0001519401false00015194012024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

Regional Management Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-35477 |

|

57-0847115 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

979 Batesville Road, Suite B

Greer, South Carolina 29651

(Address of principal executive offices) (zip code)

(864) 448-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

Common Stock, $0.10 par value |

|

RM |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 31, 2024, the Company issued a press release announcing financial results for the three and six months ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. On July 31, 2024, the Company will host a conference call to discuss financial results for the three and six months ended June 30, 2024. A copy of the presentation to be used during the conference call is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

All information in the press release and the presentation is furnished under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition,” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On July 31, 2024, the Company also announced that its Board of Directors has declared a quarterly cash dividend of $0.30 per share of outstanding common stock, payable on September 12, 2024 to stockholders of record as of the close of business on August 21, 2024.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Regional Management Corp. |

|

|

|

|

Date: July 31, 2024 |

By: |

|

/s/ Harpreet Rana |

|

Name: |

|

Harpreet Rana |

|

Title: |

|

Executive Vice President and Chief Financial Officer |

Regional Management Corp. Announces Second Quarter 2024 Results

- Net income of $8.4 million and diluted earnings per share of $0.86, up 37% from $0.63 in the prior-year period -

- Year-over-year growth in customer accounts, originations, and revenue of 7%; revenue growth driven by 5% ending net receivables growth and 80 bps increase in total revenue yield -

- 30+ day contractual delinquency rate of 6.9% as of June 30, 2024 -

- Continued expense discipline with operating expense ratio of 13.8% -

Greenville, South Carolina – July 31, 2024 – Regional Management Corp. (NYSE: RM), a diversified consumer finance company, today announced results for the second quarter ended June 30, 2024.

“We are very pleased with our quarterly and year-to-date results,” said Robert W. Beck, President and Chief Executive Officer of Regional Management Corp. “We delivered $8.4 million of net income in the second quarter, or $0.86 of diluted EPS. We grew our portfolio by $29 million sequentially to $1.8 billion in the quarter, up 5.0% from the prior year. Our interest and fee yield increased 110 basis points year-over-year from a combination of increased pricing, growth of our higher-margin small loan portfolio, and improved credit performance. Our larger portfolio and stronger yield combined to drive total revenue to $143 million in the second quarter, up 7% from last year. At the same time, we have maintained a tight grip on G&A expense while still investing in our growth and strategic initiatives. Together, these strong line item outcomes drove net income up 40% compared to the second quarter of last year.”

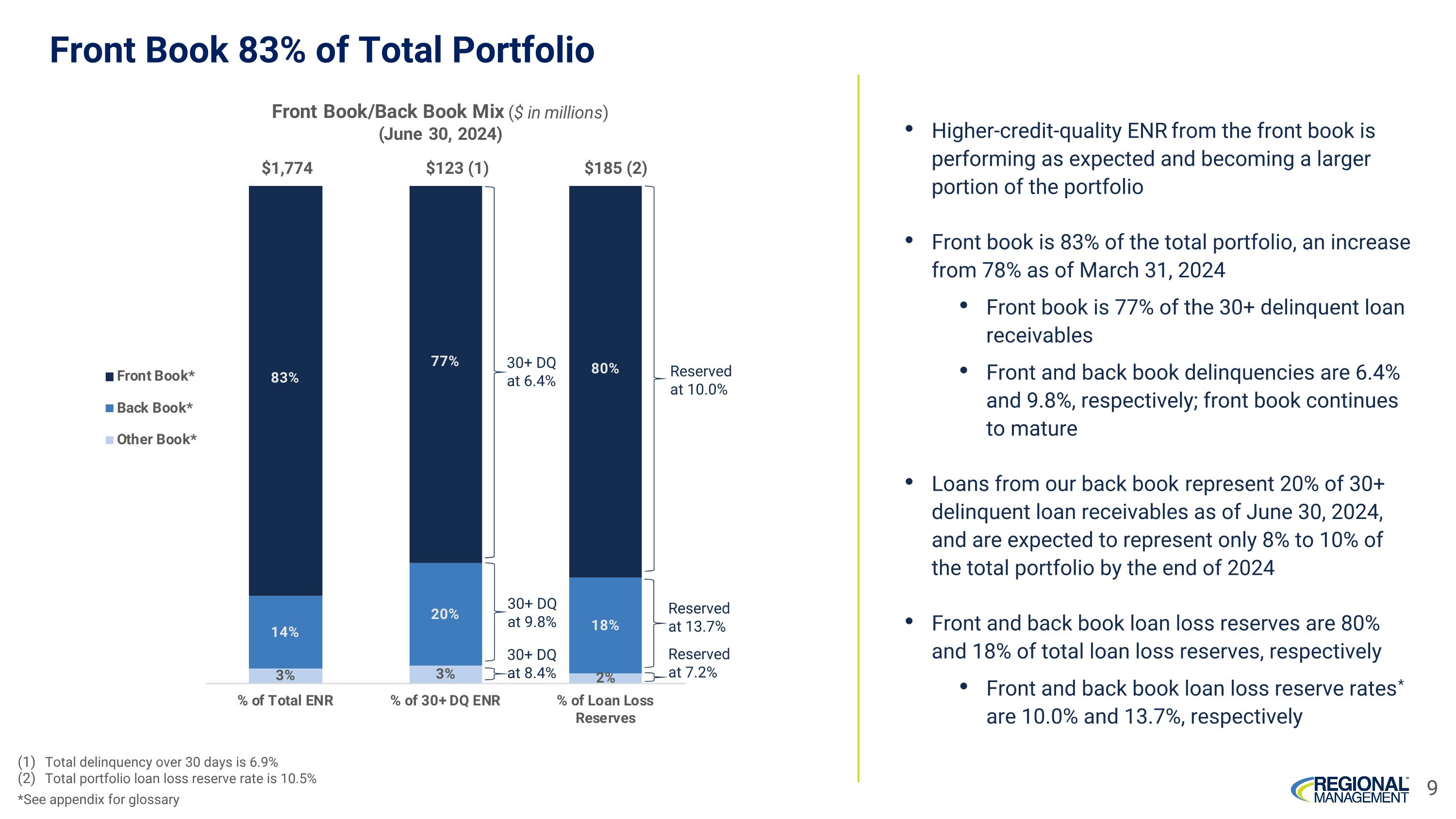

“Along with our strong first half results, we continue to carefully manage our portfolio’s credit quality and performance,” added Mr. Beck. “Our 30+ day delinquency rate remained stable at 6.9% at the end of the quarter, 20 basis points better sequentially. Our net credit loss rate improved 40 basis points from the prior year, as the front book continues to perform in line with our expectations and makes up a larger portion of our total portfolio. We grew our small loan portfolio by $61 million, or 14%, year-over-year, representing more than 70% of our total portfolio growth over the past year. Our portfolio of loans with greater than 36% APR grew from 14% to 17% of the total portfolio over that same time period. While these portfolios naturally come with higher delinquencies and credit losses, it is an excellent trade given the stronger margins and bottom-line returns that the portfolios generate.”

“We had a very successful first half of 2024, posting strong top- and bottom-line results despite the continued impacts of inflation on credit performance,” continued Mr. Beck. “We remain well-positioned to operate effectively through the current economic cycle. As we expect credit losses to improve in the second half of the year, we are excited to begin increasing our investment in our strategic initiatives and portfolio growth, including through the opening of ten new branch locations before year-end and continued expansion of our higher-margin and auto-secured loan portfolios. We look forward to continuing to deliver strong returns to our shareholders while also investing in the business in a way that will enable us to achieve additional, sustainable growth, improved credit performance, and greater productivity, operating efficiency, and leverage over the long-term.”

Second Quarter 2024 Highlights

•Net income for the second quarter of 2024 was $8.4 million and diluted earnings per share was $0.86, up 37% from $0.63 in the prior-year period.

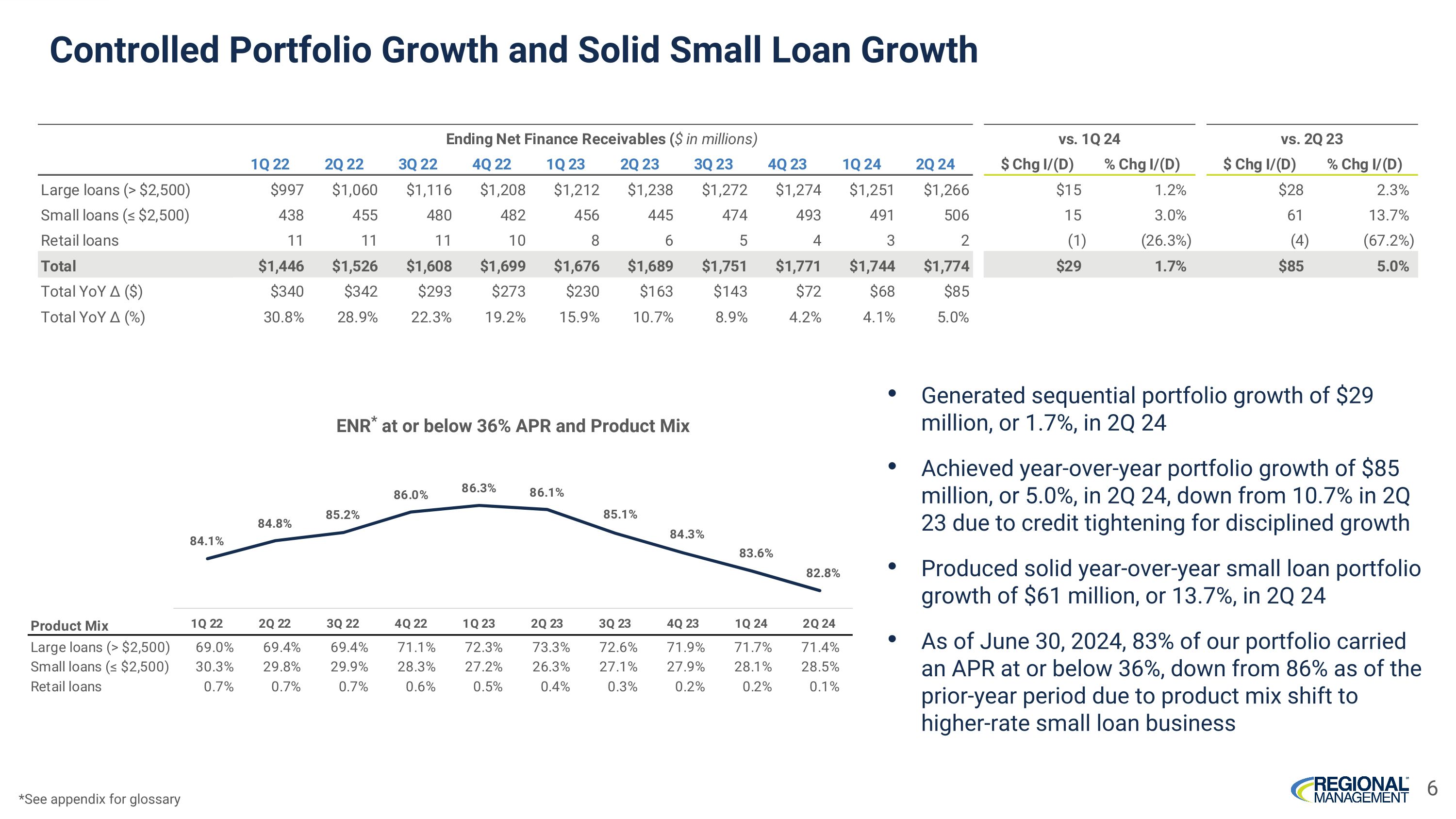

•Net finance receivables as of June 30, 2024 were $1.8 billion, an increase of $84.8 million, or 5.0%, from the prior-year period.

- Large loan net finance receivables of $1.3 billion increased $28.0 million, or 2.3%, from the prior-year period and represented 71.4% of the total loan portfolio, compared to 73.3% in the prior-year period.

- Small loan net finance receivables of $505.6 million increased $61.1 million, or 13.7%, from the prior-year period and represented 28.5% of the total loan portfolio, compared to 26.3% in the prior-year period.

- Net finance receivables with annual percentage rates (APRs) above 36% increased to 17.2% of the portfolio from 13.9% in the prior-year period.

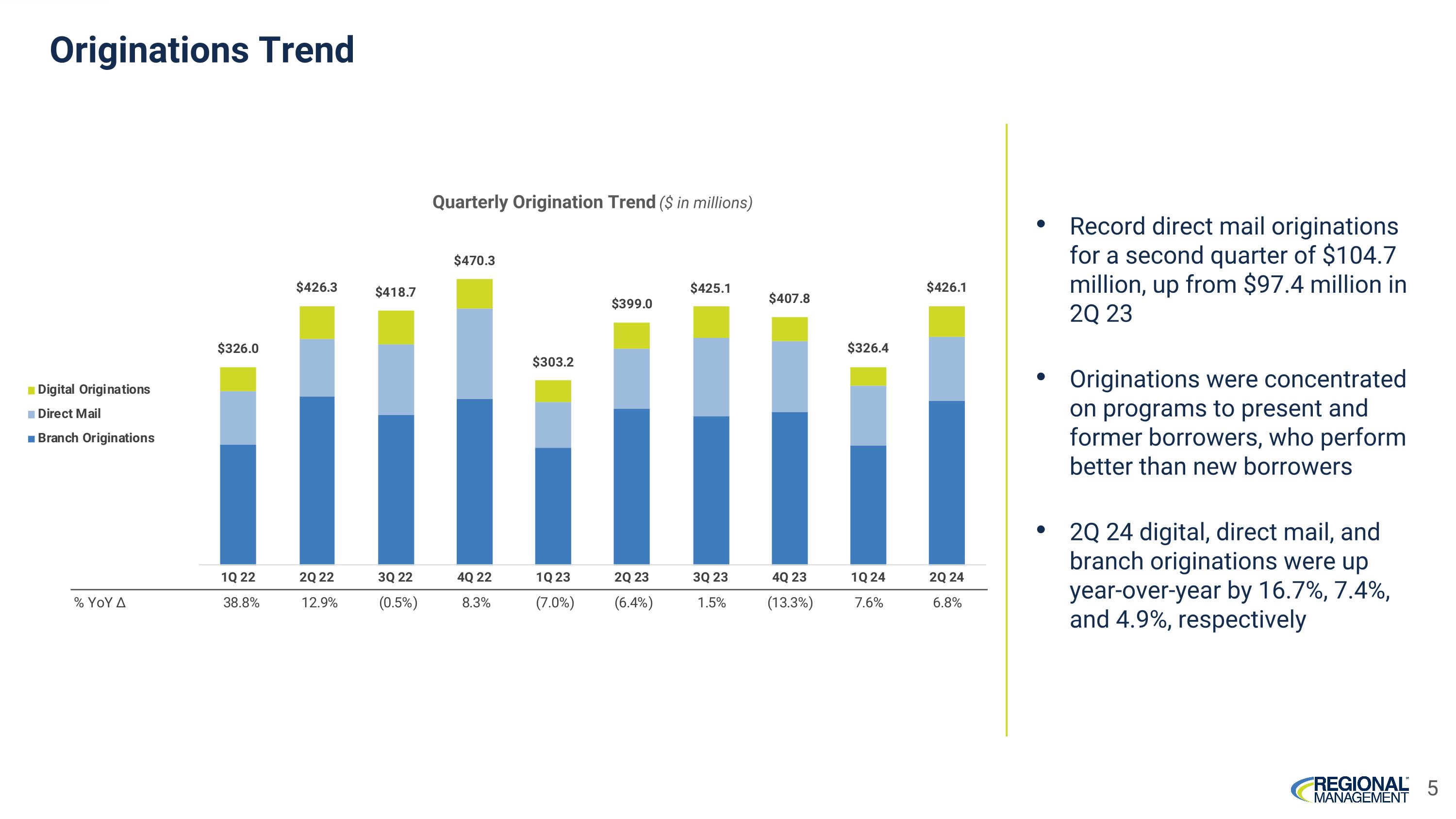

- Total loan originations were $426.1 million in the second quarter of 2024, an increase of $27.1 million, or 6.8%, from the prior-year period, due to controlled growth from credit-tightening actions.

