Guardian Capital Announces Final Valuation of Guardian i3 Global REIT ETF

18 Diciembre 2023 - 1:30PM

Guardian Capital LP (the “

Manager”) today

announced the final valuation of Guardian i3 Global REIT ETF (the

“

ETF”).

The ETF was voluntarily delisted from the

Toronto Stock Exchange, at the request of the Manager, effective as

of market close on December 15, 2023, and terminated earlier

today.

The final net asset value

(“NAV”) per unit of the ETF is as follows:

|

|

Breakdown of Final NAV per Unit |

|

Ticker |

Final NAV per Unit |

Incomeper Unit |

Capital Gainsper Unit |

Capitalper Unit |

|

GIGR |

$16.537886 |

$0.040629 |

$0.000000 |

$16.497257 |

|

GIGR.B |

$16.898914 |

$0.055762 |

$0.000000 |

$16.843152 |

Remaining unitholders of the ETF will be paid

the final NAV per unit on a pro rata basis, at the rate shown in

the table above, and no further action is required by

unitholders.

For further information regarding the Guardian

Capital ETFs, please visit

www.guardiancapital.com/investmentsolutions.

About Guardian Capital LP

Guardian Capital LP is the manager and portfolio

manager of the Guardian Capital Funds and Guardian Capital ETFs,

with capabilities that span a range of asset classes, geographic

regions and specialty mandates. Additionally, Guardian Capital LP

manages portfolios for institutional clients such as defined

benefit and defined contribution pension plans, insurance

companies, foundations, endowments and investment funds. Guardian

Capital LP is a wholly owned subsidiary of Guardian Capital Group

Limited and the successor to its original investment management

business, which was founded in 1962. For further information on

Guardian Capital LP, please call 416-350-8899 or visit

www.guardiancapital.com.

About Guardian Capital Group

Limited

Guardian Capital Group Limited

(“Guardian”) is a global investment management

company servicing institutional, retail and private clients through

its subsidiaries. As at September 30, 2023, Guardian had C$56.2

billion of total client assets while managing a proprietary

investment portfolio with a fair market value of C$1.28 billion.

Founded in 1962, Guardian’s reputation for steady growth, long-term

relationships and its core values of authenticity, integrity,

stability and trustworthiness have been key to its success over six

decades. Its Common and Class A shares are listed on the Toronto

Stock Exchange as GCG and GCG.A, respectively. To learn more about

Guardian, visit www.guardiancapital.com.

CONTACT INFORMATION

Guardian Capital LP Richard BritnellTelephone:

+1-416-350-3117 Email: rbritnell@guardiancapital.com

Guardian Capital LP Commerce Court West Suite

2700, 199 Bay Street PO Box 201 Toronto, Ontario M5L 1E8

This communication is intended for informational

purposes only and does not constitute an offer to sell or the

solicitation of an offer to purchase Guardian Capital Funds or

Guardian Capital ETFs and is not, and should not be construed as,

investment, tax, legal or accounting advice, and should not be

relied upon in that regard. Commissions, management fees and

expenses all may be associated with investments in Guardian Capital

Funds or Guardian Capital ETFs. Please read the prospectus before

investing. Exchange traded funds (“ETFs”) and

mutual funds are not guaranteed, their values change frequently and

past performance may not be repeated. You will usually pay

brokerage fees to your dealer if you purchase or sell units of an

ETF on the Toronto Stock Exchange. If the units are purchased or

sold on the Toronto Stock Exchange, investors may pay more than the

current net asset value when buying units of the ETF and may

receive less than the current net asset value when selling

them.

All trademarks, registered and unregistered, are

owned by Guardian Capital Group Limited and are used under

licence.

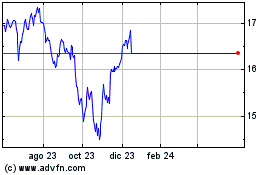

Guardian P Global REIT ETF (TSX:GIGR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Guardian P Global REIT ETF (TSX:GIGR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024