false

0001349436

0001349436

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

September 30, 2024

SandRidge Energy, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-33784 |

|

20-8084793 |

|

(State or other jurisdiction

of Incorporation) |

|

(Commission file number) |

|

(I.R.S. Employer

Identification No.) |

| 1 E. Sheridan Ave, Suite 500, Oklahoma City, OK 73104 |

| (Address of principal executive offices, zip code) |

Registrant’s telephone number, including

area code: (405) 429-5500

Not Applicable.

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

SD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

Appointment of Jonathan Frates as Executive Vice President and

Chief Financial Officer and Brandon Brown as Senior Vice President and Chief Accounting Officer

On September 30, 2024, Mr.

Jonathan Frates notified the Board of Directors (the “Board”) of SandRidge Energy, Inc. (“SandRidge”

or the “Company”) that he will resign as Chairman of the Board, effective October 1, 2024. Mr. Frates is not resigning

from the Board as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or

practices.

On September 30, 2024, the

Board announced that it had appointed (i) Mr. Frates to serve as the Company’s Executive Vice President and Chief Financial Officer,

effective October 21, 2024 and (ii) Mr. Brandon Brown to serve as the Company’s Senior Vice President and Chief Accounting Officer,

effective October 21, 2024. Mr. Brown will no longer serve as Chief Financial Officer upon the commencement of Mr. Frates’ role

as Chief Financial Officer on October 21, 2024.

Mr. Frates, age 41, has served

most recently as Investment Director of Vision One Management Partners, a Miami-based investment manager from July 2022 through September

2024. Prior to Vision One, Mr. Frates served as Managing Director and Head of Family Office of Daughters Capital Corp., a single-family

office from July 2021 through June 2022, and as Managing Director of Icahn Enterprises L.P., a diversified holding company engaged in

a variety of businesses, from November 2015 through July 2021. Prior to Icahn Enterprises, Mr. Frates held roles at First Acceptance Corp.,

Diamond A Ford Corp., and Wachovia Securities LLC. Mr. Frates has served as Chairman of the Board of Directors of the Company since June

2018. Mr. Frates previously served as a director of Herc Holdings, Inc. from August 2019 until May 2022, VIVUS, Inc. from December 2020

until July 2021, Viskase Companies, Inc. from March 2016 until July 2021, American Railcar Industries, Inc. from March 2016 until December

2018, CVR Refining, LP from April 2016 until January 2019, Ferrous Resources Ltd. from December 2016 until July 2019, CVR Partners from

April 2016 until July 2021, and CVR Energy, Inc. from March 2016 until July 2021. Mr. Frates received a BBA from Southern Methodist University

and an MBA from Columbia Business School.

There is no arrangement or

understanding between Mr. Frates and any other persons pursuant to which Mr. Frates was selected as Executive Vice President and Chief

Financial Officer. There are no family relationships between Mr. Frates and any director, executive officer or person nominated or chosen

by the Company to become an executive officer of the Company within the meaning of Item 401(d) of Regulation S-K under the U.S. Securities

Act of 1933 (“Regulation S-K”). Since the beginning of the Company’s last fiscal year, the Company has not engaged

in any transaction in which Mr. Frates had a direct or indirect material interest within the meaning of Item 404(a) of Regulation S-K.

In connection with the Mr.

Frates’ appointment as Executive Vice President and Chief Financial Officer, the Company designated Mr. Frates as the Company’s

principal financial officer, effective as of October 21, 2024.

Mr. Brown, age 46, served

as the Company’s Senior Vice President and Chief Financial Officer from September 27, 2023 to October 21, 2024. Mr. Brown served

as the Company’s Vice President of Accounting beginning March 2023 and Corporate Controller from June 2020 to March 2023. Prior

to joining the Company in June 2020, Mr. Brown was employed at Black Stone Minerals, L.P. as the Assistant Controller and Financial Reporting

Manager from August 2016 to February 2020. Mr. Brown served as the Assistant Controller and held various other accounting and financial

reporting roles at Goodrich Petroleum Corporation from August 2011 to August 2016. Prior to joining Goodrich Petroleum Corporation, Mr. Brown

was employed as an external auditor at HEIN & Associates LLP and Ernst & Young LLP. Mr. Brown earned his Bachelor

of Science in Accounting from Southern University and A&M College and is a Certified Public Accountant.

