Subscription revenue growth reached 22% in

FXN

Gross profit increased by 28% in FXN, reaching

a margin of 74%

Non-GAAP operating income margin reached 14%,

representing a 10p.p. YoY expansion

Free cash flow margin reached 14%, representing

an 8p.p. YoY expansion

VTEX (NYSE: VTEX), the composable and complete commerce platform

for premier brands and retailers, today announced results for the

third quarter of 2024 ended September 30, 2024. VTEX results have

been prepared in accordance with International Financial Reporting

Standards as issued by the International Accounting Standards Board

(“IFRS Accounting Standards”) IAS 34 Interim Financial

Reporting.

Geraldo Thomaz Jr., founder and co-CEO of VTEX, commented, “Our

product innovation and expanded platform capabilities continue to

drive growth, evidenced by our customers’ consistent above-market

performance and our strong new contract signature momentum. This

fuels consistent financial improvements that bring us closer to our

Rule of 40 target. We’ll remain focused on product excellence and

relentlessly dedicate ourselves to meeting the evolving needs of

our customers as we continue to execute our profitable growth

strategy.” Mariano Gomide de Faria, founder and co-CEO of VTEX,

added, “Our strong sales momentum, marked by key go-lives like Fast

Shop in Brazil and US Electrical Services in the US, along with the

expansion of existing customers across Europe and the US,

strengthens our confidence in VTEX’s growth trajectory. We are

solidifying our position as a trusted partner for global brands and

seizing the opportunity to become the backbone for connected

commerce.”

Third Quarter 2024 Financial Highlights

- GMV reached US$4.4 billion in the third quarter of 2024,

representing a YoY increase of 9.5% in USD and 17.1% on an FX

neutral basis.

- Total revenue increased to US$56.0 million in the third quarter

of 2024 from US$50.6 million in the third quarter of 2023,

representing a YoY increase of 10.6% in USD and 18.7% on an FX

neutral basis.

- Subscription revenue represented 96.3% of total revenues,

reaching US$53.9 million in the third quarter of 2024, from US$47.5

million in the third quarter of 2023. This represents a YoY

increase of 13.4% in USD and 21.9% on an FX neutral basis.

- Non-GAAP subscription gross profit was US$42.3 million in the

third quarter of 2024, compared to US$36.2 million in the third

quarter of 2023, representing a YoY increase of 16.8% in USD and

26.9% on an FX neutral basis.

- Non-GAAP subscription gross margin was 78.5% in the third

quarter of 2024, compared to 76.2% in the same quarter of 2023. The

YoY margin expansion of 230 bps was mainly attributable to the

ongoing monitoring of cloud investments, migrating microservices to

more efficient solutions, among other impacts.

- Non-GAAP income from operations was US$7.7 million during the

third quarter of 2024, compared to a Non-GAAP income from

operations of US$1.7 million in the same quarter of 2023.

- Non-GAAP free cash flow was US$7.7 million during the third

quarter of 2024, compared to a Non-GAAP free cash flow of US$2.7

million in the same quarter of 2023.

- As of September 30, 2024, our total headcount was 1,409,

increasing 5.2% QoQ and 10.4% YoY.

Third Quarter 2024 Commercial Highlights:

New customers who initiated their operations with us, among

others:

- Beko in Austria;

- Bemol, Champion Relógios, Fast Shop, Ferramentas Negrão, FQM

Consumo, GrêmioMania, and Jorge Bischoff in Brazil;

- Comfama and Rimax in Colombia;

- Cálidda and Farmacia Universal in Peru; and

- US Electrical Services in the US.

Existing customers expanding their operations with us by opening

new online stores, among others:

- Colgate launched a new store in Switzerland, expanding its

footprint across Switzerland, Brazil, and the US;

- Hearst added two new stores, Harper's Bazaar and Prevention,

bringing their store count to five across the US;

- Keune Haircosmetics launched a new store in the UK, now serving

the UK, Belgium, France, and the Netherlands;

- Mazda expanded into Belgium, now operating in three countries

across Europe; and

- Samsung added two new stores in Uruguay, now operating in three

countries in Latin America.

