Brookfield Asset Management Inc. (TSX: BAM) (NYSE: BAM) (AEX: BAMA)

Investors, analysts and other interested parties can access

Brookfield Asset Management's 2008 Q3 Results as well as the

Shareholders' Letter and Supplemental Information on Brookfield's

web site under the Investor Centre/Financial Reports section at

www.brookfield.com.

The 2008 Q3 Results conference call can be accessed via webcast

on November 7, 2008 at 11 a.m. Eastern Time at www.brookfield.com

or via teleconference at 1-800-319-4610 toll free in North America.

For overseas calls please dial 1-604-638-5340, at approximately

10:50 a.m. Eastern Time. The teleconference taped rebroadcast can

be accessed at 1-800-319-6413 or 604- 638-9010 (Password 2811).

Brookfield Asset Management Inc. (TSX: BAM) (NYSE: BAM) (AEX:

BAMA) today announced its results for the third quarter ended

September 30, 2008.

Cash Flow From Operations

Cash flow from operations for the third quarter totalled $355

million ($0.58 per share). Operating cash flow in the same quarter

in 2007 was $255 million ($0.40 per share) on a comparable basis,

which excludes a security disposition gain of $66 million, or $321

million ($0.52 per share) including the gain. On a comparable

basis, operating cash flow per share increased by 45%

quarter-over-quarter due to improved water levels and pricing in

the company's renewable power business and an increased

contribution from our commercial office business.

Three months ended Nine months ended

US$ millions (except per share September 30 September 30

amounts) 2008 2007 2008 2007

---------------------------------------------------------------------------

Cash flow from operations

Comparable basis (excluding

security disposition gain) $ 355 $ 255 $ 1,176 $ 1,001

- per share 0.58 0.40 1.92 1.61

Total basis (including security

disposition gain) $ 355 $ 321 $ 1,176 $ 1,332

- per share 0.58 0.52 1.92 2.17

---------------------------------------------------------------------------

"In the last few months we increased our overall cash holdings

and liquidity to more than $3.5 billion, most of that at the

Brookfield corporate level. This is one of the highest levels of

liquidity we have ever held, but given uncertainty in the markets

we want to be prepared for the unknowns, and opportunities which

may present themselves in this environment. In addition, our

operating performance in the quarter reflected the durability of

our cash flows, most of which are supported by long-term

contractual arrangements with credit-worthy counterparties, the

high quality of our asset base and operating platforms, and the

stability of our long duration investment grade capitalization,"

commented Bruce Flatt, Senior Managing Partner of Brookfield Asset

Management. "While we are exercising caution during these turbulent

times, and preserving a high level of liquidity, we are exploring a

number of potential opportunities to expand our operating platforms

and create additional shareholder value."

In the past months, the company completed the following capital

raising initiatives:

- Formed an investment fund in October 2008, managed by

Brookfield, into which a portion of the company's U.S. Pacific

Northwest freehold timberlands were sold. Brookfield retains an

approximate 40% direct and indirect interest in the timberlands.

Total proceeds were $1.2 billion, generating net cash proceeds to

Brookfield of approximately $600 million, and will result in a

modest gain that will be recorded in the fourth quarter.

- Closed the sale of the company's Lloyds Insurance business and

committed to sell the U.S. property and casualty business, which

will generate gross proceeds of approximately $310 million and net

proceeds of approximately $150 million prior to year end.

- Sold a group of transmission lines in Brazil for $275 million

net cash proceeds, which is to close in early 2009.

- Closed the sale of a 50% interest in the Canada Trust Tower

office property in Toronto for C$425 million, generating net

proceeds after debt repayment of approximately $200 million.

- Completed $1 billion of financings, including issuing $150

million of corporate debt with a 4.5 year term and a 6.5% blended

coupon, and $850 million of property-specific financings.

Net Income

Net income was $171 million in the third quarter of 2008

compared with $93 million on the same basis last year. Increases in

operating cash flows were offset by a higher level of non-cash

charges, including depreciation on assets purchased since the

second quarter of 2007. In the company's view, these assets should

generate increasing cash flows over an extended period of time due

to their high quality, long life and value appreciation potential.