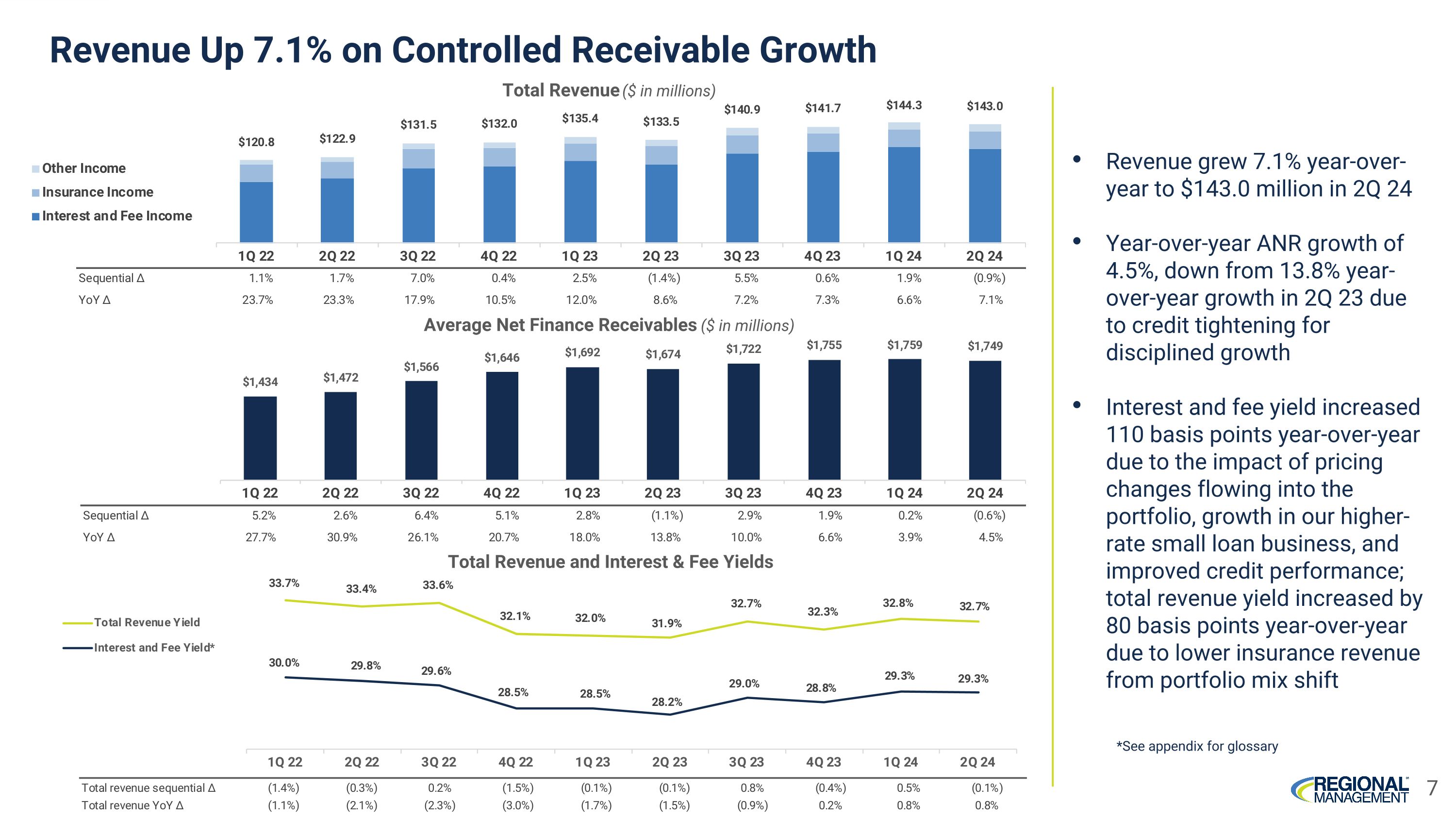

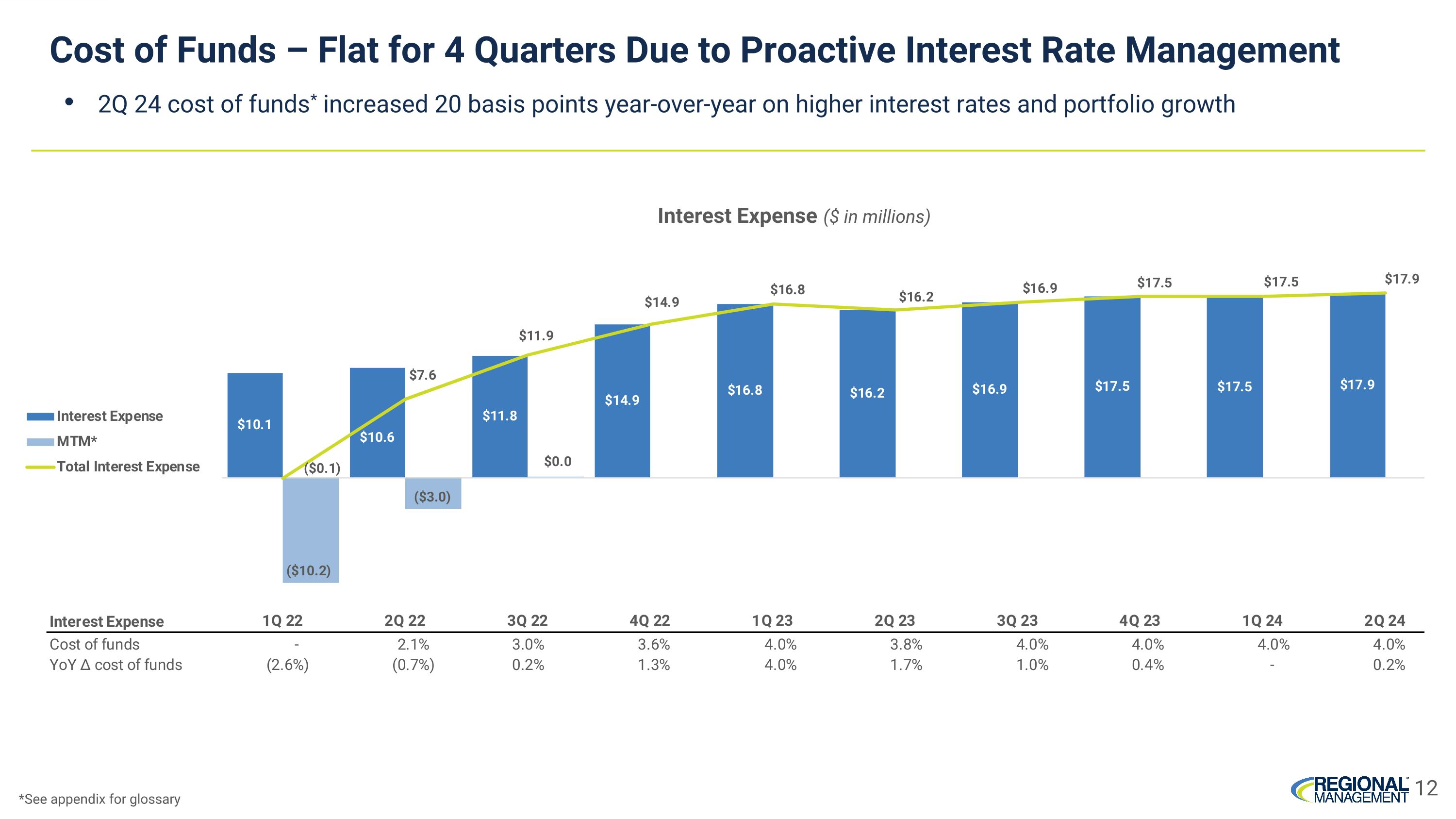

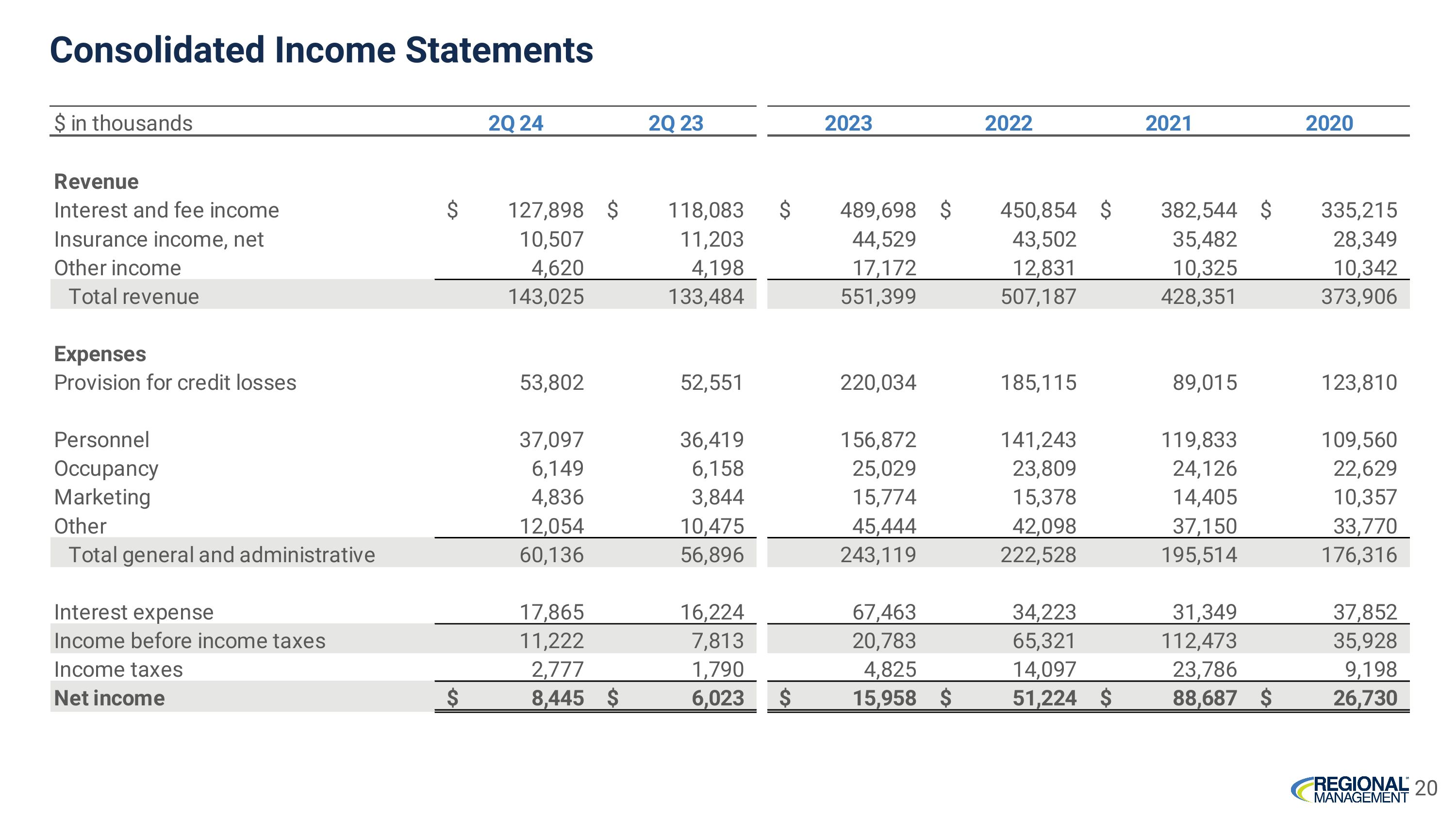

•Total revenue for the second quarter of 2024 was $143.0 million, an increase of $9.5 million, or 7.1%, from the prior-year period, primarily due to an increase in interest and fee income of $9.8 million related to higher average net finance receivables and 110 basis points of higher interest and fee yield compared to the prior-year period.

- The increase in interest and fee yield is attributable to increased pricing, growth of the higher-margin small loan portfolio, and improved credit performance.

- Total revenue yield increased 80 basis points year-over-year, 30 basis points lower than the increase in interest and fee yield due to lower insurance revenues.

