false 0001464423 0001464423 2024-10-22 2024-10-22 0001464423 us-gaap:CommonStockMember 2024-10-22 2024-10-22 0001464423 us-gaap:SeriesAPreferredStockMember 2024-10-22 2024-10-22 0001464423 us-gaap:SeriesBPreferredStockMember 2024-10-22 2024-10-22 0001464423 us-gaap:SeriesCPreferredStockMember 2024-10-22 2024-10-22 0001464423 us-gaap:SeniorNotesMember 2024-10-22 2024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 22, 2024

PennyMac Mortgage Investment Trust

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

001-34416 |

|

27-0186273 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

| 3043 Townsgate Road, Westlake Village, California |

|

91361 |

| (Address of principal executive offices) |

|

(Zip Code) |

(818) 224-7442

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares of Beneficial Interest, $0.01 par value |

|

PMT |

|

New York Stock Exchange |

| 8.125% Series A Cumulative Redeemable Preferred Shares of Beneficial Interest, $0.01 par value |

|

PMT/PA |

|

New York Stock Exchange |

| 8.00% Series B Cumulative Redeemable Preferred Shares of Beneficial Interest, $0.01 par value |

|

PMT/PB |

|

New York Stock Exchange |

| 6.75% Series C Cumulative Redeemable Preferred Shares of Beneficial Interest, $0.01 par value |

|

PMT/PC |

|

New York Stock Exchange |

| 8.50% Senior Note Due 2028 |

|

PMTU |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On October 22, 2024, PennyMac Mortgage Investment Trust (the “Company”) issued a press release and a slide presentation announcing its financial results for the fiscal quarter ended September 30, 2024. A copy of the press release and the slide presentation used in connection with the Company’s presentation of financial results were made available on October 22, 2024 and are furnished as Exhibits 99.1 and Exhibit 99.2, respectively. In addition, the Company has made available other supplemental financial information for the fiscal quarter ended September 30, 2024 on its website at pmt.pennymac.com.

The information in Item 2.02 of this report, including the exhibits hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated by reference into any disclosure document relating to the Company, except to the extent, if any, expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PENNYMAC MORTGAGE INVESTMENT TRUST |

|

|

|

|

| Dated: October 22, 2024 |

|

|

|

|

|

/s/ Daniel S. Perotti |

| |

|

|

|

|

|

Daniel S. Perotti Senior Managing Director and Chief Financial Officer |

Exhibit 99.1

PennyMac Mortgage Investment Trust Reports

Third Quarter 2024 Results

WESTLAKE

VILLAGE, Calif. – October 22, 2024 – PennyMac Mortgage Investment Trust (NYSE: PMT) today reported net income attributable to common shareholders of $31.0 million, or $0.36 per common share on a diluted basis

for the third quarter of 2024, on net investment income of $80.9 million. PMT previously announced a cash dividend for the third quarter of 2024 of $0.40 per common share of beneficial interest, which was declared on September 19, 2024,

and will be paid on October 25, 2024, to common shareholders of record as of October 11, 2024.

Third Quarter 2024 Highlights

Financial results:

| |

• |

|

Net income attributable to common shareholders of $31.0 million; annualized return on average common equity

of 9%1 |

| |

• |

|

Solid levels of income excluding market-driven fair value changes bolstered by fair value changes including

associated tax benefits |

| |

• |

|

Book value per common share decreased slightly to $15.85 at September 30, 2024, from $15.89 at June 30,

2024 |

Other investment highlights:

| |

• |

|

Investment activity driven by correspondent production volumes |

| |

• |

|

Conventional correspondent loan production volumes for PMT’s account totaled $5.9 billion in unpaid

principal balance (UPB), up 167 percent from the prior quarter as PMT retained a higher percentage of total conventional loans acquired |

| 1 |

Return on average common equity is calculated based on net income attributable to common shareholders as a

percentage of monthly average common equity during the quarter |

1

| |

• |

|

Resulted in the creation of $88 million in new mortgage servicing rights (MSRs), up from $41 million in the

prior quarter |

| |

• |

|

Redeemed $305 million of MSR term notes priced at SOFR plus 419 basis points scheduled to mature in 2027

with proceeds from a recent MSR term note issuance priced at SOFR plus 275 basis points |

| |

• |

|

Issued $159 million of new, 4-year CRT term notes in August which

refinanced $152 million of notes due to mature in 2025 |

“PMT’s third quarter financial results reflect solid levels of

income excluding market driven value changes bolstered by fair value changes including associated tax benefits” said Chairman and CEO David Spector. “We increased the amount of conventional mortgage production retained this quarter, which

drove strong results in the segment as well as the creation of nearly $90 million in new mortgage servicing rights investments. We also continue to focus on our balance sheet, replacing previously-issued MSR term notes with new term notes at a

lower spread; to that end we also issued new, 4-year CRT term notes to refinance similar notes that were originally scheduled to mature in 2025.”

Mr. Spector continued, “PMT’s synergistic relationship with its manager and services provider, PFSI, has proven to be a competitive advantage,

allowing for significant flexibility across different rate environments. Pennymac has become a top producer of mortgage loans with recent growth in originations of loan products that have strong demand from investors outside of the Agencies.

Combined with our capital markets expertise and long-standing relationships with banks, asset managers and institutional investors, I believe PMT is well-positioned to participate meaningfully in private label securitizations and the creation of

organic investments from its own production as the landscape evolves.”

2

The following table presents the contributions of PMT’s segments, consisting of Credit Sensitive

Strategies, Interest Rate Sensitive Strategies, Correspondent Production, and Corporate:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter ended Sep 30, 2024 |

|

Credit sensitive

strategies |

|

|

Interest rate sensitive

strategies |

|

|

Correspondent

production |

|

|

Corporate |

|

|

Total |

|

| |

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

| Net investment income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net gains (losses) on investments and financings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage-backed securities |

|

$ |

559 |

|

|

$ |

122,874 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

123,433 |

|

| Loans at fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Held by VIEs |

|

|

5,730 |

|

|

|

(3,292 |

) |

|

|

— |

|

|

|

— |

|

|

|

2,438 |

|

| Distressed |

|

|

(10 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10 |

) |

| CRT investments |

|

|

20,834 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

20,834 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27,113 |

|

|

|

119,582 |

|

|

|

— |

|

|

|

— |

|

|

|

146,695 |

|

| Net gains on loans acquired for sale |

|

|

— |

|

|

|

— |

|

|

|

20,059 |

|

|

|

— |

|

|

|

20,059 |

|

| Net loan servicing fees |

|

|

— |

|

|

|

(85,080 |

) |

|

|

— |

|

|

|

— |

|

|

|

(85,080 |

) |

| Net interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

21,389 |

|

|

|

128,458 |

|

|

|

23,853 |

|

|

|

3,034 |

|

|

|

176,734 |

|

| Interest expense |

|

|

21,921 |

|

|

|

136,873 |

|

|

|

24,273 |

|

|

|

1,104 |

|

|

|

184,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(532 |

) |

|

|

(8,415 |

) |

|

|

(420 |

) |

|

|

1,930 |

|

|

|

(7,437 |

) |

| Other |

|

|

(65 |

) |

|

|

— |

|

|

|

6,692 |

|

|

|

— |

|

|

|

6,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26,516 |

|

|

|

26,087 |

|

|

|

26,331 |

|

|

|

1,930 |

|

|

|

80,864 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan fulfillment and servicing fees payable to PennyMac Financial Services, Inc. |

|

|

20 |

|

|

|

22,220 |

|

|

|

11,492 |

|

|

|

— |

|

|

|

33,732 |

|

| Management fees payable to PennyMac Financial Services, Inc. |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,153 |

|

|

|

7,153 |

|

| Other |

|

|

47 |

|

|

|

3,376 |

|

|

|

1,590 |

|

|

|

8,432 |

|

|

|

13,445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

67 |

|

|

$ |

25,596 |

|

|

$ |

13,082 |

|

|

$ |

15,585 |

|

|

$ |

54,330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pretax income (loss) |

|

$ |

26,449 |

|

|

$ |

491 |

|

|

$ |

13,249 |

|

|

$ |

(13,655 |

) |

|

$ |

26,534 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Sensitive Strategies Segment

The Credit Sensitive Strategies segment primarily includes results from PMT’s organically-created GSE CRT investments, opportunistic investments in other

GSE CRT, investments in non-agency subordinate bonds from private-label securitizations of PMT’s production and legacy investments. Pretax income for the segment was $26.4 million on net investment

income of $26.5 million, compared to pretax income of $15.7 million on net investment income of $15.8 million in the prior quarter.

Net

gains on investments in the segment were $27.1 million, compared to $17.4 million in the prior quarter. These net gains include $20.8 million of gains on PMT’s organically-created GSE CRT investments, $5.7 million of gains

on investments from non-agency subordinate bonds from PMT’s production and $0.6 million in gains on other acquired subordinate CRT mortgage-backed securities (MBS).

3

Net gains on PMT’s organically-created CRT investments for the quarter were $20.8 million,

compared to $16.6 million in the prior quarter. These net gains include $6.6 million in valuation-related gains, up from $1.7 million in the prior quarter. Net gains on PMT’s organically-created CRT investments also included

$15.0 million in realized gains and carry, compared to $15.1 million in the prior quarter. Realized losses during the quarter were $0.8 million.

Net interest expense for the segment was $0.5 million, compared to 1.3 million in the prior quarter. Interest income totaled $21.4 million,

down slightly from the prior quarter, and interest expense totaled $21.9 million, down from $24.3 million in the prior quarter.

Interest

Rate Sensitive Strategies Segment

The Interest Rate Sensitive Strategies segment includes results from investments in MSRs, Agency MBS, non-Agency senior MBS and interest rate hedges. Pretax income for the segment was $0.5 million on net investment income of $26.1 million, compared to a pretax income of $16.9 million on net investment

income of $39.1 million in the prior quarter. The segment includes investments that typically have offsetting fair value exposures to changes in interest rates. For example, in a period with decreasing interest rates, MSRs are expected to

decrease in fair value, whereas Agency pass-through and non-Agency senior MBS are expected to increase in fair value.

The results in the Interest Rate Sensitive Strategies segment consist of net gains and losses on investments, net interest income and net loan servicing fees,

as well as associated expenses.

Net gains on investments for the segment were $119.6 million, which primarily consisted of gains on MBS due to lower

interest rates.

Losses from net loan servicing fees were $85.1 million, compared to $96.5 million of net loan servicing fees in the prior

quarter. Net loan servicing fees included contractually specified servicing fees of $162.6 million and $4.0 million in other fees, reduced by $100.6 million in realization of MSR cash flows, which was up slightly from the prior

quarter. Net loan servicing fees also included $84.3 million in fair value declines on MSRs due to lower interest rates, $67.2 million in hedging declines and $0.4 million of MSR recapture income. PMT’s hedging activities are

intended to manage its net exposure across all interest rate sensitive strategies, which include MSRs, MBS and related tax impacts.

4

The following schedule details net loan servicing fees:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter ended |

|

| |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

(in thousands) |

|

|

|

|

| From non-affiliates: |

|

|

|

|

|

|

|

|

|

|

|

|

| Contractually specified |

|

$ |

162,605 |

|

|

$ |

162,127 |

|

|

$ |

166,809 |

|

| Other fees |

|

|

4,012 |

|

|

|

2,815 |

|

|

|

3,752 |

|

| Effect of MSRs: |

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair value |

|

|

|

|

|

|

|

|

|

|

|

|

| Realization of cashflows |

|

|

(100,612 |

) |

|

|

(96,595 |

) |

|

|

(102,213 |

) |

| Market changes |

|

|

(84,306 |

) |

|

|

46,039 |

|

|

|

263,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(184,918 |

) |

|

|

(50,556 |

) |

|

|

160,926 |

|

| Hedging results |

|

|

(67,220 |

) |

|

|

(18,365 |

) |

|

|

(50,689 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(252,138 |

) |

|

|

(68,921 |

) |

|

|

110,237 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net servicing fees from non-affiliate |

|

|

(85,521 |

) |

|

|

96,021 |

|

|

|

280,798 |

|

| From PFSI—MSR recapture income |

|

|

441 |

|

|

|

473 |

|

|

|

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loan servicing fees |

|

$ |

(85,080 |

) |

|

$ |

96,494 |

|

|

$ |

281,298 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest expense for the segment was $8.4 million versus $20.3 million in the prior quarter. Interest income

totaled $128.5 million, up from $111.3 million in the prior quarter due to higher interest income on MBS and earnings on custodial balances due to higher average balances. Interest expense totaled $136.9 million, up from

$131.6 million the prior quarter.

Segment expenses were $25.6 million, up from $22.2 million in the prior quarter.

Correspondent Production Segment

PMT acquires newly

originated loans from correspondent sellers and typically sells or securitizes the loans, resulting in current-period income and additions to its investments in MSRs related to a portion of its production. PMT’s Correspondent Production segment

generated pretax income of $13.2 million in the third quarter, up from $9.6 million in the prior quarter.

