false000172452100017245212024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________

FORM 8-K

________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2024

________________________________________________________

Arcus Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-38419 | | 47-3898435 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 3928 Point Eden Way | | | | |

Hayward, California | | | | 94545 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 694-6200

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, Par Value $0.0001 Per Share | | RCUS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, Arcus Biosciences, Inc. issued a press release announcing its financial results for the three months ended March 31, 2024. The full text of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this Item 2.02 of this Form 8-K (including Exhibit 99.1) is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| ARCUS BIOSCIENCES, INC. |

| | |

Date: May 8, 2024 | By: | /s/ Terry Rosen, Ph. D. |

| | Terry Rosen, Ph.D. |

| | Chief Executive Officer (Principal Executive Officer) |

Exhibit 99.1

Arcus Biosciences Reports First-Quarter 2024 Financial Results and Provides a Pipeline Update

•Arcus data will be disclosed in two oral presentations at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting

◦Updated data, including median progression-free survival (PFS), from EDGE-Gastric evaluating domvanalimab plus zimberelimab and chemotherapy in upper GI cancers

◦Data, including overall survival (OS) and PFS, from ARC-9 evaluating an etrumadenant plus zimberelimab-based treatment combination in third-line metastatic colorectal cancer

•Data from the casdatifan 100 mg expansion cohort of ARC-20, a Phase 1/1b study of casdatifan in clear cell renal cell carcinoma (ccRCC), are expected to be presented in the second half of 2024

•Completion of enrollment for the Phase 3 studies STAR-221(upper GI cancers) and STAR-121 (non-small cell lung cancer) for domvanalimab plus zimberelimab and chemotherapy is expected by mid-year and the second half of 2024, respectively

•Well-positioned to advance the full pipeline with $1.1 billion in cash, cash equivalents and marketable securities and runway into 2027

•Conference call today at 1:30 PM PT / 4:30 PM ET

HAYWARD, Calif. – (BUSINESS WIRE) – May 8, 2024 – Arcus Biosciences, Inc. (NYSE:RCUS), a clinical-stage, global biopharmaceutical company focused on developing differentiated molecules and combination therapies for people with cancer, today reported financial results for the first quarter ended March 31, 2024, and provided a pipeline update on its clinical-stage investigational molecules – targeting TIGIT, the adenosine axis (CD73 and A2a/A2b receptors), HIF-2a, AXL and PD-1 – across multiple common cancers.

“Arcus has evolved to become a late-stage oncology company with multiple programs targeting lung, gastrointestinal and kidney cancers that address extremely large patient populations with high unmet need,” said Terry Rosen, Ph.D., chief executive officer of Arcus. “With two oral presentations at ASCO in GI cancers and a third dataset for our HIF-2a inhibitor expected later this year, we have several near-term catalysts that will further validate our deep pipeline of potentially first- and best-in-class molecules, which will be in at least 5 different Phase 3 studies by the first half of 2025.”

Domvanalimab (Fc-silent anti-TIGIT monoclonal antibody) plus Zimberelimab (anti-PD-1 antibody)

•Results from Arm A1 of the Phase 2 EDGE-Gastric trial evaluating domvanalimab plus zimberelimab and chemotherapy in first-line upper GI cancers, including objective response rate (ORR), median progression-free survival (PFS) and duration of response, will be presented at the ASCO Annual Meeting in June 2024. This study is evaluating the same regimen in the same setting as the STAR-221 Phase 3 study.

•Two Phase 3 studies are expected to complete enrollment this year:

◦STAR-221 evaluating domvanalimab plus zimberelimab and chemotherapy in PD-L1 all-comer first-line metastatic upper GI cancers is expected to complete enrollment by mid-year.

◦STAR-121 evaluating domvanalimab plus zimberelimab and chemotherapy in PD-L1 all-comer first-line metastatic non-small cell lung cancer (NSCLC) is expected to complete enrollment by the second half of 2024.

Casdatifan (HIF-2a inhibitor)

•Multiple expansion cohorts evaluating casdatifan in clear cell renal cell carcinoma (ccRCC) are underway, with several data presentations expected over the next 18 months:

◦ARC-20: Phase 1/1b study evaluating casdatifan as a monotherapy and in combination with other agents:

▪100 mg daily expansion cohort in 2L+ ccRCC (n=30): ORR data with minimum follow-up of at least 7 months are expected to be presented in the second half of 2024.

▪50 mg and 150mg expansion cohorts in 2L+ ccRCC (n=30 each): Enrollment has been completed for the 50mg cohort, and enrollment in the 150mg cohort was just initiated. Data from these cohorts are expected to be presented over the next 18 months.

◦STELLAR-009, a Phase 1b/2 trial evaluating casdatifan plus zanzalintinib in ccRCC, is currently enrolling.

