Investors, analysts and other interested parties can access

Acadian Timber Corp.'s 2012 Third Quarter Results conference call

via webcast on Wednesday, October 31, 2012 at 1:00 p.m. ET at

www.acadiantimber.com or via teleconference at 1-800-319-4610, toll

free in North America. For overseas calls please dial

+1-604-638-5340, at approximately 12:50 p.m. ET. The teleconference

taped rebroadcast can be accessed at 1-800-319-6413 or

+1-604-638-9010 and enter passcode 2826.

All figures in Canadian dollars unless otherwise noted

Acadian Timber Corp. ("Acadian" or the "Company") (TSX:ADN)

today reported financial and operating results(1) for the three

months ended September 29, 2012 (the "third quarter").

"The markets for softwood and hardwood sawlogs and hardwood

pulpwood were relatively stable during the third quarter", said

Reid Carter, Chief Executive Officer of Acadian. "Acadian's major

softwood sawmill and structural panel customers operated

continuously throughout the quarter and most regional pulp and

paper mills continued to run at full capacity."

Acadian generated net sales of $17.5 million during the third

quarter of 2012. While the sales volume during the quarter fell to

319 thousand m3 from 341 thousand m3 in the same quarter of 2011, a

3% year-over-year increase in the weighted average selling price

across all log products kept net sales consistent with the third

quarter of 2011.

Adjusted EBITDA of $4.4 million for the third quarter of 2012

was $0.6 million higher than in the third quarter of 2011, while

Adjusted EBITDA margin increased to 25% from 22% in the same period

of last year.

For the nine months ended September 29, 2012, Acadian generated

net sales of $50.4 million on sales volume of 976 thousand m3 as

compared to net sales of $51.0 million on sales volume of 1,010

thousand m3 in the comparable period of 2011. Adjusted EBITDA of

$11.3 million during the nine months ended September 29, 2012 is

$0.3 million lower than the comparable period of 2011.

(1) This news release makes reference to Adjusted EBITDA and

free cash flow which are key performance measures in evaluating

Acadian's operations and are important in enhancing investors'

understanding of Acadian's operating performance. Acadian's

management defines Adjusted EBITDA as earnings before interest,

taxes, fair value adjustments, unrealized exchange gain/loss on

debt, depreciation and amortization. As these performance measures

do not have standardized meanings prescribed by International

Financial Reporting Standards ("IFRS"), they may not be comparable

to similar measures presented by other companies. As a result, we

have provided in this news release reconciliations of net income,

as determined in accordance with IFRS, to Adjusted EBITDA and free

cash flow.

Review of Operations

Financial and Operating Highlights

Three Months Ended Nine Months Ended

--------------------------------------------

(CAD thousands, except per Sept 29 Sept 24 Sept 29 Sept 24

share information) 2012 2011 2012 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Sales volume (000s m3) 318.9 340.7 976.4 1,009.8

Net sales $ 17,523 $ 17,535 $ 50,428 $ 51,014

Adjusted EBITDA 4,377 3,811 11,343 11,684

Free cash flow 3,532 3,183 9,654 10,198

Net income (loss) 4,995 (341) 9,938 2,332

Dividends declared 3,451 3,451 10,353 10,353

Per share - basic and diluted

Free cash flow 0.21 0.19 0.58 0.61

Net income (loss) 0.30 (0.02) 0.59 0.14

Dividends declared 0.21 0.21 0.62 0.62

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian benefited from strong demand from local customers and

higher realized selling prices for its two main products, softwood

sawlogs and hardwood pulpwood. The majority of the softwood sawlog

price increase was attributable to increased prices in Maine where

customer inventories remain low.