5

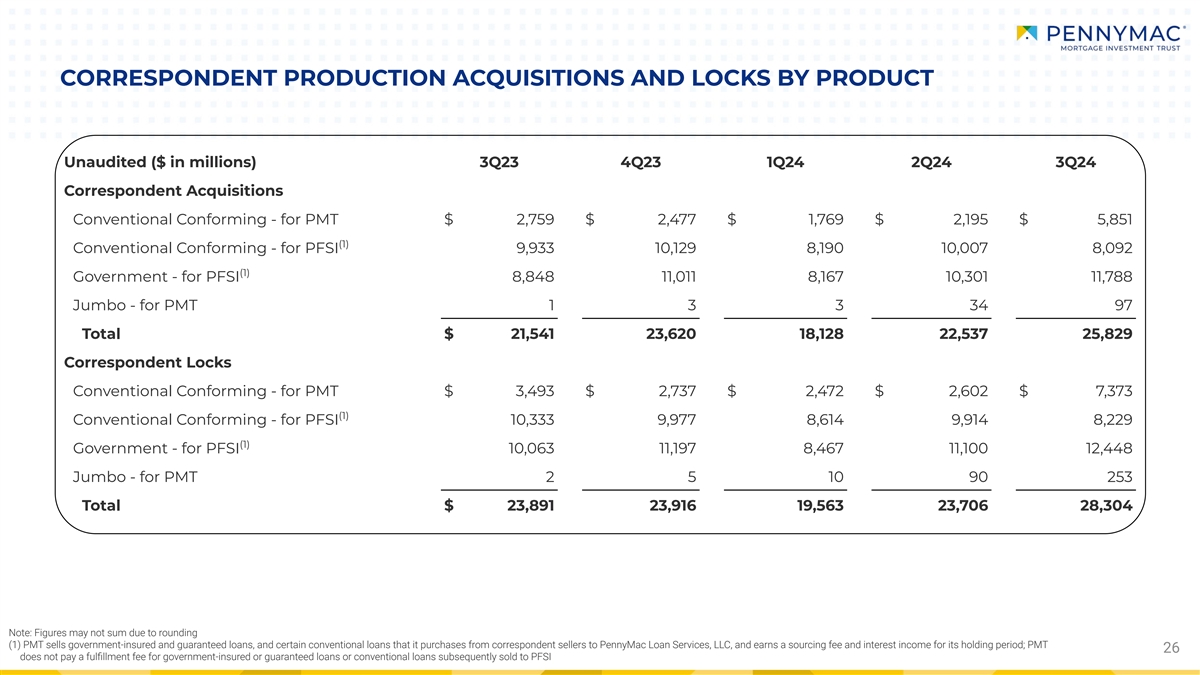

Through its correspondent production activities, PMT acquired a total of $25.8 billion in UPB of loans,

up 15 percent from the prior quarter and 20 percent from the third quarter of 2023. Of total correspondent acquisitions, government-insured or guaranteed acquisitions totaled $11.8 billion, up 14 percent from the prior quarter,

while conventional and jumbo acquisitions totaled $14.0 billion, up 15 percent from the prior quarter. $5.9 billion of conventional conforming volume was for PMT’s account, up 167 percent from the prior quarter due to PMT

retaining a larger percentage of the total conventional correspondent production. The percentage of total conventional correspondent loan production retained by PMT is expected to be 15 to 25 percent in the fourth quarter in order to optimize

PMT’s capital allocation. Interest rate lock commitments on conventional and jumbo loans for PMT’s account totaled $7.6 billion, up 183 percent from the prior quarter.

Segment revenues were $26.3 million and included net gains on loans acquired for sale of $20.1 million, other income of $6.7 million, which

primarily consists of volume-based origination fees, and net interest expense of $0.4 million. Net gains on loans acquired for sale increased $7.9 million from the prior quarter, primarily due to higher volumes. Interest income was

$23.9 million, up from $14.9 million in the prior quarter, and interest expense was $24.3 million, up from $15.0 million in the prior quarter, both due to higher volumes.

Segment expenses were $13.1 million, up from $5.0 million the prior quarter primarily due to increased fulfillment fees as a result of higher

volumes for PMT’s account. The weighted average fulfillment fee rate in the third quarter was 19 basis points, down from 20 basis points in the prior quarter.

Corporate Segment

The Corporate segment includes

interest income from cash and short-term investments, management fees, and corporate expenses.

Segment revenues were $1.9 million, up slightly from

the prior quarter. Management fees were $7.2 million, and other segment expenses were $8.4 million.

Taxes

PMT recorded a tax benefit of $14.9 million, driven primarily by fair value declines on MSRs and interest rate hedges held in PMT’s taxable

subsidiary.

***

6

Management’s slide presentation and accompanying materials will be available in the Investor Relations

section of the Company’s website at pmt.pennymac.com after the market closes on Tuesday, October 22, 2024. Management will also host a conference call and live audio webcast at 6:00 p.m. Eastern Time to review the Company’s

financial results. The webcast can be accessed at pmt.pennymac.com, and a replay will be available shortly after its conclusion.

Individuals who

are unable to access the website but would like to receive a copy of the materials should contact the Company’s Investor Relations department at 818.224.7028.

About PennyMac Mortgage Investment Trust

PennyMac

Mortgage Investment Trust is a mortgage real estate investment trust (REIT) that invests primarily in residential mortgage loans and mortgage-related assets. PMT is externally managed by PNMAC Capital Management, LLC, a wholly-owned subsidiary of

PennyMac Financial Services, Inc. (NYSE: PFSI). Additional information about PennyMac Mortgage Investment Trust is available at pmt.pennymac.com.

|

|

|

| Media |

|

Investors |

|

|

| Kristyn Clark |

|

Kevin Chamberlain |

|

|

| mediarelations@pennymac.com |

|

Isaac Garden |

|

|

| 805.225.8224 |

|

investorrelations@pennymac.com |

|

|

|

|

818.224.7028 |

7

Forward-Looking Statements

Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things,

the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,”

“anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or

“may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein and from past results discussed herein. Factors which could cause

actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in interest rates; the Company’s ability to comply with various federal, state and local laws and regulations that govern

its business; volatility in the Company’s industry, the debt or equity markets, the general economy or the real estate finance and real estate markets; events or circumstances which undermine confidence in the financial and housing markets or

otherwise have a broad impact on financial and housing markets; changes in real estate values, housing prices and housing sales; changes in macroeconomic, consumer and real estate market conditions; the degree and nature of the Company’s

competition; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in mortgage loans and mortgage-related assets that satisfy the Company’s investment objectives; the inherent difficulty in winning

bids to acquire mortgage loans, and the Company’s success in doing so; the concentration of credit risks to which the Company is exposed; the Company’s dependence on its manager and servicer, potential conflicts of interest with such

entities and their affiliates, and the performance of such entities; changes in personnel and lack of availability of qualified personnel at its manager, servicer or their affiliates; our ability to mitigate cybersecurity risks, cybersecurity

incidents and technology disruptions; the availability, terms and deployment of short-term and long-term capital; the adequacy of the Company’s cash reserves and working capital; the Company’s ability to maintain the desired relationship

between its financing and the interest rates and maturities of its assets; the timing and amount of cash flows, if any, from the Company’s investments; our substantial amount of indebtedness; the performance, financial condition and liquidity

of borrowers; our exposure to risks of loss and disruptions in operations resulting from severe weather events, man-made or other natural conditions, including climate change and pandemics; the ability of the

Company’s servicer, which also provides the Company with fulfillment services, to approve and monitor correspondent sellers and underwrite loans to investor standards; incomplete or inaccurate information or documentation provided by customers

or counterparties, or adverse changes in the financial condition of the Company’s customers and counterparties; the Company’s indemnification and repurchase obligations in connection with mortgage loans it purchases and later sells or

securitizes; the quality and enforceability of the collateral documentation evidencing the Company’s ownership and rights in the assets in which it invests; increased rates of delinquency, defaults and forbearances and/or decreased recovery

rates on the Company’s investments; the performance of mortgage loans underlying mortgage-backed securities in which the Company retains credit risk; the Company’s ability to foreclose on its investments in a timely manner or at all;

increased prepayments of the mortgages and other loans underlying the Company’s mortgage-backed securities or relating to the Company’s mortgage servicing rights and other investments; the degree to which the Company’s hedging

strategies may or may not protect it from interest rate volatility; the effect of the accuracy of or changes in the estimates the Company makes about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon

the Company’s financial condition and results of operations; the Company’s ability to maintain appropriate internal control over financial reporting; the Company’s ability to detect misconduct and fraud; developments in the secondary

markets for the Company’s mortgage loan products; legislative

8

and regulatory changes that impact the mortgage loan industry or housing market; regulatory or other changes

that impact government agencies or government-sponsored entities, or such changes that increase the cost of doing business with such agencies or entities; the Consumer Financial Protection Bureau and its issued and future rules and the enforcement

thereof; changes in government support of homeownership; changes in government or government-sponsored home affordability programs; changes in the Company’s investment objectives or investment or operational strategies, including any new lines

of business or new products and services that may subject it to additional risks; limitations imposed on the Company’s business and its ability to satisfy complex rules for it to qualify as a REIT for U.S. federal income tax purposes and

qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of the Company’s subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes; changes in governmental

regulations, accounting treatment, tax rates and similar matters; the Company’s ability to make distributions to its shareholders in the future; the Company’s failure to deal appropriately with issues that may give rise to reputational

risk; and the Company’s organizational structure and certain requirements in its charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as

well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or

any other information contained herein, and the statements made in this press release are current as of the date of this release only.

9

PENNYMAC MORTGAGE INVESTMENT TRUST AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands except share amounts) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash |

|

$ |

344,358 |

|

|

$ |

130,734 |

|

|

$ |

236,396 |

|

| Short-term investments at fair value |

|

|

102,787 |

|

|

|

336,296 |

|

|

|

150,059 |

|

| Mortgage-backed securities at fair value |

|

|

4,182,382 |

|

|

|

4,068,337 |

|

|

|

4,665,970 |

|

| Loans acquired for sale at fair value |

|

|

1,665,796 |

|

|

|

694,391 |

|

|

|

1,025,730 |

|

| Loans at fair value |

|

|

1,429,525 |

|

|

|

1,377,836 |

|

|

|

1,372,118 |

|

| Derivative assets |

|

|

81,844 |

|

|

|

90,753 |

|

|

|

29,750 |

|

| Deposits securing credit risk transfer arrangements |

|

|

1,135,447 |

|

|

|

1,163,268 |

|

|

|

1,237,294 |

|

| Mortgage servicing rights at fair value |

|

|

3,809,047 |

|

|

|

3,941,861 |

|

|

|

4,108,661 |

|

| Servicing advances |

|

|

71,124 |

|

|

|

98,989 |

|

|

|

93,614 |

|

| Due from PennyMac Financial Services, Inc. |

|

|

8,538 |

|

|

|

1 |

|

|

|

2,252 |

|

| Other |

|

|

224,806 |

|

|

|

178,484 |

|

|

|

301,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

13,055,654 |

|

|

$ |

12,080,950 |

|

|

$ |

13,223,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Assets sold under agreements to repurchase |

|

$ |

5,748,461 |

|

|

$ |

4,700,225 |

|

|

$ |

6,020,716 |

|

| Mortgage loan participation and sale agreements |

|

|

28,790 |

|

|

|

13,582 |

|

|

|

23,991 |

|

| Notes payable secured by credit risk transfer and mortgage servicing assets |

|

|

2,830,108 |

|

|

|

2,933,845 |

|

|

|

2,825,591 |

|

| Unsecured senior notes |

|

|

814,915 |

|

|

|

813,838 |

|

|

|

599,754 |

|

| Asset-backed financing of variable interest entities at fair value |

|

|

1,334,797 |

|

|

|

1,288,180 |

|

|

|

1,279,059 |

|

| Interest-only security payable at fair value |

|

|

35,098 |

|

|

|

32,708 |

|

|

|

28,288 |

|

| Derivative and credit risk transfer strip liabilities at fair value |

|

|

16,151 |

|

|

|

18,892 |

|

|

|

140,494 |

|

| Accounts payable and accrued liabilities |

|

|

114,085 |

|

|

|

126,314 |

|

|

|

92,633 |

|

| Due to PennyMac Financial Services, Inc. |

|

|

32,603 |

|

|

|

29,413 |

|

|

|

27,613 |

|

| Income taxes payable |

|

|

155,544 |

|

|

|

170,901 |

|

|

|

202,967 |

|

| Liability for losses under representations and warranties |

|

|

8,315 |

|

|

|

13,183 |

|

|

|

33,152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

11,118,867 |

|

|

|

10,141,081 |

|

|

|

11,274,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred shares of beneficial interest |

|

|

541,482 |

|

|

|

541,482 |

|

|

|

541,482 |

|

| Common shares of beneficial interest—authorized, 500,000,000 common shares of $0.01 par

value; issued and outstanding 86,860,960, 86,860,960 and 86,760,408 common shares, respectively |

|

|

869 |

|

|

|

869 |

|

|

|

868 |

|

| Additional paid-in capital |

|

|

1,924,596 |

|

|

|

1,923,780 |

|

|

|

1,923,130 |

|

| Accumulated deficit |

|

|

(530,160 |

) |

|

|

(526,262 |

) |

|

|

(516,402 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

1,936,787 |

|

|

|

1,939,869 |

|

|

|

1,949,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

13,055,654 |

|

|

$ |

12,080,950 |

|

|

$ |

13,223,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

PENNYMAC MORTGAGE INVESTMENT TRUST AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Quarterly Periods Ended |

