Onboarding of Traceability Customers Continues

to Accelerate; Company Ends Quarter with $24.5 Million in Cash, No

Debt

ReposiTrak (NYSE: TRAK), the world's largest food traceability

and regulatory compliance network, built upon its proven inventory

management and out-of-stock reduction SaaS platform, today

announced financial results for the third fiscal quarter (“FQ3

2024”) ended March 31, 2024.

Third Quarter Financial Highlights:

- Third quarter total revenue increased 5% to $5.1 million from

$4.8 million.

- Recurring revenue increased 6%, net of the planned elimination

of high-touch, low-opportunity revenue, to $5.1 million from $4.8

million, representing approximately 99% of total revenue.

- Quarterly operating expense increased 15% to $3.8 million from

$3.3 million. The third fiscal quarter last year included

approximately $1 million in an Employee Retention Credit (“ERC”),

reducing general and administrative expenses.

- Quarterly operating income decreased 17% to $1.3 million from

$1.5 million last year. Excluding the non-recurring ERC credit in

the third fiscal quarter last year, operating income would have

increased approximately $800,000 year-over-year.

- Quarterly GAAP net income decreased 7% to $1.6 million from

$1.7 million last year. Excluding the non-recurring ERC credit in

the third fiscal quarter last year, net income would have increased

approximately $900,000 year-over-year.

- Quarterly net income to common shareholders was $1.4 million,

down 7% from $1.5 million last year. Excluding the non-recurring

ERC credit in the third fiscal quarter last year, net income to

common shareholders would have increased approximately $900,000

year-over-year.

- Quarterly EPS of $0.08, unchanged from the prior year.

- During the quarter, the Company redeemed 70,093 preferred

shares for the stated redemption price of $10.70 per share for a

total of $749,995.

- The Company finished the quarter with $24.5 million in cash and

no bank debt.

Randall K. Fields, Chairman and CEO of ReposiTrak, commented,

“We continue to add new retailers and suppliers to the ReposiTrak

Traceability Network. Revenue from traceability now represents

approximately 5% of our consolidated revenue, on an annualized

basis, and we are more confident than ever that Traceability will

double our revenue over the next three years. The production

facilities in hand that have been already been implemented, and

those in the queue to be implemented in the ReposiTrak Traceability

Network (RTN), already exceed our initial estimates for the market

size and represents an annual recurring revenue (ARR) that is

expected to double our revenue base over the next three years.”

“Meanwhile, we continue to maintain robust profitability,

returning capital to shareholders in the form of a cash dividend,

redeeming preferred shares, all while growing our cash balances,”

added Fields. “This approach will not change. ReposiTrak is the

clear leader in the rapidly unfolding traceability industry, as

evidenced by our market share, industry endorsements, and the

near-term investments are already beginning to lead to higher

revenue, earnings, and cash as the FSMA 204 deadline is right

around the corner.”

Third Fiscal Quarter Financial Results (three

months ended March 31, 2024, vs. three months ended March 31,

2023):

Total revenue was up 5% to $5.08 million as compared to $4.82

million in the prior-year third quarter. Total operating expenses

were $3.82 million, up 15% compared to $3.30 million last year.

General and administrative expenses increased by 48%. GAAP net

income was $1.55 million compared to $1.66 million. Net income to

common shareholders was $1.42 million, or $0.08 per diluted share,

compared to $1.52 million, or $0.08 per diluted share.

Year-to-Date Financial Results (nine months ended March

31, 2024, vs. nine months ended March 31, 2023):

Total revenue was up 7% to $15.27 million as compared to $14.30

million in the prior-year period. Total operating expense was

$11.57 million, up 12% compared to $10.37 million last year. The

third fiscal quarter last year included non-recurring Employee

Retention Credit benefit of approximately $1 million, reducing the

year-ago operating expense. Inclusive of the impact of this credit

in the year-ago quarter, GAAP net income was $4.38 million compared

to $4.21 million. Net income to common shareholders was $3.95

million, or $0.22 per basic and $0.21 per diluted share, compared

to $3.77 million, or $0.20 per basic and $0.20 per diluted share

last year.

Return of Capital:

In the third quarter of fiscal 2024, the Company redeemed

another 70,093 preferred shares at the stated redemption price of

$10.70 per share for a total of $749,995. The remaining amount of

the preferred share redemption is $7.46 million. As previously

announced, the Company anticipates redeeming all of its preferred

shares issued and outstanding over the next three years. In

addition, the Company has approximately $8 million remaining on the

$21 million total common share buyback authorization.

In September 2022, the Company’s Board of Directors declared a

quarterly cash dividend of $0.015 per share ($0.06 per year). In

November 2023, the Board of Directors approved a 10% increase in

the quarterly cash dividend, to 6.6 cents per share annually, or

1.65 cents per share quarterly, commencing with the December 2023

dividend.

