false

0001349436

0001349436

2024-08-30

2024-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): August 30, 2024

SANDRIDGE

ENERGY, INC.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

1-33784 |

|

20-8084793 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

1 E. Sheridan Ave., Suite 500

Oklahoma City, OK 73104

(Address of Principal Executive Offices)

(405)

429-5500

Registrant’s

Telephone Number, Including Area Code

Not

Applicable.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on

which registered |

| Common Stock, $0.001 par value |

|

SD |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Agreement.

The

information set forth in Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference into this Item 1.01.

Item

2.01. Completion of Acquisition or Disposition of Assets.

On

August 30, 2024, SandRidge Exploration and Production, LLC (the “Purchaser”), a Delaware limited liability company

and a wholly owned subsidiary of SandRidge Energy, Inc. (the “Company”), Upland Exploration, LLC, a Texas limited

liability company, and Upland Operating, LLC, an Oklahoma limited liability company (together with Upland Exploration, LLC, collectively,

the “Seller”) closed the transactions (the “Transactions”) contemplated by the previously announced

Purchase and Sale Agreement, dated July 29, 2024 (the “PSA”) and the Purchaser purchased certain of Seller’s

interests in oil and gas properties, rights, and related assets in the Cherokee play of the Western Anadarko Basin (the “Assets”)

for $144 million, subject to customary purchase price adjustments (the “Closing”) and subject to final post-closing

settlement between Purchaser and Seller. The Company funded the closing payment with cash on hand.

On

August 30, 2024, and in connection with the Closing, the Purchaser and the Seller entered into an Amendment (the “Amendment”)

to the PSA, to, among other things, amend the defined term “Assets” to include additional wells and leases, as well as certain

definitions in the “Holdback Matters.”

The

foregoing description of the Amendment and the transactions contemplated thereby does not purport to be complete and is qualified in

its entirety by reference to the full text of the Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form

8-K and is incorporated herein by reference.

Item 7.01.

Regulation FD Disclosure.

On September 3, 2024, the

Company issued a press release, attached hereto as Exhibit 99.1, announcing the Closing of the Transactions (the “Press Release”).

A copy of the Press Release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information and exhibit

set forth in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall by expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

| * | Exhibits and Schedules have been omitted pursuant to Item

601(b)(2) of Regulation S-K. The Company agrees to furnish a supplemental copy of any such omitted Exhibit or Schedules to the Securities

and Exchange Commission upon request. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned, hereunto duly authorized.

| |

SandRidge Energy, Inc. |

| |

|

|

| Dated: September 3, 2024 |

By: |

/s/ Brandon Brown |

| |

Name: |

Brandon Brown |

| |

Title: |

Senior Vice President and Chief Financial Officer |

2

Exhibit 10.1

FIRST

Amendment

to

Purchase

and Sale Agreement

This First Amendment to Purchase

and Sale Agreement (this “Amendment”) is made and entered into as of August 30, 2024, by and among UPLAND EXPLORATION,

LLC, a Texas limited liability company (“Exploration”), Upland Operating,

LLC, an Oklahoma limited liability company (“Operating” and together with Exploration, collectively, “Seller”),

and SANDRIDGE EXPLORATION AND PRODUCTION, LLC, a Delaware limited liability company (the “Purchaser”). Seller

and Purchaser are sometimes hereinafter referred to individually as a “Party” and collectively as the “Parties”.

WHEREAS, reference is made

to that certain Purchase and Sale Agreement, dated as of July 29, 2024, by and among the Seller and Purchaser (as the same may be amended,

amended and restated, modified or supplemented from time to time, the “Purchase and Sale Agreement”). Capitalized terms

used but not otherwise defined herein shall have the meanings ascribed to such terms in the Purchase and Sale Agreement.

WHEREAS, the Parties desire

to amend the Purchase and Sale Agreement in the manner and upon the terms and conditions of this Amendment.

NOW, THEREFORE, for good and

valuable consideration, the receipt of which is hereby acknowledged, the Parties agree as follows:

Section 1. Defined Terms.

Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Purchase and Sale Agreement.

Section 2. Amendments

to the Purchase and Sale Agreement. The Purchase and Sale Agreement is amended as follows on the date hereof:

(a) The

following parenthetical is added to the Preamble of the Purchase and Sale Agreement immediately after “Upland Exploration, LLC,

a Texas limited liability company” and immediately before “(“Exploration”)”:

“(doing business

in the State of Oklahoma as Upland Exploration Oklahoma, LLC)”

(b) The

following definitions are hereby added to Section 1.1 of the Purchase and Sale Agreement in the appropriate alphabetical order:

“Keahey

Leases” is defined in clause (c) of the definition of “Assets.”

