Form N-CSRS - Certified Shareholder Report, Semi-Annual

01 Agosto 2024 - 1:29PM

Edgar (US Regulatory)

FORM N-CSR

CERTIFIED SHAREHOLDER

REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company

Act file number: 811-02736

ADAMS NATURAL RESOURCES

FUND, INC.

(Exact name of registrant as specified in charter)

500 East Pratt

Street, Suite 1300, Baltimore, Maryland 21202

(Address of principal executive offices)

Janis F. Kerns

Adams Natural Resources Fund, Inc.

500 East Pratt Street, Suite 1300

Baltimore, Maryland 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(410) 752-5900

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

ADAMS

NATURAL RESOURCES FUND

GET THE LATEST NEWS AND INFORMATION

Managed Distribution Policy

The Board of Directors of Adams Natural Resources Fund, Inc. (the “Fund”) adopted a Managed Distribution Policy (“MDP”) to enhance long-term shareholder value by paying level quarterly distributions at a committed rate of 8% of average net asset value (“NAV”) per year. Distributions in accordance with the MDP will begin in the third quarter of 2024.

The Fund pays distributions four times a year. Distributions under the MDP can be derived from net investment income, realized capital gains, or possibly, returns of capital, and are payable in newly issued shares of common stock, unless a shareholder specifically elects to receive cash. The Fund has committed to distribute 2% of average NAV for each quarterly distribution, with the fourth quarter distribution to be the greater of 2% of average NAV or the amount needed to satisfy minimum distribution requirements of the Internal Revenue Code for regulated investment companies. Average NAV is based on the average of the previous four quarter-end NAVs per share prior to each declaration date.

With each distribution, the Fund will issue a notice to shareholders, which will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the distributions for tax reporting purposes will depend upon the Fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Shareholders will receive a Form 1099-DIV in January for the previous calendar year that will indicate how to report these distributions for federal income tax purposes.

Disclaimers

The primary purpose of the MDP is to provide shareholders with a constant, but not guaranteed, rate of distribution each quarter. You should not draw any conclusions about the Fund’s investment performance from the amount of the current distribution or from the terms of the Fund’s MDP. The Board may amend or terminate the MDP at any time without prior notice to shareholders. However, at this time, there are no reasonably foreseeable circumstances that might cause the termination of the MDP.

Dear Fellow Shareholders,

Equities continued to rally in the first half of 2024, supported by the resilient economy and driven by stocks tied to artificial intelligence (AI). Almost 60% of the S&P 500 Index’s gain was driven by five stocks—NVIDIA, Microsoft, Amazon, Meta Platforms, and Apple—and the valuation spread between AI-related stocks and the rest of the S&P 500 continued to widen. While that does continue to drive concern about the market’s breadth, these are fundamentally some of the world’s best companies, growing rapidly and generating significant cash flows, which they are both reinvesting and returning to shareholders.

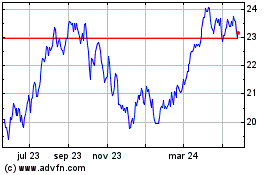

“Our Fund, with exposure to both Energy and Materials, returned 10.2% on net asset value and 15.5% on market price for the last six months, compared to a 9.6% return for the Fund’s benchmark...”

The stock market continues to discount the possibility of an economic soft landing, backed by continuing strength from the U.S. consumer and some stronger-than-expected economic data from Europe. This is tempered by occasional signs of slowing activity from other economic data. Inflation remains a big story, with the cumulative effect of high prices continuing to fuel concerns about both consumer outlooks and corporate earnings. While the U.S. Federal Reserve maintained interest rates in the first half of 2024, it continues to consider the possibility of rate cuts later in the year.

Despite a second-quarter dip, the S&P 500’s Energy sector posted a double-digit advance in the first half of 2024, while the Materials sector was up more than 4%. Our Fund, with exposure to both Energy and Materials, returned 10.2% on net asset value and 15.5% on market price for the last six months, compared to a 9.6% return for the Fund’s benchmark (80% S&P 500 Energy Sector and 20% S&P 500 Materials Sector).

West Texas Intermediate (WTI) crude oil prices climbed nearly 14% in the first half. Below-average supply levels and geopolitical conflicts helped lift WTI prices to six-month highs in April. However, prices declined modestly during the second quarter, pressured by worries about demand from China and a changing supply dynamic, as OPEC+ announced plans to phase out some voluntary production cuts in the fall of 2024.

A series of major mergers and acquisitions have been a key contributor to the Energy sector’s performance. In May, ExxonMobil completed its $60 billion purchase of Pioneer Natural Resources. Several other deals have been announced, including Chevron purchasing Hess for $53 billion, Diamondback Energy’s $26 billion buyout of private driller Endeavor Energy Resources, ConocoPhillips’ $22 billion takeover of Marathon Oil, and EQT’s $14 billion acquisition of Equitrans Midstream.

Letter to Shareholders (continued)

Natural gas prices rallied sharply in the second quarter but remained modestly lower on a year-to-date basis. Inventory levels spiked early in the year as winter weather was broadly warmer than expected, driving down demand. Henry Hub prices started to rise in April, as U.S. natural gas suppliers reduced production.

Four of the five Energy industry groups advanced in the first six months of 2024, led by a 24.7% gain for the Storage & Transportation group. Refining & Marketing stocks, as well as Integrated Oil & Gas names, also posted double-digit gains. Only the Equipment & Services sector declined during the first half.

Despite the weakness in Equipment & Services, the group was the Fund’s biggest contributor to relative performance. We benefited from our position in TechnipFMC, which gained 30.4% in the first half. Spending on exploration and production of offshore developments continues to increase, which benefits TechnipFMC as the market leader for subsea equipment. The company has started to commercialize new offshore technologies, including electric subsea equipment and full subsea processing, supplementing an already robust backlog.

Our Exploration & Production holdings advanced 7.6% for the period, compared to the group’s performance of 6.2%. A substantial overweight in Diamondback Energy was the key contributor. One of the lowest cost oil producers, Diamondback has become the largest independent operator in the Permian Basin with its acquisition of Endeavor Energy Resources. The company’s management team has proven adept at acquiring assets and improving their profitability, and with this acquisition they have two decades of highly economic drilling locations to exploit.

The Materials sector declined during the second quarter but remained positive year-to-date, bolstered in part by rising prices for industrial and precious metals. Good stock selection in the Materials sector added value during the period. The Fund benefited from an overweight position in copper miner Freeport-McMoRan, as well as an underweight position in lithium producer Albemarle. Freeport shares rose, in part, due to copper prices reaching a multi-year high, while Albemarle has struggled with depressed lithium prices caused by concerns about the rate of demand growth for electric vehicles.

