RPT Realty (NYSE:RPT) (the "Company" or "RPT")

today announced its financial and operating results for the quarter

ended September 30, 2023.

"Since the announcement of our pending

transaction with Kimco, the organization has remained disciplined

in achieving our goals. We surpassed our internal targets for the

quarter and recorded the second highest quarterly leasing volume in

the Company's history, while achieving a nearly 50% new lease

spread and a return on leasing capital of about 11%,” said Brian

Harper, President and CEO. “The majority of leases signed continued

to be with high-credit, national retailers. We signed four new

grocery tenants and we replaced two more Bed Bath & Beyond

vacancies. Additionally, the Company is progressing steadily

towards the closing of the proposed merger with Kimco. Our

continued focus and operational success gives me confidence in the

combined future of our two companies."

FINANCIAL RESULTS

Net (loss) income attributable to common

shareholders for the third quarter 2023 of $(7.9) million, or

$(0.09) per diluted share, compared to $11.3 million, or $0.13 per

diluted share for the same period in 2022.

FFO for the third quarter 2023 of $16.6 million,

or $0.19 per diluted share, compared to $24.1 million, or $0.26 per

diluted share for the same period in 2022.

Operating FFO for the third quarter 2023 of

$21.4 million, or $0.24 per diluted share, compared to $25.2

million or $0.27 per diluted share for the same period in 2022.

Operating FFO for the third quarter 2023 excludes certain net

expenses that totaled $4.8 million, primarily attributable to

merger costs, partially offset by above and below market lease

intangible write-offs. The change in Operating FFO per share was

primarily attributable to lower NOI from dispositions completed in

2022 and higher general and administrative expenses.

Same property NOI during the third quarter 2023

increased 2.6% compared to the same period in 2022. The increase

was primarily driven by higher base rent, lower rent not probable

of collection and higher net recovery income, partially offset by

higher non-recoverable expense.

OPERATING RESULTS

The Company's operating results include its

consolidated properties and its pro-rata share of unconsolidated

joint venture properties for the aggregate portfolio.

During the third quarter 2023, the Company

signed 72 leases totaling 747,672 square feet. Blended re-leasing

spreads on comparable leases were 11.4% with ABR of $17.54 per

square foot. Re-leasing spreads on six comparable new and 41

renewal leases were 49.9% and 7.4%, respectively.

As of September 30, 2023, the Company had

$13.1 million of signed not commenced rent and recovery

income.

The table below summarizes the Company's leased

rate and occupancy results at September 30, 2023, June 30,

2023 and September 30, 2022 for the same property

portfolio.

|

Same Property Portfolio |

September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

|

Total |

|

|

|

|

Leased rate |

94.2% |

94.9% |

95.4% |

|

Occupancy |

89.9% |

91.6% |

90.1% |

|

Anchor (GLA of 10,000 square feet or more) |

|

|

|

|

Leased rate |

96.5% |

97.6% |

98.4% |

|

Occupancy |

91.3% |

93.9% |

92.3% |

|

Small Shop (GLA of less than 10,000 square

feet) |

|

|

|

|

Leased rate |

88.7% |

88.3% |

88.2% |

|

Occupancy |

86.5% |

86.0% |

84.6% |

The impact of the remaining Bed Bath &

Beyond closures detracted 130 and 220 basis points from the

Company's same property leased rate and occupancy, respectively, as

of September 30, 2023.

BALANCE SHEET

The Company ended the third quarter 2023 with

$4.6 million in consolidated cash, cash equivalents and restricted

cash and $472.0 million of unused capacity on its $500.0 million

unsecured revolving credit facility. At September 30, 2023,

the Company had approximately $852.9 million of consolidated

notional debt and finance lease obligations. Including the

Company's pro-rata share of joint venture cash and notional debt of

$3.7 million and $53.8 million, respectively, resulted in

a third quarter 2023 net debt to annualized adjusted EBITDA ratio

of 6.9x. Proforma for the $13.1 million signed not commenced

rent and recovery income balance, the net debt to annualized

adjusted EBITDA ratio would be 6.3x. Total debt including RPT's

pro-rata share of joint venture debt had a weighted average

interest rate of 3.76% and a weighted average maturity of 4.4

years.

DIVIDEND

As previously announced, on October 25, 2023,

the Board of Trustees declared a regular cash dividend of $0.14 per

common share. The cash dividend is payable on December 21, 2023 for

shareholders of record on December 7, 2023. The Board of Trustees

also approved a Series D convertible preferred share dividend of

$0.90625 per share. The current conversion ratio of the Series D

convertible preferred shares can be found on the Company's website

at investors.rptrealty.com/shareholder-information/dividends. The

convertible preferred dividend is payable on January 2, 2024 for

shareholders of record on December 20, 2023.

2023 GUIDANCE

In light of the Company's previously-announced

proposed merger with Kimco Realty, the Company is not providing

guidance and it is not affirming past guidance.

The Company is not hosting a webcast conference

call to discuss its quarterly results and operating

performance.

SUPPLEMENTAL MATERIALS

The Company’s quarterly financial and operating

supplement is available on its corporate investor relations website

at investors.rptrealty.com. If you wish to receive copies via

email, please send requests to invest@rptrealty.com.

