Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend]

07 Febrero 2024 - 5:06AM

Edgar (US Regulatory)

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

| |

| SCHEDULE 13G/A |

| |

|

Under the Securities Exchange Act of 1934

(Amendment No. 2)* |

| |

| RLX Technology Inc. |

| (Name of Issuer) |

| |

| Class A and Class B ordinary shares, par value of $0.00001 per share |

| (Title of Class of Securities) |

| |

| 74969N 103** |

| (CUSIP Number) |

| |

| December 31, 2023 |

| (Date of Event Which Requires Filing of this Statement) |

| |

| Check the appropriate box to designate the rule pursuant to which this Schedule is filed: |

| |

| ¨ Rule 13d-1(b) |

| |

| ¨ Rule 13d-1(c) |

| |

| x Rule 13d-1(d) |

| |

| * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. |

| |

| ** CUSIP number 74969N 103 has been assigned to the American Depositary Shares (“ADSs”) of the Issuer, which are listed on the New York Stock Exchange under the symbol “RLX.” Each ADS represents one Class A ordinary share, par value US$0.00001 per share. |

| |

| The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes). |

| CUSIP No. 74969N 103 | | Page 2 of 14 pages |

| 1 |

NAMES OF REPORTING PERSONS

Ying (Kate) Wang |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH: |

5 |

SOLE VOTING POWER

814,907,560(1) |

| 6 |

SHARED VOTING POWER

0 |

| 7 |

SOLE DISPOSITIVE POWER

380,555,770(2) |

| 8 |

SHARED DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

814,907,560(1) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

51.9% of Class A ordinary shares, assuming conversion of the Class

B ordinary shares beneficially owned by the Reporting Person into Class A ordinary shares. 19.7% economic interest, representing

the economic interest owned by Ms. Ying (Kate) Wang as a percentage of the economic interest of all of the issued and outstanding

shares of the Issuer as of December 31, 2023.(3) |

| 12 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

| CUSIP No. 74969N 103 | | Page 3 of 14 pages |

| (1) |

Represents (i) 71,840,780 Class A ordinary shares held by BJ BJ Limited, (ii) 308,714,990 Class B ordinary shares held by Leo Valley

Holding Limited, and (iii) 434,351,790 Class A ordinary shares in which Ms. Ying (Kate) Wang is entitled to the voting power pursuant

to the Founders’ Acting-In- Concert Undertakings and the Minority Shareholders’ Acting-In-Concert Undertakings, respectively

(each as defined below).

a) On October 19, 2022, a series of acting-in-concert undertakings (the “Founders’ Acting-In- Concert Undertakings”)

were entered into among RLX Technology Inc., Leo Valley Holding Limited, Ms. Ying (Kate) Wang, on the one hand, and each of Mr. Long (David)

Jiang and Longtian Holding Limited, Mr. Yilong Wen and StarryInv Holding Limited, and certain minority shareholders of RLX Technology

Inc., on the other hand. Pursuant to the Founders’ Acting-In-Concert Undertakings, each of (i) Mr. Long (David) Jiang and Longtian

Holding Limited, (ii) Mr. Yilong Wen and StarryInv Holding Limited, and (iii) certain minority shareholders of RLX Technology Inc. agrees

to act in concert with, and take the same action as, Leo Valley Holding Limited in relation to all matters that require the decisions

of the shareholders of RLX Technology Inc.

b) On December 21, 2023, an acting-in-concert undertakings (the “Minority Shareholders’ Acting-In-Concert Undertakings”)

was entered into among RLX Technology Inc., Leo Valley Holding Limited, Ms. Ying (Kate) Wang, on the one hand, and certain minority shareholders

of RLX Technology Inc., on the other hand. Pursuant to the Minority Shareholders’ Acting- In-Concert Undertakings, each of the undersigned

minority shareholders of the Minority Shareholders’ Acting-In-Concert Undertakings agrees to act in concert with, and take the same

action as, Leo Valley Holding Limited in relation to all matters that require the decisions of the shareholders of RLX Technology Inc.

