Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

10 Mayo 2024 - 4:15PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-275898

| • |

Trade Date: May 28, 2024

|

| • |

Issue Date: May 31, 2024

|

| • |

Valuation Date: May 29, 2029

|

| • |

Maturity Date: June 1, 2029

|

| • |

Reference Asset: the SPDR® Gold Shares (“GLD”)

|

| • |

Participation Rate: 100% (subject to the Maximum Redemption Amount)

|

| • |

Minimum Payment: $1,000 per $1,000 in principal amount

|

| • |

Maximum Redemption Amount: At least 160.00% of the principal amount (to be determined on the Trade Date)

|

| • |

Percentage Change of the Reference Asset:

|

Final Price – Initial Price

Initial Price

| • |

The notes will pay at maturity a return equal to 100% of the Percentage Change if the price of the Reference Asset increases from the Initial Price to the Final Price, subject to the Maximum Redemption Amount.

|

| • |

Return of principal amount only if the Final Price of the Reference Asset is less than or equal to the Initial Price.

|

| • |

The notes are subject to Royal Bank of Canada’s credit risk.

|

| • |

The notes do not pay interest.

|

| • |

Your notes are likely to have limited liquidity.

|

| • |

Your potential payment at maturity is limited.

|

| • |

Please see the following page for important risk factor information.

|

| • |

We intend to take the position that the notes will be treated as debt instruments subject to the special tax rules governing contingent payment debt instruments for U.S. federal income tax purposes.

|

DETERMINING PAYMENT AT MATURITY

Additional Key Information:

This document is a summary of the preliminary terms of an equity linked note that Royal Bank of Canada will issue. It does not contain all of the material terms of, or risks related to, these notes. You should read the

preliminary terms supplement for the notes and the documents described below before investing. In addition, you should consult your accounting, legal and tax advisors before investing. The preliminary terms supplement for this offering will be

provided to you prior to your investment decision, and it may also be accessed here:

The notes are not bail-inable notes under the Canada Deposit Insurance Corporation Act.

You should review the preliminary terms supplement carefully prior to investing in the notes. In particular, you should carefully review the relevant risk factors set forth therein, including, but not limited to, the

following:

| |

• |

You May Not Earn a Positive Return on Your Investment

|

|

• |

The Notes Do Not Pay Interest and Your Return May Be Lower than the Return on a Conventional Debt Security of Comparable Maturity.

|

|

• |

Your Potential Payment at Maturity Is Limited.

|

|

• |

Payments on the Notes Are Subject to Our Credit Risk, and Changes in Our Credit Ratings Are Expected to Affect the Market Value of the Notes.

|

|

• |

You Will Be Required to Include Income on the Notes Over Their Term Based Upon a Comparable Yield, Even Though You Will Not Receive Any Payments Until Maturity.

|

|

• |

There May Not Be an Active Trading Market for the Notes—Sales in the Secondary Market May Result in Significant Losses.

|

|

• |

The Initial Estimated Value of the Notes Will Be Less than the Price to the Public.

|

|

• |

The Initial Estimated Value of the Notes that We Will Provide in the Final Pricing Supplement Will Be an Estimate Only, Calculated as of the Time the Terms of the Notes Are Set.

|

|

• |

Our Business Activities May Create Conflicts of Interest.

|

|

• |

The Price of the Reference Asset Is Linked Closely to the Price of Gold, Which May Change Unpredictably and Affect the Value of the Notes in Unforeseeable Ways.

|

|

• |

Investing in the Notes Linked to the Reference Asset Is Not the Same as Investing Directly in Gold.

|

|

• |

Changes in the Methodology Used to Calculate the Gold Price or Changes in Laws or Regulations Which Affect the Price of Gold May Affect the Value of the Notes.

|

|

• |

There Are Risks Associated with the LBMA Gold Price.

|

|

• |

Single Commodity Prices Tend to Be More Volatile Than, and May Not Correlate with, the Prices of Commodities Generally.

|

|

• |

Adjustments to the Reference Asset Could Adversely Affect the Notes.

|

|

• |

The Reference Asset Is Subject to Management Risks.

|

|

• |

The Payments on the Notes Are Subject to Postponement Due to Market Disruption Events and Adjustments.

|

|

• |

We and Our Affiliates Do Not Have Any Affiliation with the Sponsor and Are Not Responsible for its Public Disclosure of Information.

|

RBC Capital Markets is the global brand name for the capital markets business of Royal Bank of Canada and its affiliates, including RBC Capital Markets, LLC (member FINRA, NYSE and SIPC); RBC Dominion Securities Inc.

(member IIROC and CIPF); Royal Bank of Canada - Sydney Branch (ABN 86 076 940 880); RBC Capital Markets (Hong Kong) Limited (regulated by the Securities and Futures Commission of Hong Kong and the Hong Kong Monetary Authority) and RBC Europe

Limited (authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority.) ® Registered trademark of Royal Bank of Canada. Used under license. All rights reserved.

Royal Bank of Canada has filed a registration statement (including a product prospectus supplement, a prospectus supplement, and a prospectus) with the SEC for the offering to which this document relates. Before you

invest, you should read those documents and the other documents relating to this offering that we have filed with the SEC for more complete information about us and this offering. You may obtain these documents without cost by visiting EDGAR on the

SEC website at www.sec.gov. Alternatively, Royal Bank of Canada, any agent or any dealer participating in this offering will arrange to send you the product prospectus supplement, the prospectus supplement and the prospectus if you so request by

calling toll-free at 1-877-688-2301.

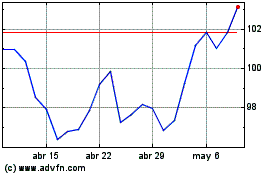

Royal Bank of Canada (NYSE:RY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Royal Bank of Canada (NYSE:RY)

Gráfica de Acción Histórica

De May 2023 a May 2024