RPT Realty owns and operates a national

portfolio of open-air shopping destinations principally located in

top U.S. markets. The Company's shopping centers offer diverse,

locally-curated consumer experiences that reflect the lifestyles of

their surrounding communities and meet the modern expectations of

the Company's retail partners. The Company is a fully integrated

and self-administered REIT publicly traded on the New York Stock

Exchange (the “NYSE”). The common shares of the Company, par value

$0.01 per share (the “common shares”) are listed and traded on the

NYSE under the ticker symbol “RPT”. As of September 30, 2023,

the Company's property portfolio (the "aggregate portfolio")

consisted of 43 wholly-owned shopping centers, 13 shopping centers

owned through its grocery-anchored joint venture, and 49 retail

properties owned through its net lease joint venture, which

together represent 14.9 million square feet of gross leasable area

(“GLA”). As of September 30, 2023, the Company’s pro-rata

share of the aggregate portfolio was 93.5% leased. For additional

information about the Company please visit rptrealty.com.

Company Contact:

Vin Chao, Managing Director -

Finance19 W 44th St. 10th Floor, Ste

1002New York, New York

10036vchao@rptrealty.com(212)

221-1752FORWARD-LOOKING STATEMENTS

This communication contains certain

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended. We

intend such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with the safe harbor

provisions. Forward-looking statements, which are based on certain

assumptions and describe our future plans, strategies and

expectations, are generally identifiable by use of the words

“believe,” “expect,” “intend,” “anticipate,” “estimate,” “predict,”

“may,” “will,” “should,” “target,” “plan” or similar expressions.

The forward-looking statements included in this communication are

based on our good faith beliefs, reasonable assumptions and our

best judgment based upon current information, and, with respect to

the proposed transaction with Kimco, each of the companies’ current

plans, objectives, estimates, expectations and intentions, and, in

each case, inherently involve significant risks and uncertainties

that could cause actual results to differ materially from those in

the forward-looking statements. You should not rely on

forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which, in some cases, are

beyond our ability to predict or control. Factors which may cause

actual results to differ materially from current expectations

include, but are not limited to: our success or failure in

implementing our business strategy; economic conditions generally

(including supply chain disruptions and construction delays) and in

the commercial real estate and finance markets, including, without

limitation, as a result of disruptions and instability in the

banking and financial services industries, continued high inflation

rates or further increases in inflation or interest rates, such as

the inability to obtain equity, debt or other sources of funding or

refinancing on favorable terms to the Company and the costs and

availability of capital, which depends in part on our asset quality

and our relationships with lenders and other capital providers; the

level and volatility of interest rates; risks associated with

bankruptcies or insolvencies or general downturn in the businesses

of tenants; impact of any future pandemic, epidemic or outbreak of

any other highly infectious disease, on the U.S., regional and

global economies and on the Company’s business, financial condition

and results of operations and that of its tenants; the potential

adverse impact from tenant defaults generally or from the

unpredictability of the business plans and financial condition of

the Company’s tenants; the execution of deferral or rent concession

agreements by tenants; our business prospects and outlook;

acquisition, disposition, development and joint venture risks;

risks and uncertainties associated with our and Kimco’s ability to

complete the proposed transaction on the proposed terms or on the

anticipated timeline, or at all, including risks and uncertainties

related to securing the necessary RPT shareholder approval and

satisfaction of other closing conditions to consummate the proposed

transaction and the occurrence of any event, change or other

circumstance that could give rise to the termination of the

definitive merger agreement relating to the proposed transaction;

risks related to future opportunities and plans for the combined

company, including the uncertainty of expected future financial

performance and results of the combined company following

completion of the proposed merger; our insurance costs and

coverages; increases in cost of operations; risks related to

cybersecurity and loss of confidential information and other

business interruptions; changes in governmental regulations, tax

rates and similar matters; our continuing to qualify as a REIT;

risks related to our ability to enter into leases based on the

status of current LOIs or negotiations, on the terms and timelines

currently contemplated or at all, and the other risks and

uncertainties affecting us, including those described from time to

time in our Securities and Exchange Commission (“SEC”) filings and

reports, including in particular those set forth under “Risk

Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2022 and future filings and reports by us. Except as

required by law, we assume no obligation to update these

forward-looking statements, even if new information becomes

available in the future.

Important Additional Information and

Where to Find ItIn connection with the proposed

transaction, Kimco has filed with the SEC a registration statement

on Form S-4 to register the shares of Kimco common stock, Kimco

preferred stock and depositary shares in respect thereof to be

issued in connection with the proposed transaction. The

registration statement has not yet been declared effective. The

registration statement includes a proxy statement/prospectus which

will be sent to the shareholders of RPT seeking their approval of

certain transaction-related proposals after the registration

statement has been declared effective. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4

AND THE RELATED PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT

DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE

PROPOSED TRANSACTION, AS AND WHEN THEY BECOME AVAILABLE, BECAUSE

THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION ABOUT RPT,

KIMCO AND THE PROPOSED TRANSACTION.

Investors and security holders may obtain copies

of these documents free of charge through the website maintained by

the SEC at www.sec.gov or from RPT at its website,

www.rptrealty.com or from Kimco at its website,

www.kimcorealty.com. Documents filed with the SEC by RPT will be

available free of charge by accessing RPT’s website at

www.rptrealty.com under the heading Investors or, alternatively, by

directing a request to RPT at invest@rptrealty.com or 19 West 44th

Street, Suite 1002, New York, NY 10036, telephone: (212) 221-7139,

and documents filed with the SEC by Kimco will be available free of

charge by accessing Kimco’s website at kimcorealty.com under the

heading Investors or, alternatively, by directing a request to

Kimco at ir@kimcorealty.com or 500 North Broadway, Suite 201,

Jericho, NY 11753, telephone: (516) 869-9000.