“Keahey

Wells” is defined in clause (c) of the definition of “Assets.”

“PV-10”

is defined on Schedule 7.16(d).

“Rams Well”

means that certain non-producing well known as the RAMS #1H-17R well, PUN: 045-121186-0-000, located in Section 17-T20N-R25W, Ellis County,

Oklahoma.

“Troubadour

Matter” means, with respect to the Troubadour Well, any difference between (a) the PV-10 of Seller’s interest in the

Troubadour Well as of the Effective Time determined pursuant to Section 7.16(d) and (b) the Allocated Value of the Troubadour Well

set forth on Exhibit A-2, Part A.

“Troubadour

Release Date” is defined in Section 7.16(d).

“Troubadour

Well” means that certain Hydrocarbon well set forth on Exhibit A-2, Part A (Troubadour 5/32 2H in Roger Mills, Oklahoma).

“Troubadour

Well Holdback Amount” is defined in Section 7.16(d).

(c) The

following clause (r) is hereby added to the definition of Assets in Section 1.1 of the Purchase and Sale Agreement to read as follows:

“(r) the

wellbore of the Rams Well, together with all Hydrocarbons produced from or allocated to the Rams Well after the Effective Time, if any,

and all other rights and interests of Seller of any kind or character (whether legal or equitable, vested or contingent) that relate to,

or arise from, the Rams Well, or the ownership or operation thereof (including for the avoidance of doubt, any Plugging and Abandonment

obligations with respect to the Rams Well);”

(d) The

following clauses in the definition of Assets in Section 1.1 of the Purchase and Sale Agreement are hereby amended and restated in their

entirety to read as follows:

“(c) (i)

an undivided seventy percent (70%) of Seller’s right, title and interest (A) in and to the wellbore of the Hydrocarbon well described

on Exhibit A-2, Part C (the “Jana M Well”), which seventy percent (70%) interest is set forth in the

row identified as “1” on Exhibit A-2, Part C and (B) in, under and derived from the Hydrocarbon leases described on

Exhibit A-1, Part C (the “Jana M Leases”), together with an undivided seventy percent (70%) of all other interests

of Seller of any kind or character (whether legal or equitable, vested or contingent) in the Jana M Leases that relate to the Jana M Well;

(ii) subject to Section 7.19, the right to acquire, when earned, an undivided seventy percent (70%) of Seller’s right, title

and interest (A) in and to the Jana M Well expected to be earned by Seller under the Farmout, which seventy percent (70%) interest is

set forth in the row identified as “2” on Exhibit A-2, Part C and (B) in, under and derived from the Hydrocarbon leases

expected to be earned by Seller under the Farmout with respect to the Jana M Well (such Hydrocarbon leases, the “Additional

JM Leases”), together with an undivided seventy percent (70%) of all other interests of Seller of any kind or character

(whether legal or equitable, vested or contingent) in the Additional JM Leases, when earned, that relate to the Jana M Well; and (iii)

an undivided seventy percent (70%) of Seller’s right, title and interest (A) in and to the wellbore of all Hydrocarbon wells described

on Exhibit A-2, Part D (the “Keahey Wells”) and (B) in, under and derived from the Hydrocarbon leases

described on Exhibit A-1, Part E (the “Keahey Leases”), together with an undivided seventy percent (70%)

of all other interests of Seller of any kind or character (whether legal or equitable, vested or contingent) in the Keahey Leases that

relate to the Keahey Wells;”

“(e) all

rights and interests in, under or derived from all unitization and pooling agreements, declarations and orders in effect (collectively,

the “Unitizations”) with respect to (i) (A) the Leases, (B) the Wells, (C) the Other Wells and the units created

thereby (other than the DSU’s), (D) the DSU Leases and (E) the DSU’s; and (ii) in accordance with clause (c), an undivided

seventy percent (70%) of Seller’s right, title and interest in the Unitizations with respect to (A) the Jana M Leases, (B) the Additional

JM Leases, (C) the Jana M Well, (D) the Keahey Wells and (E) the Keahey Leases (the oil and gas assets described in clause (a),

clause (b), clause (c), clause (d) and clause (e) of “Assets”, collectively, the

“Oil and Gas Properties”);”

“provided, however,

with respect to such items in clause (f), clause (g), clause (i), clause (j), clause (k), clause

(n), clause (o), clause (p) and clause (q) to be conveyed to Purchaser shall, in each case, be (x) an undivided

seventy percent (70%) of Seller’s right, title and interest INSOFAR AND ONLY INSOFAR as they relate to the Jana M Leases, the Additional

JM Leases, the Jana M Well, the Keahey Leases and the Keahey Well conveyed to Purchaser in accordance with clause (c) and (y) with

respect to the DSU Leases and DSU’s, INSOFAR AND ONLY INSOFAR as such items relate to the interests conveyed to Purchaser in the

DSU Leases and such DSU or are located within the boundaries of a DSU.”