Balance Sheet:

The Company had $24.5 million in cash and cash equivalents at

March 31, 2024, compared to $24.0 million at June 30, 2023. The

Company had nothing drawn on its working line of credit as of March

31, 2024 or June 30, 2023.

Conference Call:

The Company will host a conference call at 4:15 p.m. Eastern

today to discuss the Company’s results. The conference call will

also be webcast and will be available via the investor relations

section of the Company’s website, www.parkcitygroup.com.

Participant Dial-In Numbers: Date: Wednesday, May 15,

2024 Time: 4:15 p.m. ET (1:15 p.m. PT) Toll-Free: 1-877-300-8521

Toll/International 1-412-317-6026 Conference ID: 10188893

Replay Dial-In Numbers: Toll Free: 1-844-512-2921

Toll/International: 1-412-317-6671 Replay Start: Wednesday, May 15,

2024, 7:15 p.m. ET Replay Expiry: Saturday, June 15, 2024, at 11:59

PM ET Replay Pin Number: 10188893

About ReposiTrak

ReposiTrak (NYSE:TRAK), formerly Park City Group, provides

retailers, suppliers and wholesalers with a robust solution suite

to help reduce risk and remain in compliance with regulatory

requirements, enhance operational controls and increase sales with

unrivaled brand protection. Consisting of three product families –

food traceability, compliance and risk management and supply chain

solutions – ReposiTrak’s integrated, cloud-based applications are

supported by an unparalleled team of experts. For more information,

visit https://repositrak.com

Forward-Looking Statement

Any statements contained in this document that are not

historical facts are forward-looking statements as defined in the

U.S. Private Securities Litigation Reform Act of 1995. Words such

as “anticipate,” “believe,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “project,” “predict,” “if”, “should” and

“will” and similar expressions as they relate to Park City Group,

Inc., Park City Group d/b/a ReposiTrak, or ReposiTrak (“Park City

Group”) are intended to identify such forward-looking statements.

Park City Group may from time-to-time update these publicly

announced projections, but it is not obligated to do so. Any

projections of future results of operations should not be construed

in any manner as a guarantee that such results will in fact occur.

These projections are subject to change and could differ materially

from final reported results. For a discussion of such risks and

uncertainties, see “Risk Factors” in Park City Group annual report

on Form 10-K, its quarterly report on Form 10-Q, and its other

reports filed with the Securities and Exchange Commission under the

Securities Exchange Act of 1934, as amended. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the dates on which they are made.

REPOSITRAK, INC.

Consolidated Condensed Balance

Sheets (Unaudited)

March 31, 2024

June 30, 2023

Assets

Current Assets

Cash and cash equivalents

$

24,452,680

$

23,990,879

Receivables, net of allowance for doubtful

accounts of $226,198 and $170,103 at March 31, 2024 and June 30,

2023, respectively

3,776,472

2,523,019

Contract asset – unbilled current

portion

147,520

186,959

Prepaid expense and other current

assets

451,041

573,763

Total Current Assets

28,827,713

27,274,620

Property and Equipment, net

591,724

986,300

Other Assets:

Deposits and other assets

22,414

22,414

Prepaid expense – less current portion

6,677

36,282

Contract asset – unbilled long-term

portion

108,052

108,052

Operating lease – right-of-use asset

265,726

310,796

Customer relationships

164,250

262,800

Goodwill

20,883,886

20,883,886

Capitalized software costs, net

463,036

698,281

Total Other Assets

21,914,041

22,322,511

Total Assets

$

51,333,478

$

50,583,431

Liabilities and Shareholders’

Equity

Current Liabilities

Accounts payable

$

510,412

$

431,387

Accrued liabilities

1,390,232

1,620,000

Contract liability – deferred revenue

2,466,262

1,903,001

Operating lease liability – current

62,725

58,771

Notes payable and financing leases –

current

215,274

219,262

Total Current Liabilities

4,644,905

4,232,421

Long-Term Liabilities

Operating lease liability – less current

portion

215,676

263,047

Notes payable and financing leases – less

current portion

-

206,032

Total Liabilities

4,860,581

4,701,500

Commitments and Contingencies

Stockholders’ Equity:

Preferred Stock; $0.01 par value,

30,000,000 shares authorized;

Series B Preferred, 700,000 shares

authorized; 625,375 shares issued and outstanding at March 31, 2024

and June 30, 2023;

6,254

6,254

Series B-1 Preferred, 550,000 shares

authorized; 72,216 and 212,402 shares issued and outstanding at

March 31, 2024 and June 30, 2023, respectively

722

2,124

Common Stock, $0.01 par value, 50,000,000

shares authorized; 18,221,527 and 18,309,051 issued and outstanding

at March 31, 2024 and June 30, 2023, respectively

182,218

183,093

Additional paid-in capital

65,277,419

67,732,887

Accumulated other comprehensive loss

(31,006

)

-

Accumulated deficit

(18,962,710

)

(22,042,427

)

Total Stockholders’

Equity

46,472,897

45,881,931

Total Liabilities and Stockholders’

Equity

$

51,333,478

$

50,583,431

REPOSITRAK, INC.

