Allied Completes $250 Million Offering of Series J Senior Unsecured Debentures

26 Septiembre 2024 - 7:09AM

Allied Properties Real Estate Investment Trust (“Allied”)

(TSX:AP.UN) announced today that it has completed its previously

announced offering, on a private placement basis in certain

provinces of Canada (the “

Offering”), of $250

million aggregate principal amount of series J senior unsecured

debentures of Allied bearing interest at a rate of 5.534% per annum

and maturing on September 26, 2028 (the

“

Debentures”).

The Debentures were sold at par with a yield of

5.534% per annum on an agency basis by a syndicate of agents co-led

by Scotiabank and RBC Capital Markets and including BMO Capital

Markets, CIBC Capital Markets, Desjardins Capital Markets and

National Bank Financial Markets. Allied intends to use the net

proceeds of the Offering to repay short-term, variable-rate

indebtedness.

The Debentures are rated “BBB” with a Negative

trend by Morningstar DBRS. The Debentures rank equally with all

other unsecured indebtedness of Allied that has not been

subordinated.

The Debentures offered have not been, and will

not be, registered under the United States Securities Act of 1933,

as amended, or any state securities laws, and may not be offered or

sold in the United States absent registration or an applicable

exemption from such registration requirements. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy the Debentures in the United States or in any

jurisdiction in which such offer, sale or solicitation would be

unlawful.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

CAUTIONARY STATEMENTS

This press release may contain forward-looking

statements with respect to Allied including the intended use of the

net proceeds of the Offering. These statements generally can be

identified by use of forward-looking words such as “may”, “will”,

“expect”, “estimate”, “anticipate”, “intends”, “believe” or

“continue” or the negative thereof or similar variations. The

actual results and performance of Allied discussed herein could

differ materially from those expressed or implied by such

statements. Such statements are qualified in their entirety by the

inherent risks and uncertainties surrounding future expectations.

Important factors that could cause actual results to differ

materially from expectations include, among other things, financing

and interest rates, general economic and market conditions and

other factors described under “Risks and Uncertainties” in Allied’s

Annual MD&A, which is available at www.sedarplus.ca. These

cautionary statements qualify all forward-looking statements

attributable to Allied and persons acting on Allied’s behalf.

Unless otherwise stated, all forward-looking statements speak only

as of the date of this press release and, except as required by

applicable law, Allied has no obligation to update such

statements.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Cecilia C. Williams, President & CEO(416)

977-9002cwilliams@alliedreit.com

Nanthini Mahalingam, Senior Vice President & CFO(416)

977-9002nmahalingam@alliedreit.com

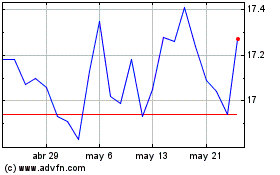

Allied Properties Real E... (TSX:AP.UN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Allied Properties Real E... (TSX:AP.UN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025