Primoris Services Corporation (NYSE: PRIM) (“Primoris” or

the “Company”) today announced financial results for its second

quarter ended June 30, 2024 and provided comments on the Company’s

operational performance and outlook for 2024.

For the second quarter of 2024, Primoris reported the

following highlights (1):

- Revenue of $1,563.7 million, up $150.3 million, or 10.6

percent, compared to the second quarter of 2023 driven by strong

growth in the Energy segment;

- Net income of $49.5 million, or $0.91 per diluted share, an

increase of $10.5 million, or $0.19 per diluted share, from the

second quarter of 2023;

- Adjusted net income of $57.1 million, or $1.04 per diluted

share, an increase of $13.7 million, or $0.24 per diluted share,

from the second quarter of 2023;

- Adjusted earnings before interest, income taxes, depreciation,

and amortization (“Adjusted EBITDA”) of $117.1 million, up $14.7

million, or 14.4 percent, from the second quarter of 2023.

- Raising EPS and Adjusted EPS guidance ranges to $2.70 to $2.90

and $3.25 to $3.45 per diluted share, respectively.

(1)

Please refer to “Non-GAAP Measures” and

Schedules 1, 2, 3 and 4 for the definitions and reconciliations of

our Non-GAAP financial measures, including “Adjusted Net Income,”

“Adjusted EPS” and “Adjusted EBITDA.”

“Primoris delivered another excellent quarter achieving solid

revenue growth and improved profitability,” said Tom McCormick,

President and Chief Executive Officer of Primoris. “The demand for

our services remains strong across many of our end markets and we

continue to win work with our customers, who value our partnership

to provide safe and quality performance on their projects.”

“We are growing profitability and cash flow through focused

capital allocation, and our second quarter results demonstrate

early success toward achieving our objectives. We are capitalizing

on the growing trend for additional solar and natural gas power

generation sources while helping build and maintain our power

delivery, gas, and communications infrastructure,” he added.

“Primoris is well-positioned to grow and serve our customers in the

years ahead as they invest to meet the infrastructure needs of

North America that will support emerging technologies and drive

economic growth.”

“As we progress through the second half of the year, I am

confident we will stay focused on safely and efficiently serving

our customers to exceed our goals for 2024 and move us further down

the path toward our strategic goals.”

Second Quarter 2024 Results

Overview Revenue was $1,563.7 million for the three

months ended June 30, 2024, an increase of $150.3 million, or 10.6

percent, compared to the same period in 2023. The increase was

primarily due to strong growth across our renewables and industrial

construction businesses, partially offset by lower activity in

pipeline and gas utilities. Gross profit was $186.7 million for the

three months ended June 30, 2024, an increase of $29.4 million, or

18.7 percent, compared to the same period in 2023. The increase was

primarily due to an increase in Energy segment revenue and improved

margins in both segments. Gross profit as a percentage of revenue

increased to 11.9 percent for the three months ended June 30, 2024,

compared to 11.1 percent for the same period in 2023. The increase

was primarily as a result of a favorable mix of higher margin

renewable work, a strong performance in the industrial businesses,

and improved execution in the Utilities segment.

During the second quarter of 2024, net income was $49.5 million

compared to net income of $39.0 million in the prior year. Diluted

earnings per share (“EPS”) was $0.91 for the second quarter of 2024

compared to $0.72 for the same period in 2023. The increase in net

income and diluted earnings can be largely attributed to higher

operating income from higher revenue and improved margins in both

segments. Adjusted Net Income was $57.1 million for the second

quarter, compared to $43.4 million for the same period in 2023.

Adjusted diluted EPS was $1.04 for the second quarter of 2024,

compared to $0.80 for the second quarter of 2023. The increase in

adjusted net income and adjusted diluted EPS was due to higher net

income and an unrealized gain on interest rate swap recognized in

the second quarter of 2023. Adjusted EBITDA was $117.1 million for

the second quarter of 2024, compared to $102.4 million for the same

period in 2023.