c) Based on the above, Ms. Ying (Kate) Wang is deemed to have

sole voting power over all of the 814,907,560 ordinary shares beneficially owned by her, consisting of (i) 71,840,780 Class A ordinary

shares held by BJ BJ Limited, (ii) 308,714,990 Class B ordinary shares by The Alpha Trust through Leo Valley Holding Limited, (iii) 434,351,790

Class A ordinary shares in which she is entitled to the voting rights pursuant to the Acting-In-Concert Undertakings, including (a) under

the Founders’ Acting-In-Concert Undertakings, 142,797,680 Class A ordinary shares held by Longtian Holding Limited, 93,343,940

Class A ordinary shares held by StarryInv Holding Limited, and 73,315,180 Class A ordinary shares held by certain minority shareholders

of RLX Technology Inc., and (b) under the Minority Shareholders’ Acting-In-Concert Undertakings, 124,894,990 Class A ordinary shares

held by certain minority shareholders of RLX Technology Inc. |

| |

|

| (2) |

Represents (i) 71,840,780 Class A ordinary shares held by BJ BJ Limited

and (ii) 308,714,990 Class B ordinary shares held by Leo Valley Holding Limited. Ms. Ying (Kate) Wang is the sole director of BJ BJ Limited

and Leo Valley Holding Limited. Leo Valley Holding Limited is beneficially owned and controlled by Lion Valley Limited, a British Virgin

Islands company. Lion Valley Limited is wholly owned by Zedra Trust Company (Cayman) Limited, on behalf of and for the benefit of The

Alpha Trust as the trustee. Ms. Ying (Kate) Wang is the settlor and enforcer of The Alpha Trust, and Ms. Wang and her family members are

the trust’s beneficiaries.

Based on the above, Ms. Ying (Kate) Wang is deemed to have sole dispositive

power over an aggregate of 380,555,770 ordinary shares, consisting of (a) 71,840,780 Class A ordinary shares held by BJ BJ Limited and

(b) 308,714,990 Class B ordinary shares by The Alpha Trust through Leo Valley Holding Limited. |

| |

|

| (3) |

Based on 1,262,075,580 Class A ordinary shares and 308,714,990 Class

B ordinary shares issued and outstanding as of December 31, 2023, assuming the conversion of all such Class B ordinary shares into the

same number of Class A ordinary shares. The percentage of economic interest of Ms. Ying (Kate) Wang excludes the economic interest represented

by 71,840,780 Class A ordinary shares held by BJ BJ

Limited for the purpose of administering share incentive awards under

the 2021 share incentive plan

(“2021 Plan”) to the plan participants.

|

| CUSIP No. 74969N 103 | | Page 4 of 14 pages |

| 1 |

NAMES OF REPORTING PERSONS

Leo Valley Holding Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH: |

5 |

SOLE VOTING POWER

308,714,990(1) |

| 6 |

SHARED VOTING POWER

0 |

| 7 |

SOLE DISPOSITIVE POWER

308,714,990(1) |

| 8 |

SHARED DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

308,714,990(1) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

19.7%(2) |

| 12 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

| (1) |

Represents 308,714,990 Class B ordinary shares held by Leo Valley Holding

Limited, a British Virgin Islands company. Ms. Ying (Kate) Wang is the sole director of Leo Valley Holding Limited. Leo Valley Holding

Limited is beneficially owned and controlled by Lion Valley Limited, a British Virgin Islands company. Lion Valley Limited is wholly owned

by Zedra Trust Company (Cayman) Limited, on behalf of and for the benefit of The Alpha Trust as the trustee. Ms. Ying (Kate) Wang is the

settlor and enforcer of The Alpha Trust, and Ms. Wang and her family members are the trust’s beneficiaries. |

| (2) |

Based on 1,262,075,580 Class A ordinary shares and 308,714,990 Class

B ordinary shares issued and outstanding as of December 31, 2023, assuming the conversion of all such Class B ordinary shares into the

same number of Class A ordinary shares. Leo Valley Holding Limited owns 100% of Class B ordinary shares of RLX Technology Inc. |

