Highlights: * Net income increases 40% to a record $28.5 million or

$1.01 per unit * Revenues increase 28% to a record $46.5 million *

Distributable cash flow increases 45% to a record $34.3 million

HOUSTON, May 3 /PRNewswire-FirstCall/ -- Natural Resource Partners

L.P. (NYSE:NRPNYSE:andNYSE:NYSE:NYSE:NSP) today reported a 40%

increase in net income to a record $28.5 million, or $1.01 per

unit, for the first quarter of 2006 compared to $20.4 million, or

$0.77 per unit, for the first quarter of 2005. Distributable cash

flow, a non-GAAP performance measure reconciled in the attached

tables, rose to $34.3 million, which is a 45% increase over the

first quarter 2005 distributable cash flow of $23.7 million.

"Strong pricing in all regions helped boost NRP to record earnings,

revenues and, most importantly, distributable cash flows for the

first quarter of 2006," said Nick Carter, President and Chief

Operating Officer. "These results reflect the efforts of all of our

lessees, who we believe are among the best coal miners in the

industry. They also are indicative not only of the continued

strength of the coal market but also the diversity of our growing

reserve base." First Quarter 2006 Total revenues increased 28% to a

record $46.5 million for the first quarter of 2006 compared to

$36.2 million reported for the same period last year. First quarter

2006 coal royalty revenues increased 20% to $39.1 million from

$32.5 million last year as the partnership experienced increased

coal royalty revenues per ton in all regions and increased

production in all regions except Central Appalachia where

production was comparable to the first quarter of 2005. Coal

royalty revenues increased due to a 9% improvement in the average

coal royalty revenue per ton to $2.79 in the first quarter 2006

from $2.55 for the same period last year. Production by our lessees

grew 10% to 14.0 million tons over the 12.8 million tons reported

for the same period last year. Production from two of the

properties NRP acquired in Appalachia in 2005 offset the decline of

production from other Appalachian properties as some of the lessees

are mining off NRP properties and will return at a later date.

Metallurgical coal, which sells for much higher prices than steam

coal, accounted for approximately 30% of the first quarter 2006

coal royalty revenues and 24% of production. Oil and gas revenues

increased 274% to $1.7 million from $0.5 million due to increases

in price and production, as well as lease bonus payments on several

new leases. Other revenues also increased 334% primarily due to a

$2.2 million gain on the sale of timber properties during the

quarter. The sale is the first, and largest, of three related

transactions involving timber and the associated surface acreage

located in Virginia that we acquired at the time we purchased the

coal and mineral rights. The remaining two transactions are

expected to close in the second quarter of 2006. The gain increased

net income for the quarter by $0.08 per unit. Total expenses

increased 10% to $14.9 million from $13.6 million for the first

quarter 2005. General and administrative expenses increased $0.8

million to $4.1 million. The increase includes approximately $0.7

million related to the adoption this quarter of Statement of

Financial Accounting Standards No. 123R "Share-Based Payments."

This adjustment had the impact of reducing net income for the

quarter by $0.02 per unit. Property, franchise and other taxes

increased $0.4 million mainly due to taxes on properties acquired

since last year, the majority of which are offset by reimbursements

from our lessees which are recorded in revenues. Interest expense

increased 47% over last year to $3.6 million due to additional

borrowings associated with acquisitions completed during the last

year. Acquisitions and Capital Structure During the first quarter,

Natural Resource Partners completed the second closing of the

Williamson Development acquisition of high sulfur reserves in the

Illinois Basin for $35 million. NRP borrowed an additional $50

million of senior notes at 5.05% that financed the acquisition and

repaid $15 million in borrowings under the credit facility. At

March 31, 2006, the partnership had a debt to total capitalization

ratio of 37% and a cash balance in excess of $67 million, which

equates to three full quarters of coverage of its current

distribution for both NRP and NSP. "Our strong balance sheet and

capital structure will allow us to continue to aggressively pursue

accretive acquisitions to fuel growth for our future while

continuing to increase our distributions," said Dwight Dunlap,

Chief Financial Officer. 2006 Guidance "Our results for this

quarter exceeded our expectations due to higher than expected

prices received by our lessees and an opportunistic sale of some of

our timber assets and surface acreage," said Dwight L. Dunlap.