Additionally, Ecolab was a standout performer in the Chemicals group. After facing margin challenges from the pandemic and subsequent supply chain disruptions, Ecolab has emerged as a more efficient operator with an improved product offering. This is having tangible effects on results, evidenced by its strong earnings results and a robust growth outlook. Partially offsetting this strength, our underweight in DuPont de Nemours, which announced a plan to split into three companies, and an overweight in coatings maker PPG Industries – although reduced during the period – weighed on relative performance.

Letter to Shareholders (continued)

For the six months ended June 30, 2024, the total return on the Fund’s net asset value (“NAV”) per share (with dividends and capital gains reinvested) was 10.2%. This compares to the 9.6% total return for the Fund’s benchmark. The total return on the market price of the Fund’s shares for the period was 15.5%.

For the twelve months ended June 30, 2024, the Fund’s total return on NAV was 16.5%. Comparable return for the Fund’s benchmark was 14.4%. The total return on the market price of the Fund’s shares for the period was 20.9%.

During the first half of the year, the Fund paid distributions to shareholders of $5.1 million, or $.20 per share. On July 18, 2024, an additional distribution of $.54 per share was declared for payment on August 30, 2024, in newly issued shares unless shareholders elect to receive cash. This most recent declaration marks the initial payment under the Fund’s Managed Distribution Policy announced during the second quarter to pay at least 2% of average NAV each quarter.

As we head into the second half of 2024, we take heart in the strength of corporate earnings and the U.S. economy’s resilience. Inflation remains a concern, as witnessed by a consumer that continues to have to make choices – from the gas pump to the grocery store – as credit card balances and delinquency rates show signs of increasing. Still, one could argue that some of these worrisome data points have marked a return to pre-pandemic levels, potentially showing more signs of normalization than a significant slowdown and/or a forthcoming recession.

The biggest risk going forward, in our view, would be a meaningful rise in interest rates, whether driven by resurgent inflation fears or by the need to attract investors to buy government bonds. The latter reason, which is likely to grow in significance over the coming years, seems less likely to impact rates in the near term. The election in November, with its starker-than-usual choice of Presidential candidates, has the potential to impact investor sentiment. Geopolitical risk factors, including the ongoing conflicts in Ukraine and the Middle East, and narrow stock market leadership add additional layers of uncertainty. Against this backdrop of questions and concerns, we will keep our focus on managing risk, and continue to seek long-term investing success by finding opportunities through high-quality, fundamentally strong companies at attractive prices.

By order of the Board of Directors,

James P. Haynie, CFA

Chief Executive Officer & President

July 18, 2024

June 30, 2024

(unaudited)

Ten Largest Equity Portfolio Holdings

| |

|

|

Market Value

|

|

|

Percent of

Net Assets

|

|

| Exxon Mobil Corporation |

|

|

|

$ |

170,211,252 |

|

|

|

|

|

24.7% |

|

|

| Chevron Corporation |

|

|

|

|

82,069,038 |

|

|

|

|

|

11.9 |

|

|

| ConocoPhillips |

|

|

|

|

39,103,777 |

|

|

|

|

|

5.7 |

|

|

| Linde plc |

|

|

|

|

30,058,485 |

|

|

|

|

|

4.4 |

|

|

| Marathon Petroleum Corporation |

|

|

|

|

29,112,026 |

|

|

|

|

|

4.2 |

|

|

| EOG Resources, Inc. |

|

|

|

|

27,750,181 |

|

|

|

|

|

4.0 |

|

|

| Phillips 66 |

|

|

|

|

21,807,236 |

|

|

|

|

|

3.2 |

|

|

| Hess Corporation |

|

|

|

|

20,946,217 |

|

|

|

|

|

3.0 |

|

|

| Diamondback Energy, Inc. |

|

|

|

|

19,598,601 |

|

|

|

|

|

2.8 |

|

|

| Williams Companies, Inc. |

|

|

|

|

19,165,375 |

|

|

|

|

|

2.8 |

|

|

|

|

|

|

$ |

459,822,188 |

|

|

|

|

|

66.7% |

|

|

Industry Weightings

Statement of Assets and Liabilities

June 30, 2024

(unaudited)

| |

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Investments at value*: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common stocks (cost $478,804,756)

|

|

|

|

$ |

685,391,471 |

|

|

|

|

|

|

|

|

| |

Short-term investments (cost $4,464,244)

|

|

|

|

|

4,463,884 |

|

|

|

|

$ |

689,855,355 |

|

|

| |

Cash |

|

|

|

|

|

|

|

|

|

|

150,854 |

|

|

| |

Dividends receivable |

|

|

|

|

|

|

|

|

|

|

261,649 |

|

|

| |

Net unrealized gain on open total return swap agreements

|

|

|

|

|

|

|

|

|

|

|

338,385 |

|

|

| |

Prepaid expenses and other assets |

|

|

|

|

|

|

|

|

|

|

1,666,323 |

|

|

| |

Total Assets

|

|

|

|

|

|

|

|

|

|

|

692,272,566 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Due to officers and directors (note 8) |

|

|

|

|

|

|

|

|

|

|

508,324 |

|

|

| |

Accrued expenses and other liabilities |

|

|

|

|

|

|

|

|

|

|

1,777,696 |

|

|

| |

Total Liabilities

|

|

|

|

|

|

|

|

|

|

|

2,286,020 |

|

|

| |

Net Assets

|

|

|

|

|

|

|

|

|

|

$ |

689,986,546 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock at par value $0.001 per share, authorized

50,000,000 shares; issued and outstanding 25,453,641

shares (includes 11,050 deferred stock units) (note 7)

|

|

|

|

|

|

|

|

|

|

$ |

25,454 |

|

|

| |

Additional capital surplus |

|

|

|

|

|

|

|

|

|

|

466,813,588 |

|

|

| |

Total distributable earnings (loss) |

|

|

|

|

|

|

|

|

|

|

223,147,504 |

|

|

| |

Net Assets Applicable to Common Stock

|

|

|

|

|

|

|

|

|

|

$ |

689,986,546 |

|

|

| |

Net Asset Value Per Share of Common Stock

|

|

|

|

|

|

|

|

|

|

$ |

27.11 |

|

|

*

See Schedule of Investments beginning on page 15.

The accompanying notes are an integral part of the financial statements.