| CUSIP No. 74969N 103 | | Page 5 of 14 pages |

| 1 |

NAMES OF REPORTING PERSONS

BJ BJ Limited(1) |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH: |

5 |

SOLE VOTING POWER

71,840,780(2) |

| 6 |

SHARED VOTING POWER

0 |

| 7 |

SOLE DISPOSITIVE POWER

71,840,780(2) |

| 8 |

SHARED DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

71,840,780(2) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.6%(3) |

| 12 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

| (2) |

Represents 71,840,780 Class A ordinary shares held by BJ BJ Limited,

a British Virgin Islands company. |

| (3) |

Based on 1,262,075,580 Class A ordinary shares and 308,714,990 Class

B ordinary shares issued and outstanding as of December 31, 2023, assuming the conversion of all such Class B ordinary shares into the

same number of Class A ordinary shares. |

| CUSIP No. 74969N 103 | | Page 6 of 14 pages |

| 1 |

NAMES OF REPORTING PERSONS

Long (David) Jiang |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH: |

5 |

SOLE VOTING POWER

142,797,680(1) |

| 6 |

SHARED VOTING POWER

0 |

| 7 |

SOLE DISPOSITIVE POWER

142,797,680(1) |

| 8 |

SHARED DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

142,797,680(1) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.1%(2) |

| 12 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

| |

(1) |

Represents 142,797,680 Class A ordinary shares held by Longtian Holding

Limited, a British Virgin Islands company. Mr. Long (David) Jiang is the sole director of Longtian Holding Limited. Longtian Holding Limited

is owned by Cititrust Private (Cayman) Limited as the trustee of The HuaDi Family Trust. Under the terms of The HuaDi Family Trust, Mr.

Long (David) Jiang is the settlor of The HuaDi Family Trust. Mr. Long (David) Jiang and his family members are the trust’s beneficiaries. |

| |

(2) |

Based on 1,262,075,580 Class A ordinary shares and 308,714,990 Class

B ordinary shares issued and outstanding as of December 31, 2023, assuming the conversion of all such Class B ordinary shares into the

same number of Class A ordinary shares. |

| CUSIP No. 74969N 103 | | Page 7 of 14 pages |

| 1 |

NAMES OF REPORTING PERSONS

Longtian Holding Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH: |

5 |

SOLE VOTING POWER

142,797,680(1) |

| 6 |

SHARED VOTING POWER

0 |

| 7 |

SOLE DISPOSITIVE POWER

142,797,680(1) |

| 8 |

SHARED DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

142,797,680(1) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.1%(2) |

| 12 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

| |

(1) |

Represents 142,797,680 Class A ordinary shares held by Longtian Holding

Limited, a British Virgin Islands company. Mr. Long (David) Jiang is the sole director of Longtian Holding Limited. Longtian Holding Limited

is owned by Cititrust Private (Cayman) Limited as the trustee of The HuaDi Family Trust. Under the terms of The HuaDi Family Trust, Mr.

Long (David) Jiang is the settlor of The HuaDi Family Trust. Mr. Long (David) Jiang and his family members are the trust’s beneficiaries. |

| |

(2) |

Based on 1,262,075,580 Class A ordinary shares and 308,714,990 Class

B ordinary shares issued and outstanding as of December 31, 2023, assuming the conversion of all such Class B ordinary shares into the

same number of Class A ordinary shares. |

| CUSIP No. 74969N 103 | | Page 8 of 14 pages |

| 1 |

NAMES OF REPORTING PERSONS

Yilong Wen |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH: |

5 |

SOLE VOTING POWER

93,343,940(1) |

| 6 |

SHARED VOTING POWER

0 |

| 7 |

SOLE DISPOSITIVE POWER

93,343,940(1) |

| 8 |

SHARED DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

93,343,940(1) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

5.9%(2) |

| 12 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

| |

(1) |

Represents 93,343,940 Class A ordinary shares held by StarryInv Holding

Limited, a British Virgin Islands company. Mr. Yilong Wen is the sole director of StarryInv Holding Limited. StarryInv Holding Limited

is owned by Cititrust Private (Cayman) Limited as the trustee of The UBGDX Family Trust. Under the terms of The UBGDX Family Trust, Mr.