New Brunswick Timberlands

The table below summarizes operating and financial results for

New Brunswick Timberlands:

Three Months Ended September Three Months Ended September

29, 2012 24, 2011

----------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 92.3 94.7 $ 5,091 98.0 99.0 $ 5,174

Hardwood 113.9 106.0 6,222 121.1 119.5 6,886

Biomass 53.6 53.6 877 60.3 60.3 795

----------------------------------------------------------------------------

259.8 254.3 12,190 279.4 278.8 12,855

Other sales 1,545 1,418

----------------------------------------------------------------------------

Net sales $ 13,735 $ 14,273

----------------------------------------------------------------------------

Adjusted

EBITDA $ 3,626 $ 3,410

Adjusted

EBITDA

margin 26% 24%

----------------------------------------------------------------------------

Nine Months Ended September 29, Nine Months Ended September 24,

2012 2011

----------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 302.0 307.3 $ 15,413 352.8 351.6 $ 17,888

Hardwood 299.0 314.7 18,874 346.3 337.7 19,807

Biomass 159.7 159.7 2,745 164.2 164.2 2,430

----------------------------------------------------------------------------

760.7 781.7 37,032 863.3 853.5 40,125

Other sales 2,250 2,696

----------------------------------------------------------------------------

Net sales $ 39,282 $ 42,821

----------------------------------------------------------------------------

Adjusted

EBITDA $ 9,227 $ 10,904

Adjusted

EBITDA

margin 23% 25%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 95 thousand m3,

106 thousand m3 and 54 thousand m3, respectively, for the third

quarter of 2012. Approximately 41% was sold as sawlogs, 38% as

pulpwood and 21% as biomass. This compares to 34% sold as sawlogs,

44% as pulpwood and 22% as biomass in the third quarter of

2011.

Net sales for the third quarter of 2012 were $13.7 million (2011

- $14.3 million) with an average selling price across all log

products of $56.39 per m3, which compares to an average log selling

price of $55.18 per m3 during the third quarter of 2011. This

year-over-year increase in the average selling price reflects the

higher percentage of sawtimber in the sales mix, higher prices for

hardwood pulpwood due to strong demand and a greater proportion of

sales made to more distant markets. Net sales for the nine months

ended September 29, 2012 were $39.3 million, a decrease of $3.5

million over the comparable period of 2011 primarily as a result of

decreased sales volume.

Costs for the third quarter were $10.1 million (2011 - $10.9

million). Variable costs per m3 were 7% higher than the third

quarter of 2011 due to increased hauling costs as a greater

proportion of sales were made to more distant markets. Total costs

per m3 were 3% higher than in the third quarter of 2011.

Adjusted EBITDA for the third quarter was $3.6 million, compared

to $3.4 million in the comparable period of 2011 as a result of an

increase in other sales and an increased proportion of higher

margin softwood sawtimber in the sales mix. Adjusted EBITDA margin

increased to 26%, compared to 24% for the third quarter of

2011.

NB Timberlands experienced one recordable safety incident among

contractors and one recordable incident involving an employee

during the third quarter of 2012. Both individuals are expected to

return to work before the end of the year.

Maine Timberlands

The table below summarizes operating and financial results for

Maine Timberlands:

Three Months Ended September Three Months Ended September

29, 2012 24, 2011

----------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 45.3 45.3 $ 2,563 43.8 44.1 $ 2,283

Hardwood 18.1 15.8 989 14.0 13.8 781

Biomass 3.5 3.5 22 4.0 4.0 41

----------------------------------------------------------------------------

66.9 64.6 3,574 61.8 61.9 3,105

Other sales 214 157

----------------------------------------------------------------------------

Net sales $ 3,788 $ 3,262

----------------------------------------------------------------------------

Adjusted

EBITDA $ 849 $ 549

Adjusted

EBITDA

margin 22% 17%

----------------------------------------------------------------------------

Nine Months Ended September 29, Nine Months Ended September 24,

2012 2011

----------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 141.7 141.5 $ 7,947 113.8 114.1 $ 5,968