Participants in the

SolicitationRPT and Kimco and certain of their respective

trustees, directors and executive officers and other members of

management and employees may be deemed to be participants in the

solicitation of proxies from the shareholders of RPT in respect of

the proposed transaction under the rules of the SEC. Information

about RPT’s trustees and executive officers is available in RPT’s

proxy statement dated March 16, 2023 for its 2023 Annual Meeting of

Shareholders. Information about Kimco’s directors and executive

officers is available in Kimco’s proxy statement dated March 15,

2023 for its 2023 Annual Meeting of Stockholders. Other information

regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security

holdings or otherwise, is and will be contained in the proxy

statement/prospectus and other relevant materials filed and to be

filed with the SEC regarding the proposed transaction as and when

they become available. Investors should read the proxy

statement/prospectus carefully before making any voting or

investment decisions. You may obtain free copies of these documents

from RPT or Kimco using the sources indicated above.

No Offer or SolicitationThis

communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act.

|

RPT REALTY |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands, except per share amounts) |

|

(unaudited) |

|

|

|

September 30,2023 |

|

|

|

December 31,2022 |

|

|

ASSETS |

|

|

|

|

Income producing properties, at cost: |

|

|

|

|

Land |

$ |

301,404 |

|

|

$ |

302,062 |

|

|

Buildings and improvements |

|

1,376,161 |

|

|

|

1,373,893 |

|

|

Less accumulated depreciation and amortization |

|

(409,263 |

) |

|

|

(386,036 |

) |

|

Income producing properties, net |

|

1,268,302 |

|

|

|

1,289,919 |

|

|

Construction in progress and land available for development |

|

37,778 |

|

|

|

37,772 |

|

|

Real estate held for sale |

|

4,800 |

|

|

|

3,115 |

|

|

Net real estate |

|

1,310,880 |

|

|

|

1,330,806 |

|

|

Equity investments in unconsolidated joint ventures |

|

414,404 |

|

|

|

423,089 |

|

|

Cash and cash equivalents |

|

4,155 |

|

|

|

5,414 |

|

|

Restricted cash and escrows |

|

412 |

|

|

|

461 |

|

|

Accounts receivable, net |

|

18,377 |

|

|

|

19,914 |

|

|

Acquired lease intangibles, net |

|

32,496 |

|

|

|

40,043 |

|

|

Operating lease right-of-use assets |

|

16,759 |

|

|

|

17,269 |

|

|

Other assets, net |

|

111,694 |

|

|

|

109,443 |

|

|

TOTAL ASSETS |

$ |

1,909,177 |

|

|

$ |

1,946,439 |

|

| |

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

Notes payable, net |

$ |

847,732 |

|

|

$ |

854,596 |

|

|

Finance lease obligation |

|

763 |

|

|

|

763 |

|

|

Accounts payable and accrued expenses |

|

54,094 |

|

|

|

41,985 |

|

|

Distributions payable |

|

15,803 |

|

|

|

14,336 |

|

|

Acquired lease intangibles, net |

|

27,484 |

|

|

|

33,157 |

|

|

Operating lease liabilities |

|

16,684 |

|

|

|

17,016 |

|

|

Other liabilities |

|

6,361 |

|

|

|

5,933 |

|

|

TOTAL LIABILITIES |

|

968,921 |

|

|

|

967,786 |

|

| |

|

|

|

|

Commitments and Contingencies |

|

|

|

| |

|

|

|

|

RPT Realty ("RPT") Shareholders' Equity: |

|

|

|

|

Preferred shares of beneficial interest, $0.01 par, 2,000 shares

authorized: 7.25% Series D Cumulative Convertible Perpetual

Preferred Shares, (stated at liquidation preference $50 per share),

1,849 shares issued and outstanding as of September 30, 2023

and December 31, 2022, respectively |

|

92,427 |

|

|

|

92,427 |

|

|

Common shares of beneficial interest, $0.01 par, 240,000 shares

authorized, 85,712 and 85,525 shares issued and outstanding as of

September 30, 2023 and December 31, 2022,

respectively |

|

857 |

|

|

|

855 |

|

|

Additional paid-in capital |

|

1,261,478 |

|

|

|

1,255,087 |

|

|

Accumulated distributions in excess of net income |

|

(456,006 |

) |

|

|

(409,290 |

) |

|

Accumulated other comprehensive gain |

|

24,074 |

|

|

|

21,434 |

|

|

TOTAL SHAREHOLDERS' EQUITY ATTRIBUTABLE TO

RPT |

|

922,830 |

|

|

|

960,513 |

|

|

Noncontrolling interest |

|

17,426 |

|

|

|

18,140 |

|

|

TOTAL SHAREHOLDERS' EQUITY |

|

940,256 |

|

|

|

978,653 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

1,909,177 |

|

|

$ |

1,946,439 |

|

|

RPT REALTY |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In thousands, except per share amounts) |