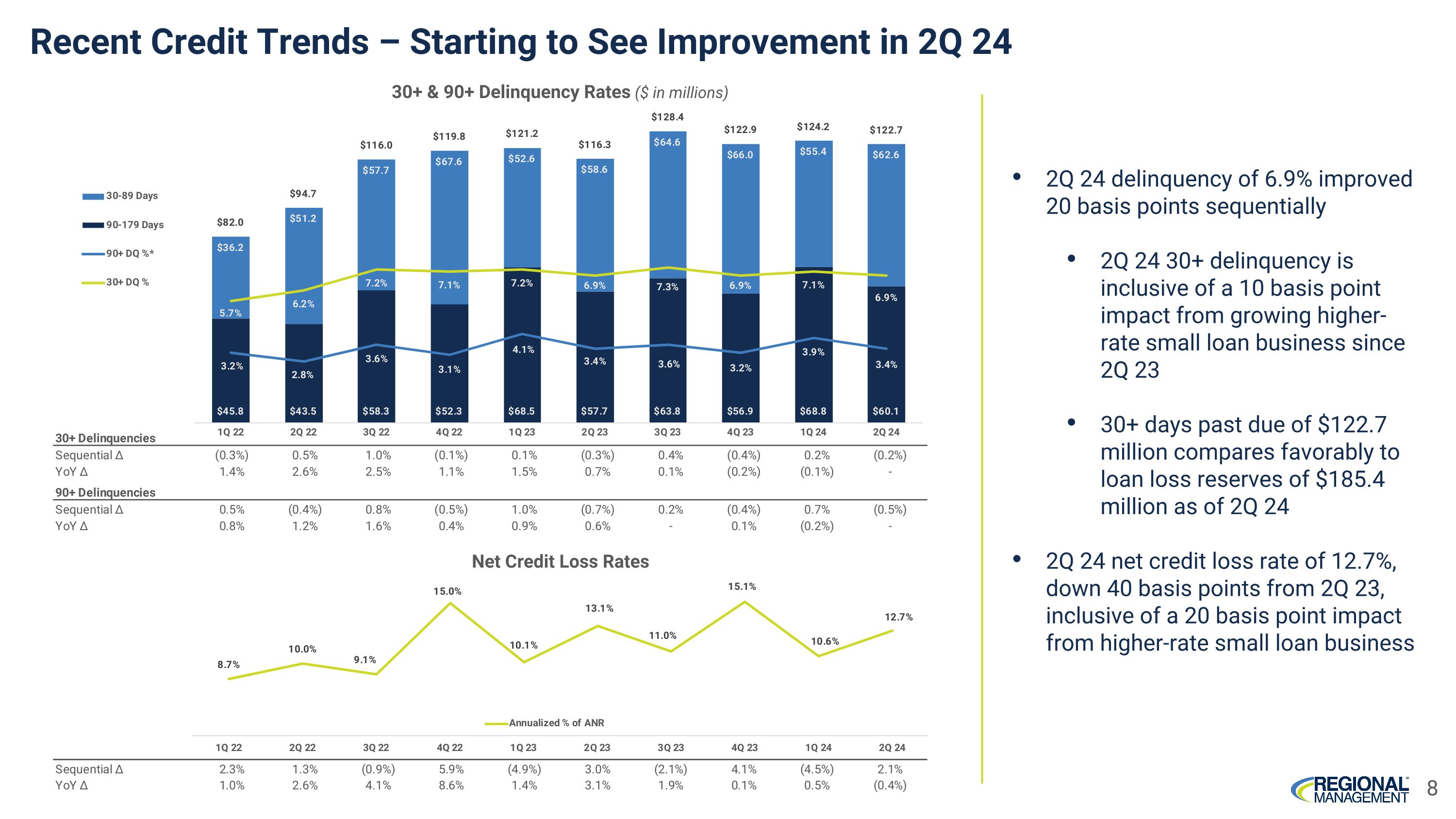

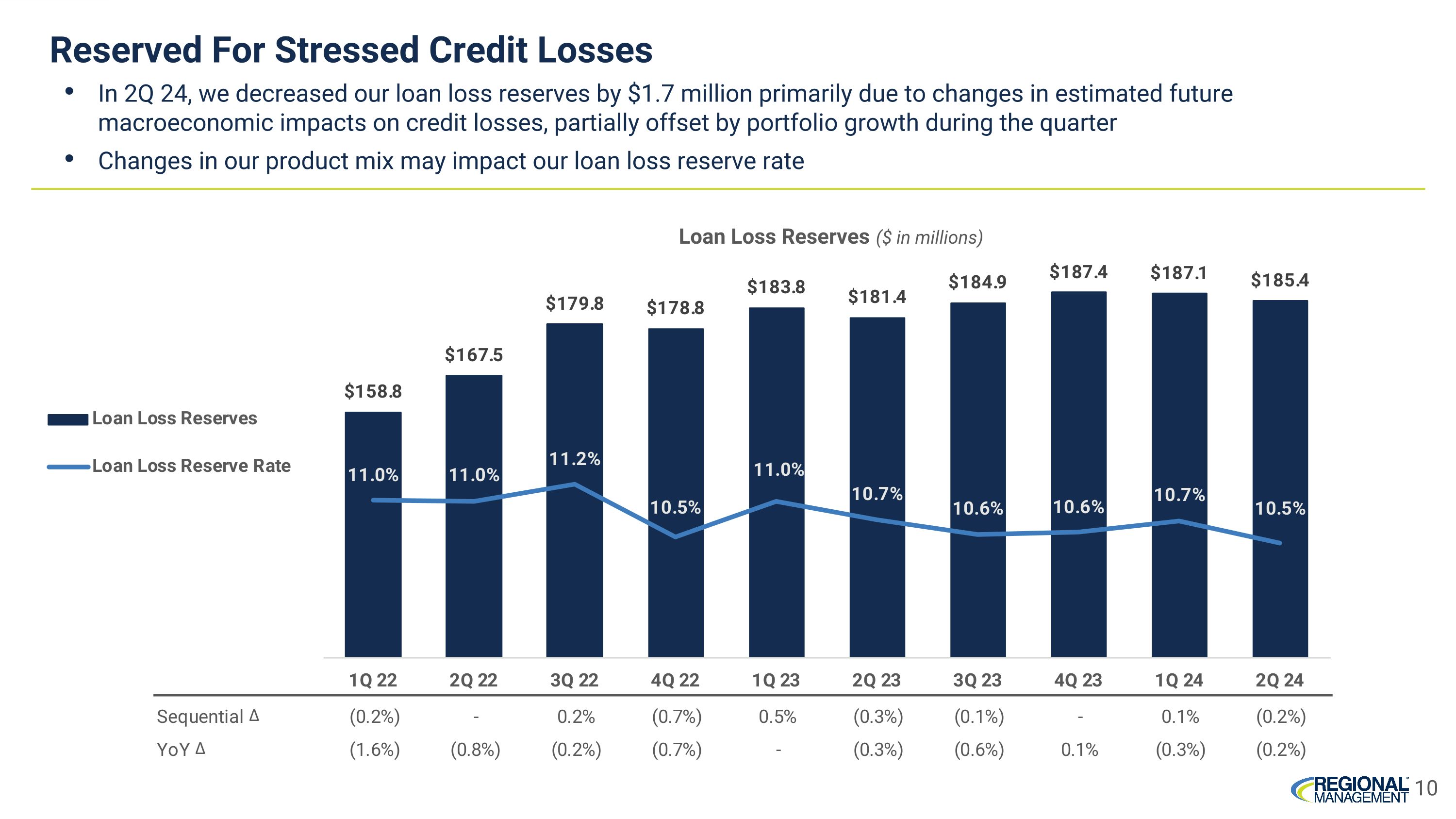

•Provision for credit losses for the second quarter of 2024 was $53.8 million, an increase of $1.3 million, or 2.4%, from the prior-year period, due to higher net credit losses from higher average net receivables ($0.6 million) and a lower provision release compared to the prior-year period ($0.7 million).

- Annualized net credit losses as a percentage of average net finance receivables for the second quarter of 2024 were 12.7%, a 40 basis point improvement compared to 13.1% in the prior-year period. The second quarter 2024 net credit loss rate is inclusive of a 20 basis point impact from growth of the higher-rate, small loan portfolio.

- The provision for credit losses for the second quarter of 2024 included a reserve reduction of $1.7 million primarily due to changes in estimated future macroeconomic impacts on credit losses, partially offset by portfolio growth during the quarter.

- Allowance for credit losses was $185.4 million as of June 30, 2024, or 10.5% of net finance receivables, a 20 basis point decrease sequentially from 10.7% due to improved portfolio credit quality and expectations for improving future macroeconomic conditions.

•As of June 30, 2024, 30+ day contractual delinquencies totaled $122.7 million, or 6.9% of net finance receivables, a 20 basis point improvement sequentially and comparable to June 30, 2023. The second quarter 2024 delinquency rate is inclusive of a 10 basis point impact from growth of the higher-rate, small loan portfolio.

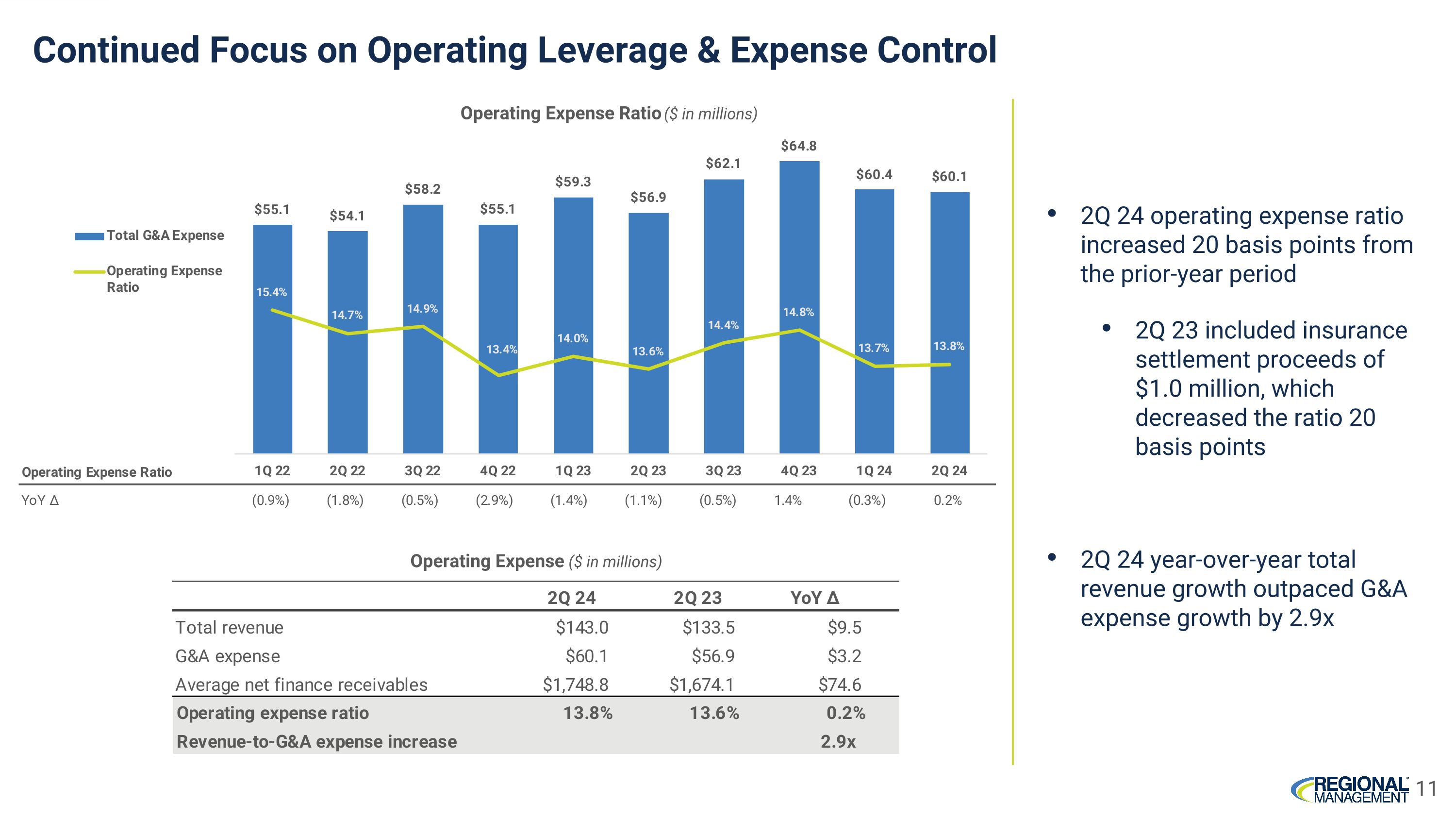

•General and administrative expenses for the second quarter of 2024 were $60.1 million, an increase of $3.2 million from the prior-year period. The operating expense ratio (annualized general and administrative expenses as a percentage of average net finance receivables) for the second quarter of 2024 was 13.8%. The prior-year period included an insurance settlement benefit, improving general and administrative expenses and the operating expense ratio in the prior-year period by $1.0 million and 20 basis points, respectively.

Third Quarter 2024 Dividend

The company’s Board of Directors has declared a dividend of $0.30 per common share for the third quarter of 2024. The dividend will be paid on September 12, 2024 to shareholders of record as of the close of business on August 21, 2024. The declaration and payment of any future dividend is subject to the discretion of the Board of Directors and will depend on a variety of factors, including the company’s financial condition and results of operations.

Liquidity and Capital Resources

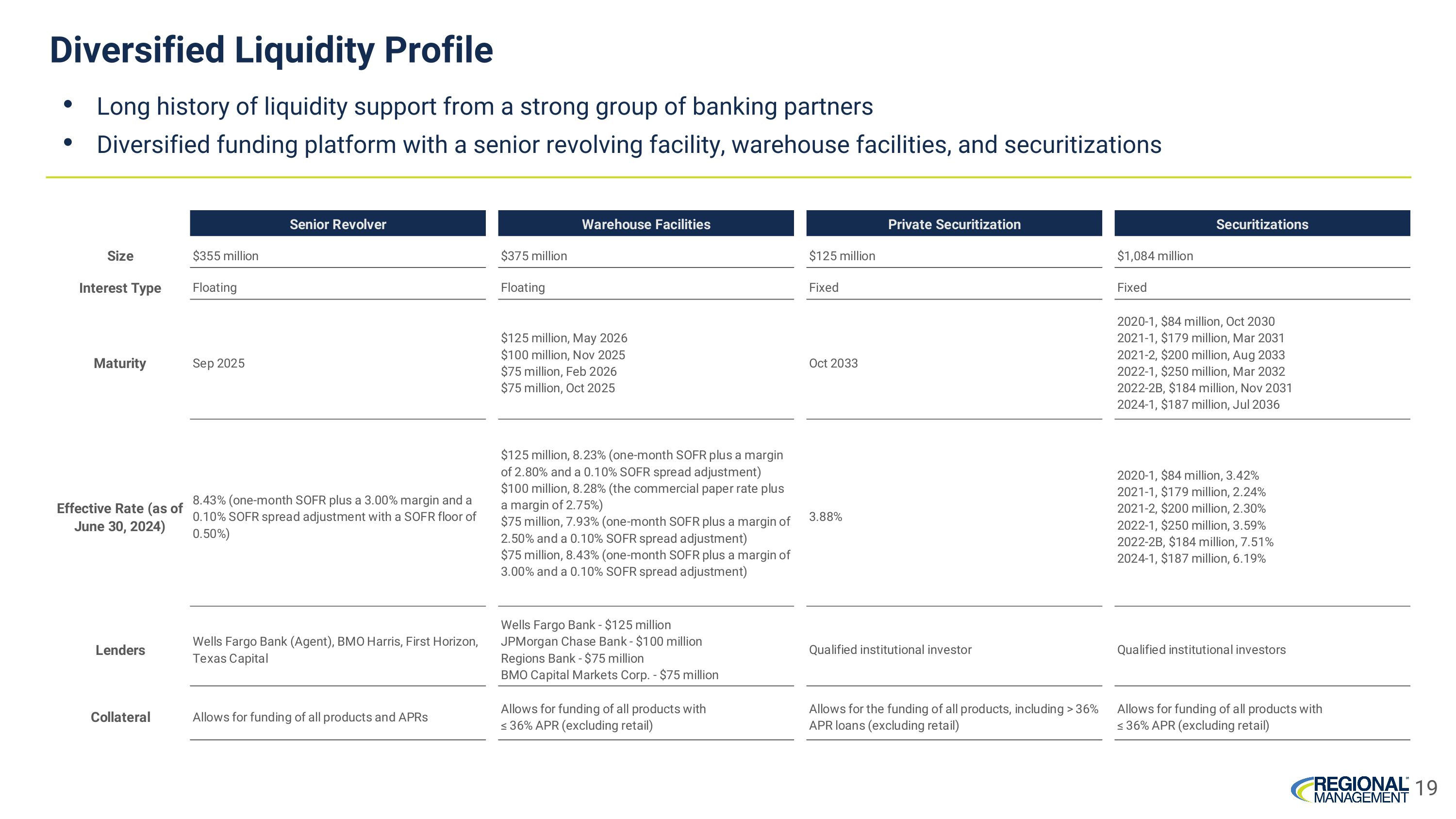

As of June 30, 2024, the company had net finance receivables of $1.8 billion and debt of $1.4 billion. The debt consisted of:

•$145.7 million on the company’s $355 million senior revolving credit facility,

•$21.4 million on the company’s aggregate $375 million revolving warehouse credit facilities, and

•$1.2 billion through the company’s asset-backed securitizations.

