so long as the director’s interest was disclosed to the board prior to the company’s entry into the transaction or was not required to be disclosed because the transaction is between the company and the director himself or herself and is otherwise in the ordinary course of business and on usual terms and conditions. As permitted by British Virgin Islands law and our Memorandum and Articles, a director interested in a particular transaction may vote on it, attend meetings at which it is considered and sign documents on our behalf that relate to the transaction. In addition, if our directors have other fiduciary obligations, including to other companies on whose board of directors they presently sit and to other companies whose board of directors they may join in the future, to the extent that they identify business opportunities that may be suitable for us or other companies on whose board of directors they may sit, our directors are permitted to honor those pre-existing fiduciary obligations ahead of their obligations to us. Accordingly, they may refrain from presenting certain opportunities to us that come to their attention in the performance of their duties as directors of such other entities unless the other companies have declined to accept such opportunities or clearly lack the resources to take advantage of such opportunities.

Transactions with “Interested Shareholders”

Delaware corporate law contains a business combination statute applicable to Delaware public corporations whereby, unless the corporation has specifically elected not to be governed by that statute by appropriate action, it is

prohibited from engaging in certain business combinations with an “interested stockholder” for three years following the date that the person becomes an “interested stockholder.” An “interested stockholder” generally is a person or group that owns or owned 15% or more of the corporation’s outstanding voting stock within the past three years. This statute has the effect of limiting the ability of a potential acquirer to make a two-tiered bid for the corporation in which all shareholders would not be treated equally. The statute does not apply if, among other things, prior to the date on which the shareholder becomes an “interested stockholder,” the board of directors approves either the business combination or the transaction that resulted in the person becoming an “interested stockholder.”

British Virgin Islands law has no comparable provision. However, although British Virgin Islands law does not regulate transactions between a company and its significant shareholders, it does provide that these transactions must be entered into in the bona fide best interests of the company and not with the effect of constituting a fraud on the minority shareholders.

Independent Directors

There are no provisions under Delaware corporate law or under the BVI Act that require a majority of our directors to be independent.

Cumulative Voting

Under Delaware corporate law, cumulative voting for elections of directors is not permitted unless the corporation’s certificate of incorporation specifically provides for it. Cumulative voting potentially facilitates the representation of minority shareholders on a board of directors since it permits the minority shareholder to cast all the votes to which the shareholder is entitled on a single director, which increases the shareholder’s voting power with respect to electing such director. There are no prohibitions on cumulative voting under the laws of the British Virgin Islands, but our Memorandum and Articles do not provide for cumulative voting.

Shareholders’ Rights under British Virgin Islands Law Generally

The BVI Act provides for certain remedies that may be available to shareholders. Where a company incorporated under the BVI Act or any of its directors engages in, or proposes to engage in, conduct that contravenes the BVI Act or the company’s memorandum and articles of association, British Virgin Islands courts can issue a restraining or compliance order. However, shareholders cannot also bring derivative, personal and representative actions under certain circumstances. The traditional English basis for shareholders’ remedies has also been incorporated into the BVI Act: where a shareholder of a company considers that the affairs of the company have been, are being or are likely to be conducted in a manner likely to be oppressive, unfairly discriminating or unfairly prejudicial to them, they may apply to the court for an order based on such conduct. In addition, any shareholder of a company may apply to the courts for the appointment of a liquidator of the company and the court may appoint a liquidator of the company if it is of the opinion that it is just and equitable to do so.

The BVI Act also provides that any shareholder of a company is entitled to payment of the fair value of his shares upon dissenting from any of the following: (i) a merger, if the company is a constituent company, unless the company is the surviving company and the shareholder continues to hold the same or similar shares; (ii) a consolidation, if the company is a constituent company; (iii) any sale, transfer, lease, exchange or other disposition of more than 50% in value of the assets or business of the company if not made in the usual or regular course of the business carried on by the company but not including (a) a disposition pursuant to an order of the court having jurisdiction in the matter, (b) a disposition for money on terms requiring all or substantially all net proceeds to be distributed to the shareholders in accordance with their respective interest within one year after the date of disposition, or (c) a transfer pursuant to the power of the directors to transfer assets for the protection thereof; (iv) a redemption of 10% or fewer of the issued shares of the company required by the holders of 90% or more of the shares of the company pursuant to the terms of the BVI Act; and (v) an arrangement, if permitted by the court.