|

(unaudited) |

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

REVENUE |

|

|

|

|

|

|

|

|

Rental income |

$ |

52,413 |

|

|

$ |

52,487 |

|

|

$ |

150,724 |

|

|

$ |

160,032 |

|

|

Other property income |

|

889 |

|

|

|

1,012 |

|

|

|

2,690 |

|

|

|

3,227 |

|

|

Management and other fee income |

|

1,586 |

|

|

|

1,231 |

|

|

|

4,772 |

|

|

|

2,848 |

|

|

TOTAL REVENUE |

|

54,888 |

|

|

|

54,730 |

|

|

|

158,186 |

|

|

|

166,107 |

|

| |

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

Real estate tax expense |

|

6,734 |

|

|

|

7,329 |

|

|

|

20,877 |

|

|

|

22,731 |

|

|

Recoverable operating expense |

|

6,913 |

|

|

|

6,832 |

|

|

|

21,975 |

|

|

|

21,119 |

|

|

Non-recoverable operating expense |

|

2,972 |

|

|

|

2,817 |

|

|

|

8,383 |

|

|

|

7,792 |

|

|

Depreciation and amortization |

|

19,961 |

|

|

|

18,442 |

|

|

|

54,247 |

|

|

|

57,825 |

|

|

Transaction costs |

|

3 |

|

|

|

405 |

|

|

|

13 |

|

|

|

4,881 |

|

|

General and administrative expense |

|

9,673 |

|

|

|

9,372 |

|

|

|

27,968 |

|

|

|

26,394 |

|

|

TOTAL EXPENSES |

|

46,256 |

|

|

|

45,197 |

|

|

|

133,463 |

|

|

|

140,742 |

|

| |

|

|

|

|

|

|

|

|

Gain on sale of real estate |

|

— |

|

|

|

11,144 |

|

|

|

900 |

|

|

|

26,234 |

|

| |

|

|

|

|

|

|

|

|

OPERATING INCOME |

|

8,632 |

|

|

|

20,677 |

|

|

|

25,623 |

|

|

|

51,599 |

|

| |

|

|

|

|

|

|

|

|

OTHER INCOME AND EXPENSES |

|

|

|

|

|

|

|

|

Other (expense) income, net |

|

(8,049 |

) |

|

|

530 |

|

|

|

(7,392 |

) |

|

|

895 |

|

|

Earnings from unconsolidated joint ventures |

|

1,948 |

|

|

|

1,779 |

|

|

|

3,388 |

|

|

|

467 |

|

|

Interest expense |

|

(8,803 |

) |

|

|

(9,568 |

) |

|

|

(26,342 |

) |

|

|

(26,650 |

) |

|

Loss on extinguishment of debt |

|

— |

|

|

|

(121 |

) |

|

|

— |

|

|

|

(121 |

) |

|

(LOSS) INCOME BEFORE TAX |

|

(6,272 |

) |

|

|

13,297 |

|

|

|

(4,723 |

) |

|

|

26,190 |

|

|

Income tax provision |

|

(24 |

) |

|

|

(71 |

) |

|

|

(254 |

) |

|

|

(142 |

) |

|

NET (LOSS) INCOME |

|

(6,296 |

) |

|

|

13,226 |

|

|

|

(4,977 |

) |

|

|

26,048 |

|

|

Net loss (income) attributable to noncontrolling partner

interest |

|

114 |

|

|

|

(251 |

) |

|

|

90 |

|

|

|

(502 |

) |

|

NET (LOSS) INCOME ATTRIBUTABLE TO RPT |

|

(6,182 |

) |

|

|

12,975 |

|

|

|

(4,887 |

) |

|

|

25,546 |

|

|

Preferred share dividends |

|

(1,676 |

) |

|

|

(1,676 |

) |

|

|

(5,026 |

) |

|

|

(5,026 |

) |

|

NET (LOSS) INCOME AVAILABLE TO COMMON

SHAREHOLDERS |

$ |

(7,858 |

) |

|

$ |

11,299 |

|

|

$ |

(9,913 |

) |

|

$ |

20,520 |

|

| |

|

|

|

|

|

|

|

|

(LOSS) EARNINGS PER COMMON SHARE |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.09 |

) |

|

$ |

0.13 |

|

|

$ |

(0.12 |

) |

|

$ |

0.24 |

|

|

Diluted |

$ |

(0.09 |

) |

|

$ |

0.13 |

|

|

$ |

(0.12 |

) |

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

Basic |

|

85,704 |

|

|

|

84,259 |

|

|

|

85,640 |

|

|

|

84,133 |

|

|

Diluted |

|

85,704 |

|

|

|

84,855 |

|

|

|

85,640 |

|

|

|

84,861 |

|

|

RPT REALTY |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

FUNDS FROM OPERATIONS |

|

(In thousands, except per share data) |

|

(unaudited) |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net (loss) income |

$ |

(6,296 |

) |

|

$ |

13,226 |

|

|

$ |

(4,977 |

) |

|

$ |

26,048 |

|

|

Net loss (income) attributable to noncontrolling partner

interest |

|

114 |

|

|

|

(251 |

) |

|

|

90 |

|

|

|

(502 |

) |

|

Preferred share dividends |

|

(1,676 |

) |

|

|

(1,676 |

) |

|

|

(5,026 |

) |

|

|

(5,026 |

) |

|

Net (loss) income available to common shareholders |

|

(7,858 |

) |

|

|

11,299 |

|

|

|

(9,913 |

) |

|

|

20,520 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Rental property depreciation and amortization expense |