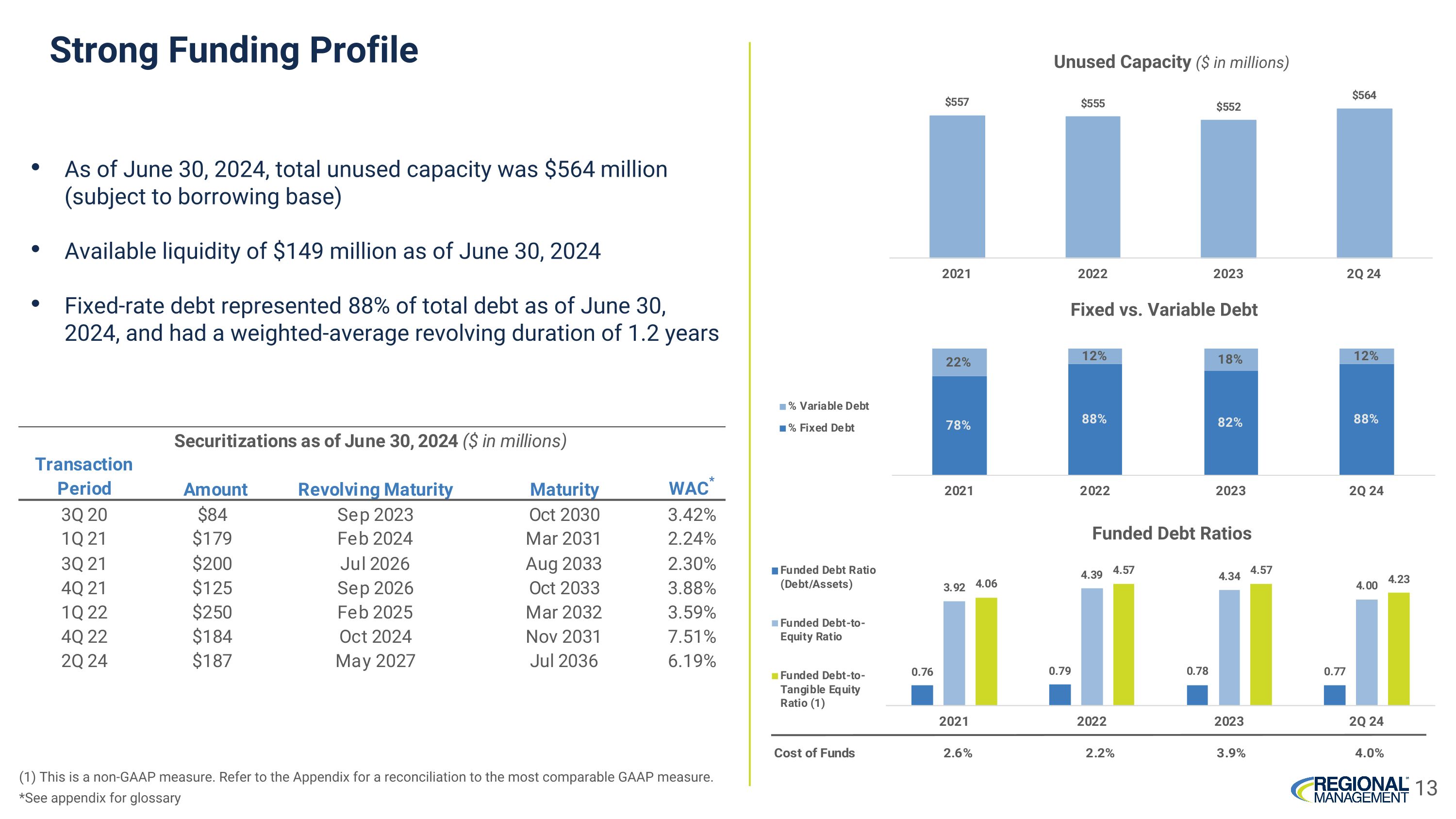

As of June 30, 2024, the company’s unused capacity to fund future growth on its revolving credit facilities (subject to the borrowing base) was $564 million, or 77.3%, and the company had available liquidity of $149.4 million, including unrestricted cash on hand and immediate availability to draw down cash from its revolving credit facilities. As of June 30, 2024, the company’s fixed-rate debt as a percentage of total debt was 88%, with a weighted-average coupon of 4.2% and a weighted-average revolving duration of 1.2 years.

The company had a funded debt-to-equity ratio of 4.0 to 1.0 and a stockholders’ equity ratio of 19.3%, each as of June 30, 2024. On a non-GAAP basis, the company had a funded debt-to-tangible equity ratio of 4.2 to 1.0, as of June 30, 2024. Please refer to the reconciliations of non-GAAP measures to comparable GAAP measures included at the end of this press release.

Conference Call Information

Regional Management Corp. will host a conference call and webcast today at 5:00 PM ET to discuss these results.

The dial-in number for the conference call is (855) 327-6837 (toll-free) or (631) 891-4304 (direct). Please dial the number 10 minutes prior to the scheduled start time.

*** A supplemental slide presentation will be made available on Regional’s website prior to the earnings call at www.RegionalManagement.com. ***

In addition, a live webcast of the conference call will be available on Regional’s website at www.RegionalManagement.com.

A webcast replay of the call will be available at www.RegionalManagement.com for one year following the call.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer finance company that provides attractive, easy-to-understand installment loan products primarily to customers with

limited access to consumer credit from banks, thrifts, credit card companies, and other lenders. Regional Management operates under the name “Regional Finance” online and in branch locations in 19 states across the United States. Most of its loan products are secured, and each is structured on a fixed-rate, fixed-term basis with fully amortizing equal monthly installment payments, repayable at any time without penalty. Regional Management sources loans through its multiple channel platform, which includes branches, centrally managed direct mail campaigns, digital partners, and its consumer website. For more information, please visit www.RegionalManagement.com.

Forward-Looking Statements

This press release may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent Regional Management Corp.’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning financial outlooks or future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of Regional Management. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on forward-looking statements.

Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: managing growth effectively, implementing Regional Management’s growth strategy, and opening new branches as planned; Regional Management’s convenience check strategy; Regional Management’s policies and procedures for underwriting, processing, and servicing loans; Regional Management’s ability to collect on its loan portfolio; Regional Management’s insurance operations; exposure to credit risk and repayment risk, which risks may increase in light of adverse or recessionary economic conditions; the implementation of evolving underwriting models and processes, including as to the effectiveness of Regional Management's custom scorecards; changes in the competitive environment in which Regional Management operates or a decrease in the demand for its products; the geographic concentration of Regional Management’s loan portfolio; the failure of third-party service providers, including those providing information technology products; changes in economic conditions in the markets Regional Management serves, including levels of unemployment and bankruptcies; the ability to achieve successful acquisitions and strategic alliances; the ability to make technological improvements as quickly as competitors; security breaches, cyber-attacks, failures in information systems, or fraudulent activity; the ability to originate loans; reliance on information technology resources and providers, including the risk of prolonged system outages; changes in current revenue and expense trends, including trends affecting delinquencies and credit losses;

any future public health crises, including the impact of such crisis on our operations and financial condition; changes in operating and administrative expenses; the departure, transition, or replacement of key personnel; the ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support Regional Management’s operations and initiatives; changes in interest rates; existing sources of liquidity may become insufficient or access to these sources may become unexpectedly restricted; exposure to financial risk due to asset-backed securitization transactions; risks related to regulation and legal proceedings, including changes in laws or regulations or in the interpretation or enforcement of laws or regulations; changes in accounting standards, rules, and interpretations and the failure of related assumptions and estimates; the impact of changes in tax laws and guidance, including the timing and amount of revenues that may be recognized; risks related to the ownership of Regional Management’s common stock, including volatility in the market price of shares of Regional Management’s common stock; the timing and amount of future cash dividend payments; and anti-takeover provisions in Regional Management’s charter documents and applicable state law.

The foregoing factors and others are discussed in greater detail in Regional Management’s filings with the Securities and Exchange Commission. Regional Management will not update or revise forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. Regional Management is not responsible for changes made to this document by wire services or Internet services.

Contact

Investor Relations

Garrett Edson, (203) 682-8331

investor.relations@regionalmanagement.com

Regional Management Corp. and Subsidiaries

Consolidated Statements of Income

(Unaudited)

(dollars in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Better (Worse) |

|

|

|

|

|

|

|

|

Better (Worse) |

|

|

|

2Q 24 |

|

|

2Q 23 |

|

|

$ |

|

|

% |

|

|

YTD 24 |

|

|

YTD 23 |

|

|

$ |

|

|

% |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fee income |

|

$ |

127,898 |

|

|

$ |

118,083 |

|

|

$ |

9,815 |

|

|

|

8.3 |

% |

|

$ |

256,716 |

|

|

$ |

238,490 |

|

|

$ |

18,226 |

|

|

|

7.6 |

% |

Insurance income, net |

|

|

10,507 |

|

|

|

11,203 |

|

|

|

(696 |

) |

|

|

(6.2 |

)% |

|

|

21,481 |

|

|

|

22,162 |

|

|

|

(681 |

) |

|

|

(3.1 |

)% |

Other income |

|

|

4,620 |

|

|

|

4,198 |

|

|

|

422 |

|

|

|

10.1 |

% |

|

|

9,136 |

|

|

|

8,210 |

|

|

|

926 |

|

|

|

11.3 |

% |

Total revenue |

|

|

143,025 |

|

|

|

133,484 |

|

|

|

9,541 |

|

|

|

7.1 |

% |

|

|

287,333 |

|

|

|

268,862 |

|

|

|

18,471 |

|

|

|

6.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses |

|

|

53,802 |

|

|

|

52,551 |

|

|

|

(1,251 |

) |

|

|

(2.4 |

)% |

|

|

100,225 |

|

|

|

100,219 |

|

|

|

(6 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

|

37,097 |

|

|

|

36,419 |

|

|

|

(678 |

) |

|

|

(1.9 |

)% |

|

|

74,917 |

|

|

|

75,016 |

|

|

|

99 |

|

|

|

0.1 |

% |

Occupancy |

|

|

6,149 |

|

|

|

6,158 |

|

|

|

9 |

|

|

|

0.1 |

% |

|

|

12,524 |

|

|

|

12,446 |

|

|

|

(78 |

) |

|

|

(0.6 |

)% |

Marketing |

|

|

4,836 |

|

|

|

3,844 |

|

|

|

(992 |

) |

|

|

(25.8 |

)% |

|

|

9,151 |

|

|

|

7,223 |

|

|

|

(1,928 |

) |

|

|

(26.7 |

)% |

Other |

|

|

12,054 |

|

|

|

10,475 |

|

|

|

(1,579 |

) |

|

|

(15.1 |

)% |

|

|

23,992 |

|

|

|

21,534 |

|

|

|

(2,458 |

) |

|

|

(11.4 |

)% |

Total general and administrative |

|

|

60,136 |

|

|

|

56,896 |

|

|

|

(3,240 |

) |

|

|

(5.7 |

)% |

|

|

120,584 |

|

|

|

116,219 |

|

|

|

(4,365 |

) |

|

|

(3.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

17,865 |

|

|

|

16,224 |

|

|

|

(1,641 |

) |

|

|

(10.1 |

)% |

|

|

35,369 |

|

|

|

33,006 |

|

|

|

(2,363 |

) |

|

|

(7.2 |

)% |

Income before income taxes |

|

|

11,222 |

|

|

|

7,813 |

|

|

|

3,409 |

|

|

|

43.6 |

% |

|

|

31,155 |

|

|

|

19,418 |

|

|

|

11,737 |

|

|

|

60.4 |

% |

Income taxes |

|

|

2,777 |

|

|

|

1,790 |

|

|

|

(987 |

) |

|

|

(55.1 |

)% |

|

|

7,505 |

|

|

|

4,706 |

|

|

|

(2,799 |

) |

|

|

(59.5 |

)% |

Net income |

|

$ |

8,445 |

|

|

$ |

6,023 |

|

|

$ |

2,422 |

|

|

|

40.2 |

% |

|

$ |

23,650 |

|

|

$ |

14,712 |

|

|

$ |

8,938 |

|

|

|

60.8 |

% |

Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.88 |

|

|

$ |

0.64 |

|

|

$ |

0.24 |

|

|

|

37.5 |

% |

|

$ |

2.47 |

|

|

$ |

1.57 |

|

|

$ |

0.90 |

|

|

|

57.3 |

% |

Diluted |

|

$ |

0.86 |

|

|

$ |

0.63 |

|

|

$ |

0.23 |

|

|

|

36.5 |

% |

|

$ |

2.41 |

|

|

$ |

1.53 |

|

|

$ |

0.88 |

|

|

|

57.5 |

% |

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

9,613 |

|

|

|

9,399 |

|

|

|

(214 |

) |

|

|

(2.3 |

)% |

|

|

9,591 |

|

|

|

9,363 |

|

|

|

(228 |

) |

|

|

(2.4 |

)% |

Diluted |

|

|

9,863 |

|

|

|

9,566 |

|

|

|

(297 |

) |

|

|

(3.1 |

)% |

|

|

9,805 |

|

|

|

9,595 |

|

|

|

(210 |

) |

|

|

(2.2 |

)% |

Return on average assets (annualized) |

|

|

1.9 |

% |

|

|

1.4 |

% |

|

|

|

|

|

|

|

|

2.7 |

% |

|

|

1.7 |

% |

|

|

|

|

|

|

Return on average equity (annualized) |

|

|

10.0 |

% |

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

14.1 |

% |

|

|

9.3 |

% |

|

|

|

|

|

|

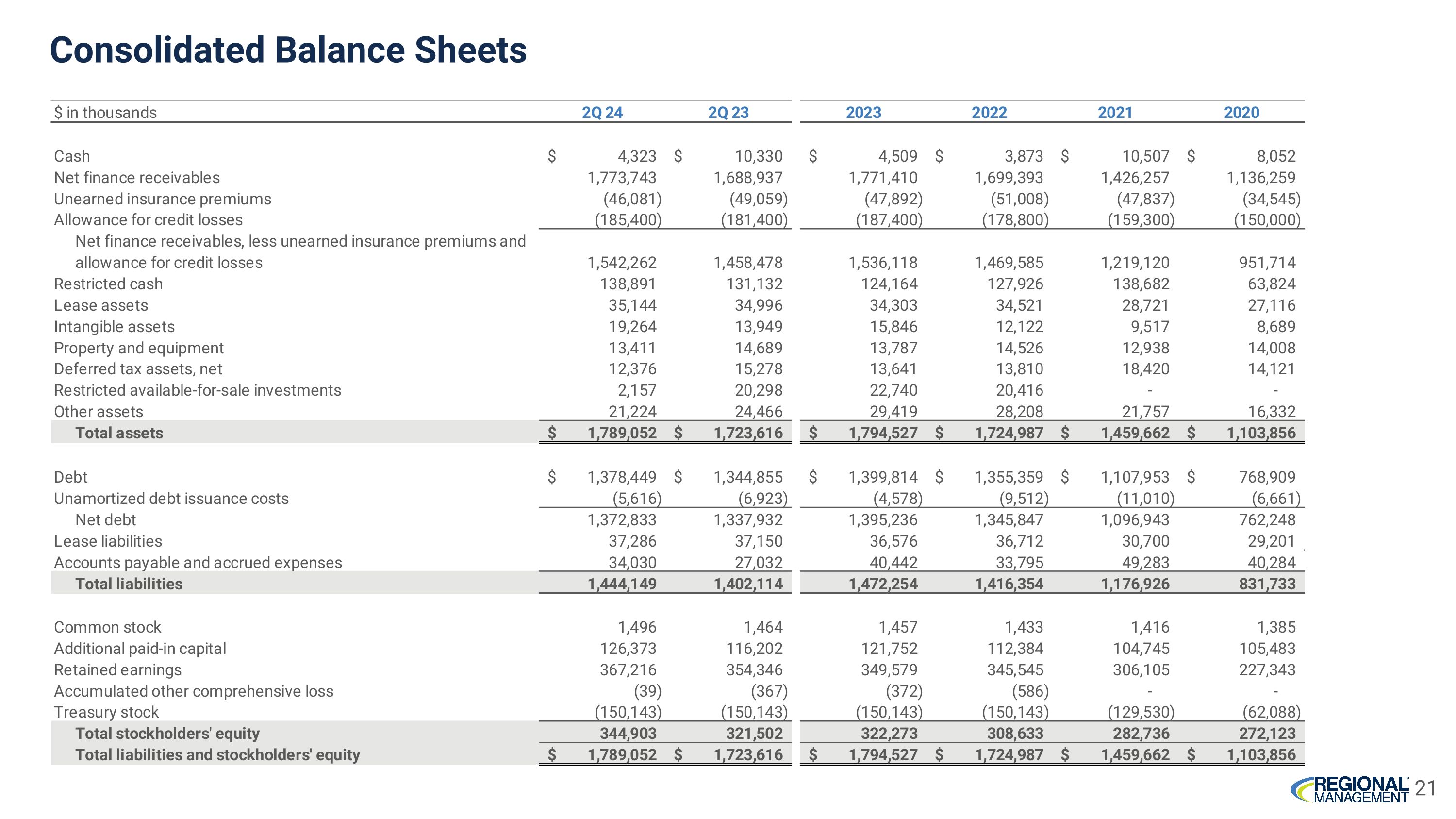

Regional Management Corp. and Subsidiaries

Consolidated Balance Sheets

(Unaudited)