Hardwood 46.3 44.7 2,762 30.4 31.6 1,826

Biomass 8.5 8.5 75 10.6 10.6 98

----------------------------------------------------------------------------

196.5 194.7 10,784 154.8 156.3 7,892

Other sales 362 301

----------------------------------------------------------------------------

Net sales $ 11,146 $ 8,193

----------------------------------------------------------------------------

Adjusted

EBITDA $ 2,650 $ 1,630

Adjusted

EBITDA

margin 24% 20%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 45 thousand m3, 16

thousand m3 and 3 thousand m3, respectively, for the third quarter

of 2012. Approximately 59% was sold as sawlogs, 36% as pulpwood and

5% as biomass. This compares to 60% sold as sawlogs, 34% as

pulpwood and 6% as biomass in the third quarter of 2011.

Net sales for the third quarter of 2012 were $3.8 million (2011

- $3.3 million) with an average selling price across all log

products of $57.80 per m3, compared to the average log selling

price of $52.90 per m3 during the third quarter of 2011. The

year-over-year selling price increase reflects a higher value mix

of products sold and improved demand which has resulted in

increased prices for most primary products. Net sales for the first

nine months ended September 29, 2012 were $11.1 million, an

increase of $2.9 million over the comparable period of 2011.

Costs for the third quarter were $2.9 million (2011 - $2.7

million). Variable costs per m3 increased 4% in Canadian dollar

terms as a result of a 2% increase in U.S. dollar-based contractor

rates and the year-over-year weakening of the Canadian dollar

compared to the U.S. dollar.

Adjusted EBITDA for the third quarter was $0.8 million, compared

to $0.5 million in the comparable period of 2011 primarily as a

result of increased selling prices. Adjusted EBITDA margin was 22%

in the third quarter of 2012 as compared to 17% during the third

quarter of 2011.

Maine Timberlands experienced one recordable safety incident

without lost time among contractors and no recordable incidents

among employees during the third quarter of 2012.

Market Outlook

The following Market Outlook contains forward-looking statements

about Acadian Timber Corp.'s market outlook for the remainder of

fiscal 2012 and 2013. Reference should be made to the

"Forward-looking Statements" section of this news release. For a

description of material factors that could cause actual results to

differ materially from the forward-looking statements in the

following, please see the Risk Factors section of our management's

discussion and analysis of Acadian's most recent Annual Report and

Annual Information Form available on our website at

www.acadiantimber.com or filed with SEDAR at www.sedar.com.

The U.S. housing market continues to gain momentum. U.S. private

residential construction has increased 18% over the past year with

single family construction rising 21% and the multifamily

increasing 45%. In September, housing starts reached a seasonally

adjusted annual rate of 872 thousand, the highest since July 2008.

Inventories of new homes available for sale are at 50-year lows and

U.S. home pricing appears to have bottomed with the FHFA and

CoreLogic home price indices up nearly 4% year-over-year and the

Case-Schiller 20-City Home Price Index up 1.2% year-over-year.

Mortgage rates remain at record lows, housing affordability is at

near-record highs and mortgage underwriting standards are becoming

more accommodative. As stated in the past, for the U.S. housing

market to fully recover the economy must continue to improve,

inventories of unsold homes and homes in foreclosure must decline

to more normal levels and appraisers and lenders must become

convinced that home price declines are coming to an end. The past

six months has offered consistent good news in all of these

areas.

Acadian's outlook for the remainder of 2012 and into 2013

remains cautiously optimistic as demand for spruce-fir sawlogs

continues to be reasonably strong with most of Acadian's softwood

sawmilling customers maintaining active operations. Markets for

hardwood sawlogs remain stable and appear to have a similar outlook

for the foreseeable future.

