Canadian Natural Resources Limited Provides an Update on Its Horizon Oil Sands Project and Summary of Third Quarter Operations

10 Octubre 2013 - 4:00AM

Marketwired Canada

Canadian Natural Resources Limited (TSX:CNQ) (NYSE:CNQ) ("Canadian Natural" or

the "Company") is pleased to provide an update on its Horizon Oil Sands

("Horizon") project. Several key milestones were completed at Horizon in Q3/13

as the Company continues to deliver on its strategy to transition to a longer

life, low decline asset base which continues to deliver significant and growing

free cash flow.

HORIZON EXPANSION

Overall Horizon Phase 2/3 construction, which is targeted to increase production

capacity to 250,000 bbl/d of synthetic crude oil ("SCO"), reached approximately

30% physical completion in Q3/13 with current costs continuing to trend slightly

below sanctioned cost estimates, as the Company executes a cost driven strategy

for expansion.

-- The Reliability Phase is approximately 91% physically complete and is

trending under its budget of $1.09 billion by approximately 5%. The

absorber towers for the Gas Recovery Unit were safely erected and

installed in September 2013. The Reliability Phase will increase

performance, overall production reliability and recovery of additional

light oil barrels with the Gas Recovery Unit as the Company moves into

2014.

-- The Reliability Phase provides additional redundancies that

facilitate operating the plant more consistently and provides more

confidence in reliable production.

-- In Q3/13, Phase 2A reached a major milestone with the installation of

Coke Drums 33-D-3A/B (see photos attached below). The Coke Drums are

approximately 9 meters in diameter and stand approximately 43 meters

high and were safely lifted and installed in August 2013. Phase 2A is

approximately 70% physically complete, on schedule for completion in

2015 and is targeted to add 10,000 bbl/d of additional SCO production

capacity at Horizon.

-- Completion of Phase 2A will utilize pre-invested infrastructure and

equipment to expand the Coker Plant and alleviate the current

bottleneck.

-- Phase 2B continues to progress on cost and on schedule to add a targeted

additional 45,000 bbl/d of SCO in 2016. Currently Phase 2B is

approximately 20% physically complete and will increase bitumen yield

through the addition of the Vacuum Distillation Unit.

-- Phase 2B will expand the capacity of froth treatment, the Gas/Oil

hydrotreater and the hydrogen plant. Bids are out for major

components on this Phase.

-- Phase 3 continues to progress on cost and on schedule to add a targeted

additional 80,000 bbl/d of SCO in 2017. Currently Phase 3 is

approximately 19% physically complete and will bring Horizon production

capacity to 250,000 bbl/d of SCO and will result in additional

reliability, redundancy and significant operating cost savings.

-- Phase 3 will expand capacity through adding extraction trains 3 and

4.

To view the first photo associated with this release, click the following link:

http://media3.marketwire.com/docs/cnrl_1.jpg

To view the second photo associated with this release, click the following link:

http://media3.marketwire.com/docs/cnrl_2.jpg

HORIZON OPERATIONS

Operating performance at Horizon has been strong since the Company executed its

first major turnaround in May 2013. SCO production for Q3/13 was approximately

111,900 bbl/d, with September 2013 production at approximately 117,200 bbl/d.

Canadian Natural expects continued strong production reliability at Horizon with

Q4/13 production volumes currently targeted to average between 110,000 bbl/d and

115,000 bbl/d.

Q3/13 OPERATIONAL/FINANCIAL SUMMARY HIGHLIGHTS

Overall Q3/13 was a strong operational quarter for the Company as it achieved

record quarterly crude oil production of approximately 508,000 bbl/d and record

quarterly BOE production of approximately 701,000 BOE/d. Strong production was

driven by operational reliability across all assets. Due to these record

production levels and the robust liquids pricing received during Q3/13, cash

flow from operations for the quarter will be approximately $2,400 million

(approximately $2.21 per common share), which cash flow from operations does not

include approximately $170 million of after tax gains realized on certain oil

and gas property dispositions completed in Q3/13.

The Company's full operational and financial results for Q3/13 will be released

in the normal course on November 7th, 2013. A conference call will be held on

that day at 9:00 a.m. Mountain Standard Time, 11:00 a.m. Eastern Standard Time.

Q3/13 was a strong quarter for crude oil pricing as shown below:

-----------------------------------------------

WCS Blend SCO Differential

WTI Pricing Differential from WTI

Benchmark Pricing (US$/bbl) from WTI (%) (US$/bbl)

----------------------------------------------------------------------------

2013

July $ 104.70 14% $ 5.98

August $ 106.54 15% $ 3.20

September $ 106.24 21% $ 3.24

----------------------------------------------------------------------------

----------------------------------------------------------------------------

--------------------------------

Dated Brent Condensate

Differential Differential

from WTI from WTI

Benchmark Pricing (US$/bbl) (US$/bbl)

-------------------------------------------------------------

2013

July $ 3.25 $ 1.60

August $ 4.71 $ (2.78)

September $ 5.66 $ (4.88)

-------------------------------------------------------------

-------------------------------------------------------------

Commenting on the activities in Q3/13 Canadian Natural's President Steve Laut

said "The strong operational and financial results achieved in the third quarter

of 2013 demonstrate the strength of our teams and our ability to effectively

deliver on our strategy. The major expansion milestones achieved at Horizon are

a big step in delivering on a project that will provide significant value to our

shareholders for decades to come. We are in an enviable position with a suite of

balanced assets that are well positioned to economically grow the company in the

short, mid and long term."

In Q4/13 the Company anticipates strong oil pricing, with some potential

volatility and normal seasonal variation. October 2013 heavy oil differentials

are 26%, November 2013 indications are 32%(i) and December 2013 indications are

at 32%(i) discount to West Texas Intermediate.

(i)Indications are as at October 8, 2013.

Canadian Natural is a senior oil and natural gas production company, with

continuing operations in its core areas located in Western Canada, the U.K.

portion of the North Sea and Offshore Africa.

Certain information regarding the Company contained herein may constitute

forward-looking statements under applicable securities laws. Such statements,

including the statements regarding anticipated production volumes and targeted

project phase completion dates, are subject to known or unknown risks and

uncertainties that may cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. Refer to our website

for complete forward-looking statements www.cnrl.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Steve W. Laut

President

Douglas A. Proll

Executive Vice-President

Corey B. Bieber

Chief Financial Officer & Senior Vice-President, Finance

Canadian Natural Resources Limited

2500, 855 - 2nd Street S.W.

Calgary, Alberta, T2P 4J8 Canada

Phone: (403) 514-7777

(403) 514-7888 (FAX)

ir@cnrl.com

www.cnrl.com

Canadian Natural Resources (TSX:CNQ)

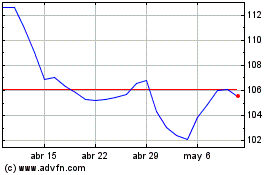

Gráfica de Acción Histórica

De Abr 2024 a May 2024

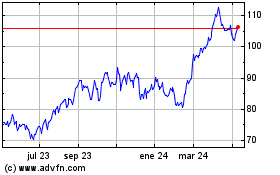

Canadian Natural Resources (TSX:CNQ)

Gráfica de Acción Histórica

De May 2023 a May 2024