The current reportable segments include the Utilities segment

and the Energy segment. Revenue and gross profit for the segments

for the three and six months ended June 30, 2024, and 2023 were as

follows:

Segment

Revenue (in thousands, except

%) (unaudited)

For the three months ended

June 30,

2024

2023

Segment

Revenue

Revenue

Utilities

$

620,798

$

649,238

Energy

973,492

778,715

Intersegment Eliminations

(30,575

)

(14,576

)

Total

$

1,563,715

$

1,413,377

For the six months ended June

30,

2024

2023

Segment

Revenue

Revenue

Utilities

$

1,108,722

$

1,183,001

Energy

1,921,070

1,506,371

Intersegment Eliminations

(53,370

)

(19,099

)

Total

$

2,976,422

$

2,670,273

Segment Gross

Profit (in thousands, except %)

(unaudited)

For the three months ended

June 30,

2024

2023

% of

% of

Segment

Segment

Segment

Gross Profit

Revenue

Gross Profit

Revenue

Utilities

$

64,066

10.3

%

$

66,510

10.2

%

Energy

122,644

12.6

%

90,754

11.7

%

Total

$

186,710

11.9

%

$

157,264

11.1

%

For the six months ended June

30,

2024

2023

% of

% of

Segment

Segment

Segment

Gross Profit

Revenue

Gross Profit

Revenue

Utilities

$

93,545

8.4

%

$

100,081

8.5

%

Energy

226,541

11.8

%

156,916

10.4

%

Total

$

320,086

10.8

%

$

256,997

9.6

%

Utilities Segment (“Utilities”): Revenue decreased by

$28.4 million, or 4.4 percent, for the three months ended June 30,

2024, compared to the same period in 2023, primarily due to the

substantial completion of a major substation in our power delivery

business in 2023 and lower activity in gas operations. These

impacts were partially offset by increased renewable energy

transmission and substation projects and increased activity in

communications. Gross profit for the three months ended June 30,

2024, was lower by $2.4 million, or 3.7 percent compared to the

same period in 2023 on lower revenue. Gross profit as a percentage

of revenue was 10.3 percent for the three months ended June 30,

2024, up slightly from 10.2 percent for the same period in

2023.

Energy Segment (“Energy”): Revenue increased by $194.8

million, or 25.0 percent, for the three months ended June 30, 2024,

compared to the same period in 2023. The increase was primarily due

to increased renewables and industrial construction activity,

partially offset by lower pipeline activity. Gross profit for the

three months ended June 30, 2024, increased by $31.9 million, or

35.1 percent, compared to the same period in 2023, primarily due to

higher revenue and margins. Gross profit as a percentage of revenue

increased to 12.6 percent during the three months ended June 30,

2024, compared to 11.7 percent in the same period in 2023. The

increase in gross margin is primarily due to strong execution on

natural gas generation projects in the western U.S. and the

increase in renewables revenue.

Other Income Statement

Information

Selling, general and administrative (“SG&A”) expenses were

$100.1 million during the quarter ended June 30, 2024, an increase

of $14.5 million, or 17.0 percent, compared to 2023. The increase

was primarily due to an increase in personnel costs to support

revenue growth and higher technology costs associated with ongoing

initiatives. SG&A expense as a percentage of revenue increased

to 6.4 percent in the second quarter of 2024, compared to 6.1

percent in the second quarter 2023.

Interest expense, net for the quarter ended June 30, 2024, was

$17.1 million compared to $16.9 million for the quarter ended June

30, 2023. The increase of $0.2 million was primarily due to a $0.4

million unrealized loss on our interest rate swap in 2024 compared

to a $3.2 million unrealized gain in 2023, mostly offset by lower

average debt balances. Interest expense for the full year 2024 is

expected to be $71 to $74 million due to lower average debt

balances.

The effective tax rate on income for the six months ended June

30, 2024, of 29.0% differs from the U.S. federal statutory rate of

21.0% primarily due to state income taxes and nondeductible

components of per diem expenses. We recorded income tax expense for

the six months ended June 30, 2024, of $28.0 million compared to

$16.5 million for the six months ended June 30, 2023. The $11.5

million increase in income tax expense is driven by higher pre-tax

income.

Outlook The Company is

raising its estimates for the year ending December 31, 2024. Net

income is expected to be between $148.5 million and $159.5 million,

or $2.70 and $2.90 per fully diluted share. Adjusted EPS is

estimated in the range of $3.25 to $3.45 per fully diluted share.

Adjusted EBITDA for full year 2024 is expected to range from $400

million to $420 million.

The Company is targeting SG&A expense as a percentage of

revenue in the low six percent range for full year 2024. The

Company’s targeted gross margins by segment are as follows:

Utilities in the range of 9 to 11 percent and Energy in the range

of 10 to 12 percent. The Company expects its effective tax rate for

2024 to be approximately 29 percent, but it may vary depending on

the mix of states in which the Company operates.