Yilong Wen is the settlor of The UBGDX Family Trust. Mr. Yilong Wen and his family members are the trust’s beneficiaries. |

| |

|

|

| |

(2) |

Based on 1,262,075,580 Class A ordinary shares and 308,714,990 Class

B ordinary shares issued and outstanding as of December 31, 2023, assuming the conversion of all such Class B ordinary shares into the

same number of Class A ordinary shares. |

| CUSIP No. 74969N 103 | | Page 9 of 14 pages |

| 1 |

NAMES OF REPORTING PERSONS

StarryInv Holding Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH: |

5 |

SOLE VOTING POWER

93,343,940(1) |

| 6 |

SHARED VOTING POWER

0 |

| 7 |

SOLE DISPOSITIVE POWER

93,343,940(1) |

| 8 |

SHARED DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

93,343,940(1) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

5.9%(2) |

| 12 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

| |

(1) |

Represents 93,343,940 Class A ordinary shares held by StarryInv Holding

Limited, a British Virgin Islands company. Mr. Yilong Wen is the sole director of StarryInv Holding Limited. StarryInv Holding Limited

is owned by Cititrust Private (Cayman) Limited as the trustee of The UBGDX Family Trust. Under the terms of The UBGDX Family Trust, Mr.

Yilong Wen is the settlor of The UBGDX Family Trust. Mr. Yilong Wen and his family members are the trust’s beneficiaries. |

| |

(2) |

Based on 1,262,075,580 Class A ordinary shares and 308,714,990 Class

B ordinary shares issued and outstanding as of December 31, 2023, assuming the conversion of all such Class B ordinary shares into the

same number of Class A ordinary shares. |

| CUSIP No. 74969N 103 | | Page 10 of 14 pages |

| ITEM 1(a). |

NAME OF ISSUER: |

RLX Technology Inc. (the “Issuer”)

| ITEM 1(b). |

ADDRESS OF ISSUER’S PRINCIPAL EXECUTIVE OFFICES: |

35/F, Pearl International Financial Center

No. 9 Jian’an First Road, Financial Street

Third District, Bao’an District

Shenzhen, Guangdong Province

People’s Republic of China

| ITEM 2(a). |

NAME OF PERSON FILING: |

| |

1) |

Ying (Kate) Wang |

| |

2) |

Leo Valley Holding Limited |

| |

3) |

BJ BJ Limited |

| |

4) |

Long (David) Jiang |

| |

5) |

Longtian Holding Limited |

| |

6) |

Yilong Wen |

| |

7) |

StarryInv Holding Limited |

(collectively, the “Reporting Persons”, each

a “Reporting Person”)

| ITEM 2(b). |

ADDRESS OF PRINCIPAL BUSINESS OFFICE, OR, IF NONE, RESIDENCE: |

For each of the Reporting Persons:

35/F, Pearl International Financial Center

No. 9 Jian’an First Road, Financial Street

Third District, Bao’an District

Shenzhen, Guangdong Province

People’s Republic of China

| |

1) |

Ying (Kate) Wang – People’s Republic of China |

| |

2) |

Leo Valley Holding Limited – British Virgin Islands |

| |

3) |

BJ BJ Limited – British Virgin Islands |

| |

4) |

Long (David) Jiang – People’s Republic of China |

| |

5) |

Longtian Holding Limited – British Virgin Islands |

| |

6) |

Yilong Wen – People’s Republic of China |

| |

7) |

StarryInv Holding Limited – British Virgin Islands |

| ITEM 2(d). |

TITLE OF CLASS OF SECURITIES: |

Class A ordinary shares, par value of $0.00001 per share,

of the Issuer. The Issuer’s ordinary shares consist of Class A ordinary shares and Class B ordinary shares, par value of $0.00001

per share. The rights of the holders of Class A ordinary shares and Class B ordinary shares are identical, except with respect to conversion

rights and voting rights. Each Class B ordinary share is convertible at the option of the holder at any time into one Class A ordinary

share. Each Class B ordinary share is entitled to ten votes per share, whereas each Class A ordinary share is entitled to one vote per

share.