"While the performance of our lessees in the first quarter bodes

well for the partnership's annual performance, we are reaffirming

our current guidance for net income of $2.85 to $3.15 per unit. We

will monitor our lessees' production and sales prices during the

second quarter and update our annual guidance if necessary when our

second quarter results are announced in early August." Market

Outlook Pricing in the coal industry remains very strong as coal

stockpile levels, while improved, remain low at the utilities and

several factors continue to constrain expansion of coal production

by the various mining companies. The expansion of coal-fired power

generation is being planned by several utilities and the

development of coal conversion technologies such as

coal-gasification and coal-to-liquids are expected to result in

significant growth in coal demand over the long-term. "We see coal

prices remaining strong for the foreseeable future," said Nick

Carter. Distributions On April 18, the partnership announced its

eleventh consecutive increase in its quarterly distribution to

$0.79 per unit or $3.16 on an annualized basis, a 15% increase over

the first quarter distribution last year. The distribution will be

paid on May 12, 2006 to unitholders of record on May 1, 2006.

Natural Resource Partners L.P. is headquartered in Houston, TX,

with its operations headquarters in Huntington, WV. NRP is a master

limited partnership that is principally engaged in the business of

owning and managing coal properties in the three major coal

producing regions of the United States: Appalachia, the Illinois

Basin and the Powder River Basin. For additional information,

please contact Kathy Hager at 713-751-7555 or . Further information

about NRP is available on the partnership's website at

http://www.nrplp.com/ . Disclosure of Non-GAAP Financial Measures

Distributable cash flow represents cash flow from operations less

actual principal payments and cash reserves set aside for scheduled

principal payments on the senior notes. Distributable cash flow is

a "non-GAAP financial measure" that is presented because management

believes it is a useful adjunct to net cash provided by operating

activities under GAAP. Distributable cash flow is a significant

liquidity metric that is an indicator of NRP's ability to generate

cash flows at a level that can sustain or support an increase in

quarterly cash distributions paid to its partners. Distributable

cash flow is also the quantitative standard used throughout the

investment community with respect to publicly traded partnerships.

Distributable cash flow is not a measure of financial performance

under GAAP and should not be considered as an alternative to cash

flows from operating, investing or financing activities. A

reconciliation of distributable cash flow to net cash provided by

operating activities is included in the tables attached to this

release. Distributable cash flow may not be calculated the same for

NRP as other companies. Forward Looking Statements This press

release may include "forward-looking statements" as defined by the

Securities and Exchange Commission. Such statements include the

2006 outlook. All statements, other than statements of historical

facts, included in this press release that address activities,

events or developments that the partnership expects, believes or

anticipates will or may occur in the future are forward-looking

statements. These statements are based on certain assumptions made

by the partnership based on its experience and perception of

historical trends, current conditions, expected future developments

and other factors it believes are appropriate in the circumstances.

Such statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the

partnership. These risks include, but are not limited to, decreases

in demand for coal; changes in operating conditions and costs;

production cuts by our lessees; commodity prices; unanticipated

geologic problems; changes in the legislative or regulatory

environment and other factors detailed in Natural Resource

Partners' Securities and Exchange Commission filings. Natural

Resource Partners L.P. has no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise. -Financial statements

follow- NATURAL RESOURCE PARTNERS L.P. OPERATING STATISTICS (In

thousands, except per ton data) For the three months ended March

31, 2006 2005 (Unaudited) Coal royalty revenues: Appalachia

Northern $ 3,307 $ 2,464 Central 25,842 22,178 Southern 5,484 5,011

Total Appalachia $34,633 $29,653 Illinois Basin 1,953 1,307

Northern Powder River Basin 2,524 1,570 Total $39,110 $32,530 Sales

volumes (tons): Appalachia Northern 1,732 1,308 Central 8,195 8,239

Southern 1,426 1,324 Total Appalachia 11,353 10,871 Illinois Basin

1,162 867 Northern Powder River Basin 1,500 1,032 Total 14,015

12,770 Average royalty revenue per ton: Appalachia Northern $ 1.91

$ 1.88 Central 3.15 2.69 Southern 3.85 3.79 Total Appalachia $ 3.05

$ 2.73 Illinois Basin 1.68 1.51 Northern Powder River Basin 1.68

1.52 Total $ 2.79 $ 2.55 NATURAL RESOURCE PARTNERS L.P.

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per unit

data) For the three months ended March 31, 2006 2005 (Unaudited)

Revenues: Coal royalties $39,110 $32,530 Oil and gas royalties

1,719 460 Property taxes 1,749 1,434 Minimums recognized as revenue

371 453 Override royalties 303 615 Other 3,276 755 Total revenues

46,528 36,247 Operating costs and expenses: Depletion and

amortization 7,853 7,879 General and administrative 4,115 3,312

Property, franchise and other taxes 2,245 1,830 Coal royalty and

override payments 691 553 Total operating costs and expenses 14,904

13,574 Income from operations 31,624 22,673 Other income (expense)