|

| |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

| Investment Income |

|

|

|

|

|

|

|

|

|

|

|

|

| Net gains (losses) on investments and financings |

|

$ |

146,695 |

|

|

$ |

(19,743 |

) |

|

$ |

(109,544 |

) |

| Net gains on loans acquired for sale |

|

|

20,059 |

|

|

|

12,160 |

|

|

|

13,558 |

|

| Loan origination fees |

|

|

6,640 |

|

|

|

2,451 |

|

|

|

3,226 |

|

| Net loan servicing fees: |

|

|

|

|

|

|

|

|

|

|

|

|

| From nonaffiliates |

|

|

|

|

|

|

|

|

|

|

|

|

| Servicing fees |

|

|

166,617 |

|

|

|

164,942 |

|

|

|

170,561 |

|

| Change in fair value of mortgage servicing rights |

|

|

(184,918 |

) |

|

|

(50,556 |

) |

|

|

160,926 |

|

| Hedging results |

|

|

(67,220 |

) |

|

|

(18,365 |

) |

|

|

(50,689 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(85,521 |

) |

|

|

96,021 |

|

|

|

280,798 |

|

| From PennyMac Financial Services, Inc. |

|

|

441 |

|

|

|

473 |

|

|

|

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(85,080 |

) |

|

|

96,494 |

|

|

|

281,298 |

|

| Interest income |

|

|

176,734 |

|

|

|

151,835 |

|

|

|

158,926 |

|

| Interest expense |

|

|

184,171 |

|

|

|

171,841 |

|

|

|

183,918 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest expense |

|

|

(7,437 |

) |

|

|

(20,006 |

) |

|

|

(24,992 |

) |

| Other |

|

|

(13 |

) |

|

|

(158 |

) |

|

|

(117 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

80,864 |

|

|

|

71,198 |

|

|

|

163,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Earned by PennyMac Financial Services, Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

| Loan servicing fees |

|

|

22,240 |

|

|

|

20,264 |

|

|

|

20,257 |

|

| Management fees |

|

|

7,153 |

|

|

|

7,133 |

|

|

|

7,175 |

|

| Loan fulfillment fees |

|

|

11,492 |

|

|

|

4,427 |

|

|

|

5,531 |

|

| Professional services |

|

|

2,614 |

|

|

|

2,366 |

|

|

|

2,133 |

|

| Compensation |

|

|

1,326 |

|

|

|

1,369 |

|

|

|

1,961 |

|

| Loan collection and liquidation |

|

|

2,257 |

|

|

|

671 |

|

|

|

1,890 |

|

| Safekeeping |

|

|

1,174 |

|

|

|

961 |

|

|

|

467 |

|

| Loan origination |

|

|

1,408 |

|

|

|

533 |

|

|

|

710 |

|

| Other |

|

|

4,666 |

|

|

|

4,865 |

|

|

|

4,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

|

54,330 |

|

|

|

42,589 |

|

|

|

45,009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before (benefit from) provision for income taxes |

|

|

26,534 |

|

|

|

28,609 |

|

|

|

118,420 |

|

| (Benefit from) provision for income taxes |

|

|

(14,873 |

) |

|

|

3,175 |

|

|

|

56,998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

41,407 |

|

|

|

25,434 |

|

|

|

61,422 |

|

| Dividends on preferred shares |

|

|

10,455 |

|

|

|

10,454 |

|

|

|

10,455 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common shareholders |

|

$ |

30,952 |

|

|

$ |

14,980 |

|

|

$ |

50,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.36 |

|

|

$ |

0.17 |

|

|

$ |

0.59 |

|

| Diluted |

|

$ |

0.36 |

|

|

$ |

0.17 |

|

|

$ |

0.51 |

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

86,861 |

|

|

|

86,849 |

|

|

|

86,760 |

|

| Diluted |

|

|

86,861 |

|

|

|

86,849 |

|

|

|

111,088 |

|

11

Exhibit 99.2 3Q24 EARNINGS REPORT PennyMac Mortgage Investment Trust

October 2024

FORWARD LOOKING STATEMENTS This presentation contains forward-looking

statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial

results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,”

“promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may”

are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein and from past results discussed herein. These forward-looking statements include, but

are not limited to, statements regarding future changes in interest rates, housing, and prepayment rates; future loan originations and production; future loan delinquencies, defaults and forbearances; future investment and hedge expenses; future

investment strategies, future earnings and return on equity as well as other business and financial expectations. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not

limited to: changes in interest rates; the Company’s ability to comply with various federal, state and local laws and regulations that govern its business; the general economy or the real estate finance and real estate markets; events or

circumstances which undermine confidence in the financial and housing markets or otherwise have a broad impact on financial and housing markets; changes in real estate values, housing prices and housing sales; changes in

macroeconomic, consumer and real estate market conditions; the degree and nature of the Company’s competition; the availability of, and level of competition for, attractive risk adjusted investment opportunities in mortgage loans and mortgage

related assets that satisfy the Company’s investment objectives; the inherent difficulty in winning bids to acquire mortgage loans, and the Company’s success in doing so; the concentration of credit risks to which the Company is

exposed; the Company’s dependence on its manager and servicer, potential conflicts of interest with such entities and their affiliates, and the performance of such entities; changes in personnel and lack of availability of

qualified personnel at its manager, servicer or their affiliates; our ability to mitigate cybersecurity risks, cybersecurity incidents and technology disruptions; the availability, terms and deployment of short term and long term capital;

the adequacy of the Company’s cash reserves and working capital; the Company’s ability to maintain the desired relationship between its financing and the interest rates and maturities of its assets; the timing and amount of cash

flows, if any, from the Company’ s investments; our substantial amount of indebtedness; the performance, financial condition and liquidity of borrowers; our exposure to risks of loss and disruptions in operations resulting from

severe weather events, man-made or other natural conditions, including climate change and pandemics; the ability of the Company’s servicer, which also provides the Company with fulfillment services, to approve and monitor correspondent

sellers and underwrite loans to investor standards; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of the Company’s customers and

counterparties; the Company’s indemnification and repurchase obligations in connection with mortgage loans it purchases and later sells or securitizes; the quality and enforceability of the collateral documentation evidencing the

Company’ s ownership and rights in the assets in which it invests; increased rates of delinquency, defaults and forbearances and/or decreased recovery rates on the Company’s investments; the performance of mortgage loans underlying

mortgage backed securities in which the Company retains credit risk; the Company’s ability to foreclose on its investments in a timely manner or at all; increased prepayments of the mortgages and other loans underlying the Company’s

mortgage backed securities or relating to the Company’s mortgage servicing rights and other investments; the degree to which the Company’s hedging strategies may or may not protect it from interest rate volatility; the effect of the

accuracy of or changes in the estimates the Company makes about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon the Company’s financial condition and results of operations; the

Company’s ability to maintain appropriate internal control over financial reporting; the Company’s ability to detect misconduct and fraud; developments in the secondary markets for the Company’s mortgage loan products;

legislative and regulatory changes that impact the mortgage loan industry or housing market regulatory or other changes that impact government agencies or government sponsored entities, or such changes that increase the cost of doing business with

such agencies or entities; the Consumer Financial Protection Bureau and its issued and future rules and the enforcement thereof; changes in government support of homeownership; changes in government or government sponsored home affordability

programs; changes in the Company’s investment objectives or investment or operational strategies, including any new lines of business or new products and services that may subject it to additional risks volatility in the Company’s

industry, the debt or equity markets; limitations imposed on the Company’s business and its ability to satisfy complex rules for it to qualify as a REIT for U.S. federal income tax purposes and qualify for an exclusion from the Investment

Company Act of 1940 and the ability of certain of the Company’s subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes; changes in governmental regulations, accounting treatment, tax rates and

similar matters; the Company’s ability to make distributions to its shareholders in the future; the Company’s failure to deal appropriately with issues that may give rise to reputational risk; and the Company’s organizational

structure and certain requirements in its charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in

reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained

herein, and the statements made in this presentation are current as of the date of this presentation only. This presentation contains financial information calculated other than in accordance with U.S. generally accepted accounting principles

(“GAAP”), such as income excluding market driven value changes that provide a meaningful perspective on the Company’s business results since the Company utilizes this information to evaluate and manage the business. Non-GAAP

disclosures have limitations as an analytical tool and should not be viewed as a substitute for financial information determined in accordance with GAAP. 2

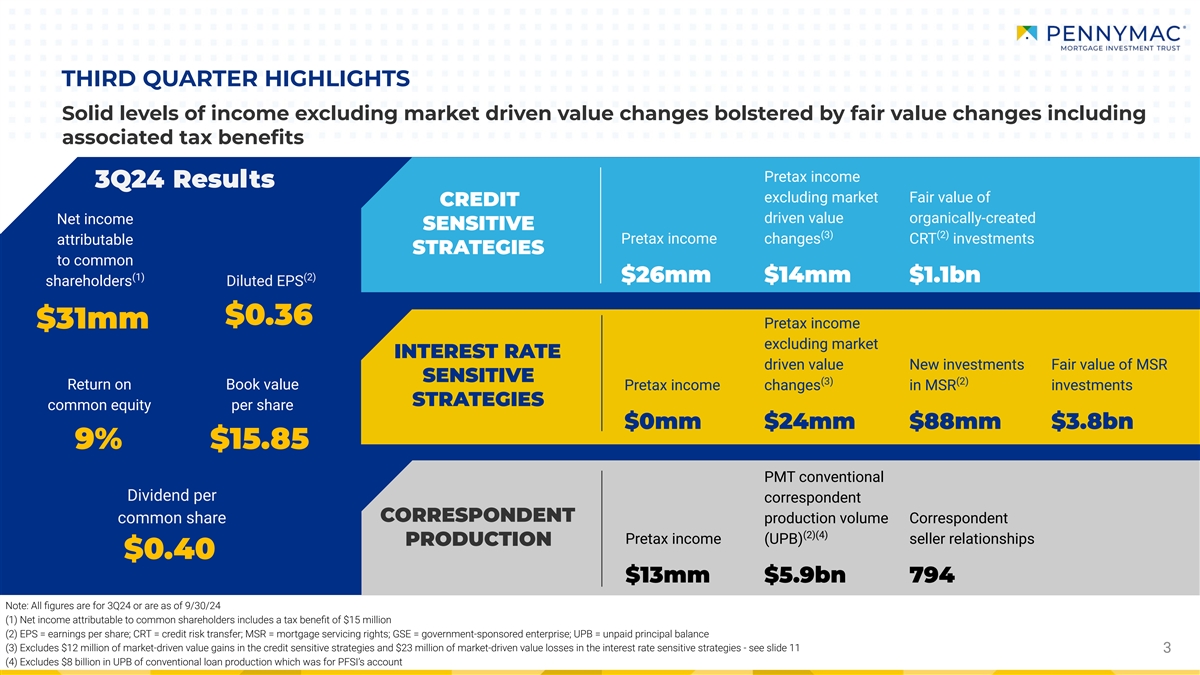

THIRD QUARTER HIGHLIGHTS Solid levels of income excluding market driven

value changes bolstered by fair value changes including associated tax benefits Pretax income 3Q24 Results excluding market Fair value of CREDIT driven value organically-created Net income SENSITIVE (3) (2) Pretax income changes CRT

investments attributable STRATEGIES to common (1) (2) $26mm $14mm $1.1bn shareholders Diluted EPS $0.36 $31mm Pretax income excluding market INTEREST RATE driven value New investments Fair value of MSR SENSITIVE (3) (2) Return on Book value Pretax

income changes in MSR investments STRATEGIES common equity per share $0mm $24mm $88mm $3.8bn 9% $15.85 PMT conventional Dividend per correspondent CORRESPONDENT common share production volume Correspondent (2)(4) Pretax income (UPB) seller

relationships PRODUCTION $0.40 $13mm $5.9bn 794 Note: All figures are for 3Q24 or are as of 9/30/24 (1) Net income attributable to common shareholders includes a tax benefit of $15 million (2) EPS = earnings per share; CRT = credit risk

transfer; MSR = mortgage servicing rights; GSE = government-sponsored enterprise; UPB = unpaid principal balance (3) Excludes $12 million of market-driven value gains in the credit sensitive strategies and $23 million of market-driven value losses

in the interest rate sensitive strategies - see slide 11 3 3 (4) Excludes $8 billion in UPB of conventional loan production which was for PFSI’s account

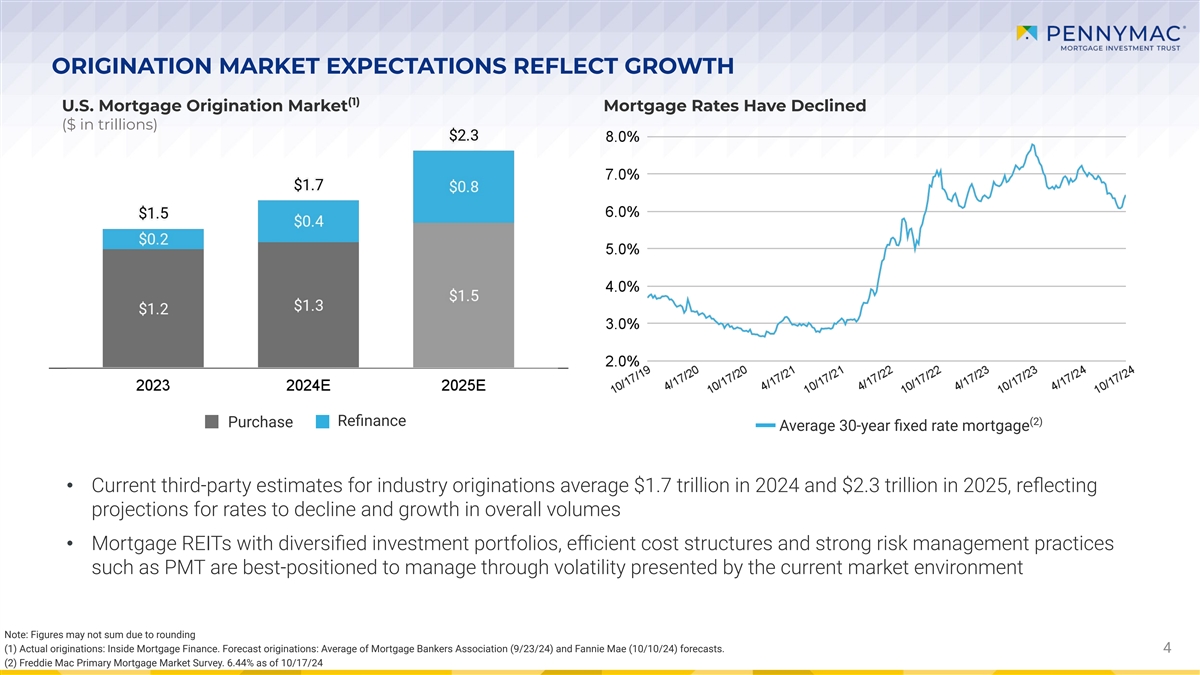

ORIGINATION MARKET EXPECTATIONS REFLECT GROWTH (1) U.S. Mortgage

Origination Market Mortgage Rates Have Declined ($ in trillions) (2) Refinance Purchase Average 30-year fixed rate mortgage • Current third-party estimates for industry originations average $1.7 trillion in 2024 and $2.3 trillion

in 2025, reflecting projections for rates to decline and growth in overall volumes • Mortgage REITs with diversified investment portfolios, efficient cost structures and strong risk management practices such as PMT are

best-positioned to manage through volatility presented by the current market environment Note: Figures may not sum due to rounding (1) Actual originations: Inside Mortgage Finance. Forecast originations: Average of Mortgage Bankers Association