Adjusted EPS and Adjusted EBITDA are non-GAAP financial

measures. Please refer to “Non-GAAP Measures” and Schedules 1 - 4

below for the definitions and reconciliations. The guidance

provided above constitutes forward-looking statements, which are

based on current economic conditions and estimates, and the Company

does not include other potential impacts, such as changes in

accounting or unusual items. Supplemental information relating to

the Company’s financial outlook is posted in the Investor Relations

section of the Company’s website at www.prim.com.

Backlog

(in millions)

June 30, 2024

December 31, 2023

Next 12 Months

Total

Next 12 Months

Total

Utilities

Fixed Backlog

$

68.7

$

68.7

$

96.3

$

96.3

MSA Backlog

1,821.4

5,171.9

1,776.5

5,093.6

Backlog

$

1,890.1

$

5,240.6

$

1,872.8

$

5,189.9

Energy

Fixed Backlog

$

2,207.6

$

4,798.4

$

2,599.0

$

5,102.6

MSA Backlog

159.1

414.8

308.2

602.4

Backlog

$

2,366.7

$

5,213.2

$

2,907.2

$

5,705.0

Total

Fixed Backlog

$

2,276.3

$

4,867.1

$

2,695.3

$

5,198.9

MSA Backlog

1,980.5

5,586.7

2,084.7

5,696.0

Backlog

$

4,256.8

$

10,453.8

$

4,780.0

$

10,894.9

At June 30, 2024, total Fixed Backlog was $4.9 billion, flat

compared to March 31, 2024, and a decrease of $0.3 billion, or 6.4

percent compared to December 31, 2023. Total MSA Backlog was $5.6

billion, a decrease of $0.2 billion, or 3.4 percent, compared to

March 31, 2024, and $0.1 billion, or 1.9 percent, compared to

December 31, 2023. Total Backlog as of June 30, 2024, was $10.5

billion, including Utilities backlog of approximately $5.3 billion

and Energy backlog of $5.2 billion. The decrease in backlog

sequentially and from year end 2023 is primarily due to the timing

of fixed backlog awards in the Energy segment.

Backlog, including estimated MSA revenue, should not be

considered a comprehensive indicator of future revenue. Revenue

from certain projects where scope, and therefore contract value, is

not adequately defined, is not included in Fixed Backlog. At any

time, any project may be cancelled at the convenience of the

Company’s customers.

Balance Sheet and Capital

Allocation At June 30, 2024, the Company had $207.4

million of unrestricted cash and cash equivalents. In the second

quarter of 2024, capital expenditures were $24.2 million, including

$9.6 million in construction equipment purchases. Capital

expenditures for the six months ended June 30, 2024, were $34.6

million, including $14.5 million in construction equipment

purchases. For the remaining six months of 2024, capital

expenditures are expected to total between $45.0 million and $65.0

million, which includes $5.0 million to $25.0 million for

equipment.

The Company also announced that on July 31, 2024, its Board of

Directors declared a $0.06 per share cash dividend to stockholders

of record on September 27, 2024, payable on approximately October

11, 2024. During the six months ended June 30, 2024 the Company did

not purchase any shares of common stock under its share purchase

program. As of June 30, 2024, the Company had $25.0 million

remaining for purchase under the share purchase program. The share

purchase plan currently expires on December 31, 2024.

Conference Call and Webcast

As previously announced, management will host a conference call and

webcast on Tuesday, August 6, 2024, at 9:00 a.m. U.S. Central Time

(10:00 a.m. U.S. Eastern Time). Tom McCormick, President and Chief

Executive Officer, and Ken Dodgen, Executive Vice President and

Chief Financial Officer, will discuss the Company’s results and

business outlook.

Investors and analysts are invited to participate in the call by

phone at 1-800-715-9871, or internationally at 1-646-307-1963

(access code: 1324356) or via the Internet at www.prim.com. A

replay of the call will be available on the Company’s website or by

phone at 1-800-770-2030, or internationally at 1-609-800-9909

(access code: 1324356), for a seven-day period following the

call.

Presentation slides to accompany the conference call are

available for download under “Events & Presentations” in the

“Investors” section of the Company’s website at www.prim.com.

