Boralex Inc. (“Boralex” or the “Company”) (TSX: BLX) is pleased to

report the addition of new projects to its portfolio and

significant progress made on certain development projects in the

second quarter of 2023.

“The increase in combined operating income and

combined EBITDA(A) in the second quarter is attributable to the

commissioning of assets and to high electricity prices in France as

well as to the contribution of the acquisition of wind assets in

the United States. These elements more than offset the pressure on

results due to unfavorable weather conditions in North America at

the end of the quarter. The second quarter also saw the selection

of two energy storage projects totalling 380 MW under the Ontario

request for proposals,” said Patrick Decostre, President and Chief

Executive Officer of Boralex. “This announcement marks a very

important milestone for Boralex as we aim to expand our energy

storage portfolio and achieve the growth and diversification

objectives of our 2025 Strategic Plan.”

|

1 |

The terms

“Combined”, “cash flows from operations”, “discretionary cash

flows” and “available cash resources and authorized financing”

designate non-GAAP financial measures and do not have a

standardized meaning under IFRS. Accordingly, such measures may not

be comparable to similarly named measures used by other companies.

For more details, see the Non-IFRS and other financial measures

section of this press release. |

|

2 |

EBITDA(A) is a total of segment measures. For more details, see

the Non-IFRS and other financial measures section of this press

release. |

|

3 |

Figures in brackets indicate results on a Combined basis as

opposed to those on a Consolidated basis. |

|

4 |

Anticipated production" is an additional financial measure. For

more details, see the Non-IFRS and other financial measures section

of this press release. |

With respect to Boralex’s prospects for the

coming quarters, Mr. Decostre added: “We added 369 MW of projects

to our portfolio, which now represents over 6.2 GW of capacity, and

continued to integrate the American wind farms with a total

capacity of 894 MW that we acquired in late 2022. There are

numerous development opportunities in the markets where we have a

presence, as evidenced by the many requests for proposals planned

for the next six months: Hydro-Québec’s request for proposals for

1,500 MW, Ontario’s second request for proposals for energy

storage, and the NYSERDA solar solicitation for North America. A

500 MW technology-neutral tender and two 925 MW onshore wind tender

are also expected in France. Our teams are working very hard to

prepare high-quality projects in order to provide sustainable

renewable energy supply solutions in our target markets. We are

continuing with these multiple development initiatives, as well as

with project construction and the search for strategic

acquisitions, while maintaining our financial discipline and

flexibility."

2nd quarter highlights

Three-month periods

ended June

30

|

|

|

Consolidated |

|

|

|

|

Combined 1 |

|

|

|

|

2023 |

2022 |

|

Change |

|

|

2023 |

2022 |

|

Change |

|

(in millions of Canadian dollars, unless otherwise specified)

(unaudited) |

|

|

$ |

|

% |

|

|

|

$ |

% |

|

Power production (GWh)2 |

1,353 |

1,298 |

55 |

|

4 |

|

1,861 |

1,452 |

409 |

28 |

|

Revenues from energy sales andfeed-in premium |

210 |

168 |

42 |

|

25 |

|

237 |

185 |

52 |

28 |

|

Operating income |

38 |

45 |

(7 |

) |

(16 |

) |

57 |

53 |

4 |

6 |

|

EBITDA(A)3 |

119 |

121 |

(2 |

) |

(2 |

) |

143 |

133 |

10 |

7 |

|

Net earnings (loss) |

22 |

14 |

8 |

|

59 |

|

22 |

14 |

8 |

59 |

|

Net earnings attributable to shareholders of Boralex |

19 |

10 |

9 |

|

82 |

|

19 |

10 |

9 |

82 |

|

Per share - basic and diluted |

$0.19 |

$0.10 |

$0.09 |

|

84 |

|

$0.19 |

$0.10 |

$0.09 |

84 |

|

Net cash flows related to operating activities |

144 |

97 |

47 |

|

48 |

|

— |

— |

— |

— |

|

Cash flows from operations1 |

76 |

86 |

(10 |

) |

(12 |

) |

— |

— |

— |

— |

|

Discretionary cash flows1 |

3 |

13 |

(10 |

) |

(82 |

) |

— |

— |

— |

— |

In the second quarter of 2023, Boralex produced

1,353 GWh (1,861 GWh) of electricity, 4% (28%) more than the 1,298

GWh (1,452 GWh) produced in the same quarter of 2022. The increase

on a Consolidated basis is attributable to the commissioning of

wind farms, while the increase on a Combined basis is due to the

integration of the wind farms acquired in the United States in late

2022.