•Arcus intends to initiate its first Phase 3 study evaluating casdatifan in combination with a TKI in ccRCC in the first half of 2025.

CD-73-Adenosine Axis: Etrumadenant (A2a/A2b receptor antagonist) and Quemliclustat (small-molecule CD73 inhibitor)

•Data from ARC-9, a randomized Phase 1b/2 study evaluating etrumadenant plus zimberelimab, bevacizumab and chemotherapy versus regorafenib in third-line metastatic colorectal cancer (mCRC), will be presented at ASCO in June.

•Data from MORPHEUS-PDAC, a randomized Phase 2 study operationalized by Roche, evaluating etrumadenant plus atezolizumab plus chemotherapy versus chemotherapy in first-line metastatic pancreatic ductal adenocarcinoma (PDAC), were presented at the American Association for Cancer Research (AACR) Annual Meeting in April 2024.

◦Median PFS of 8.2 months for the etrumadenant-containing regimen versus 6.8 months (HR = 0.67) for the chemotherapy arm.

◦Median OS of 16.5 months for the etrumadenant-containing regimen versus 12.1 months for the chemotherapy arm.

•These data further validate the results observed for quemliclustat in the Phase 1/1b ARC-8 trial, which showed a 15.7-month median OS (pooled analysis) when combined with chemotherapy in 1L pancreatic cancer, well above historical benchmark data for chemotherapy alone.

◦Initiation of a Phase 3 trial of quemliclustat combined with chemotherapy in pancreatic cancer is expected to begin by early 2025.

Early Clinical Programs

•Dose escalation for AB801, a potent and highly selective small-molecule AXL inhibitor, continues. Arcus anticipates advancing this molecule into expansion cohorts in NSCLC in early 2025.

Financial Results for First Quarter 2024:

•Cash, Cash Equivalents and Marketable Securities were $1.1 billion as of March 31, 2024, compared to $866 million as of December 31, 2023. The increase during the period is primarily due to the receipt of $320 million in cash from Gilead for their January 2024 equity investment, partially offset by the use of cash in research and development activities. We believe our cash, cash equivalents and marketable securities on-hand will be sufficient to fund operations into 2027. Cash, cash equivalents and marketable securities are expected to be between $870 million and $920 million at the end of 2024.

•Revenues were $145 million for the first quarter 2024, compared to $25 million for the same period in 2023. In the first quarter 2024, Arcus recognized $135 million in license and development services revenue related to the advancement of programs, primarily driven by a cumulative catch-up to revenue of $107 million relating to the Gilead collaboration amendments we executed in January 2024, as well as $10 million in other collaboration revenue primarily related to Gilead’s ongoing rights to access Arcus’s research and development pipeline in accordance with the Gilead collaboration agreement.

•Research and Development (R&D) Expenses were $109 million for the first quarter 2024, compared to $81 million for the same period in 2023. The net increase of $28 million was primarily driven by higher clinical manufacturing, clinical trial and headcount-related costs associated with our late-stage development program activities. Non-cash stock-based compensation expense was $10 million for the first quarter 2024, compared to $9 million for the same period in 2023. For the first quarter 2024 and 2023, Arcus recognized gross reimbursements of $37 million and $42 million, respectively, for shared expenses from its collaborations, primarily the Gilead collaboration. R&D expense by quarter may fluctuate due to the timing of clinical manufacturing and standard-of-care therapeutic purchases with a corresponding impact on reimbursements.

•General and Administrative (G&A) Expenses were $32 million for the first quarter 2024, compared to $30 million for the same period in 2023. The increase was primarily driven by compensation related to higher headcount and our 2024 stock awards, and costs incurred to obtain the Third Gilead Agreement Amendment. Non-cash stock-based compensation expense was $10 million for each of the first quarters 2024 and 2023.

•Impairment of Long-lived Assets was $20 million for the first quarter 2024, without similar expense for the same period in 2023. In the first quarter, we evaluated our needs for office space under our lease agreements. As a result, we now plan to sublease a portion of our facilities, resulting in a $20 million non-cash impairment charge.

•Net Loss was $4 million for the first quarter 2024, compared to $80 million for the same period in 2023.

Conference Call Information:

Arcus will host a conference call and webcast today, May 8, at 1:30 PM PT / 4:30 PM ET to discuss its first-quarter 2024 financial results and pipeline updates. To access the call, please dial (404) 975-4839 (local) or (833) 470-1428 (toll-free), using Access Code: 034427. To access the live webcast and accompanying slide presentation, please visit the “Investors & Media” section of the Arcus Biosciences website at www.arcusbio.com. A replay of the webcast will be available following the live event.