Non-GAAP Measures This press

release contains certain financial measures that are not recognized

under generally accepted accounting principles in the United States

(“GAAP”). Primoris uses earnings before interest, income taxes,

depreciation, and amortization (“EBITDA”), Adjusted EBITDA,

Adjusted Net Income, and Adjusted EPS as important supplemental

measures of the Company’s operating performance. The Company

believes these measures enable investors, analysts, and management

to evaluate Primoris’ performance excluding the effects of certain

items that management believes impact the comparability of

operating results between reporting periods. In addition,

management believes these measures are useful in comparing the

Company’s operating results with those of its competitors. The

non-GAAP measures presented in this press release are not intended

to be considered in isolation or as a substitute for, or superior

to, the financial information prepared and presented in accordance

with GAAP. In addition, Primoris’ method of calculating these

measures may be different from methods used by other companies,

and, accordingly, may not be comparable to similarly titled

measures as calculated by other companies that do not use the same

methodology as Primoris. Please see the accompanying tables to this

press release for reconciliations of the following non‐GAAP

financial measures for Primoris’ current and historical results:

EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted EPS.

About Primoris Primoris

Services Corporation is a leading provider of critical

infrastructure services to the utility, energy, and renewables

markets throughout the United States and Canada. Built on a

foundation of trust, we deliver a range of engineering,

construction, and maintenance services that power, connect, and

enhance society. On projects spanning utility-scale solar,

renewables, power delivery, communications, and transportation

infrastructure, we offer unmatched value to our clients, a safe and

entrepreneurial culture to our employees, and innovation and

excellence to our communities. To learn more, visit www.prim.com

and follow us on social media at @PrimorisServicesCorporation.

Forward Looking Statements

This press release contains certain forward-looking statements,

including the Company’s outlook, that reflect, when made, the

Company’s expectations or beliefs concerning future events that

involve risks and uncertainties, including with regard to the

Company’s future performance. Forward-looking statements include

all statements that are not historical facts and can be identified

by terms such as “anticipates”, “believes”, “could”, “estimates”,

“expects”, “intends”, “may”, “plans”, “potential”, “predicts”,

“projects”, “should”, “targets”, “will”, “would” or similar

expressions. Forward-looking statements include information

concerning the possible or assumed future results of operations,

business strategies, financing plans, competitive position,

industry environment, potential growth opportunities, the effects

of regulation and the economy, generally. Forward-looking

statements involve known and unknown risks, uncertainties, and

other factors, which may cause actual results, performance, or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Actual results may differ materially as

a result of a number of factors, including, among other things,

customer timing, project duration, weather, and general economic

conditions; changes in the mix of customers, projects, contracts

and business; regional or national and/or general economic

conditions and demand for the Company’s services; price,

volatility, and expectations of future prices of oil, natural gas,

and natural gas liquids; variations and changes in the margins of

projects performed during any particular quarter; increases in the

costs to perform services caused by changing conditions; the

termination, or expiration of existing agreements or contracts; the

budgetary spending patterns of customers; inflation and other

increases in construction costs that the Company may be unable to

pass through to customers; cost or schedule overruns on fixed-price

contracts; availability of qualified labor for specific projects;

changes in bonding requirements and bonding availability for

existing and new agreements; the need and availability of letters

of credit; increases in interest rates and slowing economic growth

or recession; the instability in the banking system; costs incurred

to support growth, whether organic or through acquisitions; the

timing and volume of work under contract; losses experienced in the

Company’s operations; the results of the review of prior period

accounting on certain projects and the impact of adjustments to

accounting estimates; developments in governmental investigations

and/or inquiries; intense competition in the industries in which

the Company operates; failure to obtain favorable results in

existing or future litigation or regulatory proceedings, dispute

resolution proceedings or claims, including claims for additional

costs; failure of partners, suppliers or subcontractors to perform

their obligations; cyber-security breaches; failure to maintain

safe worksites; risks or uncertainties associated with events

outside of the Company’s control, including conflicts in the Middle

East and between Russia and Ukraine, severe weather conditions,

public health crises and pandemics, political crises or other

catastrophic events; client delays or defaults in making payments;

the cost and availability of credit and restrictions imposed by

credit facilities; failure to implement strategic and operational

initiatives; risks or uncertainties associated with acquisitions,

dispositions and investments; possible information technology

interruptions, cybersecurity threats or inability to protect

intellectual property; the Company’s failure, or the failure of the

Company’s agents or partners, to comply with laws; the Company's

ability to secure appropriate insurance; new or changing political

conditions and legal requirements, including those relating to

environmental, health and safety matters; the loss of one or a few

clients that account for a significant portion of the Company's

revenues; asset impairments; and risks arising from the inability

to successfully integrate acquired businesses. In addition to

information included in this press release, additional information

about these and other risks can be found in Part I, Item 1A “Risk

Factors” of the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, and the Company’s other filings with the

