false000148158200014815822024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 29, 2024 |

Ryerson Holding Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-34735 |

26-1251524 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

227 W. Monroe St. 27th Floor |

|

Chicago, Illinois |

|

60606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (312) 292-5000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value, 100,000,000 shares authorized |

|

RYI |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information contained within Item 2.02 of this Form 8-K and Exhibit 99.1 and Exhibit 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

On October 29, 2024, Ryerson Holding Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The Company also provided a presentation as a supplement to its press release. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

(b) As previously disclosed in the Company’s Current Report on Form 8-K, filed on July 30, 2024, Michael J. Burbach, age 63, notified on July 30, 2024, the Company of his intent to retire from his position as our Chief Operating Officer, effective December 31, 2024. Attached is the agreement memorializing the Company’s intention to (i) grant Mr. Burbach a one-time special grant of 10,000 long-term incentive shares pursuant to the Company’s Second Amended and Restated Omnibus Incentive Plan and (ii) waive the continued service requirement for any outstanding long-term incentive shares at the time of retirement.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

The following exhibits are being furnished or filed, as applicable, with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

RYERSON HOLDING CORPORATION |

|

|

|

|

Date: |

October 29, 2024 |

By: |

/s/ James. J. Claussen |

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Ryerson Reports Third Quarter 2024 Results

Quarterly business highlights include operating cash flow of $134.6 million, Central Steel & Wire’s University Park, IL distribution hub and service center open house, progress on expansion and modernization of the Shelbyville, KY non-ferrous processing center, closing of the Production Metals acquisition and entry into aerospace, defense, and semiconductor metals markets, and ongoing cost-reduction work across our North America service center network

CHICAGO – October 29, 2024 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the third quarter ended September 30, 2024.

Highlights:

•Generated $1.13 billion of revenue from 485,000 tons shipped and average selling price of $2,323 per ton

•Incurred Net Loss attributable to Ryerson Holding Corporation of $6.6 million, or Diluted Loss Per Share of $0.20 and Adjusted EBITDA1, excluding LIFO of $21.0 million as counter-cyclical and seasonal bottoming continues

•Generated Operating Cash Flow of $134.6 million and Free Cash Flow of $103.4 million

•Reduced inventory by $80.8 million on a FIFO cost basis2, compared to the second quarter of 2024

•Returned $42.0 million to shareholders during the quarter, comprised of $36.0 million in share repurchases and $6.0 million in dividends

•Ended the quarter with debt of $522 million and net debt3 of $487 million as of September 30, 2024, compared to $525 million and $497 million, respectively, on June 30, 2024

•Progressing well towards $60 million of annualized cost reduction expectations from operating expenses4

•Acquired Production Metals, a value-added processor of aluminum, stainless, and specialty steel

•Hosted open house at Central Steel & Wire’s University Park, IL distribution hub and service center for customers, suppliers, vendors, investors, and employees

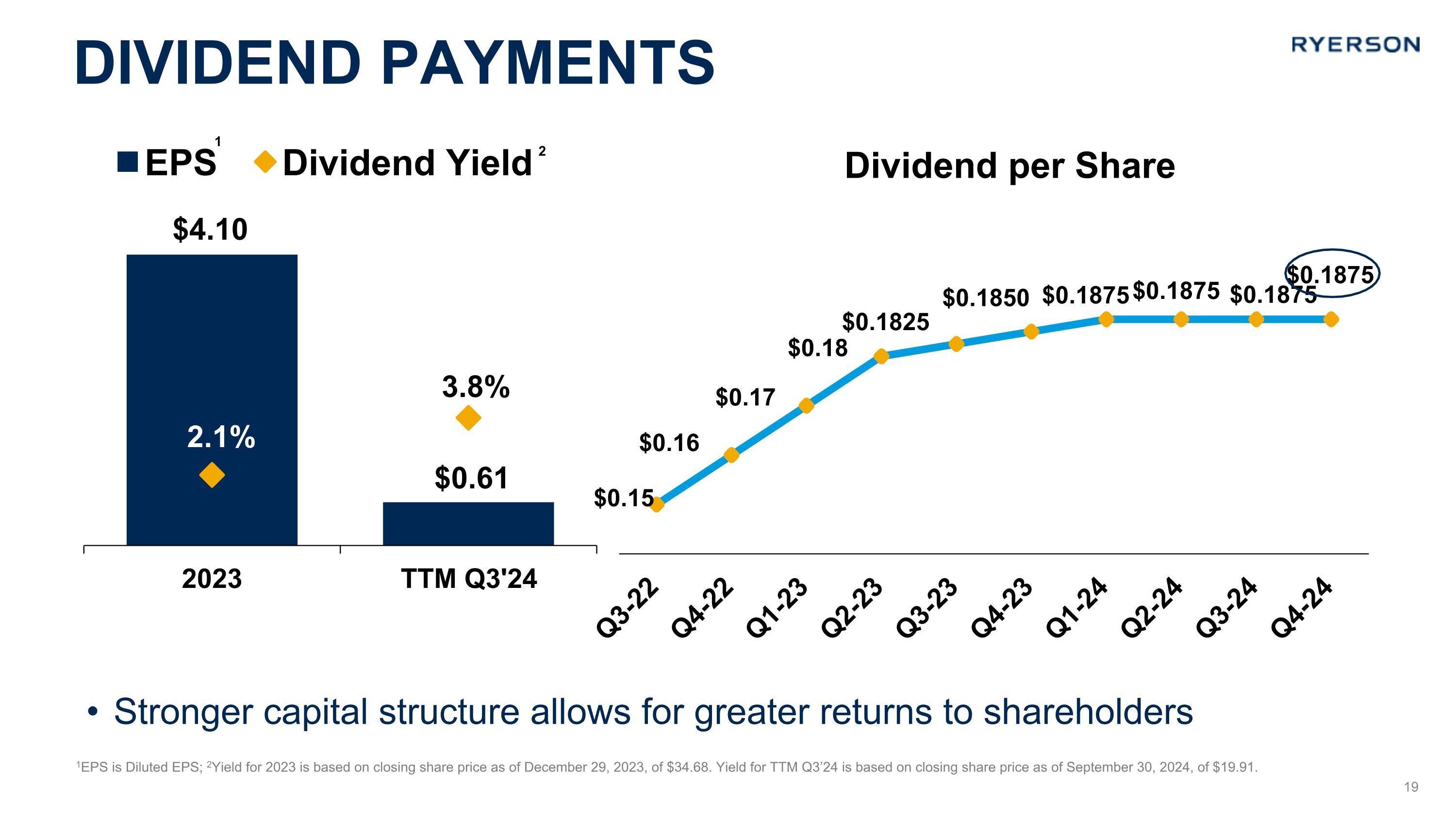

•Declared a fourth-quarter 2024 dividend of $0.1875 per share

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in millions, except tons (in thousands), average selling prices, and earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights: |

|

Q3 2024 |

|

Q2 2024 |

|

Q3 2023 |

|

QoQ |

|

YoY |

|

9MO 2024 |

|

9MO 2023 |

|

YoY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$1,126.6 |

|

$1,225.5 |

|

$1,246.7 |

|

(8.1)% |

|

(9.6)% |

|

$3,591.3 |

|

$3,996.3 |

|

(10.1)% |

Tons shipped |

|

485 |

|

508 |

|

478 |

|

(4.5)% |

|

1.5% |

|

1,490 |

|

1,493 |

|

(0.2)% |

Average selling price/ton |

|

$2,323 |

|

$2,412 |

|

$2,608 |

|

(3.7)% |

|

(10.9)% |

|

$2,410 |

|

$2,677 |

|

(10.0)% |

Gross margin |

|

17.9% |

|

18.2% |

|

20.0% |

|

-30 bps |

|

-210 bps |

|

17.9% |

|

19.4% |

|

-150 bps |

Gross margin, excl. LIFO |

|

16.3% |

|

17.4% |

|

17.3% |

|

-110 bps |

|

-100 bps |

|

17.2% |

|

18.4% |

|

-120 bps |

Warehousing, delivery, selling, general, and administrative expenses |

|

$196.9 |

|

$199.0 |

|

$193.0 |

|

(1.1)% |

|

2.0% |

|

$612.7 |

|

$589.8 |

|

3.9% |

As a percentage of revenue |

|

17.5% |

|

16.2% |

|

15.5% |

|

130 bps |

|

200 bps |

|

17.1% |

|

14.8% |

|

230 bps |

Net income (loss) attributable to Ryerson Holding Corporation |

|

$(6.6) |

|

$9.9 |

|

$35.0 |

|

(166.7)% |

|

(118.9)% |

|

$(4.3) |

|

$119.9 |

|

(103.6)% |

Diluted earnings (loss) per share |

|

$(0.20) |

|

$0.29 |

|

$1.00 |

|

$(0.49) |

|

$(1.20) |

|

$(0.13) |

|

$3.34 |

|

$(3.47) |

Adjusted diluted earnings (loss) per share |

|

$(0.20) |

|

$0.33 |

|

$1.00 |

|

$(0.53) |

|

$(1.20) |

|

$(0.05) |

|

$3.34 |

|

$(3.39) |

Adj. EBITDA, excl. LIFO |

|

$21.0 |

|

$42.6 |

|

$45.0 |

|

(50.7)% |

|

(53.3)% |

|

$103.8 |

|

$205.2 |

|

(49.4)% |

Adj. EBITDA, excl. LIFO margin |

|

1.9% |

|

3.5% |

|

3.6% |

|

-160 bps |

|

-170 bps |

|

2.9% |

|

5.1% |

|

-220 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet and Cash Flow Highlights: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt |

|

$522.1 |

|

$525.4 |

|

$365.9 |

|

(0.6)% |

|

42.7% |

|

$522.1 |

|

$365.9 |

|

42.7% |

Cash and cash equivalents |

|

$35.0 |

|

$28.0 |

|

$37.4 |

|

25.0% |

|

(6.4)% |

|

$35.0 |

|

$37.4 |

|

(6.4)% |

Net debt |

|

$487.1 |

|

$497.4 |

|

$328.5 |

|

(2.1)% |

|

48.3% |

|

$487.1 |

|

$328.5 |

|

48.3% |

Net debt / LTM Adj. EBITDA, excl. LIFO |

|

3.8x |

|

3.2x |

|

1.4x |

|

0.6x |

|

2.4x |

|

3.8x |

|

1.4x |

|

2.4x |

Cash conversion cycle (days) |

|

79.3 |

|

77.6 |

|

78.3 |

|

1.7 |

|

1.0 |

|

76.5 |

|

77.6 |

|

(1.1) |

Net cash provided by operating activities |

|

$134.6 |

|

$25.9 |

|

$79.3 |

|

$108.7 |

|

$55.3 |

|

$112.7 |

|

$275.0 |

|

$(162.3) |

Management Commentary

Eddie Lehner, Ryerson’s President, Chief Executive Officer, and Director, said, “I want to thank all my Ryerson teammates for working safely while striving to create an always improving Ryerson that delivers the industry’s best customer experience safely, enjoyably, and productively. Two things can be true at the same time: 1) the industry is experiencing a cyclical bottoming marked by twenty-four months of moving average demand and price contraction; and 2) Ryerson’s record investments in systems, capital expenditures, and acquisitions over this same period are positioning the company well for the next cyclical upturn. Over the third quarter we managed the business effectively through a contractionary industrial metals and manufacturing environment that produced compressed margins, most notably in carbon steels and across the commodity spectrum with lagging OEM customer contract price resets. Despite these challenges, we experienced improvements in key performance indicators including cash flow, expense and working capital management, and most importantly, we are seeing investment related growth pains and disruptions across our network beginning to subside as we move through the balance of 2024 with budding optimism for 2025. Ryerson has emerged more efficient and better through every previous counter-cycle and, looking forward, our optimization phase will bring together a greatly modernized service center network, enhanced value-added capabilities, across a digitally enabled enterprise to provide Ryerson’s best-ever customer experience while setting the table for realization of our next stage financial targets.”

Third Quarter Results

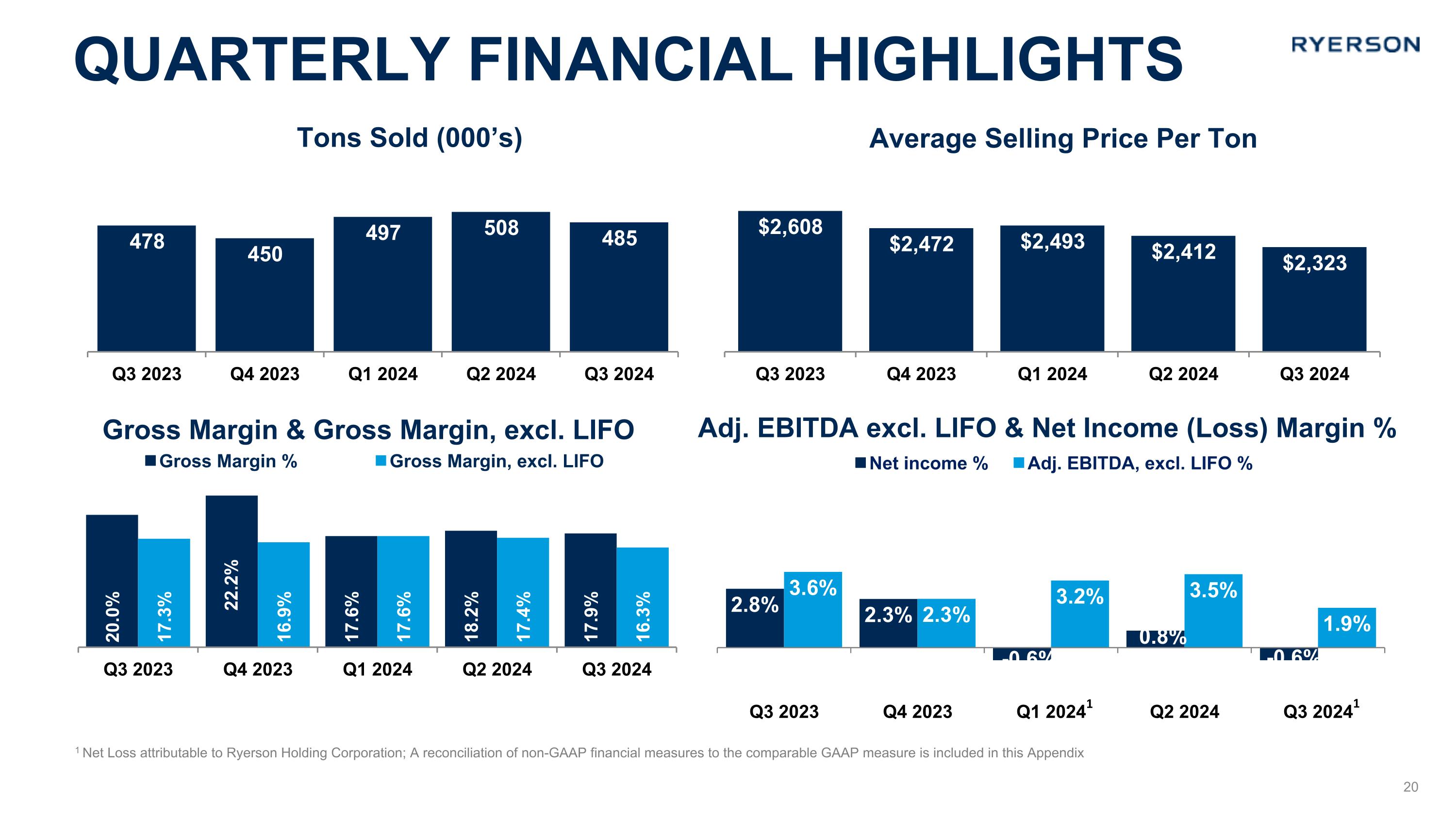

Ryerson generated net sales of $1.13 billion in the third quarter of 2024, a decrease of 8.1%, compared to the second quarter of 2024, and within our guidance expectations. Revenue performance during the quarter was impacted by seasonal and weather impacted volume declines of 4.5%, in addition to average selling prices decreasing 3.7%.

