RPT Realty (NYSE:RPT) (“RPT” or the “Company”)

announced today that, at a special meeting of the shareholders of

RPT (the “Special Meeting”), the RPT shareholders approved the

proposal necessary for the closing of the previously announced

mergers pursuant to the Agreement and Plan of Merger, dated as of

August 28, 2023 (the “Merger Agreement”), by and among Kimco Realty

Corporation (“Kimco”), Kimco Realty OP, LLC, a Delaware limited

liability company and wholly owned subsidiary of Kimco (“Kimco

OP”), Tarpon Acquisition Sub, LLC, a Delaware limited liability

company and a direct wholly owned subsidiary of Kimco (“Merger

Sub”), Tarpon OP Acquisition Sub, LLC, a Delaware limited liability

company and direct wholly owned subsidiary of Kimco OP (“OP Merger

Sub”), RPT and RPT Realty, L.P., a Delaware limited partnership

(“RPT OP”), whereby (i) OP Merger Sub will merge with and into RPT

OP, with RPT OP surviving the partnership merger (the “Partnership

Merger”), (ii) RPT will merge with and into Merger Sub (the

“Company Merger” and, together with the Partnership Merger, the

“Mergers”), with Merger Sub surviving the Company Merger as a

wholly owned subsidiary of Kimco and (iii) immediately after the

Company Merger, Kimco will contribute all outstanding membership

interests of Merger Sub to Kimco OP.

At the Special Meeting, approximately 99.8% of

the votes were cast for the approval of the Company Merger and the

other transactions contemplated by the Merger Agreement, which

represented approximately 87.6% of outstanding RPT common shares,

including restricted shares, as of November 1, 2023, the record

date of the Special Meeting.

The final voting results will be reported on a

Form 8-K filed with the Securities and Exchange Commission by RPT

with respect to the Special Meeting.

The Mergers are expected to close on January 2,

2024, subject to the satisfaction or waiver of customary closing

conditions. Upon completion of the Mergers, pursuant to the terms

of the Merger Agreement, (i) holders of RPT common shares will have

the right to receive 0.6049 newly issued shares of Kimco common

stock for each RPT common share that they own immediately prior to

the effective time of the Company Merger and (ii) holders of RPT

7.25% Series D Cumulative Convertible Perpetual Preferred Shares of

Beneficial Interest (the “RPT Preferred Shares”) will have the

right to receive one depositary share representing one

one-thousandth of a share of newly issued Kimco Class N Preferred

Stock for each RPT Preferred Share that they own immediately prior

to the effective time of the Company Merger. Upon completion of the

Mergers, the common stock of the combined company will trade under

the ticker symbol “KIM” on the NYSE, and RPT’s common shares will

be delisted from the NYSE.

About RPT Realty

RPT Realty owns and operates a national

portfolio of open-air shopping destinations principally located in

top U.S. markets. The Company’s shopping centers offer diverse,

locally-curated consumer experiences that reflect the lifestyles of

their surrounding communities and meet the modern expectations of

the Company’s retail partners. The Company is a fully integrated

and self-administered REIT publicly traded on the New York Stock

Exchange (the “NYSE”). The common shares of the Company, par value

$0.01 per share are listed and traded on the NYSE under the ticker

symbol “RPT”. As of September 30, 2023, the Company’s property

portfolio (the “aggregate portfolio”) consisted of 43 wholly-owned

shopping centers, 13 shopping centers owned through its grocery-

anchored joint venture, and 49 retail properties owned through its

net lease joint venture, which together represent 14.9 million

square feet of gross leasable area (“GLA”). As of September 30,

2023, the Company’s pro-rata share of the aggregate portfolio was

93.5% leased. For additional information about the Company please

visit rptrealty.com.