U.S. Securities and Exchange Commission (“SEC”). Such filings are

available on the SEC’s website at www.sec.gov. Given these risks

and uncertainties, you should not place undue reliance on

forward-looking statements. Primoris does not undertake any

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required under applicable securities

laws.

PRIMORIS SERVICES CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In Thousands, Except

Per Share Amounts) (Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenue

$

1,563,715

$

1,413,377

$

2,976,422

$

2,670,273

Cost of revenue

1,377,005

1,256,113

2,656,336

2,413,276

Gross profit

186,710

157,264

320,086

256,997

Selling, general and administrative

expenses

100,118

85,571

188,706

163,581

Transaction and related costs

522

898

1,072

3,593

Operating income

86,070

70,795

130,308

89,823

Other income (expense):

Foreign exchange gain, net

761

376

1,321

1,302

Other income (expense), net

81

713

(45

)

1,044

Interest expense, net

(17,133

)

(16,884

)

(35,125

)

(35,349

)

Income before provision for income

taxes

69,779

55,000

96,459

56,820

Provision for income taxes

(20,236

)

(15,968

)

(27,973

)

(16,478

)

Net income

49,543

39,032

68,486

40,342

Dividends per common share

$

0.06

$

0.06

$

0.12

$

0.12

Earnings per share:

Basic

$

0.92

$

0.73

$

1.28

$

0.76

Diluted

$

0.91

$

0.72

$

1.26

$

0.75

Weighted average common shares

outstanding:

Basic

53,640

53,301

53,565

53,243

Diluted

54,653

54,324

54,522

54,083

PRIMORIS SERVICES CORPORATION

CONSOLIDATED BALANCE SHEETS (In Thousands)

(Unaudited)

June

30,

December

31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

207,363

$

217,778

Accounts receivable, net

888,267

685,439

Contract assets

873,008

846,176

Prepaid expenses and other current

assets

122,583

135,840

Total current assets

2,091,221

1,885,233

Property and equipment, net

446,314

475,929

Operating lease assets

421,024

360,507

Intangible assets, net

217,283

227,561

Goodwill

857,650

857,650

Other long-term assets

16,396

20,547

Total assets

$

4,049,888

$

3,827,427

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

583,664

$

628,962

Contract liabilities

483,878

366,476

Accrued liabilities

324,732

263,492

Dividends payable

3,217

3,202

Current portion of long-term debt

89,270

72,903

Total current liabilities

1,484,761

1,335,035

Long-term debt, net of current portion

843,758

885,369

Noncurrent operating lease liabilities,

net of current portion

308,114

263,454

Deferred tax liabilities

59,444

59,565

Other long-term liabilities

54,580

47,912

Total liabilities

2,750,657

2,591,335

Commitments and contingencies

Stockholders’ equity

Common stock

6

6

Additional paid-in capital

278,830

275,846

Retained earnings

1,023,075

961,028

Accumulated other comprehensive income

(2,680

)

(788

)

Total stockholders’ equity

1,299,231

1,236,092

Total liabilities and stockholders’

equity

$

4,049,888

$

3,827,427

PRIMORIS SERVICES CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (In Thousands)

(Unaudited)

Six Months Ended

June 30,

2024

2023

Cash flows from operating activities:

Net income

$

68,486

$

40,342

Adjustments to reconcile net income to net

cash used in operating activities (net of effect of

acquisitions):

Depreciation and amortization

50,274

54,754

Stock-based compensation expense

6,360

5,388

Gain on sale of property and equipment

(26,237

)

(14,735

)

Unrealized gain on interest rate swap

(231

)

(2,745

)

Other non-cash items

2,749

982

Changes in assets and liabilities:

Accounts receivable

(208,407

)

(154,016

)

Contract assets

(27,953

)

(170,479

)

Other current assets

(5,183

)

27,291

Other long-term assets

(2,240

)

