Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

31 Julio 2024 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 31, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly Held Company

Corporate Taxpayer ID (CNPJ/MF) No. 16.404.287/0001-55

Company Registry (NIRE) 29.3.0001633-1

MATERIAL FACT

São Paulo, July 31st, 2024 – Suzano S.A. (“Company” or “Suzano”) (B3:SUZB3/ NYSE: SUZ), in compliance with the provisions of Law No. 6,404, dated as of December 15th, 1976, as amended, of CVM Resolution No. 44, dated as of August 23rd, 2021 and of CVM Resolution No. 80, dated as of March 29th, 2022, as amended, in line with corporate governance best practices, and in addition to information disclosed through the Material Fact of December 23rd, 2023, hereby informs its shareholders and the market in general the conclusion, on this date, of the acquisition by the Company of the totality of the capital shares of Timber VII SPE S.A. (CNPJ 23.741.553/0001-09) and Timber XX SPE S.A. (CNPJ 40.157.006/0001-91) (“Target Companies”) (“Transaction”), managed by BTG Pactual Timberland Investment Group, LLC., since all conditions precedent have been fulfilled and closing acts have been performed as established in the share purchase and sale agreements executed on December 23rd, 2023.

In consideration for the shares of the Target Companies and considering the corrections and adjustments provided for in the agreements, the Transaction was settled on this date, at the price of BRL 2,122,859,858.01 (Two billion, one hundred and twenty-two million, eight hundred and fifty-nine thousand, eight hundred and fifty-eight reais and one cent), which is subject to non-material post-closing adjustments to reflect the position of the Target Companies as of the closing date, with respect to the usual economic and operational aspects of this type of Transaction.

The Target Companies own approximately 70,000 hectares of land in the state of Mato Grosso do Sul, in the coverage region of Suzano’s operations, with 50,000 hectares of productive area, in which part of it has eucalyptus plantation with different ages.

The Company reiterates that the Transaction is aligned with its strategy to create optionality to its business and to expand its wood supply self-sufficiency.

Lastly, as per information disclosed in this Material Fact, Suzano reiterates its commitment to keep shareholders and the market in general informed about matters of interest to its shareholders and the market.

São Paulo, July 31st, 2024.

Marcelo Feriozzi Bacci

Chief Financial and Investor Relations Officer

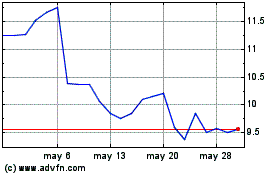

Suzano (NYSE:SUZ)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

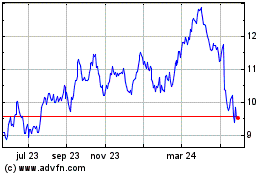

Suzano (NYSE:SUZ)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024