For the three-month period ended June 30, 2023,

revenues from energy sales and feed-in premiums totalled $210

million ($237 million), 25% (28%) more than in the second quarter

of 2022. This increase is attributable the commissioning of assets,

as well as high electricity prices in France on a Consolidated

basis and to the contribution of the acquisition in the United

States on a Combined basis. EBITDA(A)3 amounted to $119 million

($143 million), 2% decrease (7% increase) compared to the second

quarter of 2022. The slight decrease in EBITDA(A) is attributable

to lower production from Canadian wind farms. It should be noted

that EBITDA(A) for the second quarter of 2022 included an amount of

$14 million attributable to certain contracts for which Boralex had

to record a provision in the third quarter of 2022 following the

publication of the 2022 Supplementary Budget Act in France. On a

Combined basis, the increase is attributable to the acquisition of

wind farms in the United States. Operating income amounted to $38

million ($57 million), which compares to $45 million ($53 million)

for the same quarter of 2022.

|

1 |

Combined, Cash

Flow from operations, Discretionary Cash Flows and available cash

resources and authorized financing facilities are non-GAAP

financial measures and do not have a standardized definition under

IFRS. Therefore, these measures may not be comparable to similar

measures used by other companies. For more details, see the

Non-IFRS financial measures and other financial measures section of

this press release. |

|

2 |

Power production includes the production for which Boralex

received financial compensation following power generation

limitations imposed by its customers since management uses this

measure to evaluate the Corporation’s performance. This adjustment

facilitates the correlation between power production and revenues

from energy sales and feed-in premium. |

|

3 |

EBITDA(A) is a total of sector measures. For more details, see

the Non-IFRS financial measures and other financial measures

section of this press release. |

Six-month periods

ended June

30

|

|

|

Consolidated |

|

|

|

|

Combined1 |

|

|

|

|

|

2023 |

2022 |

|

Change |

|

|

2023 |

2022 |

|

Change |

|

|

|

(in millions of Canadian dollars, unless otherwise specified) |

|

|

$ |

|

% |

|

|

|

$ |

|

% |

|

|

Power production (GWh)2 |

3,050 |

2,979 |

71 |

|

2 |

|

4,147 |

3,327 |

820 |

|

25 |

|

|

Revenues from energy sales and feed-in premium |

508 |

395 |

113 |

|

29 |

|

565 |

433 |

132 |

|

31 |

|

|

Operating income |

115 |

136 |

(21 |

) |

(16 |

) |

163 |

158 |

5 |

|

3 |

|

|

EBITDA(A)3 |

290 |

294 |

(4 |

) |

(1 |

) |

335 |

316 |

19 |

|

6 |

|

|

Net earnings |

77 |

71 |

6 |

|

9 |

|

77 |

71 |

6 |

|

9 |

|

|

Net earnings attributable to shareholders of Boralex |

62 |

60 |

2 |

|

2 |

|

62 |

60 |

2 |

|

2 |

|

|

Per share - basic and diluted |

$0.60 |

$0.59 |

$0.01 |

|

2 |

|

$0.60 |

$0.59 |

$0.01 |

|

2 |

|

|

Net cash flows related to operating activities |

388 |

234 |

154 |

|

65 |

|

— |

— |

— |

|

— |

|

|

Cash flows from operations1 |

217 |

222 |

(5 |

) |

(2 |

) |

— |

— |

— |

|

— |

|

|

|

As at June

30 |

As at Dec.

31 |

|

Change |

|

|

As at June

30 |

As at Dec.

