Boralex Inc. (“Boralex” or the “Company”) (TSX: BLX) held its

annual meeting of shareholders earlier today. During the online

meeting chaired by Alain Rhéaume, Chairman of the Board,

shareholders elected directors and adopted the resolutions

proposed. The retirement of Mr. Edward H. Kernaghan, a director of

the Company for the past 15 years, and his significant contribution

to Boralex were also highlighted.

Mr. Rhéaume opened the meeting with

congratulations to Boralex’s teams on the outstanding achievements

of 2021, including the updating of the strategic plan with the

adoption of ambitious objectives, success in getting several

projects selected under calls for tender in North America and

Europe, securing a first sustainability-linked loan and the

partnership recently formed with Energy Infrastructure Partners

(EIP) through EIP’s acquisition of a 30% stake of Boralex's French

operations. All of this was accomplished in the midst of a

leadership transition, with Patrick Decostre succeeding Patrick

Lemaire as President and Chief Executive Officer.

Highlights of speeches from the

Executive Team

Boralex's President and Chief Executive Officer,

Patrick Decostre, described the context in which Boralex is

currently evolving and will evolve in the coming decades. On the

one hand, in the face of the enormous and glaring challenge of

climate change, Mr. Decostre called for immediate action and

commitments to limit global temperature rise to 1.5 degrees. On the

other hand, he addressed economic issues, including supply chain

issues and the accelerating electrification of transportation. Mr.

Decostre argued that for these forces to develop in harmony, not in

conflict, we must capitalize on renewable energy.

Mr. Decostre underscored the work accomplished

in 2021 in implementing the Company’s robust corporate social

responsibility (CSR) strategy, as well as the publication of a

second CSR report that included expanded discussion of Boralex’s

key indicators, policies and business processes. He closed his

remarks with a description of the considerable progress Boralex had

made in implementing its 2021‒2025 strategic plan over the past

year, reiterating in particular the significance of the partnership

with EIP.

The Vice-President and Chief Financial Officer,

Bruno Guilmette, presented the fiscal highlights of fiscal 2021.

Apart from the financial results, Mr. Guilmette expressed who

pleased he was that the Company had entered into its first

sustainability-linked loan. In September 2021, Boralex secured an

extension of its revolving credit facility and letter of credit

facility, to September 2026, for a total of $525 million. The

credit facility qualified as a sustainability-linked loan, meaning

that it was based on performance targets linked to environmental,

social and governance (ESG) criteria.

Mr. Guilmette also presented the key financial

results for the first quarter of 2022, which he said were

“excellent” and “impressive” thanks to rigorous execution of the

strategic plan and the favourable context. During the quarter,

Boralex generated 1,681 GWh (1,875 GWh)1 of electricity, up 3% (2%)

from the corresponding quarter of 2021. As a result, EBITDA(A)2

increased by 14% (13%) over the first quarter of 2021 to $173

million ($183 million). Operating income totalled $91 million

($105 million), up 18% (16%) from the same quarter in 2021.

Finally, discretionary cash flow3 was $77 million, up 28% from the

first quarter of 2021.

Election of directors

All nominees proposed in the Management Proxy

Circular dated March 3, 2022, were elected directors of Boralex.

The results of the vote by ballot were as follows:

|

Nominee |

For |

Withheld |

|

|

# |

% |

# |

% |

|

André Courville |

74,431,736 |

99.94% |

45,774 |

0.06% |

|

Lise Croteau |

72,823,714 |

97.78% |

1,653,796 |

2.22% |

|

Patrick Decostre |

74,431,466 |

99.94% |

46,044 |

0.06% |

|

Ghyslain Deschamps |

74,429,851 |

99.94% |

47,659 |

0.06% |

|

Marie-Claude Dumas |

73,430,816 |

98.59% |

1,046,694 |

1.41% |

|

Marie Giguère |

72,214,160 |

96.96% |

2,263,350 |

3.04% |

|

Ines Kolmsee |

74,428,999 |

99.93% |

48,511 |

0.07% |

|

Patrick Lemaire |

73,786,123 |

99.07% |

691,387 |

0.93% |

|

Alain Rhéaume |

73,847,325 |

99.15% |

630,185 |

0.85% |

|

Zin Smati |

73,667,853 |

98.91% |

809,657 |

1.09% |

|

Dany St-Pierre |

73,670,496 |

98.92% |

807,014 |

1.08% |

The final voting results on all questions

submitted to a vote at the Annual Meeting will be filed

with SEDAR (www.sedar.com).

About Boralex

At Boralex, we have been providing affordable

renewable energy accessible to everyone for over 30 years. As a

leader in the Canadian market and France’s largest independent

producer of onshore wind power, we also have facilities in the

United States and development projects in the United Kingdom. Over

the past five years, our installed capacity has more than doubled

to 2.5 GW. We are developing a portfolio of more than 3 GW in wind

and solar projects and nearly 200 MW in storage projects, guided by

our values and our corporate social responsibility (CSR) approach.

Through profitable and sustainable growth, Boralex is actively

participating in the fight against global warming. Thanks to our

fearlessness, our discipline, our expertise and our diversity, we

continue to be an industry leader. Boralex’s shares are listed on

the Toronto Stock Exchange under the ticker symbol BLX.