Six Months Ended June 30, 2024

(unaudited)

| |

Investment Income |

|

|

|

|

|

|

|

| |

Income:

|

|

|

|

|

|

|

|

| |

Dividends (net of $15,009 in foreign taxes)

|

|

|

|

$ |

10,101,327 |

|

|

| |

Other income

|

|

|

|

|

159,765 |

|

|

| |

Total Income

|

|

|

|

|

10,261,092 |

|

|

| |

Expenses:

|

|

|

|

|

|

|

|

| |

Investment research compensation and benefits

|

|

|

|

|

858,463 |

|

|

| |

Administration and operations compensation and benefits

|

|

|

|

|

427,779 |

|

|

| |

Occupancy and other office expenses

|

|

|

|

|

136,144 |

|

|

| |

Investment data services

|

|

|

|

|

100,393 |

|

|

| |

Directors’ compensation

|

|

|

|

|

209,500 |

|

|

| |

Shareholder reports and communications

|

|

|

|

|

88,453 |

|

|

| |

Transfer agent, custody, and listing fees

|

|

|

|

|

68,007 |

|

|

| |

Accounting, recordkeeping and other professional fees

|

|

|

|

|

53,925 |

|

|

| |

Insurance

|

|

|

|

|

36,147 |

|

|

| |

Audit and tax services

|

|

|

|

|

67,744 |

|

|

| |

Legal services

|

|

|

|

|

58,918 |

|

|

| |

Total Expenses

|

|

|

|

|

2,105,473 |

|

|

| |

Net Investment Income

|

|

|

|

|

8,155,619 |

|

|

| |

|

|

|

|

|

|

|

|

| |

Realized Gain (Loss) and Change in Unrealized Appreciation |

|

|

|

|

|

|

|

| |

Net realized gain (loss) on investments

|

|

|

|

|

12,346,452 |

|

|

| |

Net realized gain (loss) on total return swap agreements

|

|

|

|

|

332,327 |

|

|

| |

Change in unrealized appreciation on investments

|

|

|

|

|

41,877,398 |

|

|

| |

Change in unrealized appreciation on total return swap agreements

|

|

|

|

|

338,385 |

|

|

| |

Net Gain (Loss)

|

|

|

|

|

54,894,562

|

|

|

| |

Change in Net Assets from Operations |

|

|

|

$

|

63,050,181

|

|

|

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| |

|

|

(unaudited)

Six Months Ended

June 30, 2024

|

|

|

Year Ended

December 31, 2023

|

|

| From Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

|

$ |

8,155,619 |

|

|

|

|

$ |

17,091,832 |

|

|

|

Net realized gain (loss)

|

|

|

|

|

12,678,779 |

|

|

|

|

|

17,507,537 |

|

|

|

Change in unrealized appreciation

|

|

|

|

|

42,215,783 |

|

|

|

|

|

(24,905,493) |

|

|

|

Change in Net Assets from Operations

|

|

|

|

|

63,050,181 |

|

|

|

|

|

9,693,876 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions to Shareholders from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total distributable earnings

|

|

|

|

|

(5,097,828) |

|

|

|

|

|

(33,803,770) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Capital Share Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of shares issued in payment of distributions (note 5)

|

|

|

|

|

3,439 |

|

|

|

|

|

10,099,505 |

|

|

|

Cost of shares purchased (note 5)

|

|

|

|

|

(1,416,187) |

|

|

|

|

|

(3,879,111) |

|

|

|

Change in Net Assets from Capital Share Transactions

|

|

|

|

|

(1,412,748) |

|

|

|

|

|

6,220,394 |

|

|

|

Total Change in Net Assets

|

|

|

|

|

56,539,605 |

|

|

|

|

|

(17,889,500) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of period

|

|

|

|

|

633,446,941 |

|

|

|

|

|

651,336,441 |

|

|

|

End of period

|

|

|

|

$ |

689,986,546 |

|

|

|

|

$ |

633,446,941 |

|

|

The accompanying notes are an integral part of the financial statements.

Notes to Financial Statements (unaudited)

Adams Natural Resources Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 (“1940 Act”) as a non-diversified investment company. The Fund is an internally managed closed-end fund specializing in energy and other natural resources stocks. The investment objectives of the Fund are preservation of capital, the attainment of reasonable income from investments, and an opportunity for capital appreciation.

1. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation — The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for investment companies, which require the use of estimates by Fund management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates and the valuations reflected in the financial statements may differ from the value the Fund ultimately realizes. Additionally, unpredictable events such as natural disasters, war, terrorism, global pandemics, and similar public health threats may significantly affect the economy, markets, and companies in which the Fund invests. The Fund could be negatively impacted if the value of portfolio holdings are harmed by such events.

Affiliates — Adams Diversified Equity Fund, Inc. (“ADX”), a diversified, closed-end investment company, owns 8.6% of the Fund’s outstanding shares and is, therefore, an “affiliated company” as defined by the 1940 Act. During the six months ended June 30, 2024, the Fund paid dividends and capital gain distributions of $437,355 to ADX. Directors of the Fund are also directors of ADX. The Fund, ADX, and Adams Funds Advisers, LLC (“AFA”), an ADX-affiliated investment adviser to external parties, have a shared management team.

Distributions — Distributions to shareholders are recorded on the ex-dividend date. The Fund employs a Managed Distribution Policy (“MDP”) whereby it seeks to pay quarterly distributions based on an annual rate of 8% of the Fund’s average net asset value. Average net asset value is based on the average of the previous four quarter-end net asset values per share prior to the declaration date. Distributions are generated from portfolio income and capital gains derived from managing the portfolio. If such earnings do not meet the distribution commitment, or it’s deemed in the best interest of shareholders, the Fund may return capital. A return of capital is not taxable to shareholders and does not necessarily reflect the Fund’s investment performance.

Expenses — The Fund shares personnel, systems, and other infrastructure items with ADX and AFA and is charged a portion of the shared expenses. To protect the Fund from potential conflicts of interest, policies and procedures are in place covering the sharing of expenses among the entities. Expenses solely attributable to an entity are charged to that entity. Expenses that are not solely attributable to one entity are allocated in accordance with the Fund’s expense sharing policy. The Fund’s policy dictates that expenses, other than those related to personnel, are attributed to AFA based on the average estimated amount of time spent by all personnel on AFA-related activities relative to overall job functions; the remaining portion is attributed to the Fund and ADX based on relative net assets excluding affiliated holdings. Personnel-related expenses are attributed to AFA based on the individual’s time spent on AFA-related activities; the remaining portion is attributed to the Fund and ADX based on relative market values of portfolio securities covered for research staff and relative net assets excluding affiliated holdings for all others. Expense allocations are updated quarterly. Because AFA has no assets under management, only those expenses directly attributable to AFA are charged to AFA.

Notes to Financial Statements (continued)

For the six months ended June 30, 2024, shared expenses totaled $10,594,786, of which $8,488,579 and $734 were charged to ADX and AFA, respectively, in accordance with the Fund’s expense sharing policy. There were no amounts due to, or due from, affiliated companies at June 30, 2024.

