Doman Building Materials Group Ltd. (“Doman” or “the Company”)

(TSX:DBM) announced today its third quarter 2023 financial

results(1) for the period ended September 30, 2023.

For the three-month period ended September 30,

2023(1), consolidated revenues amounted to $643.9 million, compared

to $744.1 million in the same period in 2022. The decrease in

revenues is largely due to the impact of construction materials

pricing, which resulted in lower average pricing for lumber and

plywood during the current year quarter. The Company’s sales by

product group in the period were made up of 72% construction

materials, consistent with the same quarter last year, with the

remaining balance resulting from specialty and allied products of

23%, and other sources of 5%.

Gross margin dollars increased to $102.8 million

in the three-month period versus $91.5 million in the comparative

quarter of 2022. Gross margin percentage increased to 16.0% in the

quarter, an improvement from 12.3% achieved in the same quarter of

2022.

EBITDA(2) for the three-month period ended

September 30, 2023(1), amounted to $52.0 million, compared to $40.0

million in the same period in 2022. Net earnings for the quarter

were $21.2 million compared to $11.6 million in the same quarter of

2022.

The Company declared a $0.14 per share(3)

quarterly dividend during the third quarter, which was paid on

October 13, 2023, to shareholders of record at the close of

business on September 29, 2023.

Subsequent to quarter-end, on October 20, 2023,

Fitch Ratings (“Fitch”) upgraded the ratings of Doman including the

company's Long-Term Issuer Default Rating (“IDR”), to 'B+' from

'B'. Fitch has also upgraded the Company’s 2026 unsecured notes

rating to 'BB-'/'RR3' from 'B'/'RR4'.

For the nine-month period ended September 30,

2023(1), the Company generated EBITDA of $162.9 million, on

revenues of $2.0 billion. Gross margin and gross margin percentage

during the period amounted to $322.2 million, and 16.4%,

respectively. This compares to 2022 EBITDA of $170.2 million, on

revenues of $2.5 billion. Gross margin and gross margin percentage

during the 2022 period amounted to $326.8 million and 13.3%. Net

earnings for the nine-month period ended September 30, 2023 were

$65.3 million versus $74.4 million in the comparative period of

2022.

“I am very pleased with the strength of our

business model and our financial performance during current market

conditions which include much volatility and macroeconomic

headwinds,” commented Amar S. Doman, Chairman of the Board. “Our

year-to-date, and third quarter gross margin performance was solid

and a validation of the strength of the business platform we have

on both sides of the border.”

Reconciliation of Net Earnings to Earnings before Interest, Tax,

Depreciation and Amortization (EBITDA) and Adjusted EBITDA:

|

|

Three months ended September

30, |

Nine months ended September

30, |

|

|

2023 |

2022 |

2023 |

2022 |

|

(in thousands of dollars) |

$ |

$ |

$ |

$ |

|

Net earnings |

21,158 |

11,630 |

65,261 |

74,407 |

| Provision for income

taxes |

3,889 |

1,709 |

15,160 |

18,577 |

| Finance costs |

10,131 |

9,833 |

31,191 |

27,803 |

| Depreciation and

amortization |

16,837 |

16,875 |

51,245 |

49,462 |

|

|

|

|

|

|

|

EBITDA |

52,015 |

40,047 |

162,857 |

170,249 |

About Doman Building Materials Group

Ltd.

Doman is headquartered in Vancouver, British

Columbia and trades on the Toronto Stock Exchange under the symbol

DBM and is a leading North American distributor of building

materials and is Canada’s only fully integrated national

distributor in the building materials and related products sector.

Doman operates several distinct divisions: CanWel Building

Materials with multiple treating plants, planing facilities and

distribution centres coast-to-coast in all major cities and

strategic locations across Canada; founded in 1959, Hixson Lumber

Company in the central United States, with 19 treating plants, two

specialty planing mills and five specialty sawmills located in

eight states, headquartered in Dallas, Texas, distributing,

producing and treating lumber, fencing and building materials;

California Cascade in the western United States near Portland,

Oregon, San Francisco and Los Angeles, California with treating

facilities and distribution of building materials, lumber and

renovation products; founded in 1935, the Honsador Building

Products Group in 14 locations in the State of Hawaii, with

treating facilities, truss plants and distribution of a wide range

of building materials, lumber, renovation and electrical products.

The Company’s operations also include timber ownership and

management of private timberlands and forest licenses, and

agricultural post-peeling and pressure treating through its fibre

division. Please see our filings on SEDAR under Doman Building

Materials Group Ltd. for additional information.

