B2Gold Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or

the “Company”) is pleased to announce that it has agreed to terms

(the “Agreement”) with the State of Mali (the “State”) in

connection with the ongoing operation and governance of the Fekola

Complex, including the development of both the underground project

at the Fekola Mine (owned 80% by B2Gold and 20% by the State of

Mali) and Fekola Regional. The Fekola Complex is comprised of the

Fekola Mine (Medinandi permit hosting the Fekola and Cardinal pits

and Fekola underground) and Fekola Regional (Anaconda Area

(Bantako, Menankoto, and Bakolobi permits) and the Dandoko permit),

which is located approximately 20 kilometers (“km”) from the Fekola

Mine. All dollar figures are in United States dollars unless

otherwise indicated.

Highlights:

- Exploitation permits for

Fekola Regional and approval of exploitation phase of Fekola

underground to be expedited: Upon issuance of the

exploitation permit for Fekola Regional, mining operations will

begin with initial gold production expected to commence in early

2025, with the potential to generate approximately 80,000 to

100,000 ounces of additional gold production per year from Fekola

Regional sources through the trucking of open pit ore to the Fekola

mill. Initial gold production from Fekola underground is expected

to commence in mid-2025.

- Fekola Mine to continue to

be governed by Mali’s 2012 Mining Code, with the Fekola Mining

Convention remaining in place until 2040; Fekola Regional to be

governed by the 2023 Mining Code: For the Fekola Mine, the

Agreement includes continued stability of the ownership, income tax

and customs regimes and the Company’s dispute resolution rights

under the Fekola Mining Convention.

- Provides the Fekola Complex

a clean slate to move forward under the new economic partnership

with the State of Mali: The Agreement contemplates the

distribution of all retained earnings currently attributable to the

State’s 10% ordinary share interest and conversion of that interest

to a 10% preferred share interest with priority dividends going

forward, and settles any and all existing tax assessments, customs

disputes, and other assessments currently outstanding.

In 2022, the State initiated an audit of the

mining sector, including a review of existing mining conventions

for existing mines. In August 2023, the State issued a new Mining

Code (the “2023 Mining Code”) and later in 2023 established a

commission comprised of Malian Government advisors and

representatives (the “Commission”) which was tasked with

negotiating certain aspects of existing mining conventions and

clarifying the application of the 2023 Mining Code to both existing

and new mining projects. In July 2024, the State finalized and

issued the Implementation Decree for the 2023 Mining Code, which

included certain details relating to economic parameters not

previously included in the 2023 Mining Code.

Throughout the latter half of 2023 and the first

half of 2024, B2Gold continued to hold meetings with the

Commission, and such discussions have culminated with finalizing

the terms of the Agreement. The Agreement includes an overall

framework which covers the settlement of outstanding matters

arising from the State’s mining audit, income tax and customs

audits, as well as clarification and agreement on the application

of the 2023 Mining Code to the Fekola Complex going forward. A

majority of the Company’s obligations under the Agreement remain

subject to the completion of certain implementing acts by the State

relating to the items discussed below.

The material terms of the Agreement include:

- The Fekola Mine

(including Fekola underground) continues to be governed by the 2012

Mining Code and the Fekola Mining Convention through 2040. This

includes continued stability of the ownership, income tax and

customs regimes and the Company’s dispute resolution rights under

the Fekola Mining Convention;

- Distribution of

all retained earnings currently attributable to the State’s 10%

ordinary share interest and conversion of that interest to a 10%

preferred share interest with priority dividends going

forward;

- Settlement of

any and all income tax assessments for the period from 2016 through

2023;

- Settlement of

any and all customs disputes and assessments that are currently

outstanding; and

- Acknowledgement by the State of

outstanding value-added tax (“VAT”) credits and agreement on a

repayment schedule outlining the timing for reimbursement of

outstanding VAT, together with clear guidelines on the expectation

for reimbursement of VAT going forward.

As outlined above, upon approval of the Fekola

Board of Directors and completion of remaining local statutory

requirements, Fekola plans on distributing to the State the amount

of retained earnings already accruing to the State as at December

31, 2023, from its ordinary share ownership. For 2024 onwards, the

State will hold a 20% preference share interest, and the remaining

80% interest in Fekola will continue to be held by B2Gold as an

ordinary share interest.

The Company has agreed to begin to pay taxes on

Fekola Mine fuel imports that were previously exonerated under the

Fekola Mining Convention. To offset the cost of these taxes, the

State has agreed to a 2% reduction in revenue-based taxes and

royalties to be applied to the entire Fekola Complex, including

both the Fekola Mine and Fekola Regional. The 2% reduction in

revenue-based taxes and royalties is expected to offset

substantially all of the cost of Fekola Mine fuel taxes going

forward.