Arcus Ongoing and Announced Clinical Studies:

| | | | | | | | | | | | | | |

| Trial Name | Arms | Setting | Status | NCT No. |

| Lung Cancer |

STAR-121 | dom + zim + chemo vs. pembro + chemo | 1L NSCLC (PD-L1 all-comers) | Ongoing Registrational Phase 3 | NCT05502237 |

PACIFIC-8 | dom + durva vs. durva | Unresectable Stage 3 NSCLC | Ongoing Registrational Phase 3 | NCT05211895 |

| STAR-131 | dom + zim + chemo; dom + zim | Perioperative NSCLC | Registrational Phase 3 In Planning | TBD |

| ARC-7 | zim vs. dom + zim vs. etruma + dom + zim | 1L NSCLC (PD-L1 ≥ 50%) | Ongoing Randomized Phase 2 | NCT04262856 |

| EDGE-Lung | dom +/- zim +/- quemli +/- chemo | 1L/2L NSCLC (lung cancer platform study) | Ongoing Randomized Phase 2 | NCT05676931 |

VELOCITY-Lung | dom +/- zim +/- etruma +/- sacituzumab govitecan-hziy or other combos | 1L/2L NSCLC (lung cancer platform study) | Ongoing Randomized Phase 2 | NCT05633667 |

| Upper Gastrointestinal Cancers |

| STAR-221 | dom + zim + chemo vs. nivo + chemo | 1L Gastric, GEJ and EAC | Ongoing Registrational Phase 3 | NCT05568095 |

| EDGE-Gastric (ARC-21) | dom +/- zim +/- quemli +/- chemo | 1L/2L Upper GI Malignancies | Ongoing Randomized Phase 2 | NCT05329766 |

| Colorectal Cancer |

| ARC-9 | etruma + zim + mFOLFOX vs. SOC | 2L/3L/3L+ CRC | Ongoing

Randomized Phase 2

| NCT04660812 |

| Pancreatic Cancer |

| PRISM-1 | quemli + gem/nab-pac vs. gem/nab-pac | 1L PDAC | Planned Phase 3 | TBD |

| ARC-8 | quemli + zim + gem/nab-pac vs. quemli + gem/nab-pac | 1L, 2L PDAC | Ongoing Randomized Phase 1/1b | NCT04104672 |

| Kidney Cancer |

| STELLAR-009 | cas + zanza | ccRCC | Ongoing Phase 1b/2 | NCT06191796 |

| ARC-20 | cas, cas + cabo | Cancer Patients / ccRCC | Ongoing Phase 1/1b | NCT05536141 |

| Other |

| ARC-25 | AB598 | Advanced Malignancies | Ongoing | NCT05891171 |

| ARC-27 | AB801 | Advanced Malignancies | Ongoing | NCT06120075 |

cabo: cabozantinib; cas: casdatifan; dom: domvanalimab; durva: durvalumab; etruma: etrumadenant; gem/nab-pac: gemcitabine/nab-paclitaxel; nivo: nivolumab; pembro: pembrolizumab; quemli: quemliclustat; SOC: standard of care; zanza: zanzalintinib; zim: zimberelimab; ccRCC: clear-cell renal cell carcinoma; CRC: colorectal cancer; EAC: esophageal

adenocarcinoma; GEJ: gastroesophageal junction; GI: gastrointestinal; NSCLC: non-small cell lung cancer; PDAC: pancreatic ductal adenocarcinoma

About the Gilead Collaboration

In May 2020, Arcus established a 10-year collaboration with Gilead to strategically advance our portfolio. Under this collaboration, Gilead obtained time-limited exclusive option rights to all of our clinical programs arising during the collaboration term. Arcus and Gilead are co-developing four investigational products, including zimberelimab (Arcus’s anti-PD-1 molecule), domvanalimab (Arcus’s anti-TIGIT antibody), etrumadenant (Arcus’s adenosine receptor antagonist) and quemliclustat (Arcus’s CD73 inhibitor). The collaboration was expanded in November 2021 and May 2023 to include research directed to two targets for oncology and two targets for inflammatory diseases.

About Arcus Biosciences

Arcus Biosciences is a clinical-stage, global biopharmaceutical company developing differentiated molecules and combination medicines for people with cancer. In partnership with industry collaborators, patients and physicians around the world, Arcus is expediting the development of first- or best-in-class medicines against well-characterized biological targets and pathways and studying novel, biology-driven combinations that have the potential to help people with cancer live longer. Founded in 2015, the company has expedited the development of multiple investigational medicines into clinical studies, including new combination approaches that target TIGIT, PD-1, the adenosine axis (CD73 and dual A2a/A2b receptor), HIF-2a, CD39, and AXL. For more information about Arcus Biosciences’ clinical and preclinical programs, please visit www.arcusbio.com.

Domvanalimab, etrumadenant, quemliclustat, and zimberelimab are investigational molecules, and neither Gilead nor Arcus has received approval from any regulatory authority for any use globally, and their safety and efficacy have not been established. Casdatifan, AB598 and AB801 are also investigational molecules, and Arcus has not received approval from any regulatory authority for any use globally, and their safety and efficacy have not been established.