Markets for hardwood pulpwood are reasonably strong with

Acadian's major hardwood pulp customers all operating and actively

competing for deliveries suggesting prices will remain relatively

stable through the remainder of 2012. After several quarters of

excess supply, softwood pulpwood markets improved slightly in the

third quarter, but we expect demand for softwood pulpwood to remain

soft as a result of recent capacity closures. As pointed out in the

past, this is not expected to significantly affect Acadian's

financial performance as softwood pulpwood typically accounts for

less than 6% of total sales and an even smaller proportion of free

cash flow.

Biomass demand and pricing is expected to continue to face

challenges owing to depressed prices for electricity and decade-low

prices for natural gas. Despite this challenging market

environment, Acadian continues to be able to sell all of its

biomass with a stable outlook for gross margins generated from

sales of this product.

Quarterly Dividend

Acadian is pleased to announce a dividend of $0.20625 per share,

payable on January 15, 2013 to shareholders of record on December

31, 2012.

Acadian Timber Corp. is a leading supplier of primary forest

products in Eastern Canada and the Northeastern U.S. With a total

of 2.4 million acres of land under management, Acadian is the

second largest timberland operator in New Brunswick and Maine.

Acadian owns and manages approximately 1.1 million acres of

freehold timberlands in New Brunswick and Maine, and provides

management services relating to approximately 1.3 million acres of

Crown licensed timberlands. Acadian also owns and operates a forest

nursery in Second Falls, New Brunswick. Acadian's products include

softwood and hardwood sawlogs, pulpwood and biomass by-products,

sold to approximately 90 regional customers.

Acadian's shares are listed for trading on the Toronto Stock

Exchange under the symbol ADN.

For further information, please visit our website at

www.acadiantimber.com.

Forward-Looking Statements

This News Release contains forward-looking information within

the meaning of applicable Canadian securities laws that involve

known and unknown risks, uncertainties and other factors that may

cause the actual results, performance or achievements of Acadian

Timber Corp. and its subsidiaries (collectively, "Acadian"), or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. When used in this News Release, such

statements may contain such words as "may," "will," "intend,"

"should," "expect," "believe," "outlook," "predict," "remain,"

"anticipate," "estimate," "potential," "continue," "plan," "could,"

"might," "project," "targeting" or the negative of these terms or

other similar terminology. Forward-looking information in this News

Release includes, without limitation, statements made in sections

entitled "Free Cash Flow," Liquidity and Capital Resources" and

"Market Outlook," and other statements regarding management's

beliefs, intentions, results, performance, goals, achievements,

future events, plans and objectives, business strategy, access to

capital, liquidity and trading volumes, dividends, taxes, capital

expenditures, costs, market trends and similar statements

concerning anticipated future events, results, achievements,

circumstances, performance or expectations that are not historical

facts. These statements which reflect management's current

expectations regarding future events and operating performance are

based on information currently available to management and speak

only as of the date of this News Release. All forward-looking

statements in this News Release are qualified by these cautionary

statements. Forward-looking statements involve significant risks

and uncertainties, should not be read as guarantees of future

performance or results, should not be unduly relied upon, and will

not necessarily be accurate indications of whether or not such

results will be achieved.

Factors that could cause actual results to differ materially

from the results discussed in the forward-looking statements

include, but are not limited to: general economic and market

conditions; product demand; concentration of customers; commodity

pricing; interest rate and foreign currency fluctuations;

seasonality; weather and natural conditions; regulatory, trade or

environmental policy changes; changes in Canadian income tax law;

economic situation of key customers; and other factors discussed

under the heading "Risk Factors" in each of the Annual Information

Form of Acadian dated March 28, 2012 and the Management Information

Circular of Acadian dated March 28, 2012, and other filings of

Acadian made with securities regulatory authorities, which are

available on SEDAR at www.sedar.com. Forward-looking information is

based on various material factors or assumptions, which are based

on information currently available to Acadian. Material factors or

assumptions that were applied in drawing a conclusion or making an

estimate set out in the forward-looking information contained

herein may include, but are not limited to: anticipated financial

performance; business prospects; strategies; regulatory

developments; exchange rates; the sufficiency of budgeted capital

expenditures in carrying out planned activities; the availability

and cost of labour and services and the ability to obtain financing

on acceptable terms, which are subject to change based on commodity

prices, market conditions for timber and wood products, and the

economic situation of key customers. Readers are cautioned that the

preceding list of material factors or assumptions is not

exhaustive. Although the forward-looking statements contained in

this News Release are based upon what management believes are

reasonable assumptions, Acadian cannot assure readers that actual

results will be consistent with these forward-looking statements.