|

19,816 |

|

|

|

18,292 |

|

|

|

53,804 |

|

|

|

57,366 |

|

|

Pro-rata share of real estate depreciation from unconsolidated

joint ventures(1) |

|

4,776 |

|

|

|

3,715 |

|

|

|

16,969 |

|

|

|

14,535 |

|

|

Gain on sale of income producing real estate |

|

— |

|

|

|

(11,144 |

) |

|

|

(297 |

) |

|

|

(25,980 |

) |

|

FFO available to common shareholders |

|

16,734 |

|

|

|

22,162 |

|

|

|

60,563 |

|

|

|

66,441 |

|

|

Noncontrolling interest in Operating Partnership(2) |

|

(114 |

) |

|

|

251 |

|

|

|

(90 |

) |

|

|

502 |

|

|

Preferred share dividends (assuming conversion)(3) |

|

— |

|

|

|

1,676 |

|

|

|

— |

|

|

|

5,026 |

|

|

FFO available to common shareholders and dilutive

securities |

$ |

16,620 |

|

|

$ |

24,089 |

|

|

$ |

60,473 |

|

|

$ |

71,969 |

|

| |

|

|

|

|

|

|

|

|

Gain on sale of land |

|

— |

|

|

|

— |

|

|

|

(603 |

) |

|

|

(254 |

) |

|

Transaction costs |

|

3 |

|

|

|

405 |

|

|

|

13 |

|

|

|

4,881 |

|

|

Merger costs(4) |

|

8,234 |

|

|

|

— |

|

|

|

8,234 |

|

|

|

— |

|

|

Severance expense(5) |

|

— |

|

|

|

— |

|

|

|

1,130 |

|

|

|

— |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

121 |

|

|

|

— |

|

|

|

121 |

|

|

Above and below market lease intangible write-offs |

|

(3,571 |

) |

|

|

(422 |

) |

|

|

(3,571 |

) |

|

|

(2,022 |

) |

|

Lease incentive write-offs |

|

156 |

|

|

|

— |

|

|

|

213 |

|

|

|

— |

|

|

Pro-rata share of transaction costs from unconsolidated joint

ventures(1) |

|

— |

|

|

|

8 |

|

|

|

— |

|

|

|

8 |

|

|

Pro-rata share of above and below market lease intangible

write-offs from unconsolidated joint ventures(1) |

|

(1 |

) |

|

|

— |

|

|

|

(22 |

) |

|

|

(984 |

) |

|

Pro-rata share of loss on extinguishment of debt from

unconsolidated joint ventures(1) |

|

— |

|

|

|

20 |

|

|

|

— |

|

|

|

20 |

|

|

Payment of loan amendment fees(6) |

|

— |

|

|

|

958 |

|

|

|

— |

|

|

|

958 |

|

|

Insurance proceeds, net(4) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(136 |

) |

|

Operating FFO available to common shareholders and dilutive

securities |

$ |

21,441 |

|

|

$ |

25,179 |

|

|

$ |

65,867 |

|

|

$ |

74,561 |

|

| |

|

|

|

|

|

|

|

|

Weighted average common shares |

|

85,704 |

|

|

|

84,259 |

|

|

|

85,640 |

|

|

|

84,133 |

|

|

Shares issuable upon conversion of Operating Partnership Units (“OP

Units”)(2) |

|

1,604 |

|

|

|

1,635 |

|

|

|

1,604 |

|

|

|

1,685 |

|

|

Dilutive effect of restricted stock |

|

2,249 |

|

|

|

596 |

|

|

|

2,091 |

|

|

|

728 |

|

|

Shares issuable upon conversion of preferred shares(3) |

|

— |

|

|

|

7,017 |

|

|

|

— |

|

|

|

7,017 |

|

|

Weighted average equivalent shares outstanding,

diluted |

|

89,557 |

|

|

|

93,507 |

|

|

|

89,335 |

|

|

|

93,563 |

|

| |

|

|

|

|

|

|

|

|

FFO available to common shareholders and dilutive

securities per share, diluted |

$ |

0.19 |

|

|

$ |

0.26 |

|

|

$ |

0.68 |

|

|

$ |

0.77 |

|

| |

|

|

|

|

|

|

|

|

Operating FFO available to common shareholders and dilutive

securities per share, diluted |

$ |

0.24 |

|

|

$ |

0.27 |

|

|

$ |

0.74 |

|

|

$ |

0.80 |

|

| |

|

|

|

|

|

|

|

|

Dividend per common share |

$ |

0.14 |

|

|

$ |

0.13 |

|

|

$ |

0.42 |

|

|

$ |

0.39 |

|

|

Payout ratio - Operating FFO |

|

58.3 |

% |

|

|

48.1 |

% |

|

|

56.8 |

% |

|

|

48.8 |

% |

|

|

|

|

|

|

|

|

|

|

(1) |

Amounts noted

are included in Earnings from unconsolidated joint ventures. |

| (2) |

The total noncontrolling interest reflects OP Units convertible

on a one-of-one basis into common shares. |

| (3) |

7.25% Series D Cumulative Convertible Perpetual Preferred

Shares of Beneficial Interest, $0.01 par (“Series D Preferred

Shares”) are paid annual dividends of $6.7 million and are

currently convertible into approximately 7.0 million shares of

common stock. They are dilutive only when earnings or FFO exceed

approximately $0.24 per diluted share per quarter and $0.96 per

diluted share per year. The conversion ratio is subject to

adjustment based upon a number of factors, and such adjustment

could affect the dilutive impact of the Series D Preferred Shares

on FFO and earning per share in future periods. In instances when

the Preferred Share ratio exceeds basic FFO, the Preferred Shares

are considered anti-dilutive, and as a result are not included in

the calculation of fully diluted FFO and Operating FFO for the

three and nine months ended September 30, 2023. |

| (4) |

Amounts noted are included in Other (expense) income, net. |

| (5) |

For the nine months ended September 30, 2023, severance expense

is comprised of one-time employee termination benefits resulting

from the reduction in force during February 2023. Amounts noted are

included in General and administrative expense. |

| (6) |

Amounts noted are included in General and administrative

expense. |

|

RPT REALTY |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

(amounts in thousands) |

|

(unaudited) |

| |

|

Reconciliation of net (loss) income available to common

shareholders to Same Property Net Operating Income

(NOI) |

| |

|

|

|

|

|

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net (loss) income available to common shareholders |

