Earnings Preview: Paychex Inc. - Analyst Blog

24 Septiembre 2012 - 4:00AM

Zacks

Paychex Inc.

(PAYX), specializing in payment processing services, is scheduled

to announce its first quarter fiscal 2013 results on September 24

after the closing bell, and we notice limited movement in estimates

at this point.

Fourth Quarter

Overview

Paychex delivered modest fourth

quarter 2012 results, with earnings of 34 cents per share, in line

with the Zacks Consensus Estimate. The 3.6% increase from the

year-ago quarter was on account of revenue improvement across all

its segments, partially offset by low new business generation.

Revenues grew 5.5% year over year,

backed by increases of 11.5% in Human Resource Service revenue and

3.5% in Payroll Service revenue.

Despite higher operating expenses,

operating margin increased 70 basis points year over year owing to

favorable mix.

Outlook

Paychex appeared to be a bit

cautious as far as its fiscal 2013 guidance is concerned. Keeping

in view the current market and economic condition, Paychex believes

that checks per client will moderate through fiscal 2013. But this

will be partially offset by modest client growth and improved

revenue per check. Also, Human Resources organic revenue growth

will follow the historical trend.

Agreement of

Analysts

Out of the 17 and 23 analysts

providing estimates for the first quarter and fiscal 2013,

respectively, we noticed absolutely no revision in the past 30

days. No estimate revisions were either noticed for fiscal 2014.

The limited movement since Paychex reported fourth quarter results

suggests that there is a lack of driving events.

But some analysts prefer to remain

cautious based on management’s commentary regarding the

sluggishness of new small-business formation. Moreover, a few

analysts think that aggressive pricing from Automated Data

Processing Inc. (ADP) is stealing customers away from

Paychex.

The time difference between when

the company receives payments from its clients and pays it out to

employees typically earns some interest for Paychex. Now, with the

government contemplating lower interest rates, this quick income

stream of the company will also be restricted.

However, some analysts are positive

about Paychex’s efforts to be technologically advanced by launching

mobile apps for Apple Inc.’s (AAPL) iPad and Android tablets, which

allows its users to use the apps whether they are using a personal

computer or laptop. In addition, Paychex launched smartphone

applications targeting both employers and employees who are always

on the move.

Magnitude of Estimate

Revisions

There was no change in the Zacks

Consensus Estimate for the first quarter and fiscal 2013 in the

past 30 days. But the estimates moved down by 2 cents each to 41

cents and $1.61 for the first quarter and fiscal 2013, respectively

in the past 90 days. The estimate for fiscal 2014 plunged 5 cents

to $1.71 in the past 90 days.

Recommendation

We are encouraged by management’s

commentary regarding continued investments in product development

and focus toward building sales force to support revenue

growth.

But lingering unemployment

situation, strict interest rates and stiff competition from

Automated Data Processing and Insperity (NSP),

keep us concerned. However, Paychex’ zero European exposure will be

beneficial for the company.

Paychex has a Zacks # 3 Rank,

implying a short-term Hold rating.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

INSPERITY INC (NSP): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

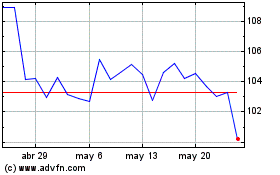

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

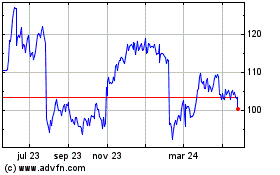

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024