Third Quarter 2024 Operational Highlights:

We innovate aligned with our guiding principles. We express our

brand through the success of our customers. VTEX key operational

highlights this quarter are:

- Zero friction onboarding and collaboration:

- Colgate-Palmolive, the global leader in oral, skin, and pet

care, continues expanding with VTEX. After successful B2B launches

of PCA Skin Professional and Colgate Oral Professional in the US,

Colgate recently launched Oral Professional in Switzerland, its

first European B2B site on VTEX. Powered by VTEX’s headless global

architecture, the seamless rollout highlights the platform’s

adaptability and scalability across diverse markets and business

models.

- Grupo Arcor, Latin America's leading food and beverage company,

partnered with VTEX to launch TOKIN, a transformative B2B platform

reshaping the distribution ecosystem in Argentina. Connecting

retail points and active buyers, TOKIN has generated sales

accounting for more than 30% of the distributor's sales through the

VTEX Platform. Its success lies in personalized experiences,

real-time inventory, and an optimized checkout, driving high

adoption and engagement. We’re excited to support Arcor as it

expands TOKIN across the region and continues to enhance its

capabilities to drive growth.

- Decathlon, a global leader in sporting goods retail with over

1,700 stores across 64 countries, leveraged VTEX’s Sales App in

Brazil to enhance its omnichannel strategy and create a seamless

shopping experience across both physical and digital stores. By

integrating their sales channels, Decathlon allows customers to

purchase items not in local stock by accessing a unified inventory

across all stores. The VTEX Sales App enabled personalized customer

interactions, real-time stock visibility, and flexible checkout,

ensuring a faster, more agile shopping experience.

- Single control panel for every order:

- Bemol, one of Brazil’s largest retailers, successfully migrated

its entire operation to VTEX, including its B2C franchise and

headless app, seeking a scalable platform to unify operations and

introduce financial solutions like Bemol Store Credit and Bemol

PIX. During the rollout, conversion rates increased by 12% and

average revenue per session by 33%. After full migration, organic

traffic rose 8%, supported by an up to 56% faster load time on

mobile. These improvements enhance the user experience and

strengthen Bemol’s expansion across Brazil, positioning it for

further growth with VTEX.

- Hearst, one of the world’s largest media companies, has

integrated with Sephora using VTEX's multi-site architecture and

developer cloud, VTEX IO, to launch a seamless digital marketplace.

Now featured in top lifestyle publications like Women’s Health,

Cosmopolitan, Harper’s Bazaar, Men’s Health and Prevention, this

integration transforms the reader experience—allowing users to

purchase Sephora products directly from articles. With over 8,500

products available through Sephora’s Beauty Insider loyalty

program, Hearst is redefining how media connects with

commerce.

- VTEX Sales App, designed to unlock customers’ omnichannel

potential and transform retail operations, now allows sales

associates to sell in-store and endless aisle products in one

seamless checkout. Enhanced with multi-cart management features, it

empowers sales associates to serve their consumers with more

personalized experiences and to offer value-added services like

extended warranties. VTEX Sales App improved navigation, search,

and customizable displays, boost efficiency, while new integrations

with Mercado Pago and Cielo simplify payments across Latin

America.

- Commerce on auto-pilot and co-pilot:

- Hinode, a Latin American leader in beauty, fragrances, and

wellness, migrated its B2B operations from a legacy platform to

VTEX to modernize and boost efficiency. Already successful with its

B2C operations in Brazil and Mexico on VTEX, Hinode unified both

B2C and B2B under a single platform for scalability. Using VTEX’s

API-first architecture, they enhanced the reseller experience with

personalized checkout, point-based purchasing, and flexible

delivery options. Since implementing VTEX’s SmartCheckout, Hinode’s

conversion rate increased by more than 5x. We’re excited to support

Hinode’s continued growth across channels.

- VTEX Ad Network is expanding its media kit with new ad types

for diverse formats, such as sponsored products in search

auto-complete and product galleries, boosting visibility and

customer engagement. Also, our ads will now effectively reach

audiences on their preferred mobile devices, with upcoming features

including product recommendation ads and sponsored banners aimed at

engaging shoppers during the consideration phase. Lastly, we're

simplifying ad performance measurement and visualization, enabling

advertisers to easily export campaign data and insights with just a

few clicks. VTEX Ads Network continues to partner with leading

publishers such as Fast Shop, Grupo Drogarias Pacheco e São Paulo,

and Zona Sul.