(9/23/24) and Fannie Mae (10/10/24) forecasts. 4 (2) Freddie Mac Primary Mortgage Market Survey. 6.44% as of 10/17/24

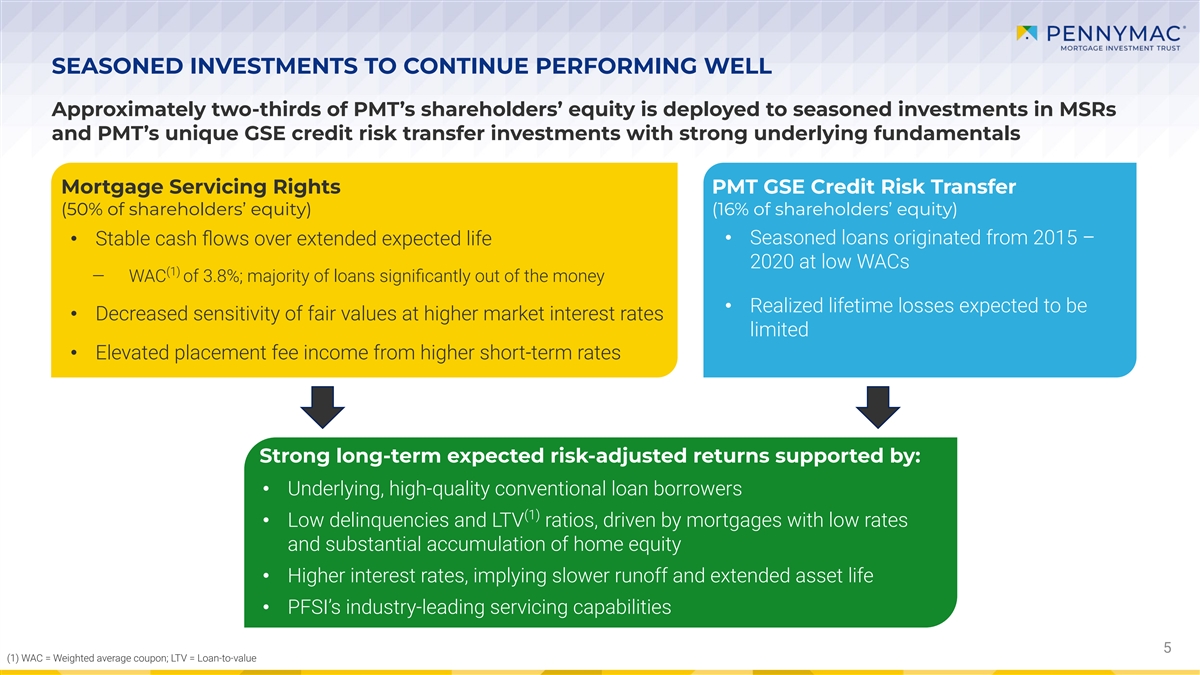

SEASONED INVESTMENTS TO CONTINUE PERFORMING WELL Approximately

two-thirds of PMT’s shareholders’ equity is deployed to seasoned investments in MSRs and PMT’s unique GSE credit risk transfer investments with strong underlying fundamentals Mortgage Servicing Rights PMT GSE Credit Risk Transfer

(50% of shareholders’ equity) (16% of shareholders’ equity) • Stable cash flows over extended expected life • Seasoned loans originated from 2015 – 2020 at low WACs (1) ‒ WAC of 3.8%; majority of loans

significantly out of the money • Realized lifetime losses expected to be • Decreased sensitivity of fair values at higher market interest rates limited • Elevated placement fee income from higher short-term rates Strong

long-term expected risk-adjusted returns supported by: • Underlying, high-quality conventional loan borrowers (1) • Low delinquencies and LTV ratios, driven by mortgages with low rates and substantial accumulation of home equity •

Higher interest rates, implying slower runoff and extended asset life • PFSI’s industry-leading servicing capabilities 5 (1) WAC = Weighted average coupon; LTV = Loan-to-value

EVOLVING LANDSCAPE DRIVING EMERGING INVESTMENT OPPORTUNITIES Top

residential mortgage loan producer and synergistic partnership with manager and services provider, PFSI Potential for increased Changing securitization activity in the mortgage private label market Access to a growing origination market via

correspondent landscape and PFSI’s direct lending channels Leading origination Strong alignment of interests with PFSI fulfilling and Volume or pricing limits for the GSEs and servicing the underlying loans investment related to certain

types of loans (i.e. platform non-owner occupied, second homes) Opportunity in non-owner occupied and other loan types to drive future securitization activity for PMT Jumbo loans increasingly originated Long-standing relationships with global banks,

asset Organic asset by non-banks versus banks creation and managers and institutional asset-backed investors investment We currently expect to close a securitization of non-owner occupied loans in 4Q24, followed by another transaction in 1Q25 6

6

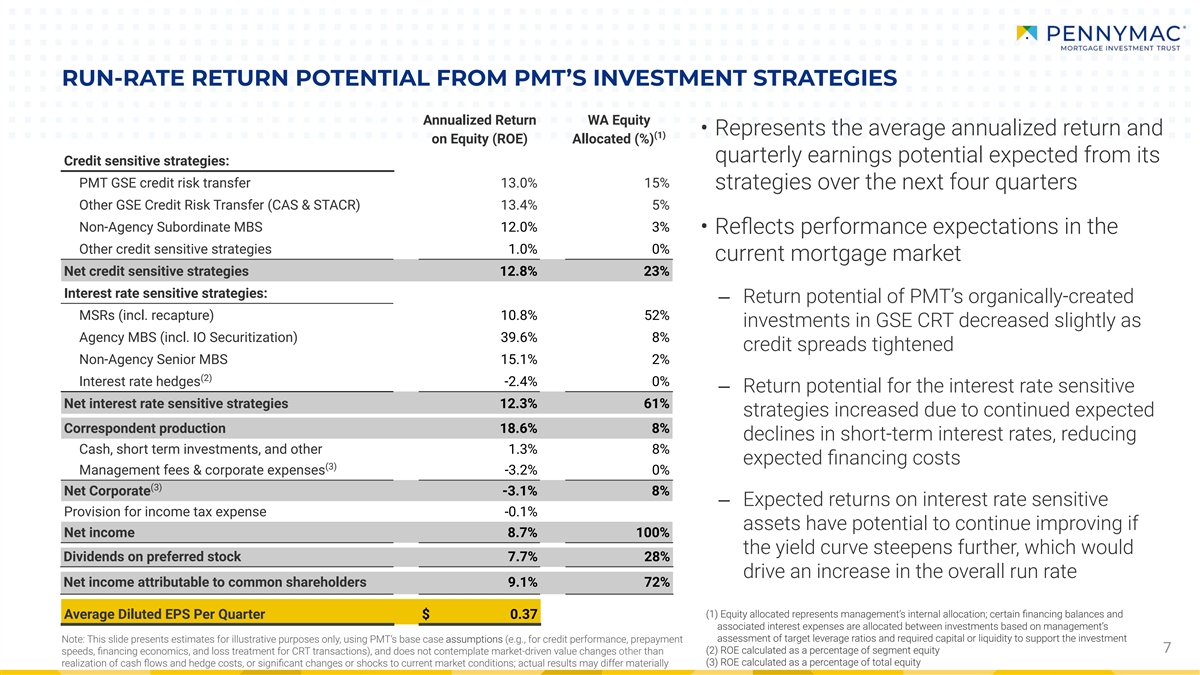

RUN-RATE RETURN POTENTIAL FROM PMT’S INVESTMENT STRATEGIES

Annualized Return WA Equity • Represents the average annualized return and (1) on Equity (ROE) Allocated (%) quarterly earnings potential expected from its Credit sensitive strategies: PMT GSE credit risk transfer 13.0% 15% strategies over the

next four quarters Other GSE Credit Risk Transfer (CAS & STACR) 13.4% 5% Non-Agency Subordinate MBS 12.0% 3% • Reflects performance expectations in the Other credit sensitive strategies 1.0% 0% current mortgage market Net credit

sensitive strategies 12.8% 23% Interest rate sensitive strategies: ‒ Return potential of PMT’s organically-created MSRs (incl. recapture) 10.8% 52% investments in GSE CRT decreased slightly as Agency MBS (incl. IO Securitization) 39.6%

8% credit spreads tightened Non-Agency Senior MBS 15.1% 2% (2) Interest rate hedges -2.4% 0% ‒ Return potential for the interest rate sensitive Net interest rate sensitive strategies 12.3% 61% strategies increased due to continued expected

Correspondent production 18.6% 8% declines in short-term interest rates, reducing Cash, short term investments, and other 1.3% 8% expected financing costs (3) Management fees & corporate expenses -3.2% 0% (3) Net Corporate -3.1% 8% ‒

Expected returns on interest rate sensitive Provision for income tax expense -0.1% assets have potential to continue improving if Net income 8.7% 100% the yield curve steepens further, which would Dividends on preferred stock 7.7% 28% drive an

increase in the overall run rate Net income attributable to common shareholders 9.1% 72% (1) Equity allocated represents management’s internal allocation; certain financing balances and Average Diluted EPS Per Quarter $ 0.37 associated

interest expenses are allocated between investments based on management’s assessment of target leverage ratios and required capital or liquidity to support the investment Note: This slide presents estimates for illustrative purposes only,

using PMT’s base case assumptions (e.g., for credit performance, prepayment 7 (2) ROE calculated as a percentage of segment equity speeds, financing economics, and loss treatment for CRT transactions), and does not contemplate

market-driven value changes other than (3) ROE calculated as a percentage of total equity realization of cash flows and hedge costs, or significant changes or shocks to current market conditions; actual results may differ materially

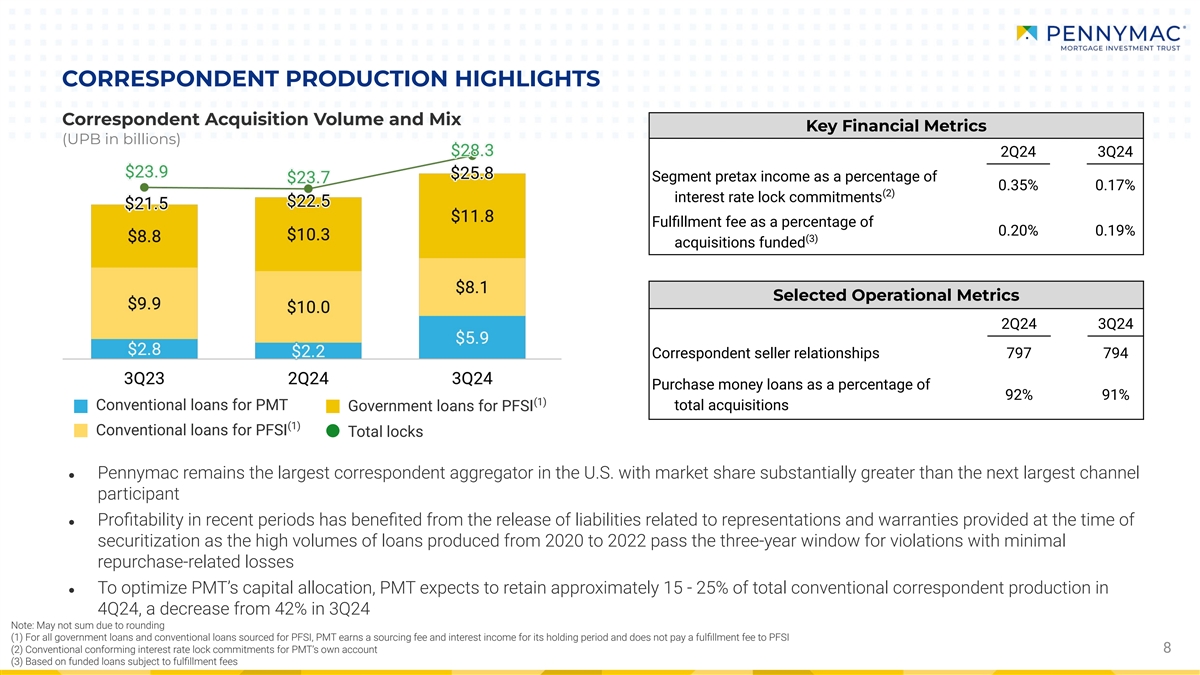

CORRESPONDENT PRODUCTION HIGHLIGHTS Correspondent Acquisition Volume and

Mix Key Financial Metrics (UPB in billions) 2Q24 3Q24 Segment pretax income as a percentage of 0.35% 0.17% (2) interest rate lock commitments Fulfillment fee as a percentage of 0.20% 0.19% (3) acquisitions funded Selected Operational Metrics