The company believes that the depreciation and amortization being

recorded is far greater than the expenditures required to maintain

the assets.

Three months ended Nine months ended

US$ millions (except per share September 30 September 30

amounts) 2008 2007 2008 2007

---------------------------------------------------------------------------

Net income

- total $ 171 $ 93 $ 478 $ 441

- per share $ 0.27 $ 0.13 $ 0.75 $ 0.68

---------------------------------------------------------------------------

This news release and accompanying financial statements make

reference to cash flow from operations on a total and per share

basis. Cash flow from operations is defined as net income excluding

depreciation and amortization, interests of non-controlling

shareholders, future income taxes and other items as described as

such in the consolidated statements of income, and including

dividends and disposition gains that are not otherwise included in

net income. Brookfield uses cash flow from operations to assess its

operating results and the value of its business and believes that

many of its shareholders and analysts also find this measure of

value to them. The company provides the components of cash flow

from operations and a full reconciliation between cash flow from

operations and net income with the supplemental information

accompanying this news release. Cash flow from operations is a

non-GAAP measure which does not have any standard meaning

prescribed by GAAP and therefore may not be comparable to similar

measures presented by other companies.

Dividend Declaration

The Board of Directors declared a dividend of US$0.13 per Class

A Common Share, payable on February 28, 2009, to shareholders of

record as at the close of business on February 1, 2009. The Board

also declared all of the regular monthly and quarterly dividends on

its preferred shares.

Information on Brookfield Asset Management's declared share

dividends can be found on the company's web site under Investor

Centre/Stock and Dividend Information.

Additional Information

The Letter to Shareholders and the company's Supplemental

Information for the nine months ended September 30, 2008 contain

further information on the company's strategy, operations and

financial results. Shareholders are encouraged to read these

documents, which are available on the company's web site.

Brookfield Asset Management Inc., focused on property, power and

infrastructure assets, has approximately $90 billion of assets

under management and is co-listed on the New York and Toronto Stock

Exchanges under the symbol BAM and on NYSE Euronext under the

symbol BAMA. For more information, please visit our web site at

www.brookfield.com.

Please note that Brookfield's audited annual and unaudited

quarterly reports have been filed on Edgar and Sedar and can also

be found in the investor section of our web site at

www.brookfield.com. Hard copies of the annual and quarterly reports

can be obtained free of charge upon request.

For more information, please visit our web site at

www.brookfield.com.

Note: This news release contains forward-looking information

within the meaning of Canadian provincial securities laws and

"forward-looking statements" within the meaning of Section 27A of

the U.S. Securities Act of 1933, as amended, Section 21E of the

U.S. Securities Exchange Act of 1934, as amended, "safe harbor"

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations. The words, "sustainable," "should," "may," "prepared,"

"uncertainty," "exploring," "expand," "create," "increasing,"

"extended," "potential," "preserving," "generate," "appreciation,"

"believe," derivations thereof, and other expressions which are

predictions of or indicate future events, trends or prospects and

which do not relate to historical matters identify forward-looking

statements. Forward-looking statements in this news release include

statements in regards to durability of the company's cash flows,

future gains and proceeds, potential opportunities, the company's

ability to increase cash flows over an extended period of time, the

company's long-term contractual arrangements, the stability of its

long duration investment grade capitalization and the expenditures

required to maintain assets purchased since the second quarter of

2007. Although Brookfield Asset Management believes that its

anticipated future results, performance or achievements expressed

or implied of such assets by the forward-looking statements and

information are based upon reasonable assumptions and expectations,

the reader should not place undue reliance on forward-looking

statements and information as such statements and information

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the company to differ materially from anticipated future results,

performance or achievement expressed or implied by such

forward-looking statements and information.