- VTEX Data Pipeline, the secure data-sharing service that offers

our customers seamless access to all their commerce data without

expensive custom integrations, now offers additional data models

for catalog, promotion, and external marketplace data. Data

Pipeline is now compatible with any preferred data warehouse, BI

tools, and CRM systems, enabling the delivery of VTEX commerce data

precisely wherever customers need it. All customers can now

leverage our new data models to create a unified view of their

commerce operations.

- VTEX Pick and Pack incorporated new fulfillment solutions.

These improvements include the implementation of smart store

selection, optimized product location, and multi-picking

capabilities, all designed to enhance logistical efficiency. Our

upgraded admin interface now provides real-time order tracking and

instantaneous notifications, while the AI-powered returns module

facilitates expedited customer feedback. These advancements

position VTEX customers’ logistics as a strategic advantage,

ultimately delivering a superior shopping experience that fosters

consumers’ loyalty and retention.

- The development platform of choice for digital commerce:

- Fast Shop, a leading Brazilian retailer with 85 stores and 15

distribution centers, chose VTEX to replace its costly, inflexible

legacy platform. With VTEX, Fast Shop has lowered its total cost of

ownership, expanded into new channels like B2B, and gained access

to a robust third-party ecosystem. Now, all operations—stores,

online, marketplace, and B2B—are integrated into one platform.

They've also developed a custom app for in-store teams, enhancing

the customer journey with personalized experiences and their Fast

Prime loyalty program.

Business Outlook

VTEX is well-positioned to capture an attractive market

opportunity, and we remain encouraged by our sales momentum and

operational leverage. We will face tougher GMV comparisons in the

fourth quarter of 2024, which will ease by year-end.

In this context, we are targeting FX neutral YoY revenue growth

of 14% to 17% for the fourth quarter of 2024, implying a US$64.8

million to US$66.8 million range.

For the full year 2024, as we continue executing our profitable

growth strategy, we are targeting FX neutral YoY revenue growth to

18.5% to 19.5%, implying a range of US$230 million to US$232

million based on Q3’s average FX rate. We are raising our non-GAAP

operating income and free cash flow margins target to low

teens.

We are confident in VTEX's ability to capitalize on current

market opportunities. We are empowering our customers to digitally

transform their commerce operations while helping them to

outperform the market.

The business outlook provided above constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

Actual results could vary materially as a result of numerous

factors, including certain risk factors, many of which are beyond

VTEX’s control. See the cautionary note regarding “Forward-Looking

Statements” below. Fluctuations in VTEX’s operating results may be

particularly pronounced in the current economic environment. There

can not be an assurance that VTEX will achieve these results.

The following table summarizes certain key financial and

operating metrics for the three and nine months ended September 30,

2024 and 2023.

Three months ended September

30,

Nine months ended September

30,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

GMV

4,380.2

3,999.3

12,854.7

11,141.5

GMV growth YoY FXN (1)

17.1

%

27.8

%

18.8

%

23.2

%

Revenue

56.0

50.6

165.2

140.8

Revenue growth YoY FXN (1)

18.7

%

24.5

%

20.6

%

23.2

%

Non-GAAP subscription gross profit

(2)(4)

42.3

36.2

123.4

99.3

Non-GAAP subscription gross profit margin

(3)(4)

78.5

%

76.2

%

78.0

%

75.2

%

Non-GAAP income (loss) from operations

(4)

7.7

1.7

17.1

(3.9

)

Total number of employees

1,409

1,276

1,409

1,276

(1)

Calculated by using the average monthly

exchange rates for the applicable months during 2023, adjusted by

inflation in countries with hyperinflation, and applying them to

the corresponding months in 2024, as applicable, so as to calculate

what our results would have been had exchange rates remained stable

from one year to the next.

(2)

Corresponds to our subscription revenues

minus our subscription costs.