The forward-looking statements in this News Release are made as of

the date of this News Release, and should not be relied upon as

representing Acadian's views as of any date subsequent to the date

of this News Release. Acadian Corp. assumes no obligation to update

or revise these forward-looking statements to reflect new

information, events, circumstances or otherwise, except as may be

required by applicable law.

Acadian Timber Corp.

Interim Consolidated Statements of Net Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept 29 Sept 24 Sept 29 Sept 24

(CAD thousands) 2012 2011 2012 2011

----------------------------------------------------------------------------

Net sales $ 17,523 $ 17,535 $ 50,428 $ 51,014

----------------------------------------------------------------------------

Operating costs and expenses

Cost of sales 11,628 12,061 34,453 34,285

Selling, administration and

other 1,405 1,498 4,376 4,685

Reforestation 157 174 319 467

Depreciation and amortization 138 137 411 409

----------------------------------------------------------------------------

13,328 13,870 39,559 39,846

----------------------------------------------------------------------------

Operating earnings 4,195 3,665 10,869 11,168

Interest expense, net (711) (745) (2,169) (2,422)

Other items

Fair value adjustments 42 (177) 449 (575)

Unrealized exchange gain

(loss) on long-term debt 2,399 (2,941) 2,769 (3,928)

Gain on sale of timberlands 44 9 63 107

----------------------------------------------------------------------------

Earnings (loss) before income

taxes 5,969 (189) 11,981 4,350

Deferred tax expense (974) (152) (2,043) (2,018)

----------------------------------------------------------------------------

Net income (loss) for the period $ 4,995 $ (341) $ 9,938 $ 2,332

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) per share -

basic and diluted $ 0.30 $ (0.02) $ 0.59 $ 0.14

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statements of Comprehensive Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept 29 Sept 24 Sept 29 Sept 24

(CAD thousands) 2012 2011 2012 2011

----------------------------------------------------------------------------

Net income (loss) $ 4,995 $ (341) $ 9,938 $ 2,332

----------------------------------------------------------------------------

Other comprehensive income

(loss)

Unrealized foreign currency

translation income (loss) (2,820) 3,366 (3,237) 3,134

Amortization of derivative

designated as hedge (48) (48) (146) (270)

----------------------------------------------------------------------------

Comprehensive income $ 2,127 $ 2,977 $ 6,555 $ 5,196

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Balance Sheets

(unaudited)

----------------------------------------------------------------------------

As at September 29 December 31

(CAD thousands) 2012 2011

----------------------------------------------------------------------------

ASSETS

Current Assets

Cash and cash equivalents $ 6,381 $ 4,019

Accounts receivable and other assets 8,737 8,726

Inventory 1,343 2,263

----------------------------------------------------------------------------

16,461 15,008

Timber 228,498 231,370

Land, roads and other fixed assets 32,613 33,438

Investment property 39 -

Intangible asset 6,140 6,140

Deferred income tax asset 1,501 3,038

----------------------------------------------------------------------------

$ 285,252 $ 288,994

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 7,775 $ 4,534

Dividends payable to shareholders 3,452 3,451

----------------------------------------------------------------------------

11,227 7,985

Long-term debt 70,494 73,079

Deferred income tax liability 20,971 21,572

Shareholders' equity 182,560 186,358

----------------------------------------------------------------------------

$ 285,252 $ 288,994

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statements of Cash Flows

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept 29 Sept 24 Sept 29 Sept 24

