Pebblebrook Hotel Trust Completes Sale of Hotel Zoe Fisherman’s Wharf

15 Noviembre 2023 - 6:00AM

Business Wire

Pebblebrook Hotel Trust (NYSE: PEB) (the “Company”) announced

today that on November 14, 2023, it closed on the sale of the

221-room Hotel Zoe Fisherman’s Wharf in San Francisco, California

for $68.5 million to a third party.

For the trailing twelve months ended September 30, 2023, the

hotel’s net loss was ($1.2) million, its net operating income was

$2.2 million, and its earnings before interest, taxes, depreciation

and amortization (“EBITDA”) was $2.7 million. The $68.5 million

sales price reflects a 25.0x EBITDA multiple and a 3.2% net

operating income capitalization rate (assuming a capital reserve of

4.0% of total hotel revenues).

Year to date, the Company has completed $300.8 million of

property dispositions comprised of six property sales. The $300.8

million aggregate sales proceeds reflect a combined 21.8x EBITDA

multiple and a 3.8% net operating income capitalization rate

(assuming a capital reserve of 4.0% of total hotel revenues) based

on the trailing twelve-month performance prior to the completion of

each respective sale, or the trailing twelve-month performance

ended September 30, 2023 in the case of Hotel Zoe.

Proceeds from the sale of Hotel Zoe Fisherman’s Wharf will be

used for general corporate purposes, including reducing the

Company’s outstanding debt and repurchasing the Company’s common

and preferred shares.

About Pebblebrook Hotel

Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real

estate investment trust (“REIT”) and the largest owner of urban and

resort lifestyle hotels in the United States. The Company owns 46

hotels, totaling approximately 12,000 guest rooms across 13 urban

and resort markets. For more information, visit

www.pebblebrookhotels.com and follow us at @PebblebrookPEB.

This press release contains certain “forward-looking statements”

made pursuant to the safe harbor provisions of the Private

Securities Reform Act of 1995. Forward-looking statements are

generally identifiable by the use of forward-looking terminology

such as “estimated” and “will” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions and can include future expectations, future plans and

strategies, financial and operating projections and forecasts and

other forward-looking information and estimates. The intended use

of proceeds is a forward-looking statement. These forward-looking

statements are subject to various risks and uncertainties, many of

which are beyond the Company’s control, which could cause actual

results to differ materially from such statements. These risks and

uncertainties include, but are not limited to, the state of the

U.S. economy, the operating performance of our hotels and the

supply of hotel properties, and other factors as are described in

greater detail in the Company’s filings with the Securities and

Exchange Commission, including, without limitation, the Company’s

Annual Report on Form 10-K for the year ended December 31, 2022.

Unless legally required, the Company disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

For further information about the Company’s business and

financial results, please refer to the “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of the Company’s SEC filings, including,

but not limited to, its Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q, copies of which may be obtained at the

Investor Relations section of the Company’s website at

www.pebblebrookhotels.com.

All information in this press release is as of November 15,

2023. The Company undertakes no duty to update the statements in

this press release to conform the statements to actual results or

changes in the Company’s expectations.

For additional information or to receive press

releases via email, please visit our website at

www.pebblebrookhotels.com

Pebblebrook Hotel Trust Hotel Zoe Fisherman's Wharf

Reconciliation of Hotel Net Income to Hotel EBITDA and Hotel Net

Operating Income September 2023 Trailing Twelve Months

(Unaudited, in millions) Twelve Months

EndedSeptember 30,

2023

Hotel net income (loss)

($1.2

)

Adjustment: Depreciation and amortization

3.9

Hotel EBITDA

$2.7

Adjustment: Capital reserve

(0.5

)

Hotel Net Operating Income

$2.2

This press release includes certain non-GAAP financial measures as

defined under Securities and Exchange Commission (SEC) rules. These

measures are not in accordance with, or an alternative to, measures

prepared in accordance with U.S. generally accepted accounting

principles, or GAAP, and may be different from non-GAAP measures

used by other companies. In addition, these non-GAAP measures are

not based on any comprehensive set of accounting rules or

principles. Non-GAAP measures have limitations in that they do not

reflect all of the amounts associated with the hotel’s results of

operations determined in accordance with GAAP.The Company has

presented estimated trailing twelve-month hotel EBITDA and

estimated trailing twelve-month hotel net operating income after

capital reserves because it believes these measures provide

investors and analysts with an understanding of the hotel-level

operating performance. These non-GAAP measures do not represent

amounts available for management’s discretionary use, because of

needed capital replacement or expansion, debt service obligations

or other commitments and uncertainties, nor are they indicative of

funds available to fund the Company’s cash needs, including its

ability to make distributions.The Company’s presentation of the

hotel’s estimated trailing twelve-month EBITDA and estimated

trailing twelve-month net operating income after capital reserves

should not be considered as an alternative to net income (computed

in accordance with GAAP) as an indicator of the hotel’s financial

performance. The table above is a reconciliation of the hotel’s

estimated trailing twelve-month EBITDA and net operating income

after capital reserves calculations to net income in accordance

with GAAP. Any differences are a result of rounding.

Pebblebrook

Hotel Trust Historical Operating Data ($ in millions,

except ADR and RevPAR) (Unaudited)

Historical Operating Data: First Quarter Second

Quarter Third Quarter Fourth Quarter Full

Year

2019

2019

2019

2019

2019

Occupancy

74%

86%

86%

77%

81%

ADR

$251

$275

$272

$250

$263

RevPAR

$186

$236

$234

$192

$212

Hotel Revenues

$295.8

$377.0

$374.0

$320.3

$1,367.1

Hotel EBITDA

$74.9

$133.4

$127.2

$85.5

$420.9

Hotel EBITDA Margin

25.3%

35.4%

34.0%

26.7%

30.8%

First Quarter Second Quarter Third

Quarter Fourth Quarter Full Year

2022

2022

2022

2022

2022

Occupancy

49%

69%

73%

61%

63%

ADR

$301

$324

$326

$297

$314

RevPAR

$146

$224

$238

$180

$197

Hotel Revenues

$230.3

$362.8

$383.9

$305.5

$1,282.6

Hotel EBITDA

$46.7

$124.6

$122.0

$63.3

$356.6

Hotel EBITDA Margin

20.3%

34.3%

31.8%

20.7%

27.8%

First Quarter Second Quarter Third

Quarter

2023

2023

2023

Occupancy

59%

73%

75%

ADR

$303

$312

$312

RevPAR

$177

$229

$235

Hotel Revenues

$291.6

$373.7

$384.4

Hotel EBITDA

$60.3

$111.2

$112.4

Hotel EBITDA Margin

20.7%

29.8%

29.2%

These historical hotel operating results include information for

all of the hotels the Company owned as of November 14, 2023,

(excluding LaPlaya Beach Club & Resort), following the sale of

Hotel Zoe Fisherman's Wharf. These historical operating results

include periods prior to the Company's ownership of the hotels. The

information above does not reflect the Company's corporate general

and administrative expense, interest expense, property acquisition

costs, depreciation and amortization, taxes and other expenses. Any

differences are a result of rounding.The information above has not

been audited and has been presented only for comparison purposes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231115484608/en/

Raymond D. Martz, Co-President and Chief Financial Officer,

Pebblebrook Hotel Trust - (240) 507-1330

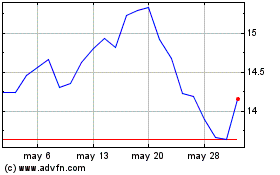

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024