There is no arrangement or

understanding between Mr. Brown and any other persons pursuant to which Mr. Brown was selected as Senior Vice President and Chief Accounting

Officer. There are no family relationships between Mr. Brown and any director, executive officer, or person nominated or chose by the

Company to become an executive officer of the Company within the meaning of Item 401(d) of Regulation S-K. Since the beginning of the

Company’s last fiscal year, the Company has not engaged in any transaction in which Mr. Brown had a direct or indirect material

interest within the meaning of Item 404(a) of Regulation S-K.

In connection with Mr. Brown’s

appointment as Senior Vice President and Chief Accounting Officer, the Company designated Mr. Brown as the Company’s principal accounting

officer, effective as of October 21, 2024.

As Executive Vice President

and Chief Financial Officer, Mr. Frates will receive an annual base salary of $335,000 per annum beginning October 21, 2024 and will be

eligible to participate in the Company’s Annual Incentive and Long Term Incentive Plans. Mr. Frates will also be entitled to participate

in the retirement, welfare, incentive, fringe, and perquisite programs generally made available to the executive officers of the Company.

As Senior Vice President and

Chief Accounting Officer, there will be no change to Mr. Brown’s compensatory arrangement and will continue receiving his current

salary and benefits.

Appointment of Vincent Intrieri as Chairman of the Board of Directors

On September 30, 2024, the

Company announced that the Board had appointed Mr. Vincent Intrieri to serve as the Company’s Chairman of the Board, effective October

1, 2024, to fill the vacancy following Mr. Frates’ appointment as Executive Vice President and Chief Financial Officer (the “Intrieri

Appointment”). Mr. Intrieri will also join the Compensation and Nominating and Governance Committees.

Mr. Intrieri, age 68, is

the Founder and CEO of VDA Capital Management LLC, a private investment fund founded in 2017. Mr. Intrieri was previously employed by

entities associated with Carl Icahn from 1998 to 2016 in various investment-related capacities, including most recently as Senior Managing

Director of Icahn Capital LP from 2008 to 2016, and as Senior Managing Director of Icahn Offshore LP from 2004 to 2016 and as Senior Managing

Director of Icahn Offshore LP from 2004 to 2016. Prior to that, Mr. Intrieri was a partner at Arthur Anderson LLP. Mr. Intrieri has served

as a director of Transocean Ltd. and Hertz Global Holdings, Inc. since 2014. Mr. Intrieri previously served as a director of Navistar

International Corporation from 2012 until 2021. Mr. Intrieri earned his Bachelor of Science in Accounting from Pennsylvania State University.

There is no arrangement or

understanding between Mr. Intrieri and any other persons pursuant to which Mr. Intrieri was selected as Chairman of the Board of Directors.

There are no family relationships between Mr. Intrieri and any director, executive officer or person nominated or chosen by the Company

to become an executive officer of the Company within the meaning of Item 401(d) of Regulation S-K. Since the beginning of the Company’s

last fiscal year, the Company has not engaged in any transaction in which Mr. Intrieri had a direct or indirect material interest within

the meaning of Item 404(a) of Regulation S-K. Mr. Intrieri will enter into the Company’s standard form of directors’ indemnification

agreement with the Company, pursuant to which the Company agrees to indemnify its directors to fullest extent permitted by applicable

law and to advance expenses in connection with proceedings as described in the indemnification agreement.

Item 7.01. Regulation FD

Disclosure.