(dollars in thousands, except par value amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (Decrease) |

|

|

|

2Q 24 |

|

|

2Q 23 |

|

|

$ |

|

|

% |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

4,323 |

|

|

$ |

10,330 |

|

|

$ |

(6,007 |

) |

|

|

(58.2 |

)% |

Net finance receivables |

|

|

1,773,743 |

|

|

|

1,688,937 |

|

|

|

84,806 |

|

|

|

5.0 |

% |

Unearned insurance premiums |

|

|

(46,081 |

) |

|

|

(49,059 |

) |

|

|

2,978 |

|

|

|

6.1 |

% |

Allowance for credit losses |

|

|

(185,400 |

) |

|

|

(181,400 |

) |

|

|

(4,000 |

) |

|

|

(2.2 |

)% |

Net finance receivables, less unearned insurance premiums and allowance for credit losses |

|

|

1,542,262 |

|

|

|

1,458,478 |

|

|

|

83,784 |

|

|

|

5.7 |

% |

Restricted cash |

|

|

138,891 |

|

|

|

131,132 |

|

|

|

7,759 |

|

|

|

5.9 |

% |

Lease assets |

|

|

35,144 |

|

|

|

34,996 |

|

|

|

148 |

|

|

|

0.4 |

% |

Intangible assets |

|

|

19,264 |

|

|

|

13,949 |

|

|

|

5,315 |

|

|

|

38.1 |

% |

Property and equipment |

|

|

13,411 |

|

|

|

14,689 |

|

|

|

(1,278 |

) |

|

|

(8.7 |

)% |

Deferred tax assets, net |

|

|

12,376 |

|

|

|

15,278 |

|

|

|

(2,902 |

) |

|

|

(19.0 |

)% |

Restricted available-for-sale investments |

|

|

2,157 |

|

|

|

20,298 |

|

|

|

(18,141 |

) |

|

|

(89.4 |

)% |

Other assets |

|

|

21,224 |

|

|

|

24,466 |

|

|

|

(3,242 |

) |

|

|

(13.3 |

)% |

Total assets |

|

$ |

1,789,052 |

|

|

$ |

1,723,616 |

|

|

$ |

65,436 |

|

|

|

3.8 |

% |

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Debt |

|

$ |

1,378,449 |

|

|

$ |

1,344,855 |

|

|

$ |

33,594 |

|

|

|

2.5 |

% |

Unamortized debt issuance costs |

|

|

(5,616 |

) |

|

|

(6,923 |

) |

|

|

1,307 |

|

|

|

18.9 |

% |

Net debt |

|

|

1,372,833 |

|

|

|

1,337,932 |

|

|

|

34,901 |

|

|

|

2.6 |

% |

Lease liabilities |

|

|

37,286 |

|

|

|

37,150 |

|

|

|

136 |

|

|

|

0.4 |

% |

Accounts payable and accrued expenses |

|

|

34,030 |

|

|

|

27,032 |

|

|

|

6,998 |

|

|

|

25.9 |

% |

Total liabilities |

|

|

1,444,149 |

|

|

|

1,402,114 |

|

|

|

42,035 |

|

|

|

3.0 |

% |

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock ($0.10 par value, 100,000 shares authorized, none issued or outstanding) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock ($0.10 par value, 1,000,000 shares authorized, 14,962 shares issued and 10,156 shares outstanding at June 30, 2024 and 14,636 shares issued and 9,829 shares outstanding at June 30, 2023) |

|

|

1,496 |

|

|

|

1,464 |

|

|

|

32 |

|

|

|

2.2 |

% |

Additional paid-in capital |

|

|

126,373 |

|

|

|

116,202 |

|

|

|

10,171 |

|

|

|

8.8 |

% |

Retained earnings |

|

|

367,216 |

|

|

|

354,346 |

|

|

|

12,870 |

|

|

|

3.6 |

% |

Accumulated other comprehensive loss |

|

|

(39 |

) |

|

|

(367 |

) |

|

|

328 |

|

|

|

89.4 |

% |

Treasury stock (4,807 shares at June 30, 2024 and June 30, 2023) |

|

|

(150,143 |

) |

|

|

(150,143 |

) |

|

|

— |

|

|

|

— |

|

Total stockholders’ equity |

|

|

344,903 |

|

|

|

321,502 |

|

|

|

23,401 |

|

|

|

7.3 |

% |

Total liabilities and stockholders’ equity |

|

$ |

1,789,052 |

|

|

$ |

1,723,616 |

|

|

$ |

65,436 |

|

|

|

3.8 |

% |

Regional Management Corp. and Subsidiaries

Selected Financial Data

(Unaudited)

(dollars in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Finance Receivables |

|

|

|

2Q 24 |

|

|

1Q 24 |

|

|

QoQ $

Inc (Dec) |

|

|

QoQ %

Inc (Dec) |

|

|

2Q 23 |

|

|

YoY $

Inc (Dec) |

|

|

YoY %

Inc (Dec) |

|

Large loans |

|

$ |

1,266,032 |

|

|

$ |

1,250,647 |

|

|

$ |

15,385 |

|

|

|

1.2 |

% |

|

$ |

1,238,031 |

|

|

$ |

28,001 |

|

|

|

2.3 |

% |

Small loans |

|

|

505,640 |

|

|

|

490,830 |

|

|

|

14,810 |

|

|

|

3.0 |

% |

|

|

444,590 |

|

|

|

61,050 |

|

|

|

13.7 |

% |

Retail loans |

|

|

2,071 |

|

|

|

2,809 |

|

|

|

(738 |

) |

|

|

(26.3 |

)% |

|

|

6,316 |

|

|

|

(4,245 |

) |

|

|

(67.2 |

)% |

Total net finance receivables |

|

$ |

1,773,743 |

|

|

$ |

1,744,286 |

|

|

$ |

29,457 |

|

|

|

1.7 |

% |

|

$ |

1,688,937 |

|

|

$ |

84,806 |

|

|

|

5.0 |

% |

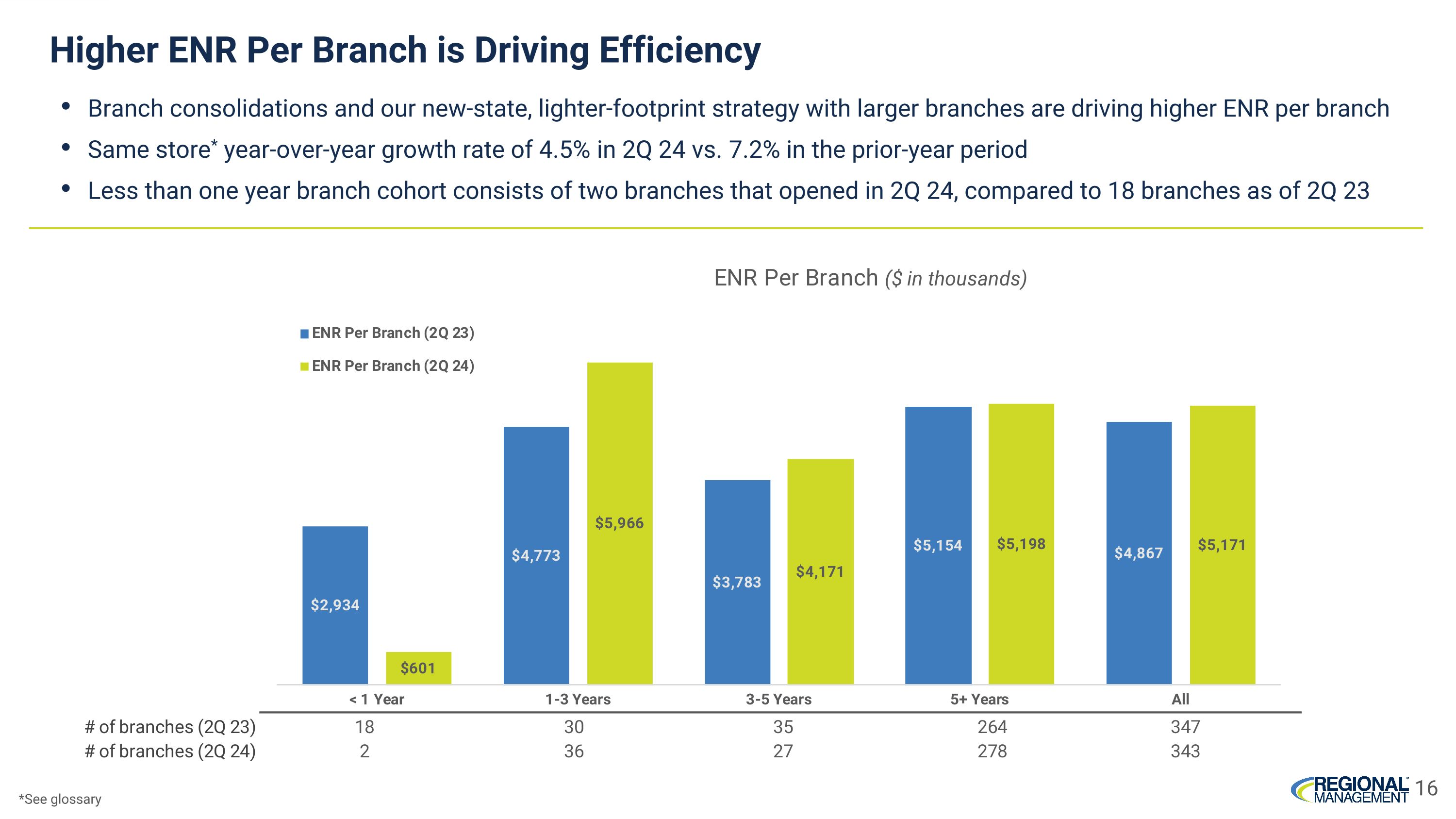

Number of branches at period end |

|

|

343 |

|

|

|

343 |

|

|

|

— |

|

|

|

— |

|

|

|

347 |

|

|

|

(4 |

) |

|

|

(1.2 |

)% |

Net finance receivables per branch |

|

$ |

5,171 |

|

|

$ |

5,085 |

|

|

$ |

86 |

|

|

|

1.7 |

% |

|

$ |

4,867 |

|

|

$ |

304 |

|

|

|

6.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Averages and Yields |

|

|

|

2Q 24 |

|

|

1Q 24 |

|

|

2Q 23 |

|

|

|

Average Net Finance Receivables |

|

|

Average

Yield (1) |

|

|

Average Net Finance Receivables |

|

|

Average

Yield (1) |

|

|

Average Net Finance Receivables |

|

|

Average

Yield (1) |

|

Large loans |

|

$ |

1,255,729 |

|

|

|

26.1 |

% |

|

$ |

1,263,491 |

|

|

|

26.0 |

% |

|

$ |

1,223,339 |

|

|

|

26.0 |

% |

Small loans |

|

|

490,615 |

|

|

|

37.3 |

% |

|

|

491,911 |

|

|

|

37.8 |

% |

|

|

443,601 |

|

|

|

34.5 |

% |

Retail loans |

|

|

2,433 |

|

|

|

16.6 |

% |

|

|

3,341 |

|

|

|

15.8 |

% |

|

|

7,191 |

|

|

|

16.6 |

% |

Total interest and fee yield |

|

$ |

1,748,777 |

|

|

|

29.3 |

% |

|

$ |

1,758,743 |

|

|

|

29.3 |

% |

|

$ |

1,674,131 |

|

|

|

28.2 |

% |

Total revenue yield |

|

$ |

1,748,777 |

|

|

|

32.7 |

% |

|

$ |

1,758,743 |

|

|

|

32.8 |

% |

|

$ |

1,674,131 |

|

|

|

31.9 |

% |

(1) Annualized interest and fee income as a percentage of average net finance receivables.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Components of Increase in Interest and Fee Income |

|

|

|

2Q 24 Compared to 2Q 23 |

|

|

|

Increase (Decrease) |

|

|

|

Volume |

|

|

Rate |

|

|

Volume & Rate |

|

|

Total |

|

Large loans |

|

$ |

2,105 |

|

|

$ |

380 |

|

|

$ |

10 |

|

|

$ |

2,495 |

|

Small loans |

|

|

4,057 |

|

|

|

3,129 |

|

|

|

331 |

|

|

|

7,517 |

|

Retail loans |

|

|

(197 |

) |

|

|

1 |

|

|

|

(1 |

) |

|

|

(197 |

) |

Product mix |

|

|

(700 |

) |

|

|

846 |

|

|

|

(146 |

) |

|

|

— |

|

Total increase in interest and fee income |

|

$ |

5,265 |

|

|

$ |

4,356 |

|

|

$ |

194 |

|

|

$ |

9,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans Originated (1) |

|

|

|

2Q 24 |

|

|

1Q 24 |

|

|

QoQ $

Inc (Dec) |

|

|

QoQ %

Inc (Dec) |

|

|

2Q 23 |

|

|

YoY $

Inc (Dec) |

|

|

YoY %

Inc (Dec) |

|

Large loans |

|

$ |

254,779 |

|

|

$ |

185,074 |

|

|

$ |

69,705 |

|

|

|

37.7 |

% |

|

$ |

249,514 |

|

|

$ |

5,265 |

|

|

|

2.1 |

% |

Small loans |

|

|

171,282 |

|

|

|

141,281 |

|

|

|

30,001 |

|

|

|

21.2 |

% |

|

|

149,460 |

|

|

|

21,822 |

|

|

|

14.6 |

% |

Total loans originated |

|

$ |

426,061 |

|

|

$ |

326,355 |

|

|

$ |

99,706 |

|

|

|

30.6 |

% |

|

$ |

398,974 |

|

|

$ |

27,087 |

|

|

|

6.8 |

% |

(1) Represents the principal balance of loan originations and refinancings.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Key Metrics |