Factors that could cause actual results to differ materially

from those contemplated or implied by forward-looking statements

include: economic and financial conditions in the countries in

which we do business; the behaviour of financial markets, including

fluctuations in interest and exchange rates; market demand for an

infrastructure company, which is unknown; ability to compete for

new acquisitions in the competitive infrastructure space;

availability of equity and debt financing; strategic actions

including dispositions; the ability to effectively integrate

acquisitions into existing operations and the ability to attain

expected benefits; the company's continued ability to attract

institutional partners to its Specialty Investment Funds; adverse

hydrology conditions; regulatory and political factors within the

countries in which the company operates; acts of God, such as

earthquakes and hurricanes; the possible impact of international

conflicts and other developments including terrorist acts; and

other risks and factors detailed from time to time in the company's

form 40-F filed with the Securities and Exchange Commission as well

as other documents filed by the company with the securities

regulators in Canada and the United States including the company's

most recent Annual Information Form under the heading "Business

Environment and Risks."

We caution that the foregoing factors that may affect future

results is not exhaustive. When relying on our forward-looking

statements to make decisions with respect to Brookfield Asset

Management, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Except as required by law, the company undertakes no obligation to

publicly update or revise any forward-looking statements or

information, whether written or oral, as a result of new

information, future events or otherwise.

CONSOLIDATED STATEMENTS OF CASH FLOW FROM OPERATIONS

(Unaudited) Three months ended Nine months ended

US$ millions (except per September 30 September 30

share amounts) 2008 2007 2008 2007

---------------------------------------------------------------------------

Fees earned $ 109 $ 96 $ 336 $ 323

Revenues less direct

operating costs

Commercial properties(1) 595 350 1,474 1,134

Power generation 213 105 728 463

Infrastructure(2) 36 54 128 257

Development and other

properties 62 40 245 303

Specialty funds 32 16 255 137

Investment and other income 247 319 682 866

---------------------------------------------------------------------------

1,294 980 3,848 3,483

Expenses

Interest 535 454 1,537 1,276

Other operating costs 167 108 480 323

Current income taxes 2 (6) 40 40

Non-controlling interests 235 103 615 512

---------------------------------------------------------------------------

Cash flow from operations $ 355 $ 321 $ 1,176 $ 1,332

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Cash flow from operations

per common share

Diluted $ 0.58 $ 0.52 $ 1.92 $ 2.17

Diluted - excluding

security disposition

gain $ 0.58 $ 0.40 $ 1.92 $ 1.61

---------------------------------------------------------------------------

---------------------------------------------------------------------------

(1) Commercial properties includes $31 million (2007 - $nil) of dividend

income recognized in the first three months of 2008 from Canary Wharf

Group which is included in "Investment and Other Income" in the

company's consolidated financial statements, which are prepared in

accordance with Canadian GAAP

(2) Infrastructure includes the results of the company's Chilean

transmission operations, which are recorded on a consolidated basis for

the first six months of 2007 and on an equity accounted basis in 2008

Notes

Cash flow from operations is reconciled to net income before

other items on page 7 of this news release as follows:

Three months ended Nine months ended

(Unaudited) September 30 September 30

US$ millions 2008 2007 2008 2007

---------------------------------------------------------------------------

Net income excluding other items

(see page 7) $ 350 $ 250 $ 1,159 $ 986

Dividends from equity accounted

investments(1) 5 5 17 15

Gain on sale of exchangeable

debentures(1) - 66 - 331

---------------------------------------------------------------------------

Cash flow from operations (per

above) $ 355 $ 321 $ 1,176 $ 1,332

---------------------------------------------------------------------------

-

---------------------------------------------------------------------------

-

(1) Included in "Investment and Other Income" in the Statements of Cash

Flow

from Operations

The consolidated statements of cash flow from operations above

are prepared on a basis that is consistent with management's

discussion and analysis and differ from the company's consolidated

financial statements presented in its interim report, which are

prepared in accordance with Canadian generally accepted accounting

principles ("GAAP"). Management uses cash flow from operations as a

key measure to evaluate performance and to determine the underlying

value of its businesses. Readers are encouraged to consider both

measures in assessing Brookfield Asset Management's results. Cash

flow from operations is equal to net income excluding "other items"

as presented in the following consolidated statements of income and

including dividends from investments and the gain on the sale of an

exchangeable debenture investment. The exchangeable debenture gain

would have been included in income prior to the implementation of a

change in accounting requirements but, as a result of a

transitional provision, has been recorded in shareholders'

