0001477294false00014772942024-12-172024-12-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

__________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 17, 2024

__________________________________________

SENSATA TECHNOLOGIES HOLDING PLC

(Exact name of Registrant as specified in its charter)

__________________________________________

| | | | | | | | | | | | | | |

| England and Wales | | 001-34652 | | 98-1386780 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

529 Pleasant Street

Attleboro, Massachusetts 02703, United States

(Address of Principal executive offices, including Zip Code)

+1(508) 236 3800

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

__________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Ordinary Shares - nominal value €0.01 per share | ST | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(1)On December 17, 2024, the Board of Directors (the “Board”) of Sensata Technologies Holding plc (the “Company”) announced the appointment of Stephan von Schuckmann as Chief Executive Officer (“CEO”) of the Company, effective upon his commencement of employment, which is to begin on January 1, 2025 (the “Employment Date”). The Board also approved the appointment of Mr. von Schuckmann to the Company’s Board effective as of the Employment Date to serve until the Company’s 2025 Annual Meeting of Shareholders (“2025 Meeting”) as a non-independent director. Martha Sullivan will remain as the Company’s interim President and CEO until immediately prior to the Employment Date and will thereafter continue to serve her term as a non-independent director of the Company. Ms. Sullivan has agreed to assume a Special Advisor role to Mr. von Schuckmann for a period of up to six months following the Employment Date, to ensure a seamless transition of her duties. She will receive a $20,000 monthly stipend for these services. She will also receive the standard annual cash retainer payable to non-executive directors, prorated from the Employment Date to the 2025 Meeting.

Mr. von Schuckmann, age 50, has decades of financial, operational, and strategic leadership experience in the automotive and technology sectors. Most recently, he served as a Member of the Management Board of ZF Friedrichshafen AG (“ZF”) and oversaw ZF’s Electric Mobility, Procurement, and Asia Pacific Region divisions from January 2021 until July 2024. He held various leadership roles at ZF within its car division, including Executive Vice President and CEO, Powertrain Technology & Electric Mobility from October 2018 to January 2021, Senior Vice President and Chief Financial Officer, Powertrain Technology from October 2015 to September 2018, and Vice President, Restructuring & Performance Improvement Program, Powertrain Technology from March 2015 to September 2015. Prior to joining ZF, he served in various leadership capacities at Robert Bosch Automotive Steering, including Vice President, Business Unit Aftermarket, Small Series & Military from January 2012 to February 2015 and Managing Director & Plant Manager from January 2005 to December 2011. Mr. von Schuckmann studied Engineering and Economics in Germany at the University of Paderborn and Ruprecht-Karls-University Heidelberg, respectively, and holds a Master of Commerce in Accounting & Finance from Macquarie University, Sydney, Australia.

Mr. von Schuckmann currently resides in Germany. In connection with his appointment as CEO, the Company entered into three agreements (collectively the “Agreements”) with Mr. von Schuckmann: (1) A German employment agreement with a German subsidiary of the Company (the “German Employment Agreement”), (2) a U.S. employment agreement with a U.S. subsidiary of the Company (the “U.S. Employment Agreement”) and (3) an incentive compensation agreement with the Company (the “U.K. Letter Agreement”). The German Employment Agreement will govern the terms of Mr. von Schuckmann’s employment and the U.K. Letter Agreement will govern the terms of Mr. von Schuckmann’s incentive compensation starting on the Employment Date until Mr. von Schuckmann relocates and commences employment in the United States, whereupon, the U.S. Employment Agreement will become effective and will replace the German Employment Agreement.

During Mr. von Schuckmann’s employment, he will receive an initial base salary of $1,117,000 per year and an annual cash incentive opportunity with a target of 125% of base salary and a maximum of 200% of base salary. Mr. von Schuckmann will also be eligible to participate in the benefit programs available to Sensata’s other senior executive employees.

Mr. von Schuckmann will receive an equity grant with a grant date fair value equal to $1,000,000 to make him whole for certain ZF compensation opportunities previously granted to him, and will consist of 45% time-based restricted stock units and 55% performance-based restricted stock units (“Replacement Awards”). The vesting of these awards will accelerate in the event that Mr. von Schuckmann’s employment is terminated by Sensata without cause or he resigns for good reason. Pursuant to the U.K. Letter Agreement, Mr. von Schuckmann will also receive a one-time lump sum cash payment of €1,267,000, to be paid promptly following the Employment Date, to compensate for the forfeiture of certain ZF cash incentive opportunities previously granted to him (“Replacement Cash Payment”). If the German Employment Agreement is terminated by Sensata without cause prior to the Employment Date, Mr. von Schuckmann will be entitled to the cash value of the Replacement Awards and the Replacement Cash Payment.