For more information, visit www.boralex.com or

www.sedar.com. Follow us on Facebook, LinkedIn and

Twitter.

Disclaimer regarding forward-looking

statements

Certain statements contained in this release,

including those related to results and performance for future

periods, installed capacity targets, EBITDA(A) and discretionary

cash flows, the Company’s strategic plan, business model and growth

strategy, organic growth and growth through mergers and

acquisitions, obtaining an investment grade credit rating, payment

of a quarterly dividend, the Company’s financial targets, the

partnership with Énergir and Hydro-Québec for the elaboration of

three 400 MW projects for which the development will depend on

Hydro-Québec's changing needs, the portfolio of renewable energy

projects, the Company’s Growth Path and its Corporate Social

Responsibility (CSR) objectives are forward-looking statements

based on current forecasts, as defined by securities legislation.

Positive or negative verbs such as “will,” “would,” “forecast,”

“anticipate,” “expect,” “plan,” “project,” “continue,” “intend,”

“assess,” “estimate” or “believe,” or expressions such as “toward,”

“about,” “approximately,” “to be of the opinion,” “potential” or

similar words or the negative thereof or other comparable

terminology, are used to identify such statements.

Forward-looking statements are based on major

assumptions, including those about the Company’s return on its

projects, as projected by management with respect to wind and other

factors, opportunities that may be available in the various sectors

targeted for growth or diversification, assumptions made about

EBITDA(A) margins, assumptions made about the sector realities and

general economic conditions, competition, exchange rates as well as

the availability of funding and partners. While the Company

considers these factors and assumptions to be reasonable, based on

the information currently available to the Company, they may prove

to be inaccurate.

Boralex wishes to clarify that, by their very

nature, forward-looking statements involve risks and uncertainties,

and that its results, or the measures it adopts, could be

significantly different from those indicated or underlying those

statements, or could affect the degree to which a given

forward-looking statement is achieved. The main factors that may

result in any significant discrepancy between the Company’s actual

results and the forward-looking financial information or

expectations expressed in forward-looking statements include the

general impact of economic conditions, fluctuations in various

currencies, fluctuations in energy prices, the Company’s financing

capacity, competition, changes in general market conditions,

industry regulations, litigation and other regulatory issues

related to projects in operation or under development, as well as

other factors listed in the Company’s filings with the various

securities commissions.

Unless otherwise specified by the Company,

forward-looking statements do not take into account the effect that

transactions, non-recurring items or other exceptional items

announced or occurring after such statements have been made may

have on the Company’s activities. There is no guarantee that the

results, performance or accomplishments, as expressed or implied in

the forward-looking statements, will materialize. Readers are

therefore urged not to rely unduly on these forward-looking

statements.

Unless required by applicable securities

legislation, Boralex’s management assumes no obligation to update

or revise forward-looking statements in light of new information,

future events or other changes.

Percentage figures are calculated in thousands

of dollars.

Non-IFRS financial measures and other

financial measures

In order to assess the performance of its assets

and reporting segments, Boralex uses performance measures that are

not in accordance with International Financial Reporting Standards

("IFRS"). Management believes that these measures are widely

accepted financial indicators used by investors to assess the

operational performance of a company and its ability to generate

cash through operations. The non-IFRS financial measures and other

financial measures also provide investors with insight into the

Corporation’s decision making as the Corporation uses these

non-IFRS financial measures to make financial, strategic and

operating decisions. The non-IFRS financial measures and other

financial measures should not be considered as a substitute for

IFRS measures.

These non-IFRS financial measures are derived

primarily from the audited consolidated financial statements, but

do not have a standardized meaning under IFRS; accordingly, they

may not be comparable to similarly named measures used by other

companies. Non-IFRS financial measures and other financial measures

are not audited. They have important limitations as analytical

tools and investors are cautioned not to consider them in isolation

or place undue reliance on ratios or percentages calculated using

these non-IFRS financial measures.

The Corporation uses the terms "EBITDA(A)",

"Combined", and "discretionary cash flows" to assess the

performance of its assets and business lines. For more details, see

the Non-IFRS financial measures and other financial measures

section of Boralex's 2022 interim Report 1.

For more information:

| Media |

Investor Relations |

| Isabelle FontaineDirector, Public

Affairs and CommunicationsBoralex Inc.819

345-0043isabelle.fontaine@boralex.com |

Stéphane MilotSenior

Director – Investor RelationsBoralex Inc.514

213-1045stephane.milot@boralex.com |

| |

|

Source: Boralex Inc.

1 The figures in brackets indicated the results

according to the Combined3, compared to those obtained according to

the Consolidated2 EBITDA(A) is a total of segments measure. For

more details, see the Non-IFRS financial measures and other

financial measures section of the 2022 Interim Report 1.3 The

terms, Combined and Discretionary cash flow are non-GAAP measures

and do not have a standardized meaning under IFRS. Accordingly,

they may not be comparable to similarly named measures used by

other companies. For more details, see the Non-IFRS financial

measures and other financial measures section in the 2022 Interim

Report 1.

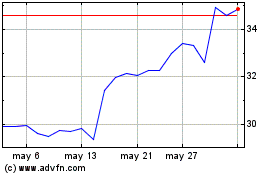

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025