On October 1, 2024, the Company

issued a press release, attached as Exhibit 99.1, announcing Mr. Intrieri’s appointment as Chair of the Board, Mr. Frates’

appointment as Executive Vice President and Chief Financial Officer, and Mr. Brown’s appointment as Senior Vice President and Chief

Accounting Officer (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

The information set forth

in this Item 7.01 and the attached Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SandRidge Energy, Inc. |

|

| |

|

|

| By: |

/s/ Grayson Pranin |

|

| |

Grayson Pranin |

|

| |

President & Chief Executive Officer |

|

Date: October 1, 2024

3

Exhibit 99.1

NEWS RELEASE

SANDRIDGE ENERGY, INC. ANNOUNCES APPOINTMENT

OF VINCENT INTRIERI AS CHAIRMAN

OF THE BOARD AND JONATHAN FRATES AS CHIEF FINANCIAL OFFICER

Oklahoma City, Oklahoma, October 1, 2024 /

PRNewswire / -- SandRidge Energy, Inc. (the “Company” or “SandRidge”) (NYSE: SD) today announced changes to

the Board and Management that will further position the Company to execute on its strategy.

Vincent (“Vince”) Intrieri has been

appointed by the Board, by recommendation of the Nominating and Governance Committee, as Chairman effective October 1, 2024.

Mr. Intrieri is the Founder and CEO of VDA Capital

Management LLC, a private investment fund founded in 2017. Mr. Intrieri was previously employed by Carl C. Icahn-related entities in various

investment-related capacities from 1998 to 2016. From 2008 to 2016, Mr. Intrieri served as Senior Managing Director of Icahn Capital LP,

the entity through which Carl C. Icahn manages private investment funds. In addition, from 2004 to 2016, Mr. Intrieri was a Senior Managing

Director of Icahn Onshore LP, the general partner of Icahn Partners LP, and Icahn Offshore LP, the general partner of Icahn Partners Master

Fund LP, entities through which Mr. Icahn invests in securities. Mr. Intrieri has served as a director of Transocean Ltd. (NYSE: RIG)

since 2014 and Hertz Global Holdings, Inc. (NYSE: HTZ) since 2014. Mr. Intrieri previously served as a director of Navistar International

Corporation from 2012 until 2021, Energen Corporation from March 2018 until November 2018, Conduent Incorporated from 2017 to 2018, Chesapeake

Energy Corporation from 2012 to 2016, CVR Refining, GP, LLC, the general partner of CVR Refining, LP, from 2012 to 2014, Ferrous Resources

Limited from 2015 to 2016, Forest Laboratories Inc. from 2013 to 2014, CVR Energy, Inc. from 2012 to 2014, Federal-Mogul Holdings Corporation

from 2007 to 2013, Icahn Enterprises L.P. from 2006 to 2012, and was Senior Vice President of Icahn Enterprises L.P. from 2011 to 2012.

Mr. Intrieri was also a director of Dynegy Inc. from 2011 to 2012, and Chair and a director of PSC Metals Inc. from 2007 to 2012. He served

as a director of Motorola Solutions, Inc. from 2011 to 2012, XO Holdings from 2006 to 2011, National Energy Group, Inc. from 2006 to 2011,

American Railcar Industries, Inc. from 2005 to 2011, WestPoint Home LLC from 2005 to 2011, and as Chair and a director of Viskase Companies,

Inc. from 2003 to 2011. Ferrous Resources Limited, CVR Refining, CVR Energy, American Railcar Industries, Federal-Mogul, Icahn Enterprises,

XO Holdings, National Energy Group, WestPoint Home, Viskase Companies and PSC Metals each are or previously were indirectly controlled

by Carl C. Icahn. Mr. Icahn also has or previously had a noncontrolling interest in Dynegy, Hertz, Forest Laboratories, Navistar, Chesapeake

Energy, Motorola Solutions and Transocean through the ownership of securities. Mr. Intrieri graduated, with Distinction, from The Pennsylvania

State University (Erie Campus) with a B.S. in Accounting in 1984. Mr. Intrieri was a certified public accountant.

