Adams Diversified Equity Fund Announces $21.29 Issue Price of Shares and Sources of Distribution for Third Quarter Distribution Payable August 30, 2024

22 Agosto 2024 - 8:12PM

Adams Diversified Equity Fund, Inc. (NYSE: ADX) has determined that

$21.29 per share is the issue price for the Fund’s third quarter

distribution to shareholders. This price is the mean between the

high and low sales prices of the Fund’s stock on the New York Stock

Exchange on August 21, 2024, the valuation date.

The shares of common stock will be issued in connection with

payment of the $0.44 third quarter distribution, the first

distribution paid pursuant to the Fund’s new managed distribution

policy. The policy commits to pay a minimum 8% annual rate of

average net asset value (“NAV”) distributed evenly at 2% of average

NAV per quarter, with the fourth quarter distribution to be the

greater of 2% of average NAV or the amount needed to satisfy

minimum distribution requirements of the Internal Revenue Code for

regulated investment companies. Average NAV is based on the average

of the previous four quarter-end NAVs per share prior to each

declaration date.

The Fund’s estimated sources for the distribution to be paid on

August 30, 2024 and for all distributions declared in 2024 to date

are as follows:

|

|

Distribution per Share |

Net Investment Income |

Net Realized Short-Term Gains |

Net Realized Long-Term Gains |

Return of Capital |

|

August 30, 2024 |

$0.44 |

$0.04 (9%) |

$0.00 (0%) |

$0.40 (91%) |

$0.00 (0%) |

|

YTD 2024 |

$0.54 |

$0.13 (24%) |

$0.00 (0%) |

$0.41 (76%) |

$0.00 (0%) |

Fund Performance and Distribution Rate Information:

|

Average Annual Total Return (on NAV for the 5-year period ended on

July 31, 2024)1 |

Annualized Current Distribution Rate (expressed as apercentage of

NAV as of July 31, 2024) 2 |

Cumulative Total Return (on NAV for the fiscal year through July

31, 2024) 1 |

Cumulative Fiscal Year Distribution Rate (as a percentage of NAV as

of July 31, 2024) 3 |

|

15.2% |

7.4 |

% |

15.9 |

% |

2.3 |

% |

1 Total return is calculated assuming a purchase of a Fund share

at the beginning of the period and a sale on the last day of the

period at reported net asset value per share, excluding any

brokerage commissions. Distributions are assumed to be reinvested

at the price received in the Fund’s dividend reinvestment plan. For

periods greater than one year, returns are presented on an

annualized basis.

2 The annualized Current Distribution Rate is the current

quarter’s distribution rate per share annualized and expressed as a

percentage of the Fund’s NAV per share as of July 31, 2024.3 The

Cumulative Fiscal Year Distribution Rate is the distributions per

share for the fiscal year period (January 1, 2024 to July 31,

2024), expressed as a percentage of the Fund’s NAV per share as of

July 31, 2024.

You should not draw any conclusions about the Fund's

investment performance from the amount of the current distribution

or from the terms of the Fund's Distribution Policy. The amounts

and sources of distributions reported herein are only estimates and

are not being provided for tax reporting purposes. The actual

amounts and sources of the amounts for tax reporting purposes will

depend upon the Fund's investment experience during the remainder

of its fiscal year and may be subject to changes based on tax

regulations. The Fund will send you a Form 1099-DIV for the

calendar year that will tell you how to report these distributions

for federal income tax purposes.

The Fund has paid out capital gains to its shareholders for more

than 60 consecutive years and has paid dividends for more than 89

consecutive years.

Adams Funds

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 85 years across many

market cycles. The Funds are committed to paying an annual

distribution rate of 8% of NAV or more, providing reliable income

to long-term investors. Shares can be purchased through our

transfer agent or through a broker. For more information about

Adams Funds, please

visit: adamsfunds.com.

For further information please

contact:adamsfunds.com/about/contact800.638.2479

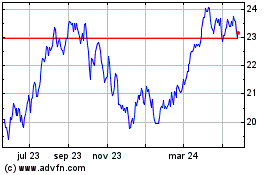

Adams Natural Resources (NYSE:PEO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

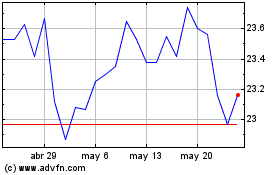

Adams Natural Resources (NYSE:PEO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024