2Q24 3Q24 Correspondent seller relationships 797 794 Purchase money loans as a percentage of 92% 91% (1) Conventional loans for PMT total acquisitions Government loans for PFSI (1) Conventional loans for PFSI Total locks ● Pennymac remains the

largest correspondent aggregator in the U.S. with market share substantially greater than the next largest channel participant ● Profitability in recent periods has benefited from the release of liabilities related to

representations and warranties provided at the time of securitization as the high volumes of loans produced from 2020 to 2022 pass the three-year window for violations with minimal repurchase-related losses ● To optimize PMT’s capital

allocation, PMT expects to retain approximately 15 - 25% of total conventional correspondent production in 4Q24, a decrease from 42% in 3Q24 Note: May not sum due to rounding (1) For all government loans and conventional loans sourced for PFSI, PMT

earns a sourcing fee and interest income for its holding period and does not pay a fulfillment fee to PFSI (2) Conventional conforming interest rate lock commitments for PMT’s own account 8 (3) Based on funded loans subject to

fulfillment fees

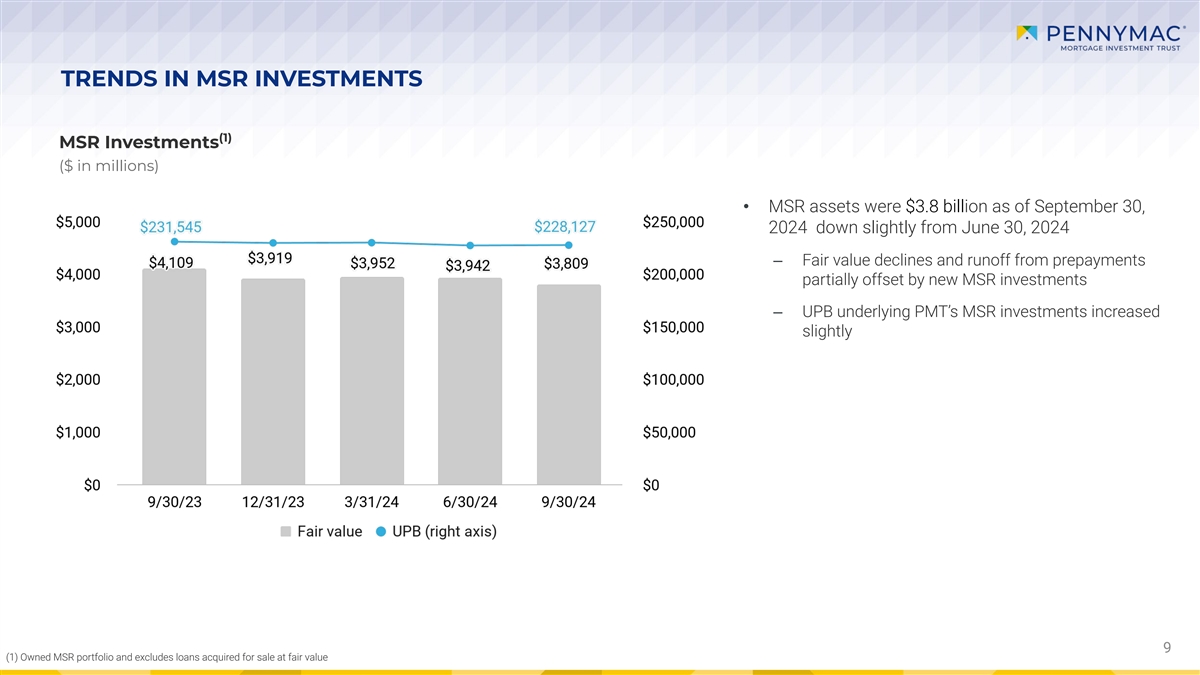

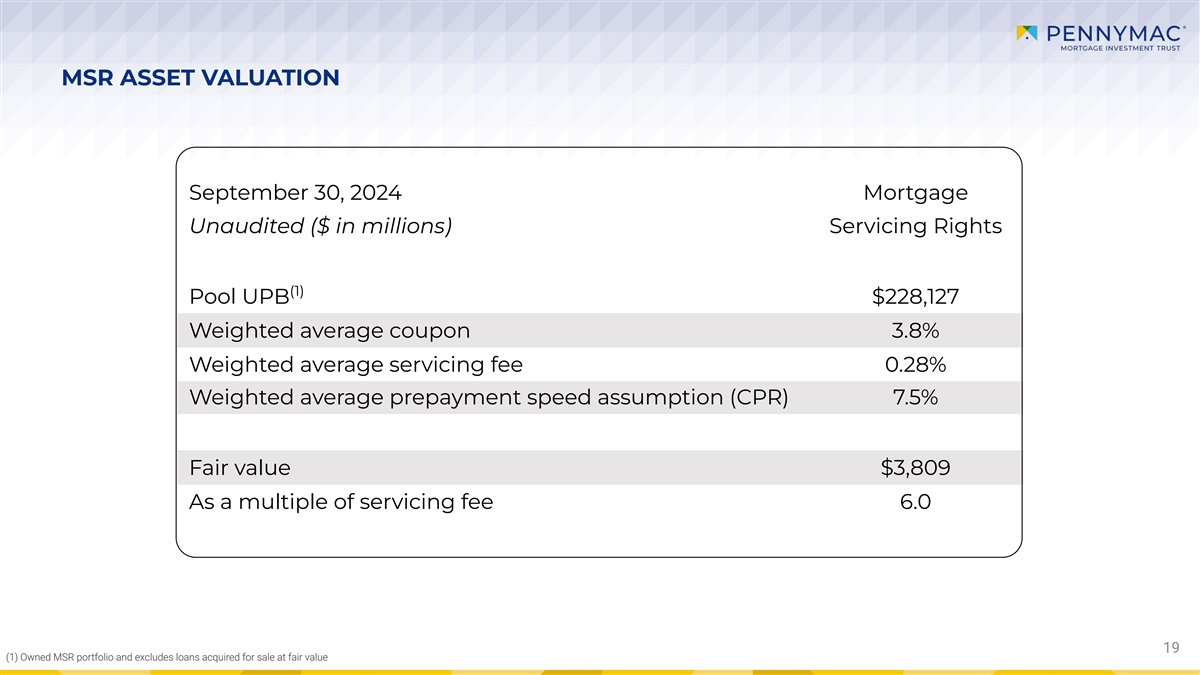

TRENDS IN MSR INVESTMENTS (1) MSR Investments ($ in millions) •

MSR assets were $3.8 billion as of September 30, 2024 down slightly from June 30, 2024 ‒ Fair value declines and runoff from prepayments partially offset by new MSR investments ‒ UPB underlying PMT’s MSR investments increased

slightly 9 (1) Owned MSR portfolio and excludes loans acquired for sale at fair value

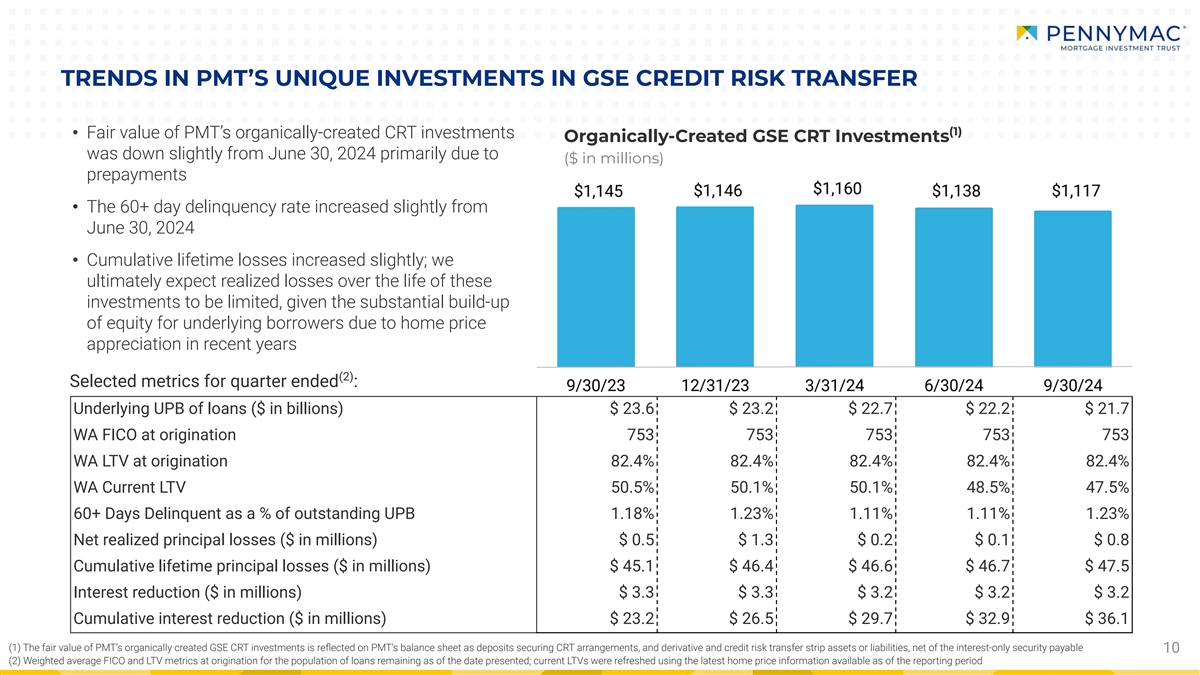

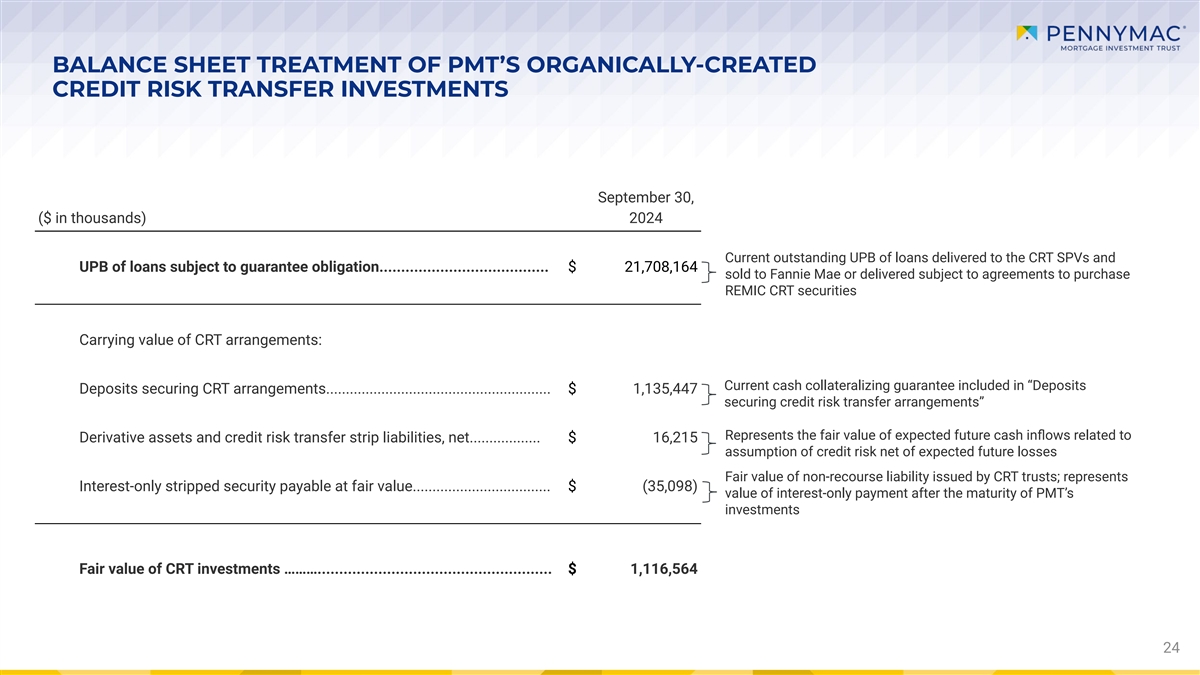

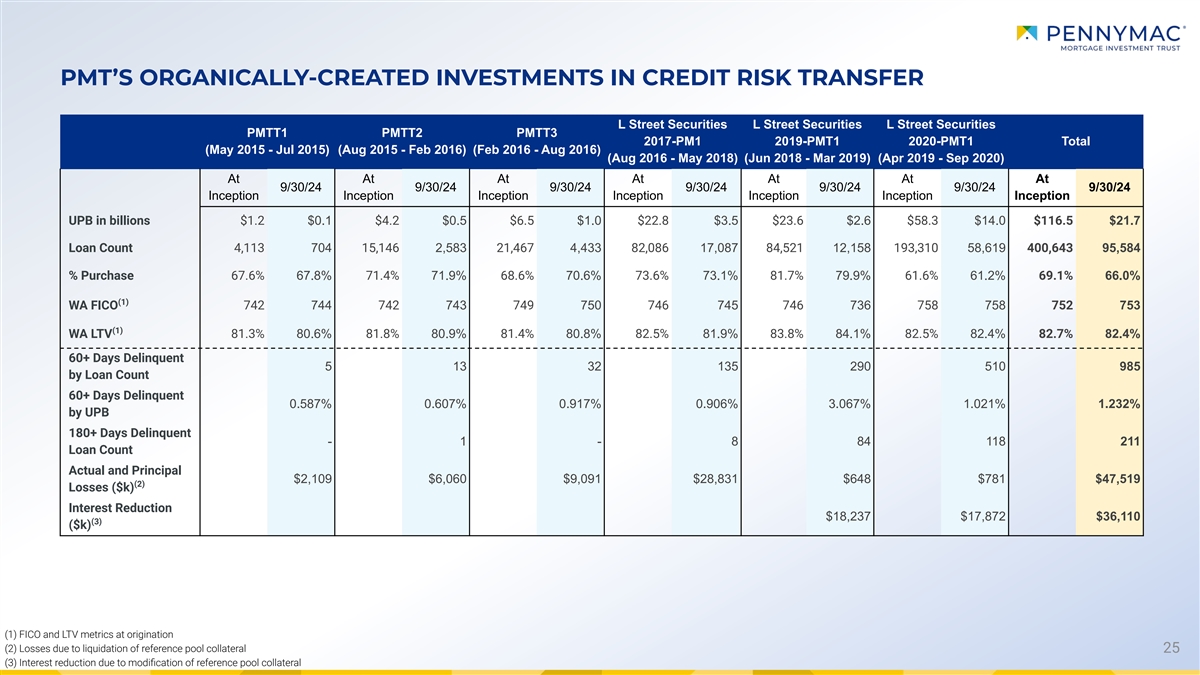

TRENDS IN PMT’S UNIQUE INVESTMENTS IN GSE CREDIT RISK TRANSFER

(1) • Fair value of PMT’s organically-created CRT investments Organically-Created GSE CRT Investments was down slightly from June 30, 2024 primarily due to ($ in millions) prepayments • The 60+ day delinquency rate increased

slightly from June 30, 2024 • Cumulative lifetime losses increased slightly; we ultimately expect realized losses over the life of these investments to be limited, given the substantial build-up of equity for underlying borrowers due to home

price appreciation in recent years (2) Selected metrics for quarter ended : Underlying UPB of loans ($ in billions) $ 23.6 $ 23.2 $ 22.7 $ 22.2 $ 21.7 WA FICO at origination 753 753 753 753 753 WA LTV at origination 82.4% 82.4% 82.4% 82.4% 82.4% WA