74969N 103

There is no CUSIP number assigned to the Class A ordinary

shares. This CUSIP number applies to the American depositary shares of the Issuer, each representing one Class A ordinary share of the

Issuer.

| CUSIP No. 74969N 103 | | Page 11 of 14 pages |

| ITEM 3. |

If this statement is filed pursuant to §§ 240.13d-1(b), or 240.13d -2(b) or (c), check whether the persons filing is a: |

Not applicable

Reporting

Person(1) | |

Amount

beneficially

owned: | | |

Percent

of

beneficial

ownership: | | |

Percentage

of economic

interest | | |

Percent

of

aggregate

voting power: | | |

Sole

power to

vote or direct

the vote: | | |

Shared

power to

vote or to direct

the vote: | | |

Sole

power to

dispose or to

direct the

disposition of: | | |

Shared

power

to dispose or to

direct the

disposition of: | |

| Ying (Kate) Wang(2) | |

| 814,907,560 | | |

| 51.9 | % | |

| 19.7 | % | |

| 82.6 | % | |

| 814,907,560 | | |

| 0 | | |

| 380,555,770 | | |

| 0 | |

| Leo Valley Holding Limited(3) | |

| 308,714,990 | | |

| 19.7 | % | |

| 19.7 | % | |

| 71.0 | % | |

| 308,714,990 | | |

| 0 | | |

| 308,714,990 | | |

| 0 | |

| BJ BJ Limited(4) | |

| 71,840,780 | | |

| 4.6 | % | |

| 4.6 | % | |

| 1.7 | % | |

| 71,840,780 | | |

| 0 | | |

| 71,840,780 | | |

| 0 | |

| Long (David) Jiang(5) | |

| 142,797,680 | | |

| 9.1 | % | |

| 9.1 | % | |

| 3.3 | % | |

| 142,797,680 | | |

| 0 | | |

| 142,797,680 | | |

| 0 | |

| Longtian Holding Limited(6) | |

| 142,797,680 | | |

| 9.1 | % | |

| 9.1 | % | |

| 3.3 | % | |

| 142,797,680 | | |

| 0 | | |

| 142,797,680 | | |

| 0 | |

| Yilong Wen(7) | |

| 93,343,940 | | |

| 5.9 | % | |

| 5.9 | % | |

| 2.1 | % | |

| 93,343,940 | | |

| 0 | | |

| 93,343,940 | | |

| 0 | |

| StarryInv Holding Limited(8) | |

| 93,343,940 | | |

| 5.9 | % | |

| 5.9 | % | |

| 2.1 | % | |

| 93,343,940 | | |

| 0 | | |

| 93,343,940 | | |

| 0 | |

| |

(1) |

For each Reporting Person included in this table, percentage of voting power

is calculated by dividing the voting power beneficially owned by such Reporting Person by the voting power of all of the Issuer’s

issued and outstanding Class A and Class B ordinary shares as a single class. Each holder of Class A ordinary shares is entitled

to one vote per share and each holder of Class B ordinary shares is entitled to ten votes per share on all matters submitted to them

for a vote. The Issuer’s Class A ordinary shares and Class B ordinary shares vote together as a single class on all matters

submitted to a vote of the Issuer’s shareholders, except as may otherwise be required by law. The Issuer’s Class B ordinary

shares are convertible at any time by the holder thereof into Class A ordinary shares on a one-for-one basis. For each Reporting

Person included in this table, the percentage of economic interest is calculated by the economic interest owned by such Reporting

Person by the economic interest of all of the Issuer’s issued and outstanding ordinary shares. |

| |

|

|

| |

(2) |

Represents

the voting power over (i) 71,840,780 Class A ordinary shares held by BJ BJ Limited, (ii) 308,714,990 Class

B ordinary shares held by Leo Valley Holding Limited, and (iii) 434,351,790 Class A ordinary shares in

which Ms. Ying (Kate) Wang is entitled to the voting rights pursuant the Founders’ Acting-In-Concert

Undertakings and the Minority Shareholders’ Acting-In-Concert Undertakings, respectively. Ms. Ying

(Kate) Wang does not have dispositive power over the 434,351,790 Class A ordinary shares under the Founders’

Acting-In-Concert Undertakings and the Minority Shareholders’ Acting-In-Concert Undertakings, respectively.