$ |

(7,858 |

) |

|

$ |

11,299 |

|

|

$ |

(9,913 |

) |

|

$ |

20,520 |

|

|

Preferred share dividends |

|

1,676 |

|

|

|

1,676 |

|

|

|

5,026 |

|

|

|

5,026 |

|

|

Net (loss) income attributable to noncontrolling partner

interest |

|

(114 |

) |

|

|

251 |

|

|

|

(90 |

) |

|

|

502 |

|

|

Income tax provision |

|

24 |

|

|

|

71 |

|

|

|

254 |

|

|

|

142 |

|

|

Interest expense |

|

8,803 |

|

|

|

9,568 |

|

|

|

26,342 |

|

|

|

26,650 |

|

|

Earnings from unconsolidated joint ventures |

|

(1,948 |

) |

|

|

(1,779 |

) |

|

|

(3,388 |

) |

|

|

(467 |

) |

|

Gain on sale of real estate |

|

— |

|

|

|

(11,144 |

) |

|

|

(900 |

) |

|

|

(26,234 |

) |

|

Other expense (income), net |

|

8,049 |

|

|

|

(530 |

) |

|

|

7,392 |

|

|

|

(895 |

) |

|

Management and other fee income |

|

(1,586 |

) |

|

|

(1,231 |

) |

|

|

(4,772 |

) |

|

|

(2,848 |

) |

|

Depreciation and amortization |

|

19,961 |

|

|

|

18,442 |

|

|

|

54,247 |

|

|

|

57,825 |

|

|

Transaction costs |

|

3 |

|

|

|

405 |

|

|

|

13 |

|

|

|

4,881 |

|

|

General and administrative expenses |

|

9,673 |

|

|

|

9,372 |

|

|

|

27,968 |

|

|

|

26,394 |

|

|

Pro-rata share of NOI from R2G Venture LLC(1) |

|

7,108 |

|

|

|

5,547 |

|

|

|

21,125 |

|

|

|

14,590 |

|

|

Pro-rata share of NOI from RGMZ Venture REIT LLC(2) |

|

300 |

|

|

|

276 |

|

|

|

909 |

|

|

|

757 |

|

|

Lease termination fees |

|

(5 |

) |

|

|

— |

|

|

|

(66 |

) |

|

|

(154 |

) |

|

Amortization of lease inducements |

|

306 |

|

|

|

190 |

|

|

|

743 |

|

|

|

618 |

|

|

Amortization of acquired above and below market lease intangibles,

net |

|

(3,979 |

) |

|

|

(907 |

) |

|

|

(4,843 |

) |

|

|

(3,766 |

) |

|

Straight-line ground rent expense |

|

77 |

|

|

|

77 |

|

|

|

230 |

|

|

|

230 |

|

|

Straight-line rental income |

|

(262 |

) |

|

|

(362 |

) |

|

|

(374 |

) |

|

|

(1,151 |

) |

|

NOI at Pro-Rata |

|

40,228 |

|

|

|

41,342 |

|

|

|

119,903 |

|

|

|

122,741 |

|

|

NOI from Other Investments |

|

(2,657 |

) |

|

|

(4,726 |

) |

|

|

(8,548 |

) |

|

|

(13,897 |

) |

|

Pro-rata share of NOI from RGMZ Venture REIT LLC(2) |

|

(300 |

) |

|

|

(276 |

) |

|

|

(909 |

) |

|

|

(757 |

) |

|

Same Property NOI |

$ |

37,271 |

|

|

$ |

36,340 |

|

|

$ |

110,446 |

|

|

$ |

108,087 |

|

|

|

|

|

|

|

|

|

|

|

(1) |

Represents

51.5% of the NOI from the properties owned by R2G Venture LLC for

all periods presented. |

| (2) |

Represents 6.4% of the NOI from the properties owned by RGMZ

Venture REIT LLC for all periods presented. |

|

RPT REALTY |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

(amounts in thousands) |

|

(unaudited) |

| |

|

|

|

| |

Three Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

Reconciliation of net (loss) income to annualized proforma

adjusted EBITDA |

|

|

|

|

Net (loss) income |

$ |

(6,296 |

) |

|

$ |

13,226 |

|

|

Interest expense |

|

8,803 |

|

|

|

9,568 |

|

|

Income tax provision |

|

24 |

|

|

|

71 |

|

|

Depreciation and amortization |

|

19,961 |

|

|

|

18,442 |

|

|

Gain on sale of income producing real estate |

|

— |

|

|

|

(11,144 |

) |

|

Pro-rata share of interest expense from unconsolidated

entities |

|

555 |

|

|

|

489 |

|

|

Pro-rata share of depreciation and amortization from unconsolidated

entities |

|

4,776 |

|

|

|

3,715 |

|

|

EBITDAre |

|

27,823 |

|

|

|

34,367 |

|

| |

|

|

|

|

Merger costs |

|

8,234 |

|

|

|

— |

|

|

Above and below market lease intangible write-offs |

|

(3,571 |

) |

|

|

(422 |

) |

|

Lease incentive write-offs |

|

156 |

|

|

|

— |

|

|

Transaction costs |

|

3 |

|

|

|

405 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

121 |

|

|

Pro-rata share of transaction costs from unconsolidated

entities |

|

— |

|

|

|

8 |

|

|

Pro-rata share of above and below market lease intangible

write-offs from unconsolidated entities |

|

(1 |

) |

|

|

— |

|

|

Pro-rata share of loss on extinguishment of debt from

unconsolidated entities |

|

— |

|

|

|

20 |

|

|

Payment of loan amendment fees |

|

— |

|

|

|

958 |

|

|

Adjusted EBITDA |

|

32,644 |

|

|

|

35,457 |

|

|

Annualized adjusted EBITDA |

$ |

130,576 |

|

|

$ |

141,828 |

|

| |

|

|

|

|

Reconciliation of Notes Payable, net to Net

Debt |

|

|

|

|

Notes payable, net |

$ |

847,732 |

|

|

$ |

946,758 |

|

|

Unamortized premium |

|

(49 |

) |

|

|

(97 |

) |

|

Deferred financing costs, net |

|

4,490 |

|

|

|

5,531 |

|

|

Consolidated notional debt |

|

852,173 |

|

|

|

952,192 |

|

|