Investment Transactions and Income — The Fund’s investment decisions are made by the portfolio management team with recommendations from the research staff. Policies and procedures are in place covering the allocation of investment opportunities among the Fund and its affiliates to protect the Fund from potential conflicts of interest. Investment transactions are accounted for on trade date. Realized gains and losses on sales of investments are recorded on the basis of specific identification. Dividend income is recognized on the ex-dividend date.

Valuation — The Fund’s financial instruments are reported at fair value, which is defined as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund has a Valuation Committee (“Committee”) so that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight and approval by the Board of Directors, the Committee establishes methodologies and procedures to value securities for which market quotations are not readily available.

GAAP establishes the following hierarchy that categorizes the inputs used to measure fair value:

•

Level 1 — fair value is determined based on market data obtained from independent sources; for example, quoted prices in active markets for identical investments;

•

Level 2 — fair value is determined using other assumptions obtained from independent sources; for example, quoted prices for similar investments;

•

Level 3 — fair value is determined using the Fund’s own assumptions, developed based on the best information available under the circumstances.

Investments in securities traded on national exchanges are valued at the last reported sale price as of the close of regular trading on the relevant exchange on the day of valuation. Over-the-counter and listed equity securities for which a sale price is not available are valued at the last quoted bid price. Money market funds are valued at net asset value. These securities are generally categorized as Level 1 in the hierarchy.

Total return swap agreements are valued using independent, observable inputs, including underlying security prices, dividends, and interest rates. These securities are generally categorized as Level 2 in the hierarchy.

At June 30, 2024, the Fund’s financial instruments were classified as follows:

| |

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stocks |

|

|

|

$ |

685,391,471 |

|

|

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

|

|

$ |

685,391,471 |

|

| Short-term investments |

|

|

|

|

4,463,884 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

4,463,884 |

|

| Total investments |

|

|

|

$ |

689,855,355 |

|

|

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

|

|

$ |

689,855,355 |

|

|

Total return swap agreements *

|

|

|

|

$ |

— |

|

|

|

|

$ |

338,385 |

|

|

|

|

$ |

— |

|

|

|

|

$ |

338,385 |

|

*

Unrealized appreciation (depreciation)

Notes to Financial Statements (continued)

2. FEDERAL INCOME TAXES

No federal income tax provision is required since the Fund’s policy is to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable income and gains to its shareholders. Additionally, management has analyzed the tax positions included in federal income tax returns from the previous three years that remain subject to examination, and concluded no provision was required. Any income tax-related interest or penalties would be recognized as income tax expense. At June 30, 2024, the identified cost of securities for federal income tax purposes was $483,468,507 and net unrealized appreciation aggregated $206,386,848, consisting of gross unrealized appreciation of $228,961,466 and gross unrealized depreciation of $22,574,618.

Distributions are determined in accordance with the Fund’s MDP and income tax regulations, which may differ from GAAP. Such differences are primarily related to the Fund’s retirement plan, equity-based compensation, wash sales, and tax straddles for total return swaps. Differences that are permanent are reclassified in the capital accounts of the Fund’s annual financial statements and have no impact on net assets.

3. INVESTMENT TRANSACTIONS

Purchases and sales of portfolio investments, other than short-term investments, securities lending collateral, and derivative transactions, during the six months ended June 30, 2024 were $61,611,403 and $61,020,047, respectively.

4. DERIVATIVES

The Fund may invest in derivative instruments. The Fund uses derivatives for a variety of purposes, including, but not limited to, the ability to gain or limit exposure to particular market sectors or securities, to provide additional capital gains, to limit equity price risk in the normal course of pursuing its investment objectives, and/or to obtain leverage.

Total Return Swap Agreements — The Fund utilizes total return swap agreements in carrying out a paired trade strategy, where it enters into a long contract for a single stock and a short contract for a sector exchange-traded fund in comparable notional amounts. Total return swap agreements involve commitments based on a notional amount to pay interest in exchange for a market-linked return of a reference security. Upon closing a long contract, the Fund will receive a payment to the extent the total return of the reference security is positive for the contract period and exceeds the offsetting interest rate obligation or will make a payment if the total return is negative for the contract period. Upon closing a short contract, the Fund will receive a payment to the extent the total return of the reference security is negative for the contract period and exceeds the offsetting interest rate obligation or will make a payment if the total return is positive for the contract period. The fair value of each total return swap agreement is determined daily and the change in value is recorded as a change in unrealized appreciation on total return swap agreements in the Statement of Operations. Payments received or made upon termination during the period are recorded as a realized gain or loss on total return swap agreements in the Statement of Operations.

Total return swap agreements entail risks associated with counterparty credit, liquidity, and equity price risk. Such risks include that the Fund or the counterparty may default on its obligation, that there is no liquid market for these agreements, and that there may be unfavorable changes in the price of the reference security. To mitigate the Fund’s counterparty credit risk, the Fund enters into master netting and collateral arrangements

Notes to Financial Statements (continued)

with the counterparty. A master netting agreement allows either party to terminate the agreement prior to termination date and provides the ability to offset amounts the Fund owes the counterparty against the amounts the counterparty owes the Fund for a single net settlement. The Fund’s policy is to net all derivative instruments subject to a netting agreement and offset the value of derivative liabilities against the value of derivative assets. The net cumulative unrealized gain (asset) on open total return swap agreements or the net cumulative unrealized loss (liability) on open total return swap agreements is presented in the Statement of Assets and Liabilities. The fair value of each open total return swap agreement is presented on the Schedule of Investments. During the six months ended June 30, 2024 , the average daily notional amounts of open long and short total return swap agreements, an indicator of the volume of activity, were $3,016,587 and $(3,015,092), respectively.

A collateral arrangement requires each party to provide collateral with a value, adjusted daily and subject to a minimum transfer amount, equal to the net amount owed to the other party under the agreement. The counterparty provides cash collateral to the Fund and the Fund provides collateral by segregating portfolio securities, subject to a valuation allowance, into a tri-party account at its custodian. At June 30, 2024, there were no securities pledged as collateral and no cash collateral was held by the Fund.

5. CAPITAL STOCK

The Fund has 5,000,000 authorized and unissued preferred shares, $0.001 par value.

During the six months ended June 30, 2024, the Fund issued 160 shares of its Common Stock at a weighted average price of $21.57 per share as dividend equivalents to holders of deferred stock units under the 2005 Equity Incentive Compensation Plan.

On December 15, 2023, the Fund issued 503,730 shares of its Common Stock at a price of $19.96 per share (the average market price on December 6, 2023) to shareholders of record November 20, 2023, who elected to take stock in payment of the year-end distribution. During the year ended December 31, 2023, the Fund issued 2,167 shares of Common Stock at a weighted average price of $20.76 per share as dividend equivalents to holders of deferred stock units under the 2005 Equity Incentive Compensation Plan.