(1,230

)

Accounts payable

(44,520

)

(21,959

)

Contract liabilities

117,410

136,202

Operating lease assets and liabilities,

net

(4,788

)

2,354

Accrued liabilities

52,521

16,037

Other long-term liabilities

9,362

982

Net cash used in operating activities

(12,397

)

(80,832

)

Cash flows from investing activities:

Purchase of property and equipment

(34,637

)

(42,392

)

Proceeds from sale of assets

73,930

23,465

Cash paid for acquisitions, net of cash

and restricted cash acquired

—

9,300

Net cash provided by (used in) investing

activities

39,293

(9,627

)

Cash flows from financing activities:

Borrowings under revolving lines of

credit

—

390,000

Payments on revolving lines of credit

—

(370,000

)

Payments on long-term debt

(26,148

)

(51,234

)

Payments related to tax withholding for

stock-based compensation

(4,772

)

(1,391

)

Dividends paid

(6,424

)

(6,383

)

Other

(1,760

)

(2,106

)

Net cash used in financing activities

(39,104

)

(41,114

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

1,654

946

Net change in cash, cash equivalents and

restricted cash

(10,554

)

(130,627

)

Cash, cash equivalents and restricted cash

at beginning of the period

223,542

258,991

Cash, cash equivalents and restricted cash

at end of the period

$

212,988

$

128,364

Non-GAAP

Measures

Schedule 1 Primoris Services

Corporation Reconciliation of Non-GAAP Financial Measures Adjusted

Net Income and Adjusted EPS (In Thousands, Except Per Share

Amounts) (Unaudited)

Adjusted Net Income and Adjusted

EPS

Primoris defines Adjusted Net Income as

net income (loss) adjusted for certain items including, (i)

non‐cash stock‐based compensation expense; (ii)

transaction/integration and related costs; (iii) asset impairment

charges; (iv) changes in fair value of the Company’s interest rate

swap; (v) change in fair value of contingent consideration

liabilities; (vi) amortization of intangible assets; (vii)

amortization of debt discounts and debt issuance costs; (viii)

losses on extinguishment of debt; (ix) severance and restructuring

changes; (x) selected (gains) charges that are unusual or

non-recurring; and (xi) impact of changes in statutory tax rates.

The Company defines Adjusted EPS as Adjusted Net Income divided by

the diluted weighted average shares outstanding. Management

believes these adjustments are helpful for comparing the Company’s

operating performance with prior periods. Because Adjusted Net

Income and Adjusted EPS, as defined, exclude some, but not all,

items that affect net income and diluted earnings per share, they

may not be comparable to similarly titled measures of other

companies. The most comparable GAAP financial measures, net income

and diluted earnings per share, and information reconciling the

GAAP and non‐GAAP financial measures, are included in the table

below.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income as reported (GAAP)

$

49,543

$

39,032

$

68,486

$

40,342

Non-cash stock-based compensation

3,954

3,009

6,360

5,388

Transaction/integration and related

costs

522

898

1,072

3,593

Amortization of intangible assets

5,086

5,363

10,278

11,437

Amortization of debt issuance costs

600

491

1,200

982

Unrealized loss (gain) on interest rate

swap

431

(3,213

)

(231

)

(2,745

)

Change in fair value of contingent

consideration

—

(449

)

—

(694

)

Impairment of fixed assets

—

—

1,549

—

Income tax impact of adjustments

(3,072

)

(1,769

)

(5,866

)

(5,209

)

Adjusted net income

$

57,064

$

43,362

$

82,848

$

53,094

Weighted average shares (diluted)

54,653

54,324

54,522

54,083

Diluted earnings per share

$

0.91

$

0.72

$

1.26

$

0.75

Adjusted diluted earnings per share

$

1.04

$

0.80

$

1.52

$

0.98

Schedule 2 Primoris Services

Corporation Reconciliation of Non-GAAP Financial Measures EBITDA

and Adjusted EBITDA (In Thousands) (Unaudited)

EBITDA and Adjusted

EBITDA

Primoris defines EBITDA as net income

(loss) before interest, income taxes, depreciation, and

amortization. Adjusted EBITDA is defined as EBITDA adjusted for

certain items including, (i) non‐cash stock‐based compensation

expense; (ii) transaction/integration and related costs; (iii)

asset impairment charges; (iv) severance and restructuring changes;

(v) change in fair value of contingent consideration liabilities;

and (vi) selected (gains) charges that are unusual or

non-recurring. The Company believes the EBITDA and Adjusted EBITDA

financial measures assist in providing a more complete

understanding of the Company’s underlying operational measures to

manage its business, to evaluate its performance compared to prior

periods and the marketplace, and to establish operational goals.