Forward Looking Statements

This communication contains certain

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended. RPT

intends such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with the safe harbor

provisions. Forward-looking statements, which are based on certain

assumptions and describe RPT’s future plans, strategies and

expectations, are generally identifiable by use of the words

“believe,” “expect,” “intend,” “commit,” “anticipate,” “estimate,”

“project,” “will,” “target,” “plan,” “forecast” or similar

expressions. Forward-looking statements regarding Kimco and RPT,

include, but are not limited to, statements related to the

anticipated acquisition of RPT by Kimco and the anticipated timing

and benefits thereof and other statements that are not historical

facts. These forward-looking statements are based on each of the

companies’ current plans, objectives, estimates, expectations and

intentions and inherently involve significant risks and

uncertainties. You should not rely on forward-looking statements

since they involve known and unknown risks, uncertainties and other

factors which, in some cases, are beyond RPT’s and Kimco’s control

and could materially affect actual results, performances or

achievements. Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to, risks and uncertainties associated with: RPT’s and Kimco’s

ability to complete the proposed transaction on the proposed terms

or on the anticipated timeline, or at all, including risks and

uncertainties related to satisfaction of closing conditions to

consummate the proposed transaction; the occurrence of any event,

change or other circumstance that could give rise to the

termination of the definitive transaction agreement relating to the

proposed transaction; risks related to diverting the attention of

RPT and Kimco management from ongoing business operations; failure

to realize the expected benefits of the proposed transaction;

significant transaction costs and/or unknown or inestimable

liabilities; the risk of shareholder litigation in connection with

the proposed transaction, including resulting expense or delay; the

ability to successfully integrate the operations of RPT and Kimco

following the closing of the transaction and the risk that such

integration may be more difficult, time-consuming or costly than

expected; risks related to future opportunities and plans for the

combined company, including the uncertainty of expected future

financial performance and results of the combined company following

completion of the proposed transaction; effects relating to the

announcement of the proposed transaction or any further

announcements or the consummation of the proposed transaction on

the market price of RPT’s common shares or Kimco’s common stock or

on each company’s respective relationships with tenants, employees

and third-parties; the ability to attract, retain and motivate key

personnel; the possibility that, if Kimco does not achieve the

perceived benefits of the proposed transaction as rapidly or to the

extent anticipated by financial analysts or investors, the market

price of Kimco’s common stock could decline; general adverse

economic and local real estate conditions; the impact of

competition, including the availability of suitable acquisition,

disposition, development and redevelopment opportunities; adverse

changes in the financial condition of joint venture partner(s) or

major tenants, including as a result of bankruptcy, insolvency or a

general downturn in their business; the potential impact of

e-commerce and other changes in consumer buying practices, and

changing trends in the retail industry and perceptions by retailers

or shoppers, including safety and convenience; disruptions and

increases in operating costs due to inflation and supply chain

issues; risks associated with the development of properties;

changes in governmental laws and regulations, including, but not

limited to changes in data privacy, environmental (including

climate change), safety and health laws; impairment charges;

criminal cybersecurity attacks disruption, data loss or other

security incidents and breaches; impact of natural disasters and

weather and climate-related events; pandemics or other health

crises, such as COVID-19; financing risks, such as the inability to

obtain equity, debt or other sources of financing or refinancing on

favorable terms or at all; the level and volatility of interest

rates; changes in dividend rates or the ability to pay dividends at

current levels; RPT’s and Kimco’s ability to continue to maintain

their respective status as a REIT for United States federal income

tax purposes and potential risks and uncertainties in connection

with their respective UPREIT structure; and the other risks and

uncertainties affecting RPT and Kimco, including those described

from time to time under the caption “Risk Factors” and elsewhere in

RPT’s and Kimco’s SEC filings and reports, including RPT’s Annual

Report on Form 10-K for the year ended December 31, 2022, Kimco’s

Annual Report on Form 10-K for the year ended December 31, 2022,

and future filings and reports by either company. Moreover, other

risks and uncertainties of which RPT or Kimco are not currently

aware may also affect each of the companies’ forward-looking

statements and may cause actual results and the timing of events to

differ materially from those anticipated. The forward-looking

statements made in this communication are made only as of the date

hereof or as of the dates indicated in the forward-looking

statements, even if they are subsequently made available by RPT or

Kimco on their respective websites or otherwise. Neither RPT nor

Kimco undertakes any obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made.

Company Contact:

Vin Chao, Managing Director - Finance19 W 44th

St. 10th Floor, Ste 1002New York, New York

10036vchao@rptrealty.com(212) 221-1752

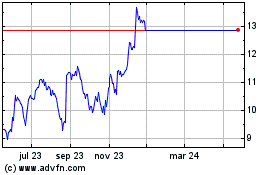

Rithm Property (NYSE:RPT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Rithm Property (NYSE:RPT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024