Forward-Looking Statements

This press release contains forward-looking statements. All statements regarding events or results to occur in the future contained herein are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, the statements in Dr. Rosen’s quote and statements regarding: Arcus’s expectation that its cash, cash equivalents and marketable securities on-hand are sufficient to fund operations into 2027; the timing and scope of analyses, data disclosures and presentations; whether data and results from studies validate our pipeline or support further development of a program; expected timing of clinical milestones, including the completion of enrollment; the potency, efficacy or safety of Arcus’s investigational products; and the initiation of and associated timing for future studies, including statements about the number of Phase 3 studies that Arcus’s investigational products will be in by the end of the year and Arcus’s intention to initiate its first Phase 3 study evaluating casdatifan. All forward-looking statements involve known and unknown risks and uncertainties and other important factors that may cause Arcus’s actual results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: risks associated with preliminary and interim data not being guarantees that future data will be similar; the unexpected emergence of adverse events or other undesirable side effects in Arcus’s investigational products; difficulties or delays in initiating or conducting clinical trials due to difficulties or delays in the regulatory process, enrolling subjects or manufacturing or supplying product for such clinical trials; unfavorable global economic, political and trade conditions; Arcus’s dependence on the collaboration with Gilead for the successful development and commercialization of its optioned molecules; difficulties associated with the management of the collaboration activities or expanded clinical programs; changes in the competitive landscape for Arcus’s programs; and the inherent uncertainty associated with pharmaceutical product development and clinical trials. Risks and uncertainties facing Arcus are described more fully in the “Risk Factors” section of Arcus’s most recent periodic report filed with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this press release. Arcus disclaims any obligation or undertaking to update, supplement or revise any forward-looking statements contained in this press release except to the extent required by law.

The Arcus name and logo are trademarks of Arcus Biosciences, Inc. All other trademarks belong to their respective owners.

Investor Inquiries:

Pia Eaves

VP of Investor Relations & Strategy

(617) 459-2006

peaves@arcusbio.com

Media Inquiries:

Holli Kolkey

VP of Corporate Communications

(650) 922-1269

hkolkey@arcusbio.com

ARCUS BIOSCIENCES, INC.

Consolidated Statements of Operations

(unaudited)

(In millions, except per share amounts)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| License and development services revenue | | | | | $ | 135 | | | $ | 17 | |

| Other collaboration revenue | | | | | 10 | | | 8 | |

| Total revenues | | | | | 145 | | | 25 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | | | | | 109 | | | 81 | |

| General and administrative | | | | | 32 | | | 30 | |

| Impairment of long-lived assets | | | | | 20 | | | — | |

| Total operating expenses | | | | | 161 | | | 111 | |

| | | | | | | |

| Loss from operations | | | | | (16) | | | (86) | |

| | | | | | | |

| Non-operating income (expense): | | | | | | | |

| Interest and other income, net | | | | | 13 | | | 9 | |

| Effective interest on liability for sale of future royalties | | | | | (1) | | | (1) | |

| Total non-operating income, net | | | | | 12 | | | 8 | |

| | | | | | | |

| Loss before income taxes | | | | | (4) | | | (78) | |

| | | | | | | |

| Income tax expense | | | | | — | | | (2) | |

| | | | | | | |

| Net loss | | | | | $ | (4) | | | $ | (80) | |

| | | | | | | |

| Net loss per share: | | | | | | | |

| Basic and diluted | | | | | $ | (0.05) | | | $ | (1.09) | |

| | | | | | | |

| Shares used to compute net loss per share: | | | | | | | |

| Basic and diluted | | | | | 86.2 | | | 73.0 |

Selected Consolidated Balance Sheet Data

(unaudited)

(In millions)

| | | | | | | | | | | |

| March 31,

2024 | | December 31, 2023 (1) |

| Cash, cash equivalents and marketable securities | $ | 1,095 | | | $ | 866 | |

| Total assets | 1,293 | | | 1,095 | |

| Total liabilities | 586 | | | 633 | |

| Total stockholders’ equity | 707 | | | 462 | |

(1)Derived from the audited financial statements for the quarter ended December 31, 2023, included in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 21, 2024.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

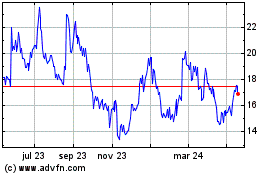

Arcus Biosciences (NYSE:RCUS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

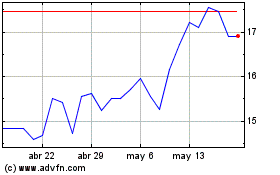

Arcus Biosciences (NYSE:RCUS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024