The Fund may purchase shares of its Common Stock from time to time, in accordance with parameters set by the Board of Directors, at such prices and amounts as the portfolio management team deems appropriate. Additionally, the Fund will repurchase shares under the Fund’s enhanced discount management and liquidity program, subject to certain restrictions, when the discount exceeds 15% of net asset value for at least 30 consecutive trading days. The enhanced program also provides that the Fund will engage in a proportional tender offer to repurchase shares when the discount exceeds 19% of net asset value for 30 consecutive trading days, not to exceed one such offer in any twelve-month period.

Notes to Financial Statements (continued)

Transactions in its Common Stock for 2024 and 2023 were as follows:

| |

|

|

Shares

|

|

|

Amount

|

|

| |

|

|

Six months

ended

June 30,

2024

|

|

|

Year ended

December 31,

2023

|

|

|

Six months

ended

June 30,

2024

|

|

|

Year ended

December 31,

2023

|

|

|

Shares issued in payment of distributions

|

|

|

|

|

160 |

|

|

|

|

|

505,897 |

|

|

|

|

$ |

3,439 |

|

|

|

|

$ |

10,099,505 |

|

|

Shares purchased (at a weighted average discount from net asset value of 15.4% and 16.0%, respectively)

|

|

|

|

|

(60,960) |

|

|

|

|

|

(185,012) |

|

|

|

|

|

(1,416,187) |

|

|

|

|

|

(3,879,111) |

|

|

| Net change |

|

|

|

|

(60,800) |

|

|

|

|

|

320,885 |

|

|

|

|

$ |

(1,412,748) |

|

|

|

|

$ |

6,220,394 |

|

6. RETIREMENT PLANS

The Fund sponsors a qualified defined contribution plan for all employees with at least six months of service and a nonqualified defined contribution plan for eligible employees to supplement the qualified plan. The Fund matches employee contributions made to the plans and, subject to Board approval, may also make a discretionary contribution to the plans. During the six months ended June 30, 2024, the Fund recorded matching contributions of $87,762 and a liability, representing the 2024 discretionary contribution, of $42,346.

7. EQUITY-BASED COMPENSATION

The Fund’s 2005 Equity Incentive Compensation Plan, adopted at the 2005 Annual Meeting and reapproved at the 2010 Annual Meeting, expired on April 27, 2015. Restricted stock units granted to non-employee directors that are 100% vested, but payment of which has been deferred by the election of the director, remain outstanding at June 30, 2024.

Outstanding awards were granted at fair market value on grant date (determined by the average of the high and low price on that date) and earn an amount equal to the Fund’s per share distribution, payable in reinvested shares, which are paid concurrently with the payment of the original share grant.

A summary of the activity during the six months ended June 30, 2024 is as follows:

|

Awards

|

|

|

Units

|

|

|

Weighted Average

Grant-Date

Fair Value

|

|

| Balance at December 31, 2023 |

|

|

|

|

10,974 |

|

|

|

|

$ |

26.68 |

|

|

| Reinvested dividend equivalents |

|

|

|

|

160 |

|

|

|

|

|

21.57 |

|

|

| Issued |

|

|

|

|

(84) |

|

|

|

|

|

20.61 |

|

|

| Balance at June 30, 2024 |

|

|

|

|

11,050 |

|

|

|

|

$ |

26.65 |

|

|

At June 30, 2024, the Fund had no unrecognized compensation cost. The total fair value of awards issued during the six months ended June 30, 2024 was $1,711.

8. OFFICER AND DIRECTOR COMPENSATION

The aggregate remuneration paid by the Fund during the six months ended June 30, 2024 to officers and directors amounted to $1,557,563, of which $209,500 was paid to non-employee directors. These amounts represent the taxable income to the Fund’s

Notes to Financial Statements (continued)

officers and directors and, therefore, may differ from the amounts reported in the accompanying Statement of Operations that are recorded and expensed in accordance with GAAP. At June 30, 2024, $508,324 was due to officers and directors, representing amounts related to estimated cash compensation and estimated retirement plan discretionary contributions payable to officers and reinvested dividend payments on deferred stock awards payable to directors.

9. PORTFOLIO SECURITIES LOANED

The Fund makes loans of securities to approved brokers to earn additional income. The loans are collateralized by cash and/or U.S. Treasury and government agency obligations valued at 102% of the value of the securities on loan. The market value of the loaned securities is calculated based upon the most recent closing prices and any additional required collateral is delivered to the Fund on the next business day. On loans collateralized by cash, the cash collateral is invested in a registered money market fund. The Fund accounts for securities lending transactions as secured financing and retains a portion of the income from lending fees and interest on the investment of cash collateral. The Fund also continues to receive dividends on the securities loaned. Gain or loss in the fair value of securities loaned that may occur during the term of the loan will be for the account of the Fund. At June 30, 2024, the Fund had no securities on loan. The Fund is indemnified by the custodian, serving as lending agent, for the loss of loaned securities and has the right under the lending agreement to recover the securities from the borrower on demand.

10. LEASES

The Fund and its affiliates lease office space and equipment under non-cancelable lease agreements expiring at various dates through 2029. Payments are made in aggregate pursuant to these agreements but are deemed variable for each entity, as the allocable portion to each entity fluctuates when applying the expense sharing policy among all affiliates at each payment date. Variable payments of this nature do not require recognition of an asset or an offsetting liability in the Statement of Assets and Liabilities and are recognized as rental expense on a straight-line basis over the lease term within occupancy and other office expenses in the Statement of Operations. During the six months ended June 30, 2024, the Fund recognized rental expense of $47,456.

11. COMMITMENTS AND CONTINGENCIES

In the normal course of business, the Fund enters into agreements that can expose the Fund to some risk of loss. The risk of future loss arising from any such agreements, while not quantifiable, is expected to be remote. As such, and as of the end of the reporting period, the Fund did not have any unfunded commitments. From time to time, the Fund may be a party to certain legal proceedings in the ordinary course of business, including proceedings relating to the enforcement of the Fund’s rights under contracts or within bylaws. As of the end of the reporting period, management has determined that any legal proceedings the Fund is subject to are unlikely to have a material impact to the Fund’s financial statements.

| |

|

|

(unaudited)