Current LTV 50.5% 50.1% 50.1% 48.5% 47.5% 60+ Days Delinquent as a % of outstanding UPB 1.18% 1.23% 1.11% 1.11% 1.23% Net realized principal losses ($ in millions) $ 0.5 $ 1.3 $ 0.2 $ 0.1 $ 0.8 Cumulative lifetime principal losses ($ in millions) $

45.1 $ 46.4 $ 46.6 $ 46.7 $ 47.5 Interest reduction ($ in millions) $ 3.3 $ 3.3 $ 3.2 $ 3.2 $ 3.2 Cumulative interest reduction ($ in millions) $ 23.2 $ 26.5 $ 29.7 $ 32.9 $ 36.1 (1) The fair value of PMT’s organically created GSE CRT

investments is reflected on PMT’s balance sheet as deposits securing CRT arrangements, and derivative and credit risk transfer strip assets or liabilities, net of the interest-only security payable 10 (2) Weighted average FICO and LTV

metrics at origination for the population of loans remaining as of the date presented; current LTVs were refreshed using the latest home price information available as of the reporting period

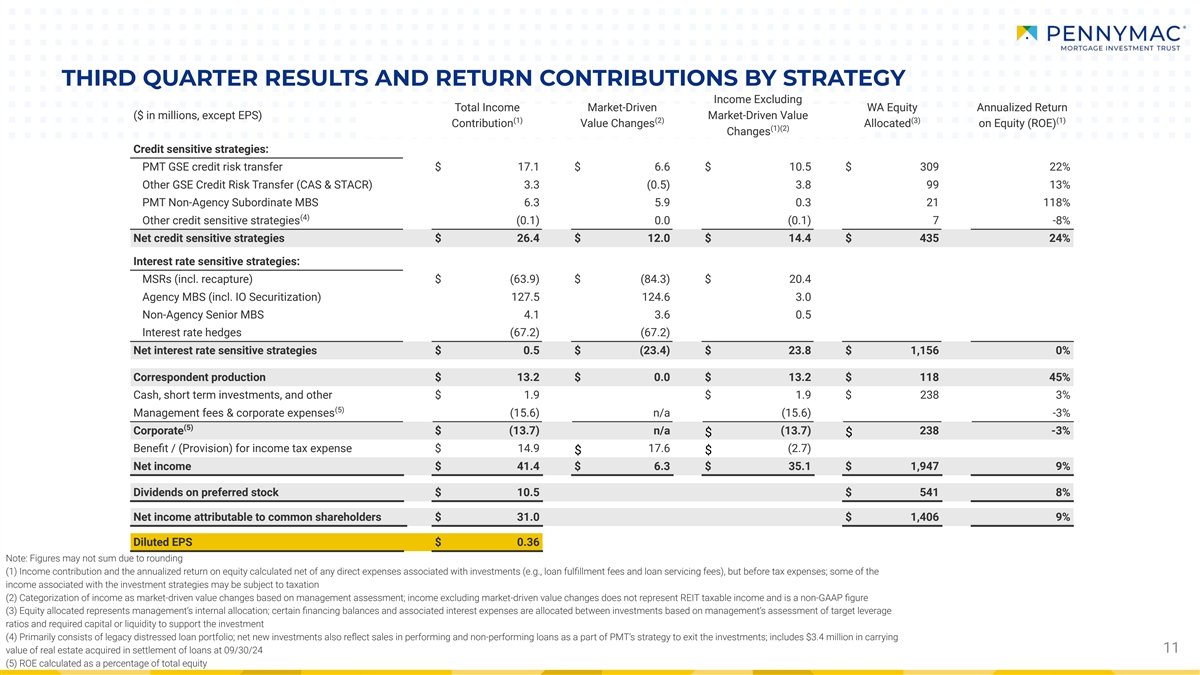

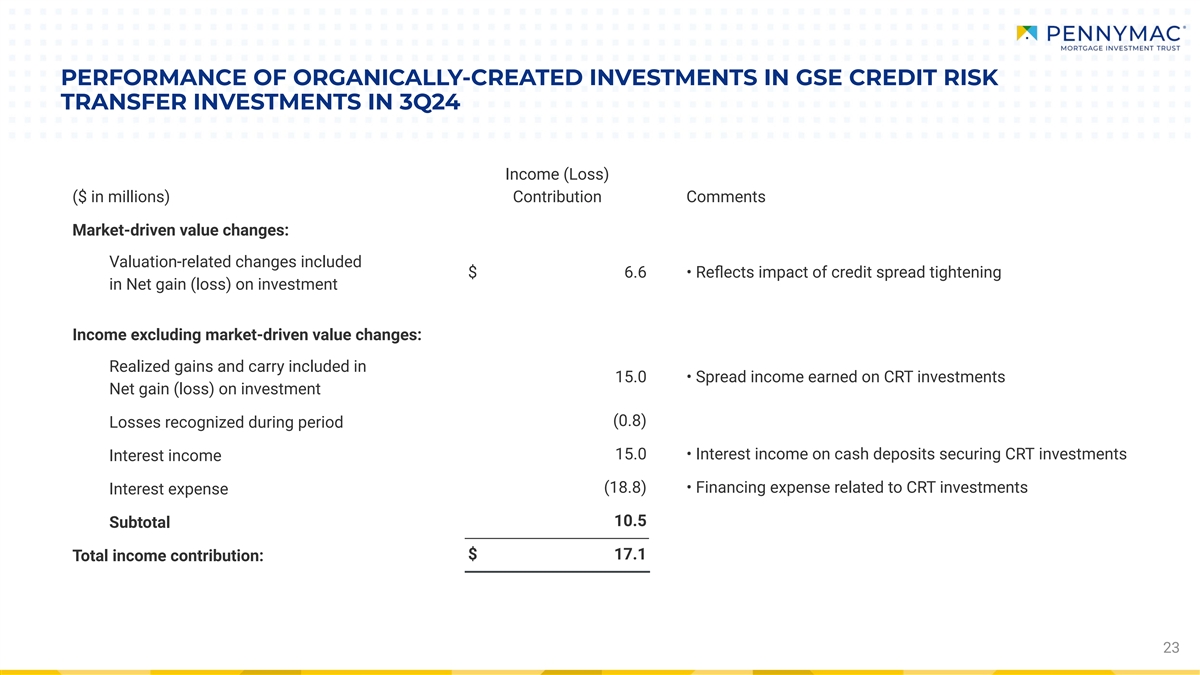

THIRD QUARTER RESULTS AND RETURN CONTRIBUTIONS BY STRATEGY Income

Excluding Total Income Market-Driven WA Equity Annualized Return ($ in millions, except EPS) Market-Driven Value (1) (2) (3) (1) Contribution Value Changes Allocated on Equity (ROE) (1)(2) Changes Credit sensitive strategies: PMT GSE credit risk

transfer $ 17.1 $ 6.6 $ 10.5 $ 309 22% Other GSE Credit Risk Transfer (CAS & STACR) 3.3 (0.5) 3.8 99 13% PMT Non-Agency Subordinate MBS 6.3 5.9 0.3 21 118% (4) Other credit sensitive strategies (0.1) 0.0 (0.1) 7 -8% Net credit sensitive

strategies $ 26.4 $ 12.0 $ 14.4 $ 435 24% Interest rate sensitive strategies: MSRs (incl. recapture) $ (63.9) $ (84.3) $ 20.4 Agency MBS (incl. IO Securitization) 127.5 124.6 3.0 Non-Agency Senior MBS 4.1 3.6 0.5 Interest rate hedges (67.2) (67.2)

Net interest rate sensitive strategies $ 0.5 $ (23.4) $ 23.8 $ 1,156 0% Correspondent production $ 13.2 $ 0.0 $ 13.2 $ 118 45% Cash, short term investments, and other $ 1.9 $ 1.9 $ 238 3% (5) Management fees & corporate expenses (15.6) n/a

(15.6) -3% (5) Corporate $ (13.7) n/a (13.7) 238 -3% $ $ Benefit / (Provision) for income tax expense $ 14.9 17.6 (2.7) $ $ Net income $ 41.4 $ 6.3 $ 35.1 $ 1,947 9% Dividends on preferred stock $ 10.5 $ 541 8% Net income attributable to

common shareholders $ 31.0 $ 1,406 9% Diluted EPS $ 0.36 Note: Figures may not sum due to rounding (1) Income contribution and the annualized return on equity calculated net of any direct expenses associated with investments (e.g., loan

fulfillment fees and loan servicing fees), but before tax expenses; some of the income associated with the investment strategies may be subject to taxation (2) Categorization of income as market-driven value changes based on management

assessment; income excluding market-driven value changes does not represent REIT taxable income and is a non-GAAP figure (3) Equity allocated represents management’s internal allocation; certain financing balances and associated

interest expenses are allocated between investments based on management’s assessment of target leverage ratios and required capital or liquidity to support the investment (4) Primarily consists of legacy distressed loan portfolio; net new

investments also reflect sales in performing and non-performing loans as a part of PMT’s strategy to exit the investments; includes $3.4 million in carrying 11 value of real estate acquired in settlement of loans at 09/30/24 (5) ROE

calculated as a percentage of total equity

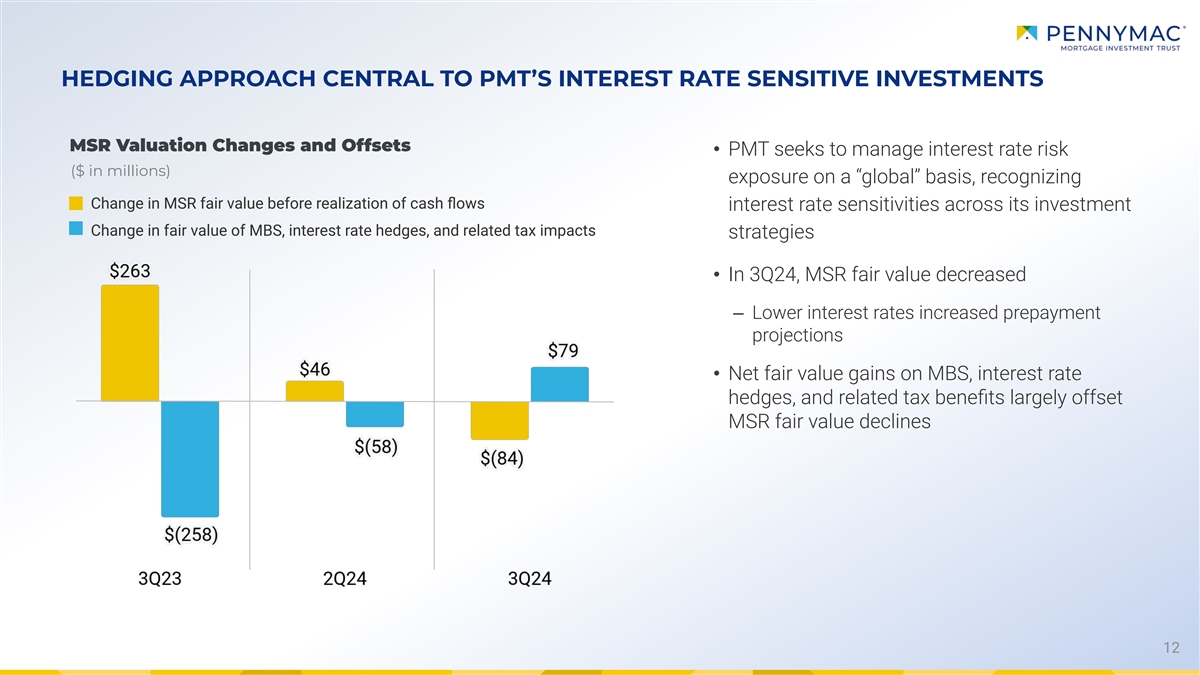

HEDGING APPROACH CENTRAL TO PMT’S INTEREST RATE SENSITIVE

INVESTMENTS MSR Valuation Changes and Offsets • PMT seeks to manage interest rate risk ($ in millions) exposure on a “global” basis, recognizing Change in MSR fair value before realization of cash flows interest rate

sensitivities across its investment Change in fair value of MBS, interest rate hedges, and related tax impacts strategies • In 3Q24, MSR fair value decreased ‒ Lower interest rates increased prepayment projections • Net fair value

gains on MBS, interest rate hedges, and related tax benefits largely offset MSR fair value declines 12