EBITDA and Adjusted EBITDA are non‐GAAP financial measures and

should not be considered in isolation or as a substitute for

financial information provided in accordance with GAAP. These

non‐GAAP financial measures may not be computed in the same manner

as similarly titled measures used by other companies. The most

comparable GAAP financial measure, net income, and information

reconciling the GAAP and non‐GAAP financial measures are included

in the table below.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income as reported (GAAP)

$

49,543

$

39,032

$

68,486

$

40,342

Interest expense, net

17,133

16,884

35,125

35,349

Provision for income taxes

20,236

15,968

27,973

16,478

Depreciation and amortization

25,693

27,021

50,274

54,754

EBITDA

112,605

98,905

181,858

146,923

Non-cash stock-based compensation

3,954

3,009

6,360

5,388

Transaction/integration and related

costs

522

898

1,072

3,593

Change in fair value of contingent

consideration

—

(449

)

—

(694

)

Impairment of fixed assets

—

—

1,549

—

Adjusted EBITDA

$

117,081

$

102,363

$

190,839

$

155,210

Schedule 3 Primoris Services

Corporation Reconciliation of Non-GAAP Financial Measures

Forecasted Adjusted Net Income and Adjusted Diluted Earnings Per

Share for Full Year 2024 (In Thousands, Except Per Share Amounts)

(Unaudited)

The following table sets forth a

reconciliation of the forecasted GAAP net income to Adjusted Net

Income and EPS to Adjusted EPS for the year ending December 31,

2024.

Estimated Range

Full Year Ending

December 31, 2024

Net income as defined (GAAP)

$

148,500

$

159,500

Non-cash stock-based compensation

15,500

15,500

Transaction/integration and related

costs

3,000

3,000

Amortization of intangible assets

19,500

19,500

Amortization of debt issuance costs

2,500

2,500

Impairment of fixed assets

1,500

1,500

Income tax impact of adjustments (1)

(12,000

)

(12,000

)

Adjusted net income

$

178,500

$

189,500

Weighted average shares (diluted)

55,000

55,000

Diluted earnings per share

$

2.70

$

2.90

Adjusted diluted earnings per share

$

3.25

$

3.45

(1)

Adjustments above are reported on a

pre-tax basis before the income tax impact of adjustments. The

income tax impact for each adjustment is determined by calculating

the tax impact of the adjustment on the Company's quarterly and

annual effective tax rate, as applicable, unless the nature of the

item and/or the tax jurisdiction in which the item has been

recorded requires application of a specific tax rate or tax

treatment, in which case the tax effect of such item is estimated

by applying such specific tax rate or tax treatment.

Schedule 4 Primoris Services

Corporation Reconciliation of Non-GAAP Financial Measures

Forecasted EBITDA and Adjusted EBITDA for Full Year 2024 (In

Thousands, Except Per Share Amounts) (Unaudited)

The following table sets forth a

reconciliation of the forecasted GAAP net income to EBITDA and

Adjusted EBITDA for the year ending December 31, 2024.

Estimated Range

Full Year Ending

December 31, 2024

Net income as defined (GAAP)

$

148,500

$

159,500

Interest expense, net

71,000

74,000

Provision for income taxes

60,500

66,500

Depreciation and amortization

100,000

100,000

EBITDA

380,000

400,000

Non-cash stock-based compensation

15,500

15,500

Transaction/integration and related

costs

3,000

3,000

Impairment of fixed assets

1,500

1,500

Adjusted EBITDA

$

400,000

$

420,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240805615706/en/

Ken Dodgen Executive Vice President, Chief Financial Officer

(214) 740-5608 kdodgen@prim.com

Blake Holcomb Vice President, Investor Relations (214) 545-6773

bholcomb@prim.com

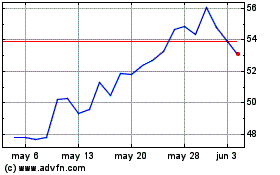

Primoris Services (NYSE:PRIM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Primoris Services (NYSE:PRIM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024