Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

30 Octubre 2024 - 3:10PM

Edgar (US Regulatory)

|

Royal Bank of Canada

Market Linked Securities

|

Filed Pursuant to Rule 433

Registration Statement No. 333-275898

|

Market Linked Securities—Leveraged Upside Participation

and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the EURO STOXX

50® Index due May 31, 2029

Term Sheet dated October 30, 2024

|

Summary of Terms

| Issuer: |

Royal Bank of Canada |

| Market Measure: |

The EURO STOXX 50® Index (the “Index”) |

| Pricing Date: |

November 25, 2024 |

| Issue Date: |

November 29, 2024 |

| Calculation Day: |

May 25, 2029 |

| Stated Maturity Date: |

May 31, 2029 |

| Face Amount: |

$1,000 per security |

| Maturity Payment Amount (per security): |

· if the ending value is greater than the starting

value:

$1,000 + ($1,000 ×

index return × upside participation rate);

· if

the ending value is less than or equal to the starting value, but greater than or equal to the threshold value:

$1,000; or

· if

the ending value is less than the threshold value:

$1,000 + [$1,000

× (index return + buffer amount)] |

| Starting Value: |

The closing value of the Index on the pricing date |

| Ending Value: |

The closing value of the Index on the calculation day |

| Threshold Value: |

60% of the starting value |

| Buffer Amount: |

40% |

| Upside Participation Rate: |

At least 150% (to be determined on the pricing date) |

| Index Return: |

(ending value – starting value) / starting value |

| Calculation Agent: |

RBC Capital Markets, LLC (“RBCCM”), an affiliate of the issuer |

| Denominations: |

$1,000 and any integral multiple of $1,000 |

| Agent Discount: |

Up to 3.325%; dealers, including those using the trade name Wells Fargo Advisors (“WFA”), may receive a selling concession of up to 2.75% and WFA may receive a distribution expense fee of 0.075%. In addition, selected dealers may receive a fee of up to 0.30% for marketing and other services. |

| CUSIP: |

78017GVF5 |

Hypothetical Payout Profile*

* Assumes an upside participation rate equal to the lowest possible

upside participation rate that may be determined on the pricing date

If the ending value is less than the threshold value, you will have

1-to-1 downside exposure to the decrease in the value of the Index in excess of the buffer amount and will lose up to 60% of the face

amount of your securities at maturity.

The issuer’s initial estimated value of the securities as of the

pricing date is expected to be between $900.00 and $949.50 per $1,000 in principal amount, which is less than the public offering price.

The final pricing supplement relating to the securities will set forth the issuer’s estimate of the initial value of the securities

as of the pricing date. The market value of the securities at any time will reflect many factors, cannot be predicted with accuracy, and

may be less than this amount. See “Estimated Value of the Securities” in the accompanying preliminary pricing supplement for

further information.

Preliminary Pricing Supplement:

https://www.sec.gov/Archives/edgar/data/1000275/000095010324015561/dp219921_424b2-wfceln273sx5e.htm

| |

The securities have complex features and investing in the securities

involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this

term sheet and the accompanying preliminary pricing supplement and “Risk Factors” in the accompanying product supplement.

This introductory term sheet

does not provide all of the information that an investor should consider prior to making an investment decision.

Investors should carefully review the accompanying

preliminary pricing supplement, product supplement, prospectus supplement and prospectus before making a decision to invest in the securities.

|

| NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR ANY

OTHER GOVERNMENTAL AGENCY

|

Selected Risk Considerations

The risks set forth below are discussed in detail in the “Selected

Risk Considerations” section in the accompanying preliminary pricing supplement and the “Risk Factors” section in the

accompanying product supplement. Please review those risk disclosures carefully.

Risks Relating To The Terms And Structure Of The Securities

| · | If The Ending Value Is Less Than The Threshold Value, You Will Lose Up To 60% Of The Face Amount Of Your Securities At Maturity. |

| · | The Securities Do Not Pay Interest, And Your Return On The Securities May Be Lower Than The Return On A Conventional Debt Security

Of Comparable Maturity. |

| · | Payments On The Securities Are Subject To Our Credit Risk, And Market Perceptions About Our Creditworthiness May Adversely Affect

The Market Value Of The Securities. |

| · | The U.S. Federal Income Tax Consequences Of An Investment In The Securities Are Uncertain. |

Risks Relating To The Estimated Value Of The Securities And Any Secondary

Market

| · | There May Not Be An Active Trading Market For The Securities And Sales In The Secondary Market May Result In Significant Losses. |

| · | The Initial Estimated Value Of The Securities Will Be Less Than The Original Offering Price. |

| · | The Initial Estimated Value Of The Securities Is Only An Estimate, Calculated As Of The Time The Terms Of The Securities Are Set. |

| · | The Value Of The Securities Prior To Stated Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways. |

Risks Relating To Conflicts Of Interest

| · | Our Economic Interests And Those Of Any Dealer Participating In The Offering Are Potentially Adverse To Your Interests. |

Risks Relating To The Index

| · | The Securities Are Subject To Risks Relating To Non-U.S. Securities Markets. |

| · | The Securities Do Not Provide Direct Exposure To Fluctuations In Exchange Rates Between The U.S. Dollar And The Euro. |

| · | Investing In The Securities Is Not The Same As Investing In The Index. |

| · | Historical Values Of The Index Should Not Be Taken As An Indication Of The Future Performance Of The Index During The Term Of The

Securities. |

| · | Changes That Affect The Index May Adversely Affect The Value Of The Securities And The Maturity Payment Amount. |

| · | We Cannot Control Actions By Any Of The Unaffiliated Companies Whose Securities Are Included In The Index. |

| · | We And Our Affiliates Have No Affiliation With The Index Sponsor And Have Not Independently Verified Its Public Disclosure Of Information. |

| |

The issuer has filed a registration statement (including a prospectus)

with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration

statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You

may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, any underwriter or any dealer participating

in the offering will arrange to send you the prospectus if you request it by calling your financial advisor or by calling Royal Bank of

Canada toll-free at 1-877-688-2301.

As used in this term sheet, “Royal Bank of Canada,” “we,”

“our” and “us” mean only Royal Bank of Canada. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing

Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates

of Wells Fargo & Company.

|

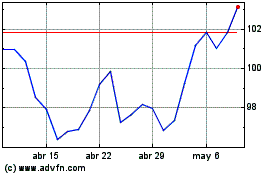

Royal Bank of Canada (NYSE:RY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Royal Bank of Canada (NYSE:RY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024