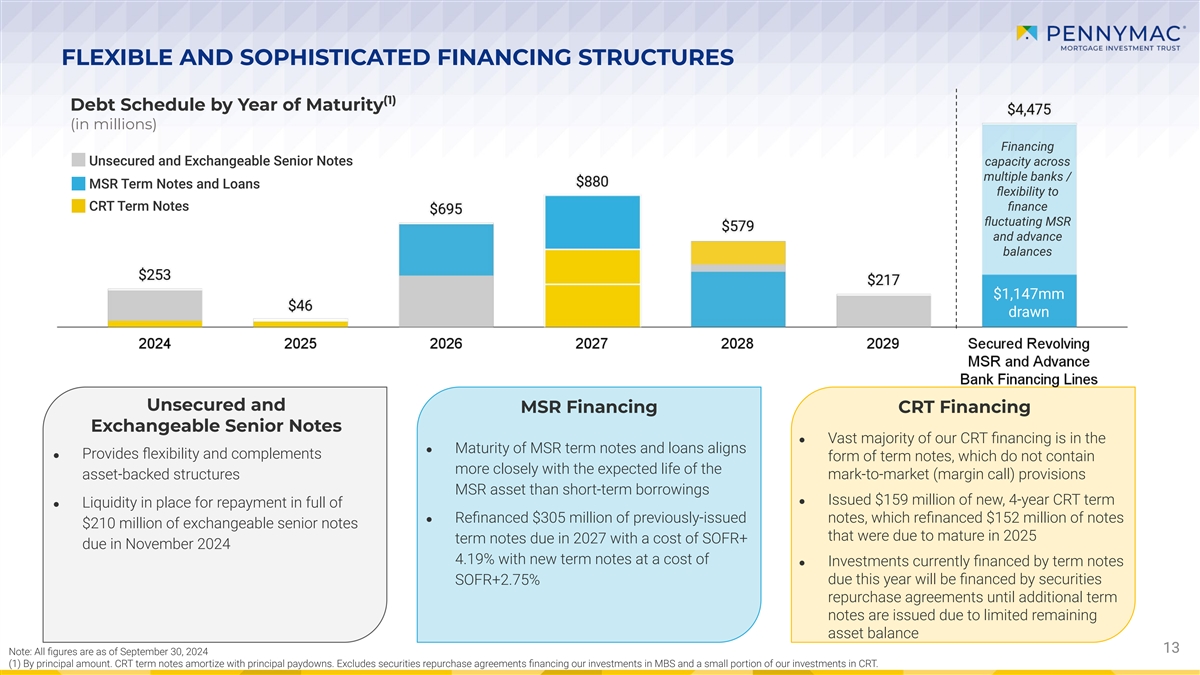

FLEXIBLE AND SOPHISTICATED FINANCING STRUCTURES (1) Debt Schedule by

Year of Maturity (in millions) Financing Unsecured and Exchangeable Senior Notes capacity across multiple banks / MSR Term Notes and Loans flexibility to CRT Term Notes finance fluctuating MSR and advance balances $1,147mm drawn

Unsecured and MSR Financing CRT Financing Exchangeable Senior Notes ● Vast majority of our CRT financing is in the ● Maturity of MSR term notes and loans aligns ● Provides flexibility and complements form of term notes,

which do not contain more closely with the expected life of the asset-backed structures mark-to-market (margin call) provisions MSR asset than short-term borrowings ● Issued $159 million of new, 4-year CRT term ● Liquidity in place for

repayment in full of ● Refinanced $305 million of previously-issued notes, which refinanced $152 million of notes $210 million of exchangeable senior notes that were due to mature in 2025 term notes due in 2027 with a cost of SOFR+

due in November 2024 4.19% with new term notes at a cost of ● Investments currently financed by term notes SOFR+2.75% due this year will be financed by securities repurchase agreements until additional term notes are issued due to

limited remaining asset balance 13 13 Note: All figures are as of September 30, 2024 (1) By principal amount. CRT term notes amortize with principal paydowns. Excludes securities repurchase agreements financing our investments in MBS and

a small portion of our investments in CRT.

APPENDIX

PMT IS FOCUSED ON UNIQUE INVESTMENT STRATEGIES IN THREE SEGMENTS

• Leading acquirer and producer of conventional conforming mortgage loans • Significant growth in market share over PMT’s more than 15-year history driven by PFSI’s Correspondent operational excellence and high service

levels Production • Provides unique ability to produce investment assets organically • MSR investments created through the securitization of conventional correspondent loan production Interest Rate Sensitive • Hedged with Agency

MBS and interest rate derivatives Strategies • Strong track record and discipline in hedging interest rate risk • Investments in credit risk on PMT’s high-quality loan production with ability to influence performance through

active servicing supplemented by opportunistic investments in CRT bonds Credit issued by the GSEs Sensitive Strategies • Approximately $21.7 billion in UPB of loans underlying PMT’s front-end GSE CRT investments at September 30, 2024

15

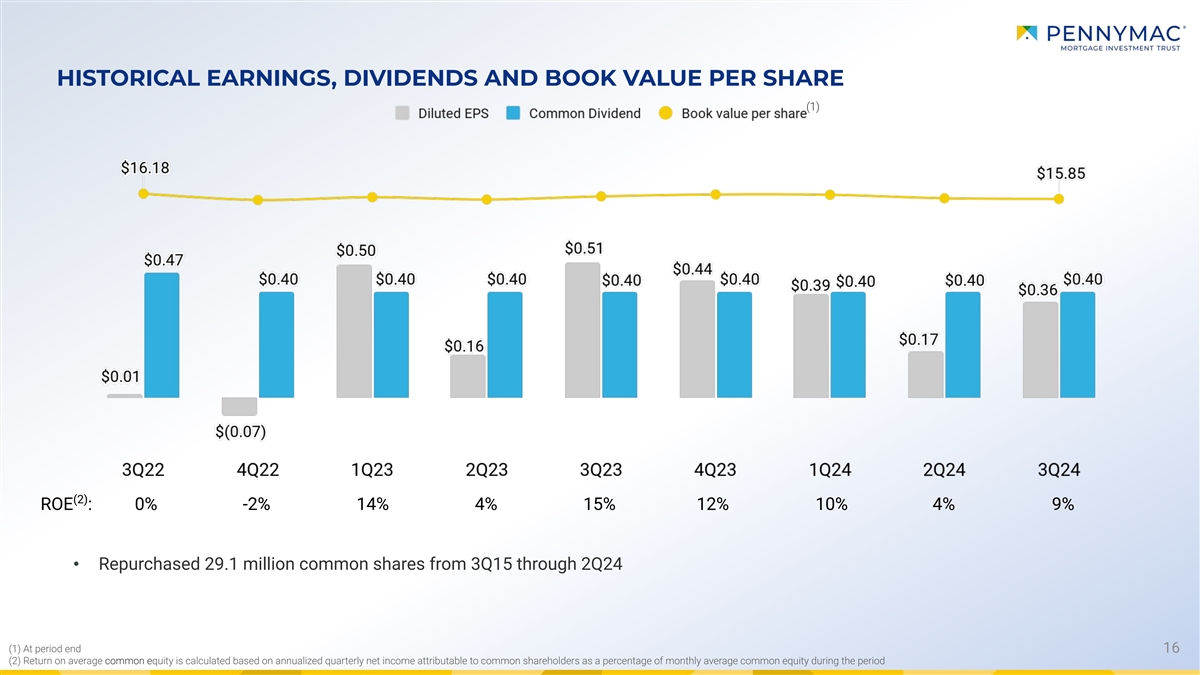

(1) At period end (2) Return on average common equity is calculated

based on annualized quarterly net income attributable to common shareholders as a percentage of monthly average common equity during the period HISTORICAL EARNINGS, DIVIDENDS AND BOOK VALUE PER SHARE (1) (2) ROE : 0% -2% 14% 4% 15% 12% 10% 4% 9%

• Repurchased 29.1 million common shares from 3Q15 through 2Q24 16

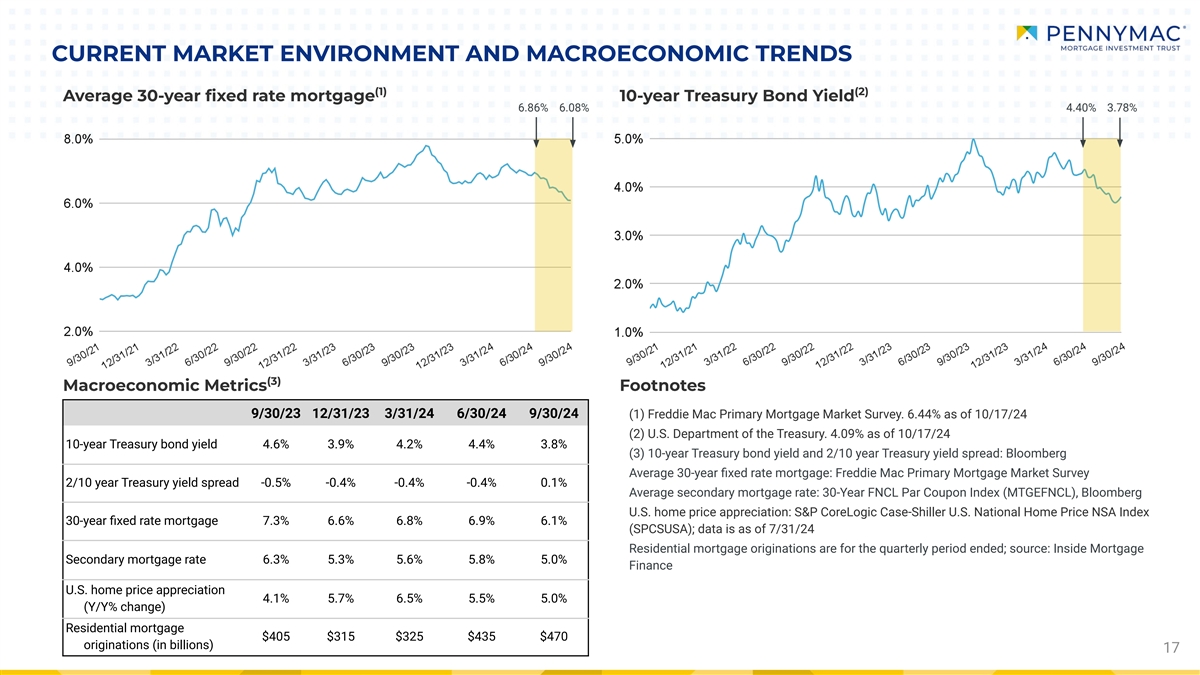

CURRENT MARKET ENVIRONMENT AND MACROECONOMIC TRENDS (1) (2) Average

30-year fixed rate mortgage 10-year Treasury Bond Yield 6.86% 6.08% 4.40% 3.78% (3) Macroeconomic Metrics Footnotes 9/30/23 12/31/23 3/31/24 6/30/24 9/30/24 (1) Freddie Mac Primary Mortgage Market Survey. 6.44% as of 10/17/24 (2) U.S.

Department of the Treasury. 4.09% as of 10/17/24 10-year Treasury bond yield 4.6% 3.9% 4.2% 4.4% 3.8% (3) 10-year Treasury bond yield and 2/10 year Treasury yield spread: Bloomberg Average 30-year fixed rate mortgage: Freddie Mac Primary

Mortgage Market Survey 2/10 year Treasury yield spread -0.5% -0.4% -0.4% -0.4% 0.1% Average secondary mortgage rate: 30-Year FNCL Par Coupon Index (MTGEFNCL), Bloomberg U.S. home price appreciation: S&P CoreLogic Case-Shiller U.S. National Home

Price NSA Index 30-year fixed rate mortgage 7.3% 6.6% 6.8% 6.9% 6.1% (SPCSUSA); data is as of 7/31/24 Residential mortgage originations are for the quarterly period ended; source: Inside Mortgage Secondary mortgage rate 6.3% 5.3% 5.6% 5.8%

5.0% Finance U.S. home price appreciation 4.1% 5.7% 6.5% 5.5% 5.0% (Y/Y% change) Residential mortgage $405 $315 $325 $435 $470 originations (in billions) 17