(e) Section

7.16(a) of the Purchase and Sale Agreement is hereby amended and restated in its entirety to read as follows:

“(a) From

the Closing Date until the date that is twelve (12) months after such date, one of the Seller Entities shall remain Solvent in order to

support Seller’s indemnification obligations in Article 12, the special warranty of Defensible Title in the Conveyances,

the Troubadour Matter (subject to Section 7.16(d)), and any post-Closing payments owing to Purchaser pursuant to Section 2.6,

if any (the “Holdback Matters”); provided, however, notwithstanding anything in this Agreement

to the contrary, from and after the date on which the final Adjusted Purchase Price pursuant to Section 2.6(b) is fully resolved

and paid, the Holdback Matters shall not be deemed to include any post-Closing payments owing to Purchaser pursuant to Section 2.6.”

(f) Section

7.16(d) of the Purchase and Sale Agreement is hereby amended and restated in its entirety to read as follows:

“(d) Except

as set forth on Schedule 7.16(d), on the first Business Day following the ninetieth (90th) day after the Closing (the “Holdback

Date”), Purchaser and Seller shall jointly execute and deliver to the Escrow Agent written instructions instructing the

Escrow Agent to release and deliver the Troubadour Well Holdback Amount (as defined on Schedule 7.16(d)) in accordance with the

terms and on the conditions set forth on Schedule 7.16(d).

(g) Schedule

7.16(d) of the Disclosure Schedules is hereby amended and restated in its entirety as set forth on Schedule 7.16(d) attached hereto.

(h) Exhibit

A-1, Part A (PDP Leases) to the Purchase and Sale Agreement is hereby replaced in its entirety with Exhibit A-1, Part A (PDP

Leases) attached hereto.

(g) Exhibit

A-1, Part E (Keahey Leases) attached hereto is hereby added to the Purchase and Sale Agreement as a new Exhibit A-1, Part E

(Keahey Leases).

(h) Exhibit

A-2, Part A (PDP Wells) to the Purchase and Sale Agreement is hereby replaced in its entirety with Exhibit A-2, Part A (PDP

Wells) attached hereto.

(i) Exhibit

A-2, Part B (DUC Wells) to the Purchase and Sale Agreement is hereby replaced in its entirety with Exhibit A-2, Part 2 (DUC

Wells) attached hereto.

(j) Exhibit

A-2, Part D (Keahey Wells) attached hereto is hereby added to the Purchase and Sale Agreement as a new Exhibit A-2, Part D (Keahey

Wells).

(k) Exhibit

A-3 (DSUs) to the Purchase and Sale Agreement is hereby replaced in its entirety with Exhibit A-3 (DSUs) attached hereto.

Section 3. Entire Agreement.

This Amendment (together with the Purchase and Sale Agreement and the Exhibits and Schedules to the Purchase and Sale Agreement (as amended

hereunder)) constitutes the entire agreement among the Parties with respect to the amendments dealt with herein. All previous documents,

undertakings and agreements, whether oral, written or otherwise, among the Parties with respect to the amendments herein are hereby cancelled

and superseded and shall not affect or modify any of the terms or obligations set forth in this Amendment. Upon the execution of this

Amendment by the Parties, this Amendment shall be binding upon and inure to the benefit of the Parties.

Section 4. Limited Effect.

This Amendment is limited in effect and, except as specifically set forth above, shall apply only as expressly set forth in this Amendment

and shall not constitute a consent, waiver, modification, approval, amendment or consent of any other provision of the Purchase and Sale

Agreement. Nothing herein shall limit in any way the rights and remedies of the Parties under the Purchase and Sale Agreement. The Purchase

and Sale Agreement, as amended by this Amendment, shall continue in full force and effect, and the Purchase and Sale Agreement, as modified

by this Amendment, is hereby ratified and confirmed by the Parties in all respects. By executing this Amendment, each Party certifies

on its own behalf that this Amendment has been executed and delivered in compliance with Section 13.7 of the Purchase and Sale Agreement.