equity.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

September 30 December 31

US$ millions 2008 2007

---------------------------------------------------------------------------

Assets

Cash and cash equivalents $ 1,670 $ 1,561

Financial assets 1,038 1,529

Operating assets

Securities 1,327 1,646

Loans and notes receivable 2,285 909

Property, plant and equipment 38,186 37,972

Investments 949 1,352

Intangible assets 1,838 1,773

Goodwill 1,811 1,528

Accounts receivable and other 6,868 7,327

---------------------------------------------------------------------------

$ 55,972 $ 55,597

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Liabilities and Shareholders' Equity

Liabilities

Corporate borrowings $ 2,348 $ 2,048

Non-recourse borrowings

Property specific mortgages 24,167 21,644

Other debt of subsidiaries 5,216 7,463

Accounts payable and other liabilities 9,286 10,055

Intangible liabilities 963 1,047

Capital securities 1,618 1,570

Non-controlling interests of others in assets 5,683 4,256

Preferred equity 870 870

Common equity 5,821 6,644

---------------------------------------------------------------------------

$ 55,972 $ 55,597

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Note

Investment in Canary Wharf Group included in "Commercial

Properties" with a carried value of $182 million (2007 $182

million) is included in "Securities" in the company's consolidated

financial statements, which are prepared in accordance with

Canadian GAAP.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) Three months ended Nine months ended

US$ millions (except per September 30 September 30

share amounts) 2008 2007 2008 2007

--------------------------------------------------------------------------

Total revenues $ 3,216 $ 2,219 $ 9,862 $ 6,185

Fees earned $ 109 $ 96 $ 336 $ 323

Revenues less direct

operating costs

Commercial properties(1) 595 350 1,474 1,134

Power generation 213 105 728 463

Infrastructure(2) 36 54 128 257

Development and other

properties 62 40 245 303

Specialty funds 32 16 255 137

Investment and other

income 242 248 665 520

--------------------------------------------------------------------------

1,289 909 3,831 3,137

Expenses

Interest 535 454 1,537 1,276

Other operating costs 167 108 480 323

Current income taxes 2 (6) 40 40

Non-controlling interests 235 103 615 512

--------------------------------------------------------------------------

350 250 1,159 986

Other items

Depreciation and

amortization (333) (250) (975) (740)

Equity accounted losses

from investments (6) - (34) (68)

Provisions and other 104 (33) (5) (17)

Future income taxes (105) 11 (84) (123)

Non-controlling interests

in the foregoing items 161 115 417 403

--------------------------------------------------------------------------

Net income $ 171 $ 93 $ 478 $ 441

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Net income per common

share

Diluted $ 0.27 $ 0.13 $ 0.75 $ 0.68

Basic $ 0.27 $ 0.13 $ 0.76 $ 0.70

---------------------------------------------------------------------------

---------------------------------------------------------------------------

(1) Commercial properties includes $31 million (2007 - $nil) of dividend

income recognized in the first three months of 2008 from Canary Wharf

Group which is included in "Investment and Other Income" in the

company's consolidated financial statements, which are prepared in

accordance with Canadian GAAP

(2) Infrastructure includes the results of the company's Chilean

transmission operations, which are recorded on a consolidated basis for

the first six months of 2007 and on an equity accounted basis in 2008

Note

The consolidated statements of income are prepared on a basis

consistent with the company's financial statements presented in its

interim report, which are prepared in accordance with Canadian

GAAP.

Contacts: Brookfield Asset Management Denis Couture, SVP,

Investor Relations and Corporate and International Affairs (416)

956-5189 (416) 363-2856 (FAX) Email: dcouture@brookfield.com

Website: www.brookfield.com

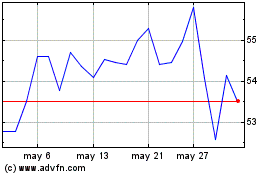

Brookfield Asset Managem... (TSX:BAM)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Brookfield Asset Managem... (TSX:BAM)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024