|

|

|

2Q 24 |

|

|

1Q 24 |

|

|

2Q 23 |

|

Net credit losses |

|

$ |

55,502 |

|

|

$ |

46,723 |

|

|

$ |

54,951 |

|

Percentage of average net finance receivables (annualized) |

|

|

12.7 |

% |

|

|

10.6 |

% |

|

|

13.1 |

% |

Provision for credit losses |

|

$ |

53,802 |

|

|

$ |

46,423 |

|

|

$ |

52,551 |

|

Percentage of average net finance receivables (annualized) |

|

|

12.3 |

% |

|

|

10.6 |

% |

|

|

12.6 |

% |

Percentage of total revenue |

|

|

37.6 |

% |

|

|

32.2 |

% |

|

|

39.4 |

% |

General and administrative expenses |

|

$ |

60,136 |

|

|

$ |

60,448 |

|

|

$ |

56,896 |

|

Percentage of average net finance receivables (annualized) |

|

|

13.8 |

% |

|

|

13.7 |

% |

|

|

13.6 |

% |

Percentage of total revenue |

|

|

42.0 |

% |

|

|

41.9 |

% |

|

|

42.6 |

% |

Same store results (1): |

|

|

|

|

|

|

|

|

|

Net finance receivables at period-end |

|

$ |

1,759,075 |

|

|

$ |

1,733,237 |

|

|

$ |

1,636,131 |

|

Net finance receivable growth rate |

|

|

4.5 |

% |

|

|

3.4 |

% |

|

|

7.2 |

% |

Number of branches in calculation |

|

|

338 |

|

|

|

340 |

|

|

|

329 |

|

(1) Same store sales reflect the change in year-over-year sales for the comparable branch base. The comparable branch base includes those branches open for at least one year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractual Delinquency |

|

|

|

2Q 24 |

|

|

1Q 24 |

|

|

2Q 23 |

|

Allowance for credit losses |

|

$ |

185,400 |

|

|

|

10.5 |

% |

|

$ |

187,100 |

|

|

|

10.7 |

% |

|

$ |

181,400 |

|

|

|

10.7 |

% |

Current

|

|

|

1,497,219 |

|

|

|

84.4 |

% |

|

|

1,489,510 |

|

|

|

85.4 |

% |

|

|

1,433,787 |

|

|

|

84.9 |

% |

1 to 29 days past due |

|

|

153,788 |

|

|

|

8.7 |

% |

|

|

130,578 |

|

|

|

7.5 |

% |

|

|

138,810 |

|

|

|

8.2 |

% |

Delinquent accounts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 to 59 days |

|

|

34,924 |

|

|

|

1.9 |

% |

|

|

30,020 |

|

|

|

1.7 |

% |

|

|

33,676 |

|

|

|

2.0 |

% |

60 to 89 days |

|

|

27,689 |

|

|

|

1.6 |

% |

|

|

25,409 |

|

|

|

1.5 |

% |

|

|

24,931 |

|

|

|

1.5 |

% |

90 to 119 days |

|

|

21,607 |

|

|

|

1.2 |

% |

|

|

23,460 |

|

|

|

1.3 |

% |

|

|

20,041 |

|

|

|

1.1 |

% |

120 to 149 days |

|

|

19,333 |

|

|

|

1.1 |

% |

|

|

22,163 |

|

|

|

1.3 |

% |

|

|

18,087 |

|

|

|

1.1 |

% |

150 to 179 days |

|

|

19,183 |

|

|

|

1.1 |

% |

|

|

23,146 |

|

|

|

1.3 |

% |

|

|

19,605 |

|

|

|

1.2 |

% |

Total contractual delinquency |

|

$ |

122,736 |

|

|

|

6.9 |

% |

|

$ |

124,198 |

|

|

|

7.1 |

% |

|

$ |

116,340 |

|

|

|

6.9 |

% |

Total net finance receivables |

|

$ |

1,773,743 |

|

|

|

100.0 |

% |

|

$ |

1,744,286 |

|

|

|

100.0 |

% |

|

$ |

1,688,937 |

|

|

|

100.0 |

% |

1 day and over past due |

|

$ |

276,524 |

|

|

|

15.6 |

% |

|

$ |

254,776 |

|

|

|

14.6 |

% |

|

$ |

255,150 |

|

|

|

15.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractual Delinquency by Product |

|

|

|

2Q 24 |

|

|

1Q 24 |

|

|

2Q 23 |

|

Large loans |

|

$ |

76,432 |

|

|

|

6.0 |

% |

|

$ |

78,055 |

|

|

|

6.2 |

% |

|

$ |

74,637 |

|

|

|

6.0 |

% |

Small loans |

|

|

46,015 |

|

|

|

9.1 |

% |

|

|

45,804 |

|

|

|

9.3 |

% |

|

|

40,894 |

|

|

|

9.2 |

% |

Retail loans |

|

|

289 |

|

|

|

14.0 |

% |

|

|

339 |

|

|

|

12.1 |

% |

|

|

809 |

|

|

|

12.8 |

% |

Total contractual delinquency |

|

$ |

122,736 |

|

|

|

6.9 |

% |

|

$ |

124,198 |

|

|

|

7.1 |

% |

|

$ |

116,340 |

|

|

|

6.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Statement Quarterly Trend |

|

|

|

2Q 23 |

|

|

3Q 23 |

|

|

4Q 23 |

|

|

1Q 24 |

|

|

2Q 24 |

|

|

QoQ $

B(W) |

|

|

YoY $

B(W) |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fee income |

|

$ |

118,083 |

|

|

$ |

125,018 |

|

|

$ |

126,190 |

|

|

$ |

128,818 |

|

|

$ |

127,898 |

|

|

$ |

(920 |

) |

|

$ |

9,815 |

|

Insurance income, net |

|

|

11,203 |

|

|

|

11,382 |

|

|

|

10,985 |

|

|

|

10,974 |

|

|

|

10,507 |

|

|

|

(467 |

) |

|

|

(696 |

) |

Other income |

|

|

4,198 |

|

|

|

4,478 |

|

|

|

4,484 |

|

|

|

4,516 |

|

|

|

4,620 |

|

|

|

104 |

|

|

|

422 |

|

Total revenue |

|

|

133,484 |

|

|

|

140,878 |

|

|

|

141,659 |

|

|

|

144,308 |

|

|

|

143,025 |

|

|

|

(1,283 |

) |

|

|

9,541 |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses |

|

|

52,551 |

|

|

|

50,930 |

|

|

|

68,885 |

|

|

|

46,423 |

|

|

|

53,802 |

|

|

|

(7,379 |

) |

|

|

(1,251 |

) |

Personnel

|

|

|

36,419 |

|

|

|

39,832 |

|

|

|

42,024 |

|

|

|

37,820 |

|

|

|

37,097 |

|

|

|

723 |

|

|

|

(678 |

) |

Occupancy |

|

|

6,158 |

|

|

|

6,315 |

|

|

|

6,268 |

|

|

|

6,375 |

|

|

|

6,149 |

|

|

|

226 |

|

|

|

9 |

|

Marketing |

|

|

3,844 |

|

|

|

4,077 |

|

|

|

4,474 |

|

|

|

4,315 |

|

|

|

4,836 |

|

|

|

(521 |

) |

|

|

(992 |

) |

Other |

|

|

10,475 |

|

|

|

11,880 |

|

|

|

12,030 |

|

|

|

11,938 |

|

|

|

12,054 |

|

|

|

(116 |

) |

|

|

(1,579 |

) |

Total general and administrative |

|

|

56,896 |

|

|

|

62,104 |

|

|

|

64,796 |

|

|

|

60,448 |

|

|

|

60,136 |

|

|

|

312 |

|

|

|

(3,240 |

) |

Interest expense

|

|

|

16,224 |

|

|

|

16,947 |

|

|

|

17,510 |

|

|

|

17,504 |

|

|

|

17,865 |

|

|

|

(361 |

) |

|

|

(1,641 |

) |

Income before income taxes |

|

|

7,813 |

|

|

|

10,897 |

|

|

|

(9,532 |

) |

|

|

19,933 |

|

|

|

11,222 |

|

|

|

(8,711 |

) |

|

|

3,409 |

|

Income taxes |

|

|

1,790 |

|

|

|

2,077 |

|

|

|

(1,958 |

) |

|

|

4,728 |

|

|

|

2,777 |

|

|

|

1,951 |

|

|

|

(987 |

) |

Net income (loss) |

|

$ |

6,023 |

|

|

$ |

8,820 |

|

|

$ |

(7,574 |

) |

|

$ |

15,205 |

|

|

$ |

8,445 |

|

|

$ |

(6,760 |

) |

|

$ |

2,422 |

|

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.64 |

|

|

$ |

0.94 |

|

|

$ |

(0.80 |

) |

|

$ |

1.59 |

|

|

$ |

0.88 |

|

|

$ |

(0.71 |

) |

|

$ |

0.24 |

|

Diluted |

|

$ |

0.63 |

|

|

$ |

0.91 |

|

|

$ |

(0.80 |

) |

|

$ |

1.56 |

|

|

$ |

0.86 |

|

|

$ |

(0.70 |

) |

|

$ |

0.23 |

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

9,399 |

|

|

|

9,429 |

|

|

|

9,437 |

|

|

|

9,569 |

|

|

|

9,613 |

|

|

|

(44 |

) |

|

|

(214 |

) |

Diluted |

|

|

9,566 |

|

|

|

9,650 |

|

|

|

9,437 |

|

|

|

9,746 |

|

|

|

9,863 |

|

|

|

(117 |

) |

|

|

(297 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Quarterly Trend |

|

|

|

2Q 23 |

|

|

3Q 23 |

|

|

4Q 23 |

|

|

1Q 24 |

|

|

2Q 24 |

|

|

QoQ $

Inc (Dec) |

|

|

YoY $

Inc (Dec) |

|

Total assets |

|

$ |

1,723,616 |

|

|

$ |

1,765,340 |

|

|

$ |

1,794,527 |

|

|

$ |

1,756,748 |

|

|

$ |

1,789,052 |

|

|

$ |

32,304 |

|

|

$ |

65,436 |

|

Net finance receivables |

|

$ |

1,688,937 |

|

|

$ |

1,751,009 |

|

|

$ |

1,771,410 |

|

|

$ |

1,744,286 |

|

|

$ |

1,773,743 |

|

|

$ |

29,457 |

|

|

$ |

84,806 |

|

Allowance for credit losses |

|

$ |

181,400 |

|

|

$ |

184,900 |

|

|

$ |

187,400 |

|

|

$ |

187,100 |

|

|

$ |

185,400 |

|

|

$ |

(1,700 |

) |

|

$ |

4,000 |

|

Debt |

|

$ |

1,344,855 |

|

|

$ |

1,372,748 |

|

|

$ |

1,399,814 |

|

|

$ |

1,358,795 |

|

|

$ |

1,378,449 |

|

|

$ |

19,654 |

|

|

$ |

33,594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Key Metrics Quarterly Trend |

|

|

|

2Q 23 |

|

|

3Q 23 |

|

|

4Q 23 |

|

|

1Q 24 |

|

|

2Q 24 |

|

|

QoQ

Inc (Dec) |

|

|

YoY

Inc (Dec) |

|

Interest and fee yield (annualized) |

|

|

28.2 |

% |

|

|

29.0 |

% |

|

|

28.8 |

% |

|

|

29.3 |

% |

|

|

29.3 |

% |

|

|

— |

|

|

|

1.1 |

% |

Efficiency ratio (1) |

|

|

42.6 |

% |

|

|

44.1 |

% |

|

|

45.7 |

% |

|

|

41.9 |

% |

|

|

42.0 |

% |

|

|

0.1 |

% |

|

|

(0.6 |

)% |

Operating expense ratio (2) |

|

|

13.6 |

% |

|

|

14.4 |

% |

|

|

14.8 |

% |

|

|

13.7 |

% |

|

|

13.8 |

% |

|

|

0.1 |

% |

|

|

0.2 |

% |

30+ contractual delinquency |

|

|

6.9 |

% |

|

|

7.3 |

% |

|

|

6.9 |

% |

|

|

7.1 |

% |

|

|

6.9 |

% |

|

|

(0.2 |

)% |

|

|

— |

|

Net credit loss ratio (3) |

|

|

13.1 |

% |

|

|

11.0 |

% |

|

|

15.1 |

% |

|

|

10.6 |

% |

|

|

12.7 |

% |

|

|

2.1 |

% |

|

|

(0.4 |

)% |

Book value per share |

|

$ |

32.71 |

|

|

$ |

33.61 |

|

|

$ |

33.02 |

|

|

$ |

34.10 |

|

|

$ |

33.96 |

|

|

$ |

(0.14 |

) |

|

$ |

1.25 |

|

(1) General and administrative expenses as a percentage of total revenue.

(2) Annualized general and administrative expenses as a percentage of average net finance receivables.