Gross margin contracted sequentially by 30 basis points to 17.9% in the third quarter of 2024, compared to 18.2% in the second quarter of 2024. Due to further declines in inventory costs, in the third quarter of 2024, LIFO income of $18 million was greater than our guidance expectations of LIFO income of $12 million. Excluding the impact of LIFO, gross margin contracted 110 basis points to 16.3% in the third quarter of 2024, compared to 17.4% in the second quarter. Gross margins continued to be under pressure in the quarter as demand conditions saw continuing contraction and selling price declines continued to outpace the decline in our average inventory costs.

Warehousing, delivery, selling, general and administrative expenses decreased 1.1%, or $2.1 million, to $196.9 million in the third quarter of 2024, compared to $199.0 million in the second quarter of 2024. Cost reductions were noted in personnel-related expenses, operating expenses, and general administrative expenses. Decreases in expenses were partially offset by increases in start-up, pre-operating, and reorganization expenses associated with Ryerson investments in capital expenditures and acquisitions.

Net Loss Attributable to Ryerson Holding Corporation for the third quarter of 2024 was $6.6 million, or $0.20 per diluted share, compared to net income of $9.9 million, or $0.29 per diluted share in the previous quarter. Ryerson generated Adjusted EBITDA, excluding LIFO, of $21.0 million in the third quarter of 2024, compared to the second quarter of 2024 Adjusted EBITDA, excluding LIFO of $42.6 million.

Liquidity & Debt Management

Ryerson generated $134.6 million of operating cash flow in the third quarter of 2024 due to a working capital release of $129 million. The Company ended the third quarter of 2024 with $522 million of debt and $487 million of net debt, sequential decreases of $3 million and $10 million, respectively, compared to the second quarter of 2024. Ryerson’s net leverage ratio as of the third quarter of 2024 was 3.8x above the Company’s target leverage range of 0.5x – 2.0x, but still well below Ryerson’s prior 10-year average. Ryerson’s global liquidity, composed of cash and cash equivalents and availability on its revolving credit facilities, decreased to $491 million as of September 30, 2024, compared to $585 million as of June 30, 2024.

Shareholder Return Activity

Dividends. On October 29, 2024, the Board of Directors declared a quarterly cash dividend of $0.1875 per share of common stock, payable on December 19, 2024, to stockholders of record as of December 5, 2024, unchanged from the prior quarter. During the third quarter of 2024, Ryerson’s quarterly dividend amounted to a cash return of approximately $6.0 million.

Share Repurchases and Authorization. Ryerson repurchased 1,849,017 shares for $36.0 million in the open market during the third quarter of 2024. Ryerson made these repurchases in accordance with its share repurchase authorization. As of September 30, 2024, $38.4 million remained under the existing authorization.

Outlook Commentary

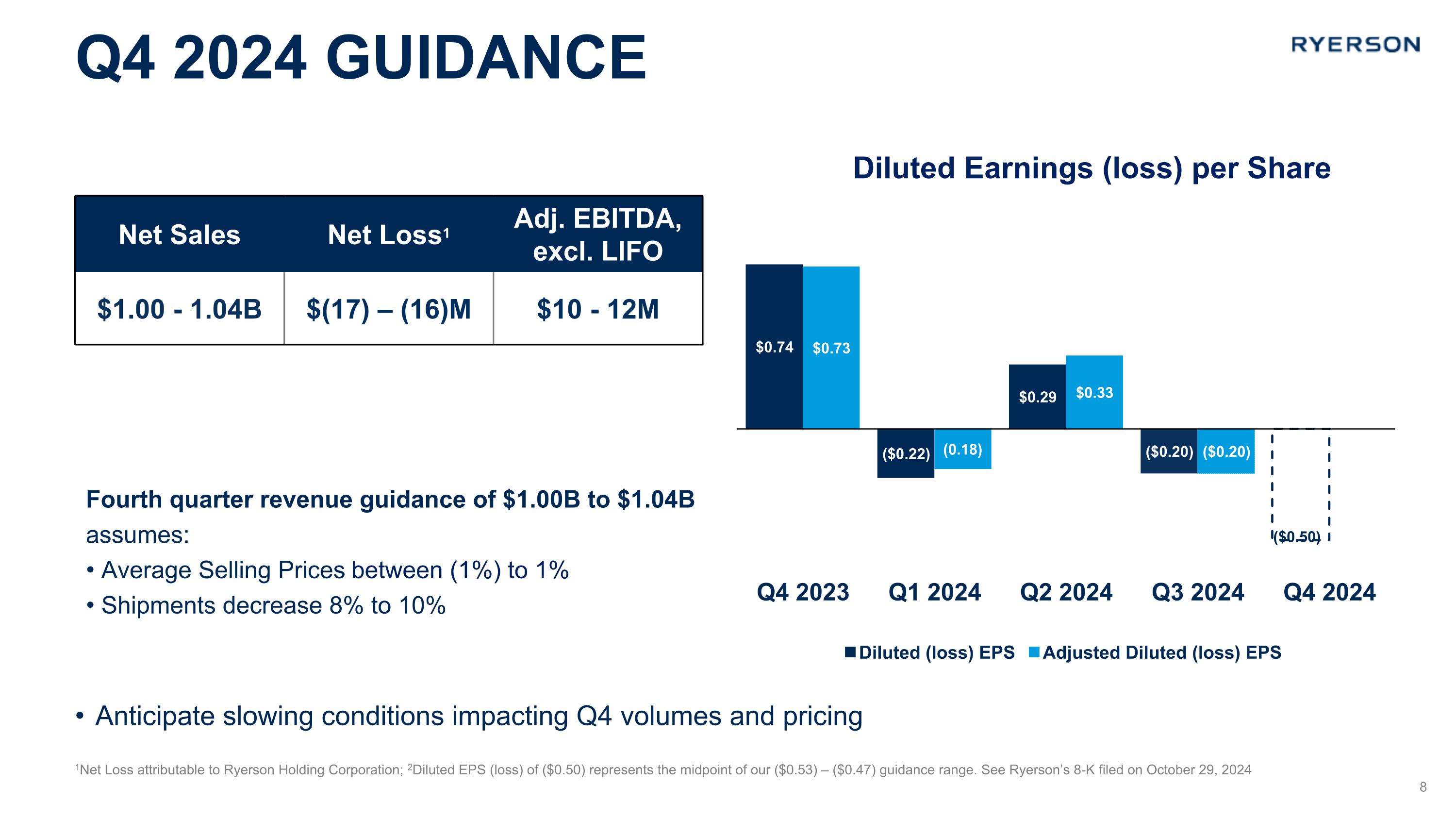

For the fourth quarter of 2024, Ryerson expects customer shipments to seasonally and counter-cyclically decrease 8% to 10%, quarter-over-quarter. The Company anticipates fourth-quarter net sales to be in the range of $1.00 billion to $1.04 billion, with average selling prices between decreasing 1% to increasing 1%. LIFO income in the fourth quarter of 2024 is expected to be $10 million. We expect adjusted EBITDA, excluding LIFO in the range of $10 million to $12 million and loss per diluted share in the range of $0.53 to $0.47.

Sales by Product Metrics

As we continue to integrate our acquisitions of the past eight quarters into our systems and processes, we have refined our methodology for allocating their net sales and tons to our major product categories. As such, in addition to the third quarter and the first nine months of 2024 product metrics provided here under the refined methodology, we are providing updated sales by product information from the first quarter of 2023 to the second quarter of 2024 to provide comparable numbers. We note that consolidated net sales, tons shipped, and average selling price per ton as previously reported are unchanged and that the updates below are only at the product level.

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter 2024 Major Product Metrics |

|

|

|

|

|

|

Net Sales (millions) |

|

|

Q3 2024 |

|

Q2 2024 |

|

|

Q3 2023 |

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

585 |

$ |

644 |

|

$ |

642 |

|

(9.2)% |

|

(8.9)% |

|

Aluminum |

$ |

250 |

$ |

277 |

|

$ |

276 |

|

(9.7)% |

|

(9.4)% |

|

Stainless Steel |

$ |

276 |

$ |

286 |

|

$ |

308 |

|

(3.5)% |

|

(10.4)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Shipped (thousands) |

|

|

Q3 2024 |

|

Q2 2024 |

|

|

Q3 2023 |

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

382 |

|

397 |

|

|

371 |

|

(3.8)% |

|

3.0% |

|

Aluminum |

|

44 |

|

49 |

|

|

48 |

|

(10.2)% |

|

(8.3)% |

|

Stainless Steel |

|

58 |

|

59 |

|

|

57 |

|

(1.7)% |

|

1.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Selling Prices (per ton) |

|

|

Q3 2024 |

|

Q2 2024 |

|

|

Q3 2023 |

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

1,531 |

$ |

1,622 |

|

$ |

1,730 |

|

(5.6)% |

|

(11.5)% |

|

Aluminum |

$ |

5,682 |

$ |

5,653 |

|

$ |

5,750 |

|

0.5% |

|

(1.2)% |

|

Stainless Steel |

$ |

4,759 |

$ |

4,847 |

|

$ |

5,404 |

|

(1.8)% |

|

(11.9)% |

|

|

|

|

|

|

|

|

|

|

|

|

First Nine Months 2024 Major Product Metrics |

|

|

|

|

|

|

|

|

|

|

Net Sales (millions) |

|

|

|

|

2024 |

|

|

2023 |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

$ |

1,873 |

|

$ |

2,007 |

|

(6.7)% |

|

Aluminum |

|

|

$ |

806 |

|

$ |

889 |

|

(9.3)% |

|

Stainless Steel |

|

$ |

859 |

|

$ |

1,031 |

|

(16.7)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Shipped (thousands) |

|

|

|

|

2024 |

|

|

2023 |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

|

1,163 |

|

|

1,156 |

|

0.6% |

|

Aluminum |

|

|

|

143 |

|

|

151 |

|

(5.3)% |

|

Stainless Steel |

|

|

178 |

|

|

179 |

|

(0.6)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Selling Prices (per ton) |

|

|

|

|

2024 |

|

|

2023 |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

$ |

1,610 |

|

$ |

1,736 |

|

(7.2)% |

|

Aluminum |

|

|

$ |

5,636 |

|

$ |

5,887 |

|

(4.3)% |

|

Stainless Steel |

|

$ |

4,826 |

|

$ |

5,760 |

|

(16.2)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restated Major Product Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales (millions) |

|

|

Q1 2023 |

|

Q2 2023 |

|

1H 2023 |

|

Q3 2023 |

|

|

9MO 2023 |

|

Q4 2023 |

|

2023 |

|

Q1 2024 |

|

Q2 2024 |

|

1H 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

687 |

$ |

678 |

$ |

1,365 |

$ |

642 |

|

$ |

2,007 |

$ |

574 |

$ |

2,581 |

$ |

644 |

$ |

644 |

$ |

1,288 |

Aluminum |

$ |

313 |

$ |

300 |

$ |

613 |

$ |

276 |

|

$ |

889 |

$ |

244 |

$ |

1,133 |

$ |

279 |

$ |

277 |

$ |

556 |

Stainless Steel |

$ |

381 |

$ |

342 |

$ |

723 |

$ |

308 |

|

$ |

1,031 |

$ |

275 |

$ |

1,306 |

$ |

297 |

$ |

286 |

$ |

583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Shipped (thousands) |

|

|

Q1 2023 |

|

Q2 2023 |

|

1H 2023 |

|

Q3 2023 |

|

|

9MO 2023 |

|

Q4 2023 |

|

2023 |

|

Q1 2024 |

|

Q2 2024 |

|

1H 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

401 |

|

384 |

|

785 |

|

371 |

|

|

1,156 |

|

352 |

|

1,508 |

|

384 |

|

397 |

|

781 |

Aluminum |

|

52 |

|

51 |

|

103 |

|

48 |

|

|

151 |

|

43 |

|

194 |

|

50 |

|

49 |

|

99 |

Stainless Steel |

|

64 |

|

58 |

|

122 |

|

57 |

|

|

179 |

|

52 |

|

231 |

|

61 |

|

59 |

|

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Selling Prices (per ton) |

|

|

Q1 2023 |

|

Q2 2023 |

|

1H 2023 |

|

Q3 2023 |

|

|

9MO 2023 |

|

Q4 2023 |

|

2023 |

|

Q1 2024 |

|

Q2 2024 |

|

1H 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

1,713 |

$ |

1,766 |

$ |

1,739 |

$ |

1,730 |

|

$ |

1,736 |

$ |

1,631 |

$ |

1,712 |

$ |

1,677 |

$ |

1,622 |

$ |

1,649 |

Aluminum |

$ |

6,019 |

$ |

5,882 |

$ |

5,951 |

$ |

5,750 |

|

$ |

5,887 |

$ |

5,674 |

$ |

5,840 |

$ |

5,580 |

$ |

5,653 |

$ |

5,616 |

Stainless Steel |

$ |

5,953 |

$ |

5,897 |

$ |

5,926 |

$ |

5,404 |

|

$ |

5,760 |

$ |

5,288 |

$ |

5,654 |

$ |

4,869 |

$ |

4,847 |

$ |

4,858 |

Earnings Call Information

Ryerson will host a conference call to discuss third quarter 2024 financial results for the period ended September 30, 2024, on Wednesday, October 30, 2024, at 10 a.m. Eastern Time. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,300 employees and over 110 locations. Visit Ryerson at www.ryerson.com.