The Fekola Mining Convention stabilized the

income tax and customs regimes in place when the Fekola mining

license was issued in 2014. Under the terms of the Agreement,

B2Gold and the State have agreed that the mining-based tax

royalties, which in the Company’s view does not meet the definition

of an income tax under the 2012 Mining Code, and state

infrastructure, local development or mining funds introduced or

clarified by the 2023 Mining Code and its related Implementation

Decree, will apply to the Fekola Mine. Such mining-based tax

royalties and new state infrastructure, local development or mining

funds will apply to the Fekola Mine once the related procedures

have been implemented by the State. The material terms of the

Agreement described above were included in the key estimates used

to determine the fair value estimate for the Fekola Complex as of

June 30, 2024, which resulted in a non-cash net impairment charge

previously disclosed in the second quarter of 2024 financial

statements. The Company does not anticipate any significant further

changes to the fair value estimate of the Fekola Complex to arise

from the application of the Agreement. Under the terms of the

Agreement, the State has agreed that the Company will be entitled

to realize the benefit of any terms that are more favorable than

those agreed to as at the date of the Agreement in the event of any

subsequent amendment to the 2023 Mining Code or Implementation

Decree.

As part of the Agreement, the State has also

committed to issuing the Company the exploitation permits for

Fekola Regional and approving the exploitation phase for Fekola

underground in an expeditious manner. The development of Fekola

Regional is expected to demonstrate positive economics through the

enhancement of the overall production profile and the extension of

mine life of the Fekola Complex. Based on B2Gold’s preliminary

planning, Fekola Regional could provide selective higher-grade

saprolite material (average annual grade of up to 2.2 grams per

tonne gold) to be trucked approximately 20 km and fed into the

Fekola mill at a rate of up to 1.5 million tonnes per annum.

Trucking of selective higher-grade saprolite material from the

Anaconda Area to the Fekola mill will increase the ore processed

and has the potential to generate approximately 80,000 to 100,000

ounces of additional gold production per year from Fekola Regional

sources. Importantly, the haul road from Fekola Regional to the

Fekola Mine is operational as construction of the haul roads and

mining infrastructure (warehouse, workshop, fuel depot and offices)

was completed on schedule in 2023. Upon issuance of the

exploitation permits for Fekola Regional, mining operations will

begin with initial gold production expected to commence in early

2025, and initial gold production from Fekola underground expected

to commence in mid-2025.

The 2024 exploration program is currently

underway in Mali with a total of $10 million budgeted, with an

ongoing focus on discovery of additional high-grade mineralization

across the Fekola Complex to supplement feed to the Fekola mill.

Significant exploration potential remains across the Fekola Complex

to further extend the mine life. A total of 20,000 meters of

diamond and reverse circulation drilling is planned for the Fekola

Complex in 2024.

About B2Gold

B2Gold is a low-cost international senior gold

producer headquartered in Vancouver, Canada. Founded in 2007,

today, B2Gold has operating gold mines in Mali, Namibia and the

Philippines, the Goose Project under construction in northern

Canada and numerous development and exploration projects in various

countries including Mali, Colombia and Finland. B2Gold forecasts

total consolidated gold production of between 800,000 and 870,000

ounces in 2024.

ON BEHALF OF B2GOLD CORP.

“Clive T.

Johnson” President

and Chief Executive

Officer

The Toronto Stock Exchange and NYSE American LLC

neither approve nor disapprove the information contained in this

news release.

Production results and production guidance

presented in this news release reflect total production at the

mines B2Gold operates on a 100% project basis. Please see our

Annual Information Form dated March 14, 2024, for a discussion of

our ownership interest in the mines B2Gold operates.

This news release includes certain

"forward-looking information" and "forward-looking statements"

(collectively forward-looking statements") within the meaning of

applicable Canadian and United States securities legislation,

including: projections; outlook; guidance; forecasts; estimates;

and other statements regarding future or estimated financial and

operational performance, gold production and sales, revenues and

cash flows, and capital costs (sustaining and non-sustaining) and

operating costs, including projected cash operating costs and AISC,

and budgets on a consolidated and mine by mine basis; future or

estimated mine life, metal price assumptions, ore grades or

sources, gold recovery rates, stripping ratios, throughput, ore

processing; statements regarding anticipated exploration, drilling,

development, construction, permitting and other activities or

achievements of B2Gold; and including, without limitation:

remaining well positioned for continued strong operational and

financial performance in 2024; projected gold production, cash

operating costs and AISC on a consolidated and mine by mine basis

in 2024; total consolidated gold production of between 800,000 and

870,000 ounces (including 20,000 attributable ounces from Calibre)

in 2024; trucking of selective higher grade saprolite material from

the Anaconda Area to the Fekola mill having the potential to

generate approximately 80,000 to 100,000 ounces of additional gold

production per year from Fekola Regional sources; the receipt of

the exploitation permit for Fekola Regional and Fekola Regional

production expected to commence at the beginning of 2025; and the

receipt of a permit for Fekola underground and Fekola underground

commencing operation in mid-2025. All statements in this news

release that address events or developments that we expect to occur

in the future are forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

generally, although not always, identified by words such as

"expect", "plan", "anticipate", "project", "target", "potential",

"schedule", "forecast", "budget", "estimate", "intend" or "believe"

and similar expressions or their negative connotations, or that

events or conditions "will", "would", "may", "could", "should" or

"might" occur. All such forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond

