UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO/A

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) or 13(e)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 2)

INSPERITY,

INC.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock, $0.01 par value

(Title of Class of Securities)

45778Q107

(CUSIP Number

of Class of Securities)

Daniel D. Herink

Senior Vice President, Legal, General Counsel and Secretary

Insperity, Inc.

19001

Crescent Springs Drive

Kingwood, Texas 77339-3802

(281) 358-8986

(Name,

address and telephone number of person authorized to

receive notices and communications on behalf of filing person)

Copy to:

Kelly

B. Rose

Baker Botts L.L.P.

910 Louisiana

Houston,

Texas 77002

(713) 229-1796

CALCULATION

OF FILING FEE

|

|

|

| Transaction Value(1) |

|

Amount of Filing Fee(2) |

| $143,163,480 |

|

$14,416.56 |

| |

| (1) |

The transaction value is estimated only for purposes of calculating the filing fee. This amount is based on the assumed purchase of 3,013,968 shares of common stock at the tender offer purchase price of $47.50 per

share. |

| (2) |

Previously paid. The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, equals $100.70 per $1,000,000 of the value of the transaction.

|

| þ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: $14,416.56 |

|

Filing Party: Insperity, Inc. |

| Form or Registration No.: Schedule TO-I |

|

Date Filed: December 8, 2015; January 8, 2016 |

| ¨ |

Check the box if filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

¨ |

third-party tender offer subject to Rule 14d-1. |

| |

þ |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going-private transaction subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: þ

If applicable, check the

appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third Party Tender Offer) |

2

This Amendment No. 2 (this “Amendment”) amends and supplements the Tender Offer

Statement on Schedule TO originally filed with the Securities and Exchange Commission (the “SEC”) by Insperity, Inc., a Delaware corporation (“Insperity” or the “Company”), on December 8, 2015, as amended and

supplemented by Amendment No. 1 to the Schedule TO filed with the SEC on January 8, 2016 (together, the “Schedule TO”), in connection with the Company’s offer to purchase, for not more than $125 million in cash, shares of its common

stock, par value $0.01 per share (the “Shares”), pursuant to (i) auction tenders at prices specified by the tendering stockholders of not less than $43.50 nor greater than $50.00 per Share or (ii) purchase price tenders, in

either case, upon the terms and subject to the conditions described in the Offer to Purchase, dated December 8, 2015 (the “Offer to Purchase”), a copy of which was filed as Exhibit (a)(1)(A) to the Schedule TO, and in the related

Letter of Transmittal (the “Letter of Transmittal,” and together with the Offer to Purchase, as they may be amended or supplemented from time to time, the “Tender Offer”), a copy of which was filed as Exhibit (a)(1)(B) to the

Schedule TO.

The purpose of this Amendment is to amend and supplement the Schedule TO. Only those items amended are reported in this

Amendment. Except as specifically provided herein, the information contained in the Schedule TO, the Offer to Purchase and the Letter of Transmittal remains unchanged. This Amendment should be read in conjunction with the Schedule TO, the Offer to

Purchase and the Letter of Transmittal.

Item 4. Terms of the Transaction.

Item 4 of the Schedule TO is hereby amended and supplemented by adding the following paragraph at the end thereof:

“The Tender Offer expired at 5:00 p.m., New York City time, on Thursday, January 7, 2016. Based on the final count by Computershare Trust

Company, N.A., the depositary for the Tender Offer, Insperity has accepted for purchase 3,013,531 Shares at a purchase price of $47.50 per Share, for an aggregate purchase price of approximately $143.1 million, excluding fees and expenses related to

the Tender Offer. Included within the Shares accepted for purchase are 381,952 Shares that Insperity elected to purchase pursuant to its right to increase the size of the Tender Offer by up to 2.0% of Insperity’s outstanding common stock. The

Shares purchased represent approximately 12.4% of the Shares issued and outstanding as of January 11, 2016.”

Item 11. Additional

Information.

Item 11 of the Schedule TO is hereby amended and supplemented by adding the following paragraph at the end thereof:

“On January 13, 2016, Insperity issued a press release announcing the final results of the Tender Offer, which expired at 5:00

p.m., New York City time, on January 7, 2016. A copy of the press release is filed as Exhibit (a)(5)(C) to this Schedule TO and is incorporated herein by reference.”

Item 12. Exhibits.

Item 12 of

the Schedule TO is hereby amended and supplemented by adding the following exhibit:

|

|

|

|

|

| (a)(5)(C) |

|

Press release announcing the final results of the Tender Offer, dated January 13, 2016 |

3

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

|

|

|

|

INSPERITY, INC. |

|

|

|

|

| Date: January 13, 2016 |

|

|

|

By: |

|

/s/ Daniel D. Herink |

|

|

|

|

|

|

Daniel D. Herink |

|

|

|

|

|

|

Senior Vice President of Legal, General Counsel and Secretary |

4

Exhibit (a)(5)(C)

Investor Relations Contact:

Douglas S. Sharp

Senior Vice

President of Finance,

Chief Financial Officer and Treasurer

281-348-3232

Insperity

Announces Final Results of Modified Dutch Auction Tender Offer

HOUSTON – Jan. 13, 2016 – Insperity, Inc. (“Insperity”) (NYSE:

NSP), a leading provider of human resources and business performance solutions for America’s best businesses, today announced the final results of its “modified Dutch auction” tender offer, which expired at 5:00 p.m., New York City

time, on Jan. 7, 2016.