Mr. von Schuckmann will receive a signing equity award in lieu of an annual equity award for fiscal year 2025 with a grant date fair value equal to $6,500,000, consisting of 45% time-based restricted stock units and 55% performance-based restricted stock units. Commencing in the Company’s fiscal year 2026, Mr. von Schuckmann will be eligible to receive an annual equity award pursuant to the terms of the Company’s shareholder approved equity plans, as

determined by the Compensation Committee of the Board. Mr. von Schuckmann will also receive a one-time lump sum cash signing bonus of $150,000, to be paid within 45 days following the Employment Date.

Pursuant to the Agreements, if Mr. von Schuckmann’s employment is terminated by Sensata on or following the Employment Date without cause or by Mr. von Schuckmann for good reason, Mr. von Schuckmann will be entitled to a severance payment equal to two years of his then-current base salary and the sum of the actual annual bonuses paid to him in the prior two years, plus continued participation in Sensata’s health and dental benefit plans for two years following the date of termination.

Mr. von Schuckmann does not have (i) any arrangements or understandings with any other person pursuant to which he was selected to serve as an officer; (ii) any family relationships with any director or executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer; or (iii) any direct or indirect material interest in any transaction or series of transactions contemplated by Item 404(a) of Regulation S-K.

(2)On December 17, 2024, the Board of the Company approved cash bonus payments of $500,000 to each of Brian Roberts, the Company’s Chief Financial Officer, and Lynne Caljouw, the Company’s Chief Administrative Officer, in connection with and in recognition of the increased responsibilities associated with recruiting Mr. von Schuckmann (the “Cash Bonus Payments”). The Cash Bonus Payments are payable April 30, 2025 (the “Payment Date”), subject to continued employment on the Payment Date. Notwithstanding the foregoing, the Cash Bonus Payments would become payable if Mr. Roberts or Ms. Caljouw are terminated without cause prior to the Payment Date.

Item 7.01 Regulation FD Disclosure

A copy of the Company’s press release relating to the announcement described in Item 5.02, dated December 17, 2024, is furnished as Exhibit 99.1 to this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 99.1 | |

104 | Cover Page Interactive Data File (embedded within inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | SENSATA TECHNOLOGIES HOLDING PLC |

| | | |

| | | | | /s/ David K. Stott |

| Date: | December 17, 2024 | | | | Name: David K. Stott |

| | | | | Title: Senior Vice President, General Counsel and Corporate Secretary |

SENSATA TECHNOLOGIES APPOINTS NEW CHIEF EXECUTIVE OFFICER

Stephan von Schuckmann Brings Extensive Experience in E-Mobility,

Automotive, and Industrial Technology to Sensata

Swindon, United Kingdom – December 17, 2024 - Sensata Technologies (NYSE: ST), a global industrial technology company and leading provider of sensors, sensor-rich solutions and electrical protection devices used in mission-critical systems to help its customers address increasingly complex engineering and operating performance requirements, today announced that its Board of Directors has appointed Stephan von Schuckmann as its new Chief Executive Officer (“CEO”) effective January 1, 2025. Mr. von Schuckmann will also become a member of the Board at that time.

Mr. von Schuckmann has more than 20 years of global automotive and industrials experience. Most recently, he was a Member of the Board of Management at ZF Friedrichshafen AG (“ZF Group”) with global leadership responsibility of its electric mobility division, the largest division within ZF Group with annual revenue of more than $12 billion. Additionally, Mr. von Schuckmann oversaw the Asia Pacific region and global procurement operations.

Andrew Teich, Chairman of the Board of Sensata, said: “On behalf of the Sensata Board of Directors, I am excited to welcome Stephan as our new CEO. At the conclusion of our thorough search process, the Board unanimously approved Stephan’s appointment. His extensive experience in the automotive and industrial sectors, including both conventional and electrified powertrains, gives us confidence that Sensata will execute strongly against the opportunities before us. Stephan has an exceptional track record of value creation, and we look forward to his leadership at Sensata.”