Manager – Investor Relations:

Pratham Dear

312.292.5033

investorinfo@ryerson.com

Notes:

1For EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding LIFO please see Schedule 2

2FIFO cost basis is inventory cost excluding LIFO

3Net debt is defined as long term debt plus short term debt less cash and cash equivalents and excludes restricted cash

4Operating expenses are Warehousing, delivery, selling, general, and administrative expenses

Legal Disclaimer

The contents herein are provided for general information purposes only and do not constitute an offer to sell or buy, or a solicitation of an offer to buy, any security (“Security”) of the Company or its affiliates (“Ryerson”) in any jurisdiction. Ryerson does not intend to solicit, and is not soliciting, any action with respect to any Security or any other contractual relationship with Ryerson. Nothing in this release, individually or taken in the aggregate, constitutes an offer of securities for sale or buy, or a solicitation of an offer to buy, any Security in the United States, or to U.S. persons, or in any other jurisdiction in which such an offer or solicitation is unlawful.

Safe Harbor Provision

Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent our annual report on Form 10-K and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Selected Income and Cash Flow Data - Unaudited |

|

(Dollars and Shares in Millions, except Per Share and Per Ton Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Nine Months Ended |

|

|

|

Third |

|

|

Second |

|

|

Third |

|

|

September 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

$ |

1,126.6 |

|

|

$ |

1,225.5 |

|

|

$ |

1,246.7 |

|

|

$ |

3,591.3 |

|

|

$ |

3,996.3 |

|

Cost of materials sold |

|

|

924.6 |

|

|

|

1,002.0 |

|

|

|

997.4 |

|

|

|

2,948.2 |

|

|

|

3,221.9 |

|

Gross profit |

|

|

202.0 |

|

|

|

223.5 |

|

|

|

249.3 |

|

|

|

643.1 |

|

|

|

774.4 |

|

Warehousing, delivery, selling, general, and administrative |

|

|

196.9 |

|

|

|

199.0 |

|

|

|

193.0 |

|

|

|

612.7 |

|

|

|

589.8 |

|

Gain on insurance settlement |

|

|

(1.3 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1.3 |

) |

|

|

— |

|

Restructuring and other charges |

|

|

1.1 |

|

|

|

1.7 |

|

|

|

— |

|

|

|

2.8 |

|

|

|

— |

|

OPERATING PROFIT |

|

|

5.3 |

|

|

|

22.8 |

|

|

|

56.3 |

|

|

|

28.9 |

|

|

|

184.6 |

|

Other income and (expense), net |

|

|

(0.2 |

) |

|

|

1.8 |

|

|

|

1.2 |

|

|

|

1.4 |

|

|

|

0.8 |

|

Interest and other expense on debt |

|

|

(11.5 |

) |

|

|

(11.3 |

) |

|

|

(9.3 |

) |

|

|

(32.9 |

) |

|

|

(25.2 |

) |

INCOME (LOSS) BEFORE INCOME TAXES |

|

|

(6.4 |

) |

|

|

13.3 |

|

|

|

48.2 |

|

|

|

(2.6 |

) |

|

|

160.2 |

|

Provision (benefit) for income taxes |

|

|

(0.4 |

) |

|

|

3.0 |

|

|

|

12.9 |

|

|

|

0.5 |

|

|

|

39.8 |

|

NET INCOME (LOSS) |

|

|

(6.0 |

) |

|

|

10.3 |

|

|

|

35.3 |

|

|

|

(3.1 |

) |

|

|

120.4 |

|

Less: Net income attributable to noncontrolling interest |

|

|

0.6 |

|

|

|

0.4 |

|

|

|

0.3 |

|

|

|

1.2 |

|

|

|

0.5 |

|

NET INCOME (LOSS) ATTRIBUTABLE TO RYERSON HOLDING CORPORATION |

|

$ |

(6.6 |

) |

|

$ |

9.9 |

|

|

$ |

35.0 |

|

|

$ |

(4.3 |

) |

|

$ |

119.9 |

|

EARNINGS (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.20 |

) |

|

$ |

0.29 |

|

|

$ |

1.02 |

|

|

$ |

(0.13 |

) |

|

$ |

3.40 |

|

Diluted |

|

$ |

(0.20 |

) |

|

$ |

0.29 |

|

|

$ |

1.00 |

|

|

$ |

(0.13 |

) |

|

$ |

3.34 |

|

Shares outstanding - basic |

|

|

32.7 |

|

|

|

34.2 |

|

|

|

34.3 |

|

|

|

33.6 |

|

|

|

35.2 |

|

Shares outstanding - diluted |

|

|

32.7 |

|

|

|

34.4 |

|

|

|

34.9 |

|

|

|

33.6 |

|

|

|

35.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share |

|

$ |

0.1875 |

|

|

$ |

0.1875 |

|

|

$ |

0.1825 |

|

|

$ |

0.5625 |

|

|

$ |

0.5325 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons shipped (000) |

|

|

485 |

|

|

|

508 |

|

|

|

478 |

|

|

|

1,490 |

|

|

|

1,493 |

|

Shipping days |

|

|

64 |

|

|

|

64 |

|

|

|

63 |

|

|

|

192 |

|

|

|

191 |

|

Average selling price/ton |

|

$ |

2,323 |

|

|

$ |

2,412 |

|

|

$ |

2,608 |

|

|

$ |

2,410 |

|

|

$ |

2,677 |

|

Gross profit/ton |

|

|

416 |

|

|

|

440 |

|

|

|

522 |

|

|

|

432 |

|

|

|

519 |

|

Operating profit/ton |

|

|

11 |

|

|

|

45 |

|

|

|

118 |

|

|

|

19 |

|

|

|

124 |

|

LIFO income per ton |

|

|

(37 |

) |

|

|

(20 |

) |

|

|

(70 |

) |

|

|

(18 |

) |

|

|

(26 |

) |

LIFO income |

|

|

(18.1 |

) |

|

|

(10.0 |

) |

|

|

(33.4 |

) |

|

|

(27.1 |

) |

|

|

(38.4 |

) |

Depreciation and amortization expense |

|

|

19.5 |

|

|

|

18.0 |

|

|

|

13.6 |

|

|

|

54.9 |

|

|

|

42.4 |

|

Cash flow provided by operating activities |

|

|

134.6 |

|

|

|

25.9 |

|

|

|

79.3 |

|

|

|

112.7 |

|

|

|

275.0 |

|

Capital expenditures |

|

|

(31.6 |

) |

|

|

(22.7 |

) |

|

|

(22.4 |

) |

|

|

(76.1 |

) |

|

|

(96.5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Schedule 1 for Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

See Schedule 2 for EBITDA and Adjusted EBITDA reconciliation |

|

|

|

|

|

|

|

|

|

|

See Schedule 3 for Adjusted EPS reconciliation |

|

|

|

|

|

|

|

|

|

|

See Schedule 4 for Free Cash Flow reconciliation |

|

|

|

|

|

|

|

|

|

|

See Schedule 5 for Fourth Quarter 2024 Guidance reconciliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 1 |

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

Condensed Consolidated Balance Sheets |

(In millions, except shares) |

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

2024 |

|

2023 |

Assets |

|

(unaudited) |

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

|

$35.0 |

|

$54.3 |

Restricted cash |

|

1.8 |

|

1.1 |

Receivables, less provisions of $3.0 at September 30, 2024 and $1.7 at December 31, 2023 |

|

499.7 |

|

467.7 |

Inventories |

|

681.4 |

|

782.5 |

Prepaid expenses and other current assets |

|

83.5 |

|

77.8 |

Total current assets |

|

1,301.4 |

|

1,383.4 |

Property, plant, and equipment, at cost |

|

1,134.8 |

|

1,071.5 |

Less: accumulated depreciation |

|

499.7 |

|

481.9 |

Property, plant, and equipment, net |

|

635.1 |

|

589.6 |

Operating lease assets |

|

348.4 |

|

349.4 |

Other intangible assets |

|

71.0 |

|

73.7 |

Goodwill |

|

160.2 |

|

157.8 |

Deferred charges and other assets |

|

17.2 |

|

15.7 |

Total assets |

|

$2,533.3 |

|

$2,569.6 |

Liabilities |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

|

$443.9 |

|

$463.4 |

Salaries, wages, and commissions |

|

35.7 |

|

51.9 |

Other accrued liabilities |

|

68.0 |

|

75.9 |

Short-term debt |

|

1.8 |

|

8.2 |

Current portion of operating lease liabilities |

|

31.7 |

|

30.5 |

Current portion of deferred employee benefits |

|

4.0 |

|

4.0 |

Total current liabilities |

|

585.1 |

|

633.9 |

Long-term debt |

|

520.3 |

|

428.3 |

Deferred employee benefits |

|

97.4 |

|

106.7 |

Noncurrent operating lease liabilities |

|

338.0 |

|

336.8 |

Deferred income taxes |

|

135.8 |

|

135.5 |

Other noncurrent liabilities |

|

14.7 |

|

13.9 |

Total liabilities |

|

1,691.3 |

|

1,655.1 |

Commitments and contingencies |

|

|

|

|

Equity |

|

|

|

|

Ryerson Holding Corporation stockholders' equity: |

|

|

|

|

Preferred stock, $0.01 par value; 7,000,000 shares authorized and no shares issued at September 30, 2024 and December 31, 2023 |

|

— |

|

— |

Common stock, $0.01 par value; 100,000,000 shares authorized; 39,896,148 and 39,450,659 shares issued at September 30, 2024 and December 31, 2023, respectively |

|

0.4 |

|

0.4 |

Capital in excess of par value |

|

422.7 |

|

411.6 |

Retained earnings |

|

789.9 |

|

813.2 |

Treasury stock, at cost - Common stock of 8,051,226 shares at September 30, 2024 and 5,413,434 shares at December 31, 2023 |

|

(234.4) |

|

(179.3) |

Accumulated other comprehensive loss |

|

(145.7) |

|

(140.0) |

Total Ryerson Holding Corporation Stockholders' Equity |

|

832.9 |

|

905.9 |

Noncontrolling interest |

|

9.1 |

|

8.6 |

Total Equity |

|

842.0 |

|

914.5 |

Total Liabilities and Stockholders' Equity |

|

$2,533.3 |

|

$2,569.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 2 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

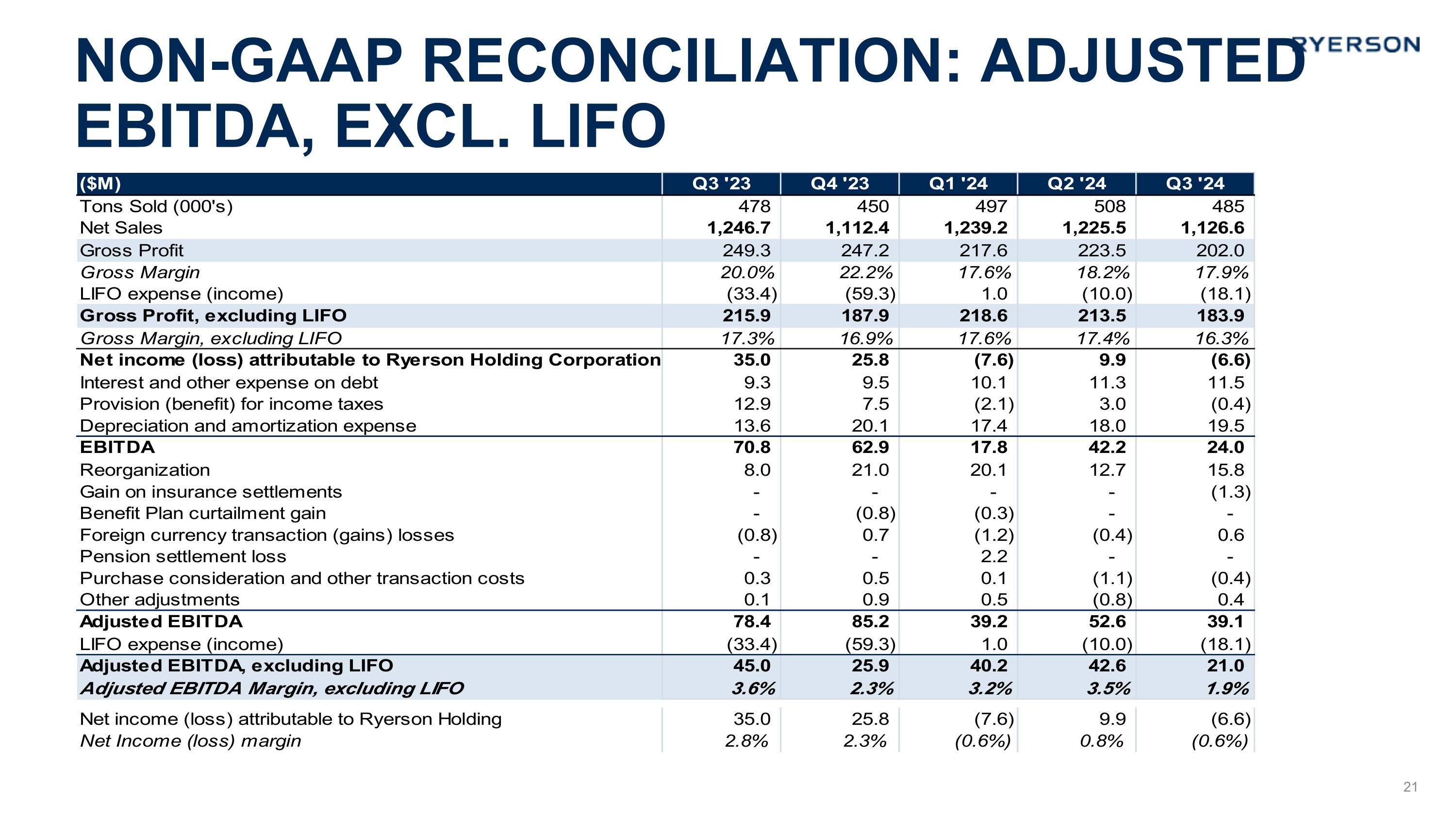

|

Reconciliations of Net Income (Loss) Attributable to Ryerson Holding Corporation to EBITDA and Gross profit to Gross profit excluding LIFO |