31 |

|

Change |

|

|

|

|

|

|

$ |

|

% |

|

|

|

$ |

|

% |

|

|

Total assets |

6,677 |

6,539 |

138 |

|

2 |

|

7,195 |

7,188 |

7 |

|

— |

|

|

Debt - principal balance |

3,347 |

3,346 |

1 |

|

— |

|

3,663 |

3,674 |

(11 |

) |

— |

|

|

Total project debt |

2,801 |

3,007 |

(206 |

) |

(7 |

) |

3,117 |

3,335 |

(218 |

) |

(7 |

) |

|

Total corporate debt |

546 |

339 |

207 |

|

61 |

|

546 |

339 |

207 |

|

61 |

|

For the six-month period ended June 30, 2023,

Boralex produced 3,050 GWh (4,147 GWh) of power, which represents

an increase of 2% (25%) compared to the 2,979 GWh (3,327 GWh)

produced in the same period in 2022. For the six-month period ended

June 30, 2023, revenues from energy sales and feed-in premiums

amounted to $508 million ($565 million), up$113 million

($132 million) or 29% (31%) from the same period in 2022.

EBITDA(A)1 was $290 million ($335 million), down

$4 million or 1% (up $19 million or 6%) from the same period last

year. Operating income totalled $115 million ($163 million), down

$21 million (up $5 million) from the same period in 2022.

Overall, for the six-month period ended June 30,

2023, Boralex posted net earnings of $77 million ($77 million)

compared to net earnings of $71 million ($71 million) for the same

period in 2022. Net earnings attributable to Boralex shareholders

amounted to$62 million ($62 million) or $0.60 ($0.60) per share

(basic and diluted), compared to $60 million ($60 million) or $0.59

($0.59) per share (basic and diluted) for the same period in

2022.

|

1 |

Combined, Cash

Flow from operations and Discretionary Cash Flows are non-GAAP

financial measures and do not have a standardized definition under

IFRS. Therefore, these measures may not be comparable to similar

measures used by other companies. For more details, see the

Non-IFRS financial measures and other financial measures section of

this press release. |

|

2 |

Power

production includes the production for which Boralex received

financial compensation following power generation limitations

imposed by its customers since management uses this measure to

evaluate the Corporation’s performance. This adjustment facilitates

the correlation between power production and revenues from energy

sales and feed-in premium. |

|

3 |

EBITDA(A) is a total of sector measures. For more details, see

the Non-IFRS financial measures and other financial measures

section of this press release. |

Outlook

Boralex’s 2025 Strategic Plan is built around

the same four strategic directions as the plan launched in 2019 –

growth, diversification, customers and optimization – and six

corporate targets. The details of the plan, which also sets out

Boralex’s corporate social responsibility strategy, are found in

the Corporation’s annual report. Highlights of the main

achievements for the quarter ended June 30, 2023, in relation to

the 2025 Strategic Plan can be found in the 2023 Interim Report 2,

available in the Investors section of the Boralex website.

In the coming quarters, Boralex will continue to

work on its various initiatives under the strategic plan, including

project development, analysis of acquisition targets and

optimization of power sales and operating costs.

Finally, to pursue its organic growth, the

Company has a pipeline of projects at various stages of development

defined on the basis of clearly identified criteria, totalling

5,326 MW in wind, solar and energy storage projects, as well as a

Growth Path of 971 MW of wind, solar and energy storage

projects.

Dividend declaration

The Company’s Board of Directors has authorized

and announced a quarterly dividend of $0.1650 per common share.

This dividend will be paid on September 18, 2023, to shareholders

of record at the close of business on August 31, 2023. Boralex

designates this dividend as an “eligible dividend” pursuant to

paragraph 89(14) of the Income Tax Act (Canada) and all provincial

legislation applicable to eligible dividends.

About Boralex

At Boralex, we have been providing affordable

renewable energy accessible to everyone for over 30 years. As a

leader in the Canadian market and France’s largest independent

producer of onshore wind power, we also have facilities in the

United States and development projects in the United Kingdom. Over

the past five years, our installed capacity has more than doubled

to over 3 GW. We are developing a portfolio of over 6.2 GW in wind,

solar and storage projects, guided by our values and our corporate

social responsibility (CSR) approach. Through profitable and

sustainable growth, Boralex is actively participating in the fight

against global warming. Thanks to our fearlessness, our discipline,

our expertise and our diversity, we continue to be an industry

leader.

Boralex’s shares are listed on the Toronto Stock

Exchange under the ticker symbol BLX.

For more information, visit www.boralex.com or

www.sedarplus.ca. Follow us on Facebook, LinkedIn and Twitter.