See footnotes (3) and (4) below and footnote (2) on Page 3 for more details. The percentage of economic

interest of Ms. Ying (Kate) Wang excludes the economic interest represented by 71,840,780 Class A ordinary

shares held by BJ BJ Limited for the purpose of administering share incentive awards under the 2021 Plan

to the plan participants. |

| |

|

|

| |

(3) |

Represents 308,714,990 Class B ordinary shares held by Leo Valley Holding

Limited, a British Virgin Islands company. Ms. Ying (Kate) Wang is the sole director of Leo Valley Holding Limited. Leo Valley Holding

Limited is beneficially owned and controlled by Lion Valley Limited, a British Virgin Islands company. Lion Valley Limited is wholly

owned by Zedra Trust Company (Cayman) Limited, on behalf of and for the benefit of The Alpha Trust as the trustee. Ms. Ying (Kate)

Wang is the settlor and enforcer of The Alpha Trust, and Ms. Wang and her family members are the trust’s beneficiaries. |

| |

|

|

| |

(4) |

Represents 71,840,780 Class A ordinary shares held by BJ BJ Limited for

the purpose of administering share incentive awards under the 2021 Plan to the plan participants, and administering the awards and

acting according to the Issuer’s instruction. BJ BJ Limited is a British Virgin Islands company, with Ms. Ying (Kate) Wang

being the sole director, and is wholly owned by Zedra Trust Company (Cayman) Limited on behalf of and for the benefit of The Nano

Trust as the trustee. Ms. Ying (Kate) Wang is the enforcer of The Nano Trust. Under the terms of the trust, Ms. Wang has the power

to direct the trustee with respect to the retention or disposal of, and the exercise of any voting and other rights attached to,

the shares held by BJ BJ Limited. |

| |

|

|

| |

(5) |

Represents 142,797,680 Class A ordinary

shares held by Longtian Holding Limited, a British Virgin Islands company. Mr. Long (David) Jiang is the sole director of Longtian

Holding Limited. Longtian Holding Limited is owned by Cititrust Private (Cayman) Limited as the trustee of The HuaDi Family Trust.

Under the terms of The HuaDi Family Trust, Mr. Long (David) Jiang is the settlor of The HuaDi Family Trust. Mr. Long (David) Jiang

and his family members are the trust’s beneficiaries. |

| |

|

|

| |

(6) |

Represents 142,797,680 Class A ordinary shares held by Longtian Holding Limited,

a British Virgin Islands company. Mr. Long (David) Jiang is the sole director of Longtian Holding Limited. Longtian Holding Limited

is owned by Cititrust Private (Cayman) Limited as the trustee of The HuaDi Family Trust. Under the terms of The HuaDi Family Trust,

Mr. Long (David) Jiang is the settlor of The HuaDi Family Trust. Mr. Long (David) Jiang and his family members are the trust’s

beneficiaries. |

| |

|

|

| |

(7) |

Represents 93,343,940 Class A ordinary shares held by StarryInv Holding Limited,

a British Virgin Islands company. Mr. Yilong Wen is the sole director of StarryInv Holding Limited. StarryInv Holding Limited is

owned by Cititrust Private (Cayman) Limited as the trustee of The UBGDX Family Trust. Under the terms of The UBGDX Family

Trust, Mr. Yilong Wen is the settlor of The UBGDX Family Trust. Mr. Yilong Wen and his family members are the trust’s beneficiaries. |

| |

|

|

| |

(8) |

Represents 93,343,940 Class A ordinary shares held by StarryInv Holding Limited,

a British Virgin Islands company. Mr. Yilong Wen is the sole director of StarryInv Holding Limited. StarryInv Holding Limited is

owned by Cititrust Private (Cayman) Limited as the trustee of The UBGDX Family Trust. Under the terms of The UBGDX Family

Trust, Mr. Yilong Wen is the settlor of The UBGDX Family Trust. Mr. Yilong Wen and his family members are the trust’s beneficiaries. |

| CUSIP No. 74969N 103 | | Page 12 of 14 pages |

| ITEM 5. |

OWNERSHIP OF FIVE PERCENT OR LESS OF A CLASS |

The statement of BJ BJ Limited is being filed to report the fact that

it has ceased to be the beneficial owner of more than 5 percent of Class A Ordinary Shares.