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Nine Months Ended |

|

|

|

Third |

|

|

Second |

|

|

Third |

|

|

September 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

(6.6 |

) |

|

$ |

9.9 |

|

|

$ |

35.0 |

|

|

$ |

(4.3 |

) |

|

$ |

119.9 |

|

Interest and other expense on debt |

|

|

11.5 |

|

|

|

11.3 |

|

|

|

9.3 |

|

|

|

32.9 |

|

|

|

25.2 |

|

Provision (benefit) for income taxes |

|

|

(0.4 |

) |

|

|

3.0 |

|

|

|

12.9 |

|

|

|

0.5 |

|

|

|

39.8 |

|

Depreciation and amortization expense |

|

|

19.5 |

|

|

|

18.0 |

|

|

|

13.6 |

|

|

|

54.9 |

|

|

|

42.4 |

|

EBITDA |

|

$ |

24.0 |

|

|

$ |

42.2 |

|

|

$ |

70.8 |

|

|

$ |

84.0 |

|

|

$ |

227.3 |

|

Gain on insurance settlement |

|

|

(1.3 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1.3 |

) |

|

|

— |

|

Reorganization |

|

|

15.8 |

|

|

|

12.7 |

|

|

|

8.0 |

|

|

|

48.6 |

|

|

|

14.7 |

|

Pension settlement loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

Benefit plan curtailment gain |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

Foreign currency transaction (gains) losses |

|

|

0.6 |

|

|

|

(0.4 |

) |

|

|

(0.8 |

) |

|

|

(1.0 |

) |

|

|

0.4 |

|

Purchase consideration and other transaction costs (credits) |

|

|

(0.4 |

) |

|

|

(1.1 |

) |

|

|

0.3 |

|

|

|

(1.4 |

) |

|

|

1.0 |

|

Other adjustments |

|

|

0.4 |

|

|

|

(0.8 |

) |

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.2 |

|

Adjusted EBITDA |

|

$ |

39.1 |

|

|

$ |

52.6 |

|

|

$ |

78.4 |

|

|

$ |

130.9 |

|

|

$ |

243.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

39.1 |

|

|

$ |

52.6 |

|

|

$ |

78.4 |

|

|

$ |

130.9 |

|

|

$ |

243.6 |

|

LIFO income |

|

|

(18.1 |

) |

|

|

(10.0 |

) |

|

|

(33.4 |

) |

|

|

(27.1 |

) |

|

|

(38.4 |

) |

Adjusted EBITDA, excluding LIFO income |

|

$ |

21.0 |

|

|

$ |

42.6 |

|

|

$ |

45.0 |

|

|

$ |

103.8 |

|

|

$ |

205.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,126.6 |

|

|

$ |

1,225.5 |

|

|

$ |

1,246.7 |

|

|

$ |

3,591.3 |

|

|

$ |

3,996.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA, excluding LIFO income, as a percentage of net sales |

|

|

1.9 |

% |

|

|

3.5 |

% |

|

|

3.6 |

% |

|

|

2.9 |

% |

|

|

5.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

202.0 |

|

|

$ |

223.5 |

|

|

$ |

249.3 |

|

|

$ |

643.1 |

|

|

$ |

774.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

|

17.9 |

% |

|

|

18.2 |

% |

|

|

20.0 |

% |

|

|

17.9 |

% |

|

|

19.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

202.0 |

|

|

$ |

223.5 |

|

|

$ |

249.3 |

|

|

$ |

643.1 |

|

|

$ |

774.4 |

|

LIFO income |

|

|

(18.1 |

) |

|

|

(10.0 |

) |

|

|

(33.4 |

) |

|

|

(27.1 |

) |

|

|

(38.4 |

) |

Gross profit, excluding LIFO income |

|

$ |

183.9 |

|

|

$ |

213.5 |

|

|

$ |

215.9 |

|

|

$ |

616.0 |

|

|

$ |

736.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin, excluding LIFO income |

|

|

16.3 |

% |

|

|

17.4 |

% |

|

|

17.3 |

% |

|

|

17.2 |

% |

|

|

18.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: EBITDA represents net income (loss) before interest and other expense on debt, provision (benefit) for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, reorganization expenses, gain on insurance settlement, pension settlement loss, benefit plan curtailment gain, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), |

|

|

|

do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit minus LIFO expense (income), divided by net sales. We have excluded LIFO expense from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), gross margin, excluding LIFO expense (income), and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

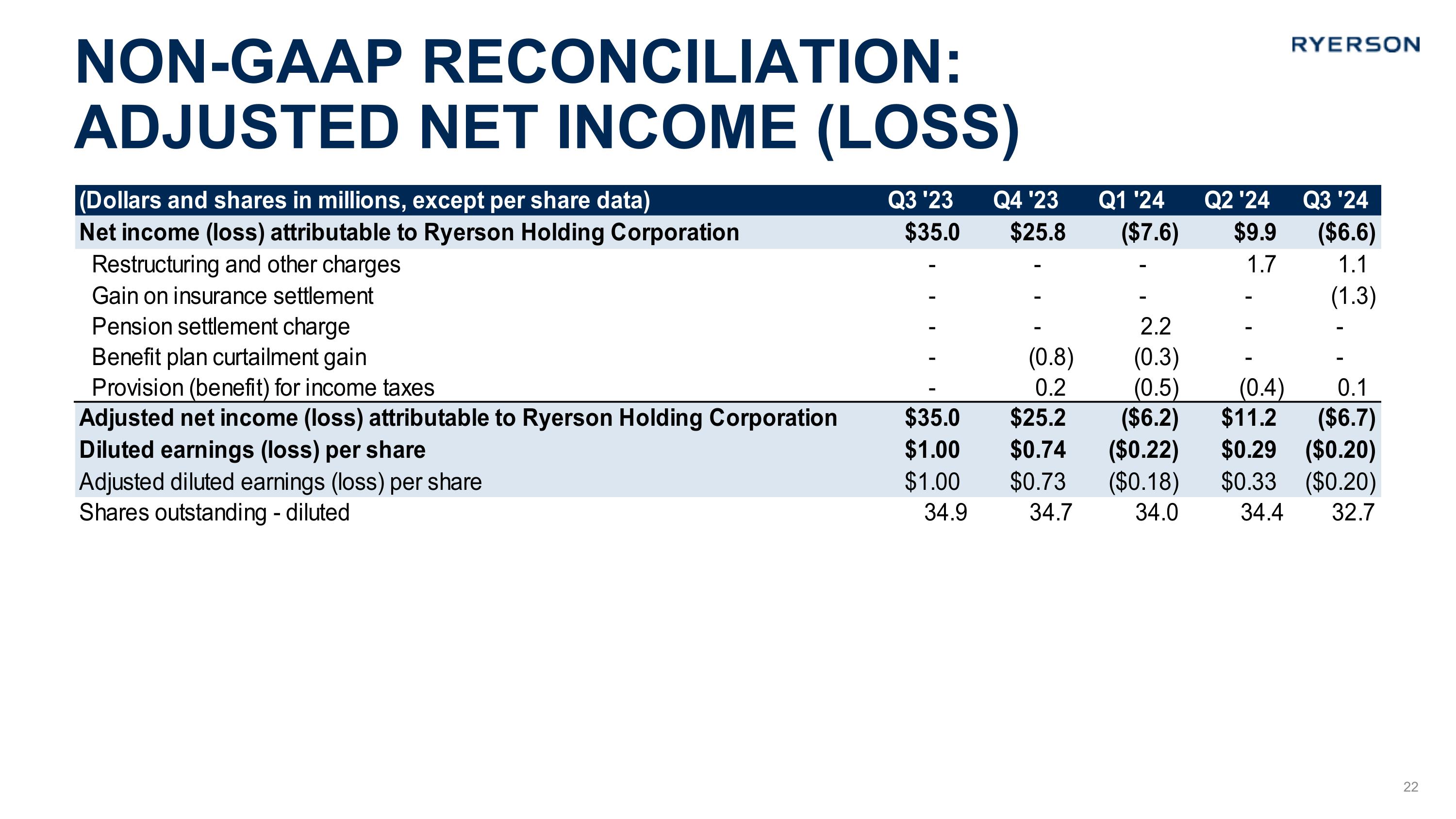

Schedule 3 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) and Adjusted Earnings (Loss) per Share |

|

(Dollars and Shares in Millions, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Nine Months Ended |

|

|

|

Third |

|

|

Second |

|

|

Third |

|

|

September 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

(6.6 |

) |

|

$ |

9.9 |

|

|

$ |

35.0 |

|

|

$ |

(4.3 |

) |

|

$ |

119.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on insurance settlement |

|

|

(1.3 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1.3 |

) |

|

|

— |

|

Restructuring and other charges |

|

|

1.1 |

|

|

|

1.7 |

|

|

|

— |

|

|

|

2.8 |

|

|

|

— |

|

Pension settlement loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

Benefit plan curtailment gain |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

Provision (benefit) for income taxes |

|

|

0.1 |

|

|

|

(0.4 |

) |

|

|

— |

|

|

|

(0.8 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

(6.7 |

) |

|

$ |

11.2 |

|

|

$ |

35.0 |

|

|

$ |

(1.7 |

) |

|

$ |

119.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings (loss) per share |

|

$ |

(0.20 |

) |

|

$ |

0.33 |

|

|

$ |

1.00 |

|

|

$ |

(0.05 |

) |

|

$ |

3.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding - diluted |

|

|

32.7 |

|

|

|

34.4 |

|

|

|

34.9 |

|

|

|

33.6 |

|

|

|

35.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Adjusted net income (loss) and Adjusted earnings (loss) per share is presented to provide a means of comparison with periods that do not include similar adjustments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 4 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Cash Flow from Operations to Free Cash Flow Yield |

|

(Dollars in Millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Nine Months Ended |

|

|

|

Third |

|

|

Second |

|

|

Third |

|

|

September 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

134.6 |

|

|

$ |

25.9 |

|

|

$ |

79.3 |

|

|

$ |

112.7 |

|

|

$ |

275.0 |

|

Capital expenditures |

|

|

(31.6 |

) |

|

|

(22.7 |

) |

|

|

(22.4 |

) |

|

|

(76.1 |

) |

|

|

(96.5 |

) |

Proceeds from sales of property, plant, and equipment |

|

|

0.4 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

1.9 |

|

|

|

0.1 |

|

Free cash flow |

|

$ |

103.4 |

|

|

$ |

3.3 |

|

|

$ |

56.9 |

|

|

$ |

38.5 |

|

|

$ |

178.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market capitalization |

|

$ |

634.0 |

|

|

$ |

657.0 |

|

|

$ |

996.5 |

|

|

$ |

634.0 |

|

|

$ |

996.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow yield |

|

|

16.3 |

% |

|

|

0.5 |

% |

|

|

5.7 |

% |

|

|

6.1 |

% |

|

|

17.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Market capitalization is calculated using September 30, 2024, June 30, 2024, and September 30, 2023 stock prices and shares outstanding. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 5 |

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

Reconciliation of Fourth Quarter 2024 Net Income Attributable to Ryerson Holding Corporation to Adj. EBITDA, excl. LIFO Guidance |

(Dollars in Millions, except Per Share Data) |

|

|

Fourth Quarter 2024 |

|

|

Low |

|

High |

Net loss attributable to Ryerson Holding Corporation |

|

$(17) |

|

$(16) |

|

|

|

|

|

Diluted loss per share |

|

$(0.53) |

|

$(0.47) |

|

|

|

|

|

Interest and other expense on debt |

|

10 |

|

10 |

Benefit for income taxes |

|

(6) |

|

(5) |

Depreciation and amortization expense |

|

19 |

|

19 |

EBITDA |

|

$6 |

|

$8 |

Adjustments |

|

14 |

|

14 |

Adjusted EBITDA |

|

$20 |

|

$22 |

LIFO income |

|

(10) |

|

(10) |

Adjusted EBITDA, excluding LIFO |

|

$10 |

|

$12 |

|

|

|

|

|

Note: See the note within Schedule 2 for a description of EBITDA and Adjusted EBITDA. |

|

|

|

|

Ryerson Quarterly Release Presentation Q3 2024 Exhibit 99.2

Important Information About Ryerson Holding Corporation These materials do not constitute an offer or solicitation to purchase or sell securities of Ryerson Holding Corporation (“Ryerson” or “the Company”) or its subsidiaries and no investment decision should be made based upon the information provided herein. Ryerson strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at https://ir.ryerson.com/financials/sec-filings/default.aspx. This site also provides additional information about Ryerson. Safe Harbor Provision Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent annual report on Form 10-K for the year ended December 31, 2023, our quarterly report on Form 10-Q for the quarter ended September 30, 2024, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. Non-GAAP Measures Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix.