Non-IFRS measuresPerformance

measures

In order to assess the performance of its assets

and reporting segments, Boralex uses performance measures.

Management believes that these measures are widely accepted

financial indicators used by investors to assess the operational

performance of a company and its ability to generate cash through

operations. The non-IFRS and other financial measures also provide

investors with insight into the Corporation’s decision making as

the Corporation uses these non-IFRS financial measures to make

financial, strategic and operating decisions. The non-IFRS and

other financial measures should not be considered as substitutes

for IFRS measures.

These non-IFRS financial measures are derived

primarily from the audited consolidated financial statements, but

do not have a standardized meaning under IFRS; accordingly, they

may not be comparable to similarly named measures used by other

companies. Non-IFRS and other financial measures are not audited.

They have important limitations as analytical tools and investors

are cautioned not to consider them in isolation or place undue

reliance on ratios or percentages calculated using these non-IFRS

financial measures.

|

Non-IFRS financial

measures |

|

Specific financial

measure |

Use |

Composition |

Most directly comparable IFRS

measure |

|

Financial data - Combined (all disclosed financial data) |

To assess the operating performance and the ability of a company to

generate cash from its operations.The Interests represent

significant investments by Boralex. |

Results from the combination of the financial information of

Boralex Inc. under IFRS and the share of the financial information

of the Interests.Interests in the Joint Ventures and associates,

Share in earnings (losses) of the Joint Ventures and associates and

Distributions received from the Joint Ventures and associates are

then replaced with Boralex’s respective share in the financial

statements of the Interests (revenues, expenses, assets,

liabilities, etc.) |

Respective financial data - Consolidated |

|

Cash flows from operations |

To assess the cash generated by the Company's operations and its

ability to finance its expansion from these funds. |

Net cash flows related to operating activities before changes in

non-cash items related to operating activities. |

Net cash flows related to operating activities |

|

Discretionary cash flows |

To assess the cash generated from operations and the amount

available for future development or to be paid as dividends to

common shareholders while preserving the long-term value of the

business. |

Net cash flows related to operating activities before "change in

non-cash items related to operating activities,” less(i)

distributions paid to non-controlling shareholders, (ii) additions

to property, plant and equipment (maintenance of operations), (iii)

repayments on non-current debt (projects) and repayments to tax

equity investors; (iv) principal payments related to lease

liabilities; (v) adjustments for non- operational items; plus (vi)

development costs (from the statement of earnings). |

Net cash flows related to operating activities |

|

|

Corporate objectives for 2025 from the strategic plan. |

|

|

|

Non-IFRS financial

measures |

|

Specific financial

measure |

Use |

Composition |

Most directly comparable IFRS

measure |

|

Available cash and cash equivalents |

To assess the cash and cash equivalents available, as at balance

sheet date, to fund the Corporation's growth. |

Represents cash and cash equivalents, as stated on the balance

sheet, from which known short-term cash requirements are

excluded. |

Cash and cash equivalents |

|

Available cash resources and authorized financing |

To assess the total cash resources available, as at balance sheet

date, to fund the Corporation's growth. |

Results from the combination of credit facilities available to fund

growth and the available cash and cash equivalents. |

Cash and cash equivalents |

|

Other financial

measures - Total

of segments

measure |

|

Specific financial

measure |

Most directly

comparable IFRS

measure |

|

EBITDA(A) |

Operating income |

|

Other financial

measures -

Supplementary Financial

Measures |

|

Specific financial

measure |

Composition |

|

Anticipated production |

Production that the Company anticipates for the oldest sites based

on adjusted historical averages, commissioning and planned

shutdowns and, for other sites, based on the production studies

carried out. |

|

Credit facilities available for growth |

The credit facilities available for growth include the unused

tranche of the parent company's credit facility, apart from the

accordion clause, as well as the unused tranche of the construction

facility. |

CombinedThe following tables reconcile

Consolidated financial data with data presented on a Combined

basis:

|

|

|

|

2023 |

|

|

2022 |

|

(in millions of Canadian dollars) (unaudited) |

Consolidated |

Reconciliation(1) |

Combined |

Consolidated |

Reconciliation(1) |

Combined |

|

Three-month periods

ended June

30: |

|

|

|

|

|

|

|

Power production (GWh)(2) |

1,353 |

508 |

1,861 |

1,298 |

154 |

1,452 |

|

Revenues from energy sales and feed-in |

|

|

|

|

|

|

|

premium |

210 |

27 |

237 |

168 |

17 |

185 |

|

Operating income |

38 |

19 |

57 |

45 |

8 |

53 |

|

EBITDA(A) |

119 |

24 |

143 |

121 |

12 |

133 |

|

Net earnings |

22 |

— |

22 |

14 |

— |

14 |

|

Six-month periods

ended June

30: |

|

|

|

|

|

|

|

Power production (GWh)(2) |

3,050 |

1,097 |

4,147 |

2,979 |

348 |

3,327 |

|

Revenues from energy sales and feed-in |

|

|

|

|

|

|

|

premiums |

508 |

57 |

565 |

395 |

38 |

433 |

|

Operating income |

115 |

48 |

163 |

136 |

22 |

158 |

|

EBITDA(A) |

290 |

45 |

335 |

294 |

22 |

316 |

|

Net earnings |

77 |

— |

77 |

71 |

— |

71 |

|

|

As at June

30, 2023 |

As at December

31, 2022 |

|

Total assets |

6,677 |

518 |

7,195 |

6,539 |

649 |

7,188 |

|

Debt - Principal balance |

3,347 |

316 |

3,663 |

3,346 |

328 |

3,674 |

|

(1) |

Includes the

respective contribution of joint ventures and associates as a

percentage of Boralex's interest less adjustments to reverse

recognition of these interests under IFRS. This contribution is

attributable to wind power sites in North America segment and

includes corporate expenses of $1 million in EBITDA(A). |

|

(2) |

Includes financial compensation following electricity

production limitations imposed by customers. |

EBITDA(A)

EBITDA(A) is a total of segment financial

measures and represents earnings before interest, taxes,

depreciation and amortization, adjusted to exclude other items such

as acquisition costs, other loss (gains), net loss (gain) on

financial instruments and foreign exchange loss (gain), the last

two items being included under Other.

EBITDA(A) is used to assess the performance of

the Corporation's reporting segments.

EBITDA(A) is reconciled to the most comparable

IFRS measure, namely, operating income, in the following table:

|

|

|

|

|

|

2023 |

|

|

|

|

|

2022 |

|

Change 2023 vs

2022 |

|

(in millions of Canadian dollars) (unaudited) |

Consolidated |

|

Reconciliation(1) |

|

Combined |

|

Consolidated |

|

Reconciliation(1) |

|

Combined |

|

Consolidated |

|

Combined |

|

|

Three-month periods

ended June

30: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA(A) |

119 |

|

24 |

|

143 |

|

121 |

|

12 |

|

133 |

|

(2 |

) |

10 |

|

|

Amortization |

(72 |

) |

(14 |

) |

(86 |

) |

(72 |

) |

(6 |

) |

(78 |

) |

— |

|

(8 |

) |

|

Impairment |

— |

|

— |

|

— |

|

(2 |

) |

(1 |

) |

(3 |

) |

2 |

|

3 |

|

|

Other gains |

— |

|

— |

|

— |

|

— |

|

1 |

|

1 |

|

— |

|

(1 |

) |

|

Share in earnings (loss) of Joint Ventures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Associates |

(26 |

) |

26 |

|

— |

|

(10 |

) |

10 |

|

— |

|

(16 |

) |

— |

|

|

Change in fair value of a derivative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

included in the share of the Joint |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ventures |

17 |

|

(17 |

) |

— |

|

8 |

|

(8 |

) |

— |

|

9 |

|

— |

|

|

Operating income |

38 |

|

19 |

|

57 |

|

45 |

|

8 |

|

53 |

|

(7 |

) |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six-month periods

ended June

30: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA(A) |

290 |

|

45 |

|

335 |

|

294 |

|

22 |

|

316 |

|

(4 |

) |

19 |

|

|

Amortization |

(145 |

) |

(27 |

) |

(172 |

) |

(144 |

) |

(12 |

) |

(156 |

) |

(1 |

) |

(16 |

) |

|

Impairment |

— |

|

— |

|

— |

|

(3 |

) |

(1 |

) |

(4 |

) |

3 |

|

4 |

|

|

Other gains |

— |

|

— |

|

— |

|

— |

|

2 |

|

2 |

|

— |

|

(2 |

) |

|

Share in earnings of joint ventures and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

associates |

(45 |

) |

45 |

|

— |

|

(34 |

) |

34 |

|

— |

|

(11 |

) |

— |

|

|

Change in fair value of a derivative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

included in the share of the joint |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ventures |