| ITEM 6. |

OWNERSHIP OF MORE THAN FIVE PERCENT ON BEHALF OF ANOTHER PERSON |

Not applicable

| ITEM 7. |

IDENTIFICATION AND CLASSIFICATION OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT HOLDING COMPANY OR CONTROL PERSON |

Not applicable

| ITEM 8. |

IDENTIFICATION AND CLASSIFICATION OF MEMBERS OF THE GROUP |

Not applicable

| ITEM 9. |

NOTICE OF DISSOLUTION OF GROUP |

Not applicable

Not applicable

| CUSIP No. 74969N 103 | | Page 13 of 14 pages |

LIST OF EXHIBITS

| CUSIP No. 74969N 103 | | Page 14 of 14 pages |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: February 7, 2024

| |

Ying (Kate) Wang |

| |

|

| |

/s/ Ying (Kate) Wang |

| |

|

| |

Leo Valley Holding Limited |

| |

|

| |

By: |

/s/ Ying (Kate) Wang |

| |

Name: |

Ying (Kate) Wang |

| |

Title: |

Director |

| |

|

| |

BJ BJ Limited |

| |

|

| |

By: |

/s/ Ying (Kate) Wang |

| |

Name: |

Ying (Kate) Wang |

| |

Title: |

Director |

| |

|

| |

Long (David) Jiang |

| |

|

| |

/s/ Long (David) Jiang |

| |

|

| |

Longtian Holding Limited |

| |

|

| |

By: |

/s/ Long (David) Jiang |

| |

Name: |

Long (David) Jiang |

| |

Title: |

Director |

| |

|

| |

Yilong Wen |

| |

|

| |

/s/ Yilong Wen |

| |

|

| |

StarryInv Holding Limited |

| |

|

| |

By: |

/s/ Yilong Wen |

| |

Name: |

Yilong Wen |

| |

Title: |

Director |

Exhibit 99.1

Joint Filing Agreement

In accordance with Rule 13d-1(k) promulgated under

the Securities Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with all other Reporting Persons (as

such term is defined in the Schedule 13G referred to below) on behalf of each of them of a statement on Schedule 13G (including amendments

thereto) with respect to the Class A ordinary shares, par value of $0.00001 per share, of RLX Technology Inc., a Cayman Islands exempted

company, and that this Agreement may be included as an exhibit to such joint filing. This Agreement may be executed in any number of counterparts,

all of which taken together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the undersigned hereby execute

this Agreement as of February 7, 2024.

| |

Ying (Kate) Wang |

| |

|

| |

/s/ Ying (Kate) Wang |

| |

|

| |

Leo Valley Holding Limited |

| |

|

| |

By: |

/s/ Ying (Kate) Wang |

| |

Name: Ying (Kate) Wang |

| |

Title: Director |

| |

|

| |

BJ BJ Limited |

| |

|

| |

By: |

/s/ Ying (Kate) Wang |

| |

Name: Ying (Kate) Wang |

| |

Title: Director |

| |

|

| |

Long (David) Jiang |

| |

|

| |

/s/ Long (David) Jiang |

| |

|

| |

Longtian Holding Limited |

| |

|

| |

By: |

/s/ Long (David) Jiang |

| |

Name: Long (David) Jiang |

| |

Title: Director |

| |

|

| |

Yilong Wen |

| |

|

| |

/s/ Yilong Wen |

| |

|

| |

StarryInv Holding Limited |

| |

|

| |

By: |

/s/ Yilong Wen |

| |

Name: Yilong Wen |

| |

Title: Director |

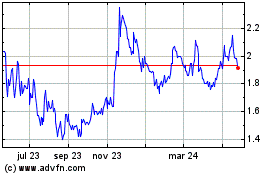

RLX Technology (NYSE:RLX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

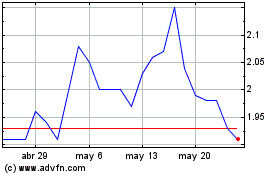

RLX Technology (NYSE:RLX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025