(3) Annualized net credit losses as a percentage of average net finance receivables.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Averages and Yields |

|

|

|

YTD 24 |

|

|

YTD 23 |

|

|

|

Average Net Finance Receivables |

|

|

Average

Yield (1) |

|

|

Average Net Finance Receivables |

|

|

Average

Yield (1) |

|

Large loans |

|

$ |

1,259,611 |

|

|

|

26.1 |

% |

|

$ |

1,219,464 |

|

|

|

26.0 |

% |

Small loans |

|

|

491,262 |

|

|

|

37.6 |

% |

|

|

455,659 |

|

|

|

34.8 |

% |

Retail loans |

|

|

2,887 |

|

|

|

16.1 |

% |

|

|

8,068 |

|

|

|

17.7 |

% |

Total interest and fee yield |

|

$ |

1,753,760 |

|

|

|

29.3 |

% |

|

$ |

1,683,191 |

|

|

|

28.3 |

% |

Total revenue yield |

|

$ |

1,753,760 |

|

|

|

32.8 |

% |

|

$ |

1,683,191 |

|

|

|

31.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Components of Increase in Interest and Fee Income |

|

|

|

YTD 24 Compared to YTD 23 |

|

|

|

Increase (Decrease) |

|

|

|

Volume |

|

|

Rate |

|

|

Volume & Rate |

|

|

Total |

|

Large loans |

|

$ |

5,219 |

|

|

$ |

407 |

|

|

$ |

13 |

|

|

$ |

5,639 |

|

Small loans |

|

|

6,193 |

|

|

|

6,378 |

|

|

|

498 |

|

|

|

13,069 |

|

Retail loans |

|

|

(459 |

) |

|

|

(64 |

) |

|

|

41 |

|

|

|

(482 |

) |

Product mix |

|

|

(954 |

) |

|

|

1,175 |

|

|

|

(221 |

) |

|

|

— |

|

Total increase in interest and fee income |

|

$ |

9,999 |

|

|

$ |

7,896 |

|

|

$ |

331 |

|

|

$ |

18,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans Originated (1) |

|

|

|

YTD 24 |

|

|

YTD 23 |

|

|

YTD $

Inc (Dec) |

|

|

YTD %

Inc (Dec) |

|

Large loans |

|

$ |

439,853 |

|

|

$ |

443,085 |

|

|

$ |

(3,232 |

) |

|

|

(0.7 |

)% |

Small loans |

|

|

312,563 |

|

|

|

258,944 |

|

|

|

53,619 |

|

|

|

20.7 |

% |

Retail loans |

|

|

— |

|

|

|

146 |

|

|

|

(146 |

) |

|

|

(100.0 |

)% |

Total loans originated |

|

$ |

752,416 |

|

|

$ |

702,175 |

|

|

$ |

50,241 |

|

|

|

7.2 |

% |

(1) Represents the principal balance of loan originations and refinancings.

|

|

|

|

|

|

|

|

|

|

|

Other Key Metrics |

|

|

|

YTD 24 |

|

|

YTD 23 |

|

Net credit losses |

|

$ |

102,225 |

|

|

$ |

97,619 |

|

Percentage of average net finance receivables (annualized) |

|

|

11.7 |

% |

|

|

11.6 |

% |

Provision for credit losses |

|

$ |

100,225 |

|

|

$ |

100,219 |

|

Percentage of average net finance receivables (annualized) |

|

|

11.4 |

% |

|

|

11.9 |

% |

Percentage of total revenue |

|

|

34.9 |

% |

|

|

37.3 |

% |

General and administrative expenses |

|

$ |

120,584 |

|

|

$ |

116,219 |

|

Percentage of average net finance receivables (annualized) |

|

|

13.8 |

% |

|

|

13.8 |

% |

Percentage of total revenue |

|

|

42.0 |

% |

|

|

43.2 |

% |

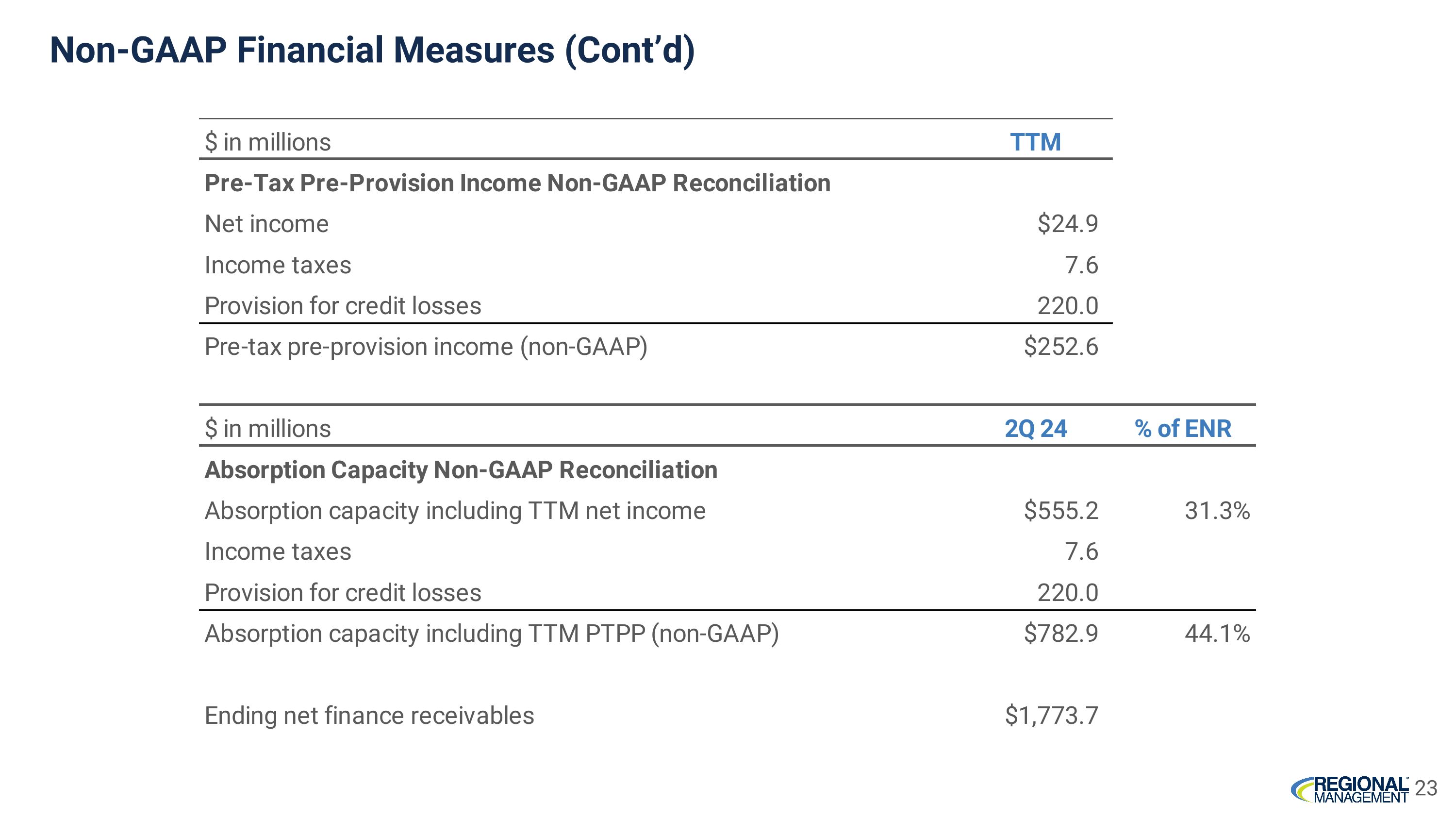

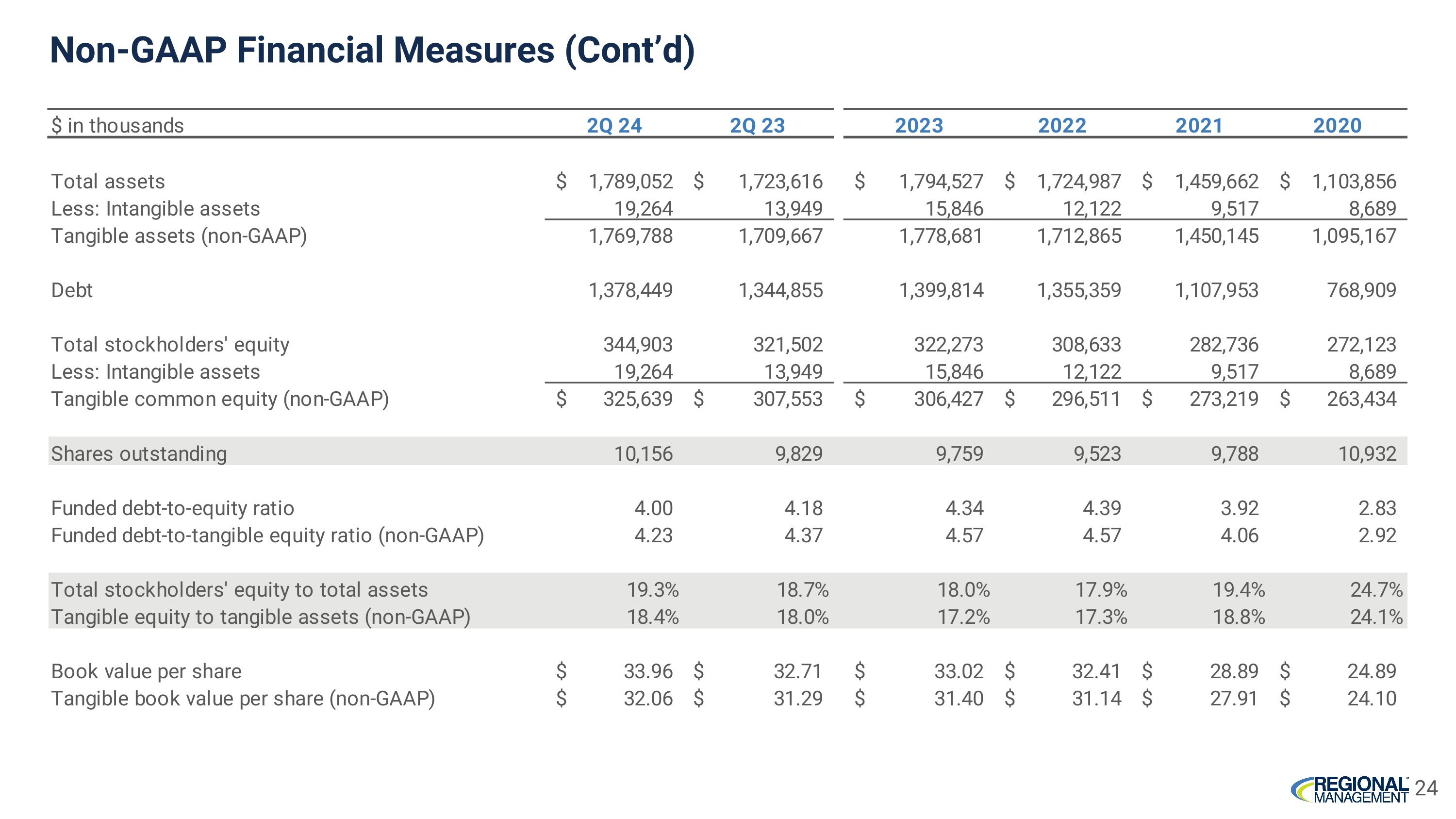

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), this press release contains certain non-GAAP financial measures. The company’s management utilizes non-GAAP measures as additional metrics to aid in, and enhance, its understanding of the company’s financial results. Tangible equity and the funded debt-to-tangible equity ratio are non-GAAP measures that adjust GAAP measures to exclude intangible assets. Management uses these equity measures to evaluate and manage the company’s capital and leverage position. The company also believes that these equity measures are commonly used in the financial services industry and provide useful information to users of the company’s financial statements in the evaluation of its capital and leverage position.

This non-GAAP financial information should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. In addition, the company’s non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies. The following tables provide a reconciliation of GAAP measures to non-GAAP measures.

|

|

|

|

|

|

|

2Q 24 |

|

Debt |

|

$ |

1,378,449 |

|

Total stockholders' equity

|

|

|

344,903 |

|

Less: Intangible assets |

|

|

19,264 |

|

Tangible equity (non-GAAP) |

|

$ |

325,639 |

|

Funded debt-to-equity ratio

|

|

|

4.0 |

x |

Funded debt-to-tangible equity ratio (non-GAAP) |

|

|

4.2 |

x |

2Q 24 Earnings Presentation July 31, 2024 Exhibit 99.2

Legal Disclosures This document contains summarized information concerning Regional Management Corp. (the “Company”) and the Company’s business, operations, financial performance, and trends. No representation is made that the information in this document is complete. For additional financial, statistical, and business information, please see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available on the Company’s website (www.regionalmanagement.com) and on the SEC’s website (www.sec.gov). The information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. This presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent the Company’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning financial outlook or future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of the Company. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on such statements. Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: managing growth effectively, implementing Regional Management's growth strategy, and opening new branches as planned; Regional Management's convenience check strategy; Regional Management's policies and procedures for underwriting, processing, and servicing loans; Regional Management's ability to collect on its loan portfolio; Regional Management's insurance operations; exposure to credit risk and repayment risk, which risks may increase in light of adverse or recessionary economic conditions; the implementation of evolving underwriting models and processes, including as to the effectiveness of Regional Management’s custom scorecards; changes in the competitive environment in which Regional Management operates or a decrease in the demand for its products; the geographic concentration of Regional Management's loan portfolio; the failure of third-party service providers, including those providing information technology products; changes in economic conditions in the markets Regional Management serves, including levels of unemployment and bankruptcies; the ability to achieve successful acquisitions and strategic alliances; the ability to make technological improvements as quickly as competitors; security breaches, cyber-attacks, failures in information systems, or fraudulent activity; the ability to originate loans; reliance on information technology resources and providers, including the risk of prolonged system outages; changes in current revenue and expense trends, including trends affecting delinquencies and credit losses; any future public health crises, including the impact of such crisis on our operations and financial condition; changes in operating and administrative expenses; the departure, transition, or replacement of key personnel; the ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support Regional Management's operations and initiatives; changes in interest rates; existing sources of liquidity may become insufficient or access to these sources may become unexpectedly restricted; exposure to financial risk due to asset-backed securitization transactions; risks related to regulation and legal proceedings, including changes in laws or regulations or in the interpretation or enforcement of laws or regulations; changes in accounting standards, rules, and interpretations and the failure of related assumptions and estimates; the impact of changes in tax laws and guidance, including the timing and amount of revenues that may be recognized; risks related to the ownership of Regional Management's common stock, including volatility in the market price of shares of Regional Management's common stock; the timing and amount of future cash dividend payments; and anti-takeover provisions in Regional Management's charter documents and applicable state law. The foregoing factors and others are discussed in greater detail in the Company's filings with the SEC. The Company will not update or revise forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. This presentation also contains certain non-GAAP measures. Please refer to the Appendix accompanying this presentation for a reconciliation of non-GAAP measures to the most comparable GAAP measures. 2