(3)

Corresponds to our subscription gross

profit divided by subscription revenues.

(4)

Reconciliation of Non-GAAP metrics can be

found in tables below.

Conference Call and Webcast

The conference call may be accessed by dialing +1-646-307-1951

(Conference ID – 18526 –) and requesting inclusion in the call for

VTEX.

The live conference call can be accessed via audio webcast at

the investor relations section of the Company's website, at

https://www.investors.vtex.com/.

An archive of the webcast will be available for one week

following the conclusion of the conference call.

Definition of Selected Operational Metrics

“ARR” means annual recurring revenue, calculated as

subscription revenue in the most recent quarter multiplied by

four.

“Customers” means companies ranging from small and

medium-sized businesses to larger enterprises that pay to use

VTEX’s platform.

“GMV” means the total value of customer orders processed

through our platform, including value-added taxes and shipping. Our

GMV does not include the value of orders processed by our SMB

customers or B2B transactions.

“FX Neutral” or “FXN” means a way of using the

average monthly exchange rates for each month during the previous

year, adjusted by inflation in countries with hyper-inflation, and

applying them to the corresponding months of the current year, so

as to calculate what results would have been had exchange rates

remained stable from one year to the next.

“Stores” or “Active Stores” means the number of

unique domains generating gross merchandise value. Each customer

might have multiple stores.

Special Note Regarding Non-GAAP financial metrics

For the convenience of investors, this document presents certain

Non-GAAP financial measures, which are not recognized under IFRS

Accounting Standards, specifically Non-GAAP subscription gross

profit, Non-GAAP income (loss) from operations, free cash flow and

FX Neutral measures.

We understand that Non-GAAP subscription gross profit, Non-GAAP

income (loss) from operations, free cash flow and FX Neutral

measures have limitations as analytical tools, and you should not

consider them in isolation or as substitutes for analysis of our

results of operations presented in accordance with IFRS Accounting

Standards. Additionally, our calculations of Non-GAAP subscription

gross profit, Non-GAAP income (loss) from operations, free cash

flow and FX Neutral measures may be different from the calculation

used by other companies, including our competitors, and therefore,

our measures may not be comparable to those of other companies.

Reconciliation of Non-GAAP measures

The following table presents a reconciliation of our Non-GAAP

subscription gross profit to subscription gross profit for the

following periods:

Three months ended September

30,

Nine months ended September

30,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Subscription revenue

53.9

47.5

158.2

132.1

Subscription cost

(11.6

)

(11.4

)

(35.0

)

(32.9

)

Subscription gross profit

42.3

36.1

123.2

99.1

Share-based compensation

0.1

0.1

0.1

0.2

Non-GAAP subscription gross

profit

42.3

36.2

123.4

99.3

Non-GAAP subscription gross

margin

78.5

%

76.2

%

78.0

%

75.2

%

The following table presents a reconciliation of our Non-GAAP

S&M expenses to S&M expenses for the following periods:

Three months ended September

30,

Nine months ended September

30,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Sales & Marketing expense

(16.4

)

(15.1

)

(50.9

)

(44.3

)

Share-based compensation expense

1.1

1.0

3.1

3.3

Amortization related to acquisitions

0.3

0.3

0.9

0.9

Earn out expenses related to

acquisitions

0.1

-

0.1

-

Non-GAAP Sales & Marketing

expense

(14.9

)

(13.8

)

(46.8

)

(40.1

)

The following table presents a reconciliation of our Non-GAAP

R&D expenses to R&D expenses for the following periods:

Three months ended September

30,

Nine months ended September

30,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Research & Development expense

(13.4

)

(15.5

)

(40.3

)

(45.8

)

Share-based compensation expense

1.2

1.9

2.7

5.6

Amortization related to acquisitions

0.1

0.3

0.4

0.9

Earn out expenses related to

acquisitions

0.1

-

0.1

-

Non-GAAP Research & Development

expense

(11.9

)

(13.3

)

(37.2

)

(39.3

)

The following table presents a reconciliation of our Non-GAAP

G&A expenses to G&A expenses for the following periods:

Three months ended September

30,

Nine months ended September

30,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

General & Administrative expense

(8.4

)