Pro-rata share of notional debt from unconsolidated entities |

|

53,823 |

|

|

|

53,698 |

|

|

Finance lease obligation |

|

763 |

|

|

|

821 |

|

|

Cash, cash equivalents and restricted cash |

|

(4,567 |

) |

|

|

(8,562 |

) |

|

Pro-rata share of unconsolidated entities cash, cash equivalents

and restricted cash |

|

(3,734 |

) |

|

|

(4,473 |

) |

|

Net debt |

$ |

898,458 |

|

|

$ |

993,676 |

|

| |

|

|

|

|

Reconciliation of interest expense to total fixed

charges |

|

|

|

|

Interest expense |

$ |

8,803 |

|

|

$ |

9,568 |

|

|

Pro-rata share of interest expense from unconsolidated

entities |

|

555 |

|

|

|

489 |

|

|

Preferred share dividends |

|

1,676 |

|

|

|

1,676 |

|

|

Scheduled mortgage principal payments |

|

209 |

|

|

|

339 |

|

|

Pro-rata share of mortgage principal payments from unconsolidated

entities |

|

7 |

|

|

|

7 |

|

|

Total fixed charges |

$ |

11,250 |

|

|

$ |

12,079 |

|

| |

|

|

|

|

Net debt to annualized adjusted EBITDA |

|

6.9 |

x |

|

|

7.0 |

x |

|

Interest coverage ratio (adjusted EBITDA / interest expense) |

|

3.5 |

x |

|

|

3.5 |

x |

|

Fixed charge coverage ratio (adjusted EBITDA / fixed charges) |

|

2.9 |

x |

|

|

2.9 |

x |

|

|

|

|

|

RPT RealtyNon-GAAP

Financial Definitions

Certain of our key performance indicators are

considered non-GAAP financial measures. Management uses these

measures along with our GAAP financial statements in order to

evaluate our operations results. We believe these measures provide

additional and useful means to assess our performance. These

measures do not represent alternatives to GAAP measures as

indicators of performance and a comparison of the Company's

presentations to similarly titled measures of other REITs may not

necessarily be meaningful due to possible differences in definition

and application by such REITs.

Funds From Operations (FFO)As

defined by the National Association of Real Estate Investment

Trusts (NAREIT), Funds From Operations (FFO) represents net income

computed in accordance with generally accepted accounting

principles, excluding gains (or losses) from sales of operating

real estate assets and impairment provisions on operating real

estate assets or on investments in non-consolidated investees that

are driven by measurable decreases in the fair value of operating

real estate assets held by the investee, plus depreciation and

amortization of depreciable real estate, (excluding amortization of

financing costs). Adjustments for unconsolidated partnerships and

joint ventures are calculated to reflect funds from operations on

the same basis. We have adopted the NAREIT definition in our

computation of FFO.

Operating FFOIn addition to

FFO, we include Operating FFO as an additional measure of our

financial and operating performance. Operating FFO excludes

transactions costs and periodic items such as gains (or losses)

from sales of non-operating real estate assets and impairment

provisions on non-operating real estate assets, bargain purchase

gains, severance expense, merger costs, accelerated amortization of

debt premiums, gains or losses on extinguishment of debt, insured

proceeds, net, accelerated write-offs of above and below market

lease intangibles, accelerated write-offs of lease incentives and

payment of loan amendment fees that are not adjusted under the

current NAREIT definition of FFO. We provide a reconciliation of

FFO to Operating FFO. In future periods, Operating FFO may also

include other adjustments, which will be detailed in the

reconciliation for such measure, that we believe will enhance

comparability of Operating FFO from period to period. FFO and

Operating FFO should not be considered alternatives to GAAP net

income available to common shareholders or as alternatives to cash

flow as measures of liquidity.

While we consider FFO available to common

shareholders and Operating FFO available to common shareholders

useful measures for reviewing our comparative operating and

financial performance between periods or to compare our performance

to different REITs, our computations of FFO and Operating FFO may

differ from the computations utilized by other real estate

companies, and therefore, may not be comparable. We recognize the

limitations of FFO and Operating FFO when compared to GAAP net

income available to common shareholders. FFO and Operating FFO

available to common shareholders do not represent amounts available

for needed capital replacement or expansion, debt service

obligations, or other commitments and uncertainties. In addition,

FFO and Operating FFO do not represent cash generated from

operating activities in accordance with GAAP and are not

necessarily indicative of cash available to fund cash needs,

including the payment of dividends.