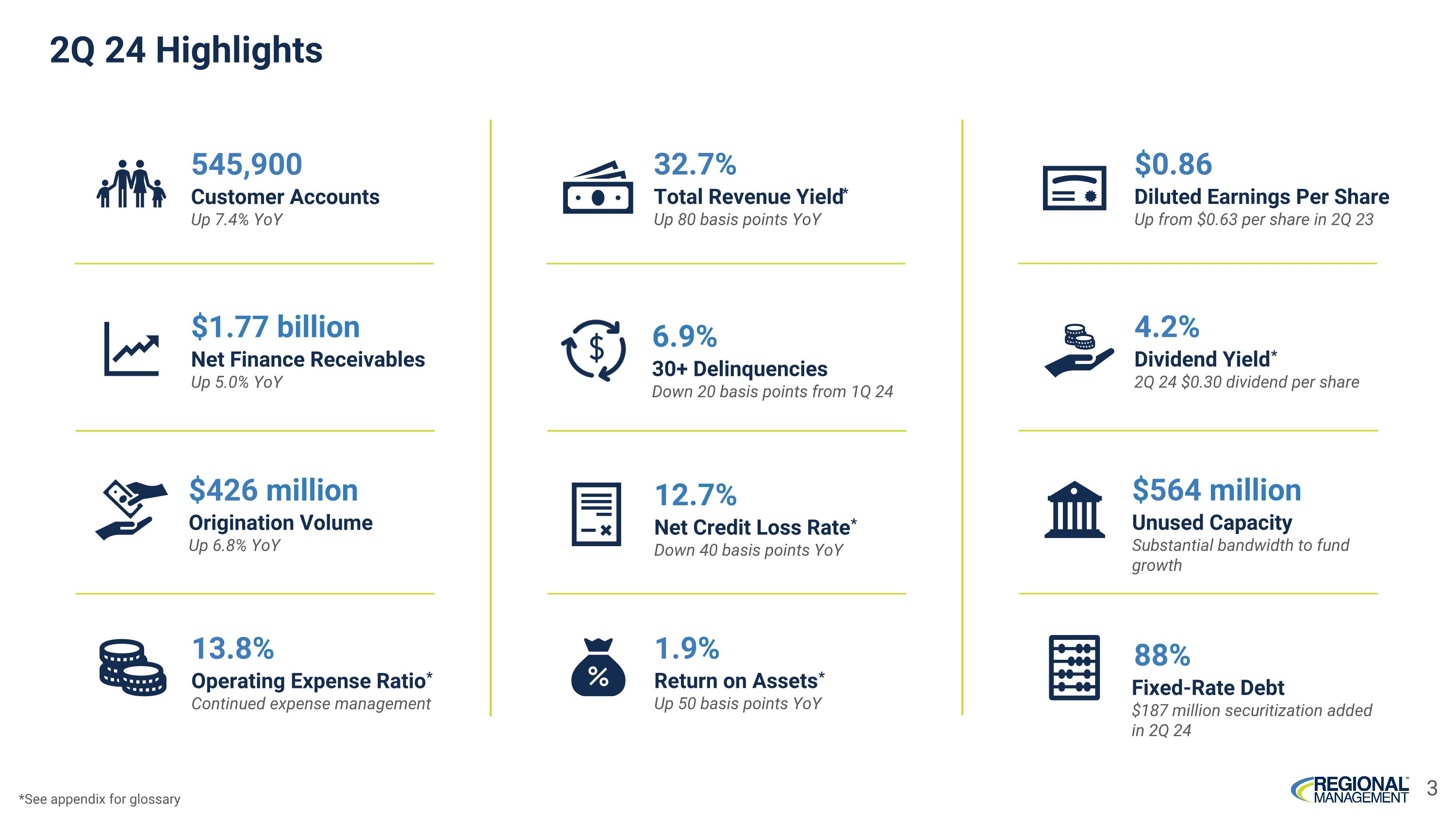

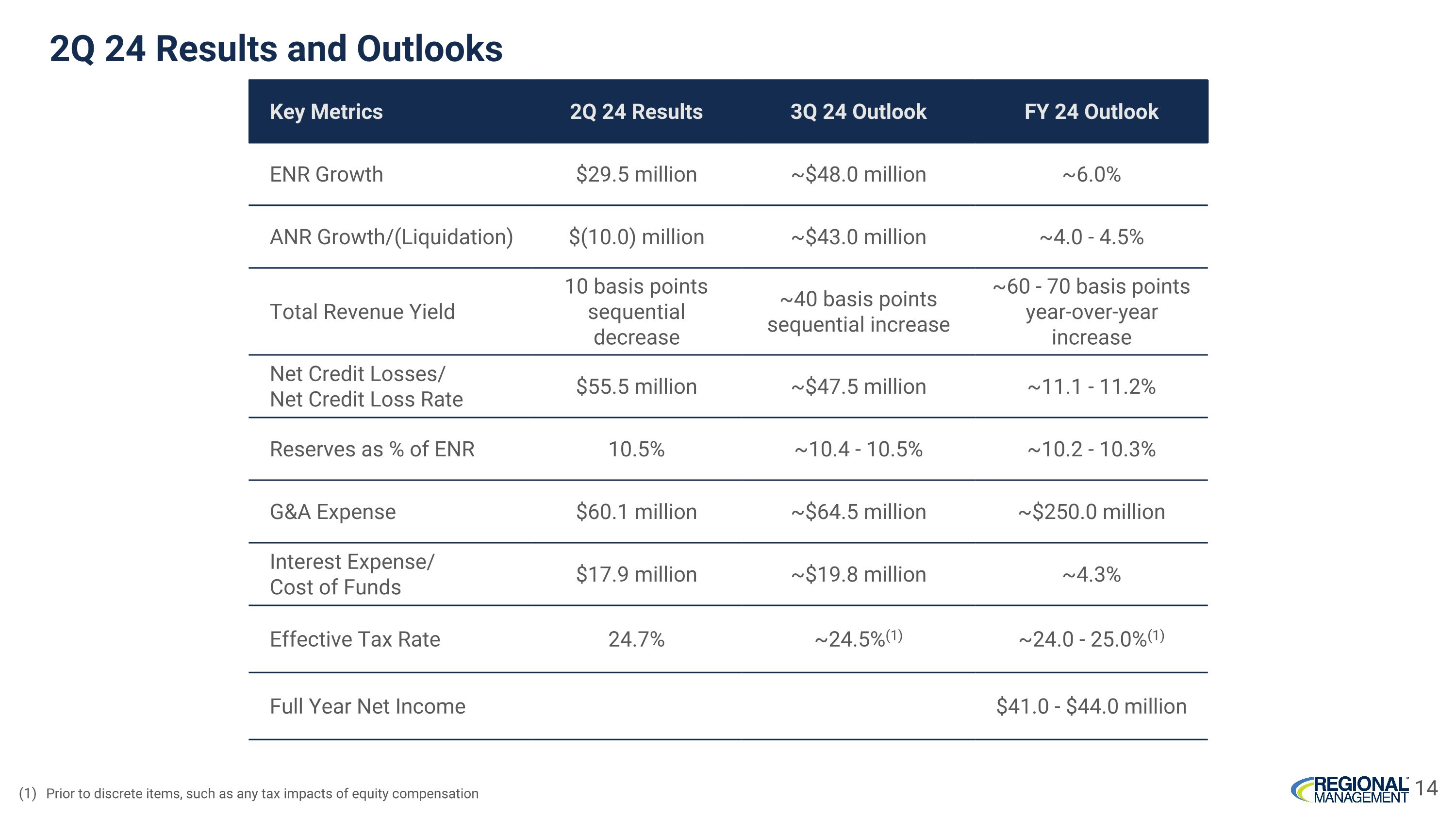

2Q 24 Highlights 545,900 Customer Accounts Up 7.4% YoY $1.77 billion Net Finance Receivables Up 5.0% YoY $426 million Origination Volume Up 6.8% YoY 13.8% Operating Expense Ratio* Continued expense management 32.7% Total Revenue Yield* Up 80 basis points YoY 6.9% 30+ Delinquencies Down 20 basis points from 1Q 24 12.7% Net Credit Loss Rate* Down 40 basis points YoY 1.9% Return on Assets* Up 50 basis points YoY $0.86 Diluted Earnings Per Share Up from $0.63 per share in 2Q 23 4.2% Dividend Yield* 2Q 24 $0.30 dividend per share $564 million Unused Capacity Substantial bandwidth to fund growth 88% Fixed-Rate Debt $187 million securitization added in 2Q 24 3 *See appendix for glossary

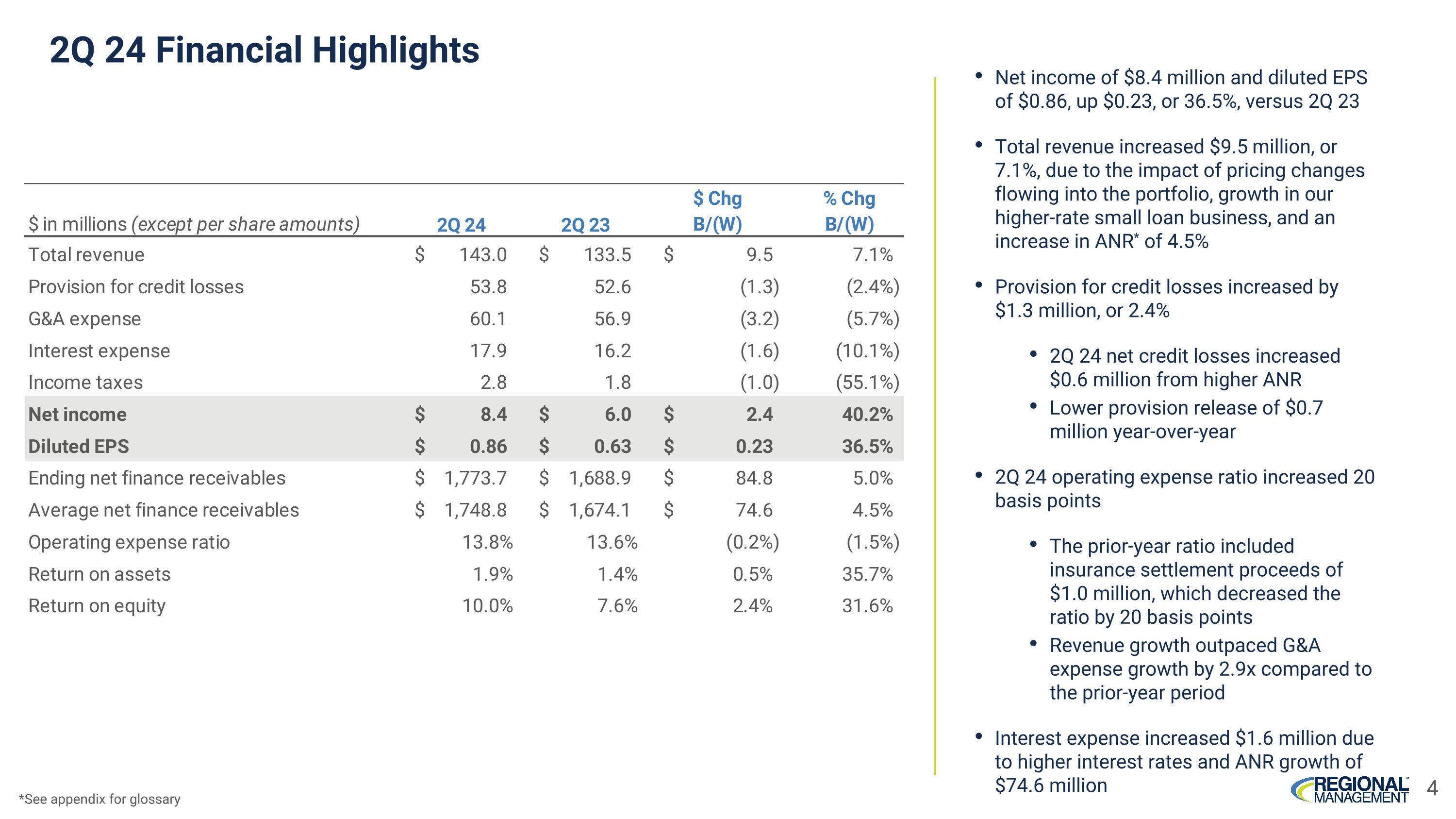

2Q 24 Financial Highlights Net income of $8.4 million and diluted EPS of $0.86, up $0.23, or 36.5%, versus 2Q 23 Total revenue increased $9.5 million, or 7.1%, due to the impact of pricing changes flowing into the portfolio, growth in our higher-rate small loan business, and an increase in ANR* of 4.5% Provision for credit losses increased by $1.3 million, or 2.4% 2Q 24 net credit losses increased $0.6 million from higher ANR Lower provision release of $0.7 million year-over-year 2Q 24 operating expense ratio increased 20 basis points The prior-year ratio included insurance settlement proceeds of $1.0 million, which decreased the ratio by 20 basis points Revenue growth outpaced G&A expense growth by 2.9x compared to the prior-year period Interest expense increased $1.6 million due to higher interest rates and ANR growth of $74.6 million 4 *See appendix for glossary

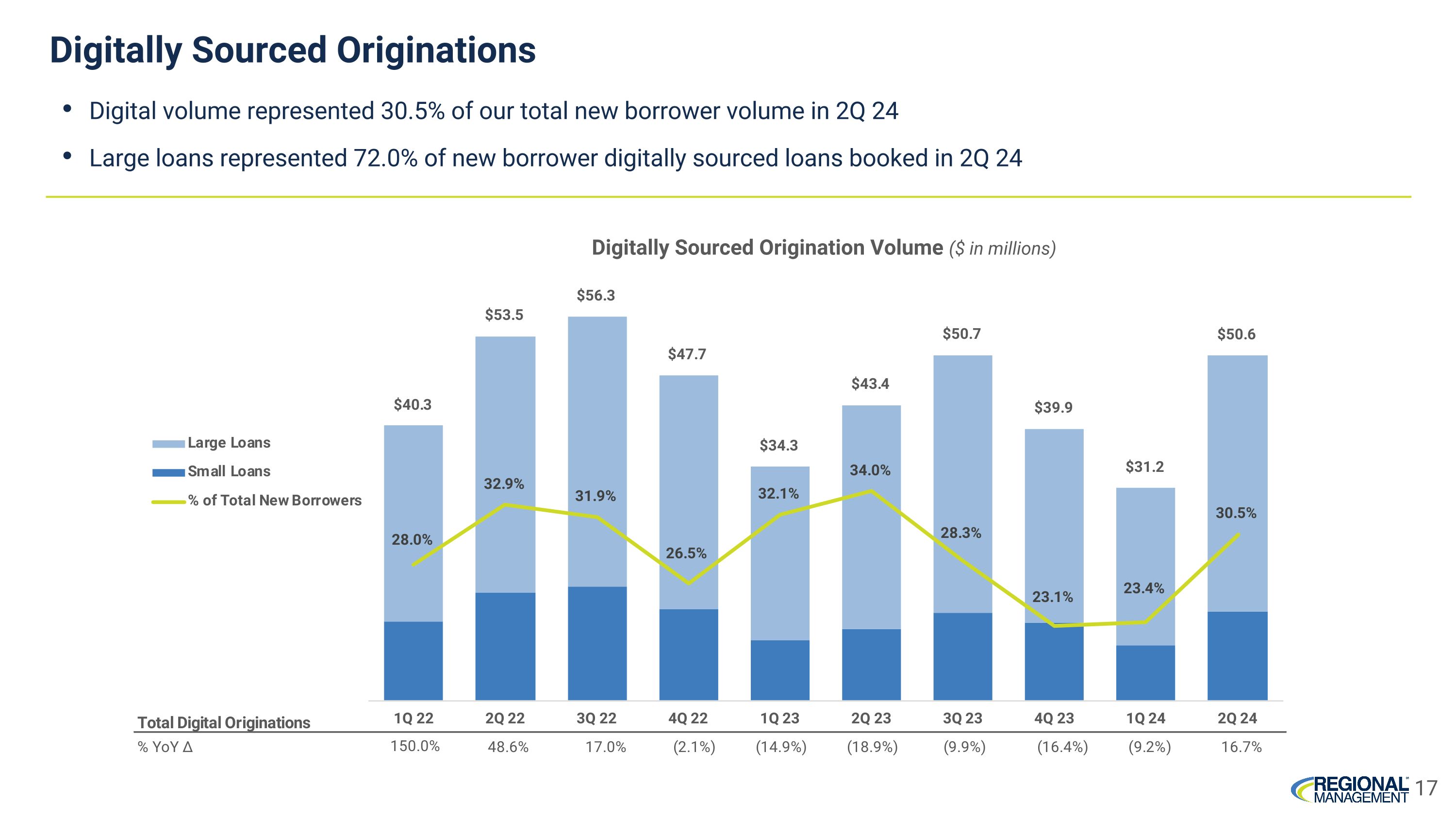

Record direct mail originations for a second quarter of $104.7 million, up from $97.4 million in 2Q 23 Originations were concentrated on programs to present and former borrowers, who perform better than new borrowers 2Q 24 digital, direct mail, and branch originations were up year-over-year by 16.7%, 7.4%, and 4.9%, respectively Originations Trend Quarterly Origination Trend ($ in millions) 5