Consolidated Condensed

Statements of Operations and Comprehensive Income

(Unaudited)

Three Months Ended March

31,

Nine Months Ended March

31,

2024

2023

2024

2023

Revenue

$

5,084,866

$

4,824,101

$

15,270,729

$

14,295,091

Operating expense:

Cost of services and product support

831,912

840,272

2,571,533

2,539,618

Sales and marketing

1,349,838

1,239,946

4,119,716

3,667,017

General and administrative

1,352,197

916,237

3,978,798

3,392,056

Depreciation and amortization

288,576

305,864

897,479

771,030

Total operating expense

3,822,523

3,302,319

11,567,526

10,369,721

Income from operations

1,262,343

1,521,782

3,703,203

3,925,370

Other income (expense):

Interest income

350,691

275,941

925,297

554,299

Interest expense

(8,036

)

(9,771

)

(21,956

)

(52,481

)

Unrealized gain (loss) on short term

investments

5,429

35,068

48,071

(3,753

)

Other gain

-

-

-

70,047

Income before income taxes

1,610,427

1,823,020

4,654,615

4,493,482

(Provision) for income taxes:

(60,000

)

(160,000

)

(274,491

)

(280,006

)

Net income

1,550,427

1,663,020

4,380,124

4,213,476

Dividends on preferred stock

(134,345

)

(146,611

)

(427,567

)

(439,833

)

Net income applicable to common

shareholders

$

1,416,082

$

1,516,409

$

3,952,557

$

3,773,643

Weighted average shares, basic

18,194,000

18,394,000

18,194,000

18,408,000

Weighted average shares, diluted

18,954,000

18,751,000

18,874,000

18,702,000

Basic income per share

$

0.08

$

0.08

$

0.22

$

0.20

Diluted income per share

$

0.08

$

0.08

$

0.21

$

0.20

REPOSITRAK, INC.

Consolidated Condensed

Statements of Cash Flows (Unaudited)

Nine months

Ended March 31,

2024

2023

Cash flows from operating activities:

Net income

$

4,380,124

$

4,213,476

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

897,479

771,030

Amortization of operating right-of-use

asset

45,070

43,019

Stock compensation expense

260,853

315,216

Bad debt expense

225,000

1,200,000

(Increase) decrease in:

Accounts receivables

(1,439,014

)

86,972

Long-term receivables, prepaids and other

assets

751

655,391

Increase (decrease) in:

Accounts payable

79,025

(309,812

)

Operating lease liability

(43,417

)

(39,777

)

Accrued liabilities

(58,391

)

122,744

Deferred revenue

563,261

7,631

Net cash provided by operating

activities

4,910,741

7,065,890

Cash flows from investing activities:

Purchase of property and equipment

(17,532

)

(133,944

)

Capitalization of software costs

-

(769,243

)

Purchase of marketable securities

(31,006

)

-

Net cash (used in) investing

activities

(48,538

)

(903,187

)

Cash flows from financing activities:

Net (decrease) in lines of credit

-

(2,590,907

)

Common Stock buyback/retirement

(1,515,574

)

(981,194

)

Redemption of series B-1 preferred

(1,499,990

)

-

Proceeds from employee stock plan

111,839

92,728

Dividends paid

(1,286,657

)

(993,037

)

Payments on notes payable and capital

leases

(210,020

)

(209,748

)

Net cash used in financing

activities

(4,400,402

)

(4,682,158

)

Net increase (decrease) in cash and

cash equivalents

461,801

1,480,545

Cash and cash equivalents at beginning of

period

23,990,879

21,460,948

Cash and cash equivalents at end of

period

$

24,452,680

$

22,941,493

Supplemental disclosure of cash flow

information:

Cash paid for income taxes

$

317,944

$

264,486

Cash paid for interest

$

11,711

$

52,481

Cash paid for operating leases

$

54,606

$

53,015

Supplemental disclosure of non-cash

investing and financing activities:

Common stock to pay accrued

liabilities

$

445,980

$

256,977

Dividends accrued on preferred stock

$

427,567

$

439,833

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240515114345/en/

Investor Relations Contact: John Merrill, CFO

Investor-relations@repositrak.com

Or

FNK IR Rob Fink 646.809.4048 rob@fnkir.com

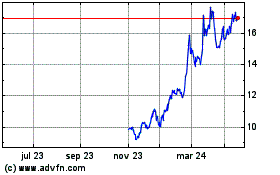

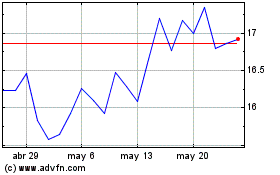

ReposiTrak (NYSE:TRAK)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

ReposiTrak (NYSE:TRAK)

Gráfica de Acción Histórica

De May 2023 a May 2024