Six Months Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

June 30,

2024

|

|

|

June 30,

2023

|

|

|

Year Ended December 31,

|

|

| |

|

|

2023

|

|

|

2022

|

|

|

2021

|

|

|

2020

|

|

|

2019

|

|

|

Per Share Operating Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of period

|

|

|

|

|

$24.83 |

|

|

|

|

|

$25.85 |

|

|

|

|

|

$25.85 |

|

|

|

|

|

$19.22 |

|

|

|

|

|

$13.76 |

|

|

|

|

|

$18.79 |

|

|

|

|

|

$17.71 |

|

|

|

Net investment income

|

|

|

|

|

0.32 |

|

|

|

|

|

0.35 |

|

|

|

|

|

0.68 |

|

|

|

|

|

0.80 |

|

|

|

|

|

0.55 |

|

|

|

|

|

0.45 |

|

|

|

|

|

0.80 (a) |

|

|

|

Net realized gain (loss) and change in unrealized appreciation

|

|

|

|

|

2.15 |

|

|

|

|

|

(1.22) |

|

|

|

|

|

(0.28) |

|

|

|

|

|

7.57 |

|

|

|

|

|

5.86 |

|

|

|

|

|

(4.85) |

|

|

|

|

|

1.41 |

|

|

| Total from operations |

|

|

|

|

2.47 |

|

|

|

|

|

(0.87) |

|

|

|

|

|

0.40 |

|

|

|

|

|

8.37 |

|

|

|

|

|

6.41 |

|

|

|

|

|

(4.40) |

|

|

|

|

|

2.21 |

|

|

| Less distributions from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

|

|

(0.19) |

|

|

|

|

|

(0.15) |

|

|

|

|

|

(0.65) |

|

|

|

|

|

(0.79) |

|

|

|

|

|

(0.56) |

|

|

|

|

|

(0.47) |

|

|

|

|

|

(0.78) |

|

|

|

Net realized gain

|

|

|

|

|

(0.01) |

|

|

|

|

|

(0.05) |

|

|

|

|

|

(0.70) |

|

|

|

|

|

(0.84) |

|

|

|

|

|

(0.35) |

|

|

|

|

|

(0.26) |

|

|

|

|

|

(0.32) |

|

|

| Total distributions |

|

|

|

|

(0.20) |

|

|

|

|

|

(0.20) |

|

|

|

|

|

(1.35) |

|

|

|

|

|

(1.63) |

|

|

|

|

|

(0.91) |

|

|

|

|

|

(0.73) |

|

|

|

|

|

(1.10) |

|

|

|

Capital share repurchases (note 5)

|

|

|

|

|

0.01 |

|

|

|

|

|

0.03 |

|

|

|

|

|

0.03 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

0.14 |

|

|

|

|

|

— |

|

|

|

Reinvestment of distributions

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

(0.10) |

|

|

|

|

|

(0.11) |

|

|

|

|

|

(0.04) |

|

|

|

|

|

(0.04) |

|

|

|

|

|

(0.03) |

|

|

| Total capital share transactions |

|

|

|

|

0.01 |

|

|

|

|

|

0.03 |

|

|

|

|

|

(0.07) |

|

|

|

|

|

(0.11) |

|

|

|

|

|

(0.04) |

|

|

|

|

|

0.10 |

|

|

|

|

|

(0.03) |

|

|

|

Net asset value, end of period

|

|

|

|

|

$27.11 |

|

|

|

|

|

$24.81 |

|

|

|

|

|

24.83 |

|

|

|

|

|

$25.85 |

|

|

|

|

|

$19.22 |

|

|

|

|

|

$13.76 |

|

|

|

|

|

$18.79 |

|

|

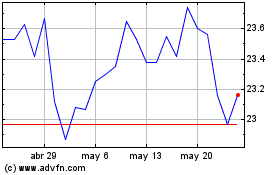

| Market price, end of period |

|

|

|

|

$23.61 |

|

|

|

|

|

$20.82 |

|

|

|

|

|

20.63 |

|

|

|

|

|

$21.80 |

|

|

|

|

|

$16.52 |

|

|

|

|

|

$11.37 |

|

|

|

|

|

$16.46 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investment Return (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Based on market price

|

|

|

|

|

15.5% |

|

|

|

|

|

-3.6% |

|

|

|

|

|

1.0% |

|

|

|

|

|

42.2% |

|

|

|

|

|

53.6% |

|

|

|

|

|

-26.6% |

|

|

|

|

|

21.1% |

|

|

|

Based on net asset value

|

|

|

|

|

10.2% |

|

|

|

|

|

-3.1% |

|

|

|

|

|

2.5% |

|

|

|

|

|

44.9% |

|

|

|

|

|

47.7% |

|

|

|

|

|

-22.2% |

|

|

|

|

|

13.7% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental Data (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of period (in millions)

|

|

|

|

|

$690 |

|

|

|

|

|

$621 |

|

|

|

|

|

$633 |

|

|

|

|

|

$651 |

|

|

|

|

|

$471 |

|

|

|

|

|

$332 |

|

|

|

|

|

$561 |

|

|

|

Ratio of expenses to average net

assets

|

|

|

|

|

0.60% |

|

|

|

|

|

0.64% |

|

|

|

|

|

0.64% |

|

|

|

|

|

0.56% |

|

|

|

|

|

0.88% |

|

|

|

|

|

1.47% |

|

|

|

|

|

0.97% |

|

|

|

Ratio of net investment income to

average net assets

|

|

|

|

|

2.44% |

|

|

|

|

|

2.78% |

|

|

|

|

|

2.66% |

|

|

|

|

|

3.31% |

|

|

|

|

|

3.15% |

|

|

|

|

|

3.27% |

|

|

|

|

|

4.18% |

|

|

|

Portfolio turnover

|

|

|

|

|

18.2% |

|

|

|

|

|

23.0% |

|

|

|

|

|

19.8% |

|

|

|

|

|

24.3% |

|

|

|

|

|

20.7% |

|

|

|

|

|

31.8% |

|

|

|

|

|

29.5% |

|

|

|

Number of shares outstanding at

end of period (in 000’s)

|

|

|

|

|

25,454 |

|

|

|

|

|

25,033 |

|

|

|

|

|

25,514 |

|

|

|

|

|

25,194 |

|

|

|

|

|

24,485 |

|

|

|

|

|

24,122 |

|

|

|

|

|

29,875 |

|

|

(a)

In 2019, the Fund received additional dividend income of $9,693,399, or $0.33 per Fund share, from the acquisition of Anadarko Petroleum Corporation by Occidental Petroleum Corporation.

(b)

Total investment return is calculated assuming a purchase of a Fund share at the beginning of the period and a sale on the last day of the period reported either at net asset value or market price per share, excluding any brokerage commissions. Distributions are assumed to be reinvested at the price received in the Fund’s dividend reinvestment plan.

(c)

Ratios and portfolio turnover presented on an annualized basis.

The accompanying notes are an integral part of the financial statements.