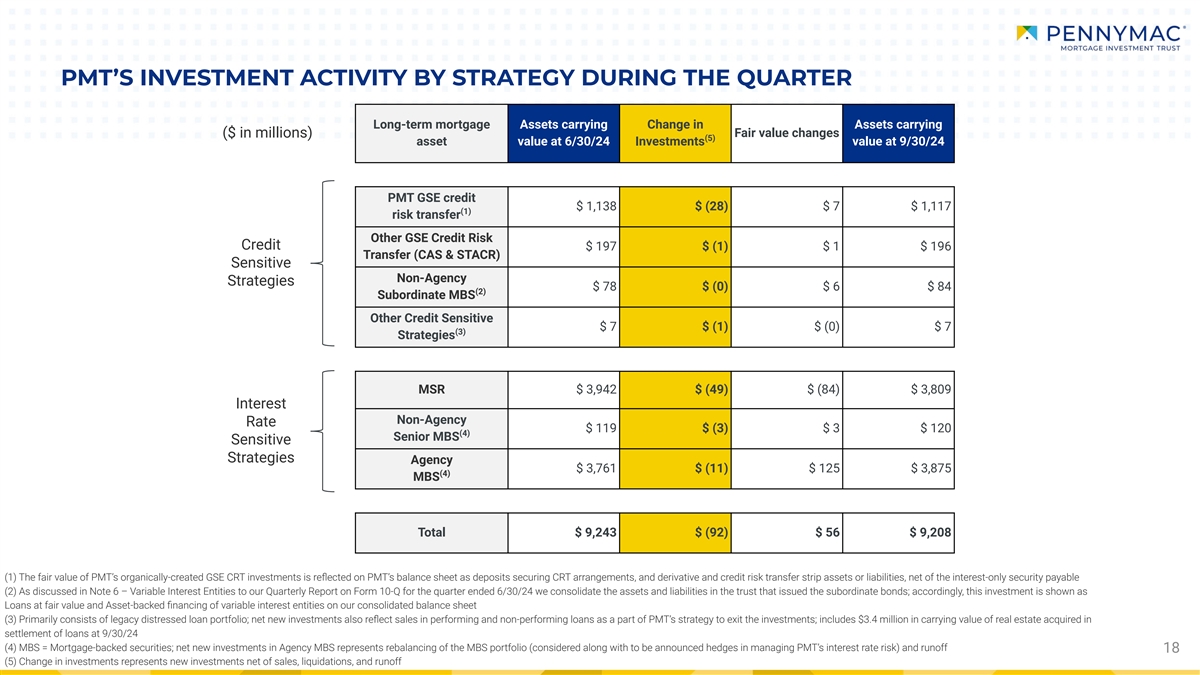

PMT’S INVESTMENT ACTIVITY BY STRATEGY DURING THE QUARTER

Long-term mortgage Assets carrying Change in Assets carrying ($ in millions) Fair value changes (5) asset value at 6/30/24 Investments value at 9/30/24 PMT GSE credit $ 1,138 $ (28) $ 7 $ 1,117 (1) risk transfer Other GSE Credit Risk Credit $ 197 $

(1) $ 1 $ 196 Transfer (CAS & STACR) Sensitive Non-Agency Strategies $ 78 $ (0) $ 6 $ 84 (2) Subordinate MBS Other Credit Sensitive $ 7 $ (1) $ (0) $ 7 (3) Strategies MSR $ 3,942 $ (49) $ (84) $ 3,809 Interest Non-Agency Rate $ 119 $ (3) $ 3 $

120 (4) Senior MBS Sensitive Strategies Agency $ 3,761 $ (11) $ 125 $ 3,875 (4) MBS Total $ 9,243 $ (92) $ 56 $ 9,208 (1) The fair value of PMT’s organically-created GSE CRT investments is reflected on PMT’s balance sheet as

deposits securing CRT arrangements, and derivative and credit risk transfer strip assets or liabilities, net of the interest-only security payable (2) As discussed in Note 6 – Variable Interest Entities to our Quarterly Report on Form 10-Q for

the quarter ended 6/30/24 we consolidate the assets and liabilities in the trust that issued the subordinate bonds; accordingly, this investment is shown as Loans at fair value and Asset-backed financing of variable interest entities on our

consolidated balance sheet (3) Primarily consists of legacy distressed loan portfolio; net new investments also reflect sales in performing and non-performing loans as a part of PMT’s strategy to exit the investments; includes $3.4

million in carrying value of real estate acquired in settlement of loans at 9/30/24 (4) MBS = Mortgage-backed securities; net new investments in Agency MBS represents rebalancing of the MBS portfolio (considered along with to be announced hedges in

managing PMT’s interest rate risk) and runoff 18 (5) Change in investments represents new investments net of sales, liquidations, and runoff

MSR ASSET VALUATION September 30, 2024 Mortgage Unaudited ($ in

millions) Servicing Rights (1) Pool UPB $228,127 Weighted average coupon 3.8% Weighted average servicing fee 0.28% Weighted average prepayment speed assumption (CPR) 7.5% Fair value $3,809 As a multiple of servicing fee 6.0 19 (1) Owned MSR

portfolio and excludes loans acquired for sale at fair value

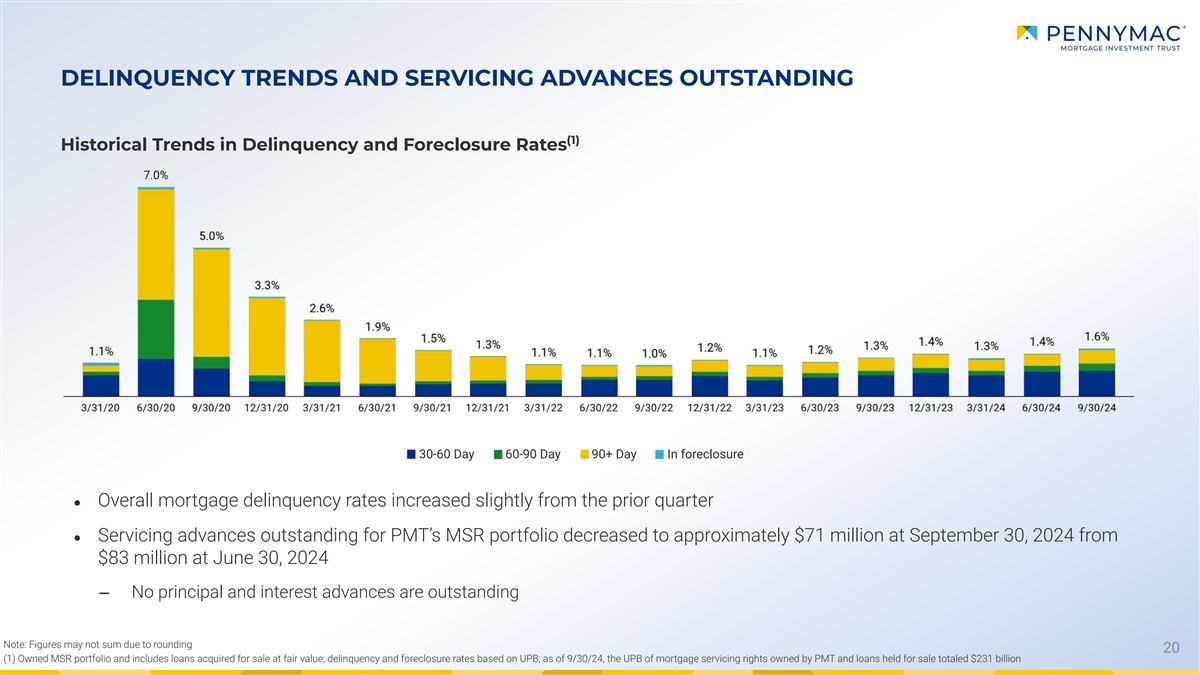

DELINQUENCY TRENDS AND SERVICING ADVANCES OUTSTANDING (1) Historical

Trends in Delinquency and Foreclosure Rates 30-60 Day 60-90 Day 90+ Day In foreclosure ● Overall mortgage delinquency rates increased slightly from the prior quarter ● Servicing advances outstanding for PMT’s MSR portfolio

decreased to approximately $71 million at September 30, 2024 from $83 million at June 30, 2024 ‒ No principal and interest advances are outstanding Note: Figures may not sum due to rounding 20 (1) Owned MSR portfolio and includes loans

acquired for sale at fair value; delinquency and foreclosure rates based on UPB; as of 9/30/24, the UPB of mortgage servicing rights owned by PMT and loans held for sale totaled $231 billion

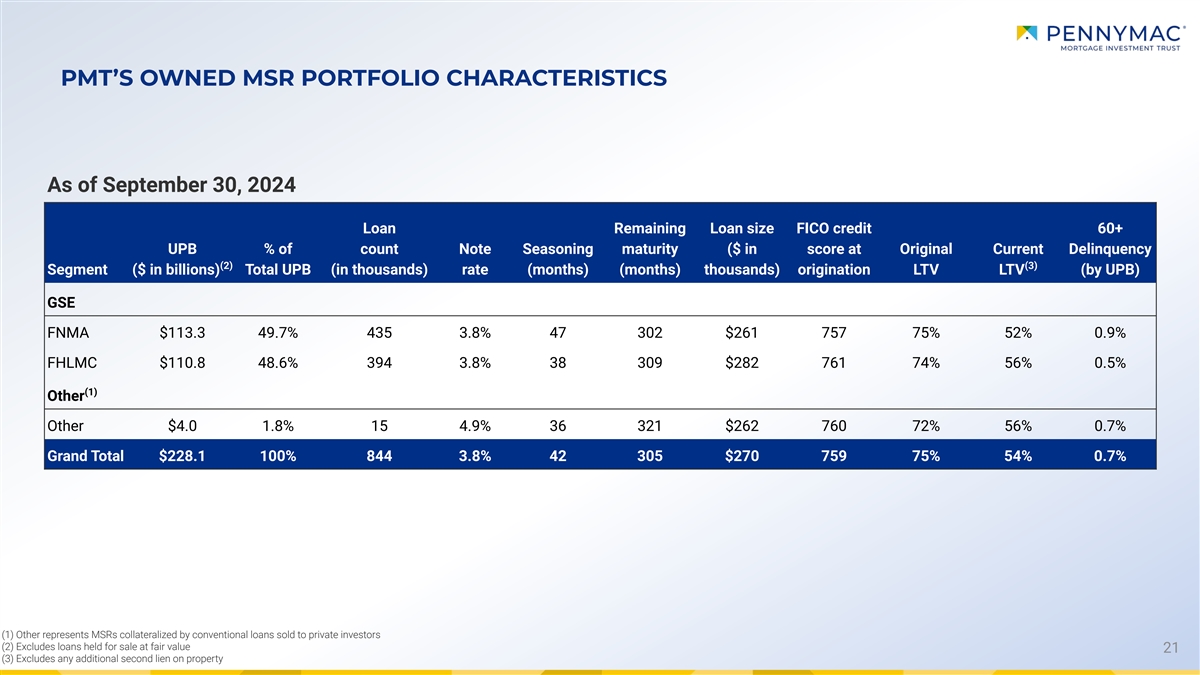

PMT’S OWNED MSR PORTFOLIO CHARACTERISTICS As of September 30,

2024 Loan Remaining Loan size FICO credit 60+ UPB % of count Note Seasoning maturity ($ in score at Original Current Delinquency (2) (3) Segment ($ in billions) Total UPB (in thousands) rate (months) (months) thousands) origination LTV LTV (by UPB)

GSE FNMA $113.3 49.7% 435 3.8% 47 302 $261 757 75% 52% 0.9% FHLMC $110.8 48.6% 394 3.8% 38 309 $282 761 74% 56% 0.5% (1) Other Other $4.0 1.8% 15 4.9% 36 321 $262 760 72% 56% 0.7% Grand Total $228.1 100% 844 3.8% 42 305 $270 759 75% 54% 0.7% (1)

Other represents MSRs collateralized by conventional loans sold to private investors (2) Excludes loans held for sale at fair value 21 (3) Excludes any additional second lien on property

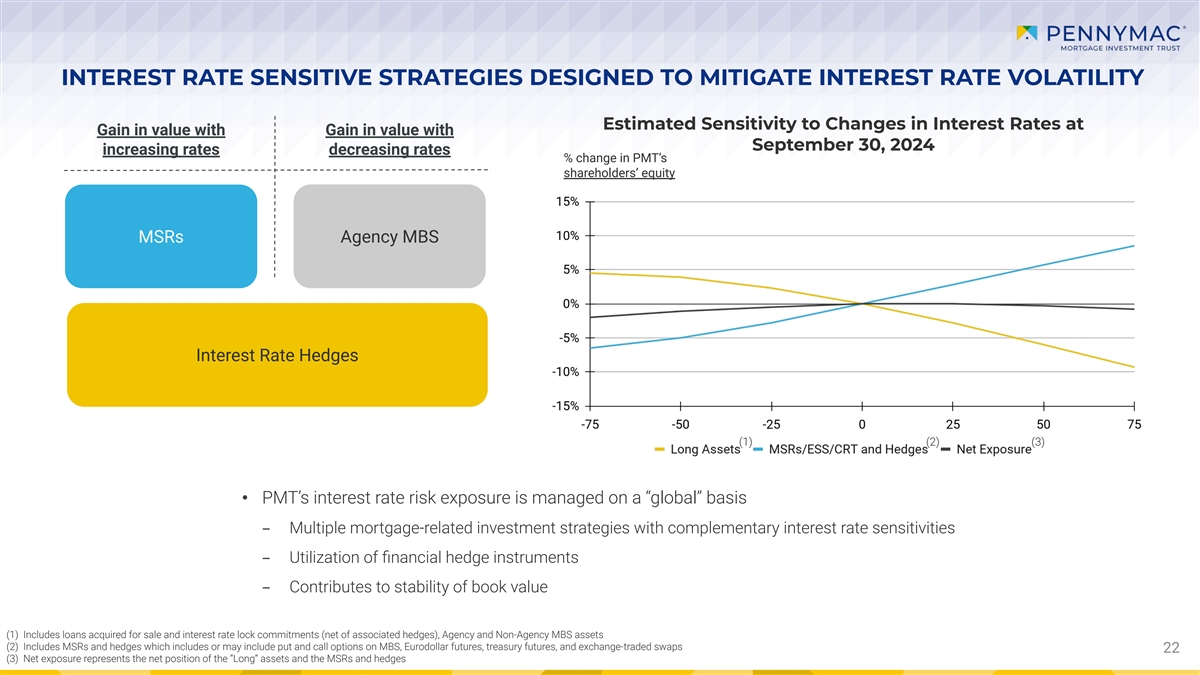

INTEREST RATE SENSITIVE STRATEGIES DESIGNED TO MITIGATE INTEREST RATE

VOLATILITY Estimated Sensitivity to Changes in Interest Rates at Gain in value with Gain in value with September 30, 2024 increasing rates decreasing rates % change in PMT’s shareholders’ equity MSRs Agency MBS Interest Rate Hedges (1)