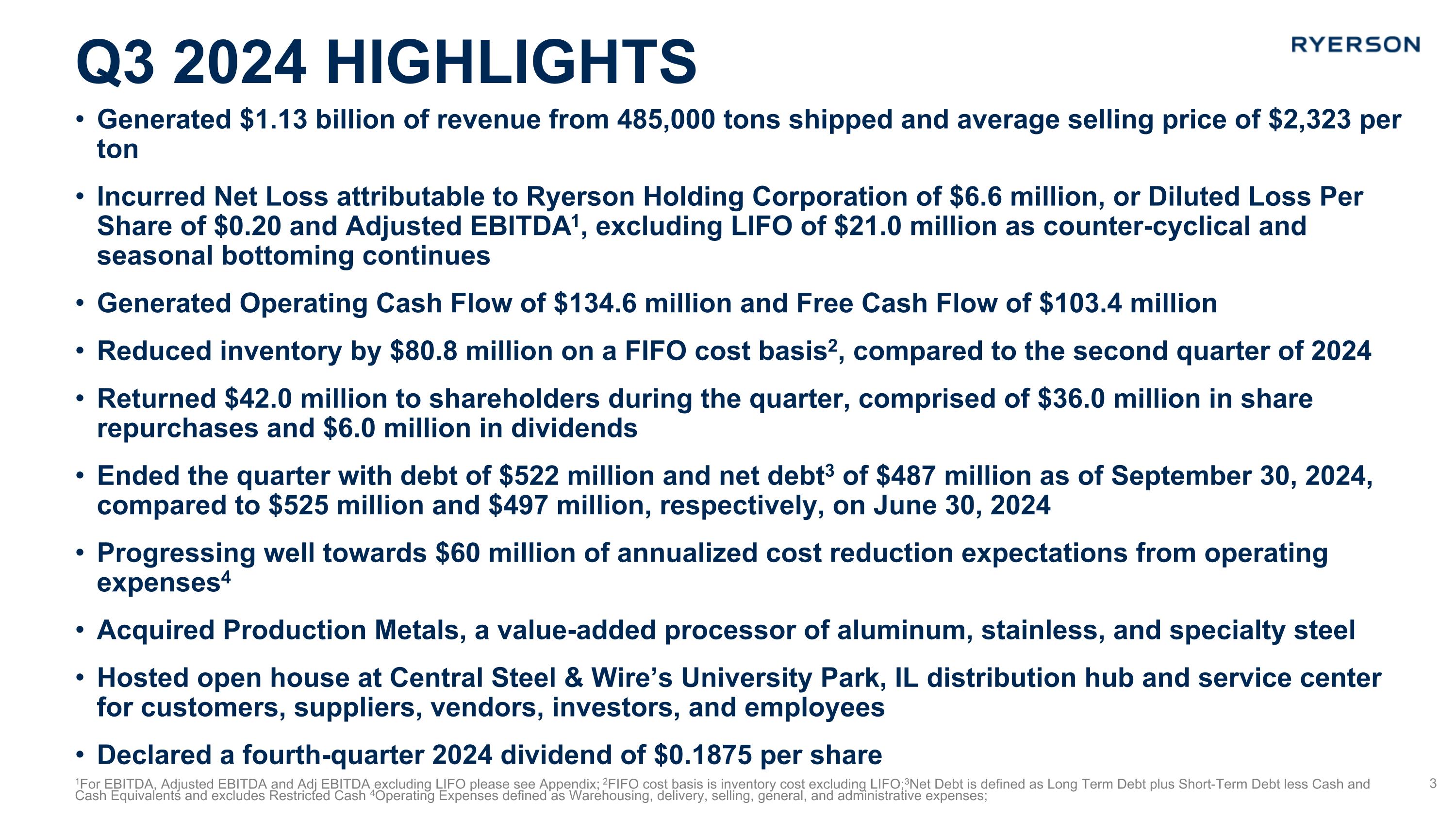

Generated $1.13 billion of revenue from 485,000 tons shipped and average selling price of $2,323 per ton Incurred Net Loss attributable to Ryerson Holding Corporation of $6.6 million, or Diluted Loss Per Share of $0.20 and Adjusted EBITDA1, excluding LIFO of $21.0 million as counter-cyclical and seasonal bottoming continues Generated Operating Cash Flow of $134.6 million and Free Cash Flow of $103.4 million Reduced inventory by $80.8 million on a FIFO cost basis2, compared to the second quarter of 2024 Returned $42.0 million to shareholders during the quarter, comprised of $36.0 million in share repurchases and $6.0 million in dividends Ended the quarter with debt of $522 million and net debt3 of $487 million as of September 30, 2024, compared to $525 million and $497 million, respectively, on June 30, 2024 Progressing well towards $60 million of annualized cost reduction expectations from operating expenses4 Acquired Production Metals, a value-added processor of aluminum, stainless, and specialty steel Hosted open house at Central Steel & Wire’s University Park, IL distribution hub and service center for customers, suppliers, vendors, investors, and employees Declared a fourth-quarter 2024 dividend of $0.1875 per share Q3 2024 Highlights 1For EBITDA, Adjusted EBITDA and Adj EBITDA excluding LIFO please see Appendix; 2FIFO cost basis is inventory cost excluding LIFO;3Net Debt is defined as Long Term Debt plus Short-Term Debt less Cash and Cash Equivalents and excludes Restricted Cash 4Operating Expenses defined as Warehousing, delivery, selling, general, and administrative expenses;

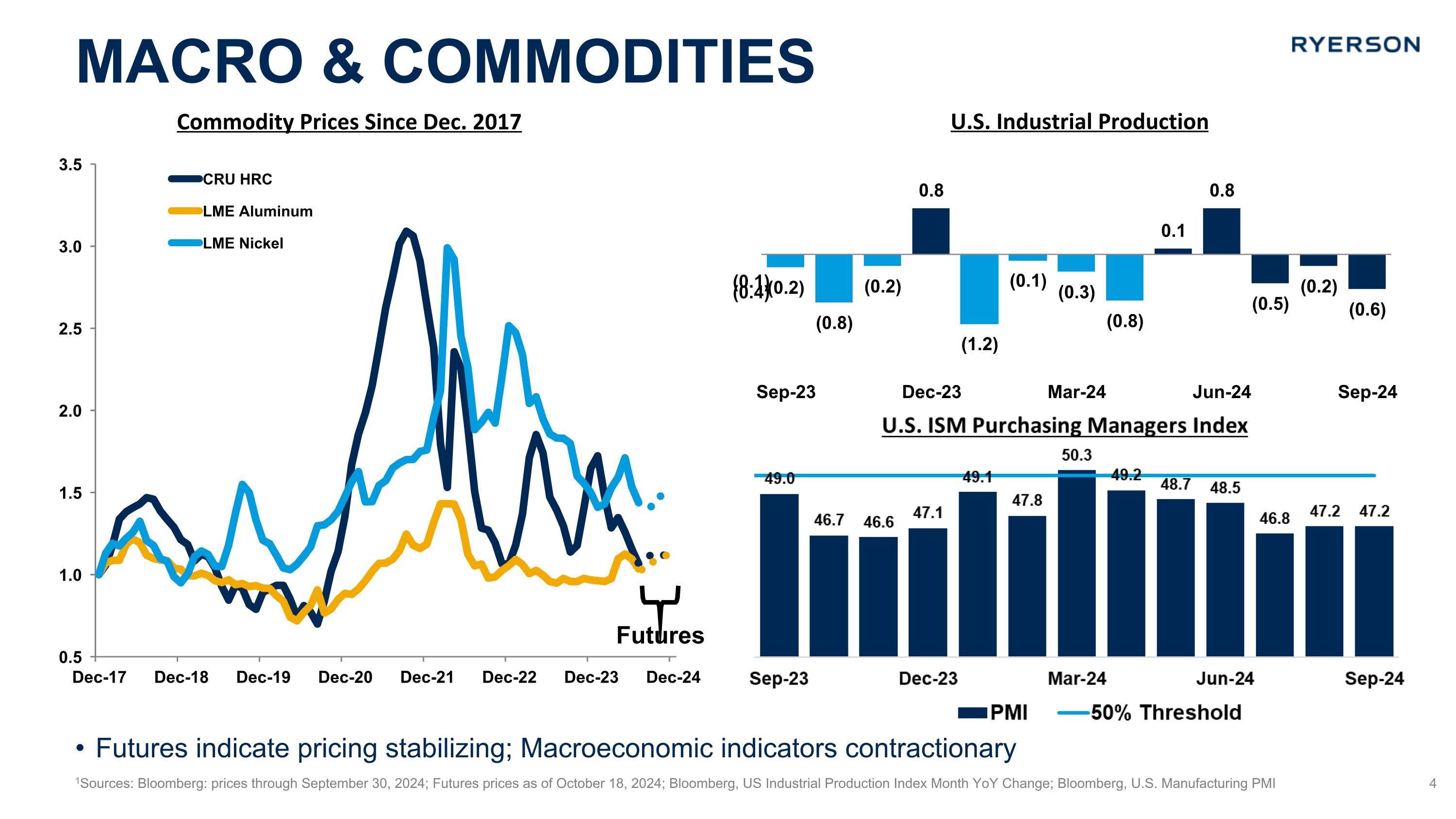

Macro & commodities 1Sources: Bloomberg: prices through September 30, 2024; Futures prices as of October 18, 2024; Bloomberg, US Industrial Production Index Month YoY Change; Bloomberg, U.S. Manufacturing PMI Commodity Prices Since Dec. 2017 Futures indicate pricing stabilizing; Macroeconomic indicators contractionary Futures U.S. Industrial Production

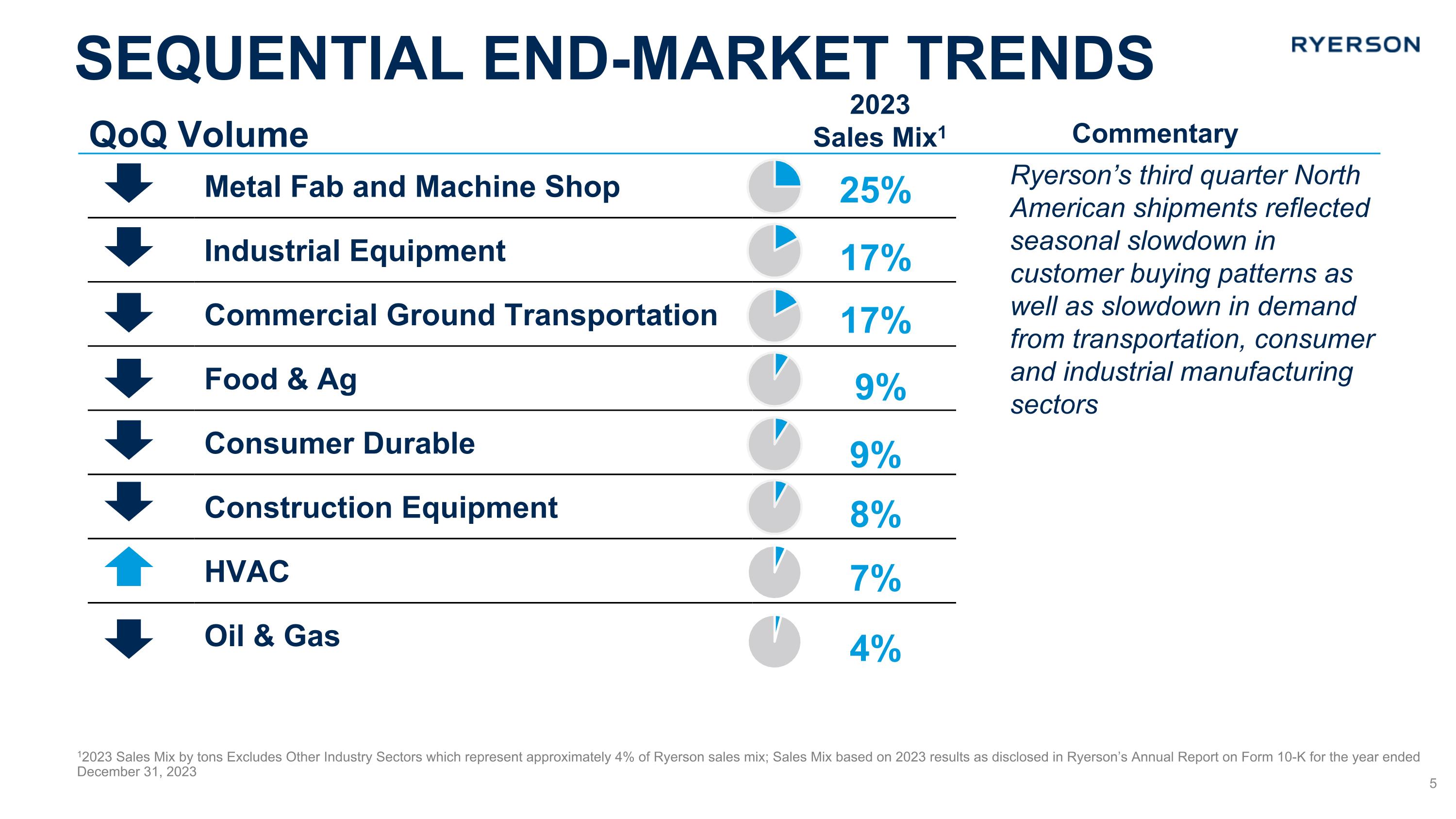

12023 Sales Mix by tons Excludes Other Industry Sectors which represent approximately 4% of Ryerson sales mix; Sales Mix based on 2023 results as disclosed in Ryerson’s Annual Report on Form 10-K for the year ended December 31, 2023 Metal Fab and Machine Shop Industrial Equipment Commercial Ground Transportation Food & Ag Consumer Durable Construction Equipment HVAC Oil & Gas 2023 Sales Mix1 Commentary QoQ Volume 25% 17% 17% 9% 9% 8% 7% 4% Ryerson’s third quarter North American shipments reflected seasonal slowdown in customer buying patterns as well as slowdown in demand from transportation, consumer and industrial manufacturing sectors Sequential end-market trends