Based on the final count by Computershare Trust Company, N.A., the depositary for the tender offer, Insperity has accepted for

purchase 3,013,531 shares of its common stock at a purchase price of $47.50 per share, for an aggregate purchase price of approximately $143.1 million, excluding fees and expenses related to the tender offer. Included within the shares

accepted for purchase are 381,952 shares that Insperity elected to purchase pursuant to its right to increase the size of the tender offer by up to 2.0% of Insperity’s outstanding common stock. The shares purchased represent approximately 12.4%

of Insperity’s common stock issued and outstanding as of Jan. 11, 2016.

As noted in the Offer to Purchase related to the tender offer, Insperity may

purchase additional shares of its common stock in the future in the open market subject to market conditions. Insperity may also purchase shares of its common stock in private transactions, tender offers or otherwise. Under applicable securities

laws, however, Insperity may not purchase any such shares of its common stock until after Jan. 22, 2016. Any possible future purchases by Insperity will depend on many factors, including the market price of the shares, the final results of the

tender offer, Insperity’s business and financial position and general economic and market conditions.

Credit Suisse Securities (USA) LLC served as

dealer manager for the tender offer. Stockholders who have questions or would like additional information about the tender offer may contact the information agent for the tender offer, Innisfree M&A Incorporated, at (888) 750-5834

(toll-free) or (212) 750-5833 (collect).

About Insperity

Insperity, a trusted adviser to America’s best businesses for more than 29 years, provides an array of human resources and business solutions designed to

help improve business performance. Insperity® Business Performance Advisors offer the most comprehensive suite of products and services available in the marketplace. Insperity delivers

administrative relief, better benefits, reduced liabilities and a systematic way to improve productivity through its premier Workforce Optimization® solution. Additional company offerings

include Human Capital Management, Payroll Services, Time and Attendance, Performance Management, Organizational Planning, Recruiting Services, Employment Screening, Financial Services, Expense Management, Retirement Services and Insurance Services.

Insperity business performance solutions support more than 100,000 businesses with over 2 million employees. With 2014 revenues of $2.4 billion, Insperity operates in 60 offices throughout the United States.

Information on Forward Looking Statements

The statements

contained herein that are not historical facts are forward-looking statements within the meaning of the federal securities laws (Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). You can identify

such forward-looking statements by the words “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “likely,” “possibly,” “probably,”

“goal,” “opportunity,” “objective,” “target,” “assume,” “outlook,” “guidance,” “predicts,” “appears,” “indicator” and similar expressions.

Forward-looking statements involve a number of risks and uncertainties. In the normal course of business, Insperity, Inc., in an effort to help keep our stockholders and the public informed about our operations, may from time to time issue such

forward-looking statements, either orally or in writing. Generally, these statements relate to business plans or strategies, projected or anticipated benefits or other consequences of such plans or strategies, or projections involving anticipated

revenues, earnings, unit growth, profit per worksite employee, pricing, operating expenses or other aspects of operating results. We base the forward-looking statements on our expectations, estimates and projections at the time such statements are

made. These statements are not guarantees of future performance and involve risks and uncertainties that we cannot predict. In addition, we have based many of these forward-looking statements on assumptions about future events that may prove to be

inaccurate. Therefore, the actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ

materially are: (i) adverse economic conditions; (ii) regulatory and tax developments and possible adverse application of various federal, state and local regulations; (iii) the ability to secure competitive replacement contracts for

health insurance and workers’ compensation insurance at expiration of current contracts; (iv) cancellation of client contracts on short notice, or the inability to renew client contracts or attract new clients; (v) vulnerability to

regional economic factors because of our geographic market concentration; (vi) increases in health insurance costs and workers’ compensation rates and underlying claims trends, health care reform, financial solvency of workers’

compensation carriers, other insurers or financial institutions, state unemployment tax rates, liabilities for employee and client actions or payroll-related claims; (vii) failure to manage growth of our operations and the effectiveness of our

sales and marketing efforts; (viii) the impact of the competitive environment in the PEO industry on our growth and/or profitability; (ix) our liability for worksite employee payroll, payroll taxes and benefits costs; (x) our

liability for disclosure of sensitive or private information; (xi) our ability to integrate or realize expected returns on our acquisitions; (xii) failure of our information technology systems; (xiii) an adverse

final judgment or settlement of claims against Insperity; and (xiv) disruptions to our business resulting from the actions of certain stockholders. These factors are discussed in further

detail in Insperity’s filings with the U.S. Securities and Exchange Commission. Any of these factors, or a combination of such factors, could materially affect the results of our operations and whether forward-looking statements we make

ultimately prove to be accurate.

Except to the extent otherwise required by federal securities law, we do not undertake any obligation to update our

forward-looking statements to reflect events or circumstances after the date they are made or to reflect the occurrence of unanticipated events.

###

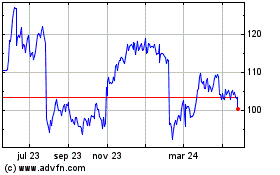

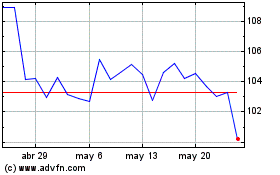

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024