For further information regarding Doman please

contact:

Ali MahdaviInvestor Relations416-962-3300

ali.mahdavi@domanbm.com

Certain statements in this press release may

constitute “forward-looking” statements. When used in this press

release, forward-looking statements often but not always, can be

identified by the use of forward-looking words such as, including

but not limited to, “may”, “will”, “would”, “should”, “expect”,

“believe”, “plan”, “intend”, “anticipate”, “predict”, “remain”,

“estimate”, “potential”, “forecast”, “budget”, “schedule”,

“continue”, “could”, “might”, “project”, “targeting”, "future" and

other similar terminology or the negative or inverse of such words

or terminology. Forward-looking information in this news release

includes, without limitation, statements with respect to: the

ultimate impact (express or implied) of: a) fluctuations in

commodity and construction materials pricing; b) the performance of

recently acquired businesses; and c) the novel coronavirus COVID-19

(“COVID-19”) pandemic, on the Company’s operational and financial

results and on consumer behavior and economic activity, including

but not limited to the second quarter and full-year 2023 results,

which impact is difficult to estimate or quantify as it will depend

on, inter alia, the duration of the contagion, the impact of

government policies, and the pace of economic recovery. These

forward-looking statements reflect the current expectations of

Doman’s management regarding future events and operating

performance, but involve other known and unknown or unpredictable

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of Doman, including but not

limited, to sales, earnings, cash flow from operations, EBITDA(2)

generated, dividends generated or paid by Doman, including whether

at the rate as of the date hereof or some other dividend rate in

the future which may be lower than either of the preceding rates

discussed therein, or industry results, to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Such forward-looking

statements should therefore be construed in the light of such

factors. Actual events could differ materially from those projected

herein and depend on a number of factors. These factors include but

are not limited to those set out in the Company’s annual

information form dated March 31, 2023, and other public filings. By

their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on

circumstances that will occur in the future. In addition, a number

of material factors or assumptions were utilized or applied in

making the forward-looking statements, and may include, but are not

limited to, assumptions regarding the performance of the Canadian

and U.S. economies, the relative stability of or level of interest

rates, exchange rates, volatility of commodity prices, availability

or more limited availability of access to equity and debt capital

markets to fund, at acceptable costs, Doman’s future growth plans,

the implementation and success of the integration of Doman’s

acquisitions and customer and supplier retention, the ability of

Doman to refinance its debts as they mature, the Canadian and

United States housing and building materials markets; the direct

and indirect effect of the U.S. housing market and economy;

exchange rate fluctuations between the Canadian and US dollar;

retention of key personnel; Doman’s ability to sustain its level of

sales and earnings margins; Doman’s ability to grow its business

long term and to manage its growth; Doman’s management information

systems upon which it is dependent are not impaired or compromised

by breaches of Doman’s cybersecurity; Doman’s insurance is

sufficient to cover losses that may occur as a result of its

operations; international trade and tariff risks, political risks,

the amount of Doman’s cash flow from operations; tax laws; and the

extent of Doman’s future acquisitions and capital spending

requirements or planning as well as the general level of economic

activity, in Canada and the U.S., and abroad, discretionary

spending and unemployment levels; the effect of general economic

conditions, including market demand for Doman’s products, and

prices for such products; the effect of forestry, land use,

environmental and other governmental regulations; and the risk of

losses from fires, floods and other natural disasters and

unemployment levels. There is a risk that some or all of these

assumptions may prove to be incorrect. These and other factors

could cause or contribute to actual results differing materially

from those contemplated by forward-looking statements. Accordingly,

readers should not place undue reliance on any forward-looking

statements or information. These forward-looking statements speak

only as of the date of this press release. We caution that the

foregoing factors that may affect future results are not

exhaustive. When relying on our forward-looking statements to make

decisions with respect to Doman, investors and others should

carefully consider the foregoing factors and other uncertainties

and potential events. Neither Doman nor any of its associates or

directors, officers, partners, affiliates, or advisers, provides

any representation, assurance or guarantee that the occurrence of

the events expressed or implied in any forward-looking statements

in these communications will actually occur. You are cautioned not

to place undue reliance on these forward-looking statements. Except

as required by applicable securities laws and legal or regulatory

obligations, Doman is not under any obligation, and expressly

disclaims any intention or obligation, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

(1) Please refer to our Q3 2023 MD&A and

Financial Statements for further information. Our Q3 2023 Financial

Statements filings are reported under International Financial

Reporting Standards (“IFRS”).

(2) In the discussion, reference is made to

EBITDA, which represents earnings from continuing operations before

interest, including amortization of deferred financing costs,

provision for income taxes, depreciation, and amortization. This is

not a generally accepted earnings measure under IFRS and does not

have a standardized meaning under IFRS, and therefore the measure

as calculated by Doman may not be comparable to similarly titled

measures reported by other companies. EBITDA is presented as we

believe it is a useful indicator of a company’s ability to meet

debt service and capital expenditure requirements and because we

interpret trends in EBITDA as an indicator of relative operating

performance. EBITDA should not be considered by an investor as an

alternative to net earnings or cash flows as determined in

accordance with IFRS. For a reconciliation of EBITDA to the most

directly comparable measures calculated in accordance with IFRS

refer to “Reconciliation of Net Earnings to Earnings before

Interest, Tax, Depreciation and Amortization (EBITDA) and Adjusted

EBITDA”.

(3) On September 15, 2023, Doman declared a

quarterly dividend of $0.14 per share, which was paid on October

13, 2023, to shareholders of record on September 29, 2023. Please

refer to our Q3 2023 MD&A and Financial Statements for more

information.

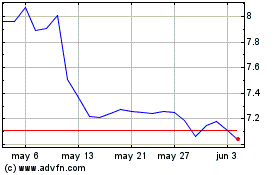

Doman Building Materials (TSX:DBM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Doman Building Materials (TSX:DBM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024