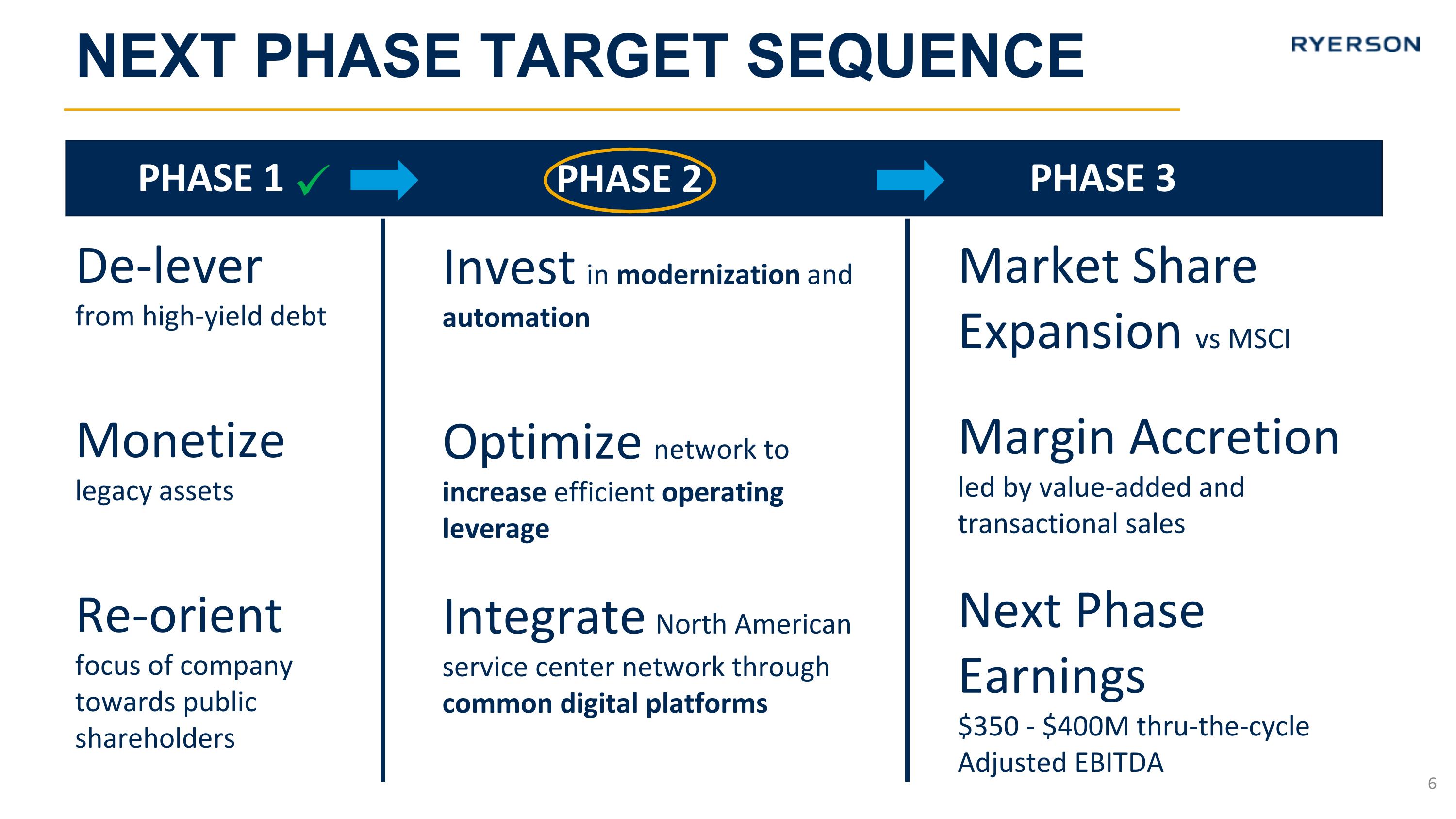

Next Phase Target sequence PHASE 1 PHASE 2 PHASE 3 Invest in modernization and automation Optimize network to increase efficient operating leverage Integrate North American service center network through common digital platforms De-lever�from high-yield debt Monetize�legacy assets Re-orient�focus of company towards public shareholders Market Share Expansion vs MSCI Margin Accretion led by value-added and transactional sales Next Phase Earnings�$350 - $400M thru-the-cycle Adjusted EBITDA

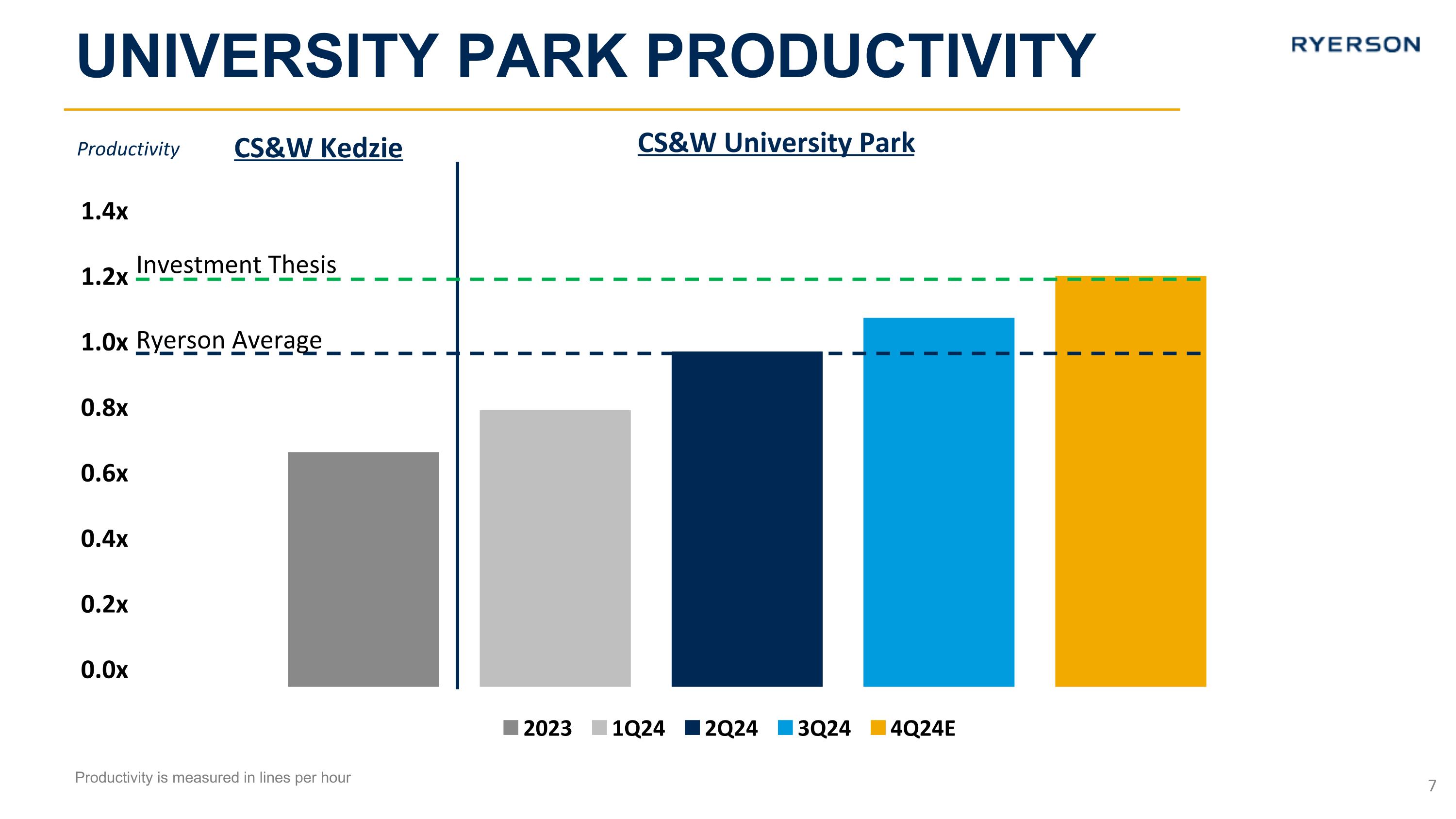

University Park Productivity Productivity is measured in lines per hour Productivity Ryerson Average CS&W Kedzie CS&W University Park Investment Thesis 1.4x 1.2x 1.0x 0.8x 0.6x 0.4x 0.2x 0.0x

Anticipate slowing conditions impacting Q4 volumes and pricing 1Net Loss attributable to Ryerson Holding Corporation; 2Diluted EPS (loss) of ($0.50) represents the midpoint of our ($0.53) – ($0.47) guidance range. See Ryerson’s 8-K filed on October 29, 2024 Net Sales Net Loss1 Adj. EBITDA, excl. LIFO $1.00 - 1.04B $(17) – (16)M $10 - 12M Fourth quarter revenue guidance of $1.00B to $1.04B assumes: Average Selling Prices between (1%) to 1% Shipments decrease 8% to 10% Diluted Earnings (loss) per Share Q4 2024 Guidance

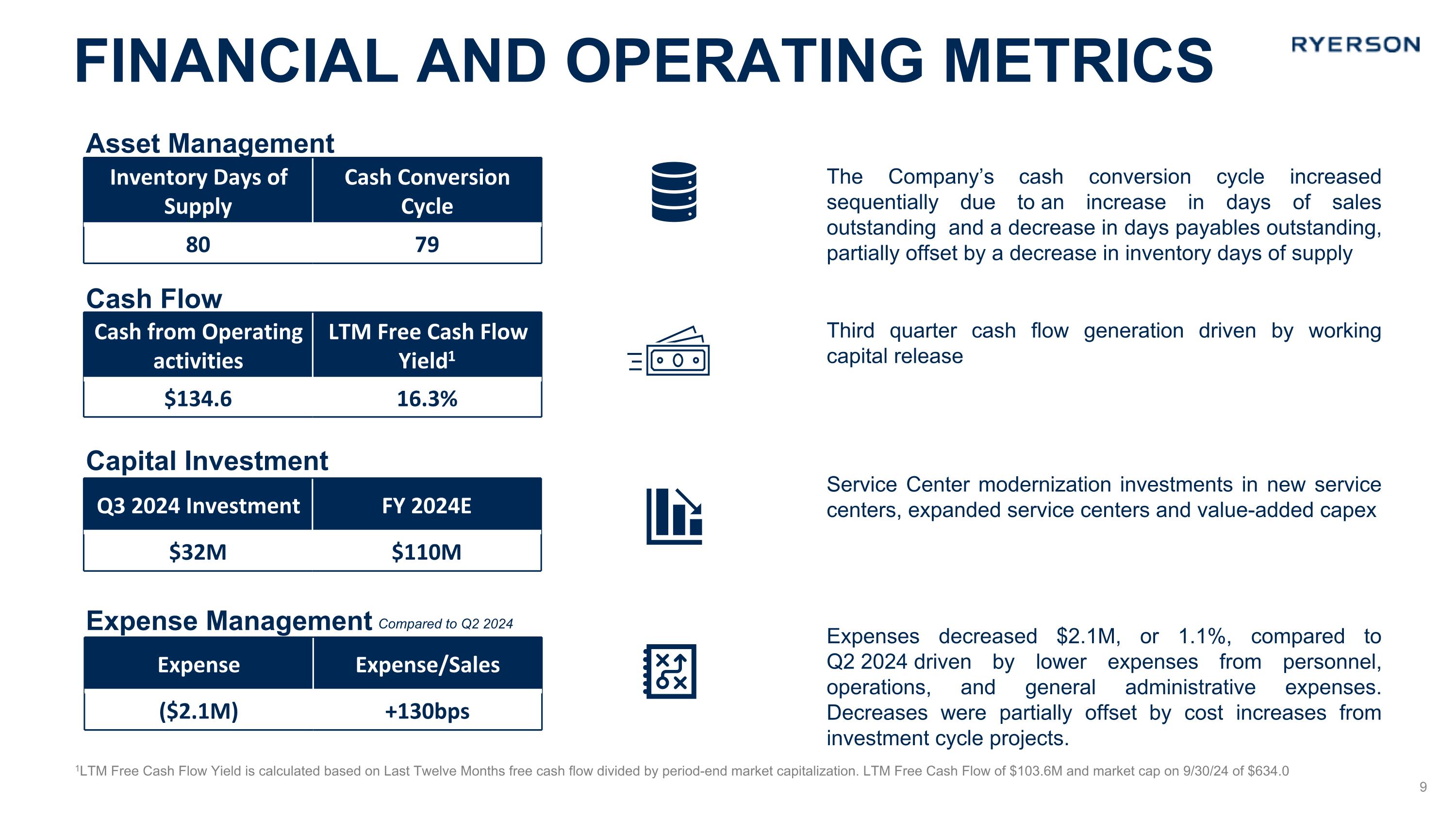

1LTM Free Cash Flow Yield is calculated based on Last Twelve Months free cash flow divided by period-end market capitalization. LTM Free Cash Flow of $103.6M and market cap on 9/30/24 of $634.0 Capital Investment Expense Management Compared to Q2 2024 Inventory Days of Supply Cash Conversion Cycle 80 79 Asset Management Cash Flow Service Center modernization investments in new service centers, expanded service centers and value-added capex Third quarter cash flow generation driven by working capital release The Company’s cash conversion cycle increased sequentially due to an increase in days of sales outstanding and a decrease in days payables outstanding, partially offset by a decrease in inventory days of supply Cash from Operating activities LTM Free Cash Flow Yield1 $134.6 16.3% Q3 2024 Investment FY 2024E $32M $110M Expense Expense/Sales ($2.1M) +130bps Expenses decreased $2.1M, or 1.1%, compared to Q2 2024 driven by lower expenses from personnel, operations, and general administrative expenses. Decreases were partially offset by cost increases from investment cycle projects. financial and operating metrics