(8.4

)

(26.3

)

(24.5

)

Share-based compensation expense

1.7

1.5

6.3

4.9

Amortization related to acquisitions

0.0

0.0

0.0

0.0

Non-GAAP General & Administrative

expense

(6.7

)

(6.9

)

(20.0

)

(19.6

)

The following table presents a reconciliation of our Non-GAAP

income (loss) from operations to income (loss) from operations for

the following periods:

Three months ended September

30,

Nine months ended September

30,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Income (loss) from operations

2.9

(3.5

)

3.0

(20.3

)

Share-based compensation expense

4.2

4.6

12.6

14.4

Amortization related to acquisitions

0.4

0.6

1.3

2.0

Earn out expenses related to

acquisitions

0.2

-

0.2

-

Non-GAAP income (loss) from

operations

7.7

1.7

17.1

(3.9

)

The following table presents a reconciliation of our free cash

flow to net cash provided by (used in) operating activities for the

following periods:

Three months ended September

30,

Nine months ended September

30,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Net cash provided by (used in) operating

activities

8.1

2.8

14.5

(5.4

)

Acquisitions of property and equipment

(0.4

)

(0.1

)

(1.7

)

(0.3

)

Free Cash Flow

7.7

2.7

12.8

(5.7

)

The following table sets forth the FX neutral measures related

to our reported results of the operations for the three months

ended September 30, 2024:

As Reported

FXN

As Reported

FXN

(in millions of US$, except as otherwise

indicated)

3Q24

3Q23

% Change

3Q24

3Q23

% Change

Subscription revenue

53.9

47.5

13.4

%

57.9

47.5

21.9

%

Services revenue

2.1

3.1

(31.9

%)

2.2

3.1

(29.6

%)

Total revenue

56.0

50.6

10.6

%

60.1

50.6

18.7

%

Gross profit

41.7

35.6

17.2

%

45.4

35.6

27.6

%

Income (loss) from operations

2.9

(3.5

)

N/A

3.7

(3.5

)

N/A

This announcement does not contain sufficient information to

constitute an interim financial report as defined in International

Financial Reporting Standards as issued by the International

Accounting Standards Board (“IFRS Accounting Standards”) IAS 34

Interim Financial Reporting, "Interim Financial Reporting" nor a

financial statement as defined by IFRS Accounting Standards 1

"Presentation of Financial Statements". The financial information

in this press release has not been audited. Numbers have been

calculated using whole amounts rather than rounded amounts. This

might cause some figures not to total due to rounding.

About VTEX

VTEX (NYSE: VTEX) is the composable and complete commerce

platform that delivers more efficiency and less maintenance to

organizations seeking to make smarter IT investments and modernize

their tech stack. Through our pragmatic composability approach, we

empower brands, distributors, and retailers with unparalleled

flexibility and comprehensive solutions, enabling them to invest

solely in what provides a clear business advantage and boosts

profitability.

VTEX is trusted by 2,600 global B2C and B2B customers, including

Carrefour, Colgate, Motorola, Sony, Stanley Black & Decker, and

Whirlpool, having 3,500 active online stores across 43 countries

(as of FY ended on December 31, 2023). For more information, visit

www.vtex.com.

Forward-looking Statements

This announcement contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1993, as

amended, and Section 21E of the Securities Exchange of 1934, as

amended. Statements contained herein that are not clearly

historical in nature, including statements about the VTEX

strategies and business plans, are forward-looking, and the words

“anticipate,” “believe,” “continues,” “expect,” “estimate,”

“intend,” ”strategy,” “project,” “target” and similar expressions

and future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “can,” “may,” or similar expressions are

generally intended to identify forward-looking statements.

VTEX may also make forward-looking statements in its periodic

reports filed with the U.S. Securities and Exchange Commission, or

the SEC, in press releases and other written materials and in oral

statements made by its officers and directors. These

forward-looking statements speak only as of the date they are made

and are based on the VTEX’s current plans and expectations and are

subject to a number of known and unknown uncertainties and risks,

many of which are beyond VTEX’s control. A number of factors and

risks could cause actual results to differ materially from those

contained in any forward-looking statement. Further information

regarding these and other risks is included in VTEX filings with

the SEC.