(CAD thousands) 2012 2011 2012 2011

----------------------------------------------------------------------------

Cash provided by (used for):

----------------------------------------------------------------------------

Operating activities

Net income (loss) $ 4,995 $ (341) $ 9,938 $ 2,332

Adjustments to net income (loss)

Deferred tax expense 974 152 2,043 2,018

Depreciation and amortization 138 137 411 409

Fair value adjustments (42) 177 (449) 575

Unrealized exchange (gain)

loss on long-term debt (2,399) 2,941 (2,769) 3,928

Interest expense, net 711 745 2,169 2,422

Interest paid, net (740) (619) (1,476) (1,463)

Gain on sale of timberlands (44) (9) (63) (107)

----------------------------------------------------------------------------

3,593 3,183 9,804 10,114

Net change in non-cash working

capital and other 172 1,457 3,061 2,179

----------------------------------------------------------------------------

3,765 4,640 12,865 12,293

----------------------------------------------------------------------------

Financing activities

Borrowing on term facility - - - 70,608

Repayment of bank term credit

facility and term loan - - - (73,639)

Deferred financing costs - - - (1,205)

Dividends paid to shareholders (3,451) (3,451) (10,353) (7,739)

----------------------------------------------------------------------------

(3,451) (3,451) (10,353) (11,975)

----------------------------------------------------------------------------

Investing activities

Additions to timber, property,

plant and other fixed assets (105) (9) (215) (25)

Proceeds from sale of

timberlands 44 9 65 109

----------------------------------------------------------------------------

(61) - (150) 84

----------------------------------------------------------------------------

Increase in cash and cash

equivalents during the period 253 1,189 2,362 402

Cash and cash equivalents,

beginning of period 6,128 6,546 4,019 7,333

----------------------------------------------------------------------------

Cash and cash equivalents, end

of period $ 6,381 $ 7,735 $ 6,381 $ 7,735

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Reconciliations to Adjusted EBITDA and Free Cash Flow

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept 29 Sept 24 Sept 29 Sept 24

(CAD thousands) 2012 2011 2012 2011

----------------------------------------------------------------------------

Net income (loss) $ 4,995 $ (341) $ 9,938 $ 2,332

Add (deduct):

Interest expense, net 711 745 2,169 2,422

Deferred tax expense 974 152 2,043 2,018

Depreciation and amortization 138 137 411 409

Fair value adjustments (42) 177 (449) 575

Unrealized exchange (gain)

loss on long-term debt (2,399) 2,941 (2,769) 3,928

----------------------------------------------------------------------------

Adjusted EBITDA 4,377 3,811 11,343 11,684

Add (deduct):

Interest paid on debt, net (740) (619) (1,476) (1,463)

Additions to timber, land,

roads and other fixed assets (105) (9) (215) (25)

Gain on sale of timberlands (44) (9) (63) (107)

Proceeds on sale of

timberlands 44 9 65 109

----------------------------------------------------------------------------

Free cash flow $ 3,532 $ 3,183 $ 9,654 $ 10,198

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Dividends declared $ 3,451 $ 3,451 $ 10,353 $ 10,353

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Payout ratio 98% 108% 107% 102%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contacts: Acadian Timber Corp. Robert Lee Investor Relations and

Communications 604-661-9607rlee@acadiantimber.com

www.acadiantimber.com

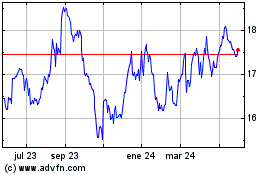

Acadian Timber (TSX:ADN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

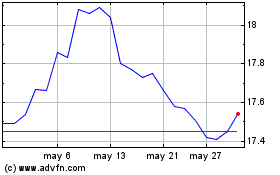

Acadian Timber (TSX:ADN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024