Section 5. Incorporation

by Reference. Section 7.7 (Closing Efforts and Further Assurances) and Article 13 (Miscellaneous) of the Purchase and Sale Agreement

are hereby incorporated by reference as if fully set forth in this Amendment mutatis mutandis.

Section 6. Counterparts

and Facsimile or Electronic Mail Execution. This Amendment may be executed in any number of counterparts, each of which shall be deemed

an original, but all of which together shall constitute one and the same instrument, and any of the Parties hereto may execute this Amendment

by signing any such counterpart. Delivery of an executed counterpart of this Amendment by facsimile or by electronic mail or other electronic

imaging means shall be equally as effective as delivery of an original executed counterpart of this Amendment.

[SIGNATURE PAGES FOLLOW]

IN WITNESS WHEREOF,

the Parties have caused this Amendment to be duly executed and delivered as of the date first above written.

| |

PURCHASER: |

| |

|

| |

SANDRIDGE EXPLORATION AND PRODUCTION, LLC |

| |

|

| |

By: |

/s/ Grayson R. Pranin |

| |

Name: |

Grayson R. Pranin |

| |

Title: |

President and CEO |

[Signature Page to First Amendment to Purchase and Sale Agreement]

| |

SELLER: |

| |

|

| |

UPLAND EXPLORATION, LLC |

| |

|

| |

By: |

/s/ David R. Watts |

| |

Name: |

David R. Watts |

| |

Title: |

President |

| |

|

| |

UPLAND OPERATING, LLC |

| |

|

| |

By: |

/s/ David R. Watts |

| |

Name: |

David R. Watts |

| |

Title: |

President |

[Signature Page to First Amendment to Purchase and Sale Agreement]

Exhibit 99.1

NEWS RELEASE

SANDRIDGE ENERGY, INC.

ANNOUNCES CLOSING OF WESTERN ANADARKO BASIN

ACQUISITION AND UPDATES FULL-YEAR 2024 GUIDANCE

Oklahoma City, Oklahoma, September 3,

2024 /PRNewswire/ – SandRidge Energy, Inc. (the “Company” or “SandRidge”) (NYSE: SD) today announced

the closing of its previously announced acquisition of certain producing assets and leasehold interests in the Cherokee play of the Western

Anadarko Basin for $144 million, before customary purchase price adjustments. The Company funded the transaction with cash on hand. SandRidge

also provided updated guidance for the full-year 2024, incorporating contributions from the new producing assets and joint development

program, and made available an investor presentation regarding the acquisition on its website at investors.sandridgeenergy.com.

Full-Year 2024 Guidance Update

Presented in the table below is the Company’s

updated operational and capital expenditure guidance for 2024(1):

| | |

| Prior 2024E

Guidance(2) | | |

| Updated 2024E

Guidance(3) | |

| Production | |

| | | |

| | |

| Oil (MMBbls) | |

| 0.7 - 0.9 | | |

| 0.8 – 1.1 | |

| Natural Gas Liquids (MMBbls) | |

| 1.3 - 1.7 | | |

| 1.6 – 1.9 | |

| Total Liquids (MMBbls) | |

| 2.0 - 2.6 | | |

| 2.4 – 3.0 | |

| Natural Gas (Bcf) | |

| 16.2 - 19.8 | | |

| 17.7 – 20.5 | |

| Total Production (MMBoe) | |

| 4.7 - 5.9 | | |

| 5.4 – 6.4 | |

| | |

| | | |

| | |

| Total Capital Expenditures | |

| | | |

| | |

| Drilling & Completions (“D&C”) | |

| - | | |

| $17 - $20 million | |

| Production Optimization, Leasehold and other non-D&C | |

| $8 - $11 million | | |

| $16 - $19 million | |

| Total Capital Expenditures | |

| $8 - $11 million | | |

| $33 - $39 million | |

| | |

| | | |

| | |

| Expenses | |

| | | |

| | |

| Lease Operating Expenses (“LOE”) | |

| $35 - $43 million | | |

| $36 - $43 million | |

| Adjusted General & Administrative

(“G&A”) Expenses(4) | |

| $8 - $11 million | | |

| $8.5 – $11 million | |

| Severance and Ad Valorem Taxes (% of Revenue) | |

| 6% - 7% | | |

| 6% - 7% | |

Updated 2024E Guidance Highlights

| ● | LOE and G&A decreasing on a $/Boe basis combined with

increased asset base and expanded activity |

| ● | Production and Revenue are benefited from the Western Anadarko

Basin acquisition for September through December period(3), with additional benefit in 2025 and beyond |

| ● | D&C Capex is based on the completion of 4 drilled uncompleted

(“DUC”) wells and the initiation of a drilling campaign including up to 3 new wells by year end |

| ● | Non-D&C / Production Optimization Capex includes rod

pump conversions, NW Stack heel fracs, leasing in focused areas and other projects |

Investor Presentation

The Company made available an investor presentation regarding the transaction

on its website at investors.sandridgeenergy.com.