Mr. Intrieri said, “I am eager to join SandRidge

as Chairman of the Board while the Company enters its next chapter. We plan to keep the organization lean while continuing to pursue capital

returns, efficient drilling programs and other disciplined growth opportunities. I want to thank Jonathan for his service over the past

six years and look forward to working with him and the team on the next phase of the business.”

Jonathan Frates will step down as Chairman of

the Board, effective October 1, 2024, to transition to the role of Executive Vice President and Chief Financial Officer, effective October

21, 2024.

Mr. Frates has served most recently as Investment

Director of Vision One Management Partners, a Miami-based investment manager from July 2022 through September 2024. Prior to Vision One,

Mr. Frates served as Managing Director and Head of Family Office of Daughters Capital Corp., a single-family office from July 2021 through

June 2022, and as Managing Director of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, from

November 2015 through July 2021. Prior to Icahn Enterprises, Mr. Frates held roles at First Acceptance Corp., Diamond A Ford Corp., and

Wachovia Securities LLC. Mr. Frates has served as Chairman of the Board of Directors of the Company since June 2018. Mr. Frates previously

served as a director of Herc Holdings, Inc. from August 2019 until May 2022, VIVUS, Inc. from December 2020 until July 2021, Viskase Companies,

Inc. from March 2016 until July 2021, American Railcar Industries, Inc. from March 2016 until December 2018, CVR Refining, LP from April

2016 until January 2019, Ferrous Resources Ltd. from December 2016 until July 2019, CVR Partners from April 2016 until July 2021, and

CVR Energy, Inc. from March 2016 until July 2021. Mr. Frates received a BBA from Southern Methodist University and an MBA from Columbia

Business School.

Mr. Frates said, “Following the recent

Anadarko Basin acquisition I see the opportunity to join the team at SandRidge too compelling to pass up. The Company provides a

stable platform and proven team to efficiently grow production and continue creating value for all stakeholders. I look forward to

working even more closely with the team and welcome our new Chairman to the Board. I am excited for the future of SandRidge and the

opportunity that lies ahead.”

Brandon Brown, Sr., will assume the role of Senior

Vice President, Chief Accounting Officer. Mr. Brown most recently served as Chief Financial Officer since September 2023 and as the Company’s

Corporate Controller since June 2020. Grayson Pranin, Chief Executive Officer, said, “We appreciate Brandon’s leadership over

the last several years, and for his continued efforts in leading the Company’s Accounting activities. The further strengthened team,

with Brandon’s continuity in accounting, Jonathan’s experience in finance, M&A and public markets, as well as Vince’s

own demonstrable leadership and experience in the public and energy sectors, will further position the Company to execute its strategy,

while integrating the assets associated with our recent acquisition.”

About SandRidge Energy, Inc.

SandRidge Energy, Inc. (NYSE: SD) is an independent

oil and gas company engaged in the production, development and acquisition of oil and gas properties. Its primary area of operations is

the Mid-Continent and Anadarko regions in Oklahoma, Texas, and Kansas. Further information can be found at www.sandridgeenergy.com.

Contact Information

Investor Relations

SandRidge Energy, Inc.

1 E. Sheridan Ave. Suite 500

Oklahoma City, OK 73104

investors@sandridgeenergy.com

v3.24.3

Cover

|

Sep. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 30, 2024

|

| Entity File Number |

1-33784

|

| Entity Registrant Name |

SandRidge Energy, Inc.

|

| Entity Central Index Key |

0001349436

|

| Entity Tax Identification Number |

20-8084793

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1 E. Sheridan Ave

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Oklahoma City

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

73104

|

| City Area Code |

405)

|

| Local Phone Number |

429-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

SD

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

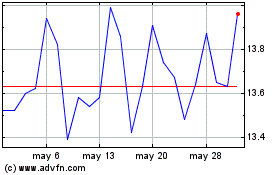

SandRidge Energy (NYSE:SD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

SandRidge Energy (NYSE:SD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024