Generally, any other claims against a company by its shareholders must be based on the general laws of contract or tort applicable in the British Virgin Islands or their individual rights as shareholders as established by a company’s memorandum and articles of association.

Foreign Private Issuer Exemption

As a “foreign private issuer,” as defined by the SEC, we are permitted to follow certain corporate governance practices of our home country, the British Virgin Islands, instead of those otherwise required under the NYSE for domestic issuers. While we voluntarily follow most NYSE corporate governance rules, we intend to take advantage of the following limited exemptions:

•Unlike NYSE corporate governance rules, under British Virgin Islands law, there is no requirement that our board of directors consist of a majority of independent directors and our independent directors are not required to hold executive sessions. Currently, six out of our ten board members are independent based on NYSE independence standards. While our board’s non-management directors will meet regularly in executive session without management, our board does not intend to hold an executive session of only independent directors at least once a year as called for by the NYSE.

•The NYSE rules applicable to domestic issuers require disclosure within four business days of any determination to grant a waiver of the code of business conduct and ethics to directors and officers. Although we will require board approval of any such waiver, we may choose not to disclose the waiver in the manner set forth in the NYSE rules, as permitted by the foreign private issuer exemption.

•We are exempt from the rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and NYSE related to the furnishing and content of proxy statements. Therefore, we intend to hold annual shareholder meetings in accordance with the corporate governance practices of the British Virgin Islands and our Memorandum and Articles of Association. Similarly, with respect to matters on which shareholders will have a right to vote, we intend to comply with corporate governance practices of the British Virgin Islands and the voting requirements under the NYSE rules applicable to foreign private issuers.

DESCRIPTION OF PREFERRED SHARES

The particular terms of each issue or series of preferred shares will be described in the related prospectus supplement. This description will include, where applicable, a description of:

•the title and nominal value of the preferred shares;

•the number of preferred shares we are offering;

•the liquidation preference per preferred share, if any;

•the issue price per preferred share (or if applicable, the calculation formula of the issue price per preferred share);

•whether preferential subscription rights will be issued to existing shareholders;

•the dividend rate per preferred share, dividend period and payment dates and method of calculation for dividends;

•whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

•our right, if any, to defer payment of dividends and the maximum length of any such deferral period;

•the relative ranking and preferences of the preferred shares as to dividend rights (preferred dividend if any) and rights if we liquidate, dissolve or wind up;

•the procedures for any auction and remarketing, if any;

•the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

•any listing of the preferred shares on any securities exchange or market;

•whether the preferred shares will be convertible into our ordinary shares or preferred shares of another category, and, if applicable, conditions of an automatic conversion into ordinary shares, if any, the conversion period, the conversion price, or how such price will be calculated, and under what circumstances it may be adjusted;

•voting rights, if any, of the preferred shares;

•preemption rights, if any;

•other restrictions on transfer, sale or assignment, if any;

•a discussion of any material or special U.S. federal and British Virgin Islands income tax considerations applicable to the preferred shares;

•any limitations on issuances of any class or series of preferred shares ranking senior to or on a parity with the series of preferred shares being issued as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

•any rights attached to the preferred shares regarding the corporate governance of Nomad, which may include, for example representation rights to the board of directors; and

•any other specific terms, rights, preferences, privileges, qualifications or restrictions of the preferred shares.

Prior to issuing preferred shares, we must convene a shareholder meeting at which shareholders would approve the terms and conditions of the preferred shares that were determined by the board of directors, or delegate authority to the board of directors to approve such terms and conditions, and vote to modify the Memorandum and Articles to include the characteristics and particular rights of the preferred shares.

If and when we issue preferred shares under this prospectus and the applicable prospectus supplement, the shares will be fully paid and non-assessable and, to the extent permitted under British Virgin Islands law, will not have, or be subject to, any preemptive or similar rights.