As a consequence, current plans, anticipated actions and future

financial position and results of operations may differ

significantly from those expressed in any forward-looking

statements in this announcement. You are cautioned not to unduly

rely on such forward-looking statements when evaluating the

information presented as there is no guarantee that expected

events, trends or results will actually occur. We undertake no

obligation to update or revise any forward-looking statements,

whether as a result of new information or future events or for any

other reason.

This announcement may also contain estimates and other

information concerning our industry that are based on industry

publications, surveys and forecasts. This information involves a

number of assumptions and limitations, and we have not

independently verified the accuracy or completeness of the

information.

VTEX

Condensed consolidated interim

statements of profit or loss (Unaudited)

In thousands of U.S. dollars, unless

otherwise indicated

Three months ended

Nine months ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Subscription revenue

53,897

47,544

158,244

132,078

Services revenue

2,099

3,084

6,941

8,718

Total revenue

55,996

50,628

165,185

140,796

Subscription cost

(11,642

)

(11,395

)

(35,023

)

(32,948

)

Services cost

(2,636

)

(3,625

)

(8,937

)

(12,144

)

Total cost

(14,278

)

(15,020

)

(43,960

)

(45,092

)

Gross profit

41,718

35,608

121,225

95,704

Operating expenses

General and administrative

(8,402

)

(8,374

)

(26,341

)

(24,541

)

Sales and marketing

(16,410

)

(15,101

)

(50,854

)

(44,332

)

Research and development

(13,366

)

(15,508

)

(40,330

)

(45,772

)

Other losses

(668

)

(99

)

(723

)

(1,364

)

Income (loss) from operations

2,872

(3,474

)

2,977

(20,305

)

Financial income

7,359

8,974

26,803

25,573

Financial expense

(7,959

)

(7,896

)

(28,006

)

(22,925

)

Financial result, net

(600

)

1,078

(1,203

)

2,648

Equity results

—

281

2

989

Income (loss) before income tax

2,272

(2,115

)

1,776

(16,668

)

Income tax

Current

98

(50

)

(83

)

(2,317

)

Deferred

874

(214

)

4,026

2,068

Total income tax

972

(264

)

3,943

(249

)

Net income (loss) for the

period

3,244

(2,379

)

5,719

(16,917

)

Attributable to controlling

shareholders

3,245

(2,374

)

5,734

(16,913

)

Non-controlling interest

(1

)

(5

)

(15

)

(4

)

Earnings (loss) per share

Basic earnings (loss) per share

0.018

(0.013

)

0.031

(0.090

)

Diluted earnings (loss) per

share

0.017

(0.013

)

0.030

(0.090

)

VTEX

Condensed consolidated interim balance

sheets (Unaudited)

In thousands of U.S. dollars, unless

otherwise indicated

September 30, 2024

December 31, 2023

ASSETS

Current assets

Cash and cash equivalents

22,525

28,035

Short-term investments

194,514

181,374

Trade receivables

53,820

44,122

Recoverable taxes

5,898

6,499

Deferred commissions

1,449

1,005

Prepaid expenses

4,313

5,143

Derivative financial instruments

—

53

Other current assets

124

22

Total current assets

282,643

266,253

Non-current assets

Long-term investments

9,649

2,000

Trade receivables

12,639

7,415

Deferred tax assets

21,424

19,926

Prepaid expenses

95

155

Recoverable taxes

4,715

4,454

Deferred commissions

4,169

2,924

Other non-current assets

1,114

902

Right-of-use assets

2,204

3,277

Property and equipment, net

3,198

2,697

Intangible assets, net

31,309

30,024

Investments in joint venture

—

1,118

Total non-current assets

90,516

74,892

Total assets

373,159

341,145

September 30, 2024

December 31, 2023

LIABILITIES

Current liabilities

Accounts payable and accrued expenses

37,726

39,728

Taxes payable

6,305

8,219

Lease liabilities

1,534

1,863

Deferred revenue

31,553

25,948

Derivative financial instruments

102

—

Accounts payable from acquisition of

subsidiaries

33

—

Other current liabilities

1,243

1,486

Total current liabilities

78,496

77,244

Non-current liabilities

Accounts payable and accrued expenses

2,165

1,632

Taxes payable

206

—

Lease liabilities

1,284

2,233

Accounts payable from acquisition of

subsidiaries

893

—

Deferred revenue

24,810

16,584

Deferred tax liabilities

2,653

2,668

Other non-current liabilities

439

452

Total non-current liabilities

32,450

23,569

EQUITY

Issued capital

19

18

Capital reserve

383,371

370,821

Other reserves

3,104

(486

)