Incoming CEO Stephan von Schuckmann said: “I am very excited to be joining Sensata at this pivotal time in its growth cycle. With a long tenure of innovative product development focused on providing high-value sensor and electrical protection solutions, I believe Sensata is uniquely positioned to support its customers with applications that meet the needs of a safer, cleaner, and more efficient world. Sensata possesses many strengths, not the least of which are its longstanding customer relationships, global manufacturing footprint, and an outstanding team of dedicated employees. I look forward to working with the team to deliver value for all constituents.”

Mr. Teich added: “I would also like to thank Martha Sullivan, for stepping back into the CEO role on an interim basis and for her leadership in the search for a new CEO. Her decades of experience and dedication to Sensata ensured that the Company would continue to execute during this period of transition. In addition to her continuing role on the Board, she has graciously agreed to act as a special advisor to Stephan as he assumes his new responsibilities.”

About Stephan Von Schuckmann

Stephan Von Schuckmann has over 20 years of expertise as a global industry leader. He possesses a robust industrial, commercial, and financial background which has uniquely prepared him to lead Sensata by capitalizing on opportunities and navigating the challenges of its diverse industries. He also brings a proven track record in driving business transformations on a global scale, most notably the transition from conventional to electric powertrains at ZF Group.

In addition to his most recent responsibilities leading ZF Group’s electric mobility division, procurement operations, and Asia Pacific region, his prior roles at ZF Group include CEO of Car Powertrain and Electric Mobility; CFO of the Car Powertrain Technology Division; VP of Restructuring and Improvement in the Car Powertrain Technology Division; VP of Aftermarket and Military for Robert Bosch Automotive Steering; and MD and Plant Manager for Robert Bosch Automotive Steering.

He holds a master’s degree of Commerce in Accounting & Finance from Macquarie University in Sydney, Australia, and completed undergraduate studies in economics at Ruprecht-Karls-University of Heidelberg and in engineering at the University of Paderborn.

About Sensata Technologies

Sensata Technologies is a global industrial technology company striving to create a safer, cleaner, more efficient and electrified world. Through its broad portfolio of mission-critical sensors, electrical protection components and sensor-rich solutions, Sensata helps its customers address increasingly complex engineering and operating performance requirements. With more than 19,000 employees and global operations in 15 countries, Sensata serves customers in the automotive, heavy vehicle & off-road, industrial, and aerospace markets. Learn more at www.sensata.com and follow Sensata on LinkedIn, Facebook, X, and Instagram.

Safe Harbor Statement

This news release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by terminology such as "may," "will," "could," "should," "expect," "anticipate," "believe," "estimate," "predict," "project," "forecast," "continue," "intend," "plan," "potential," "opportunity," "guidance," and similar terms or phrases. Forward-looking statements involve, among other things, expectations, projections, and assumptions about future financial and operating results, objectives, business and market outlook, megatrends, priorities, growth, shareholder value, capital expenditures, cash flows, demand for products and services, share repurchases, and Sensata’s strategic initiatives, including those relating to acquisitions and dispositions and the impact of such transactions on our strategic and operational plans and financial results. These statements are subject to risks, uncertainties, and other important factors relating to our operations and business environment, and we can give no assurances that these forward-looking statements will prove to be correct.

A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by these forward-looking statements, including, but not limited to, risks related to public health crises, instability and changes in the global markets, supplier interruption or non-performance, the acquisition or disposition of businesses, adverse conditions or competition in the industries upon which we are dependent, intellectual property, product liability, warranty, and recall claims, market acceptance of new product introductions and product innovations, labor disruptions or increased labor costs, and changes in existing environmental or safety laws, regulations, and programs.

Investors and others should carefully consider the foregoing factors and other uncertainties, risks, and potential events including, but not limited to, those described in Item 1A: Risk Factors in our most recent Annual Report on Form 10-K and as may be updated from time to time in Item 1A: Risk Factors in our quarterly reports on Form 10-Q or other subsequent filings with the United States Securities and Exchange Commission. All such forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update these statements other than as required by law.

###

Media & Investor Contact:

James Entwistle

+1 (508) 954-1561

jentwistle@sensata.com

investors@sensata.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

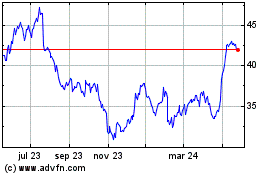

Sensata Technologies (NYSE:ST)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

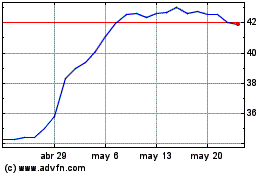

Sensata Technologies (NYSE:ST)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025