June 30, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Common Stocks — 99.3% |

|

|

Energy — 80.5%

|

|

|

Equipment & Services — 5.6%

|

|

|

Baker Hughes Company

|

|

|

|

|

296,400 |

|

|

|

|

$ |

10,424,388 |

|

|

|

Halliburton Company

|

|

|

|

|

177,353 |

|

|

|

|

|

5,990,984 |

|

|

|

Schlumberger N.V.

|

|

|

|

|

377,933 |

|

|

|

|

|

17,830,879 |

|

|

|

TechnipFMC plc

|

|

|

|

|

173,800 |

|

|

|

|

|

4,544,870 |

|

|

| |

|

|

|

|

38,791,121 |

|

|

|

Exploration & Production — 20.9%

|

|

|

APA Corporation

|

|

|

|

|

56,000 |

|

|

|

|

|

1,648,640 |

|

|

|

Chesapeake Energy Corporation

|

|

|

|

|

55,500 |

|

|

|

|

|

4,561,545 |

|

|

|

Chord Energy Corporation

|

|

|

|

|

225 |

|

|

|

|

|

37,728 |

|

|

|

Chord Energy Corporation warrants, strike price $166.37, 1 warrant for .5774 share, expires 9/1/24 (b)

|

|

|

|

|

2,654 |

|

|

|

|

|

85,140 |

|

|

|

Chord Energy Corporation warrants, strike price $133.70, 1 warrant for .5774 share, expires 9/1/25 (b)

|

|

|

|

|

1,327 |

|

|

|

|

|

31,251 |

|

|

|

ConocoPhillips

|

|

|

|

|

341,876 |

|

|

|

|

|

39,103,777 |

|

|

|

Coterra Energy Inc.

|

|

|

|

|

125,900 |

|

|

|

|

|

3,357,753 |

|

|

|

Devon Energy Corporation

|

|

|

|

|

284,700 |

|

|

|

|

|

13,494,780 |

|

|

|

Diamondback Energy, Inc.

|

|

|

|

|

97,900 |

|

|

|

|

|

19,598,601 |

|

|

|

EOG Resources, Inc.

|

|

|

|

|

220,467 |

|

|

|

|

|

27,750,181 |

|

|

|

EQT Corporation

|

|

|

|

|

27,500 |

|

|

|

|

|

1,016,950 |

|

|

|

Hess Corporation

|

|

|

|

|

141,989 |

|

|

|

|

|

20,946,217 |

|

|

|

Marathon Oil Corporation

|

|

|

|

|

95,400 |

|

|

|

|

|

2,735,118 |

|

|

|

Occidental Petroleum Corporation

|

|

|

|

|

151,951 |

|

|

|

|

|

9,577,472 |

|

|

|

|

|

|

|

143,945,153 |

|

|

|

Integrated Oil & Gas — 37.4%

|

|

|

Cenovus Energy Inc.

|

|

|

|

|

293,300 |

|

|

|

|

|

5,766,278 |

|

|

|

Chevron Corporation

|

|

|

|

|

524,671 |

|

|

|

|

|

82,069,038 |

|

|

|

Exxon Mobil Corporation

|

|

|

|

|

1,478,555 |

|

|

|

|

|

170,211,252 |

|

|

| |

|

|

|

|

258,046,568 |

|

|

|

Refining & Marketing — 9.3%

|

|

|

Marathon Petroleum Corporation

|

|

|

|

|

167,812 |

|

|

|

|

|

29,112,026 |

|

|

|

Phillips 66

|

|

|

|

|

154,475 |

|

|

|

|

|

21,807,236 |

|

|

|

Valero Energy Corporation

|

|

|

|

|

86,000 |

|

|

|

|

|

13,481,360 |

|

|

|

|

|

|

|

64,400,622 |

|

|

|

Storage & Transportation — 7.3%

|

|

|

Kinder Morgan, Inc.

|

|

|

|

|

609,092 |

|

|

|

|

|

12,102,658 |

|

|

|

ONEOK, Inc.

|

|

|

|

|

137,900 |

|

|

|

|

|

11,245,745 |

|

|

|

Targa Resources Corp.

|

|

|

|

|

59,600 |

|

|

|

|

|

7,675,288 |

|

|

|

Williams Companies, Inc.

|

|

|

|

|

450,950 |

|

|

|

|

|

19,165,375 |

|

|

| |

|

|

|

|

50,189,066 |

|

|

Schedule of Investments (continued)

June 30, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

Materials — 18.8%

|

|

|

Chemicals — 12.3%

|

|

|

Air Products and Chemicals, Inc.

|

|

|

|

|

21,700 |

|

|

|

|

$ |

5,599,685 |

|

|

|

Albemarle Corporation

|

|

|

|

|

7,200 |

|

|

|

|

|

687,744 |

|

|

|

Celanese Corporation

|

|

|

|

|

6,877 |

|

|

|

|

|

927,639 |

|

|

|

CF Industries Holdings, Inc.

|

|

|

|

|

13,369 |

|

|

|

|

|

990,910 |

|

|

|

Corteva Inc.

|

|

|

|

|

93,145 |

|

|

|

|

|

5,024,241 |

|

|

|

Dow, Inc.

|

|

|

|

|

63,945 |

|

|

|

|

|

3,392,282 |

|

|

|

DuPont de Nemours, Inc.

|

|

|

|

|

33,526 |

|

|

|

|

|

2,698,508 |

|

|

|

Eastman Chemical Company

|

|

|

|

|

54,500 |

|

|

|

|

|

5,339,365 |

|

|

|

Ecolab Inc.

|

|

|

|

|

50,000 |

|

|

|

|

|

11,900,000 |

|

|

|

FMC Corporation

|

|

|

|

|

7,255 |

|

|

|

|

|

417,525 |

|

|

|

International Flavors & Fragrances Inc.

|

|

|

|

|

21,006 |

|

|

|

|

|

1,999,981 |

|

|

|

Linde plc

|

|

|

|

|

68,500 |

|

|

|

|

|

30,058,485 |

|

|

|

LyondellBasell Industries N.V.

|

|

|

|

|

20,600 |

|

|

|

|

|

1,970,596 |

|

|

|

Mosaic Company

|

|

|

|

|

21,201 |

|

|

|

|

|

612,709 |

|

|

|

PPG Industries, Inc.

|

|

|

|

|

49,700 |

|

|

|

|

|

6,256,733 |

|

|

|

Sherwin-Williams Company

|

|

|

|

|

23,100 |

|

|

|

|

|

6,893,733 |

|

|

| |

|

|

|

|

84,770,136 |

|

|

|

Construction Materials — 1.5%

|

|

|

Martin Marietta Materials, Inc.