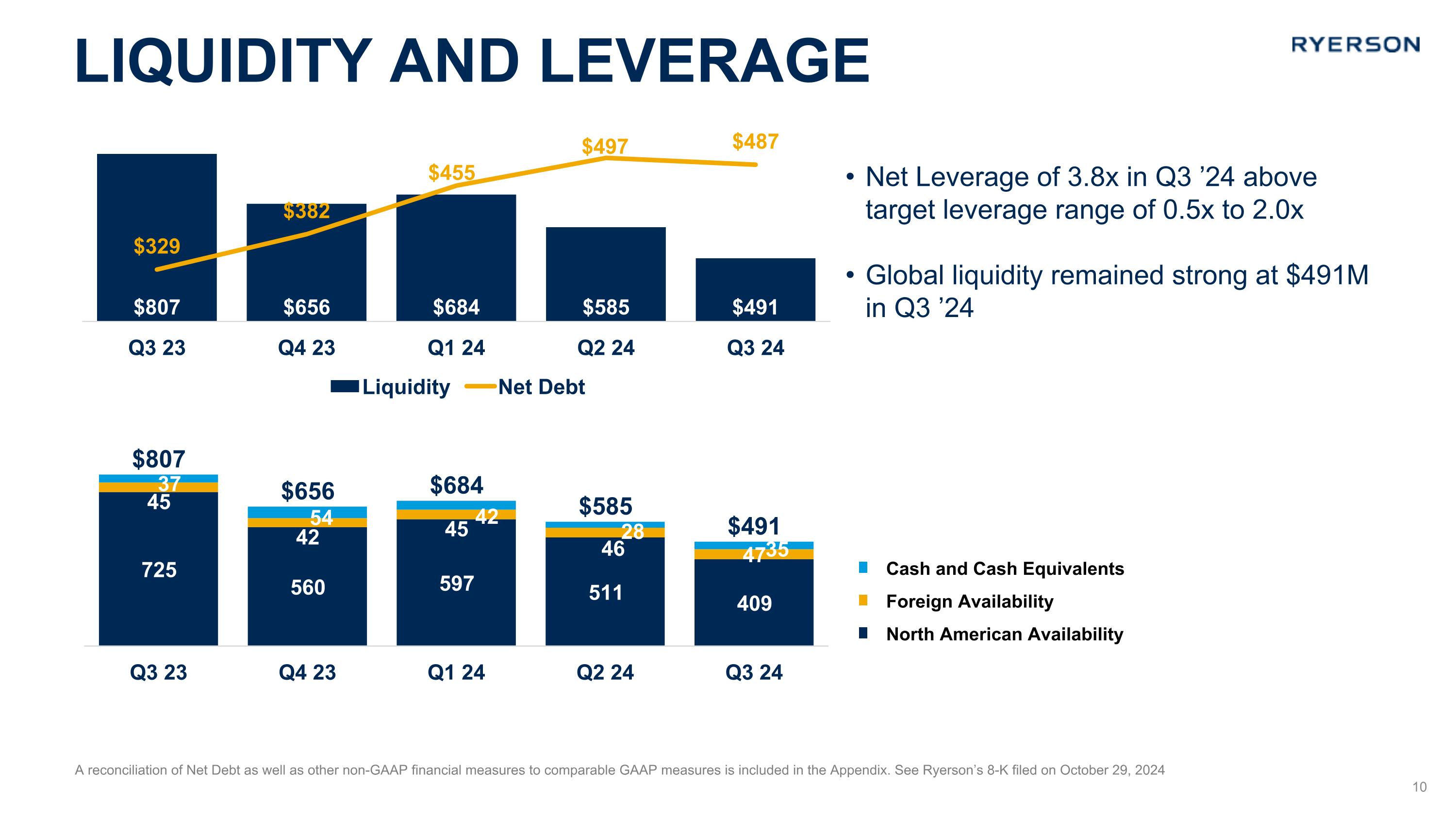

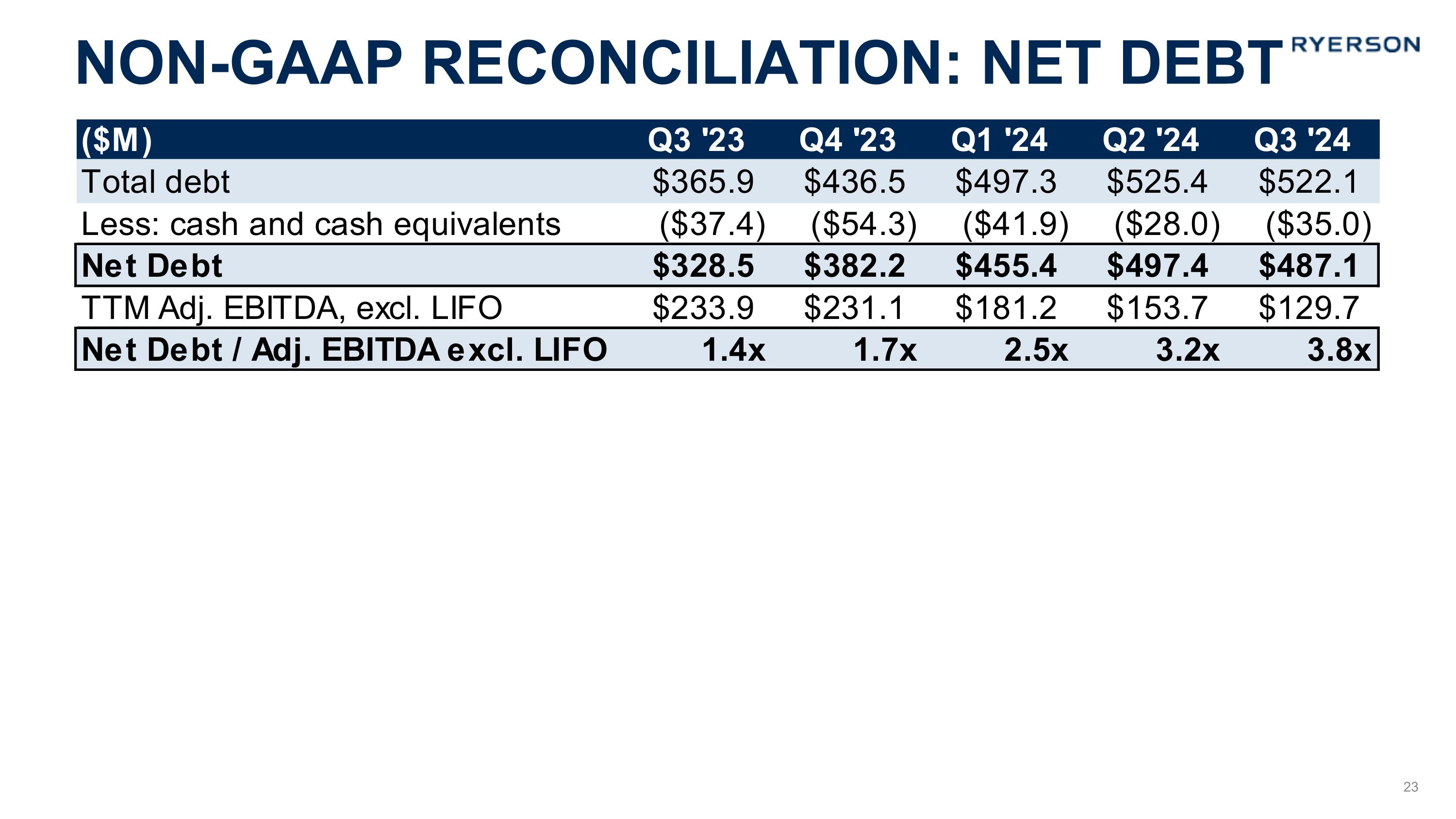

A reconciliation of Net Debt as well as other non-GAAP financial measures to comparable GAAP measures is included in the Appendix. See Ryerson’s 8-K filed on October 29, 2024 Net Leverage of 3.8x in Q3 ’24 above target leverage range of 0.5x to 2.0x Global liquidity remained strong at $491M in Q3 ’24 Cash and Cash Equivalents Foreign Availability North American Availability Liquidity and leverage

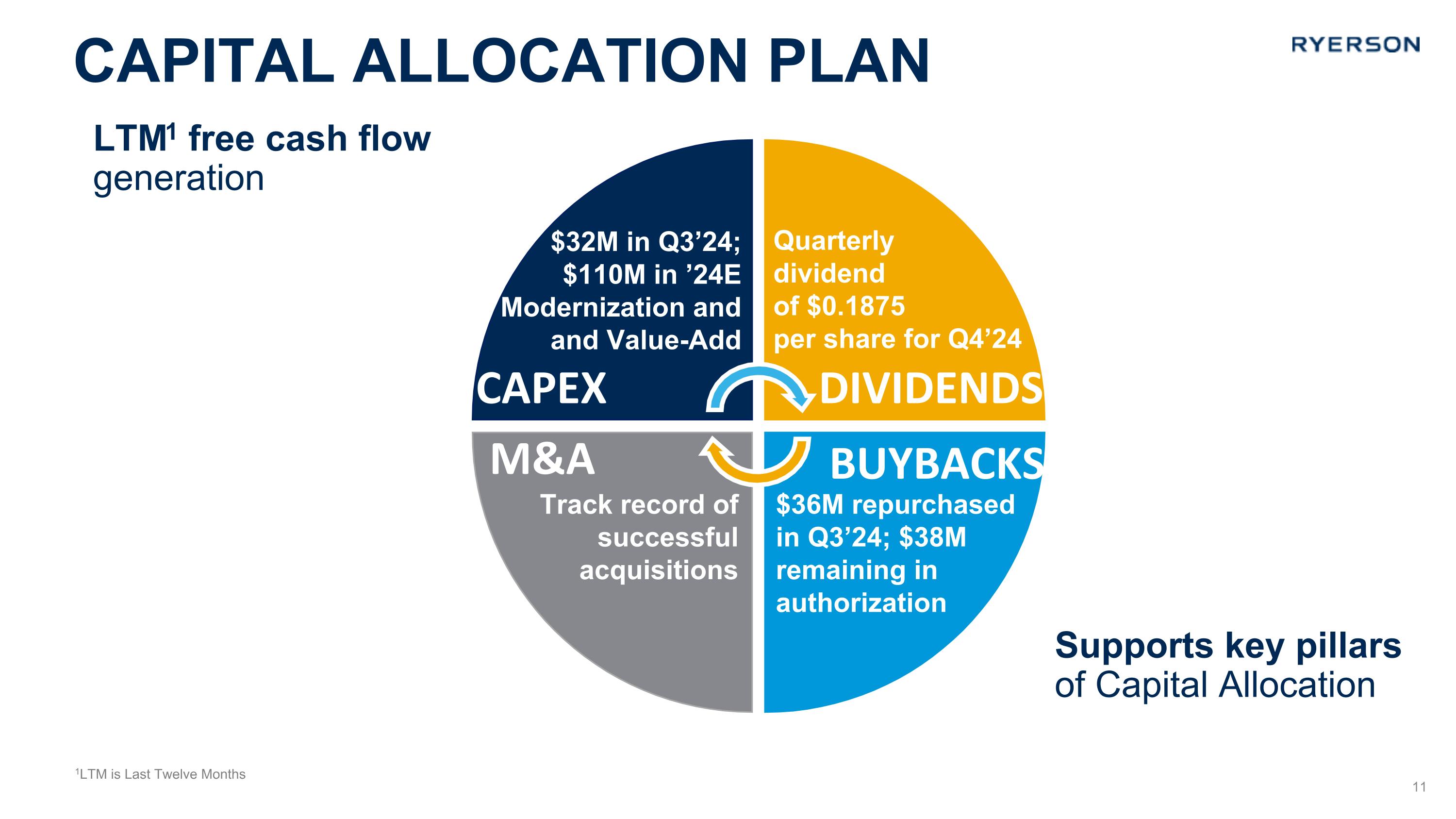

Capital allocation plan 1LTM is Last Twelve Months LTM1 free cash flow generation $32M in Q3’24;� $110M in ’24E Modernization and and Value-Add Quarterly �dividend�of $0.1875 per share for Q4’24 Track record of successful acquisitions $36M repurchased in Q3’24; $38M remaining in authorization Supports key pillars of Capital Allocation CAPEX M&A DIVIDENDS BUYBACKS

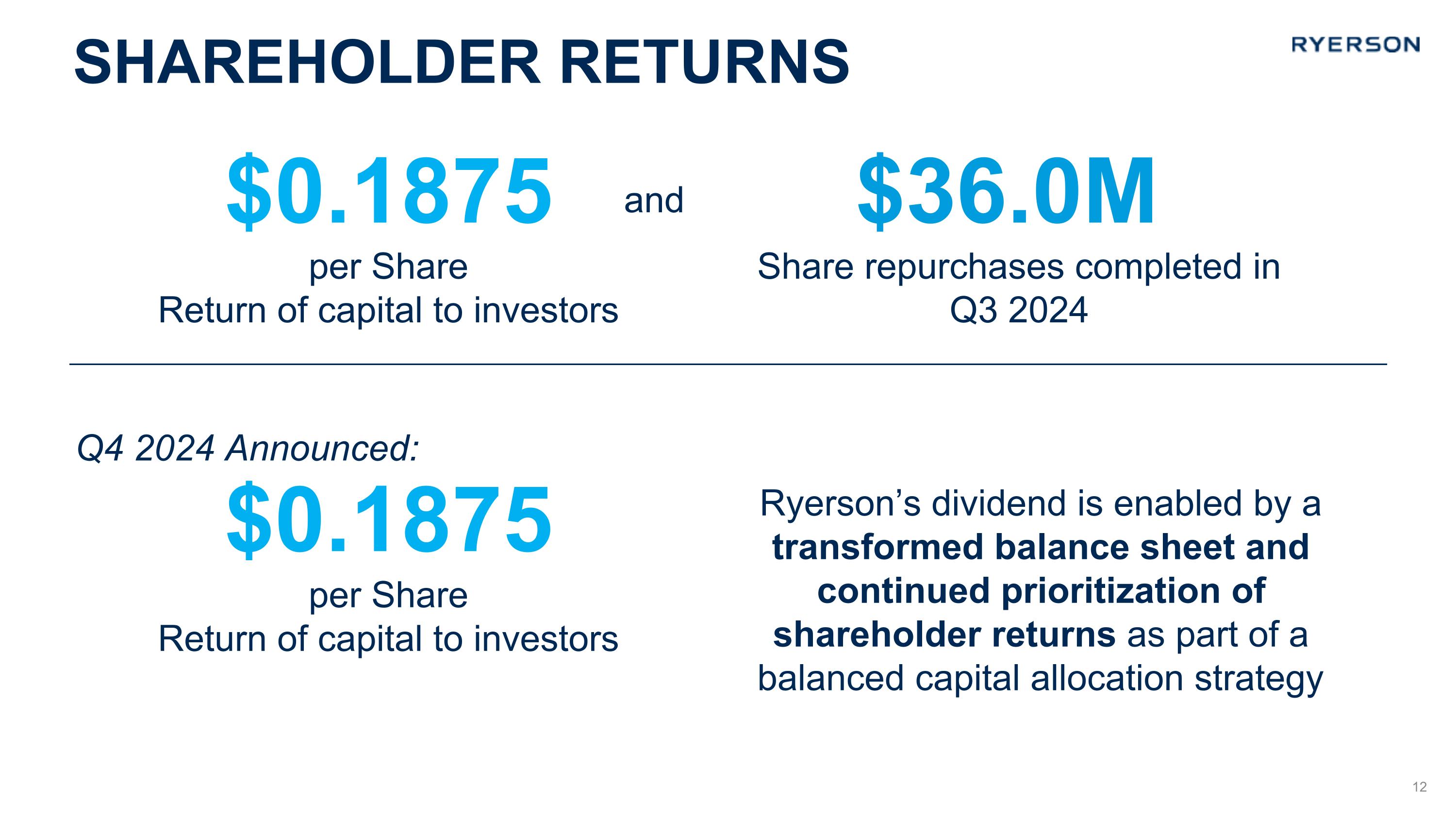

shareholder returns $0.1875 per Share Return of capital to investors and $36.0M Share repurchases completed in Q3 2024 Q4 2024 Announced: Ryerson’s dividend is enabled by a transformed balance sheet and continued prioritization of shareholder returns as part of a balanced capital allocation strategy $0.1875 per Share Return of capital to investors