15 |

|

(15 |

) |

— |

|

23 |

|

(23 |

) |

— |

|

(8 |

) |

— |

|

|

Operating income |

115 |

|

48 |

|

163 |

|

136 |

|

22 |

|

158 |

|

(21 |

) |

5 |

|

|

(1) |

Includes the

respective contribution of joint ventures and associates as a

percentage of Boralex's interest less adjustments to reverse

recognition of these interests under IFRS. |

Cash flow

from operations

and discretionary

cash flows

The Corporation computes the cash flow from operations and

discretionary cash flows as follows:

|

|

Consolidated |

|

|

Three-month periods ended |

Twelve-month periods ended |

|

(in millions of Canadian dollars) (unaudited) |

June 30,2023 |

|

June 30,2022 |

|

June 30,2023 |

|

December 31,2022 |

|

|

Net cash flows

related to

operating activities |

144 |

|

97 |

|

667 |

|

513 |

|

|

Change in non-cash items relating to operating activities |

(68 |

) |

(11 |

) |

(269 |

) |

(110 |

) |

|

Cash flows from

operations |

76 |

|

86 |

|

398 |

|

403 |

|

|

Repayments on non-current debt (projects)(1) |

(73 |

) |

(69 |

) |

(223 |

) |

(212 |

) |

|

Adjustment for non-operating items(2) |

1 |

|

4 |

|

3 |

|

7 |

|

|

|

4 |

|

21 |

|

178 |

|

198 |

|

|

Principal payments related to lease liabilities |

(4 |

) |

(3 |

) |

(16 |

) |

(15 |

) |

|

Distributions paid to non-controlling shareholders(3) |

(2 |

) |

(10 |

) |

(41 |

) |

(37 |

) |

|

Additions to property, plant and equipment |

|

|

|

|

|

|

|

|

|

(maintenance of operations) |

(4 |

) |

(3 |

) |

(14 |

) |

(12 |

) |

|

Development costs (from statement of earnings) |

9 |

|

8 |

|

38 |

|

33 |

|

|

Discretionary cash

flows |

3 |

|

13 |

|

145 |

|

167 |

|

|

(1) |

Excluding VAT

bridge financing, early debt repayments and repayments under the

construction facility - Boralex Energy Investments portfolio. |

|

(2) |

For the twelve-month period ended June 30, 2023, favourable

adjustment of $3 million consisting mainly of acquisition,

integration and transaction costs. For the year ended December 31,

2022, favourable adjustment of $7 million consisting mainly of

acquisition and transaction costs. |

|

(3) |

Comprises distributions paid to non-controlling shareholders as

well as the portion of discretionary cash flows attributable to the

non-controlling shareholder of Boralex Europe Sàrl. |

Available cash

and cash

equivalents and

available cash

resources and authorized

financing

The Corporation defines available cash and cash equivalents as

well as available cash resources and authorized financing as

follows:

|

|

Consolidated |

|

|

As at June 30, |

|

As at December 31, |

|

|

(in millions of Canadian dollars) (unaudited) |

2023 |

|

2022 |

|

|

Cash and cash equivalents |

600 |

|

361 |

|

|

Cash and cash equivalents held by entities subject to project debt

agreements(1) |

(492 |

) |

(279 |

) |

|

Bank overdraft |

(6 |

) |

(12 |

) |

|

Available cash

and cash

equivalents |

102 |

|

70 |

|

|

Credit facilities available for growth |

211 |

|

424 |

|

|

Available cash

resources and

authorized financing |

313 |

|

494 |

|

|

(1) |

This cash can

be used for the operations of the respective projects, but is

subject to restrictions for non-project related purposes under the

credit agreements. |

Disclaimer regarding forward-looking

statementsCertain statements contained in this release,

including those related to results and performance for future

periods, installed capacity targets, EBITDA(A) and discretionary

cash flows, the Corporation's strategic plan, business model and

growth strategy, organic growth and growth through mergers and

acquisitions, obtaining an investment grade credit rating, payment

of a quarterly dividend, the Corporation’s financial targets, the

partnership with Énergir and Hydro-Québec for the elaboration of

three 400 MW projects for which the development will depend on

Hydro-Québec's changing needs, the portfolio of renewable energy

projects, the Corporation’s Growth Path and its Corporate Social

Responsibility (CSR) objectives are forward-looking statements

based on current forecasts, as defined by securities legislation.

