ADENTRA Inc. (TSX:ADEN) (“

ADENTRA” or the

“

Company”) is pleased to announce that it has

entered into an agreement with National Bank Financial Inc. and

Cormark Securities Inc., acting as co-bookrunners, on behalf of a

syndicate of underwriters (collectively, the

“

Underwriters”), pursuant to which the

Underwriters have agreed to purchase 2,246,000 common shares

(the “

Common Shares”) from the

treasury of the Company, at a price of $38.75 per Common Share for

total gross proceeds of approximately $87,032,500 million (the

“

Offering”).

In addition, the Company has granted the

Underwriters an option (the “Over-Allotment

Option”) to purchase up to an additional 15% of the Common

Shares of the Offering on the same terms exercisable at any time on

or prior to the 30th day following the closing of the Offering, to

cover the Underwriters’ over-allocation position, if any, and

consequent market stabilization.

The Company maintains an attractive acquisitions

pipeline. As such, the Company intends to use the net proceeds of

the Offering to repay bank indebtedness including under its

revolving credit facility, thereby increasing the amount available

to be drawn under the revolving credit facility to fund potential

strategic acquisitions and for general corporate purposes.

“This Offering will further solidify our balance

sheet and strongly position us to pursue M&A opportunities, as

we continue to execute on our Destination 2028 plan, which includes

adding an additional U.S.$800 million in run-rate revenues from

acquisitions by 2028,” said Rob Brown, President and CEO of ADENTRA

Inc.

Closing of the Offering is expected to occur on

or about June 12th, 2024 and is subject to customary closing

conditions and regulatory approvals, including that of the Toronto

Stock Exchange (the “TSX”).

The Common Shares to be issued under the

Offering will be offered by way of a prospectus supplement (the

“Prospectus Supplement”) to the Company’s short

form base shelf prospectus dated April 22, 2024 (the “Base

Shelf Prospectus”) in each of the Provinces of Canada, and

may be offered in the United States on a private placement basis

pursuant to an exemption from the registration requirements of the

United States Securities Act of 1933, as amended, and applicable

state securities laws, and certain other jurisdictions outside of

Canada and the United States.

Access to the Prospectus Supplement, the Base

Shelf Prospectus and any amendment to such documents is provided in

accordance with securities legislation relating to the procedures

for providing access to a shelf prospectus supplement, a base shelf

prospectus and any amendment. The Base Shelf Prospectus is, and the

Prospectus Supplement will be (within two business days from the

date hereof), accessible on SEDAR+ at www.sedarplus.com. An

electronic or paper copy of the Prospectus Supplement, Base Shelf

Prospectus, and any amendment to such documents may be obtained,

without charge, from National Bank Financial Inc., by phone at

(416) 869-8414 or by e-mail at NBFSyndication@bnc.ca or Cormark

Securities Inc., by phone at (416) 362-7485 or by email at

ecm@cormark.com by providing the contact with an email address or

address, as applicable.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

This press release does not constitute an offer of securities for

sale in the United States. The securities being offered have not

been, nor will they be, registered under the United States

Securities Act of 1933, as amended, and such securities may not be

offered or sold within the United States absent registration under

U.S. federal and state securities laws or an applicable exemption

from such U.S. registration requirements.

About ADENTRA

Inc.

ADENTRA is one of North America's largest

distributors of architectural building products to the residential,

repair and remodel, and commercial construction markets. The

Company currently operates a network of 85 facilities in the United

States and Canada. ADENTRA's common shares are listed on the

Toronto Stock Exchange under the symbol ADEN.

Forward-Looking Statements

Certain statements in this press release contain

forward-looking information within the meaning of applicable

securities laws (“forward-looking information”).

Forward-looking information is generally identifiable by the use of

the words “shall”, “to be”, “may”, “will”, “expect”, “intends”,

“can”, “could” and similar expressions. Forward-looking information

in this press release includes statements regarding: the

anticipated timing and closing of the offering; the anticipated use

of the proceeds from the offering; the planned use of the revolving

credit facility, including potential strategic acquisitions; the

Destination 2028 plan; required regulatory approvals in respect of

the offering; the issuance of Common Shares pursuant to an exercise

by the Underwriters of the Over-Allotment Options and the payment

of any fees associated therewith; the conditions to closing the

offering, the listing of the Common Shares on the TSX.

In connection with the forward looking

information contained in this press release, we have made numerous

assumptions, regarding, among other things: all conditions to

closing, including all regulatory approvals will be obtained met or

waived; the Company’s ability to fulfill the listing requirements

of the TSX; there are no material exchange rate fluctuations

between the Canadian and U.S. dollar that will affect the Company’s

performance the general state of the economy does not worsen; the

Company’s products are not subjected to negative trade outcomes;

the Company does not lose any key personnel; there is no labor

shortage across multiple geographic locations; there are no

decreases in the supply of, demand for, or market values of

hardwood lumber or sheet goods that could harm the Company’s

business; the Company will not incur material losses related to

credit provided to its customers; there are no natural or man-made

disruptions to the Company’s operations and customer service

centers; no global instability or global supply chain disruptions;

environmental, social and governance risks do not adversely affect

the Company’s reputation and shareholder, employee, customer and

third party relationships; climate change does not adversely affect

the Company’s business and damage its reputation; the Company is

able to integrate acquired businesses; there is no new competition

in the Company’s markets that leads to reduced revenues and

profitability; the Company can comply with existing regulations and

will not become subject to more stringent regulations; no material

product liability claims; importation of components or other

innovative products does not increase and replace products

manufactured in North America; the Company’s management information

systems upon which its depends are not impaired; the Company is not

adversely impacted by disruptive technologies; the Company’s

information technology systems are not compromised by

cyber-attacks; and, the Company’s insurance is sufficient to cover

losses that may occur as a result of its operations.

The forward-looking information is subject to

risks, uncertainties and other factors that could cause actual

results to differ materially from historical results or results

anticipated by the forward-looking information. The factors which

could cause results to differ from current expectations include,

but are not limited to: such risks and uncertainties described in

the Company’s most recent annual information form and its

management’s discussion and analysis (available on SEDAR+ at

www.sedarplus.com); fluctuations in the market price of the

Company’s Common Shares; dilution of shareholders as a result of

further issuances of Common Shares; closing of the offering may be

delayed or may not occur at all; and the Underwriters may terminate

the Underwriting Agreement in accordance with its terms, including

under the “disaster out” provisions contained therein, and as a

result, the Company may not achieve its growth initiatives,

business objectives and strategies.

All forward-looking information in this press

release are qualified in its entirety by this cautionary statement.

These statements are made as of the date of this press release and,

except as required by applicable law, the Company undertakes no

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise

after the date hereof. Additionally, the Company undertakes no

obligation to comment on analyses, expectations or statements made

by third parties in respect of the Company, its financial or

operating results or its securities.

For further information:Maggie MacDougall Phone: (416)

220-7950Email: investors@adentragroup.com Website:

www.adentragroup.com

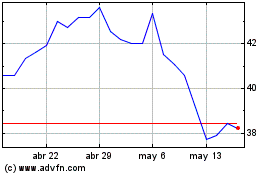

Adentra (TSX:ADEN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Adentra (TSX:ADEN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024