Interest expense (3,618) (2,457) Interest income 518 231 Net income

$28,524 $20,447 Net income attributable to: General partner (A) $

2,095 $ 830 Other holders of incentive distribution rights (A) $

821 $ 227 Limited partners $25,608 $19,390 Basic and diluted net

income per limited partner unit: Common $ 1.01 $ .77 Subordinated $

1.01 $ .77 Weighted average number of units outstanding: Common

16,825 13,987 Subordinated 8,515 11,354 (A) Other holders of the

incentive distribution rights (IDRs) include the WPP Group at 25%

and NRP Investment LP at (10%). The net income allocated to the

general partner includes the general partner's portion of the IDRs

(65%). NATURAL RESOURCE PARTNERS L.P. CONSOLIDATED STATEMENTS OF

CASH FLOWS (In thousands) For the three months ended March 31, 2006

2005 (Unaudited) Cash flows from operating activities: Net income

$28,524 $20,447 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation, depletion and

amortization 7,853 7,879 Non-cash interest charge 100 71 Gain from

sale of assets (2,176) --- Change in operating assets and

liabilities: Accounts receivable (4) (2,390) Other assets 268 250

Accounts payable 37 (285) Accrued interest 1,906 2,247 Deferred

revenue (632) (2,155) Accrued incentive plan expenses 371 5

Property, franchise and taxes payable 403 1 Net cash provided by

operating activities 36,650 26,070 Cash flows from investing

activities: Acquisition of land, plant and equipment, coal and

other mineral rights (35,000) (21,544) Proceeds from sale of assets

3,932 --- Net cash used in investing activities (31,068) (21,544)

Cash flows from financing activities: Proceeds from loans 50,000

18,000 Repayment of loans (15,000) --- Distributions to partners

(20,905) (17,526) Net cash provided by (used in) financing

activities 14,095 474 Net increase in cash and cash equivalents

19,677 5,000 Cash and cash equivalents at beginning of period

47,691 42,103 Cash and cash equivalents at end of period $67,368

$47,103 Supplemental cash flow information: Cash paid during the

period for interest $ 1,600 $ 137 NATURAL RESOURCE PARTNERS L.P.

CONSOLIDATED BALANCE SHEETS (In thousands) ASSETS March 31,

December 31, 2006 2005 (Unaudited) Current assets: Cash and cash

equivalents $ 67,368 $ 47,691 Accounts receivable 21,956 21,946

Accounts receivable - affiliate --- 6 Other 565 833 Total current

assets 89,889 70,476 Land 12,731 14,123 Plant and equipment, net

5,842 5,924 Coal and other mineral rights, net 617,487 590,459 Loan

financing costs, net 2,344 2,431 Other assets, net 1,420 1,583

Total assets $729,713 $684,996 LIABILITIES AND PARTNERS' CAPITAL

Current liabilities: Accounts payable $ 715 $ 677 Accounts payable

- affiliate 87 88 Current portion of long-term debt 9,350 9,350

Accrued incentive plan expenses - current portion 4,262 1,105

Property, franchise and other taxes payable 4,541 4,138 Accrued

interest 3,440 1,534 Total current liabilities 22,395 16,892

Deferred revenue 14,219 14,851 Accrued incentive plan expenses

2,609 5,395 Long-term debt 256,950 221,950 Partners' capital:

Common units (outstanding: 16,825,305) 297,062 292,990 Subordinated

units (outstanding: 8,515,228) 125,328 123,114 General partner's

interest 10,944 10,024 Holders of incentive distribution rights 995

582 Accumulated other comprehensive loss (789) (802) Total

partners' capital 433,540 425,908 Total liabilities and partners'

capital $729,713 $684,996 NATURAL RESOURCE PARTNERS L.P.

RECONCILIATION OF UNAUDITED GAAP FINANCIAL MEASURES TO NON-GAAP

FINANCIAL MEASURES (In thousands) For the three months ended March

31, 2006 2005 (Unaudited) Cash flow from operations $36,650 $26,070

Less reserves for future principal payments (2,350) (2,350)

Distributable cash flow $34,300 $23,720

http://www.newscom.com/cgi-bin/prnh/20060109/NRPLOGO

http://photoarchive.ap.org/ DATASOURCE: Natural Resource Partners

L.P. CONTACT: Kathy Hager of Natural Resource Partners L.P.,

+1-713-751-7555, or Web site: http://www.nrplp.com/

Copyright

Insperity (NYSE:NSP)

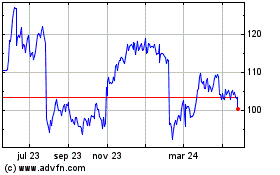

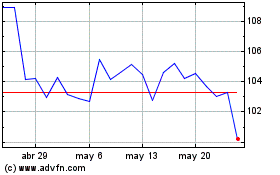

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024