Net Operating Income (NOI) / Same

Property NOI / NOI from Other InvestmentsNOI consists of

(i) rental income and other property income, before straight-line

rental income, amortization of lease inducements, amortization of

acquired above and below market lease intangibles and lease

termination fees less (ii) real estate taxes and all recoverable

and non-recoverable operating expenses other than straight-line

ground rent expense, in each case, including our share of these

items from our R2G Venture LLC and RGMZ Venture REIT LLC

unconsolidated joint ventures.

NOI, Same Property NOI and NOI from Other

Investments are supplemental non-GAAP financial measures of real

estate companies' operating performance. Same Property NOI is

considered by management to be a relevant performance measure of

our operations because it includes only the NOI of comparable

multi-tenant operating properties for the reporting period. Same

Property NOI for the three and nine months ended September 30,

2023 and 2022 represents NOI from the Company's same property

portfolio consisting of 39 consolidated operating properties and

our 51.5% pro-rata share of 11 properties owned by our R2G Venture

LLC unconsolidated joint venture. Given the relative immateriality

of our pro-rata share of RGMZ Venture REIT LLC in all periods

presented, we have excluded it from Same Property NOI. All

properties included in Same Property NOI were either acquired or

placed in service and stabilized prior to January 1, 2022. We

present Same Property NOI primarily to show the percentage change

in our NOI from period to period across a consistent pool of

properties. Same Property NOI excludes properties under

redevelopment or where activities have started in preparation for

redevelopment. A property is designated as a redevelopment when

planned improvements significantly impact the property. NOI from

Other Investments for the three and nine months ended

September 30, 2023 and 2022 represents pro-rata NOI primarily

from (i) properties disposed of and acquired during 2022, (ii)

Hunter's Square, Marketplace of Delray and The Crossroads (R2G)

where the Company has begun activities in anticipation of future

redevelopment, (iii) properties held for sale as of

September 30, 2023, (iv) certain property related employee

compensation, benefits, and travel expense and (v) noncomparable

operating income and expense adjustments.

NOI, Same Property NOI and NOI from Other

Investments should not be considered as alternatives to net income

in accordance with GAAP or as measures of liquidity. Our method of

calculating these measures may differ from methods used by other

REITs and, accordingly, may not be comparable to such other

REITs.

RPT RealtyNon-GAAP

Financial Definitions (continued)

Net DebtNet Debt represents (i)

our total debt principal, which excludes unamortized premium and

deferred financing costs, net, plus (ii) our finance lease

obligation, plus (iii) our pro-rata share of total debt principal,

which excludes unamortized discount and deferred financing costs,

net, of each of our unconsolidated entities, less (iv) our cash,

cash equivalents and restricted cash, less (v) our pro-rata share

of cash, cash equivalents and restricted cash of each of our

unconsolidated entities. We present net debt to show the ratio of

our net debt to our proforma Adjusted EBITDA.

EBITDAre/Adjusted

EBITDA/Proforma Adjusted EBITDANAREIT defines EBITDAre as

net income computed in accordance with GAAP, plus interest expense,

income tax expense (benefit), depreciation and amortization and

impairment of depreciable real estate and in substance real estate

equity investments; plus or minus gains or losses from sales of

operating real estate assets and interests in real estate equity

investments; and adjustments to reflect our share of unconsolidated

real estate joint ventures and partnerships for these items. The

Company calculates EBITDAre in a manner consistent with the NAREIT

definition. The Company also presents Adjusted EBITDA which is

EBITDAre net of other items that we believe enhance comparability

of Adjusted EBITDA across periods and are listed as adjustments in

the applicable reconciliation. EBITDAre and Adjusted EBITDA should

not be considered an alternative measure of operating results or

cash flow from operations as determined in accordance with

GAAP.

Pro-RataWe present certain

financial information on a “pro-rata” basis or including “pro-rata”

adjustments. Unless otherwise specified, pro-rata financial

information includes our proportionate economic ownership of each

of our unconsolidated joint ventures derived on an entity-by-entity

basis by applying the ownership percentage interest used to arrive

at our share of the net operations for the period consistent with

the application of the equity method of accounting to each of our

unconsolidated joint ventures. See page 33 of our quarterly

financial and operating supplement for a discussion of important

considerations and limitations that you should be aware of when

reviewing financial information that we present on a pro-rata basis

or include pro-rata adjustments.

OccupancyOccupancy is defined,

for a property or group of properties, as the ratio, expressed as a

percentage, of (a) the number of square feet of such property

economically occupied by tenants under leases with an initial term

of greater than one year, to (b) the aggregate number of square

feet for such property.

Leased RateLeased Rate is defined,

for a property or group of properties, as the ratio, expressed as a

percentage, of (a) the number of square feet of such property under

leases with an initial term of greater than one year, including

signed leases not yet commenced, to (b) the aggregate number of

square feet for such property.

Metropolitan Statistical Area

(MSA)Metropolitan Statistical Area (MSA) information is

sourced from the United States Census Bureau and rank is determined

based on the most recently available population estimates.

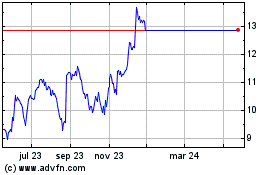

Rithm Property (NYSE:RPT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Rithm Property (NYSE:RPT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024