Positive or negative verbs such as “will,” “would,” “forecast,”

“anticipate,” “expect,” “plan,” “project,” “continue,” “intend,”

“assess,” “estimate” or “believe,” or expressions such as “toward,”

“about,” “approximately,” “to be of the opinion,” “potential” or

similar words or the negative thereof or other comparable

terminology, are used to identify such statements.

Forward-looking statements are based on major

assumptions, including those about the Corporation’s return on its

projects, as projected by management with respect to wind and other

factors, opportunities that may be available in the various sectors

targeted for growth or diversification, assumptions made about

EBITDA(A) margins, assumptions made about the sector realities and

general economic conditions, competition, exchange rates as well as

the availability of funding and partners. In particular, CSR

targets are based on a number of assumptions, including, but not

limited to, the following key assumptions: implementation of

various corporate and business initiatives to reduce direct and

indirect GHG emissions; availability of technologies to achieve

targets; absence of new business initiatives or acquisitions of

companies or technologies that would significantly increase the

expected level of performance; no negative impact resulting from

clarifications or amendments to international standards or the

methodology used to calculate our CSR performance and disclosure;

sufficient participation and collaboration of our suppliers in

setting their own targets in line with Boralex’s CSR initiatives;

the ability to find diverse and competent talent; education and

organizational engagement to help achieve our CSR targets. While

the Corporation considers these factors and assumptions to be

reasonable, based on the information currently available to the

Corporation, they may prove to be inaccurate.

Boralex wishes to clarify that, by their very

nature, forward-looking statements involve risks and uncertainties,

and that its results, or the measures it adopts, could be

significantly different from those indicated or underlying those

statements, or could affect the degree to which a given

forward-looking statement is achieved. The main factors that may

result in any significant discrepancy between the Corporation’s

actual results and the forward-looking financial information or

expectations expressed in forward-looking statements include the

general impact of economic conditions, fluctuations in various

currencies, fluctuations in energy prices, the risk of not renewing

PPAs or being unable to sign new corporate PPA, the risk of not

being able to capture the US or Canadian investment tax credit,

counterparty risk, the Corporation’s financing capacity,

cybersecurity risks, competition, changes in general market

conditions, industry regulations and amendments thereto,

particularly the legislation, regulations and emergency measures

that could be implemented for time to time to address high energy

prices in Europe, litigation and other regulatory issues related to

projects in operation or under development, as well as other

factors listed in the Corporation’s filings with the various

securities commissions.

Unless otherwise specified by the Corporation,

forward-looking statements do not take into account the effect that

transactions, non-recurring items or other exceptional items

announced or occurring after such statements have been made may

have on the Corporation’s activities. There is no guarantee that

the results, performance or accomplishments, as expressed or

implied in the forward-looking statements, will materialize.

Readers are therefore urged not to rely unduly on these

forward-looking statements.

Unless required by applicable securities

legislation, Boralex’s management assumes no obligation to update

or revise forward-looking statements in light of new information,

future events or other changes.

Percentage figures are calculated in thousands

of dollars.

|

For more

information |

|

| |

|

| Camille Laventure |

Stéphane Milot |

| Advisor, Public Affairs and External Communications |

Vice President, Investor Relations |

| Boralex Inc. |

Boralex Inc. |

| 438-883-8580 |

514-213-1045 |

| camille.laventure@boralex.com |

stephane.milot@boralex.com |

| |

|

| Source: Boralex inc. |

|

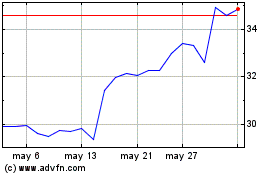

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025