The Build-to-Suit 200+ MW AI Data Center

Capacity Developed by Crusoe is Located at Lancium Clean Campus

Site Abilene, Texas

Crusoe Energy Systems LLC (“Crusoe”), a vertically-integrated AI

infrastructure company, Blue Owl Capital Inc. (“Blue Owl”), a

leading alternative asset manager, and Primary Digital

Infrastructure, an advisory and investor firm focused in the data

center industry, announced today a $3.4 billion joint-venture to

fund purpose-built data center capacity at the previously announced

Lancium Clean Campus in Abilene, Texas. Under the terms of the

fully funded forward takeout, funds managed by Blue Owl’s Real

Estate platform and Primary Digital Infrastructure will jointly

sponsor the 206 MW 998,000 square foot data center being designed,

built, and operated by Crusoe.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241015910376/en/

The Crusoe AI data center is a build-to-suit, two-building data

center constructed to industry leading efficiency and reliability

standards, and capable of supporting high energy density IT

applications. The project is 100% long-term leased to a Fortune 100

hyperscale tenant with occupancy expected to begin in 1H 2025.

Supported by Blue Owl’s investment and developed by Crusoe, the

project will incorporate an innovative DC design, sharpened to

support cutting edge AI workloads at an industry-leading scale. The

design will be optimized for direct-to-chip liquid cooling and will

also accommodate air cooling. At completion, the data center will

be able to operate up to 100,000 GPUs on a single integrated

network fabric, advancing the frontier of data center design and

scale for AI training and inference workloads.

“Rapidly expanding demand for purpose-built data centers proves

that markets know the future will be powered by AI,” said Chase

Lochmiller, CEO and co-founder of Crusoe. “We've designed this

data center to enable the largest clusters of GPUs in the world

that will drive new breakthroughs in AI. An investment of this

magnitude from a leading, trusted asset manager like Blue Owl and

Primary Digital Infrastructure is a reflection of Crusoe’s proven

ability to meet growing demand for AI compute, and to power these

workloads sustainably.”

“We are thrilled to be part of this joint venture as we see

continued growth in cloud computing and increased investor interest

in AI related technologies. We want to assist our corporate

partners by deploying meaningful capital in support of high quality

hyperscale data center assets across the US and abroad,” said

Marc Zahr, co-president and global head of real estate at Blue

Owl Capital.

“There is an unprecedented opportunity to deploy capital in the

data center market, which is expected to experience a one trillion

dollar investment boom over the next four to five years in the U.S.

alone. Our strategic vision is to ‘risk match’ this incremental

capital by purchasing the best stabilized assets from developers

and operators to allow them to recycle capital and finance their

cloud and AI facility developments,” said Bill Stein, executive

managing director and chief investment officer, Primary Digital

Infrastructure and current Crusoe advisor. “By partnering with

Blue Owl and Crusoe, Primary Digital Infrastructure is leveraging

its deep sector expertise to provide flexible capital solutions to

the largest AI data center opportunities in the US. In this

transaction, Primary Digital Infrastructure helped combine Blue

Owl’s extensive capital access and transactional expertise with

Crusoe’s ESG-forward track record as a developer and operator to

quickly and efficiently create one of the nation’s most advanced

data centers for energy dense AI workloads.”

The 200+ MW capacity will be delivered by Crusoe in 2025 on a

record-setting construction timeline. This speed is achieved

through Crusoe’s innovative design strategies and intimate

familiarity with the GPUs and other integral AI hardware that will

outfit the site.

The notional power plan for the site includes both on- and

off-site renewable resources, including surrounding wind

developments, and a potential future large-scale onsite solar

installation. The goal is to optimize existing renewable power

resources and incentivize new greenfield renewable power

development. The availability of low-carbon energy factored heavily

into site selection, as it is central to Crusoe’s climate-aligned

mission and energy-first approach to powering AI

infrastructure.

The project is expected to contribute nearly $1 billion to the

local economy over the next 20 years, as estimated by the

Development Corporation of Abilene, and will focus on local hiring,

creating almost a hundred local jobs. Combined with its limited

environmental impact due to the proposed use of renewable energy,

this project reflects Crusoe’s commitment to lead the industry in

sustainability and community stewardship.

Newmark served as advisor to the partnership.

About Crusoe Energy Systems LLC:

Crusoe is on a mission to align the future of computing with the

future of the climate. As builders and operators of clean computing

infrastructure, Crusoe reduces both the costs and the environmental

impact of the world’s expanding digital economy. By utilizing clean

sources of energy to power artificial intelligence, crypto, and

other high-performance computing applications, Crusoe is creating a

future of sustainable innovation.

To learn more, visit https://crusoe.ai/ and follow Crusoe on

Linkedin and X.

About Blue Owl Capital Inc:

Blue Owl (NYSE: OWL) is a leading asset manager that is

redefining alternatives.

With over $192 billion in assets under management as of June 30,

2024, we invest across three multi-strategy platforms: Credit, GP

Strategic Capital, and Real Estate. Anchored by a strong permanent

capital base, we provide businesses with private capital solutions

to drive long-term growth and offer institutional investors,

individual investors, and insurance companies differentiated

alternative investment opportunities that aim to deliver strong

performance, risk-adjusted returns, and capital preservation.

Together with over 820 experienced professionals, Blue Owl

brings the vision and discipline to create the exceptional. To

learn more, visit www.blueowl.com.

About Primary Digital Infrastructure

Primary Digital Infrastructure provides flexible, repeatable

financing solutions that allow data center operators to unlock

precious liquidity from existing assets and achieve their

development objectives. Primary Digital Infrastructure’s mission is

to ‘risk match’ this incremental capital by purchasing the best

stabilized assets from developers and operators to allow them to

recycle capital and finance their pipelines. Primary Digital

Infrastructure is dedicated to an operator-centric model that

allows the best data center developers and owners to recycle

capital with as little friction as possible. Established by

industry leaders Bill Stein, David Ferdman, Peter Hopper, and John

Sheputis, Primary Digital Infrastructure provides capital to

premier data center owners and operators through a range of

financial solutions including recapitalizations, outright

purchases, and forward takeouts. To learn more, visit

https://primaryinfra.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015910376/en/

Media Contacts: Crusoe: Sara Axelrod Senior Director,

Public Affairs saxelrod@crusoeenergy.com Blue Owl: Nick Theccanat

Principal, Corporate Communications & Government Affairs

Nick.Theccanat@blueowl.com Primary Digital Infrastructure: Carol

Hickins Public Relations press@primaryinfra.com

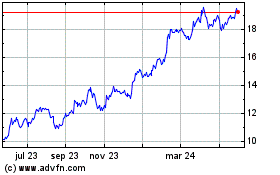

Blue Owl Capital (NYSE:OWL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

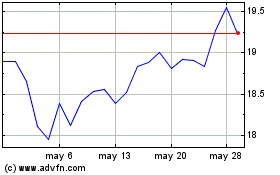

Blue Owl Capital (NYSE:OWL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024