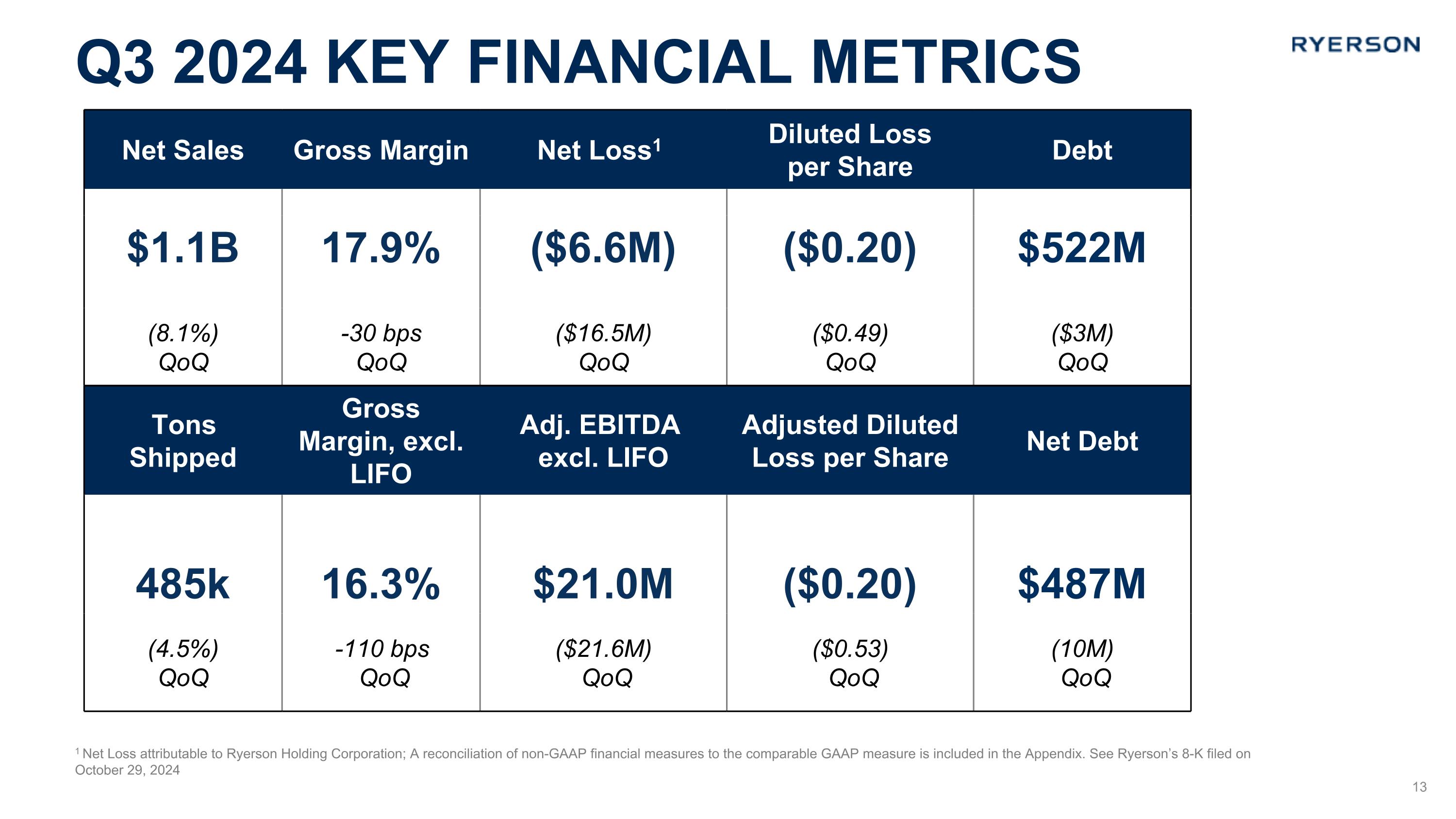

Q3 2024 key financial metrics 1 Net Loss attributable to Ryerson Holding Corporation; A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. See Ryerson’s 8-K filed on October 29, 2024 Net Sales Gross Margin Net Loss1 Diluted Loss�per Share Debt $1.1B 17.9% ($6.6M) ($0.20) $522M (8.1%) �QoQ -30 bps �QoQ ($16.5M) �QoQ ($0.49) �QoQ ($3M) �QoQ Tons Shipped Gross Margin, excl. LIFO Adj. EBITDA excl. LIFO Adjusted Diluted Loss per Share Net Debt 485k 16.3% $21.0M ($0.20) $487M (4.5%) �QoQ -110 bps� QoQ ($21.6M)� QoQ ($0.53)� QoQ (10M)� QoQ

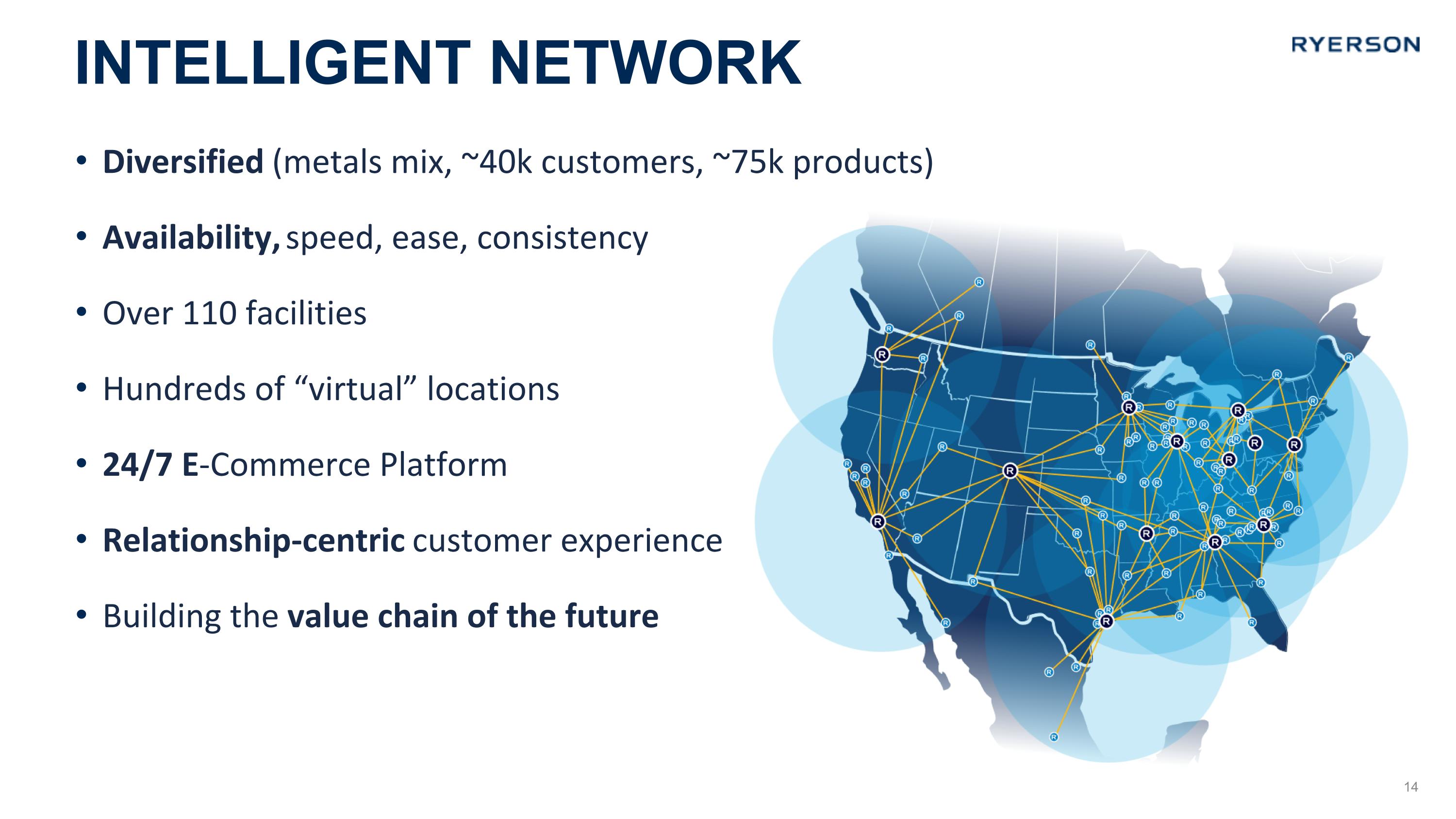

Diversified (metals mix, ~40k customers, ~75k products) Availability, speed, ease, consistency Over 110 facilities Hundreds of “virtual” locations 24/7 E-Commerce Platform Relationship-centric customer experience Building the value chain of the future Intelligent Network 14

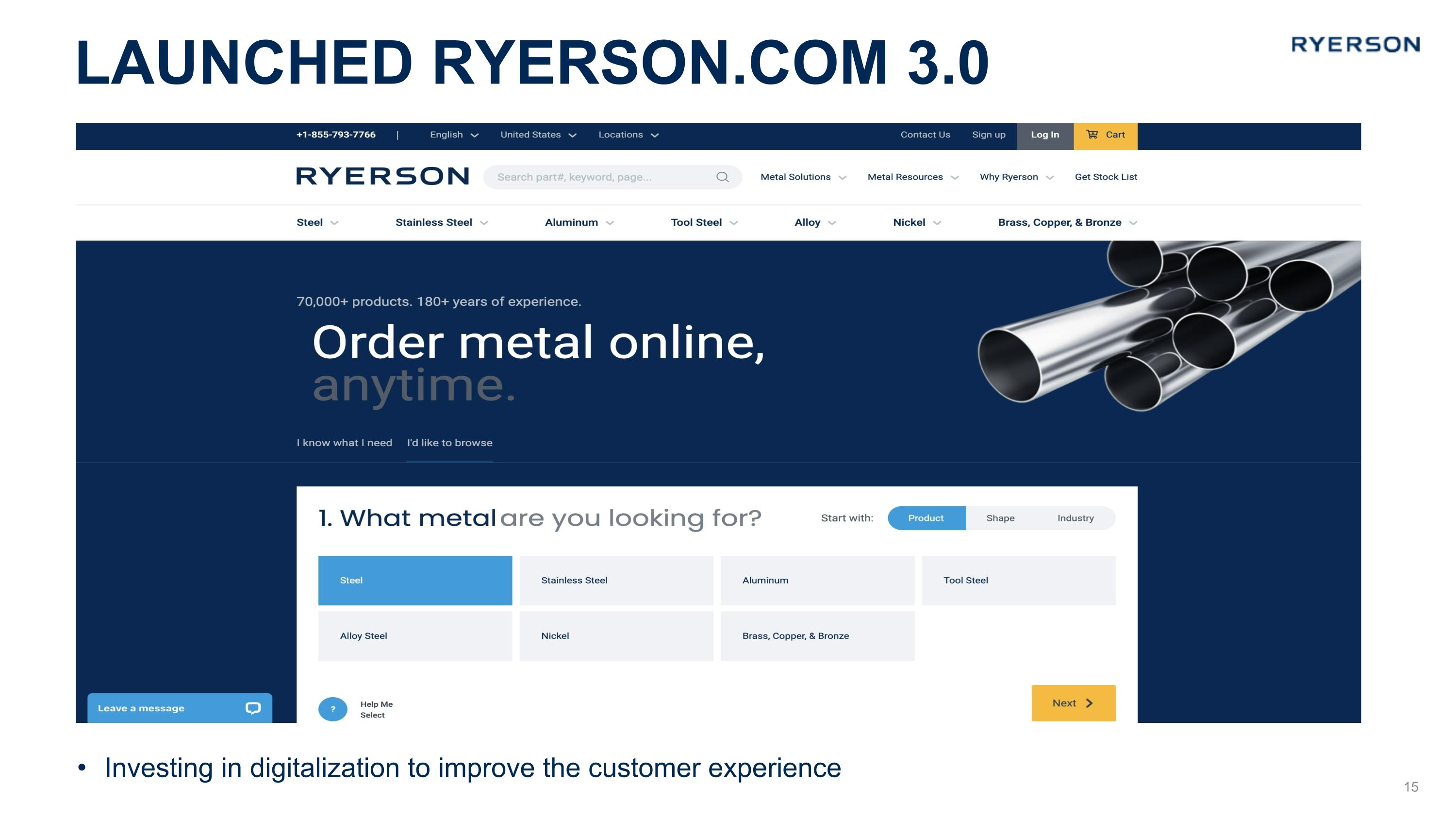

Launched Ryerson.com 3.0 Investing in digitalization to improve the customer experience 15

Appendix

University Park – New CS&W HQ 900,000 sq ft facility Significant automation and technological enhancements Investing IN the Business West Shelbyville Expansion State-of-the-art cut-to-length line (CTL) and automated storage and retrieval system for sheet products Centralia Pacific NW 214,000 sq ft facility Advanced processing capabilities for sheet, plate, and long products Portage Laser Cell Automated coil processing & laser cutting Atlanta Tube Laser Center Expanded tube processing facility SAP Conversion Converted 17 locations to SAP

Stronger capital structure allows for greater returns to shareholders Dividend payments 1EPS is Diluted EPS; 2Yield for 2023 is based on closing share price as of December 29, 2023, of $34.68. Yield for TTM Q3’24 is based on closing share price as of September 30, 2024, of $19.91. Dividend per Share 1 2 19

Quarterly financial highlights 1 Net Loss attributable to Ryerson Holding Corporation; A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix Average Selling Price Per Ton Gross Margin & Gross Margin, excl. LIFO Tons Sold (000’s) Adj. EBITDA excl. LIFO & Net Income (Loss) Margin % 1 20 1

Non-GAAP Reconciliation: Adjusted EBITDA, excl. LIFO 21

Non-GAAP Reconciliation: Adjusted Net Income (loss) 22

Non-GAAP Reconciliation: Net Debt 23

Exhibit 99.3

RETIREMENT, TRANSITION AND RELEASE AGREEMENT

This Retirement, Transition and Release Agreement (“Agreement”) is entered into by and between Joseph T. Ryerson & Son, Inc., on behalf of itself and its other related and affiliated entities (“Company”), and Michael J. Burbach (“Employee”), on behalf of himself, his heirs, and assigns:

WHEREAS, Employee desires to retire from his employment with Company on or about December 31, 2024 (“Retirement Date”);

WHEREAS, Employee and Company desire that Employee provide transition assistance;