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional information we include in any applicable prospectus supplement, summarizes certain general terms and provisions of the debt securities that we may offer under this prospectus. When we offer to sell a particular series of debt securities, we will describe the specific terms of the series in a supplement to this prospectus. The terms of any particular series and of any indenture under which such securities are issued may differ from the terms described below. We will indicate in the supplement to what extent the general terms and provisions described in this prospectus apply to a particular series of debt securities.

We may issue debt securities either separately, or together with, or upon the conversion or exercise of or in exchange for, other securities described in this prospectus. Debt securities may be our senior or subordinated obligations, and may be issued in one or more series.

The debt securities will be issued under an indenture. We have summarized select portions of the indenture below. However, because it is a summary, it does not describe every aspect of the indenture or the debt securities. This summary is subject to and qualified in its entirety by reference to all the provisions of the indenture, including some of the terms used in the indenture. The indenture is subject to the Trust Indenture Act of 1939.

The form of the indenture has been filed as an exhibit to the registration statement and you should read the indenture for provisions that may be important to you. We note that the terms of the indenture are subject to change at any time by us and may differ in whole or in part from the description below. Capitalized terms used in the summary and not defined herein have the meanings specified in the indenture.

General

The terms of each series of debt securities will be established by or pursuant to a resolution of our board of directors and set forth or determined in the manner provided in a resolution of our board of directors, in an officer’s certificate or by a supplemental indenture. The particular terms of each series of debt securities will be described in a prospectus supplement relating to such series (including any pricing supplement or term sheet).

We will set forth in a prospectus supplement (including any pricing supplement or term sheet) relating to any series of debt securities being offered, the aggregate principal amount and the following terms of the debt securities, if applicable:

•the title and ranking of the debt securities (including the terms of any subordination provisions);

•the price or prices (expressed as a percentage of the principal amount) at which we will sell the debt securities;

•any limit on the aggregate principal amount of the debt securities;

•the date or dates on which the principal of the securities of the series is payable;

•the rate or rates (which may be fixed or variable) per annum or the method used to determine the rate or rates (including any commodity, commodity index, stock exchange index or financial index) at which the debt securities will bear interest, the date or dates from which interest will accrue, the date or dates on which interest will commence and be payable and any regular record date for the interest payable on any interest payment date;

•the place or places where principal of, and interest, if any, on the debt securities will be payable (and the method of such payment), where the securities of such series may be surrendered for registration of transfer or exchange, and where notices and demands to us in respect of the debt securities may be delivered;

•the period or periods within which, the price or prices at which and the terms and conditions upon which we may redeem the debt securities;

•any obligation we have to redeem or purchase the debt securities pursuant to any sinking fund or analogous provisions or at the option of a holder of debt securities and the period or periods within which, the price or prices at which and in the terms and conditions upon which securities of the series shall be redeemed or purchased, in whole or in part, pursuant to such obligation;

•the dates on which and the price or prices at which we will repurchase debt securities at the option of the holders of debt securities and other detailed terms and provisions of these repurchase obligations;

•the denominations in which the debt securities will be issued, if other than denominations of €100,000 and any integral multiple thereof;

•whether the debt securities will be issued in the form of certificated debt securities or global debt securities;

•the portion of principal amount of the debt securities payable upon declaration of acceleration of the maturity date, if other than the principal amount;

•the currency of denomination of the debt securities, which may be Euros or any other currency, and if such currency of denomination is a composite currency, the agency or organization, if any, responsible for overseeing such composite currency;

•the designation of the currency, currencies or currency units in which payment of principal of, premium and interest on the debt securities will be made;

•if payments of principal of, premium or interest on the debt securities will be made in one or more currencies or currency units other than that or those in which the debt securities are denominated, the manner in which the exchange rate with respect to these payments will be determined;

•the manner in which the amounts of payment of principal of, premium, if any, or interest on the debt securities will be determined, if these amounts may be determined by reference to an index based on a currency or currencies or by reference to a commodity, commodity index, stock exchange index or financial index;

•any provisions relating to any security provided for the debt securities;