Legal Advisor

Winston & Strawn LLP is serving as SandRidge’s legal advisor

for the transaction.

Contact Information

Investor

Relations

SandRidge

Energy, Inc.

1 E. Sheridan

Ave. Suite 500

Oklahoma

City, OK 73104

investors@sandridgeenergy.com

About SandRidge Energy, Inc.

SandRidge Energy, Inc. (NYSE: SD) is an independent oil and gas company

engaged in the development, acquisition, and production of oil and gas assets. Its primary area of operations is the Mid-Continent and

Western Anadarko regions in Oklahoma, Texas, and Kansas. Further information can be found at sandridgeenergy.com.

| (1) |

No change to 2024E guidance for commodity price differentials versus what was provided on March 6, 2024. |

| (2) |

As disclosed on March 6, 2024. |

| (3) |

July and August production and revenue will be reported as a negative adjustment to the gross purchase price as a result of a transaction effective date of July 1, 2024. |

| (4) |

Adjusted G&A excludes stock-based compensation. |

Cautionary Note to Investors - This press

release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are neither historical facts nor

assurances of future performance and reflect SandRidge’s current beliefs and expectations regarding future events and operating

performance. The forward-looking statements include projections and estimates of the Company’s corporate strategies, anticipated

financial impacts of the transaction, future operations, development plans and appraisal programs, drilling inventory and locations,

estimated oil, natural gas and natural gas liquids production, price realizations and differentials. We have based these forward-looking

statements on our current expectations and assumptions and analyses made by us in light of our experience and our perception of historical

trends, current conditions and expected future developments, as well as other factors we believe are appropriate under the circumstances.

However, whether actual results and developments will conform with our expectations and predictions is subject to a number of risks and

uncertainties, including the performance and anticipated benefits of the acquired interests, the volatility of oil and natural gas prices,

our success in discovering, estimating, developing and replacing oil and natural gas reserves, actual decline curves and the actual effect

of adding compression to natural gas wells, the availability and terms of capital, the ability of counterparties to transact with us

to meet their obligations, our timely execution of hedge transactions, credit conditions of global capital markets, changes in economic

conditions, the amount and timing of future development costs, the availability and demand for alternative energy sources, regulatory

changes, including those related to carbon dioxide and greenhouse gas emissions, and other factors, many of which are beyond our control.

We refer you to the discussion of risk factors in Part I, Item 1A - “Risk Factors” of our Annual Report on Form 10-K and

in comparable “Risk Factor” sections of our Quarterly Reports on Form 10-Q filed after such form 10-K. All of the forward-looking

statements made in this press release are qualified by these cautionary statements. The actual results or developments anticipated may

not be realized or, even if substantially realized, they may not have the expected consequences to or effects on our Company or our business

or operations. Such statements are not guarantees of future performance and actual results or developments may differ materially from

those projected in the forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, except

as required by law.

SandRidge Energy, Inc. (NYSE: SD) is an independent

oil and gas company engaged in the development, acquisition and production of oil and gas properties. Its primary area of operations

is the Mid-Continent and Western Anadarko regions in Oklahoma, Texas, and Kansas. Further information can be found at www.sandridgeenergy.com.

3

v3.24.2.u1

Cover

|

Aug. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 30, 2024

|

| Entity File Number |

1-33784

|

| Entity Registrant Name |

SANDRIDGE

ENERGY, INC.

|

| Entity Central Index Key |

0001349436

|

| Entity Tax Identification Number |

20-8084793

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1 E. Sheridan Ave.

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Oklahoma City

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

73104

|

| City Area Code |

405

|

| Local Phone Number |

429-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

SD

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

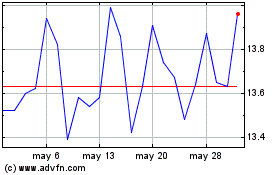

SandRidge Energy (NYSE:SD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

SandRidge Energy (NYSE:SD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024