B2Gold's control, including risks associated with or related to:

the volatility of metal prices and B2Gold's common shares; changes

in tax laws; the dangers inherent in exploration, development and

mining activities; the uncertainty of reserve and resource

estimates; not achieving production, cost or other estimates;

actual production, development plans and costs differing materially

from the estimates in B2Gold's feasibility and other studies; the

ability to obtain and maintain any necessary permits, consents or

authorizations required for mining activities; environmental

regulations or hazards and compliance with complex regulations

associated with mining activities; climate change and climate

change regulations; the ability to replace mineral reserves and

identify acquisition opportunities; the unknown liabilities of

companies acquired by B2Gold; the ability to successfully integrate

new acquisitions; fluctuations in exchange rates; the availability

of financing; financing and debt activities, including potential

restrictions imposed on B2Gold's operations as a result thereof and

the ability to generate sufficient cash flows; operations in

foreign and developing countries and the compliance with foreign

laws, including those associated with operations in Mali, Namibia,

the Philippines and Colombia and including risks related to changes

in foreign laws and changing policies related to mining and local

ownership requirements or resource nationalization generally;

remote operations and the availability of adequate infrastructure;

fluctuations in price and availability of energy and other inputs

necessary for mining operations; shortages or cost increases in

necessary equipment, supplies and labour; regulatory, political and

country risks, including local instability or acts of terrorism and

the effects thereof; the reliance upon contractors, third parties

and joint venture partners; the lack of sole decision-making

authority related to Filminera Resources Corporation, which owns

the Masbate Project; challenges to title or surface rights; the

dependence on key personnel and the ability to attract and retain

skilled personnel; the risk of an uninsurable or uninsured loss;

adverse climate and weather conditions; litigation risk;

competition with other mining companies; community support for

B2Gold's operations, including risks related to strikes and the

halting of such operations from time to time; conflicts with small

scale miners; failures of information systems or information

security threats; the ability to maintain adequate internal

controls over financial reporting as required by law, including

Section 404 of the Sarbanes-Oxley Act; compliance with

anti-corruption laws, and sanctions or other similar measures;

social media and B2Gold's reputation; as well as other factors

identified and as described in more detail under the heading "Risk

Factors" in B2Gold's most recent Annual Information Form, B2Gold's

current Form 40-F Annual Report and B2Gold's other filings with

Canadian securities regulators and the U.S. Securities and Exchange

Commission (the "SEC"), which may be viewed at www.sedar.com and

www.sec.gov, respectively (the "Websites"). The list is not

exhaustive of the factors that may affect B2Gold's forward-looking

statements.

B2Gold's forward-looking statements are based on

the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. These assumptions and factors

include, but are not limited to, assumptions and factors related to

B2Gold's ability to carry on current and future operations,

including: development and exploration activities; the timing,

extent, duration and economic viability of such operations,

including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts,

studies and assessments; B2Gold's ability to meet or achieve

estimates, projections and forecasts; the availability and cost of

inputs; the price and market for outputs, including gold; foreign

exchange rates; taxation levels; the timely receipt of necessary

approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and

political conditions; and other assumptions and factors generally

associated with the mining industry.

B2Gold's forward-looking statements are based on

the opinions and estimates of management and reflect their current

expectations regarding future events and operating performance and

speak only as of the date hereof. B2Gold does not assume any

obligation to update forward-looking statements if circumstances or

management's beliefs, expectations or opinions should change other

than as required by applicable law. There can be no assurance that

forward-looking statements will prove to be accurate, and actual

results, performance or achievements could differ materially from

those expressed in, or implied by, these forward-looking

statements. Accordingly, no assurance can be given that any events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do, what benefits or liabilities B2Gold

will derive therefrom. For the reasons set forth above, undue

reliance should not be placed on forward-looking statements.

For more information on B2Gold please visit the Company website at www.b2gold.com or contact:

Michael McDonald

VP, Investor Relations & Corporate Development

+1 604-681-8371

investor@b2gold.com

Cherry DeGeer

Director, Corporate Communications

+1 604-681-8371

investor@b2gold.com

Source: B2Gold Corp.

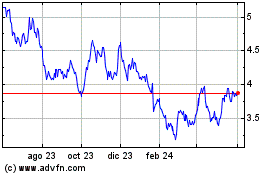

B2Gold (TSX:BTO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

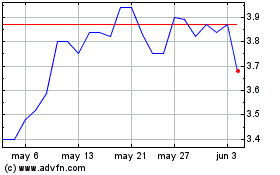

B2Gold (TSX:BTO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024