|

|

|

|

|

5,000 |

|

|

|

|

|

2,709,000 |

|

|

|

Vulcan Materials Company

|

|

|

|

|

32,100 |

|

|

|

|

|

7,982,628 |

|

|

| |

|

|

|

|

10,691,628 |

|

|

|

Containers & Packaging — 1.4%

|

|

|

Amcor plc

|

|

|

|

|

92,400 |

|

|

|

|

|

903,672 |

|

|

|

Avery Dennison Corporation

|

|

|

|

|

20,800 |

|

|

|

|

|

4,547,920 |

|

|

|

Ball Corporation

|

|

|

|

|

23,300 |

|

|

|

|

|

1,398,466 |

|

|

|

International Paper Company

|

|

|

|

|

21,500 |

|

|

|

|

|

927,725 |

|

|

|

Packaging Corporation of America

|

|

|

|

|

5,900 |

|

|

|

|

|

1,077,104 |

|

|

|

WestRock Company

|

|

|

|

|

15,400 |

|

|

|

|

|

774,004 |

|

|

| |

|

|

|

|

9,628,891 |

|

|

|

Metals & Mining — 3.6%

|

|

|

Freeport-McMoRan, Inc.

|

|

|

|

|

257,600 |

|

|

|

|

|

12,519,360 |

|

|

|

Newmont Corporation

|

|

|

|

|

172,300 |

|

|

|

|

|

7,214,201 |

|

|

|

Nucor Corporation

|

|

|

|

|

22,600 |

|

|

|

|

|

3,572,608 |

|

|

|

Steel Dynamics, Inc.

|

|

|

|

|

12,526 |

|

|

|

|

|

1,622,117 |

|

|

| |

|

|

|

|

24,928,286 |

|

|

| Total Common Stocks |

|

|

(Cost $478,804,756)

|

|

|

|

|

|

|

|

|

|

|

685,391,471 |

|

|

| |

Schedule of Investments (continued)

June 30, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Short-Term Investments — 0.7% |

|

|

Money Market Funds — 0.7%

|

|

|

Morgan Stanley Institutional Liquidity Funds Prime Portfolio, 5.34% (c)

|

|

|

|

|

3,600,379 |

|

|

|

|

$ |

3,600,379 |

|

|

|

Northern Institutional Treasury Premier

Portfolio, 5.15% (c)

|

|

|

|

|

863,505 |

|

|

|

|

|

863,505 |

|

|

| Total Short-Term Investments |

|

|

(Cost $4,464,244)

|

|

|

|

|

|

|

|

|

|

|

4,463,884 |

|

|

| Total — 100.0% |

|

|

(Cost $483,269,000)

|

|

|

|

|

|

|

|

|

|

|

689,855,355 |

|

|

| Other Assets Less Liabilities — 0.0% |

|

|

|

|

|

|

|

|

|

|

131,191 |

|

|

| Net Assets — 100.0% |

|

|

|

|

|

|

|

|

|

$

|

689,986,546

|

|

|

| |

Total Return Swap Agreements — 0.0%

|

Description

|

|

|

|

|

|

|

|

|

|

|

Value and

Unrealized

Appreciation

(Assets)

|

|

|

Value and

Unrealized

Depreciation

(Liabilities)

|

|

|

Terms

|

|

|

Contract

Type

|

|

|

Underlying

Security

|

|

|

Termination

Date

|

|

|

Notional

Amount

|

|

|

Receive total return on underlying

security and pay financing

amount based on notional

amount and daily U.S. Federal

Funds rate plus 0.55%.

|

|

|

Long

|

|

|

Schlumberger N.V.

(112,700 shares) |

|

|

7/8/2025

|

|

|

|

$ |

4,866,127 |

|

|

|

|

$ |

431,179 |

|

|

|

|

|

— |

|

|

|

Pay total return on underlying security and receive financing amount based on notional amount and daily U.S. Federal Funds rate less 0.45%.

|

|

|

Short

|

|

|

Energy Select Sector

SPDR Fund

(54,000 shares) |

|

|

7/8/2025

|

|

|

|

|

(4,851,463) |

|

|

|

|

|

— |

|

|

|

|

|

(92,794) |

|

|

| Gross unrealized gain (loss) on open total return swap agreements |

|

|

|

$ |

431,179 |

|

|

|

|

$ |

(92,794) |

|

|

| Net unrealized gain on open total return swap agreements (d) |

|

|

|

$ |

338,385 |

|

|

|

|

|

|

|

|

(a)

Common stocks and warrants are listed on the New York Stock Exchange or NASDAQ and are valued at the last reported sale price on the day of valuation.

(b)

Presently non-dividend paying.

(c)

Rate presented is as of period-end and represents the annualized yield earned over the previous seven days.

(d)

Counterparty for all open total return swap agreements is Morgan Stanley.

Principal Changes in Portfolio Securities

During the Six Months Ended June 30, 2024

(unaudited)

| |

|

|

Dollar Amount

Traded in

the Period

|

|

|

Percent of

Net Assets

Held at

Period-End

|

|

| Additions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exxon Mobil Corporation

|

|

|

|

$ |

7,755,745 |

|

|

|

|

|

24.7% |

|

|

|

Devon Energy Corporation

|

|

|

|

|

7,695,173 |

|

|

|

|

|

2.0 |

|

|

|

Chesapeake Energy Corporation

|

|

|

|

|

4,715,028* |

|

|

|

|

|

0.7 |

|

|

|

Freeport-McMoRan, Inc.

|

|

|

|

|

4,642,474 |

|

|

|

|

|

1.8 |

|

|

|

Eastman Chemical Company

|

|

|

|

|

4,390,355 |

|

|

|

|

|

0.8 |

|

|

|

Kinder Morgan, Inc.

|

|

|

|

|

3,584,524 |

|

|

|

|

|

1.8 |

|

|

|

Avery Dennison Corporation

|

|

|

|

|

3,476,683 |

|

|

|

|

|

0.7 |

|

|

|

Williams Companies, Inc.

|

|

|

|

|

3,321,285 |

|

|

|

|

|

2.8 |

|

|

|

EOG Resources, Inc.

|

|

|

|

|

3,127,822 |

|

|

|

|

|

4.0 |

|

|

|

Newmont Corporation

|

|

|

|

|

2,872,432 |

|

|

|

|

|

1.0 |

|

|

|

Hess Corporation

|

|

|

|

|

1,941,624 |

|

|

|

|

|

3.0 |

|

|

|

Corteva Inc.

|

|

|

|

|

1,171,296 |

|

|

|

|

|

0.7 |

|

|

|

Cenovus Energy Inc.

|

|

|

|

|

1,116,979 |

|

|

|

|

|

0.8 |

|

|

|

Ecolab Inc.

|

|

|

|

|

336,191 |

|

|

|

|

|

1.7 |

|

|

|

Vulcan Materials Company

|

|

|

|

|

30,685 |

|

|

|

|

|

1.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reductions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ConocoPhillips

|

|

|

|

|

7,753,853 |

|

|

|

|

|

5.7 |