•any addition to, deletion of or change in the events of default described in this prospectus or in the indenture with respect to the debt securities and any change in the acceleration provisions described in this prospectus or in the indenture with respect to the debt securities;

•any addition to, deletion of or change in the covenants described in this prospectus or in the indenture with respect to the debt securities;

•any depositaries, interest rate calculation agents, exchange rate calculation agents or other agents with respect to the debt securities;

•the provisions, if any, relating to conversion or exchange of any debt securities of such series, including if applicable, the conversion or exchange price and period, provisions as to whether conversion or exchange will be mandatory, the events requiring an adjustment of the conversion or exchange price and provisions affecting conversion or exchange;

•any other terms of the debt securities, which may supplement, modify or delete any provision of the indenture as it applies to that series, including any terms that may be required under applicable law or regulations or advisable in connection with the marketing of the securities; and

•whether any of our direct or indirect subsidiaries will guarantee the debt securities of that series, including the terms of subordination, if any, of such guarantees.

We may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture. We will provide you with information on the federal income tax considerations and other special considerations applicable to any of these debt securities in the applicable prospectus supplement.

If we denominate the purchase price of any of the debt securities in a foreign currency or currencies or a foreign currency unit or units, or if the principal of and any premium and interest on any series of debt securities is payable in a foreign currency or currencies or a foreign currency unit or units, we will provide you with information on the restrictions, elections, general tax considerations, specific terms and other information with respect to that issue of debt securities and such foreign currency or currencies or foreign currency unit or units in the applicable prospectus supplement.

Transfer and Exchange

Each debt security will be represented by either one or more global securities registered in the name of The Depository Trust Company, Clearstream Banking, “société anonyme,” in Luxembourg and Euroclear Bank S.A./N.V., as operator of the Euroclear System in Belgium, each a Depositary, or a nominee of the Depositary (we will refer to any debt security represented by a global debt security as a “book-entry debt security”), or a certificate issued in definitive registered form (we will refer to any debt security represented by a certificated security as a “certificated debt security”) as set forth in the applicable prospectus supplement. Except as set forth under the heading “Global Debt Securities and Book-Entry System” below, book-entry debt securities will not be issuable in certificated form.

Certificated Debt Securities

You may transfer or exchange certificated debt securities at any office we maintain for this purpose in accordance with the terms of the indenture. No service charge will be made for any transfer or exchange of certificated debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with a transfer or exchange.

You may effect the transfer of certificated debt securities and the right to receive the principal of, premium and interest on certificated debt securities only by surrendering the certificate representing those certificated debt securities and either reissuance by us or the trustee of the certificate to the new holder or the issuance by us or the trustee of a new certificate to the new holder.

Global Debt Securities and Book-Entry System.

Each global debt security representing book-entry debt securities will be deposited with, or on behalf of, the Depositary, and registered in the name of the Depositary or a nominee of the Depositary.

Covenants

Under the terms of the indenture, we covenant, among other things that:

•we will promptly pay the principal of and interest on the offered debt securities in accordance with the terms of such debt securities and the applicable indenture;

•so long as any offered debt securities are outstanding, we will (i) file with the SEC within the time periods prescribed by its rules and regulations and (ii) furnish to the trustee all interim and annual financial information required to be furnished or filed with the SEC pursuant to Section 13 and 15(d) of the Exchange Act and with respect to the annual consolidated financial statements only, a report thereon by our independent auditors;

•we will deliver to the trustee after the end of each fiscal year a compliance certificate as to whether we know of any default under the indenture that occurred during the previous year; and

•all payments made by us on the debt securities will be made free and clear of and without withholding or deduction for, or on account of, any taxes unless the withholding or deduction of such taxes is then required by law (subject to certain exceptions).

Any series of debt securities may have covenants in addition to or differing from those included in the indenture which limit or restrict, among other things the ability of us or one or more of our subsidiaries (as defined in the indenture, the “Restricted Subsidiaries”) to:

•incur certain indebtedness;

•make certain payments, dividends, redemptions, repurchases or investments;

•incur certain liens;

•make distributions to us or other Restricted Subsidiaries;

•sell assets or sell capital stock of Restricted Subsidiaries;

•enter into transactions with affiliates;