Accumulated losses

(124,326

)

(130,060

)

Equity attributable to VTEX’s

shareholders

262,168

240,293

Non-controlling interests

45

39

Total shareholders’ equity

262,213

240,332

Total liabilities and equity

373,159

341,145

VTEX

Condensed consolidated interim

statements of cash flows (Unaudited)

In thousands of U.S. dollars, unless

otherwise indicated

Nine months ended

September 30, 2024

September 30, 2023

Net income (loss) for the

period

5,719

(16,917

)

Adjustments for:

Depreciation and amortization

3,329

3,799

Deferred income tax

(4,026

)

(2,068

)

Loss on disposal of rights of use,

property, equipment, and intangible assets

114

614

Expected credit losses from trade

receivables

775

1,093

Share-based compensation

11,111

12,280

Provision for payroll taxes (share-based

compensation)

1,520

2,117

Adjustment of hyperinflation

6,428

10,221

Equity results

(2

)

(989

)

Accrued interest

(12,605

)

(9,875

)

Fair value gains

(2,166

)

(7,863

)

Others and foreign exchange, net

9,508

2,559

Change in operating assets and

liabilities

Trade receivables

(19,143

)

(6,781

)

Recoverable taxes

(1,611

)

(108

)

Prepaid expenses

668

206

Other assets

(462

)

(25

)

Accounts payable and accrued expenses

(2,275

)

(958

)

Taxes payable

1,056

415

Deferred revenue

17,931

5,450

Other liabilities

110

1,175

Cash provided by (used in) operating

activities

15,979

(5,655

)

Income tax paid

(1,482

)

233

Net cash provided by (used in)

operating activities

14,497

(5,422

)

Cash flows from investing

activities

Dividends received from joint venture

—

1,138

Proceeds from disposal of Joint

Venture

1,026

—

Purchase of short and long-term

investment

(116,802

)

(112,350

)

Redemption of short-term investment

105,377

139,458

Interest and dividends received from

short-term investments

591

1,941

Acquisition of subsidiaries net of cash

acquired

(2,920

)

-

Acquisitions of property and equipment

(1,691

)

(252

)

Derivative financial instruments

(3,558

)

359

Net cash provided by (used in)

investing activities

(17,977

)

30,294

Cash flows from financing

activities

Changes in restricted cash

—

1,660

Proceeds from the exercise of stock

options

3,725

632

Net-settlement of share-based payment

(2,806

)

(1,618

)

Buyback of shares

—

(25,053

)

Payment of loans and financing

(71

)

(1,238

)

Interest paid

—

(5

)

Principal elements of lease payments

(1,249

)

(1,152

)

Lease interest paid

(284

)

(440

)

Net cash used in financing

activities

(685

)

(27,214

)

Net decrease in cash and cash

equivalents

(4,165

)

(2,342

)

Cash and cash equivalents, beginning of

the period

28,035

24,394

Effect of exchange rate changes

(1,345

)

(751

)

Cash and cash equivalents, end of the

period

22,525

21,301

Non-cash transactions:

Lease liabilities arising from obtaining

right-of-use assets and remeasurement

344

85

Unpaid amount related to business

combinations

926

-

Transactions with non-controlling

interests

21

42

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105947185/en/

Julia Vater Fernández VP of Investor Relations

investors@vtex.com

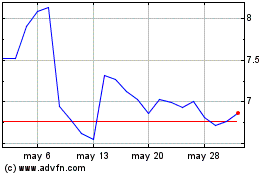

VTEX (NYSE:VTEX)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

VTEX (NYSE:VTEX)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025